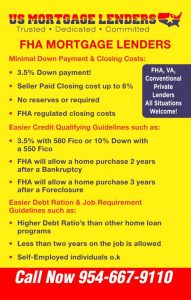

PORT ST LUCIE FLORIDA FHA MORTGAGE LENDERS – FHA MORTGAGE PORT ST LUCIE FL ADVANTAGES INCLUDE:

| Minimum 3.5% Down with 580+ | Minimum 10% Down With 500+ | 6% Seller Paid Closing Cost |

| Down payment Assistance OK! | Gift or Down payment = OK | Higher Debt To Income Up to 56% |

| Co Borrowers = OK! | Streamline Refinance! | Manual Underwrite = YES! |

PORT ST. LUCIE FL MORTGAGE LENDERS PROGRAMS INCLUDE:

PORT ST. LUCIE FL FHA MORTGAGE LENDERS

Welcome and thank you for visiting US Mortgage Lenders webpage. We are local PORT ST. LUCIE Florida mortgage lenders. We are available to answer any questions you might have 24/7.

CATEGORY: FHA MORTGAGE GUIDELINES

Do FHA Mortgage Lenders Require Collections To Be Paid Off To Qualify For An FHA Mortgage?

A Collection Account refers to a FHA mortgage applicants loan or debt that has been submitted to a collection agency by a creditor. If the credit reports used in the analysis show cumulative outstanding collection account balances of $2,000 or greater, the FHA mortgage lender must: • verify that the debt is paid in full…

Are reserves required for FHA mortgage applicants with manually underwritten loans?

Yes, the Mortgagee must verify and document Reserves equivalent to (1) one month’s Principal, Interest, Taxes, and Insurance (PITI) after closing for one- to two-unit Properties. The Mortgagee must verify and document Reserves equivalent to (3) three months’ PITI after closing for three- to four-unit properties. What are FHA mortgage reserves? FHA Mortgage reserves are…

Do FHA Mortgage Lenders Allow Gift of Down payment To come from Friends?

Do FHA Mortgage Lenders Allow Gift of Down payment To come from Friends? FHA mortgage lenders refer to gifts or contributions of cash or equity with no expectation of repayment. Gifts may be provided by: • a close friend with a clearly defined and documented interest in the Borrower; • the Borrower’s Family Member; …

Do FHA Mortgage Lenders allow employers gift the borrower’s down payment?

Do FHA Mortgage Lenders allow employers gift the FHA mortgage applicants down payment? Employer Assistance refers to benefits provided by an employer to relocate the FHA mortgage applicants or assist in the FHA mortgage applicants housing purchase, including closing costs, Mortgage Insurance Premiums (MIP), or any portion of the FHA mortgage applicants Minimum Required…

Do FHA mortgage Lenders allow realtors to give a gift of their commission for the down payment?

Do FHA mortgage Lenders allow realtors to give a gift of their commission for the down payment? Can A Realtors real estate Commission from Sale of Subject Property refers to the Borrower’s down payment portion of a real estate commission earned from the sale of the property being purchased. FHA mortgage lenders may consider Real…

Do FHA Mortgage Lenders Allow Gifts for Down Payment And Closing Cost?

Do FHA Mortgage Lenders Allow Gifts for Down Payment And Closing Cost? FHA Mortgage Lenders refer to Gifts as contributions of cash or equity with no expectation of repayment. FHA Mortgage Lenders Allow Gift Funds from the following approved sources • The FHA mortgage applicants Family Member; • The FHA mortgage applicants employer or labor…

Will FHA Mortgage Lenders Allow More Than 1 FHA Mortgage?

FHA mortgage lenders will not insure more than one Property as a Principal Residence for any FHA mortgage applicants, except as noted below. FHA mortgage lenders will not insure a Mortgage if it is determined that the transaction was designed to use FHA mortgage insurance as a vehicle for obtaining Investment Properties, even if the…

FHA Mortgage Lenders Cash Out and Rate Term Refinance

FHA Mortgage Lenders Rate Term Refinance Properties owned > 12 months: The subject property must be owner occupied for at least 12 months at the time of case number assignment. Properties owned < 12 months: The subject property must be owner occupied for the entire period of ownership at the time of case number assignment. …

FHA Mortgage Lenders Compensating Factors

FHA COMPENSATING FACTORS What are FHA compensating factors? (FHA compensating factors are the stronger elements of a credit application that it offsets something weaker in the application) but it’s more complicated than that. Different FHA Lenders manage the consideration of compensating factors in different ways. FHA’s written guidelines outline specific examples of what FHA compensating factors…

FHA Mortgage Lenders Manual Underwriting Approvals

FHA Manual Underwrite Lenders Specifications CREDIT SCORE RANGE MAXIMUM QUALIFYING RATIOS APPLICABLE GUIDELINE 500 – 579 ·31/43 ·Energy Efficient Homes may stretch ratios to 33/45 ·Max LTV 90% unless cash out (80%) ·No gifts ·No down payment assistance ·No streamlines ·One month in reserves for 1-2-unit Properties, three months in reserves for 3-4-unit properties (cannot be a…

FHA Mortgage Lenders Allow Non Occupant Co Borrowers

FHA Mortgage Lenders Non-Occupant co borrower 1-Unit properties only. Max mortgage is limited to 75% LTV unless non-occupying co- borrower’s meet FHA definition of ‘family member’. Seller cannot be non-occupant co-borrower. Non-occupant co-borrowers may be added to improve ratios. Non-occupant co-borrowers cannot be used to overcome or offset borrower’s derogatory credit. The non-occupying borrower arrangement…

FHA Mortgage Lenders Source Of Down Payment And Reserves

FHA Mortgage Lenders require a minimum cash investment from FHA mortgage applicants own funds and/or gift (no cash on hand allowed when FHA mortgage applicants uses traditional banking sources and has traditional credit history). Any deposit 1 % and greater of the sales price must be sourced and seasoned. An aggregate of deposits 1 °/o…

FHA Mortgage Lenders Can Use Non Taxable Income To Qualify

FHA Mortgage Lenders Allow Nontaxable income such as Social Security, Pension, Workers Comp and Disability Retirement income can be grossed up 115% of the income can be used to qualify for an FHA mortgage loan. Unacceptable Sources of Income Include: The following income sources are not acceptable for purposes of qualifying the borrower: Any unverified…

FHA Mortgage Lenders Debt To Income Ratios

Debt Ratio – Loans with AUS Approve/Eligible – follow AUS decision. Credit scores of 640 and under and DTI greater than 43% regardless of AUS decision require explanation for derogatory credit and a VOR or rent free letter (if applicable). Manually underwritten loans with FICO score> 580 may exceed 31°/o/43°/o ratios with acceptable compensating factors…

FHA Mortgage Lenders Cash-Out Refinance Payment History

FHA Mortgage Lenders Mortgage/Rental History Payment History All Cash Out Refinance Transactions and Manually Underwritten Rate Term Refinance Transactions: No 30 Day late payments within the last 12 months of case number assignment. FHA Mortgage Lenders Rate and Term Refinance Transactions: AUS Accept – follow AUS. ALSO CHECK FHA Mortgage Lenders Compensating Factors FHA COMPENSATING…

FHA Mortgage Lenders Minimum Trade Line Requirement

FHA Minimum Tradelines or Minimum Credit Reporting History FHA mortgage applicants must have sufficient credit history to generate a valid FICO score, or FHA mortgage applicants must meet the non-traditional FHA mortgage lenders guidelines listed below. Generally, an acceptable credit history does not have late housing, installment debt or major derogatory revolving payments. Authorized tradelines…

FHA Mortgage Lenders With Student Loans

How Do FHA Mortgage Lenders treat Student Loans? Student Loan Payments – Student loan(s) would be calculated as follows, regardless of the payment status. FHA mortgage lenders must use either the greater of: 1% of the outstanding balance on the loan; or the monthly payment reported on the FHA mortgage applicants credit report; or the…

FHA Mortgage Lenders Approval With Disputed Accounts

FHA Mortgage Lenders Approval With Disputed Accounts derogatory accounts >= $1,000 cumulative must be downgraded to “Refer” manual underwrite. Medical and accounts resulting from identity and credit card theft or unauthorized use are excluded. A letter from the creditor, police report, etc. is required. Disputed non-derogatory accounts are excluded from the $1000 cumulative total which…

FHA Mortgage Lenders Approval With Loan Modifications

FHA Mortgage Lenders Approval After A Loan Modifications FHA Mortgage Lenders Automated Underwriting System required to follow guidance for acceptable mortgage history. Manual Underwrite -follow manual mortgage requirements (Ox30 for most recent 12 months and 2×30 for the most recent 24 months on the modified mortgage.) Payment history is evaluated based upon the FHA mortgage…

FHA Mortgage Lenders Qualifying Requirements After A Short Sale

FHA Mortgage Qualifying After A Short Sale Any Short Sale within three (3) years of the case assignment requires a manual underwrite. An FHA mortgage applicant who is in default at the time of short sale/restructure or pre-foreclosure or late on any mortgage or installment obligations within 12 months of the short sale is not…

FHA Mortgage Lenders After Foreclosure or Deed In Lieu of Foreclosure

What are the guidelines for FHA mortgage applicants with a previous foreclosure or deed-in-lieu of foreclosure? A FHA mortgage applicants is generally NOT eligible for a new FHA-insured mortgage if the Borrower had a foreclosure or a deed-in-lieu of foreclosure in the last 3 three-year period prior to the date of case number assignment. This…

FHA Mortgage Lenders DoNot Consider Timeshares A Housing Obligation

Is a foreclosure on a timeshare considered a mortgage foreclosure or installment loan? A loan secured by an interest in a timeshare must be considered an Installment Loan and NOT a housing obligation and not considered a Foreclosure event! Also Check out! FHA Mortgage Lenders Credit Score For FHA Mortgage Qualifying FHA Mortgage Lenders After…

PORT ST. LUCIE FLORIDA MORTGAGE AND CITY DATA

Population in 2013: 171,016 (100% urban, 0% rural). Population change since 2000: +92.7%

Males: 83,814 (49.0%)

Females: 87,202 (51.0%)

Median resident age: 40.9 years

Florida median age: 41.5 years

Zip codes: 34953, 34983, 34984, 34986, 34987.

Port St. Lucie Zip Code Map

Estimated median household income in 2013: $48,562 (it was $40,509 in 2000)

Port St. Lucie: $48,562

FL: $46,036

Estimated per capita income in 2013: $22,966 (it was $18,059 in 2000)

Port St. Lucie city income, earnings, and wages data

Estimated median house or condo value in 2013: $135,400 (it was $87,700 in 2000)

Port St. Lucie: $135,400

FL: $153,300

Mean prices in 2013: All housing units: $150,892; Detached houses: $153,451; Townhouses or other attached units: $97,067; In 2-unit structures: $125,472; In 3-to-4-unit structures: $69,755; In 5-or-more-unit structures: $126,963; Mobile homes: $23,351

Median gross rent in 2013: $1,208.

Recent home sales, real estate maps, and home value estimator for zip codes: 34945, 34952, 34953, 34983, 34984, 34986, 34987.

Port St. Lucie, FL residents, houses, and apartments details

CAPE CORAL FL FHA-VA-Self Employed MORTGAGE LENDERS

To discuss any of our full service Cape Coral Florida programs including, FHA minimum score 550, FHA Cash Out and Streamlines refinancing, Private lenders, Jumbo Loans, VA Mortgage loans down to 550 and Foreign National Loans. Note All Subject to change without notice. CAPE CORAL FL MORTGAGE …