Bad Credit Florida No Tax Return Mortgage Lenders—Read More »

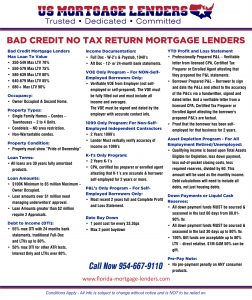

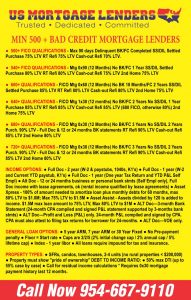

Bad Credit Florida No Tax Return Mortgage Lenders About No Tax Return Bad Credit Mortgage Lenders Bad credit

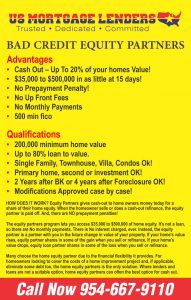

500+Bad Credit Florida Cash-out Refinance Mortgage Lenders Bad Credit Florida Cash-Out Mortgage Refinance

Bad Credit Florida Cash-Out Mortgage Refinance Bad Credit Florida Mortgage Lenders – Bad Credit Florida Home Loans— Read More »

Bad Credit Florida Mortgage Lenders – Bad Credit Florida Home Loans— Read More »

Note Bad Credit Florida Mortgage Lenders Make Approvals based on payment history are not credit score driven!

- Florida Mortgage Approvals with Poor or Bad Credit

- Bad Credit Florida Mortgage Lenders

- Cashout Florida Bad Credit Mortgage Lenders

- Cash-Out Florida Refinance – NO SEASONING REQUIRED!!

Learn About No Tax Return Bad Credit Mortgage Lenders

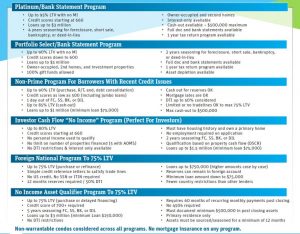

Bad credit Florida Bank statement mortgage lenders were created for self-employed borrowers that write off all of their income. Bank statement Florida mortgage lenders use 12 or 24 months of bank statements and average a borrower’s income for mortgage qualifying. These alt doc mortgage loans allow bad credit to self-employed business owners and bad credit to independent contractors who take too many deductions to qualify for a Florida mortgage.

In order to get the most benefit from cash-out refinancing your Florida FHA mortgage, it is often best to consider FHA cash-out refinancing after you have had time to build up a significant amount of equity in your Florida home. If your Florida home was purchased more than one year prior to the cash-out FHA refinance, Florida homeowners can cash out refinance the existing Florida FHA mortgage for up to 85 percent of the appraised value plus the allowable closing costs.

- Miami Florida Bad Credit Refinance with1 day out of FC, SS, BK, or DIL

- Miami Florida Bad Credit Refinance with Loans up to $1 million

- Miami Florida Bad Credit Refinance with Mortgage lates OK

- Miami Florida Bad Credit Refinance with Credit scores as low as 500

- Florida Bad Credit Refinance with 100% gift funds allowed

- Miami Florida Bad Credit Refinance with No active tradelines OK

- Miami Florida Bad Credit Refinance with Up to 80% LTV

- Florida Bad Credit Refinance with O/O, 2nd homes & investment

- Miami Florida Bad Credit Refinance with Non-warrantable condos OK

- Florida Bad Credit Refinance with SFRs, townhomes, 2-4 units

- Florida Bad Credit Refinance with Short Sale

- Miami Florida Bad Credit Refinance with Deed-in-Lieu

- Miami Florida Bad Credit Refinance with Foreclosure

- Miami Florida Bad Credit Refinance with Chapter 7Bankruptc

- Miami Florida Bad Credit Refinance with Chapter 13Bankruptcy

- Miami Florida Bad Credit Refinance with 1 day out of FC, SS, BK, or DIL

- Miami Florida Bad Credit Refinance with Loans up to $1 million

- Miami Florida Bad Credit Refinance with Mortgage lates OK

- Miami Florida Bad Credit Refinance with Credit scores as low as 500

- Miami Florida Bad Credit Refinance with 100% gift funds allowed

MIAMI FL FHA MORTGAGE LENDERS covering all MIAMI DADE areas including zip codes: 33102, 33125, 33126, 33127, 33128, 33129, 33130, 33131, 33132, 33133, 33135, 33136, 33137, 33138, 33142, 33144, 33145, 33149, 33150, 33194.

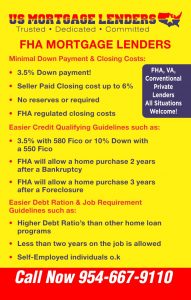

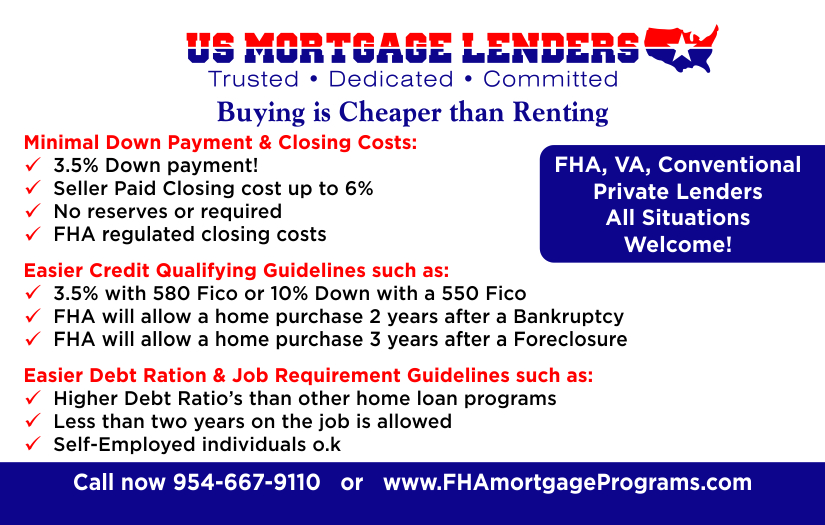

Welcome and thank you for visiting US Mortgage Lenders webpage. We are local MIAMI FL mortgage lenders. We are available to answer any questions you might have 24/7.

US Mortgage Lenders professionals have earned their excellent 5 star zillow.com and google reviews by opening more doors to homes in MIAMI FL Florida than your average Florida lender. To discuss any of our full service MIAMI FL Florida programs including, FHA minimum score 550, FHA Cash Out and Streamlines refinancing, Private lenders, Jumbo Loans, VA Mortgage loans down to 550 and Foreign National Loans. Note All Subject to change without notice.

MIAMI FL MORTGAGE LENDERS PROGRAMS INCLUDE:

FLORIDA BAD CREDIT CASH-OUT REFINANCE- CAN BE A GOOD OPTION!

The Florida Mortgage Lenders must examine the Florida mortgage applicants overall pattern of credit behavior, not just isolated unsatisfactory or slow payments, to determine the Florida mortgage applicants creditworthiness. Florida Mortgage Lenders must evaluate the Florida mortgage applicants payment histories in the following order:

(1) Previous 30 60 90 days late Florida Mortgage day late payments on housing-related expenses, including utilities;

(2) Previous 30 60 90 days late Florida Mortgage day late payments installment debts; and

(3) Previous 30 60 90 days late Florida Mortgage day late payments on revolving accounts.

Previous 30 60 90 days late Florida Mortgage day late payments on housing-related expenses, including utilities; The Florida Mortgage Lenders may consider Florida mortgage applicants to have an acceptable payment history if the Florida mortgage applicants have made all housing and installment debt payments on time for the previous 12 months and NO more than (2X) two 30 60 90 days late Florida Mortgage-day late mortgage payments or installment payments in the previous 24 months.

n order to get the most benefit from cash-out refinancing your Florida FHA mortgage, it is often best to consider FHA cash-out refinancing after you have had time to build up a significant amount of equity in your Florida home. If your Florida home was purchased more than one year prior to the cash out FHA refinance, Florida homeowners can cash out refinance the existing Florida FHA mortgage for up to 85 percent of the appraised value plus the allowable closing costs.

- Florida Bad Credit Refinance with1 day out of FC, SS, BK, or DIL

- Florida Bad Credit Refinance with Loans up to $1 million

- Florida Bad Credit Refinance with Mortgage lates OK

- Florida Bad Credit Refinance with Credit scores as low as 500

- Florida Bad Credit Refinance with 100% gift funds allowed

- Florida Bad Credit Refinance with No active tradelines OK

- Florida Bad Credit Refinance with Up to 80% LTV

- Florida Bad Credit Refinance with O/O, 2nd homes & investment

- Florida Bad Credit Refinance with Non-warrantable condos OK

- Florida Bad Credit Refinance with SFRs, townhomes, 2-4 units

- Florida Bad Credit Refinance with Short Sale

- Florida Bad Credit Refinance with Deed-in-Lieu

- Florida Bad Credit Refinance with Foreclosure

- Florida Bad Credit Refinance with Chapter 7Bankruptc

- Florida Bad Credit Refinance with Chapter 13Bankruptcy

- Florida Bad Credit Refinance with 1 day out of FC, SS, BK, or DIL

- Florida Bad Credit Refinance with Loans up to $1 million

- Florida Bad Credit Refinance with Mortgage lates OK

- Florida Bad Credit Refinance with Credit scores as low as 500

- Florida Bad Credit Refinance with 100% gift funds allowed