FLORIDA JUMBO MORTGAGE LENDERS GENERAL REQUIREMENTS

Product Type

• 30‐YR Fixed

• Loan Amounts >$1.5MM | MIN 740 Credit Score | MAX 70% LTV

Loan Purpose

• Purchase and Rate/Term Refinance

Occupancy

• Owner‐Occupied Only

Property Type

• Single Family, PUD’s, Townhouses and Condos (No Non‐Warrantable)

Appraisals

• Loan amounts ≥ $1.5MM a borrower paid second appraisal must be obtained

Rates Quoted –30 Year Fixed

FLORIDA JUMBO MATRIX SHEET

FICO x LTV ≤ 50% 55% 60% 65% 70% 75%

760 UP TO 75%

740 UP TO 70%

720 UP TO 65%

700 UP TO 65%

FLORIDA JUMBO LENDERS UNDERWRITING REQUIREMENTS

Credit Score

• Lower of 2 middle scores

Housing History

• Residential pay history 0 x 30 x 24

• Rent free not allowed

Credit History

• No 60 day late payments in past 12 months

• No collections/charge offs/Judgments in past 24 months

Trade lines

• 3 trade lines reporting for ≥ 12 month; or 2 trade lines reporting for ≥ 24 months with activity in the past 12 months

DTI Requirements

• Max 43%

Payment Shock

• Maximum 350% | FTHB 250%

Residual Income

• Minimum required $3,000

Seasoning Requirements

• Foreclosure, Deed‐in‐Lieu, Short Sale or Forbearance – 60 months from deed date

• 60 months from discharge date

• 60 months from filing date and 24 months from discharge date if paid as agreed

• Bankruptcy Chapter 7 & 11

• Bankruptcy Chapter 13

Reserves/Cash to Close

• MIN 12 months

• Loan Amounts > $1.5MM ‐ 18 months

• Loan Amounts > $2.5MM ‐ 24 months

• If using business funds, the ending balance may be the lesser of 100% or the percent of business ownership.

DOCUMENTATION

Assets

• Must be sourced or seasoned for 60 days Income

• Full Doc: Wage Earner: W‐2, Paystubs, 2 years tax returns

• Self-Employed: 2 years personal & business tax returns

For Florida Jumbo mortgage applicants looking for a larger home that exceeds $421,100 then you need a jumbo mortgage. A jumbo mortgage is a home loan with an amount that exceeds conforming loan limits imposed by Fannie Mae and Freddie Mac, in Florida that value is $421,100 . Florida Jumbo Mortgage Loans have no PMI (private mortgage insurance), so the down payments are larger and the bad credit jumbo lenders requirements are typically no lower than 600. If you are going to qualify for a Florida jumbo mortgage, then you will have to document income and assets in order to get approval. In Florida the maximum debt-to-income (DTI) ratio for jumbo loan borrowers is 45 percent. The required reserve amount (future mortgage payments in your bank account at closing) for jumbo borrowers is generally at least six (s) months’ in reserves after closing, while conforming and some government loan types may be require only have one or two months and in some cases require no reserves. Call us today to find out if a Jumbo Home Loan is right for you.

95% Florida Jumbo Mortgage Lenders

College tuition, wedding on the horizon or planning a much-needed vacation? With our new Florida Jumbo Stated Mortgage Lenders program, you only need 10% down payment for Jumbo Mortgage of your dreams and keep more money available for life’s milestones.

– 90% loan to value up to $1,500,000 Florida Jumbo loan amount

– Purchase or rate and term refinance

– 30 year fixed

– Non-occupant and co-borrowers allowed

– Primary and second homes

– Allows up to 20 acre properties

Standard Florida Jumbo Mortgage Lender Programs

- Over $$424,100 Jumbo Home Loan Value

- Up to $3,000,000

- 80% LTV Maximum

- Subject to Investor Requirements

- Fixed Rate & Adjustable Rate Options

- Local Florida Customer Service

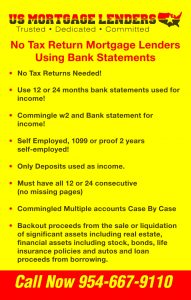

Florida Jumbo Bank Statement Only Mortgage Lenders

Most Florida self employed Jumbo mortgage applicants who have irregular cash flows, want to reap a tax benefit, or to free up cash for Florida investment opportunities.

– Florida Bank Statement Only to qualify based on a 24 month average of deposits in personal or business accounts

– 10 year interest only period

– Florida Bank Statement Only for Primary residences, 2nd homes and investment properties!

– Florida Bank Statement Only with as little as 10% down payment, 600 minimum credit, loan amounts to $2,000,000

– Interest only available

POPULAR JUMBO PAGES OF INTEREST INCLUDE:

Florida Jumbo coverage all Florida including and not limited to: