FLORIDA FHA MORTGAGE APPROVALS!

FHA mortgage Loans have been helping people Florida FHA mortgage applicants since 1934. FHA Mortgage Loans are backed by the Federal Housing Administration. FHA insures the loan so your Florida mortgage lender can offer a lower down-payment and better approval opportunities for Florida bad credit mortgage applicants.

ADVANTAGES OF USING THE FHA MORTGAGE TO PURCHASE A FLORIDA HOME INCLUDE:

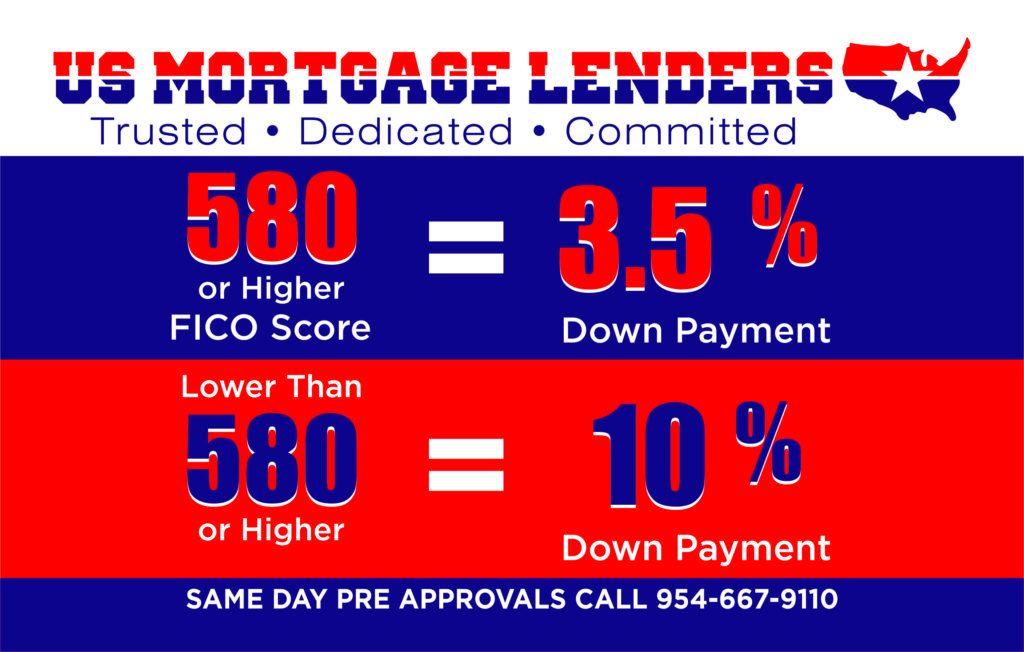

- Lower Credit Scores- Florida mortgage applicants with credit scores as low as 580 can qualify for an FHA loan and borrowers with credit scores under 680 often will receive better interest rates through an FHA mortgage than a conventional / Fannie Mae mortgage.

- No Credit Score FHA Mortgage Approvals- Using alt trade lines proof of payments you can qualify to buy a home with NO Credit Score!

- Florida FHA Mortgages are only available for a borrower’s Primary Residence ( No Second Home or Investment Properties)

- The FHA mortgage loans Loan requires a minimum down payment of 3.5% of the home sale pirce for a purchase. The loan to values ( LTVs) are higher than Conventional ( Fannie Mae ) loans.

- The underwriting process for A Florida FHA Mortgage approval is easier than a conventional loan. Although the Loan has mortgage insurance premium ( MIP ) the loan is not re-underwritten by the Florida mortgage lenders providing the mortgage insurance. FHA mortgage loan requires on one FHA underwriter approval.

- Florida FHA mortgage Loans have no prepayment penalty. The homeowner can pay the mortgage down partially or in full at any time without penalty.

- Low Credit Scores- Borrowers with credit scores as low as 580 can qualify for an FHA loan and borrowers with credit scores under 680 often will receive better interest rates through an FHA mortgage than a conventional / Fannie Mae mortgage.

- The FHA lending program is available for condomiums, but it must be an FHA approved condo list.

HOW DO I STREAMLINE REFINANCE MY FLORIDA HOUSE?

A Florida FHA Streamline Refinance Loan is a refinancing option available for borrowers that currently have an FHA Home Mortgage and are interested in refinancing to a new FHA Home Loan. It is called a FHA Streamline because it allows you to lower your interest rate with reduced documentation and sometimes without an appraisal. Borrowers who have mortgages insured by the Federal Housing Administration (FHA) have options when it comes to refinancing. If you want to restructure your FHA home loan without all the hassles and high costs associated with a conventional refnance, you should consider an FHA streamline refinance.

FHA streamline rates are often some of the most affordable on the market, competitive to most conventional loans. FHA streamline refinances usually have fewer steps and requirements than a conventional refinance possibly even avoiding appraisals, meaning this option can save you both time and money.

You may be able to restructure your current FHA home loan. You could change your rate from an Adjustable Rate Mortgage (ARM) to a low Fixed Rate Mortgage ensuring a secure and consistent monthly payment for the life of your mortgage. You also may be able to reduce the term of your current mortgage, meaning you will not only save thousands of dollars over the life of your loan, but also you will pay off your mortgage even faster.

FHA MORTGAGE STREAMLINE REFINANCE:

Some Florida Mortgage Lenders offer No-cost refinance options for FHA streamline mortgage loans. No-cost refinancing is achieved by choosing a slightly higher interest rate to obtain enough lender credits or rebaits to cover the costs. This is a great way to FHA mortgage refinance your Florida house without using a lot of your available cash.

Contact us Now to discuss your FHA streamline refinance options with a professional Florida Mortgage Lender. It could be your first step towards lowering your monthly home loan payment and saving thousands of dollars every year.