| Title |

| 3.5% BOCA FLORIDA MORTGAGE LENDERS |

| 3.5% DAYTONA FL CONDO MORTGAGE LENDERS |

| 3.5%MIAMI FL CONDO MORTGAGE LENDERS |

| 3% PALM COAST FL CONDO MORTGAGE LENDERS |

| ABE SPRINGS FL CONDO MORTGAGE LENDERS |

| ADAMSVILLE, HILLSBOROUGH COUNTY FL CONDO MORTGAGE LENDERS |

| ADAMSVILLE, SUMTER COUNTY FL CONDO MORTGAGE LENDERS |

| ALACHUA FL CONDO MORTGAGE LENDERS |

| ALAFAYA FL CONDO MORTGAGE LENDERS |

| ALAFIA FL CONDO MORTGAGE LENDERS |

| ALAMANA FL CONDO MORTGAGE LENDERS |

| ALLANDALE FL CONDO MORTGAGE LENDERS |

| ALLIGATOR POINT FL CONDO MORTGAGE LENDERS |

| ALTAMONTE SPRINGS FL CONDO MORTGAGE LENDERS |

| ALTON FL CONDO MORTGAGE LENDERS |

| ALTURAS FL CONDO MORTGAGE LENDERS |

| AMELIA CITY FL CONDO MORTGAGE LENDERS |

| AMERICAN BEACH FL CONDO MORTGAGE LENDERS |

| ANGLERS PARK FL CONDO MORTGAGE LENDERS |

| ANNA MARIA FL CONDO MORTGAGE LENDERS |

| ANTHONY FL CONDO MORTGAGE LENDERS |

| ANTIOCH FL CONDO MORTGAGE LENDERS |

| APALACHICOLA FL CONDO MORTGAGE LENDERS |

| APOPKA FL CONDO MORTGAGE LENDERS |

| ARGYLE FL CONDO MORTGAGE LENDERS |

| ARIPEKA FL CONDO MORTGAGE LENDERS |

| ARMSTRONG FL CONDO MORTGAGE LENDERS |

| ATLANTIC BEACH FL CONDO MORTGAGE LENDERS |

| AUBURNDALE FL CONDO MORTGAGE LENDERS |

| AUCILLA FL CONDO MORTGAGE LENDERS |

| AURANTIA FL CONDO MORTGAGE LENDERS |

| AVENTURA FL CONDO MORTGAGE LENDERS |

| AVON PARK FL CONDO MORTGAGE LENDERS |

| AZALEA PARK FL CONDO MORTGAGE LENDERS |

| BAKER FL CONDO MORTGAGE LENDERS |

| BAL HARBOUR FL CONDO MORTGAGE LENDERS |

| BALD POINT FL CONDO MORTGAGE LENDERS |

| BANANA FL CONDO MORTGAGE LENDERS |

| BARBER QUARTERS FL CONDO MORTGAGE LENDERS |

| BARBERVILLE FL CONDO MORTGAGE LENDERS |

| BARDIN FL CONDO MORTGAGE LENDERS |

| BARDMOOR FL CONDO MORTGAGE LENDERS |

| BAREFOOT BAY FL CONDO MORTGAGE LENDERS |

| BARRINEAU PARK FL CONDO MORTGAGE LENDERS |

| BARTOW FL CONDO MORTGAGE LENDERS |

| BAY CREST PARK FL CONDO MORTGAGE LENDERS |

| BAY HARBOR ISLANDS FL CONDO MORTGAGE LENDERS |

| BAY PINES FL CONDO MORTGAGE LENDERS |

| BAY POINT, MONROE COUNTY FL CONDO MORTGAGE LENDERS |

| BAYOU GEORGE FL CONDO MORTGAGE LENDERS |

| BEALSVILLE FL CONDO MORTGAGE LENDERS |

| BEAR CREEK FL CONDO MORTGAGE LENDERS |

| BECKER FL CONDO MORTGAGE LENDERS |

| BELAIR, LEON COUNTY FL CONDO MORTGAGE LENDERS |

| BELLAIR, CLAY COUNTY FL CONDO MORTGAGE LENDERS |

| BENSON JUNCTION FL CONDO MORTGAGE LENDERS |

| BETHLEHEM FL CONDO MORTGAGE LENDERS |

| BETHUNE BEACH FL CONDO MORTGAGE LENDERS |

| BIG COPPITT KEY FL CONDO MORTGAGE LENDERS |

| BIG PINE KEY FL CONDO MORTGAGE LENDERS |

| BIMINI FL CONDO MORTGAGE LENDERS |

| BISCAYNE GARDENS FL CONDO MORTGAGE LENDERS |

| BITHLO FL CONDO MORTGAGE LENDERS |

| BOARDMAN FL CONDO MORTGAGE LENDERS |

| BOCA GRANDE FL CONDO MORTGAGE LENDERS |

| BOCA RATON FL CONDO MORTGAGE LENDERS |

| BODEN FL CONDO MORTGAGE LENDERS |

| BONITA SPRINGS FL CONDO MORTGAGE LENDERS |

| BOSTWICK FL CONDO MORTGAGE LENDERS |

| BOULOGNE FL CONDO MORTGAGE LENDERS |

| BOYETTE FL CONDO MORTGAGE LENDERS |

| BOYNTON BEACH FL CONDO MORTGAGE LENDERS |

| BRADENTON FL CONDO MORTGAGE LENDERS |

| BRADFORDVILLE FL CONDO MORTGAGE LENDERS |

| BRADLEY JUNCTION FL CONDO MORTGAGE LENDERS |

| BROAD BRANCH FL CONDO MORTGAGE LENDERS |

| BROOKSVILLE FL CONDO MORTGAGE LENDERS |

| BROWNSVILLE FL CONDO MORTGAGE LENDERS |

| BROWNSVILLE, ESCAMBIA COUNTY FL CONDO MORTGAGE LENDERS |

| BROWNVILLE FL CONDO MORTGAGE LENDERS |

| BRYANT FL CONDO MORTGAGE LENDERS |

| BRYCEVILLE FL CONDO MORTGAGE LENDERS |

| BULL CREEK FL CONDO MORTGAGE LENDERS |

| CANAVERAL GROVES FL CONDO MORTGAGE LENDERS |

| CANDLER FL CONDO MORTGAGE LENDERS |

| CAPE CANAVERAL FL CONDO MORTGAGE LENDERS |

| CAPE CORAL FL CONDO MORTGAGE LENDERS |

| CAPE SAN BLAS FL CONDO MORTGAGE LENDERS |

| CAPITOLA FL CONDO MORTGAGE LENDERS |

| CAPPS FL CONDO MORTGAGE LENDERS |

| CARNESTOWN FL CONDO MORTGAGE LENDERS |

| CARROLLWOOD FL CONDO MORTGAGE LENDERS |

| CARROLLWOOD VILLAGE FL CONDO MORTGAGE LENDERS |

| CASSADAGA FL CONDO MORTGAGE LENDERS |

| CASSELBERRY FL CONDO MORTGAGE LENDERS |

| CELEBRATION FL CONDO MORTGAGE LENDERS |

| CENTERVILLE FL CONDO MORTGAGE LENDERS |

| CHAIRES FL CONDO MORTGAGE LENDERS |

| CHARLOTTE HARBOR FL CONDO MORTGAGE LENDERS |

| CHASON FL CONDO MORTGAGE LENDERS |

| CHATHAM FL CONDO MORTGAGE LENDERS |

| CHIPLEY FL CONDO MORTGAGE LENDERS |

| CHRISTMAS FL CONDO MORTGAGE LENDERS |

| CINCO BAYOU FL CONDO MORTGAGE LENDERS |

| CITRA FL CONDO MORTGAGE LENDERS |

| CITRUS CENTER FL CONDO MORTGAGE LENDERS |

| CLAIR-MEL CITY FL CONDO MORTGAGE LENDERS |

| CLARCONA FL CONDO MORTGAGE LENDERS |

| CLARKSVILLE FL CONDO MORTGAGE LENDERS |

| CLAY HILL FL CONDO MORTGAGE LENDERS |

| CLEARWATER FL CONDO MORTGAGE LENDERS |

| CLEWISTON FL CONDO MORTGAGE LENDERS |

| COCOA BEACH FL CONDO MORTGAGE LENDERS |

| COCOA FL CONDO MORTGAGE LENDERS |

| COCONUT CREEK FL CONDO MORTGAGE LENDERS |

| CODY FL CONDO MORTGAGE LENDERS |

| CODY’S CORNER FL CONDO MORTGAGE LENDERS |

| CONCH KEY FL CONDO MORTGAGE LENDERS |

| CONWAY FL CONDO MORTGAGE LENDERS |

| COOPERTOWN FL CONDO MORTGAGE LENDERS |

| COPELAND FL CONDO MORTGAGE LENDERS |

| CORAL GABLES FL CONDO MORTGAGE LENDERS |

| CORAL SPRINGS FL CONDO MORTGAGE LENDERS |

| CORAL TERRACE FL CONDO MORTGAGE LENDERS |

| CORAL WAY VILLAGE FL CONDO MORTGAGE LENDERS |

| COUNTRY CLUB FL CONDO MORTGAGE LENDERS |

| COURTENAY FL CONDO MORTGAGE LENDERS |

| COW CREEK FL CONDO MORTGAGE LENDERS |

| COX FL CONDO MORTGAGE LENDERS |

| CRAGGS FL CONDO MORTGAGE LENDERS |

| CRAWFORD FL CONDO MORTGAGE LENDERS |

| CRAWFORDVILLE FL CONDO MORTGAGE LENDERS |

| CREIGHTON FL CONDO MORTGAGE LENDERS |

| CROOM-A-COOCHEE FL CONDO MORTGAGE LENDERS |

| CROSS CREEK FL CONDO MORTGAGE LENDERS |

| CRYSTAL BEACH FL CONDO MORTGAGE LENDERS |

| CRYSTAL RIVER FL CONDO MORTGAGE LENDERS |

| CUBITIS FL CONDO MORTGAGE LENDERS |

| CUDJOE KEY FL CONDO MORTGAGE LENDERS |

| CURTIS FL CONDO MORTGAGE LENDERS |

| CYPRESS FL CONDO MORTGAGE LENDERS |

| DAHLBERG FL CONDO MORTGAGE LENDERS |

| DAHOMA FL CONDO MORTGAGE LENDERS |

| DALKEITH FL CONDO MORTGAGE LENDERS |

| DANIA BEACH FL CONDO MORTGAGE LENDERS |

| DAVIE FL CONDO MORTGAGE LENDERS |

| DAY FL CONDO MORTGAGE LENDERS |

| DAYTONA BEACH FL CONDO MORTGAGE LENDERS |

| DEEM CITY FL CONDO MORTGAGE LENDERS |

| DEEP CREEK FL CONDO MORTGAGE LENDERS |

| DEER PARK FL CONDO MORTGAGE LENDERS |

| DEERFIELD BEACH FL CONDO MORTGAGE LENDERS |

| DEERING BAY FL CONDO MORTGAGE LENDERS |

| DEERLAND FL CONDO MORTGAGE LENDERS |

| DEFUNIAK SPRINGS FL CONDO MORTGAGE LENDERS |

| DEL RIO FL CONDO MORTGAGE LENDERS |

| DELAND FL CONDO MORTGAGE LENDERS |

| DELRAY BEACH FL CONDO MORTGAGE LENDERS |

| DELTONA FL CONDO MORTGAGE LENDERS |

| DESTIN FL CONDO MORTGAGE LENDERS |

| DOCTORS INLET FL CONDO MORTGAGE LENDERS |

| DOGTOWN FL CONDO MORTGAGE LENDERS |

| DOWLING PARK FL CONDO MORTGAGE LENDERS |

| DR. PHILLIPS FL CONDO MORTGAGE LENDERS |

| DRIFTON FL CONDO MORTGAGE LENDERS |

| DUCK KEY FL CONDO MORTGAGE LENDERS |

| DUNEDIN FL CONDO MORTGAGE LENDERS |

| DUPONT FL CONDO MORTGAGE LENDERS |

| DURANT FL CONDO MORTGAGE LENDERS |

| DYAL FL CONDO MORTGAGE LENDERS |

| EAGLE LAKE FL CONDO MORTGAGE LENDERS |

| EARLETON FL CONDO MORTGAGE LENDERS |

| EAST LAKE WEIR FL CONDO MORTGAGE LENDERS |

| EAST LAKE, HILLSBOROUGH COUNTY FL CONDO MORTGAGE LENDERS |

| EAST LAKE, PINELLAS COUNTY FL CONDO MORTGAGE LENDERS |

| EAST NAPLES FL CONDO MORTGAGE LENDERS |

| EAST TAMPA FL CONDO MORTGAGE LENDERS |

| EATON PARK FL CONDO MORTGAGE LENDERS |

| EDGAR FL CONDO MORTGAGE LENDERS |

| EDGEVILLE FL CONDO MORTGAGE LENDERS |

| EDGEWATER FL CONDO MORTGAGE LENDERS |

| EDGEWOOD FL CONDO MORTGAGE LENDERS |

| EGYPT LAKE FL CONDO MORTGAGE LENDERS |

| EL CHICO FL CONDO MORTGAGE LENDERS |

| EL JOBEAN FL CONDO MORTGAGE LENDERS |

| ELKTON FL CONDO MORTGAGE LENDERS |

| EMATHLA FL CONDO MORTGAGE LENDERS |

| EMPORIA FL CONDO MORTGAGE LENDERS |

| ENTERPRISE FL CONDO MORTGAGE LENDERS |

| ESCAMBIA FARMS FL CONDO MORTGAGE LENDERS |

| ESPANOLA FL CONDO MORTGAGE LENDERS |

| ESTIFFANULGA FL CONDO MORTGAGE LENDERS |

| EUFALA FL CONDO MORTGAGE LENDERS |

| EUSTIS FL CONDO MORTGAGE LENDERS |

| EVERGREEN FL CONDO MORTGAGE LENDERS |

| EVINSTON FL CONDO MORTGAGE LENDERS |

| FAIRFIELD FL CONDO MORTGAGE LENDERS |

| FAIRVIEW SHORES FL CONDO MORTGAGE LENDERS |

| FAIRVILLA FL CONDO MORTGAGE LENDERS |

| FALMOUTH FL CONDO MORTGAGE LENDERS |

| FANLEW FL CONDO MORTGAGE LENDERS |

| FARMTON FL CONDO MORTGAGE LENDERS |

| FAVORETTA FL CONDO MORTGAGE LENDERS |

| FEATHER SOUND FL CONDO MORTGAGE LENDERS |

| FEDERAL POINT FL CONDO MORTGAGE LENDERS |

| FELDA FL CONDO MORTGAGE LENDERS |

| FELKEL FL CONDO MORTGAGE LENDERS |

| FELLOWSHIP FL CONDO MORTGAGE LENDERS |

| FERN CREST VILLAGE FL CONDO MORTGAGE LENDERS |

| FERN PARK FL CONDO MORTGAGE LENDERS |

| FHA+VA FLORIDA FL CONDO MORTGAGE LENDERS |

| FISH CREEK FL CONDO MORTGAGE LENDERS |

| FISHER CORNER FL CONDO MORTGAGE LENDERS |

| FIVE POINTS, WASHINGTON COUNTY FL CONDO MORTGAGE LENDERS |

| FLAGLER ESTATES FL CONDO MORTGAGE LENDERS |

| FLEMING ISLAND FL CONDO MORTGAGE LENDERS |

| FLORAHOME FL CONDO MORTGAGE LENDERS |

| FLORIDANA BEACH FL CONDO MORTGAGE LENDERS |

| FORT BRADEN FL CONDO MORTGAGE LENDERS |

| FORT LAUDERDALE FL CONDO MORTGAGE LENDERS |

| FORT MASON FL CONDO MORTGAGE LENDERS |

| FORT MCCOY FL CONDO MORTGAGE LENDERS |

| FORT MEADE FL CONDO MORTGAGE LENDERS |

| FORT MYERS BEACH FL CONDO MORTGAGE LENDERS |

| FORT MYERS FL CONDO MORTGAGE LENDERS |

| FORT OGDEN FL CONDO MORTGAGE LENDERS |

| FORT PIERCE FL CONDO MORTGAGE LENDERS |

| FORT WALTON BEACH FL CONDO MORTGAGE LENDERS |

| FORTYMILE BEND FL CONDO MORTGAGE LENDERS |

| FOUNTAIN FL CONDO MORTGAGE LENDERS |

| FOWLER’S BLUFF FL CONDO MORTGAGE LENDERS |

| FRANKLINTOWN FL CONDO MORTGAGE LENDERS |

| FRINK FL CONDO MORTGAGE LENDERS |

| FROG CITY FL CONDO MORTGAGE LENDERS |

| FRUITLAND PARK FL CONDO MORTGAGE LENDERS |

| GAINESVILLE FL CONDO MORTGAGE LENDERS |

| GANDY FL CONDO MORTGAGE LENDERS |

| GARDEN COVE FL CONDO MORTGAGE LENDERS |

| GARDEN GROVE FL CONDO MORTGAGE LENDERS |

| GARDNER FL CONDO MORTGAGE LENDERS |

| GASKINS FL CONDO MORTGAGE LENDERS |

| GEORGETOWN FL CONDO MORTGAGE LENDERS |

| GIBSONIA FL CONDO MORTGAGE LENDERS |

| GLENWOOD HEIGHTS FL CONDO MORTGAGE LENDERS |

| GRAHAM FL CONDO MORTGAGE LENDERS |

| GRAND ISLAND FL CONDO MORTGAGE LENDERS |

| GRANDIN FL CONDO MORTGAGE LENDERS |

| GRAYTON BEACH FL CONDO MORTGAGE LENDERS |

| GRAYVIK FL CONDO MORTGAGE LENDERS |

| GREEN COVE SPRINGS FL CONDO MORTGAGE LENDERS |

| GREEN-MAR ACRES FL CONDO MORTGAGE LENDERS |

| GREENACRES FL CONDO MORTGAGE LENDERS |

| GREENBRIAR FL CONDO MORTGAGE LENDERS |

| GREENHEAD FL CONDO MORTGAGE LENDERS |

| GULF BREEZE FL CONDO MORTGAGE LENDERS |

| GULF HAMMOCK FL CONDO MORTGAGE LENDERS |

| GULF HARBORS FL CONDO MORTGAGE LENDERS |

| GULFPORT FL CONDO MORTGAGE LENDERS |

| HAGUE FL CONDO MORTGAGE LENDERS |

| HAILE FL CONDO MORTGAGE LENDERS |

| HAILE PLANTATION FL CONDO MORTGAGE LENDERS |

| HAINES CITY FL CONDO MORTGAGE LENDERS |

| HALLANDALE BEACH FL CONDO MORTGAGE LENDERS |

| HARBOR BLUFFS FL CONDO MORTGAGE LENDERS |

| HARMONY FL CONDO MORTGAGE LENDERS |

| HASAN FL CONDO MORTGAGE LENDERS |

| HAWLEY HEIGHTS FL CONDO MORTGAGE LENDERS |

| HAWTHORNE FL CONDO MORTGAGE LENDERS |

| HENDERSON MILL FL CONDO MORTGAGE LENDERS |

| HIALEAH FL CONDO MORTGAGE LENDERS |

| HIALEAH GARDENS FL CONDO MORTGAGE LENDERS |

| HIBERNIA FL CONDO MORTGAGE LENDERS |

| HIGHLAND BEACH FL CONDO MORTGAGE LENDERS |

| HIGHLAND LAKES FL CONDO MORTGAGE LENDERS |

| HIGHLAND VIEW FL CONDO MORTGAGE LENDERS |

| HIGHPOINT FL CONDO MORTGAGE LENDERS |

| HILLIARDVILLE FL CONDO MORTGAGE LENDERS |

| HINSON FL CONDO MORTGAGE LENDERS |

| HOLDEN HEIGHTS FL CONDO MORTGAGE LENDERS |

| HOLDER FL CONDO MORTGAGE LENDERS |

| HOLLISTER FL CONDO MORTGAGE LENDERS |

| HOLLY HILL FL CONDO MORTGAGE LENDERS |

| HOLLYWOOD FL CONDO MORTGAGE LENDERS |

| HOLMES BEACH FL CONDO MORTGAGE LENDERS |

| HOLMES VALLEY FL CONDO MORTGAGE LENDERS |

| HOLOPAW FL CONDO MORTGAGE LENDERS |

| HOLT FL CONDO MORTGAGE LENDERS |

| HOMELAND FL CONDO MORTGAGE LENDERS |

| HOMESTEAD FL CONDO MORTGAGE LENDERS |

| HOPEWELL GARDENS FL CONDO MORTGAGE LENDERS |

| HOPEWELL, HILLSBOROUGH COUNTY FL CONDO MORTGAGE LENDERS |

| HOPEWELL, MADISON COUNTY FL CONDO MORTGAGE LENDERS |

| HORIZON WEST FL CONDO MORTGAGE LENDERS |

| HOSFORD FL CONDO MORTGAGE LENDERS |

| HOWARD FL CONDO MORTGAGE LENDERS |

| HUDSON BEACH FL CONDO MORTGAGE LENDERS |

| HULL FL CONDO MORTGAGE LENDERS |

| HUNTER’S CREEK FL CONDO MORTGAGE LENDERS |

| HUNTINGTON, MARION COUNTY FL CONDO MORTGAGE LENDERS |

| HUNTINGTON, PUTNAM COUNTY FL CONDO MORTGAGE LENDERS |

| HYPOLUXO FL CONDO MORTGAGE LENDERS |

| IAMONIA FL CONDO MORTGAGE LENDERS |

| INDIALANTIC FL CONDO MORTGAGE LENDERS |

| INDIAN LAKE ESTATES FL CONDO MORTGAGE LENDERS |

| INDIAN MOUND VILLAGE FL CONDO MORTGAGE LENDERS |

| INDIANOLA FL CONDO MORTGAGE LENDERS |

| INGLE FL CONDO MORTGAGE LENDERS |

| INNERARITY POINT FL CONDO MORTGAGE LENDERS |

| INTERCESSION CITY FL CONDO MORTGAGE LENDERS |

| IOLEE FL CONDO MORTGAGE LENDERS |

| IRVINE FL CONDO MORTGAGE LENDERS |

| ISLAND GROVE FL CONDO MORTGAGE LENDERS |

| ISLANDIA FL CONDO MORTGAGE LENDERS |

| ISLEWORTH FL CONDO MORTGAGE LENDERS |

| ITALIA FL CONDO MORTGAGE LENDERS |

| JACKSONVILLE FL CONDO MORTGAGE LENDERS |

| JEROME FL CONDO MORTGAGE LENDERS |

| JEWFISH FL CONDO MORTGAGE LENDERS |

| JONESVILLE FL CONDO MORTGAGE LENDERS |

| JOSHUA FL CONDO MORTGAGE LENDERS |

| JULINGTON CREEK PLANTATION FL CONDO MORTGAGE LENDERS |

| JUNO BEACH FL CONDO MORTGAGE LENDERS |

| JUPITER FL CONDO MORTGAGE LENDERS |

| KALAMAZOO FL CONDO MORTGAGE LENDERS |

| KENANSVILLE FL CONDO MORTGAGE LENDERS |

| KENDALL FL CONDO MORTGAGE LENDERS |

| KENDALL WEST FL CONDO MORTGAGE LENDERS |

| KENT FL CONDO MORTGAGE LENDERS |

| KEY BISCAYNE FL CONDO MORTGAGE LENDERS |

| KEY HAVEN FL CONDO MORTGAGE LENDERS |

| KEY WEST FL CONDO MORTGAGE LENDERS |

| KEYSVILLE FL CONDO MORTGAGE LENDERS |

| KILLARNEY FL CONDO MORTGAGE LENDERS |

| KINARD FL CONDO MORTGAGE LENDERS |

| KINGS FERRY FL CONDO MORTGAGE LENDERS |

| KISSIMMEE FL CONDO MORTGAGE LENDERS |

| KNIGHTS FL CONDO MORTGAGE LENDERS |

| KORONA FL CONDO MORTGAGE LENDERS |

| LABELLE FL CONDO MORTGAGE LENDERS |

| LADY LAKE FL CONDO MORTGAGE LENDERS |

| LAKE ALFRED FL CONDO MORTGAGE LENDERS |

| LAKE BUTLER, ORANGE COUNTY FL CONDO MORTGAGE LENDERS |

| LAKE COMO FL CONDO MORTGAGE LENDERS |

| LAKE FERN FL CONDO MORTGAGE LENDERS |

| LAKE GENEVA FL CONDO MORTGAGE LENDERS |

| LAKE HART FL CONDO MORTGAGE LENDERS |

| LAKE MARY FL CONDO MORTGAGE LENDERS |

| LAKE MARY JANE FL CONDO MORTGAGE LENDERS |

| LAKE MONROE FL CONDO MORTGAGE LENDERS |

| LAKE PARK FL CONDO MORTGAGE LENDERS |

| LAKE SUZY FL CONDO MORTGAGE LENDERS |

| LAKE TALLAVANA FL CONDO MORTGAGE LENDERS |

| LAKE WALES FL CONDO MORTGAGE LENDERS |

| LAKE WORTH FL CONDO MORTGAGE LENDERS |

| LAKELAND FL CONDO MORTGAGE LENDERS |

| LAKEPORT FL CONDO MORTGAGE LENDERS |

| LAKESHORE FL CONDO MORTGAGE LENDERS |

| LAKEWOOD FL CONDO MORTGAGE LENDERS |

| LAKEWOOD RANCH FL CONDO MORTGAGE LENDERS |

| LAMONT FL CONDO MORTGAGE LENDERS |

| LANARK VILLAGE FL CONDO MORTGAGE LENDERS |

| LANIER FL CONDO MORTGAGE LENDERS |

| LANSING FL CONDO MORTGAGE LENDERS |

| LANTANA FL CONDO MORTGAGE LENDERS |

| LARGO FL CONDO MORTGAGE LENDERS |

| LAUDERDALE BY THE SEA FL CONDO MORTGAGE LENDERS |

| LAUDERHILL FL CONDO MORTGAGE LENDERS |

| LEESBURG FL CONDO MORTGAGE LENDERS |

| LEMON BLUFF FL CONDO MORTGAGE LENDERS |

| LEONARDS FL CONDO MORTGAGE LENDERS |

| LESSIE FL CONDO MORTGAGE LENDERS |

| LETO FL CONDO MORTGAGE LENDERS |

| LIGHTHOUSE POINT FL CONDO MORTGAGE LENDERS |

| LILLIBRIDGE FL CONDO MORTGAGE LENDERS |

| LINDEN FL CONDO MORTGAGE LENDERS |

| LITHIA FL CONDO MORTGAGE LENDERS |

| LITTLE LAKE CITY FL CONDO MORTGAGE LENDERS |

| LLOYD FL CONDO MORTGAGE LENDERS |

| LOCHLOOSA FL CONDO MORTGAGE LENDERS |

| LONGBOAT KEY FL CONDO MORTGAGE LENDERS |

| LONGWOOD FL CONDO MORTGAGE LENDERS |

| LORIDA FL CONDO MORTGAGE LENDERS |

| LOTTIEVILLE FL CONDO MORTGAGE LENDERS |

| LOWELL FL CONDO MORTGAGE LENDERS |

| LOXAHATCHEE FL CONDO MORTGAGE LENDERS |

| LUDLAM FL CONDO MORTGAGE LENDERS |

| LULU FL CONDO MORTGAGE LENDERS |

| MABEL FL CONDO MORTGAGE LENDERS |

| MAITLAND FL CONDO MORTGAGE LENDERS |

| MARCO ISLAND FL CONDO MORTGAGE LENDERS |

| MARGATE FL CONDO MORTGAGE LENDERS |

| MARION OAKS FL CONDO MORTGAGE LENDERS |

| MARTIN FL CONDO MORTGAGE LENDERS |

| MARYSVILLE FL CONDO MORTGAGE LENDERS |

| MAYTOWN FL CONDO MORTGAGE LENDERS |

| MCALPIN FL CONDO MORTGAGE LENDERS |

| MCDAVID FL CONDO MORTGAGE LENDERS |

| MCNEAL FL CONDO MORTGAGE LENDERS |

| MCRAE FL CONDO MORTGAGE LENDERS |

| MEADOWBROOK TERRACE FL CONDO MORTGAGE LENDERS |

| MEADOWCREST FL CONDO MORTGAGE LENDERS |

| MEDART FL CONDO MORTGAGE LENDERS |

| MELBOURNE BEACH FL CONDO MORTGAGE LENDERS |

| MELBOURNE FL CONDO MORTGAGE LENDERS |

| MELBOURNE SHORES FL CONDO MORTGAGE LENDERS |

| MELROSE FL CONDO MORTGAGE LENDERS |

| MERIDIAN FL CONDO MORTGAGE LENDERS |

| MIAMI FL CONDO MORTGAGE LENDERS |

| MIAMI FL CONDO MORTGAGE LENDERS |

| MICCOSUKEE FL CONDO MORTGAGE LENDERS |

| MIDWAY, SANTA ROSA COUNTY FL CONDO MORTGAGE LENDERS |

| MIKESVILLE FL CONDO MORTGAGE LENDERS |

| MILES CITY FL CONDO MORTGAGE LENDERS |

| MILLIGAN FL CONDO MORTGAGE LENDERS |

| MILLVILLE FL CONDO MORTGAGE LENDERS |

| MILTON FL CONDO MORTGAGE LENDERS |

| MINNEOLA FL CONDO MORTGAGE LENDERS |

| MIRAMAR FL CONDO MORTGAGE LENDERS |

| MONKEY BOX FL CONDO MORTGAGE LENDERS |

| MOUNT DORA FL CONDO MORTGAGE LENDERS |

| MOUNT PLEASANT FL CONDO MORTGAGE LENDERS |

| MOUNTAIN LAKE FL CONDO MORTGAGE LENDERS |

| MUCE FL CONDO MORTGAGE LENDERS |

| MYAKKA CITY FL CONDO MORTGAGE LENDERS |

| NALCREST FL CONDO MORTGAGE LENDERS |

| NAPLES FL CONDO MORTGAGE LENDERS |

| NARCOOSSEE FL CONDO MORTGAGE LENDERS |

| NASSAUVILLE FL CONDO MORTGAGE LENDERS |

| NAVARRE BEACH FL CONDO MORTGAGE LENDERS |

| NAVARRE FL CONDO MORTGAGE LENDERS |

| NEALS FL CONDO MORTGAGE LENDERS |

| NEPTUNE BEACH FL CONDO MORTGAGE LENDERS |

| NEW HOPE FL CONDO MORTGAGE LENDERS |

| NEW PORT RICHEY FL CONDO MORTGAGE LENDERS |

| NEW SMYRNA BEACH FL CONDO MORTGAGE LENDERS |

| NEWPORT, MONROE COUNTY FL CONDO MORTGAGE LENDERS |

| NEWPORT, WAKULLA COUNTY FL CONDO MORTGAGE LENDERS |

| NICEVILLE FL CONDO MORTGAGE LENDERS |

| NICHOLS FL CONDO MORTGAGE LENDERS |

| NOCATEE, DESOTO COUNTY FL CONDO MORTGAGE LENDERS |

| NOCATEE, ST. JOHNS COUNTY FL CONDO MORTGAGE LENDERS |

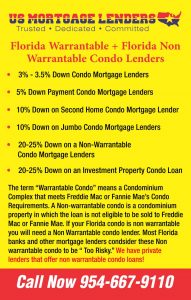

| NON WARRANTABLE CONDO LENDERS FLORIDA |

| NORTH MEADOWBROOK TERRACE FL CONDO MORTGAGE LENDERS |

| NORTH MIAMI BEACH FL CONDO MORTGAGE LENDERS |

| NORTH NAPLES FL CONDO MORTGAGE LENDERS |

| NORTH PORT FL CONDO MORTGAGE LENDERS |

| NORTH RUSKIN FL CONDO MORTGAGE LENDERS |

| NOWATNEY FL CONDO MORTGAGE LENDERS |

| O’BRIEN FL CONDO MORTGAGE LENDERS |

| O’NEIL FL CONDO MORTGAGE LENDERS |

| OAK RIDGE FL CONDO MORTGAGE LENDERS |

| OAKLAND PARK FL CONDO MORTGAGE LENDERS |

| OCALA FL CONDO MORTGAGE LENDERS |

| OCEAN RIDGE FL CONDO MORTGAGE LENDERS |

| OCHEESEE LANDING FL CONDO MORTGAGE LENDERS |

| OCHEESEULGA FL CONDO MORTGAGE LENDERS |

| OCHLOCKONEE FL CONDO MORTGAGE LENDERS |

| OCHOPEE FL CONDO MORTGAGE LENDERS |

| OCKLAWAHA FL CONDO MORTGAGE LENDERS |

| OCOEE FL CONDO MORTGAGE LENDERS |

| OJUS FL CONDO MORTGAGE LENDERS |

| OKEECHOBEE FL CONDO MORTGAGE LENDERS |

| OKEELANTA FL CONDO MORTGAGE LENDERS |

| OLD MYAKKA FL CONDO MORTGAGE LENDERS |

| OLD TOWN FL CONDO MORTGAGE LENDERS |

| OLDSMAR FL CONDO MORTGAGE LENDERS |

| OLUSTEE FL CONDO MORTGAGE LENDERS |

| ONA FL CONDO MORTGAGE LENDERS |

| ONECO FL CONDO MORTGAGE LENDERS |

| ORANGE BEND FL CONDO MORTGAGE LENDERS |

| ORANGE LAKE FL CONDO MORTGAGE LENDERS |

| ORANGE PARK FL CONDO MORTGAGE LENDERS |

| ORANGE SPRINGS FL CONDO MORTGAGE LENDERS |

| ORIENT PARK FL CONDO MORTGAGE LENDERS |

| ORIOLE BEACH FL CONDO MORTGAGE LENDERS |

| ORLANDO FL CONDO MORTGAGE LENDERS |

| ORLO VISTA FL CONDO MORTGAGE LENDERS |

| ORMOND BEACH FL CONDO MORTGAGE LENDERS |

| ORTONA, GLADES COUNTY FL CONDO MORTGAGE LENDERS |

| OSLO FL CONDO MORTGAGE LENDERS |

| OSTEEN FL CONDO MORTGAGE LENDERS |

| OVIEDO FL CONDO MORTGAGE LENDERS |

| OXFORD FL CONDO MORTGAGE LENDERS |

| OZELLO FL CONDO MORTGAGE LENDERS |

| OZONA FL CONDO MORTGAGE LENDERS |

| PAINTERS HILL FL CONDO MORTGAGE LENDERS |

| PALATKA FL CONDO MORTGAGE LENDERS |

| PALM BAY FL CONDO MORTGAGE LENDERS |

| PALM BEACH FARMS FL CONDO MORTGAGE LENDERS |

| PALM BEACH FL CONDO MORTGAGE LENDERS |

| PALM BEACH GARDENS FL CONDO MORTGAGE LENDERS |

| PALM HARBOR FL CONDO MORTGAGE LENDERS |

| PALM RIVER FL CONDO MORTGAGE LENDERS |

| PALMA SOLA FL CONDO MORTGAGE LENDERS |

| PALMDALE FL CONDO MORTGAGE LENDERS |

| PALMETTO FL CONDO MORTGAGE LENDERS |

| PANACEA FL CONDO MORTGAGE LENDERS |

| PANAMA CITY BEACH FL CONDO MORTGAGE LENDERS |

| PANAMA CITY FL CONDO MORTGAGE LENDERS |

| PARRISH FL CONDO MORTGAGE LENDERS |

| PELICAN LAKE FL CONDO MORTGAGE LENDERS |

| PEMBROKE PINES FL CONDO MORTGAGE LENDERS |

| PENNICHAW FL CONDO MORTGAGE LENDERS |

| PENSACOLA BEACH FL CONDO MORTGAGE LENDERS |

| PENSACOLA FL CONDO MORTGAGE LENDERS |

| PERDIDO KEY FL CONDO MORTGAGE LENDERS |

| PETERS FL CONDO MORTGAGE LENDERS |

| PICNIC FL CONDO MORTGAGE LENDERS |

| PINE ISLAND, CALHOUN COUNTY FL CONDO MORTGAGE LENDERS |

| PINE ISLAND, HILLSBOROUGH COUNTY FL CONDO MORTGAGE LENDERS |

| PINECREST FL CONDO MORTGAGE LENDERS |

| PINELLAS PARK FL CONDO MORTGAGE LENDERS |

| PINEOLA FL CONDO MORTGAGE LENDERS |

| PINETTA FL CONDO MORTGAGE LENDERS |

| PLANT CITY FL CONDO MORTGAGE LENDERS |

| PLANTATION FL CONDO MORTGAGE LENDERS |

| POMPANO BEACH FL CONDO MORTGAGE LENDERS |

| PONCE INLET FL CONDO MORTGAGE LENDERS |

| PORT ORANGE FL CONDO MORTGAGE LENDERS |

| PORT ST. LUCIE FL CONDO MORTGAGE LENDERS |

| PUNTA GORDA FL CONDO MORTGAGE LENDERS |

| RAINBOW LAKES ESTATES FL CONDO MORTGAGE LENDERS |

| RED HEAD FL CONDO MORTGAGE LENDERS |

| REDLAND FL CONDO MORTGAGE LENDERS |

| RESTON FL CONDO MORTGAGE LENDERS |

| RIDGECREST FL CONDO MORTGAGE LENDERS |

| RIO PINAR FL CONDO MORTGAGE LENDERS |

| ROCHELLE FL CONDO MORTGAGE LENDERS |

| ROCK HARBOR FL CONDO MORTGAGE LENDERS |

| ROCKLEDGE FL CONDO MORTGAGE LENDERS |

| ROCKY CREEK FL CONDO MORTGAGE LENDERS |

| ROLLINS CORNER FL CONDO MORTGAGE LENDERS |

| ROSEMARY BEACH FL CONDO MORTGAGE LENDERS |

| ROTONDA WEST FL CONDO MORTGAGE LENDERS |

| ROUND LAKE FL CONDO MORTGAGE LENDERS |

| ROYAL PALM BEACH FL CONDO MORTGAGE LENDERS |

| RUNYON FL CONDO MORTGAGE LENDERS |

| RUTLAND FL CONDO MORTGAGE LENDERS |

| SAFETY HARBOR FL CONDO MORTGAGE LENDERS |

| SALEM FL CONDO MORTGAGE LENDERS |

| SALT SPRINGS FL CONDO MORTGAGE LENDERS |

| SAMPSON CITY FL CONDO MORTGAGE LENDERS |

| SAN CASTLE FL CONDO MORTGAGE LENDERS |

| SAN MATEO FL CONDO MORTGAGE LENDERS |

| SANDERSON FL CONDO MORTGAGE LENDERS |

| SANFORD FL CONDO MORTGAGE LENDERS |

| SANIBEL FL CONDO MORTGAGE LENDERS |

| SANLANDO SPRINGS FL CONDO MORTGAGE LENDERS |

| SANTA MONICA FL CONDO MORTGAGE LENDERS |

| SANTA ROSA BEACH FL CONDO MORTGAGE LENDERS |

| SARASOTA FL CONDO MORTGAGE LENDERS |

| SATELLITE BEACH FL CONDO MORTGAGE LENDERS |

| SATSUMA FL CONDO MORTGAGE LENDERS |

| SCOTLAND FL CONDO MORTGAGE LENDERS |

| SCOTTOWN FL CONDO MORTGAGE LENDERS |

| SCOTTS FERRY FL CONDO MORTGAGE LENDERS |

| SCOTTSMOOR FL CONDO MORTGAGE LENDERS |

| SEACREST FL CONDO MORTGAGE LENDERS |

| SEASIDE FL CONDO MORTGAGE LENDERS |

| SEASIDE FL CONDO MORTGAGE LENDERS |

| SEBASTIAN FL CONDO MORTGAGE LENDERS |

| SELMAN FL CONDO MORTGAGE LENDERS |

| SENYAH FL CONDO MORTGAGE LENDERS |

| SEWALL’S POINT FL CONDO MORTGAGE LENDERS |

| SHADEVILLE FL CONDO MORTGAGE LENDERS |

| SHADY GROVE, JACKSON COUNTY FL CONDO MORTGAGE LENDERS |

| SHADY GROVE, TAYLOR COUNTY FL CONDO MORTGAGE LENDERS |

| SHALIMAR FL CONDO MORTGAGE LENDERS |

| SHELL POINT FL CONDO MORTGAGE LENDERS |

| SILVER PALM FL CONDO MORTGAGE LENDERS |

| SILVER SPRINGS FL CONDO MORTGAGE LENDERS |

| SLAVIA FL CONDO MORTGAGE LENDERS |

| SOUTHFORT FL CONDO MORTGAGE LENDERS |

| SOUTHPORT FL CONDO MORTGAGE LENDERS |

| SPARR FL CONDO MORTGAGE LENDERS |

| SPRING LAKE, HIGHLANDS COUNTY FL CONDO MORTGAGE LENDERS |

| SPUDS FL CONDO MORTGAGE LENDERS |

| ST. AUGUSTINE BEACH FL CONDO MORTGAGE LENDERS |

| ST. AUGUSTINE FL CONDO MORTGAGE LENDERS |

| ST. CATHERINE FL CONDO MORTGAGE LENDERS |

| ST. CLOUD FL CONDO MORTGAGE LENDERS |

| ST. HEBRON FL CONDO MORTGAGE LENDERS |

| ST. JOHN FL CONDO MORTGAGE LENDERS |

| ST. JOHNS FL CONDO MORTGAGE LENDERS |

| ST. JOSEPH, PASCO COUNTY FL CONDO MORTGAGE LENDERS |

| ST. PETE BEACH FL CONDO MORTGAGE LENDERS |

| ST. PETERSBURG FL CONDO MORTGAGE LENDERS |

| ST. TERESA FL CONDO MORTGAGE LENDERS |

| STOCK ISLAND FL CONDO MORTGAGE LENDERS |

| STUART FL CONDO MORTGAGE LENDERS |

| SUGARLOAF SHORES FL CONDO MORTGAGE LENDERS |

| SUMATRA FL CONDO MORTGAGE LENDERS |

| SUMMERFIELD FL CONDO MORTGAGE LENDERS |

| SUMMERLAND KEY FL CONDO MORTGAGE LENDERS |

| SUMNER FL CONDO MORTGAGE LENDERS |

| SUMTERVILLE FL CONDO MORTGAGE LENDERS |

| SUN ‘N LAKE OF SEBRING FL CONDO MORTGAGE LENDERS |

| SUN CITY FL CONDO MORTGAGE LENDERS |

| SUNNY HILLS FL CONDO MORTGAGE LENDERS |

| SUNNYSIDE FL CONDO MORTGAGE LENDERS |

| SUNSET POINT FL CONDO MORTGAGE LENDERS |

| SUNTREE FL CONDO MORTGAGE LENDERS |

| SURFSIDE FL CONDO MORTGAGE LENDERS |

| SUWANNEE FL CONDO MORTGAGE LENDERS |

| SVEA FL CONDO MORTGAGE LENDERS |

| SWEET GUM HEAD FL CONDO MORTGAGE LENDERS |

| SWEETWATER CREEK FL CONDO MORTGAGE LENDERS |

| SWEETWATER, HARDEE COUNTY FL CONDO MORTGAGE LENDERS |

| SWITZERLAND FL CONDO MORTGAGE LENDERS |

| SYDNEY FL CONDO MORTGAGE LENDERS |

| TAFT FL CONDO MORTGAGE LENDERS |

| TAINTSVILLE FL CONDO MORTGAGE LENDERS |

| TALLAHASSEE FL CONDO MORTGAGE LENDERS |

| TALLEVAST FL CONDO MORTGAGE LENDERS |

| TAMARAC FL CONDO MORTGAGE LENDERS |

| TAMPA FL CONDO MORTGAGE LENDERS |

| TANGELO PARK FL CONDO MORTGAGE LENDERS |

| TARPON SPRINGS FL CONDO MORTGAGE LENDERS |

| TARRYTOWN FL CONDO MORTGAGE LENDERS |

| TAVARES FL CONDO MORTGAGE LENDERS |

| TAVERNIER FL CONDO MORTGAGE LENDERS |

| TELOGIA FL CONDO MORTGAGE LENDERS |

| TEMPLE TERRACE FL CONDO MORTGAGE LENDERS |

| TERRA CEIA FL CONDO MORTGAGE LENDERS |

| THE ACREAGE FL CONDO MORTGAGE LENDERS |

| THOMPSON FL CONDO MORTGAGE LENDERS |

| TITUSVILLE FL CONDO MORTGAGE LENDERS |

| TRAIL CENTER FL CONDO MORTGAGE LENDERS |

| TREASURE ISLAND FL CONDO MORTGAGE LENDERS |

| TRILACOOCHEE FL CONDO MORTGAGE LENDERS |

| TRILBY FL CONDO MORTGAGE LENDERS |

| TURKEY CREEK FL CONDO MORTGAGE LENDERS |

| TWO EGG FL CONDO MORTGAGE LENDERS |

| TYLER FL CONDO MORTGAGE LENDERS |

| UNIVERSITY, ORANGE COUNTY FL CONDO MORTGAGE LENDERS |

| UPTHEGROVE BEACH FL CONDO MORTGAGE LENDERS |

| VALDEZ FL CONDO MORTGAGE LENDERS |

| VALPARAISO FL CONDO MORTGAGE LENDERS |

| VANDERBILT BEACH ESTATES FL CONDO MORTGAGE LENDERS |

| VANDERBILT BEACH FL CONDO MORTGAGE LENDERS |

| VENICE FL CONDO MORTGAGE LENDERS |

| VENUS FL CONDO MORTGAGE LENDERS |

| VERDIE FL CONDO MORTGAGE LENDERS |

| VERMONT HEIGHTS FL CONDO MORTGAGE LENDERS |

| VERO BEACH FL CONDO MORTGAGE LENDERS |

| VERO LAKE ESTATES FL CONDO MORTGAGE LENDERS |

| VIERA FL CONDO MORTGAGE LENDERS |

| VIKING FL CONDO MORTGAGE LENDERS |

| VINELAND FL CONDO MORTGAGE LENDERS |

| VIRGINIA VILLAGE FL CONDO MORTGAGE LENDERS |

| VOLUSIA FL CONDO MORTGAGE LENDERS |

| WACISSA FL CONDO MORTGAGE LENDERS |

| WADESBORO FL CONDO MORTGAGE LENDERS |

| WAKULLA BEACH FL CONDO MORTGAGE LENDERS |

| WALNUT HILL FL CONDO MORTGAGE LENDERS |

| WANNEE FL CONDO MORTGAGE LENDERS |

| WATERCOLOR FL CONDO MORTGAGE LENDERS |

| WATERS LAKE FL CONDO MORTGAGE LENDERS |

| WATERSOUND FL CONDO MORTGAGE LENDERS |

| WAUKEENAH FL CONDO MORTGAGE LENDERS |

| WEIRSDALE FL CONDO MORTGAGE LENDERS |

| WELCOME FL CONDO MORTGAGE LENDERS |

| WELLBORN FL CONDO MORTGAGE LENDERS |

| WELLINGTON FL CONDO MORTGAGE LENDERS |

| WEST KENDALL FL CONDO MORTGAGE LENDERS |

| WEST MELBOURNE FL CONDO MORTGAGE LENDERS |

| WEST PALM BEACH FL CONDO MORTGAGE LENDERS |

| WESTCHESTER FL CONDO MORTGAGE LENDERS |

| WESTON FL CONDO MORTGAGE LENDERS |

| WHISPERING PINES FL CONDO MORTGAGE LENDERS |

| WHITE CITY, GULF COUNTY FL CONDO MORTGAGE LENDERS |

| WILBUR-BY-THE-SEA FL CONDO MORTGAGE LENDERS |

| WILCOX FL CONDO MORTGAGE LENDERS |

| WILCOX JUNCTION FL CONDO MORTGAGE LENDERS |

| WILLIFORD FL CONDO MORTGAGE LENDERS |

| WILLIS FL CONDO MORTGAGE LENDERS |

| WILTON MANORS FL CONDO MORTGAGE LENDERS |

| WINDSOR, ALACHUA COUNTY FL CONDO MORTGAGE LENDERS |

| WINSTON FL CONDO MORTGAGE LENDERS |

| WINTER GARDEN FL CONDO MORTGAGE LENDERS |

| WINTER HAVEN FL CONDO MORTGAGE LENDERS |

| WINTER PARK FL CONDO MORTGAGE LENDERS |

| WINTER SPRINGS FL CONDO MORTGAGE LENDERS |

| YELVINGTON FL CONDO MORTGAGE LENDERS |

| YOUNGSTOWN FL CONDO MORTGAGE LENDERS |

| ZELLWOOD FL CONDO MORTGAGE LENDERS |

| ZUBER FL CONDO MORTGAGE LENDERS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|