FHA Mortgage Lenders Florida – FHA Mortgage Florida

At one point Florida FHA Mortgage Lenders provided the only alternative to local bank financing for Florida home buyers. In the fashion world, there is a saying: Wait long enough, and everything comes back into style. That rule applies just as well to FHA mortgage program. Long-overlooked, the FHA mortgage is becoming popular again with Florida Home Buyers for its low rates and the real security it provides for Florida FHA Mortgage Lenders.

FLORIDA FHA MORTGAGE LENDER REQUIRMENTS

- FHA Minimum Cash/Down payment Or Equity -FHA 3.5% Down Payment Cash or 20% Equity/ 80% LTV for cash out or 96.75% Rate term Refinance- Verity the borrower has the down payment from an acceptable source on a purchase or enough equity to cover payoffs and closing cost to include taxes insurance on a refinance.

- FHA Minimum Credit 500+ Credit Score – Does the borrower have the minimum credit score to meet the loan program? Does the borrower have collections that have to be paid off that will reflect the cash needed to close? Do student loans that are deferred need to be added to the monthly obligations? Does the lender require %1 cumulative student loan or 5% of the cumulative collections accounts over +$2000 added back to the debt to income ratios.

- Capacity-56.9% FHA Maximum- Does the borrower’s debt to income ratio meet the loan program requirements or no more debt than 56.9% of the total housing + all obligations reflected on the borrower’s credit report.

- Collateral/FHA Approved Property Types Include- Single family homes, townhomes, villas, 1-4 family multi Unit Homes, and FHA Approved Condos!

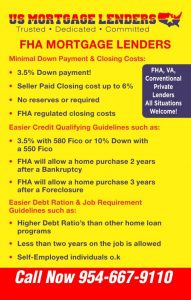

FLORIDA FHA MORTGAGE LENDERS KEY POINTS

- 550 Min Fico with 10% Down!

- 580 Min Fico with 3.5% DOWN.

- NO Credit Score Approvals!

- Bad Credit Florida Mortgage Approvals!

- Seller Paid Closing Cost up to 6%!

- Purchase Florida Home, Townhouse, Villa, Condo or Manufactured home!

- Please note we provide free credit counseling to and work with everyone to get PRE APPROVED!

What is a FHA Mortgage?

An FHA mortgage is a government-backed FHA mortgage loan with more flexible lending requirements than those for conventional loans. Because of this, interest rates for FHA mortgages may be somewhat higher, and the buyer may need to pay monthly mortgage insurance premiums along with their monthly loan payments. An FHA mortgage loan is available with fixed rates or as an adjustable-rate mortgage.

FHA loans are insured by the Federal Housing Administration (FHA) and may have an easier qualification process due to less stringent down-payment and credit requirements than conventional mortgages. Note: If you’re a current military member or veteran, you may be eligible for a VA home loan with little or no down payment.

FHA Mortgage Advantages

- Lower Down Payments

An FHA mortgage may require a down payment as low as 3.5 percent, although the interest rate may be somewhat higher than with a conventional mortgage.

- Lower Credit Thresholds

One of the benefits of the FHA loan program is that home buyer may qualify even without long credit history or outstanding credit.

- Popular for FHA Mortgage Refinancing

Many borrowers with newly adjusting ARMs look to refinance into fixed-rate FHA loans. Learn more about your refinance options.

EASY FHA MORTGAGE QUALIFYING

FHA mortgage lenders provide this popular choice for Florida home buyers and home owners without a large down payment or with limited equity in your home. Many people think that you have to be a first time buyer to use a FHA insured mortgage to buy a home, and this is simply not true. You typically cannot have more than one FHA loan at a time, unless your employment requires that you move 100 miles away, and you must live in the home as your primary residence.

PROPERTY REQUIREMENTS

Florida Properties eligible for FHA Mortgage Loans include:

- Single family House –

- Villa –

- Condominium –

- Townhouse –

- Manufactured Double wide only built in the last 20 years.

FLORIDA MORTGAGE APPLICANT REQUIREMENTS

- 2 Years in the Same line of work! Student transcripts can be used towards the 2 year requirement.

- Owner Occupied only – borrower must live in the Florida home as a primary residence.

- Credit scores as low as 620 allowed with 3.5% Down and and debt to income restrictions up to 56.9%.

- Credit scores as low as 580 allowed with 3.5% Down and debt to income restrictions of 43%.

- Credit scores as low as 550 allowed with 10% Down and debt to income restrictions of 43%.

- Full Doc approval required to include income, bank statements an W2 and/or tax returns.

- 100% down payment can be gift or grant program!

FHA MORTGAGE LOAN TERMS

- 30 Year Fixed

- 15 Year Fixed

- FHA Upfront Mortgage Insurance Premium 1.75% can be financed into loan amount

- Annual .85% FHA Mortgage Insurance Premium (paid monthly)

FHA LOAN LIMITS

The FHA maximum loan amount allowed when using an FHA insured mortgage is determined by the Florida County you live in.

FHA WAITING PERIODS AFTER BANKRUPTCY AND FORECLOSURE

- 1 Year from Discharge of Chapter 13 Bankruptcy with 12 months timely payment history and permissoin from the trusttee.

- 2 Years from Discharge of Chapter 7 Bankruptcy

- 3 Years from Foreclosure, Short Sale or Deed in Lieu of Foreclosure.

(note start counting 3 years after the deed/title transferred out of your name.)