FHA MORTGAGE LENDERS GUIDELINES

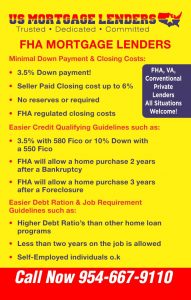

FHA Mortgage Lenders Information-FHA Mortgage Lenders provide funding for the most popular loan program in the United States. The FHA a division of HUD is within the United States Department of Housing and Development.

-620 FICO – FHA MORTGAGE LENDERS

Under the new FHA mortgage lenders guidelines that are outlined in the FHA Guide 4001. FHA Mortgage Lenders underwriting and loan approval criteria. FHA bad credit mortgage and No Credit mortgage applicants can qualify to purchase or refinance an FHA mortgage with credit score as low as 500 FICO with a maximum of 31% DTI front end debt to income ratios, which is called the housing ratios, and the maximum debt to income ratio is 43% DTI on the back end debt to income ratio. Click here to read more about debt to income ratios and FHA mortgage qualifying.

+ 620 AND OVER – FHA MORTGAGE LENDERS

FHA mortgage lenders are so popular because they will allow FHA Mortgage Applicants with credit scores over 620 FICO a maximum of 46.9% DTI front end debt to income ratios, which is called the housing expense ratios, and the maximum debt to income ratio is 56.9% DTI on the back-end debt to income ratio. These debt to income ratios can only be extended when the borrower has provided compensating factors. Click here to learn more about FHA compensating factors.

FORECLOSURE, BANKRUPTCY, SHORT SALE QUALIFYING WITH FHA MORTGAGE LENDERS

In Addition, first time FHA mortgage applicants as well as home buyers with prior bad credit, a prior bankruptcy, a prior foreclosure, a prior deed in lieu, and a prior short sale can qualify for FHA Mortgage within 3 years of a title transfer.

FORECLOSURE OR BANKRUPTCY FHA MORTGAGE LENDERS APPROVALS

To qualify for an FHA mortgage there are statutory minimum waiting periods per FHA Loan Guidelines, after a bankruptcy, foreclosure, deed in lieu of foreclosure, and short sale. For traditional FHA mortgage loan, there is a minimum 2 year waiting period after the discharge date of a bankruptcy. And, a mandatory 3 year waiting period after a foreclosure, deed in lieu of foreclosure, and short sale to qualify. The waiting period clock starts from the date of the foreclosure that is reflected on title transfer in public records and not the date where the keys were surrendered to the FHA mortgage lender or the date of the court house sale. The (3) three year waiting period after a short sale starts on the date of the short sale which is reflected on the HUD-1 Settlement Statement date. Read more about qualifying for an FHA mortgage after Foreclosure, Short sale or bankruptcy.

FHA- FHA MORTGAGE AFTER BANKRUPTCY or FORECLOSURE APPROVALS!

- Short Sale / Deed in Lieu – You may apply for a FHA insured loan THREE (3) years after the sale date of your foreclosure. FHA treats a short sale the same as a Foreclosure for now. You may have to search county records office to locate the deed to count a full 3 years.

- Credit must be re-established no late payments in past 12-24 months, depending on hardship

- Application Date must be after the above waiting period to be eligible for FHA financing after hardship. You may have to search county records office to locate the deed transfer out of your name fin order to count a full 3 years.

- Chapter 13 Bankruptcy- You may apply for a FHA mortgage after your bankruptcy has been discharged for 12 Months or (1) year with a Chapter 13 Bankruptcy. You must have 0 x 30 day late payments, and permission from the chapter 13 trustee.

- Chapter 7 Bankruptcy- You may apply for a FHA mortgage after your bankruptcy has been discharged for TWO (2) years with a Chapter 7 Bankruptcy. You may apply for a FHA insured loan after your bankruptcy has been discharged for ONE (1) year with a Chapter 13 Bankruptcy

- Foreclosure – You may apply for a FHA insured loan THREE (3) years after the Florida Foreclosure sale/deed transfer date. You may have to search county records office to locate the deed to count a full 3 years.

COLLECTION ACCOUNTS AND QUALIFYING WITH FHA MORTGAGE LENDERS GUIDELINES

FHA Mortgage Applicants can qualify for a FHA Loan with prior bad credit. FHA Collections Guidelines does not require FHA mortgage applicants to pay off unpaid outstanding collection accounts to qualify for an FHA mortgage. With unpaid outstanding medical collection accounts, debt to income ratios are excluded and the FHA mortgage underwriter can ignore medical collection accounts with unpaid outstanding medical collection account balances no matter how much the unpaid outstanding medical collection account balance is. However, with non-medical unpaid outstanding collection accounts (the sum of all non-medical collection accounts with balances) on the credit report with balances over $2,000 requires that 5% of the remaining unpaid collection account balances must be added to the borrower’s debt to income ratio. FHA Mortgage Applicants can qualify for a FHA Loan with unpaid collection accounts, charge offs, or even judgments. FHA mortgage lenders provides mortgage lenders with no FHA mortgage lender overlays and just goes off the minimum FHA Loan Guidelines and the automated approval. If FHA says no collections need to be paid off, the no collection accounts need to be paid off. Click here to read more about FHA mortgage qualifying with collections and judgments on your credit report!

TAX LIENS AND QUALIFYING FOR FHA MORTGAGE LENDERS

have a tax lien does not automatically disqualify you for an FHA mortgage. Click here to Read more about qualifying for an FHA Mortgage with a tax lien.

MEDICAL COLLECTIONS AND QUALIFYING WITH FHA MORTGAGE LENDERS

FHA mortgage lenders do not count unpaid medical collection accounts against your debt to income ratios.. Medical collections are exempt regardless of balance of unpaid medical collection accounts. With non-medical collection accounts, FHA Mortgage Applicants do not have to pay off any unpaid collection balance, however, if the total of unpaid collection balance is greater than $1,000, FHA will count 5% of the unpaid collection balance as a monthly debt obligation and will count it towards calculating FHA Mortgage Applicants debt to income ratios even though FHA Mortgage Applicants do not pay anything. This can become a problem if FHA Mortgage Applicants unpaid collection balance is of a larger amount. For instance, if FHA Mortgage Applicants have a $15,000 unpaid total collection balance, 5% of the $15,000, or $750, will be counted as a monthly debt obligation to your debt to income ratios. . For some FHA mortgage applicants this can be a loan breaker. FHA does allow for FHA Mortgage Applicants to enter a written payment agreement with the creditor and whatever FHA Mortgage Applicants agree to mutually, that will be used by the mortgage loan underwriter as FHA Mortgage Applicants monthly debt. For instance, on the $15,000 unpaid credit collection balance, if FHA Mortgage Applicants and the creditor agreed on a monthly payment of $150.00 per month, then the $150.00 per month must be used as a monthly debt payment on that collection account. There is no payment seasoning requirement with collection repayment plans.

FHA MORTGAGE LENDERS GUIDELINES ON HIGH DEBT TO INCOME RATIOS

Conventional mortgage loan Applicants who have high debt to income ratios can turn to FHA Mortgage to qualify if they do not meet conventional debt to income guidelines. Maximum conventional debt to income ratios for conventional FNMA bank loans are capped at 45% DTI. FHA is much more lenient with debt to income ratios. FHA mortgage lenders cap their back-end debt to income ratios at 56.9%. FHA Mortgage Lenders have a front-end housing debt to income ratio cap of 46.9% DTI. FHA Mortgage is an incredible mortgage loan option for first time home buyers, home buyers with bad credit and no No Credit, self-employed buyers, and FHA mortgage applicants who have high debt to income ratios. Click here to read more about FHA mortgage lenders debt to income ratios.

Under the new FHA mortgage lenders guidelines that are outlined in the FHA Guide 4001. FHA Mortgage Lenders underwriting and loan approval criteria. FHA bad credit mortgage and No Credit mortgage applicants can qualify to purchase or refinance an FHA mortgage with credit score as low as 500 FICO with a maximum of 31% DTI front end debt to income ratios, which is called the housing ratios, and the maximum debt to income ratio is 43% DTI on the back end debt to income ratio.

FHA MORTGAGE WITH NON-OCCUPANT CO BORROWERS

One advantage you will not find with a conventional loan is that with an FHA Mortgage the main borrower has little or no income documentation, FHA permits the borrower to add a non-occupant co-borrower for income qualification purposes. The non-occupant co-borrower needs to be related.

SELLER CONCESSIONS AND GIFT FUNDS FOR DOWN PAYMENT

The FHA mortgage program allows the home buyer to get 100% gift funds to be used for the down payment and closing costs. The Gift funds must be properly documented and needs to come from a relative of the home buyer. The gift letter needs to be signed by the donor stating that the funds is only a gift does not have to be paid back to the donor. Click here to learn more about FHA gift funds and documenting the gift for an FHA mortgage.

SELLER PAID CLOSING COST-

With an FHA loan the seller can pay up to 6% of the buyers closing cost and prepaids. Click here to read more about seller paid closing cost.