Georgia Mortgage 2 homes 1 Parcel or Lot or Acres Mortgage Lenders

Georgia Home Loans For 2 homes 1 Parcel or Lot or Acres Mortgage Lenders

Georgia mortgage lenders for 2 homes 1 Parcel or Lot or Acres for Primary Residence, Second Homes, and Investment 70% manufactured Georgia homes.

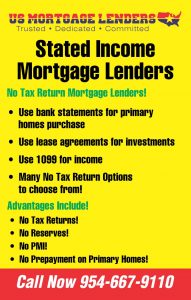

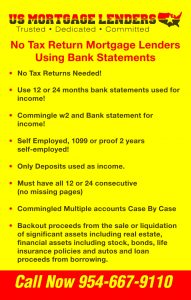

Use Bank Statement Deposits for income to Purchase or Refinance 2 homes 1 parcel Primary, 2nd Home or Investment!

Eligible Georgia 2 homes 1 parcel or lot no income mortgage Georgia 2 homes 1 parcel or lot no income property Types

One Unit Single Family Georgia 2 homes 1 parcel or lot Residences (Attached and Detached), PUDs (Attached and Detached), Condos (Low and High Rise), Site Condo, Non-Warrantable Condominiums, Townhouse, 2-4 Unit Properties, Georgia 2 homes 1 parcel or lot Modular Homes and Georgia 2 homes 1 parcel or lot Mixed-Use Georgia Properties.

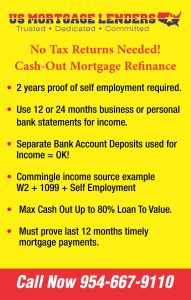

NO Tax Return-Georgia 2 homes 1 parcel or lot Cash-Out Refinance Mortgage lenders

Georgia 2 homes 1 parcel or lot mortgage lenders buying or refinancing, flipping or renting Georgia 2 homes 1 parcel or lot property, we’ve designed our no income verification home loans to help you maximize your Georgia 2 homes 1 parcel or lot investment opportunities.

COMMERCIAL NO INCOME VERIFICATION MORTGAGE LENDERS

- Georgia 2 homes 1 parcel or lot no income mortgage Lenders Program Product Types include – 30 year Fixed, 5/1 ARM, 7/1 ARM, 10/1 ARM, 5/1 ARM-IO, 7/1 ARM-IO, and 10/1 ARM-IO

- Georgia 2 homes 1 parcel or lot no income mortgage Lenders Minimum Credit Score Requirements Minimum FICO The primary wage-earner score is used as the Representative Credit Score for each loan. Primary wage-earner may be an occupying or non-occupying co-borrower. The primary wage-earner must have a valid score from at least 2 of the following 3 agencies: Experian (FICO), Trans Union (Empirica), and Equifax (Beacon). Only scores from these agencies are acceptable. Additional co-Georgia 2 homes 1 parcel or lot no income mortgage applicants on the loan must have at least one valid score of 500 or greater. To determine the Representative Credit Score for the primary wage-earner, select the middle score when 3 agency scores are provided and the lower score when only 2 agency scores are provided.

- Closing Cost Sellers Concessions Georgia 2 homes 1 parcel or lot no income mortgage Lenders Seller Concessions Up to 9% towards closing for Primary Residence and Second Homes (LTV ≤ 75%), 6% towards closing for Primary Residence and Second Homes (LTV > 75%); Up to 2% toward closing for Investment Properties.

- Debt Ratios (Georgia 2 homes 1 parcel or lot no income Primary Residence, Georgia 2 homes 1 parcel or lot no income Second Homes and Georgia 2 homes 1 parcel or lot no income Investment Properties) Standard DTI to 43% available for Grade A, B and C · Expanded DTI to 50% available for Grade A and B Min FICO = 620 · Expanded DTI to 55% available for Grade A and B with ALL of the following compensating factors present (Full Doc only): o FICO ≥ 680; Primary Residence; LTV ≤ 85%; Residual Income ≥ $3,500; 12-months Reserves · DTI to 50% available for 12-Month Bank Statements and 1-Year Documentation (W-2 or Tax Return) Min FICO = 620

- Full Documentation Income Georgia 2 homes 1 parcel or lot no income mortgage Lenders Requirements-Fully documented income requires 4506-T forms and processed transcripts for the income used to qualify. Note: If there are no transcript records available, Georgia 2 homes 1 parcel or lot no income Mortgage Lenders will accept a copy of the tax return, stamped or otherwise, and proof of receipt of the refund or a cancelled check/bank draft documenting the taxes were paid. The refund or check/bank draft must match the tax return exactly. See Carrington Flexible Advantage Program Guidelines for details.

- Georgia 2 homes 1 parcel or lot no income mortgage/Rental History/Rental History For Georgia 2 homes 1 parcel or lot no income mortgage LenderS-See Grade Determination above. Georgia 2 homes 1 parcel or lot no income mortgage and rental payments not reflected on the original credit report must be documented via an institutional Verification of Rent or Verification of Georgia 2 homes 1 parcel or lot no income mortgage (VOR/VOM). A combined total of all late Georgia 2 homes 1 parcel or lot no income mortgage and rental payments in the past 12 months must be used to determine the Georgia 2 homes 1 parcel or lot no income housinghistory for all Georgia 2 homes 1 parcel or lot no income mortgage applicants. If the borrower is making payments to an individual or interested party, 12 months of cancelled checks or bank statements must be obtained. A VOR/VOM is not required but may be requested for clarification. All Georgia 2 homes 1 parcel or lot no income mortgages and rental payments should be current at time of closing. If the credit report or VOR/VOM reflects a past-due status, updated documentation is required to verify account is current. Georgia 2 homes 1 parcel or lot no income mortgage applicants with no Georgia 2 homes 1 parcel or lot no income housinghistory or less than 12 months Georgia 2 homes 1 parcel or lot no income housinghistory are permitted. Refer to Carrington Flexible Advantage Program Guidelines for full details.

- Late Payments Rolling Late Payments Georgia 2 homes 1 parcel or lot no income mortgage Lenders Requirements-Rolling late payments are not considered a single event. Each occurrence of a contractual delinquency is considered individually for loan eligibility. Past Due Accounts: Past due consumer debts can be no more than 30 days past due at time of closing unless the past due consumer debt will be paid off at closing. For Georgia 2 homes 1 parcel or lot no income mortgage late payment requirements refer to Georgia 2 homes 1 parcel or lot no income mortgage/Rental History above.

- Bank Statement Income Georgia 2 homes 1 parcel or lot no income mortgage Lenders Requirements-Loans utilizing bank statement documentation for income will not require a 4506-T form processed for transcripts. When a file has mixed income (W-2 wage earner income) combined with the bank statement income option, Georgia 2 homes 1 parcel or lot no income Mortgage Lenders must obtain a 4506-T and transcripts for the W-2 wage earner income only. See Carrington Flexible Advantage Program Guidelines for details. Please Note: Underwriter may condition for 4506-T tax transcripts to be signed and processed on a case by case basis.

- Deferred Maintenance Georgia 2 homes 1 parcel or lot no income mortgage Lenders Requirements- Deferred Maintenance Georgia 2 homes 1 parcel or lot no income Mortgage Lenders permits appraisals to be based on the “as is” condition of the Georgia 2 homes 1 parcel or lot no income property provided existing conditions are minor and do not affect the safety, soundness, or structural integrity of the Georgia 2 homes 1 parcel or lot no income property, and the appraiser’s opinion of value reflects the existence of these conditions. Deferred maintenance is typically due to normal wear and tear from the aging process and the occupancy of the Georgia 2 homes 1 parcel or lot no income property. While such conditions generally do not rise to the level of a required repair, they must be reported. Examples of minor conditions and deferred maintenance include worn floor finishes or carpet, minor plumbing leaks, holes in window screens, or cracked window glass.

- Second Georgia 2 homes 1 parcel or lot no income Home RequirementsSecond homes are restricted to 1-unit dwellings. Second homes must be located a reasonable distance away from the borrower’s primary residence and must be available for borrower’s exclusive use. Borrower may not own any other second homes or investment properties in the same geographic market as the subject Georgia 2 homes 1 parcel or lot no income property. Second homes cannot be subject to rental pools or agreements requiring Georgia 2 homes 1 parcel or lot no income property to be rented and cannot be controlled by a management firm. Suitable for year-round occupancy.

- Georgia 2 homes 1 parcel or lot no income Condo Warrantable and Georgia 2 homes 1 parcel or lot no income Non-Warrantable Condo LendersNon-Warrantable All condominiums must have a valid project review along with a completed Georgia 2 homes 1 parcel or lot no income Mortgage Lenders Homeowners’ Association Certification (InterIsland HOA Questionnaire). ATTACHED CONDOS: Appraisal must contain 2 comparable sales from subject’s project in addition to the current comparable sale requirements. See the Carrington Flexible Advantage Program Guidelines for condominium specifications.

- 600 square feet Georgia 2 homes 1 parcel or lot no income mortgage Lenders Minimum gross living area.All One Unit Single Family Residences (Attached and Detached), PUDs (Attached and Detached), Condos (Low and High Rise), Site Condo, Non-Warrantable Condominiums, Townhouse, 2-4 Unit Properties, Modular Homes and Mixed-Use Properties. Square Footage Minimum of 600 square feet of gross living area.

- Ineligible Georgia 2 homes 1 parcel or lot no income Home –Types Co-ops, Condotels, Manufactured, Unique Properties, Leaseholds, Rural Properties, Log Homes, Agriculturally Zoned, Farms or Hobby/Working Farms, Properties with active oil, gas, or mineral drilling, excavation, etc., Builder Model Leaseback, Non-Conforming zoning regulations that prohibit rebuilding, Properties subject to Rent Control regulations, and State-approved medical marijuana producing properties

- Mixed Use Georgia 2 homes 1 parcel or lot no income property Georgia 2 homes 1 parcel or lot no income mortgage Lenders-Georgia 2 homes 1 parcel or lot no income Mortgage Lenders will allow for Georgia 2 homes 1 parcel or lot no income mortgages that are secured by properties that have a business use in addition to their residential use, such as a Georgia 2 homes 1 parcel or lot no income property with space set aside for a day care facility, a beauty or barber shop, or a doctor’s office. The following special eligibility criteria must be met: · The Georgia 2 homes 1 parcel or lot no income property must be a one-unit dwelling that the borrower occupies as a principal residence. · The borrower must be both the owner and the operator of the business. · The Georgia 2 homes 1 parcel or lot no income property must be primarily residential in nature. · The dwelling may not be modified in a manner that has an adverse impact on its marketability as a residential Georgia 2 homes 1 parcel or lot no income property. The appraisal requirements for mixed-use properties must: · provide a detailed description of the mixed-use characteristics of the subject Georgia 2 homes 1 parcel or lot no income property; · indicate that the mixed use of the Georgia 2 homes 1 parcel or lot no income property is a legal, permissible use of the Georgia 2 homes 1 parcel or lot no income property under the local zoning requirements; · report any adverse impact on marketability and market resistance to the commercial use of the Georgia 2 homes 1 parcel or lot no income property; and · report the market value of the Georgia 2 homes 1 parcel or lot no income property based on the residential characteristics, rather than of the business use or any special business-use modifications that were made. · report that no modifications have been made that would adversely affect marketability; A confirmation of the appraiser’s review will be performed by a Due Diligence (DD) firm. If the DD firm disagrees with the appraiser, DD findings will take priority over appraiser findings

- Georgia 2 homes 1 parcel or lot no income property Flipping Georgia 2 homes 1 parcel or lot no income mortgage Lenders- Title transfers within 180 days are subject to additional requirements. See the Carrington Flexible Advantage Program Guidelines for specifications.

- Refinance Requirement for Georgia 2 homes 1 parcel or lot no income mortgage Lenders- Rate/term refinance and cash-out refinance transactions are allowed. All investment Georgia 2 homes 1 parcel or lot no income property refinances require an appraisal review product. See Appraisal Review Process for detailed requirements. Determining Loan-to-Value If the subject Georgia 2 homes 1 parcel or lot no income property was acquired ˃ 12-months from application date, the appraised value must be used to determine loan-to-value. If the Georgia 2 homes 1 parcel or lot no income property was acquired ≤ 12-months from application date, the lesser of the current appraisal value or previous purchase price plus documented improvements (if any) must be used. The purchase settlement statement and any invoices for materials/labor will be required. Refinances of Short Payoffs are only acceptable for Georgia 2 homes 1 parcel or lot no income Mortgage Lenders to Georgia 2 homes 1 parcel or lot no income Mortgage Lenders (Stanwich Portfolio) transactions.

- Rate & Term Refinance Georgia 2 homes 1 parcel or lot no income mortgage Lenders / Limited Cash Out Refinance Georgia 2 homes 1 parcel or lot no income mortgage Lenders-No seasoning of first Georgia 2 homes 1 parcel or lot no income mortgage. If owned less than 12 months (recorded transfer date to application date of the new loan), the LTV is be based on lower of appraised value less any sales concessions or the original sales price. If owned more than 12 months, (recorded date to application date of new loan), the LTV is based on the current appraised value. If value has increased more than 15%, photos of improvements are required. Maximum cash in hand is the lessor of 2% of the principal of the new loan amount or $2000. HUD-1 settlement statements required from any transaction within past 6 months. If previous transaction was cash-out or if it combined a first and non-purchase money subordinate into a new first, loan to be coded cash out. If new transaction combines a 1st and non-purchase money 2nd into a new 1st loan, it is considered cash out. Must demonstrate there is a Benefit to the borrower by utilizing the Georgia 2 homes 1 parcel or lot no income Mortgage Lenders benefit to borrower form currently in use through Encompass for refinance transactions.

- Listed For Sale or Purchase Georgia 2 homes 1 parcel or lot no income mortgage Lenders-To be eligible for either a rate/term or a cash-out refinance, the subject Georgia 2 homes 1 parcel or lot no income property must be taken off the market on or before application date, provide a letter of explanation for the MLS listing and statement of intent to retain the Georgia 2 homes 1 parcel or lot no income property for 12 months after closing. For cash-out transactions, if the subject Georgia 2 homes 1 parcel or lot no income property was listed for sale in the 6 months prior to application date, a 10% LTV reduction from the maximum available for the specific transaction is required. The lesser of the most recent list price or the current appraised value should be used to determine loan-to-value for both rate/term or cash-out transactions. Cash-out Refinance For all cash-out refinance transactions, at least one borrower must have been on title a minimum of six (6) months prior to the new note date.

- Cash-out Refinance Georgia 2 homes 1 parcel or lot no income mortgage Lenders-For all cash-out refinance transactions, at least one borrower must have been on title a minimum of six (6) months prior to the new note date and a minimum of 6 months must have elapsed since the most recent Georgia 2 homes 1 parcel or lot no income mortgage transaction on the subject Georgia 2 homes 1 parcel or lot no income property (either the original purchase transaction or subsequent refinance). Note date to note date is used to calculate the 6-months. There is no waiting period if the borrower acquired the Georgia 2 homes 1 parcel or lot no income property through an inheritance or was legally awarded the Georgia 2 homes 1 parcel or lot no income property through divorce, separation, or dissolution of a domestic partnership.

- Georgia 2 homes 1 parcel or lot no income mortgage Lenders Credit History-Primary Wage-earner Requirements Standard Credit: 3 tradelines reporting for 12+ months with activity in last 12 months OR 2 tradelines reporting for 24+ months with activity in last 12 months 0X60 for most recent 12 months Trade lines must meet the following: The credit line must be reflected on the borrower’s credit report · The account must have activity in the past 12-months and may be open or closed · Tradelines used to qualify may not exceed 0x60 in the most recent 12 months · An acceptable 12- or 24-month Georgia 2 homes 1 parcel or lot no income housinghistory not reporting on credit may also be used as a tradeline Credit lines on which the borrower is not obligated to make payments are not acceptable for establishing a minimum history. e.g., loans in a deferment period, collection or charged-off accounts, accounts discharged through bankruptcy, and authorized user accounts.

- Limited Tradelines Georgia 2 homes 1 parcel or lot no income mortgage Lenders-Primary Residence and Second Homes only. Not permitted on Investment Properties. No minimum tradeline requirements (Full Doc only) If the borrower does not meet the requirements for Standard Tradelines but still has a valid credit score, he or she may qualify under Limited Tradelines. The following requirements apply when qualifying with Limited Tradelines: · Primary residence and second homes only · 10% minimum borrower contribution · Minimum 6-months reserves after closing · Full documentation of income (Bank Statement Documentation not allowed) · Not eligible for Investment Georgia 2 homes 1 parcel or lot no income property Programs When qualifying with Limited Tradelines, the lower of either the Representative Loan Score or a 580 score is used to qualify the borrower on the Non-Prime Matrix. The loan may be priced using the actual Representative Loan Score.

- Disputed Tradelines Requirements for Georgia 2 homes 1 parcel or lot no income mortgage Lenders- Georgia 2 homes 1 parcel or lot no income mortgage applicants are not required to remove disputed tradelines from their credit report regardless of the number of accounts or the amounts. A disputed account is not a waiver of the debt from consideration in underwriting. Disputed accounts must meet the guideline requirements for collections and/or charge off status unless there is documentation provided of a bonafide dispute such as a police report due to fraud or theft.

- Bankruptcy Georgia 2 homes 1 parcel or lot no income mortgage Lenders- For bankruptcy seasoning requirements, see Grade Determination above. A Chapter 13 bankruptcy may remain open after loan closing when all of the following requirements are met: · A minimum 12-month repayment period in the bankruptcy has elapsed · Bankruptcy plan payments for the last 12 months have been made on time · Borrower has received written permission from bankruptcy court to enter into the transaction · Note: Open Chapter 13 bankruptcy will be graded per the Georgia 2 homes 1 parcel or lot no income mortgage rating. If the bankruptcy has late payments within the last 12 months, they must be paid off and the loan must be graded as Credit Grade C.

- Collections/ Charge Offs Requirements Georgia 2 homes 1 parcel or lot no income mortgage Lenders-The following accounts may remain open: · Collections and charge-offs < 24 months old with a maximum cumulative balance of $2,000 · Collections and charge-offs ≥ 24 months old with a maximum of $2,500 per occurrence · Collections and charge-offs that have passed beyond the statute of limitation for that state (supporting documentation required) · All medical collections Collection and charge-off account balances remaining after the exclusions listed above may remain open when one of the following is met: · Borrower has sufficient reserves to cover remaining collection and charge-off balances (in addition to the published reserve requirement); or · Payment for remaining collections and charge-offs included in DTI results in final DTI ≤ 50% (payment calculated at 5% of balance of remaining unpaid collections and charge-offs). A combination of the two options above is allowed. A portion of the unpaid collection balance can be included in the DTI while the remainder is covered by excess reserves. Collections and charge-offs that cannot be factored into DTI or reserves must be paid off.

- Judgments/Liens Judgments and tax liens Requirements for Georgia 2 homes 1 parcel or lot no income mortgage Lenders- Judgments/Liens Judgments and tax liens must be paid off prior to or at closing, unless the requirements listed below are met. Adverse credit that will impact title must be paid in full as title must insure our lien position without exception. Court-ordered judgments may remain open when all of the following requirements are met: · A copy of the repayment agreement is obtained; · A minimum of 3 months has elapsed on the plan and evidence of timely payments for the most recent 3 months is provided; and · The maximum payment required under the plan is included in the debt-to-income ratio. Outstanding tax liens may remain open on purchase transactions only (additional LTV reductions may be required based on the size of the lien). All of the following requirements must be met: · A copy of the repayment agreement is obtained; · A minimum of 3 months has elapsed on the plan and evidence of timely payments for the most recent 3 months is provided; · The maximum payment required under the plan is included in the debt-to-income ratio; and · The title company must provide written confirmation confirming (a) the title company is aware of the outstanding tax lien, and (b) there is no impact to first lien position.

- Employment All Georgia 2 homes 1 parcel or lot no income mortgage applicants must have a 2-year employment history. Georgia 2 homes 1 parcel or lot no income mortgage applicants should provide a signed, written letter of explanation for any employment gaps that exceed 30 days in the most recent 12 month period, or that exceed 60 days in months 13-24. Georgia 2 homes 1 parcel or lot no income mortgage applicants newly employed are allowed with documentation showing the borrower was previously in school or a training program and borrower is now employed in that line of work.

- Income Paystub(s) covering the most recent 30-day period providing year-to-date earnings at approval date. E.g. paid weekly = 4 paystubs, Bi-weekly/semi-monthly = 2 paystubs.

- Self-employed Two years personal and business tax returns with all schedules if borrower has 25% or greater ownership interest in the business. Personal and business tax returns must be validated through a 4506-T and 8821 when applicable. If tax transcripts are not available due to recent filing, a copy of the IRS notice showing “No record of return filed” is required in addition to the previous 2 years validated tax returns. Georgia 2 homes 1 parcel or lot no income mortgage applicants are qualified using the returns validated. A Liquidity Test is not required to qualify the borrower.

- Non-Salaried Two years documentation and evidence of at least 3 year continuance is required. Retirement Income requires a copy of the award letter and most recent 1099’s OR 3-months consecutive bank statements showing receipt of the income. Social Security income can be taxed up 25% or an amount that is prudent based on federal tax levels but not to exceed 25%. Documentation is required to show the income is non-taxable. Alimony and child support must be received at least 6-months to be used for qualifying. Alimony and child support received less than 12-months may be used provided it does not exceed 30% of the borrower’s qualifying income.

- Rental Income Rental income from a 1-unit primary residence or second homes may not be used. Boarder income cannot be used. Note: If rental income from the subject Georgia 2 homes 1 parcel or lot no income property is not being used to qualify, the gross monthly rent must still be documented with appraisal forms 1007 and 216 for lender reporting purposes. All rental income must be accounted for in the cash flow even if not needed to qualify. Subject Georgia 2 homes 1 parcel or lot no income property (2-4 unit primary residence) – use the income approach section from the appraisal and a copy of the current lease is required. If the Georgia 2 homes 1 parcel or lot no income property has been owned for at least 1 year, borrower to provide tax returns with at least a 12 month rental history. If the Georgia 2 homes 1 parcel or lot no income property has been owned less than 1 year, rental income is calculated per the income approach from the appraisal. Rental Income from other real estate owned – rental income from another Georgia 2 homes 1 parcel or lot no income property owned prior to loan application should be calculated using the borrower’s federal income tax returns for the most recent 12-month period (Cash Flow Analysis from Schedule E). Income should be averaged. Net rental losses should be included in ratios as a liability. For properties owned for less than 1 year, rental income should be calculated using the lesser of: · 75% of the current lease minus the full PITIA; or · Cash flow analysis of the Schedule E from the most recent year’s federal income tax return (if applicable) Converting current residence into a rental: 75% of a lease minus the full PITIA may be used. Assets Must be sourced/seasoned for 60 days. Deposit verification and seasoning of assets must be documented by two months bank statements. Marketable securities require a copy of the stock certificate. Retirement accounts require documentation verifying the lending terms of the account. All sources of funds must be owned by the borrower. All large deposits must be sourced per guidelines. Asset documentation must be dated within 30 days of application and 120 days of closing. Evidence of liquidation is required for all securities used for closing and real estate. Evidence of transfer of funds is required for all cash accounts. Gifts are acceptable provided minimum borrower investment requirements are met. Eligible Sources of Assets Acceptable sources of funds are bank deposits (checking/savings), marketable public traded securities (70% of account value), loans secured by borrower’s assets, sale of real estate, funds borrowed secured by real estate, trust funds (60% of borrower’s undistributed share), cash value/surrender value of life insurance (60% of the cash value), retirement accounts using 60% of available/vested balance (SEP-IRA, 401K), borrower’s real estate commission, business assets provided borrower is 100% owner of the business, depleting the assets from the business account will not have a negative impact on the viability and cash flow of the business. Ineligible Sources of Assets Cash-on-hand, Sweat equity, Gift or grant funds which must be repaid, Down payment assistance programs, Bridge loans, Unsecured loans or cash advances, and Section 8 Voucher Assistance. Borrower Investment/ Contribution Primary Residence – 5% own funds Second Home – 10% own funds Investment Georgia 2 homes 1 parcel or lot no income property – 100% own funds The minimum 5% requirement can be waived and gift funds used for the entire down payment when either of the following requirements is met: · LTV is ≥ 5% below max; or · Borrower has an additional 3 months of reserves (non-gift funds). A minimum borrower contribution of 10% is required on the following transactions (above waiver does not apply): · Primary residence with unverifiable Georgia 2 homes 1 parcel or lot no income housing history · Loan amount over $484,350 · Second home · Limited trade lines

Georgia Mortgage 2 homes 1 Parcel or Lot or Acres Mortgage Lenders Coverage areas