In the past, traditional FHA mortgage lenders have automatically rejected FHA mortgage applicants who filed a chapter 13 bankruptcy. Today those who have declared a chapter 13 personal bankruptcy can qualify for an FHA mortgage today! Many bad credit mortgage applicants are left out of purchasing a home without the help of the FHA bankruptcy mortgage program. Most borrowers think that they must wait at least 7 to 10 years after a chapter 13 bankruptcy to purchase a home with an FHA mortgage.

Yes- Can I Get a Mortgage While In A Chapter 13 Bankruptcy?

A Chapter 13 bankruptcy does not disqualify a Borrower from obtaining an FHA-insured Mortgage, if at the time of case number assignment at least 12 months of the pay-out period under the chapter 13 payout bankruptcy has elapsed.

The Mortgagee must determine that during this time, the Borrower’s payment performance has been satisfactory and all required payments have been made on time; and the Borrower has received written permission from bankruptcy court to enter into the mortgage transaction.

FHA MORTGAGE LENDERS DOWN LOW PAYMENT CHAPTER 13 BANKRUPTCY ALLOW FOR:

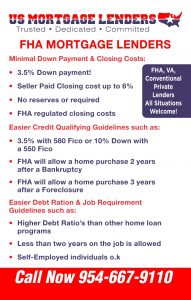

- Down payment only 3.5% of the purchase price.

- Gifts from family or FHA Grants for down payment assistance and closing costs OK!

- Sellers can credit the buyer’s up to 6% of sales price towards buyers costs and pre-paid.

- No reserves or future payments in account required.

- FHA regulated closing costs.

- Read more about buying a home with an FHA mortgage Bad Credit –No Credit – Investment –Second Home –Multi Family –

FHA MORTGAGE LENDERS ALLOW HIGHER DEBT TO INCOME WITH PREVIOUS CHAPTER 13 BANKRUPTCY-

- FHA allows higher debt ratio’s than any conventional mortgage loan programs.

- Less than two years on the same job is OK!

- Self-employed buyers can also qualify with FHA Mortgage Lenders.

- Read More about Gifts For Down Payment – Documents Checklist – Debt To Income – Student Loans –

FHA MORTGAGE LENDERS CREDIT APPROVALS WITH CHAPTER 13 BANKRUPTCY ALLOW FOR-

- 12 months after a chapter 13 Bankruptcy FHA mortgage Lender approvals!

- 24 months after a chapter 7 Bankruptcy FHA mortgage Lender approvals!

- 3 years after a Foreclosure FHA mortgage Lender approvals!

- No Credit Score FHA mortgage Lender approvals!

- 580 required for 96.5% financing or 3.5% down payment FHA mortgage Lender approvals.

- 500 required for 90% financing or 10% down payment FHA mortgage Lender approvals.

- Bad Credit with minimum 500 FICO credit score with 10% Down Payment FHA. For FHA mortgage applicants with credit scores between 500 and 579 must make down payments of at least 10% down!

- Read more about FHA Qualifying Qualification Summary – Manual Underwrite – Collections-Judgement’s – Bankruptcy or Foreclosure – Compensating Factors –

FHA MORTGAGE LOAN ARE EASIER TO QUALIFY FOR WITH A CHAPTER 13 BANKRUPTCY– FHA mortgage guidelines tend to be more lenient in areas such as a chapter 13 bankruptcy, debt to income ratios and cash to close. Because of this FHA mortgage insurance borrowers will find that FHA mortgage rates are better than a conventional mortgage rates. The FHA mortgage provides all these benefits while protecting FHA mortgage lenders from loss.

FINDING THE RIGHT FHA MORTGAGE LENDER AFTER A CHAPTER 13 BANKRUPTCY-No matter what the situation, select the FHA mortgage lenders that allow purchases after a chapter 13 bankruptcy. have a program that will work for the buyer with a bankruptcy history. If a buyer cannot get approved, there are customized plans that can re-establish credit to help the buyer become mortgage-ready, ensuring home ownership in the near future. Because of new options, chapter 13 bankruptcy no longer needs to stand in the way of getting a home loan. With the help of more compassionate lenders, those who have experienced financial difficulty will have an easier time getting a home loan.

FHA MORTGAGE LENDERS DOWN PAYMENT AFTER A BANKRUPTCY- Many don’t know this but you can qualify for an FHA loan down to a 500-fico score. Most bankruptcy FHA mortgage lenders require a bare min 580 fico score.

CHAPTER 13 BANKRUPTCY MORTGAGE MISCONCEPTION- While some declaring a chapter 13 bankruptcy have had trouble managing their money, many chapter 13 mortgage applicants of those declaring have had circumstances events beyond their control. Over the past several years, Americans have been filing chapter 13 bankruptcy at record-high levels.

FHA MORTGAGE AFTER A CHAPTER 13 BANKRUPTCY- When you file a chapter 13 bankruptcy without a doubt there is certainly a negative mark on a credit report. A chapter 13 bankruptcy it does not necessarily disqualify a borrower from attractive rates and low down-payment when you go with an FHA mortgage. Recognizing that sometimes-bad things happen to good people, some select bad credit mortgage lenders willing to take a calculated risk, but at a much higher rate. Many FHA mortgage lenders use a scoring system to determine whether potential buyers are a worthwhile risk. However a chapter 13 bankruptcy gives an automatic low score. However, a select group of FHA mortgage lenders are beginning to look beyond the scores and look at the individuals in need. Instead of waiting 2 or 4 years after being discharged from bankruptcy, some mortgage professionals are willing to give a home loan much sooner. Those who have declared Chapter 7 bankruptcy liquidation may be eligible for a loan one day after discharge, and those who have declared Chapter 13 may be eligible for a loan even while still reorganizing.

FHA MORTGAGE LENDERS DOWN PAYMENT AFTER A BANKRUPTCY- Another common misconception is that a previous bankruptcy on your credit report will require you to have a large down-payment and pay extremely high rates and points. There are currently programs available with zero down-payment and with very attractive rates and points. Some lenders are even pre-qualifying buyers for a loan, saving time and making the home-buying experience easier and more efficient. When a buyer pre-qualifies, they will have the advantage of greater negotiating power.