Palm Beach FHA Mortgage Lender, Palm Beach Home Loans

You have chosen one of the greatest Florida counties to live in, with cities like Boca Raton, West Palm Beach and Jupiter, there’s always an exciting place to visit like City Place or Clematis Street. Palm Beach County is full of its colorful boutiques, nightclubs, live music, restaurants, antique shops and other points of interest. It’s no wonder to us why you have chosen to reside in Palm Beach County. Now all you need is Florida Mortgage lender to secure your Palm Beach dream home.

US Mortgage Lenders has a long standing commitment to lowering the barriers to home ownership and to educating homebuyers as to the Mortgage programs available. We offer you exactly what you are looking for: a company with years of expert mortgage advice to guide you though the home loan application process, and the most competitive mortgage rates and service you desire.

1st Continental Mortgage has helped families find ways to accomplish their home ownership needs, whether you’re Purchasing or refinancing your Palm Beach home it’s a serious undertaking, because it involves the most valuable asset most people will ever own. We don’t take the process lightly and our duty to our clients is to deliver expert advice, competitive rates, and on-time closings to our clients. We are a local mortgage lender providing personalized services to answer all of your mortgage questions.

Building a relationship with the best lenders who are familiar with our Palm Beach Clientele has taken years to develop. We pass on our lenders bottom rates to our Buyers and repeat clients. Regardless of whether they are in Belle Glade, Bryant, Canal Point, Jupiter, Lake Harbor, Lake Worth, or even Loxahatchee you know you are dealing with a mortgage company that you can rely on.

By focusing in South Florida homebuyers and homeowners,US Mortgage Lenders can offer better mortgage rates focusing on Florida unlike a national Mortgage Lender focusing on national demographics. And, because of our daily research and diligent work effort and we offer our Palm Beach locals faster, more responsive service.

To speak directly with a Palm Beach Mortgage specialist at US Mortgage Lenders call 1-954-667-9110 or use our Full Application to find out more about the many Florida mortgage programs. Whether you need an FHA or Jumbo home loan in Palm Beach, Florida we can help. With 30 year fixed interest mortgage rates at levels near their 40-year lows, isn’t it time you made the call to 1st Continental Mortgage. Don’t wait until today’s low Florida mortgage rates are gone.

PALM BEACH FL STATED INCOME LENDERS + SAME DAY PRE APPROVALS!

Palm Beach Florida First Time Home Buyer, Palm Beach FHA Lenders

At US Mortgage Lenders helping Palm Beach first time home buyers is nothing new. We welcome first time home buyers to call us and we will gladly explain the easiest mortgage for the first time buyer to qualify for. With so many benefits to the FHA mortgage program including no credit score and no minimum credit score requirement, its no wonder that is the first financing choice to Palm Beach first time homebuyers The advantages include,

FL Mortgage Lenders

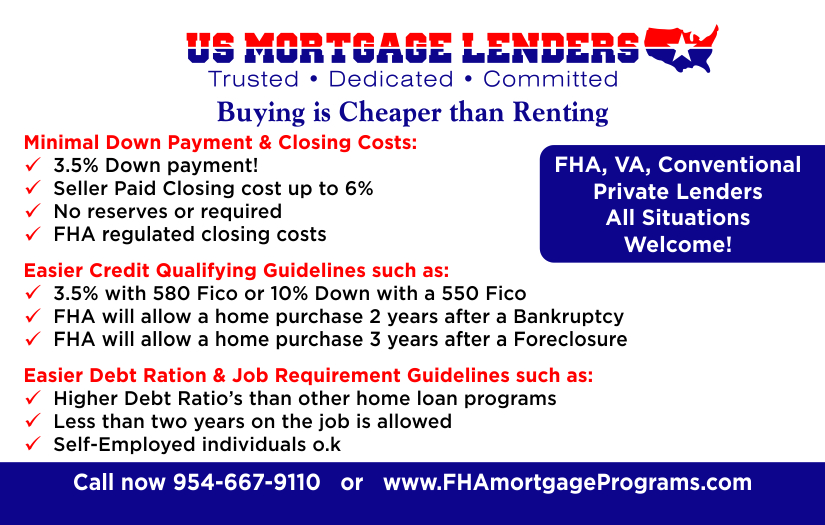

Minimal Down Payment and Closing Costs.

- Down payment less than 3% of Sales Price and 100% Financing options available

- Gift for down payment and closing costs are allowed up to 6% of Sales price.

- No reserves or savings required.

Easy Credit Qualifying Guidelines

- No minimum FICO score or credit score requirements.

- FHA will allow a home purchase 2 years after a Bankruptcy. (some cases sooner)

- FHA will allow a home purchase 3 years after a Foreclosure. ( some cases sooner)

If you are looking for a Palm Beach home loan and have questions in regards to FHA financing visit our Frequently Asked FHA Questions use our Full Application for a free, no-obligation consultation. Contact us immediately at 954-667-9110

Cash Out Refinance Palm Beach FL, Refinance Out Of Adjustable Rate Mortgage Palm Beach, Florida

Did you know that FHA will allow the Palm Beach homeowner to cash out refinance their existing home loan up to 95% of the appraised value? Currently there is no other program available other than the FHA insured home loan that will allow Palm Beach residents such a high loan to value with such competitive rates. A few years ago, you thought that you were getting a bargain with the artificially low adjustable interest rate. Today you are facing a possible mortgage rate adjustment that could skyrocket your monthly mortgage payments making your debt to income ratio unsustainable. FHA Secure launched by the Bush administration to curb foreclosures will allow you to refinance out of your Adjustable rate mortgage even if you are behind on your mortgage payments. You’ll sleep better at night knowing that 1st Continental Mortgage has options that will allow you to retain homeownership. We have superb fixed rate programs that will even finance your closing costs into the new loan. Don’t let the great 6% APR mortgage you have turn into a 9% Annual Percentage Rate. Call 1-954-667-9110 for a no-hassle quote on your Palm Beach County, Florida home loan specialist! Use our Full Application for a free, no-obligation consultation. Or contact us immediately at 954-667-9110

As long as you can prove that you were current up until the mortgage reset, FHA SECURE is the program for you. If you bought your Palm Beach home with the intention of keeping holding on to your home for years to come but are now worried because of a possible adjustment. This program will give you security they have been looking for. It’s not too late to take advantage of 40 year low interest rates contact us for Now at 954-667-9110 or fill out our Quick Response Form to lock in today’s low interest rates.

Palm Beach Rehab Loans, Finance Home Repairs Palm Beach, FHA 203K Home Lender In Palm Beach County

fhamortgageprograms.com offers the FHA 203k for the rehabilitation and repair of single family properties across Palm Beach County. The 203K home loan it is an important tool for Palm Beach homebuyers that need the extra money for repairs and rehabilitation. 1st Continental knows the importance financing the repairs into the purchase of your new home loan. The FHA 203k program is an excellent means for reinvestment and revitalization in the Palm Beach community. Other financing options only provide permanent financing and do not provide the needed financing for the repairs. This means that other mortgage programs will not fund the borrower unless the condition and value of the property provide adequate loan security. The FHA 203K home loan program will allow homebuyers to finance the repairs into the purchase price. When rehabilitation is needed, lenders usually require that the improvements are finished before a long-term mortgage is made. This is not the case with the FHA 203k financing that we provide for Palm Beach residents. Use our Full Application to find out more about the 203K Rehabilitation loan.

If you are a homebuyer and you would like to purchase a house in need of modernization or repair, the homebuyer usually has to obtain financing first to purchase then search additional financing to do the rehabilitation construction. Often the interim financing or construction loan involves relatively high interest rates with short amortization. In contrast, the FHA 203k rehab program was designed to address this situation. The borrower can get just one mortgage with have of the repair proceeds released at closing and the rest proceeded release at the completion of the rehabilitation. The initial mortgage loan will finance both the acquisition and the rehabilitation of the property. The mortgage loan amount is based on the projected value or Estimated New Value of the property with the work completed, taking into account the cost of the work.

Palm Beach, Florida Luxury Home Loans

fhamortgageprograms.com offers a full range of the best Luxury financing options for jumbo and Super Jumbo home homebuyers. These programs are for high-income borrowers who want to own a home in the Palm Beach Florida. Whether you’re purchasing a home to be a primary residence, a 2nd investment home or Palm Beach vacation home, we can make it a smooth and straightforward process.

Over the last several years Palm Beach Luxury home prices have appreciated substantially across the county of Palm Beach. Despite recent retreats, for the people searching there is always an investment opportunity. And those looking for a good tax shelter and know the advantages of advantages long term holdings in Palm Beach real estate market will take advantage of a discounted luxury home.

If you are financing a single family home in Palm Beach County with a purchase price over $417K, you will need a Luxury home loan expert. If the purchase price is over $1 Million, your Palm Beach mortgage is considered aSuper Jumbo Mortgage.

To make financing the purchase of a Palm Beach Florida executive homeeasy, fhamortgageprograms.com offers these Mortgage programs to our Jumbo and Super Jumbo mortgage clients:

Fixed Rate Florida Jumbo and Super Jumbo Mortgages:

- 30 Year Fixed

- 20 Year Fixed

- 15 Year Fixed

- Specialty Florida Mortgage Programs:

- No Income Verification Mortgage Programs

- Stated Income and Stated Assets Mortgage Programs

- Jumbo and Super Jumbo Florida mortgages with Interest Only periods of 1,3,5,7 and 10 years

Why do lenders make a distinction? Lenders have been selling the home loans they originate on the secondary market since the 1930s because it allows banks to make more loans. Fannie Mae and Freddie Mac set limits on the size of the mortgages in these market and loans within the limits are called conforming loans. Loans for amounts above the limit are called Jumbo or Super Jumbo mortgages.

As a result of market risk, they are harder for the lender to sell and so they typically carry a small premium of an extra half point or so on these Jumbo or Super Jumbo Florida mortgages. Luckily you contacted a Luxury mortgage specialist that keeps up to date all the luxury home loan offerings. Call a 1st Continental Mortgage loan officer today at 1-954-667-9110 or fill out a Full Application to get pre-approved for a Jumbo Palm Beach Florida mortgage or to discuss the best way to structure your Florida home loan.

Palm Beach Reverse Mortgage Programs, Reverse Mortgage Information

1st Continental Mortgage is here to Assist seniors of Palm Beach, Florida the opportunity to covert the equity in their home to cash with an FHA insured Reverse Mortgage. Homeowners 62 years of age or older that own their own your home outright you could qualify to tap into equity built up over years of owning your Palm Beach home. Unlike a traditional home equity loans where you pay the lender, a reverse mortgage No repayment is required until the borrowers no longer use the home as their principal residence. Your home must be a single family dwelling two to four unit property that you own and occupy. Properties that qualify include, Townhouses, detached homes, condominiums and manufactured homes. And, you choose how you would like to receive your equity:

- Equal monthly payments.

- Equal monthly payments for a fixed period of Months.

- Line of Credit – Use the line of credit unit the funds are exhausted.

- Combination of line of credit and monthly payments

- Modified Term – combination of line of credit with monthly payments for a fixed period of months selected by the borrower.

- To learn more about Reverse mortgages contact us at 954-667-9110 or fill out a Full Application.

Palm Beach Bad Credit Home Lender, Bad Credit Loans

US Mortgage Lenders has programs for Palm Beach Bad Credit borrowers. Palm Beach residents need to know that 1st Continental Mortgage provides options for you to relief from high mortgage credit card and other high interest payments with bad credit mortgages, At 1st continental Mortgage we understand that unfortunate circumstances happen to good people of Palm beach Florida. And we believe our Palm Beach borrowers deserve a second shot at credit. And work with our clients to get them either a hard money or sub prime loan just so they get their debts consolidated. Then shortly after we will refinance into a low fixed rate mortgage with either an FHA or Conventional mortgage product.

Palm Beach, Florida Refinance Out Of Chapter 13 Bankruptcy

Have you suffered a Chapter 13 Bankruptcy? If you own a home in West Palm Beach, or any other Palm Beach County location, you may be able to resume control of your financial life and rebuild your Credit much more quickly than you think. One provisions of the bankruptcy code allows for early Chapter 13 payoff under specific conditions. If you have steady payment history during a chapter 13 bankruptcy, and have the equity needed to refinance your home along with all debt included in the chapter 13 bankruptcies, then with permission from the court you could qualify to refinance and consolidate all your monthly debts into one low monthly payment. Call now for Details 954-667-9110

Palm Beach Loans To Stop Foreclosure, Avoid Foreclosure Loans In Palm Beach, Florida

Due an unforeseen job loss, divorce or chain of events in life, you may find yourself behind on your mortgage payments. Leave it to 1st Continental Mortgage to advise you as to what options are available. In many cases we were able to Refinance a Palm Beach homeowner when they never thought possible. Over the years we have made many loans and informed many homeowners of the many options available to stop the foreclosure in Palm Beach, Florida, and get back on track.

If your delinquent on your Palm Beach home loan. You may be receiving notice of foreclosure from a Palm Beach County Process server any day now. It’s not a good feeling knowing that the lender intents to sell your most valuable asset

Don’t sign away your deed to investor only to allow him to profit off your hard earned equity. Without speaking to a Florida mortgage company like 1st Continental Mortgage, we may be able to offer we may be able to inform you as to what options are available to avoid foreclosure in Palm Beach, Florida.

Call US Mortgage Lenders representative today at 1-954-667-9110, or fill out a Full Application. This call could very well be the first step to saving your Palm Beach home, Florida home from foreclosure.

Refinancing your late payments and rolling the overdue amounts into the new mortgage loan can provide the much needed relief of burden. The sooner you call 1st Continental Mortgage; the sooner can help you come up with a plan of action to save your Palm Beach Florida home from foreclosure. In Florida, once started, a foreclosure process can happen quickly. Call 1st Continental Mortgage at 954-667-9110 today!

Hard Money Lenders In Palm Beach, Florida

US Mortgage Lenders provides Palm Beach homeowners and property buyers with Hard Money Loans. Hard money lenders provide short term funds ideal for buying investment properties or refinancing out of a tight situation. Hard money lenders lend money at high interest rates for short periods of time based on the quick sale value of a property which varies based on the investors lending standards. Contact 1st continental mortgage for a Full Application on a Boca Raton or Palm Beach county hard money loan.

Because our private local hard money lenders are locales in Palm Beach they can assess your situation and make an on the spot decision in a matter of days. Hard money financing for commercial, residential or any other type of collateral has never been easier with our private lenders. Simply fill out Full Application Form on our commercial hard money loans page and a hard money lender who specializes in commercial hard money funding will contact you to discuss your project. Belle Glade, Bryant, Canal Point, Jupiter, Lake Harbor, Lake Worth, Loxahatchee, North Palm Beach, Pahokee, Palm Beach, Palm Beach Gardens and South Bay, Florida

Palm Beach Mortgage Programs

fhamortgageprograms.com has a wide range of financing options has excellent low closing cost options for homebuyers and homeowners across Palm Beach County. We can help you get the right Florida mortgage loan to accomplish your financial goals no matter where you are in Palm Beach County, Belle Glade, Bryant, Canal Point, Jupiter, Lake Harbor, Lake Worth, Loxahatchee, North Palm Beach, Pahokee, Palm Beach, Palm Beach Gardens and South Bay, or anywhere else in Florida.

Cities and areas covered by in Palm Beach County include: Belle Glade, Bryant, Canal Point, Jupiter, Lake Harbor, Lake Worth, Loxahatchee, North Palm Beach, Pahokee, Palm Beach, Palm Beach Gardens and South Bay

- 15% DOWN+STATED INCOME FLORIDA MORTGAGE LENDERS-

- 3.5% PALM BEACH FL FHA MORTGAGE LENDERS

- PALM BEACH FL BAD CREDIT FHA MORTGAGE LENDERS

-

SERVING EVERY PALM BEACH LOCATION

24 Atlantis

2 Belle Glade

37 Boca Raton

30 Boynton Beach

33 Briny Breezes

18 Cloud Lake

35 Delray Beach

17 Glen Ridge

32 Golf Village

23 Greenacres

34 Gulf Stream

16 Haverhill

36 Highland Beach

29 Hypoluxo

7 Juno Beach

6 Jupiter Town

5 Jupiter Inlet Colony

20 Lake Clarke Shores

10 Lake Park

25 Lake Worth

27 Lantana Town

38 Loxahatchee Groves

28 Manalapan

13 Mangonia Park

9 North Palm Beach

31 Ocean Ridge

1 Pahokee City

14 Palm Beach

8 Palm Beach Gardens

12 Palm Beach Shores

19 Palm Springs

11 Riviera Beach

21 Royal Palm Beach

3 South Bay

26 South Palm Beach

4 Tequesta

22 Wellington

15 West Palm Beach

Census-designated places

Belle Glade Camp(l)

Boca Del Mar(c)

Boca Pointe(a)

Canal Point(bb)

Century Village(u)

Cypress Lakes(w)

Dunes Road(cc)

Fremd Village-Padgett Island(aa)

Golden Lakes(r)

Gun Club Estates(m)

Hamptons at Boca Raton(e)

High Point(i)

Juno Ridge(z)

Kings Point(g)

Lake Belvedere Estates(o)

Lake Harbor(p)

Lake Worth Corridor(k)

Lakeside Green(x)

Limestone Creek(y)

Mission Bay(d)

Plantation Mobile Home Park(s)

Royal Palm Estates(n)

Sandalfoot Cove(b)

Schall Circle(v)

Seminole Manor(j)

Stacy Street(q)

Villages of Oriole(h)

Westgate-Belvedere Homes(t)

Whisper Walk(f)