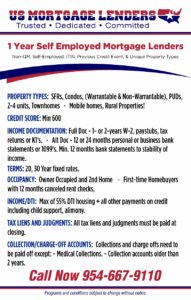

LENDING CRITERIA- TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS: Loan programs for Owner Occ and 2nd homes only

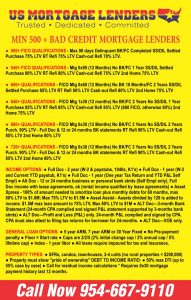

MINIMUM CREDIT SCORE FOR – TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS

Occupancy Primary Residence, Second Home, Investments

No Tax Return Self Employed Mortgage Types 30 yr Fixed, 5/1 ARM, 7/1 ARM, 10/1 ARM, 5/1 ARM-IO, 7/1 ARM-IO, and 10/1 ARM-IO

No Tax Return Self Employed Mortgage Types 30 yr Fixed, 5/1 ARM, 7/1 ARM, 10/1 ARM, 5/1 ARM-IO, 7/1 ARM-IO, and 10/1 ARM-IO

- 550+ QUALIFICATIONS- 550+ FICO Mtg 0x60 (12 Months) No BK 18 Months/FC 2 Years SS/DIL Settled Purchase 60% LTV RT Refi 55% LTV Cash-out Refi 80% LTV 2nd Home 75% LTV

- 600+ QUALIFICATIONS- 600+ FICO Mtg 0x60 (12 Months) No BK 18 Months/FC 2 Years SS/DIL Settled Purchase 75% LTV RT Refi 80% LTV Cash-out Refi 80% LTV 2nd Home 75% LTV

- 640+QUALIFICATIONS- 640+ FICO Mtg 1×30 (12 months) No BK/FC 2 Years No SS/DIL 1 Year Purchase 75% LTV RT Refi 85% LTV Cash-out Refi 85% LTV (680 FICO, otherwise 80%) 2nd Home 75% LTV

- 680+QUALIFICATIONS- 680+ FICO Mtg 0x30 (12 Months) No BK/FC 3 Years No SS/DIL 2 Years Purch. 90% LTV – Full Doc & 12 or 24 months BK statements RT Refi 80% LTV Cash-out Refi 80% LTV 2nd Home 80% LTV

- 720+QUALIFICATIONS- 720+ FICO Mtg 0x30 (12 Months) No BK/FC 3 Years No SS/DIL 2 Years Purch. 90% LTV – Full Doc & 12 or 24 months BK statements RT Refi 90% LTV Cash-out Refi 85% LTV 2nd Home 80% LTV

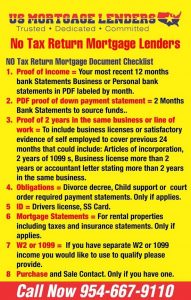

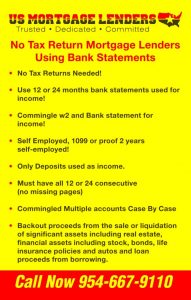

SELF EMPLOYED BANK STATEMENT MORTGAGE DOCUMENTATION:

SELF EMPLOYED BANK STATEMENT MORTGAGE DOCUMENTATION:

Texas Self-employed no tax return mortgage applicants are eligible for either Personal Bank Statement Documentation or Business Bank Statement Documentation. The following restrictions apply to both documentation types: no tax return mortgage applicants must be self-employed for at least 2years. Business must be in existence for at least 2 years. Standard Tradelines and a 12-month housing history are required. Non-Permanent Resident Aliens and Foreign Nationals are ineligible. Exceptions are not permitted. Foreign sources of income are ineligible. For Personal Bank Statement qualifying, all parties listed on each bank account must be included as no tax return mortgage applicants on the loan. For Business Bank Statements where the borrower is not 100% owner of the business or another party appears on the business bank statements, refer to the guidelines for documenting the borrower’s percent ownership of the business. Statements must be consecutive and reflect the most recent months available. Statements must support stable and generally predictable deposits. Unusual deposits must be documented. Evidence of a decline in earnings may result in disqualification. More than 3 NSFs or overdrafts within the most recent 12 months require explanation, supporting documentation, and underwriter analysis for acceptability. Refer to guidelines for additional details. Note: Overdraft Protection Transfers are not considered an NSF. If bank statements provided reflect payments being made on obligations not listed on the credit report, see Undisclosed Debts for additional guidance. PayPal business account statements are ineligible. PayPal earnings must be deposited into a business or personal bank account for consideration. W-2 Wages: Additional income deposited into the bank statements but derived from a source other than the self-employed business may not be included in the bank statement average. W-2 earnings must be documented as per the requirements in Wage-Earners along with a processed 4506-T verifying the W-2 earnings only. W-2 transcripts may be used in lieu of paper W-2s. Rental Income: Obtain the most recent lease agreement(s) for rental properties and proof of receipt at the current lease rate using a cancelled check or bank statement. Calculate the qualifying rents by using 75% of the current lease minus the full PITIA. ELIGIBLE TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE APPLICANTS INCLUDE: U.S. Citizens, Permanent Resident Aliens, and Non-Permanent Resident Aliens. Permanent Resident Aliens must provide proof of lawful residence, green card and permanent right to work in the U.S. Non-Permanent Resident Aliens must provide proof of lawful residency, work authorization, and an unexpired, valid visa with at least three years left to work in the U.S. All qualifying borrowers must have a documented 2 year consecutive work history in the U.S. CMS limits the maximum number of borrowers on one loan to eight (8).

ELIGIBLE TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE APPLICANTS INCLUDE: U.S. Citizens, Permanent Resident Aliens, and Non-Permanent Resident Aliens. Permanent Resident Aliens must provide proof of lawful residence, green card and permanent right to work in the U.S. Non-Permanent Resident Aliens must provide proof of lawful residency, work authorization, and an unexpired, valid visa with at least three years left to work in the U.S. All qualifying borrowers must have a documented 2 year consecutive work history in the U.S. CMS limits the maximum number of borrowers on one loan to eight (8).

DEBT TO INCOME – TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS:

Debt Ratios (Primary Residence and Second Homes Standard DTI to 43% available for Grade A, B and C Expanded DTI to 50% available for Grade A and B Min FICO = 640 DTI to 50% available for 12-Month Bank Statements and 1-Year Documentation (W-2 or Tax Return) Min FICO = 550

1 YEAR SELF EMPLOYED TEXAS BANK STATEMENT MORTGAGE LENDERS: Bank Statement Income Loans utilizing 12 months bank statements for documentation for income will not require a 4506-T form processed for transcripts. When a file has mixed income (W-2 wage earner income) combined with the bank statement income option,

1 YEAR SELF EMPLOYED LOAN AMOUNTS – TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS: ● Minimum loan amount $100,000 RESERVES: ● 6 months required above 75% LTV ● 6 months required on 12 Mo Cash Flow Product ● See loans > $1M for additional info

GENERAL TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS LOAN TERMS:

- 30 Year Fixed and 5 year ARM, 7 year ARM options

- No Pre-payment penalty

- Floor = Start rate

- Caps are 2/2/5 (2% initial change cap / 2% annual cap / 5% lifetime cap)

- Index – 1 year libor

- All loans require impound for tax and insurance PROPERTY TYPES:

- SFRs, condos, townhouses, 2-4 units (no rural properties < $200,000)

- Property must show “pride of ownership” DEBT TO INCOME RATIO:

- 50% max DTI (up to 55% case by case)

INCOME DOCUMENTATION FOR TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS:

- Full Doc – 2 year (W-2 & paystubs, 1040s, K1’s)

- Full Doc – 1 year (W-2 and Current YTD paystub, K1’s)

- Full Doc – 1 year (One year Tax Return and YTD P&L Self Empl)

- Alt Doc – 12 or 24 months business or personal bank stmts (Self Empl only), Full Doc income with lease agreements, ok (rental income qualified by lease agreements)

- Asset Xpress – 100% of amount needed to amortize loan plus monthly debts for 60 months, max 80% LTV to $1.0M; Max 75% LTV to $1.5M

- Asset Assist – Assets divided by 120 is added to income. $1.5M max loan amount to 75% LTV, Max 80% LTV to $1M

- ALT Doc—3-month Texas Bank Statement (24-month CPA compiled and signed P&L statement supported by 3-months bank stmts)

- ALT Doc—Profit and Loss (P&L) only. 24-month P&L compiled and signed by CPA. CPA must also attest to filing tax returns for 1 year self employed mortgage applicants for 24-months.

- ALT Doc—VOE only

DOWN PAYMENT REQUIREMENTS FOR TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS:

- All down payment funds must be verified prior to drawing loan documents

- Secondary Financing 80% Max LTV/90% Max CLTV

TAX LIENS, JUDGMENT REQUIREMENTS FOR NO TAX RETURN MORTGAGE LENDERS :

- All tax liens and judgments must be paid at closing

COLLECTION ACCOUNTS FOR TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS:

- Collections and charge offs need to be paid off except: – Medical Collections – Collection accounts older than 2 years FIRST-TIME HOME BUYER:

- A , A- and B credit grades. B- grade case by case

NON-PERMANENT RESIDENT ALIEN TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS: :

- 80% max LTV Purchase and Rate and Term Refi 75% max LTV on Cash Out

- A, A- and B credit grades only

- No FICO is allowed (when no FICO, price at Aand add 0.500% to rate)

- Visa classifications allowed (E-1 – E-3/G-1 – G-5/H-1/L-1/NATO/O-1/R1/TN (NAFTA)

TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS FEES

- Underwriting Fee

- Flood Cert Fee

- Attorney Doc Review

AGE OF DOCUMENTS FOR TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS

Credit Report/Credit Documentation: 90 days old at the time of closing

Income and Asset Documentation: Dated within 90 days of closing

Title Report/Title Commitment: Dated no later than 60 days prior to closing

APPRAISAL REQUIREMENTS BY TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS

Full Interior / Exterior appraisal required. Fannie Mae/Freddie Mac Forms 1004/70, 1025/72, 1073/465 or 2090 must be used. All Fannie Guidelines apply to

appraisal process and value determination, in addition an Appraisal Management Company must be utilized for appraiser selection.

The Appraisal should be dated no more than 120 days prior to the Note Date. After a 120 day period, a new appraisal is required. Re-certification of value is

not acceptable. Minimum Square Footage 800 Sq. Feet

Not eligible: Properties for which the appraisal indicates condition ratings of C5 or C6 or a quality rating of Q6, each as determined under the Uniform Appraisal

Dataset (UAD) guidelines. TEXAS 1 ONE YEAR SELF EMPLOYED mortgage lenders will consider if issue has been corrected prior to loan funding with proper documentation.

A 5% reduction in LTV/CLTV will be required for all properties identified to be in a declining market as designated by the appraiser.

APPRAISAL REVIEW PRODUCTS: An enhanced desk review product, (such as an ARR from ProTeck or CDA from Clear Capital), from a TEXAS 1 ONE YEAR SELF EMPLOYED mortgage lenders Approved

AMC is required on all transactions.

In lieu of an enhanced desk review product, a field review or second appraisal from a TEXAS 1 ONE YEAR SELF EMPLOYED mortgage lenders’s AMC is acceptable.

If the Appraisal Review Product value is more than 10% below the appraised value a second appraisal is required. When a second appraisal is provided, the

transactions “Appraised Value” will be the lower of the two appraisals.

A second appraisal is required on loan amounts > $1,500,000

ASSETS – CASH TO CLOSE – TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS

• Full Asset Documentation is required for both funds to close and reserves. For most asset types, this would include all pages of the most recent two months

statements or the most recent quarterly statement. All Assets from the 1 year self employed mortgage applicants (s) must be disclosed and verified by the lender.

- No business accounts may be used to meet down payment and/or reserve requirements unless the 1 year self employed mortgage applicants (s) are 100% owners of the business and requires:

o A letter from the businesses accountant OR

o An underwriter cash flow analysis of the business balance sheet to confirm that the withdrawal will not negatively impact the business.

- Stocks/Bonds/Mutual Funds – 80% may be used for reserves.

- Vested Retirement Accounts – 70% may be considered for reserves (certain eligible plans can use 70% if 1 year self employed mortgage applicants > 59 1⁄2 – i.e. 401k)

- Assets being used for dividend and interest income may not be used to meet reserve requirements

- If needed to close, verification that funds have been liquidated (if applicable) is required.

- Gift of Equity is not allowed.

- Builder profits are not allowed.

- No employer assistance assets are allowed.

- Maximum Interested Party Contributions permitted up to 3% for LTV >=80, 6% for LTV<80.

TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS ELIGIBLE 1 year self employed mortgage applicants Eligible:

- US Citizen

- Permanent Resident Aliens

- Non-Permanent Resident Aliens

- First Time Home Buyers

- Non-Occupant Co-TEXAS 1 ONE YEAR SELF EMPLOYED mortgage applicants

- Limited partnerships, general partnerships, corporations

o Personal guarantor required

In-Eligible:

- Foreign Nationals

- Irrevocable or Blind Trusts

- Inter-Vivos Revocable Trust

OVERALL CREDIT REQUIREMENTS FOR TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS

- Each 1 year self employed mortgage applicants ’s ‘Credit Score’ is the middle of three or the lesser of two.

- Representative Credit Score – Texas Bank Statement loans, the lowest Credit Score among 1 year self employed mortgage applicants s.

- Each 1 year self employed mortgage applicants ’s credit profile must include a minimum of 2 trade lines (open or closed) within the last 24 months that show a 12 month history, or a combined credit profile between 1 year self employed mortgage applicants and co-1 year self employed mortgage applicants with a minimum of 3 tradelines.

o Tradeline activity is not required. Eligible tradelines cannot have any derogatory history in previous 24 months.

- Current housing not reporting on credit can be considered an open trade if supported by bank records (cancelled checks/debits).

• 1 year self employed mortgage applicants (s) not using income to qualify are not required to meet the minimum tradeline requirements listed above. - TEXAS 1 ONE YEAR SELF EMPLOYED mortgage applicants currently enrolled in credit counseling or debt management plans are not permitted. • All derogatory accounts require a full explanation.

- All Judgments or liens affecting title must be paid.

- Non-title charge- offs and collections within 3 years and exceeding $3,000 (either individually or in aggregate) must be paid.

- Medical collections are not required to be paid.

- All past due accounts must be brought current prior to closing.

- No authorized user accounts will be used to satisfy minimum tradeline.

- Medical derogatory accounts, collections, and charge-offs permitted with letter of explanation.

- Disputed accounts require a LOE per Fannie Mae. An updated credit report not

required.

- IRS tax payment plans are permitted if current and do not carry a lien on any property.

Matrix 5000-ELITE-BS

Minimum FICO 700

Housing 0x30x12

BK (Chap 13 Discharge) 60 Mo

BK (Other) 60 Mo

Foreclosure 60 Mo

Short Sale / DIL 60Mo

TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE FOR FIRST TIME HOME BUYER REQUIREMENTS

- First Time Homebuyers (“FTHB”) are individuals that have not owned a home or had a residential mortgage in the last 3 years.

- However, only 1 year self employed mortgage applicants with no prior mortgage history or homeownership ever are restricted to the following:

Recent Event not permitted

I/Os not permitted

12 month 0X30 housing history required

Primary Residence Only

Minimum of 6 months PITI reserves required.

1 year self employed mortgage applicants MUST BE SELF-EMPLOYED TO QUALIFY FOR THIS PROGRAM.

DOCUMENT REQUIREMENTS FOR TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS

(1) 12 or 24 months Personal or 24 months Business Bank statements

TEXAS 1 ONE YEAR SELF EMPLOYED mortgage applicants who own more than 3 businesses must use personal bank statements option

Bank statements must be most recent available at time of application and must be consecutive

(2) Profit & Loss Statement

If submitting personal bank statements, a P&L prepared by the 1 year self employed mortgage applicants covering no less than 12 or 24 months is required

The P&L must be signed by the 1 year self employed mortgage applicants

If submitting business bank statements, a P&L prepared by the 1 year self employed mortgage applicants covering no less than 24 months is required

1 year self employed mortgage applicants is required to provide separate P&Ls for each business being used in qualifying.

The P&L should generally cover the same calendar months as the bank statements provided.

(3) Validation of a minimum of 2 years existence of the business from one of the following: Business License, Letter from Tax Preparer, Secretary of State Filing or equivalent

Self Employed/Wage Earner Combination – Joint 1 year self employed mortgage applicants with 1 wage earner and 1 self-employed business owner can verify income separately, with the self-

employed 1 year self employed mortgage applicants utilizing bank statements and the wage earner providing pay stubs/W-2s. The wage earner 4506T should include W-2 transcripts only.

PROFIT & LOSS ANALYSIS FOR TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS

- Net Income from the P&L will be used as Qualifying Income for both personal and business bank statements.

- The P&L used for qualifying must be signed by the 1 year self employed mortgage applicants .

- Declining Income requires an LOE

- Any amounts on the P&L representing salary/wages paid to the 1 year self employed mortgage applicants /business owner can be added back and considered in the net income analysis.

- Expense line items that can be added back to the business net income include depreciation, depletion, amortization, casualty losses, and other losses or

expenses that are not consistent and recurring.

- TEXAS 1 ONE YEAR SELF EMPLOYED mortgage applicants utilizing business bank statements that own > 50% but < 100% of a business will be qualified at the P&L/AES net income multiplied by their ownership

percentage.

- The P&L expense ratio, Gross Income minus Net Income, divided by Gross Income, should be reasonable for the profession.

Example: A home-based sole practitioner therapist/consultant can be expected to have a low expense ratio, while a retail business that has a full staff of

employees and relies heavily on inventory to generate income will have a high expense ratio.

- If the file does not contain a CPA prepared P&L, steps must be taken by the underwriter to evaluate the reasonableness of the expenses listed by the 1 year self employed mortgage applicants .

- This requires the 1 year self employed mortgage applicants to provide a business narrative which includes detail related to the size/scope and operating profile of the business, including the

following: o Description of Business/Business Profile o Location & Associated Rent o Number of Employees / Contractors o Estimated Cost of Goods Sold (Does

business involve sale of goods or just services?) o Materials/Trucks/Equipment o Commercial or Retail client base? o Business Analysis

- Expenses listed on a 1 year self employed mortgage applicants prepared P&L should generally relate to the information provided below.

Joint Accounts – A joint personal account with a non-borrowing spouse or domestic partner can be used for qualifying as follows: o If not contributing

income/deposits, it must be validated by a 1 year self employed mortgage applicants affidavit o If contributing income/deposits, source must be clearly identified (direct deposit, SSI, trust

income) and amounts must be subtracted from the analysis o Relationship letter must be present in file

Retirement, Government Annuity, and Pension Income – TEXAS 1 ONE YEAR SELF EMPLOYED mortgage lenders may recognize an ancillary income stream from employment-related assets as eligible for

income qualification. 1 year self employed mortgage applicants must evidence a 12 month history of documented draws or interest/dividend income. If, based on that history, the income will

continue for at least three years, the income may be used for loan qualification. One of the following types of income documentation is required: o Copy of

award letter or letters from the organizations providing the income o Most recent personal income tax return with all schedules o Most recent W2 or 1099 o

Most recent 2 months bank statements showing deposit of funds

If the income being used for qualifying represents at least 50% of the 1 year self employed mortgage applicants ’s total income, a five year continuance is required. The 1 year self employed mortgage applicants must have

unrestricted access, and available to the 1 year self employed mortgage applicants without penalty. Documentation of asset ownership must be in compliance with the allowable age of credit

documents.

Restricted Stock Income – TEXAS 1 ONE YEAR SELF EMPLOYED mortgage lenders will only consider restricted stock that was awarded in prior 2 years and became unrestricted (vested) in the current year. The

Vesting Schedule must indicate the income will continue for a minimum of 3 years at a similar level to the prior 2 years. Continuance is based on the vesting

schedule using a stock price based on the 52 week low for the most recent 12 months reporting at the time of closing. A 2 year average of prior income

received from RSU’s or stock option will be used. The following documentation is required: o Copy of the vesting schedule o Most recent W2 and pay stub o

Private Stock not eligible.

Component Sources of Income – A 1 year self employed mortgage applicants who has a self-employed business and also receives income from other sources is eligible for the bank

statement program. Income sources include but are not limited to rental properties, trust & investment, alimony, etc. These income sources should be

separately documented on the 1003 and should be separately supported by bank statement deposits.

o Rental Income –

months via cancelled checks, deposits clips, or bank records ed by a vacancy/expense factor of

25%

o Trust Income – idenced by unt, distribution frequency, and duration of payments

o Alimony Income –

deposit slips, or bank records

o Note Receivable Income opy of the note confirming amount and length of payment

checks, deposit slips, or bank records

MORTGAGE RENTAL VERIFICATION REQUIRED BY TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS

- 12 months housing history required.

- Rental history evidenced by 12 months proof of payment via cancelled checks or bank debits.

- Rent free letters from spouses are not permitted. Housing history is required.

PAYMENT SHOCK FOR TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS

Payment shock is limited to 250% on primary residence transactions.

Payment Shock Calculation –

(Proposed PITI – Current PITI) / Current PITI X 100

For 1 year self employed mortgage applicants who do not have a current housing payment, or own a home free and clear, payment is shock is not considered.

PRIMARY HOME – TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS

• A primary residence is a property that the 1 year self employed mortgage applicants (s) intend to occupy (within 60 days) as his or her principal residence.

- Characteristics that may indicate that a property is used as a 1 year self employed mortgage applicants ‘s primary residence include:

o It is occupied by the 1 year self employed mortgage applicants for the major portion of the year.

o It is in a location relatively convenient to the 1 year self employed mortgage applicants ‘s principal place of employment.

o It is the address of record for such activities as federal income tax reporting, voter registration, occupational licensing, and similar functions.

o 1 year self employed mortgage applicants may not own an additional single family residence of equal or greater value than subject property.

SECOND HOME – TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS

A property is considered a second home when it meets all of the following requirements:

- Must be located a reasonable distance away from the 1 year self employed mortgage applicants (s) principal residence.

- Must be occupied by the 1 year self employed mortgage applicants (s) for some portion of the year.

- Is restricted to a one-unit dwelling.

- Must be suitable for year-round occupancy.

- Cash-Out transactions are not permitted

- The 1 year self employed mortgage applicants (s) must have exclusive control over the property.

- Gifts not permitted

INVESTOR – TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS

- Occupancy designation when the 1 year self employed mortgage applicants does not occupy the subject property.

- A Non Owner Occupied property must meet the following requirements:

Cash-Out and Debt Consolidation transactions are not permitted

1 year self employed mortgage applicants with greater than 2 financed properties require an additional 3 months of reserves for each additional financed property.

The 3 months additional reserves are based on the PITI plus HOA fees of the other financed properties.

- Gifts not permitted

Alt Doc – 12 or 24 months personal or business bank stmts or 1099’s (self employed only) ● Alt Doc – Rental income qualified by lease agreements

PROPERTY TYPES ALLOWABLE BY TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS

Eligible: Single Family Residences1-4 Units (3-4 Units NOO Only), PUDs*, Townhouses, Condominiums (Warrantable Only)

*PUDs- New PUDs/Subdivisions must be at least 60% sold or under bonafide contract. The PUD questionnaire must be included with submission. • Maximum

LTV of 80% for new PUDs

Ineligible: • Acreage greater than 10 acres (appraisal must include total acreage) • Agricultural/Rural zoned property • Condo hotel • Co-ops • Hobby Farms •

Income producing properties with acreage • Leaseholds • Log Homes • Manufactured housing • Mixed use properties • Modular homes • Non-Warrantable

Condos • Properties subject to oil and/or gas leases • Unique properties • Working farms, ranches or orchards.

Fannie Mae eligible projects: TEXAS 1 ONE YEAR SELF EMPLOYED mortgage lenders. project exposure maximum shall be $3,000,000 or 15% of the project whichever is lower • 1 year self employed mortgage applicants

project/Unit concentration limit: two (2) units • Project meets all FNMA Insurance requirements for property, liability and fidelity coverage • 1 year self employed mortgage applicants must carry

H06 coverage for replacement of such items as flooring, wall covering, cabinets, fixtures, built-ins and any improvements made to the unit • The Condo Project

Questionnaire must be completed, including all the required documentation from the questionnaire including: CCR, Articles of Incorporation, By-Laws, Master

Insurance Policy, Budget / Balance Sheet & HOA questionnaire .• All projects are subject to full review and approval.

TEXAS 1 ONE YEAR SELF EMPLOYED Condos – 70% Maximum LTV

TEXAS 1 ONE YEAR SELF EMPLOYED Condos – 50% Maximum LTV

Purchase • No property flipping, prior owners must have owned the property greater than 6 months. (Bank owned REO are eligible and not considered a flip transaction).

- Maximum Interested Party Contributions permitted up to 3% for LTV >=80, 6% for LTV<80.

CASHOUT – TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS

- A Cash-Out Refinance transaction allows the 1 year self employed mortgage applicants to pay off the existing mortgage by obtaining new financing secured by the same property or allows the

property owner obtain a mortgage on a property that is currently owned free and clear. The 1 year self employed mortgage applicants can receive funds at closing as long as they do not exceed

the program requirements.

- To be eligible for a Cash-Out Refinance the 1 year self employed mortgage applicants must have owned the property for a minimum of six months prior to the application date. Properties listed

for sale within the last 12 months are ineligible for cash out.

- If the property is owned less than 12 months but greater than 6 months at the time of application, the LTV/CLTV will be based on the lesser of the original

purchase price plus documented improvements, or current appraised value. The prior HUD-1 will be required for proof of purchase price.

RATE TERM – TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE REFINANCE

- A Rate/Term Refinance transaction is when the new loan amount is limited to the payoff of the present first lien mortgage, any seasoned non-first lien

mortgages, closing costs and prepays, or a court ordered buyout settlement.

- A seasoned non-first lien mortgage is a purchase money mortgage or a closed end or HELOC mortgage that has been in place for more than 12 months

(and/or not having any draws greater than $2,000 in the past 12 months for HELOC’s. Withdrawal activity must be documented with a transaction history from

the HELOC).

- Limited cash to the 1 year self employed mortgage applicants must not be greater than 1% of the principal amount of the new mortgage to be considered a Rate/Term refinance.

- If the property is owned less than 6 months at the time of application, the LTV/CLTV will be based on the lesser of the original purchase price plus

improvements or current appraised value. The prior HUD-1 will be required for proof of purchase price. Proof of improvements is required.

- There is no waiting period if the lender documents that the 1 year self employed mortgage applicants acquired the property through an inheritance or was legally awarded the property

(divorce, separation, or dissolution of a domestic partnership). If the 1 year self employed mortgage applicants acquired the property at any time as a gift, award, inheritance or other

non-purchase transaction, the LTV will be based on the current appraised value. The lender must obtain appropriate documentation to verify the

acquisition and transfer of ownership.

- Follow FNMA for Delayed Financing guidelines.

- Properties that have been listed for sale within the past 6 months from the loan application date are not eligible for a rate/term refinance transaction.

- The rate/term refinance of a construction loan is eligible with the following conditions:

- If the lot was acquired 12 or more months before applying for the subject loan, the LTV/CLTV/HCLTV is based on the current appraised value of the property.

- If the lot was acquired less than 12 months before applying for the construction financing, the LTV/CLTV/HCLTV is based on the lesser of i) the current appraised value of the property and ii) the total acquisition costs.

TEXAS 1 ONE YEAR SELF EMPLOYED CASH OUT DEBT CONSOLIDATION REFINANCE

- A debt consolidation refinance transaction involves the repayment of an existing lien and other 1 year self employed mortgage applicants debt from the proceeds of a new mortgage. A debt

consolidation refinance may include the payoff of:

o First mortgage secured by the subject property.

o Junior liens secured by the subject property.

o Credit cards, installment loans, past due taxes, etc.

- Direct evidence of debt payment at closing is required.

- 1 year self employed mortgage applicants must own property for a minimum of 12 months

- Loan must produce a net tangible benefit to the 1 year self employed mortgage applicants resulting in an increase in residual income and a reduction of 1 year self employed mortgage applicants ’s total debt obligation payments.

- Existing subordination not permitted.

- Cash to 1 year self employed mortgage applicants at closing must not exceed 2% of the loan amount.

RESERVE REQUIRED BY TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS

Non-Occupant Co-1 year self employed mortgage applicants : An additional 6 months reserves is required

First Time Home Buyers: Minimum of 6 months PITI reserves required

Interest Only loans require a minimum of 12 months reserves

Occupancy Maximum Loan Amount Reserves

- 1 year self employed mortgage applicants with greater than 2 financed properties require 9 months or otherwise stated higher reserve amount above and an additional 3 months of reserves

for each additional financed property. The 3 months additional reserves are based on the PITI plus HOA fees of the other financed properties. For primary

residence transactions, this requirement can be waived for 1 year self employed mortgage applicants who have a minimum 18 months reserves on the primary residence.

Occupancy Maximum Loan Amount Reserves

Second Home $2,000,000 12 Months

Second Home

Debt

Consolidation

$2,000,000 2 Months

- 1 year self employed mortgage applicants with greater than 2 financed properties require an additional 3 months of reserves for each additional financed property. The 3 months additional

reserves are based on the PITI plus HOA fees of the other financed properties.

Occupancy Maximum Loan Amount Reserves

Non-Owner $1,500,000 12 Months

- 1 year self employed mortgage applicants with greater than 2 financed properties require an additional 3 months of reserves for each additional financed property. The 3 months additional

reserves are based on the PITI plus HOA fees of the other financed properties

Cash-out permitted to meet reserve requirements if loan-to-value is 5% below the matrix maximum LTV/CLTV and a minimum 680 representative FICO score

DELAYED FINANCING BY TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS

Cash-out on properties purchased by the 1 year self employed mortgage applicants with cash and owned less than 6 months is allowed. The following requirements apply:

- Original transaction was an arm’s-length transaction

- Settlement statement from purchase confirms no mortgage financing used to acquire subject

- Source of funds used for purchase documented (gift funds may not be included)

- New loan amount can be no more than the actual documented amount of the 1 year self employed mortgage applicants ‘s initial investment in purchasing the property plus the

financing of closing costs, prepaid fees, and points on the new mortgage loan

- All other cash-out refinance eligibility requirements must be met

SELF-EMPLOYED REQUIRED FOR TEXAS 1 ONE YEAR SELF EMPLOYED MORTGAGE LENDERS

1 year self employed mortgage applicants with Separated Business and Personal Accounts

Using Personal Texas Bank Statements to Qualify

Business license (if available – depending on nature of business)

Letter from a Licensed Tax Professional certifying profession & self-employment in same line of business for a min of 2 years & ownership percentage

Most recent 12 months personal bank statements – Utilize 12 months average deposits to qualify (minus disqualified/unrelated deposits)

Most recent 3 months business bank statements – Demonstrate transfers from business to personal bank account statements provided

1 year self employed mortgage applicants must own a minimum of 25% of business to be considered Self-Employed, for use of personal of personal bank statements.

Qualifying income may not exceed the income indicated on the initial 1003.

Using Business Texas Bank Statements to Qualify

Business license (if available – depending on nature of business)

Letter from a licensed tax professional certifying profession & self-employment in same line of business for a min of 2 years and that the 1 year self employed mortgage applicants is

100% owner of the business – For use of Business Texas Bank Statements/P&L for 1 year self employed mortgage applicants who own less than 100% but more than or equal to 80%, a

letter is required from each other owner of the business stating the 1 year self employed mortgage applicants has full access to the business funds. Less than 80% ownership will

require exception approval for use of Business Texas Bank Statements/P&L

Most recent 12 months business bank statements.

12 month Profit and Loss Statement (P&L) prepared by a Licensed Tax Professional – Net Income on P&L will be used for qualifying (Net Income/12)

o Gross Income must be supported by the total deposits of bank statements provided (variance of 5% allowed for deposits compared to Gross

Revenue)

o 1 year self employed mortgage applicants to provide business expenses for Licensed Tax Professional – must be reasonable for the nature of the business

o P&L is not Audited by Licensed Tax Professional

o P&L must be signed by the preparer and 1 year self employed mortgage applicants

Qualifying income may not exceed the income indicated on the initial 1003.

1 year self employed mortgage applicants with Personal Accounts (Co-mingled for business & personal use)

Business license (if available – depending on nature of business)

Letter from a licensed tax professional certifying profession & self-employment in same line of business for a min of 2 years and that the 1 year self employed mortgage applicants is

100% owner of the business – For use of Business Texas Bank Statements/P&L for 1 year self employed mortgage applicants who own less than 100% but more than or equal to 80%, a

letter is required from each other owner of the business stating the 1 year self employed mortgage applicants has full access to the business funds. Less than 80% ownership will

require exception approval for use of Business Texas Bank Statements/P&L

Most recent 12 months personal bank statements.

12 month Profit and Loss Statement (P&L) prepared by a Licensed Tax Professional – Net Income on P&L will be used for qualifying (Net Income/12)

o Gross Income must be supported by the total deposits of bank statements provided (variance of 5% allowed for deposits compared to Gross

Revenue)

o 1 year self employed mortgage applicants to provide business expenses for Licensed Tax Professional – must be reasonable for the nature of the business

o P&L is not Audited by Licensed Tax Professional

o P&L must be signed by the preparer and 1 year self employed mortgage applicants

Qualifying income may not exceed the income indicated on the initial 1003.

Other sources of income

Other sources of income must be verified in accordance with Appendix Q of Regulation Z regarding income

POPULAR TEXAS NO TAX RETURN MORTGAGE PAGES INCLUDE:

-

NO TAX RETURN TEXAS MORTGAGE LENDERS – Get Approved!

https://www.fhamortgageprograms.com/no-tax-return-texas-mortgage-lendersNO TAX RETURN TEXAS MORTGAGE LENDERS– Get approved using 12 or 24 months bank statements to purchase or refinance a home in Texas! Same Day Approvals Call Now 954-667-9110

-

NO TAX RETURN-TEXAS STATED INCOME MORTGAGE LENDERS …

texas-mortgage-lenders.com/no-tax-return-texas…NO TAX RETURN–TEXAS STATED INCOME MORTGAGE LENDERS – No Tax Return Texas Bank Statement Only Mortgage Lenders. Use 12 or 24 months bank statments for income!

-

Texas No Tax Return Self Employed Mortgage Lenders

https://www.fhamortgageprograms.com/bank-statement-tx-mortgage-lendersSELF EMPLOYED MORTGAGE LENDERS 10%DOWN+SERVING ALL TX Bank Statement Only Jumbo Mortgage Lenders 12 or 24 Month Texas Bank Statement Home Loan Program. For Texas Self Employed Texas Bank Statement Only (Personal or Business) No Tax Returns No Tax …

-

Bank Statement Mortgage Lenders Texas No Tax Returns

texas-mortgage-lenders.com/bank-statement-mortgage…Bank Statement Mortgage Lenders Texas No Tax Returns-Use 12/24 months bank statements for income. Purchase or Refinance in ALL TEXAS!

-

Texas Self Employed No Tax Return Bank Statement Mortgage …

https://www.fhamortgageprograms.com/texas-self…SELF-EMPLOYED 12 or 24 MONTHS BANK STATEMENTS DOCUMENTATION The Texas Self Employed 24 Months Bank Statements program is available to Texas Self Employed Texas Self Employed mortgage applicants only and allows the use of 24 months of bank statements to document self-employment income. Income documented through the Texas Self-Employed Bank Statement method …

-

NO TAX RETURN! 12M Texas Bank Statement Mortgage Lenders

texas-mortgage-lenders.com/no-tax-return-bank…1 YEAR Self Employed 12+ months Texas Bank Statement mortgage lenders buy or refinance in ALL Texas!

-

TEXAS SELF EMPLOYED NO TAX RETURN MORTGAGE LENDERS – …

https://www.fhamortgageprograms.com/texas-self…No Tax Return Stated Income Texas bank statement Mortgage Lenders Program summary Texas Self Employed Mortgage Lenders offer Non-Qualified Mortgages on fully amortizing 15 & 30-Year Fixed …

-

1 Year Texas Self Employed Mortgage Lenders

https://www.fhamortgageprograms.com/1-year-texas…Each 1 year self employed mortgage applicants ’s credit profile must include a minimum of 2 trade lines (open or closed) within the last 24 months that show a 12 month history, or a combined credit profile between 1 year self employed mortgage applicants and co-1 year self employed mortgage …

-

Texas 1 One Year 12 Months + Texas Self Employed Mortgage …

https://texas-mortgage-lenders.com/texas-1-one…Texas 1 One Year 12 Months + Texas Self Employed Mortgage Lenders

-

SELF EMPLOYED BANK STATEMENT MORTGAGE DOCUMENTATION:

SELF EMPLOYED BANK STATEMENT MORTGAGE DOCUMENTATION: