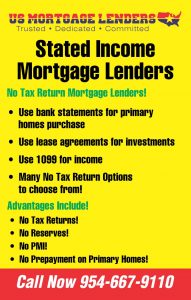

- HOW TO BUY A TEXAS HOME WITH NO TAX RETURNS!

- 1099 ONLY MORTGAGE LENDERS TO VERIFY INCOME

1099 ONLY MORTGAGE LENDERS PROGRAM – COMING SOON.

1099 ONLY MORTGAGE LENDERS PROGRAM – COMING SOON.

Buy or refinance a home with only 1099’s and a profit and loss statement!

Advantages to using a 1099 only Mortgage Lender Includes:

What Is an IRS 1099 Form? A 1099 form is a series of documents the Internal Revenue Service (IRS) refers to as “information returns.” There are a number of different 1099 forms that report the various types of income you may receive throughout the year other than the salary your employer pays you. The person or entity that pays you is responsible for filling out the appropriate 1099 tax form and sending it to you by

Who Must File 1099

Any state or its agency or instrumentality that establishes and maintains a qualified ABLE program must file a Form

1099-QA, Distributions From ABLE Accounts, with the IRS on or before February 28, 2019, for each ABLE account from which any distribution was made or which was terminated during 2018. The filing may be done by either an officer or employee of the state or its agency or instrumentality having control of the qualified ABLE program or the officer’s or employee’s designee.

1099 General Reporting Types

| What to Report | Responsible Party for this Reporting | Form & Instructions | Amounts to Report | Due to IRS | Due to Recipient |

|---|---|---|---|---|---|

| 1099 only Mortgage Interest (including points) | Persons in a trade or business that receive mortgage interest | 1098, Mortgage Interest Statement(Instructions) | $600 or more | February 28* | (To Payer/Borrower) January 31 |

| Information about the 1099 only acquisition or abandonment of property that is security for a debt for which you are the lender | There are different rules for multiple owners, governmental units, subsequent holders and multiple lenders (see instructions) | 1099-A, Acquisition or Abandonment of Secured Property(Instructions) | All amounts | February 28* | (To Borrower) January 31 |

| Sales or 1099 only redemptions of securities, futures transactions, commodities, and barter exchange transactions | A broker or barter exchange | 1099-B, Proceeds From Broker and Barter Exchange Transactions(Instructions) | All amounts | February 28* | February 15** |

| 1099 only Cancellation of Debt | Financial institutions, credit unions, federal agencies and any organization that lends money on a regular and continuing basis (see specific instructions) |

1099-C, Cancellation of Debt (Instructions) |

$600 or more | February 28* | January 31 |

| Distributions,1099 only such as dividends, capital gain distributions, or nontaxable distributions, that were paid on stock and liquidation distributions | (see specific instructions) | 1099-DIV, Dividends and Distributions(Instructions) | $10 or more, except $600 or more for liquidations | February 28* | January 31** |

| 1099 only Interest income | Report only interest payments made in the course of your trade or business. Federal, state and local government agencies, as well as nonprofit organizations and nominees/middlemen also must report interest payments. (see instructions) |

1099-INT, Interest Income(Instructions) | $10 or more ($600 or more in some cases) | February 28* | January 31** |

| 1099 only Payment card transactions | A payment settlement entity (PSE): a domestic or foreign entity that is a merchant acquiring entity (a bank or other organization that has the contractual obligation to make payment to participating payees in settlement of payment card transactions) | 1099-K, Payment Card and Third Party Network Transactions(Instructions) | All amounts | February 28* | January 31 |

| Third party 1099 only network transactions | A payment settlement entity (PSE): a domestic or foreign entity that is a third party settlement organization (the central organization that has the contractual obligation to make payments to participating payees of third party network transactions) | 1099-K, Payment Card and Third Party Network Transactions(Instructions) | $20,000 or more and200 or more transactions | February 28* | January 31 |

| 1099 only Rents (Box 1) Services (Box 7) Prizes and awards (Box 3) Other 1099 only income payments (Box 3) 1099 only Medical and health care payments (Box 6) Crop insurance proceeds (Box 10) Cash payments for fish you purchase from anyone engaged in the business of catching fish (Box 7) Cash paid from a notional principal contract to an individual, partnership, or estate |

(See specific instructions) | 1099-MISC, Miscellaneous Income | $600 or more | February 28*; If reporting non-employee compensation payments in box 7, due date is January 31 whether you file on paper or electronically. | January 31** |

| 1099 only Royalties (Box 2) |

(See specific instructions) | 1099-MISC, Miscellaneous Income | $10 or more | February 28* | January 31** |

| 1099 only Payments of any fishing boat proceeds (Box 5) |

(See specific instructions) | 1099-MISC, Miscellaneous Income | All amounts | February 28* | January 31** |

| 1099 only Payments to an attorney (Box 7 or Box 14) |

(See specific instructions) | 1099-MISC, Miscellaneous Income | $600 or more | February 28* | January 31** or February 15** |

| Gross proceeds from the sale or exchange of real estate | (see specific instructions) | 1099-S, Proceeds from Real Estate Transactions(Instructions) | Generally, $600 or more | February 28* | February 15 |

| 1099 only Timber royalties | (see specific instructions) | 1099-S, Proceeds from Real Estate Transactions(Instructions)

|

$10 or more | February 28* | January 31 |

1099 only Current Products

1099 only Recent Developments

None at this time.

Other 1099 only Items You May Find Useful

All Revisions for Form 1099-QA

About General Instructions for Certain Information Returns (Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G)

About Form 5498-QA, ABLE Account Contribution Information

Publication 1220, Specifications for Filing Forms 1097,1098, 1099, 3921, 3922, 5498, 8935,and W2-G Electronically (PDF)

Form 1099 only Information

Use the Comment on Tax Forms and Publications ;web form to provide feedback on the content of this product. Although we cannot respond individually to each comment, we do appreciate your feedback and will consider all comments submitted.

please see our Tax Law Questions page.

1099 ONLY MORTGAGE LENDERS PROGRAM – COMING SOON.

1099 ONLY MORTGAGE LENDERS PROGRAM – COMING SOON.