POMPANO BEACH FL FHA MORTGAGE LENDERS – FHA MORTGAGE POMPANO BEACH FL

Welcome and thank you for visiting US Mortgage Lenders webpage. We are local POMPANO BEACH Florida mortgage lenders. We are available to answer any questions you might have 24/7.

www.Florida-Mortgage-Lenders.com

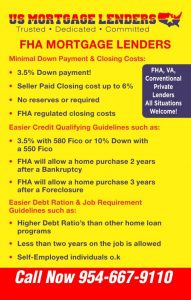

POMPANO BEACH FLORIDA FHA MORTGAGE LOANS HAVE MINIMAL DOWNPAYMENT AND CLOSING FEES:

• Pompano Beach FL Down payment only 3.5% of the purchase price.

• Gifts from family or Grants for down payment assistance and closing costs OK!

• Seller can credit buyers up to 6% of sales price towards buyer’s costs.

• No reserves or future payments in account required.

• FHA regulated closing costs.

POMPANO BEACH FLORIDA FHA MORTGAGE LOANS ARE EASY TO QUALIFY FOR BECAUSE YOU CAN:

• Purchase a Pompano Beach Florida home 12 months after a chapter 13 Bankruptcy

• Purchase a Pompano Beach Florida 24 months after a chapter 7 Bankruptcy.

• FHA will allow a FHA mortgage 3 years after a Foreclosure.

• Minimum FICO credit score of 580 required for 96.5% financing.

• Pompano Beach Bad credit Florida FHA mortgage approvals minimum FICO credit score of 530 required for 90 FHA financing.

• No Credit Score Florida mortgage loans & No Trade Line Florida FHA home loans.

POMPANO BEACH FLORIDA FHA MORTGAGE LOANS ALLOW HIGHER DEBT TO INCOME & EASIER JOB QUALIFYING:

• FHA allows higher debt ratio’s than any other Florida home loan programs.

• Less than two years on the same job is OK!

• Self-employed buyers can also qualify for FHA.

• Check Florida FHA Mortgage Articles for more information.

The Federal government insures Florida FHA mortgage lenders against losses, therefore the FHA mortgage applicants has very minimal down payment and closing cost. FHA mortgages lenders will require a minimum 3.5% financial commitment. In additions, FHA mortgage lenders allow for the home seller to pay all your closing cost up to 6% of the sale price.

• EASIEST TO QUALIFY •

Prequalifying with a Florida FHA mortgage lenders is rather easy. The result of the FHA mortgage insurance guarantee educes Florida FHA mortgage lenders make it feasible for just about anybody with a decent 12 month payment history to qualify. The primary components of an FHA mortgage include down payment, credit, debt to income ratio.

• FIXED 30 YEAR RATES WITH NO PREPAYMENT PENALTIES •

One of the big advantages of using a Florida FHA mortgage lenders is the benefit of having a fixed 30 year interest rate with 0 NO prepayment penalty. In comparison to other conventional Fannie Mae and Freddie mac mortgage loans in which you risk the possibility of a mortgage rate that could change. The FHA mortgage is typically for 30 years. The result of this FHA mortgage provision FHA mortgage applicants can budget their predetermined installment FHA mortgage payment in advance.

• NO RESERVES ARE REQUIRED •

In contrast to most conventional home loan programs, Florida’s FHA home loan is a very tempting option for Florida first time buyers that have a little saved for down payment let alone future mortgage payments.

Florida First Time buyers should click apply now at the top of this website to learn what to expect with the FHA mortgage process. Being prepared will always boost your chances in getting your FHA mortgage approved.

FLORIDA FHA MORTGAGE SUMMARY OF KEY POINTS –

- FHA Loans Are Easier To Qualify For- The Federal Housing Administration (FHA) insures FHA mortgage loans against default as a way to help first-time home buyers, as well as lower and middle-income citizens. Unlike traditional mortgages, FHA loans require lower down payments and easier credit requirements to secure a loan. In fact, FHA mortgages now make up nearly a third of all new purchase mortgages in America. Get Started Now!

- FHA Loans For Less Then Perfect Credit-– Less than prefect credit is not an problem with FHA mortgage lenders because under the right circumstances you can qualify down to a 500+ Fico score!

- FHA Mortgage Lenders For First Time Home Buyers- For the last 10 years, Florida Mortgage Lenders.com has served Florida as one of the top Florida FHA Mortgage Lenders. We’ve helped residents secure Florida FHA loans in every city and county in Florida. Buying or refinancing a home can be tricky, but we are here to help. Imagine a streamlined, stress-free Florida mortgage approval process. Click here to learn why the FHA mortgage is so popular with Florida first time homebuyers!

- FHA Mortgage for Homebuyers And Move Up Buyers– The fact is, you do not have to be a first time homebuyer to qualify for an FHA mortgage. But, you typically you cannot have more that 1 FHA mortgage at a time unless you are moving closer to work or had and increase in family size!

- FHA Streamline Refinance is an Easy Fast Way To Lower Your Mortgage Payments– With the FHA streamline mortgage program, so long as your mortgage payments have been on time for the prior 12 months, you can inexpensively take advantage of any improvements in market interest Rates. Even if you had a “payment” bump in the road, you can still possibly qualify for a FHA streamline mortgage refinance with the right circumstances.

- Florida FHA mortgage applicants can apply now to get pre approved online! Florida Mortgage requirements are always changing, and Florida homebuyers can count on Florida Mortgage Lenders.com to provide up-to-date information support. In addition, we are one of Florida most active and experienced Florida mortgage lenders. With so many options out there, our job is to help you make the best decision for you. We make the FHA application process easy to understand and are always here to answer questions. Our website is also packed with information for you to browse. Our secure mortgage application is available online when you’re ready to apply for a mortgage and we will even call you to start the process.

During the Pompano Beach Florida Housing Boom the FHA Mortgage had become an uncommon mortgage loan product because of the plentiful supply of credit including Subprime, Conventional, and Fannie Mae. Many Pompano Beach Florida homebuyers obtained Mortgage Loans with 0% down payment and reduced loan documentation requirements. After the crash, as Fannie Mae and other Pompano Beach Florida mortgage lenders retreated from these riskier loan products, FHA stepped in Pompano Beach Florida FHA Home Loans became the only option for borrowers with a lowdown payment and less than perfect credit.

FHA Mortgage Lenders For Homes For Sale Within 90 Days

Does FHA have requirements for homes sold within 90 days? Property Flipping is a practice whereby recently acquired property is resold for a considerable profit with an artificially inflated value Property Flipping refers to the purchase and resale of a property in a short period of time. The eligibility of a property for a Mortgage…

FHA Mortgage Lenders For Manufactured Homes

FHA Mortgage Lenders For Manufactured Homes FHA Mortgage Lenders accepts manufactured homes permanently affixed to the foundation, built on or after June 15, 1976, and meet all FHA Mortgage Lenders For Manufactured Homes requirements. Single-wide manufactured homes are not eligible. Manufactured homes with acceptable alterations or additions must have marketability, “like” comparable, gross living area…

FHA Mortgage Lenders For Condos

FHA Condo Mortgage Lenders – Condo FHA Mortgage Lenders FHA Mortgage Lenders approve condos on case by case bases. FHA condo mortgage lenders require the condominium complex and meet all FHA mortgage lenders minimum requirements including 51 occupancy, 15% delinquencies). All condos and attached PUD’s require 100% ‘walls-in’ H06 coverage. Stick-built site condos do not…

FHA Mortgage Lenders Ineligible Property Types

Ineligible Collateral -FHA Mortgage Lenders Ineligible Property Types to include some built before June 15, 1976 single wide Mobile homes, co-ops, Single-wide manufactured homes, houseboats, commercial or industrial zoned properties, mixed-use with residential building use less than 51%, properties encumbered with Property Assessed Clean Energy (PACE) or Home Energy Renovation Opportunity (HERO) obligations, State-approved medical…

FHA Mortgage Lenders Eligible Property Types

FHA mortgage loans are only for Owner Occupied Only Home Only To Include. 1-4 Units. Villas including FHA approved PUD’s, Condos, FHA approved condominiums projects, land contracts, FHA approved manufactured , FHA approved modular homes (minimum doublewide manufactured homes are Eligible Collateral wide) that follow manufactured housing requirements below.

FHA Mortgage Lenders Maximum Loan Amounts

FHA Mortgage Lenders Maximum FHA mortgage amounts. # of Units Lowest Maximum Floor for All FHA mortgage Amounts Highest Maximum Ceiling for All FHA mortgage Highest FHA Maximum Ceiling for all FHA. 1 Unit 356,362 548,250 822,375 2 Units 456,275 702,000 1,053,000 3 Units 551,500 848,500 1,272,750 4 Units 685,400 1,054,500 1,571,750 FHA Max Base…

FHA Mortgage Lenders Loan To Value Based On Credit Scores

FHA Mortgage Lenders to Purchase A home FHA MORTGAGE LENDERS PURCHASE MINIMUM FICO 500 = 90.00% 1-4 UNITS. PER FHA MAX COUNTY LIMITS FOR STANDARD PROGRAM. AUS Accept: Per AUS; Manual max Debt To Income Ratios:31%/43% Evaluated by **FHA Mortgage Lenders Automated Underwriting System** FHA MORTGAGE LENDERS MINIMUM FICO 580 = 96.50% 1-4 UNITS. PER…