How Do I get a Mortgage In Florida With No Tax Returns? Read More »

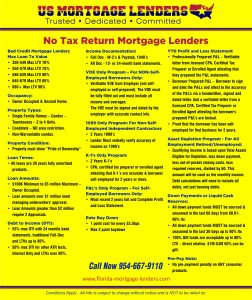

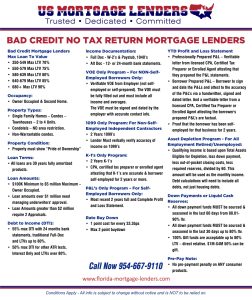

24 Months Or 12 Months Bank Statements To Avg Your Deposits! Bad Credit Florida Mortgage No Tax Returns? Bad Credit Florida Mortgage Lenders – Bad Credit Florida Home Loans Note Approvals based on payment history are Not credit score driven! Bad Credit Florida Read More »

Bad Credit Florida Mortgage No Tax Returns? Bad Credit Florida Mortgage Lenders – Bad Credit Florida Home Loans Note Approvals based on payment history are Not credit score driven! Bad Credit Florida Read More »

How do I get a Manufactured loan with NO Tax Returns? Manufactured Home – Florida No Tax Return Mortgage Lenders Business Statements: Qualify Avg Deposits. Up to 90% are subject to a Business bank statement questionnaire. Read More »

How do I get a Florida mortgage without providing Tax Returns?

How do I get a Florida mortgage without providing Tax Returns?

Bank statement loans have taken over the traditional Bank Statement income loans as an alternative for self-employed Florida mortgage applicants who are unable to verify their income by providing the previous two years’ tax returns, W2s, and pay stubs. These loans are called non-QM loans, nontraditional loans or expanded criteria loans that allow other forms of documentation to prove the ability to repay. Just as it sounds, a bank statement loan allows the borrower to verify his or her income with bank statements instead of using tax returns!

What Documents Do I Need For A No-Tax Return Florida Mortgage?

- ID = Driver’s license, SS Card.

- Proof Of Income = Your most recent 12- or 24-month bank Statements business or personal.

- Proof Of Down Payment, Closing Cost, Reserves= Most Recent2 Months Bank Statements.

- Proof of 2 years in the same business or line of work = Business licenses, Articles of incorporation, 2 years of 1099 s, or accountant letter stating more than 2 years + in the same business.

- Obligations = Divorce decree, Child support, or court order. Only if applies.

- Mortgage Statements = Rental property taxes and insurance statements. Only if applies.

- W2 or 1099= Additional W2 or 1099 income. Only if applies.

- Purchase and Sale Contact. Only if you have one.

- Verified Timely Rent Payments- For Purchases Only – 12 months rental checks clearing your account or wire transfers for the most recent 12 months to verify timely rental payments.

What Does The No Tax Return Loan Application Process Look Like?

To apply for a bank statement loan you would fill out our full mortgage application. Then provide your last 12 or 24 months’ worth of bank statements from a personal or business bank account. Bank statement mortgage loans are processed through a manual underwriting process. This means the income is calculated by a person so the process can take 24 -48 hours.

Am I Eligible for a loan with No Tax Returns? What is Required?

- You must prove self-employment for a minimum 2 years.

- Must provide proof of 12-month rental history or 3-6 months of future payments in reserves.

- You must have at least 10% down.

- You must have 4-6 months of PITI reserves

- You may qualify with as little as a 12-months bank statement.

- You must have a credit score of 600 or above to qualify.

- The minimum loan amount is $100,000, and the maximum loan is $5,000,000.

What Are the Advantages of a Bank Statement Mortgage Loan?

- The lender can look at 12 or 24-month bank statement deposits for income!

- 30-Year Fixed Options.

- Bank statement-only mortgage lenders do not need to look at your tax returns.

- Your income statements are made up of the average monthly income deposits.

- You can get a bank statement home loan for as little as 10 percent down.

- You can do a cash-out refinance.

- You can borrow up to $5 million.

- Debt to income ratio up to 55 percent.

What Are The Eligibility Requirements?

Eligibility with a Florida bank statement mortgage lenders requires total deposits minus disallowed deposits. This amount is then divided by the number of bank statements either 12 or 24 months to determine an average.

Another option is that if the co-borrower is a W2 employee you can add the W2 income to the bank statement income from the borrower or assets from the co-borrower and bank statements to help the borrower qualify. Florida No Tax return mortgage lenders allow you use multiple sources of blended incomes to help you qualify.

What Are The Considerations I need to know about?

- You can use either business or personal no commingling.

- Use 12 monthly business bank accounts or personal accounts depending on the lender.

- Deposits which are transferred from a business account into a personal account are OK.

- Combine W2 income with bank statement income as long.

- You need to count on at least 4-6 months of reserves. Reserves are defined as future total mortgage payments in your account after downpayment and closing costs.

NO TAX RETURN FLORIDA MORTGAGE LENDERS COVERAGE AREAS

(A) No Tax Return Florida Mortgage Coverage in Cities in Florida that begin with the letter “A”. Alachua, FL Alford, FL Altamonte Springs, FL Altha, FL Altoona, FL Alturas, FL Alva, FL Anna Maria, FL Anthony, FL Apalachicola, FL Apollo Beach, FL Apopka, FL Arcadia, FL Archer, FL Argyle, FL Aripeka, FL Astatula, FL Astor, FL Atlantic Beach, FL Auburndale, FL Avon Park, FL

(B) No Tax Return Florida Mortgage Coverage in Cities in Florida that begin with the letter “B”. Babson Park, FL Bagdad, FL Baker, FL Balm, FL Barberville, FL Bartow, FL Bascom, FL Bay Pines, FL Bell, FL Belle Glade, FL Belleair Beach, FL Belleview, FL Beverly Hills, FL Big Pine Key, FL Blountstown, FL Boca Grande, FL Boca Raton, FL Bokeelia, FL Bonifay, FL Bonita Springs, FL Bostwick, FL Bowling Green, FL Boynton Beach, FL Bradenton, FL Bradenton Beach, FL Bradley, FL Brandon, FL Branford, FL Bristol, FL Bronson, FL Brooker, FL Brooksville, FL Bryant, FL Bryceville, FL Bunnell, FL Bushnell, FL

(C) No Tax Return Florida Mortgage Coverage in Cities in Florida that begin with the letter “C”. Callahan, FL Campbellton, FL Canal Point, FL Candler, FL Cantonment, FL Cape Canaveral, FL Cape Coral, FL Captiva, FL Carrabelle, FL Caryville, FL Cassadaga, FL Casselberry, FL Cedar Key, FL Center Hill, FL Century, FL Chattahoochee, FL Chiefland, FL Chipley, FL Chokoloskee, FL Christmas, FL Citra, FL Citrus Ridge, FL Clarcona, FL Clarksville, FL Clearwater, FL Clearwater Beach, FL Clermont, FL Clewiston, FL Cocoa, FL Cocoa Beach, FL Coleman, FL Copeland, FL Cortez, FL Cottondale, FL Crawfordville, FL Crescent Florida , FL Crestview, FL Cross Florida , FL Crystal Beach, FL Crystal River, FL Crystal Springs, FL Cypress, FL

(D) Cities in Florida that begin with the letter “D”. Dade Florida , FL Dania, FL Davenport, FL Day, FL Daytona Beach, FL De Leon Springs, FL Debary, FL Deerfield Beach, FL Defuniak Springs, FL Deland, FL Delray Beach, FL Deltona, FL Destin, FL Doctors Inlet, FL Dover, FL Dundee, FL Dunedin, FL Dunnellon, FL Durant, FL

(E) No Tax Return Florida Mortgage Coverage in Cities in Florida that begin with the letter “E”. Eagle Lake, FL Earleton, FL East Palatka, FL Eastlake Weir, FL Eastpoint, FL Eaton Park, FL Ebro, FL Edgewater, FL Eglin AFB, FL Elfers, FL Elkton, FL Ellenton, FL Englewood, FL Estero, FL Eustis, FL Everglades Florida , FL Evinston, FL – F – Cities in Florida that begin with the letter

(F) No Tax Return Florida Mortgage Coverage in Fairfield, FL Fedhaven, FL Felda, FL Fellsmere, FL Fernandina Beach, FL Ferndale, FL Flagler Beach, FL Florahome, FL Floral Florida , FL Florida Florida , FL Fort Lauderdale, FL Fort McCoy, FL Fort Meade, FL Fort Myers, FL Fort Myers Beach, FL Fort Ogden, FL Fort Pierce, FL Fort Walton Beach, FL Fort White, FL Fountain, FL Freeport, FL Frostproof, FL Fruitland Park, FL

(G) No Tax Return Florida Mortgage Coverage in Cities in Florida that begin with the letter “G”. Gainesville, FL Geneva, FL Georgetown, FL Gibsonton, FL Glen Saint Mary, FL Glenwood, FL Goldenrod, FL Gonzalez, FL Goodland, FL Gotha, FL Graceville, FL Graham, FL Grand Island, FL Grand Ridge, FL Grandin, FL Grant, FL Green Cove Springs, FL Greensboro, FL Greenville, FL Greenwood, FL Gretna, FL Grove Florida , FL Groveland, FL Gulf Breeze, FL Gulf Hammock, FL – H – Cities in Florida that begin with the letter “H”. Haines Florida , FL Hallandale, FL Hampton, FL Harold, FL Hastings, FL Havana, FL Hawthorne, FL Heathrow, FL Hernando, FL Hialeah, FL High Springs, FL Highland Florida , FL Highland Park, FL Hilliard, FL Hobe Sound, FL Holder, FL Holiday, FL Hollister, FL Hollywood, FL Holmes Beach, FL Holt, FL Homeland, FL Homestead, FL Homosassa, FL Homosassa Springs, FL Horseshoe Beach, FL Hosford, FL Howey In The Hills, FL Hudson, FL Hunters Creek, FL Hurlburt Field, FL

(I) No Tax Return Florida Mortgage Coverage in Cities in Florida that begin with the letter “I”. Immokalee, FL Indialantic, FL Indian Lake Estates, FL Indian Rocks Beach, FL Indiantown, FL Inglis, FL Intercession Florida , FL Interlachen, FL Inverness, FL Islamorada, FL Island Grove, FL Istachatta, FL – J – Cities in Florida that begin with the letter “J”. Jacksonville, FL Jacksonville Beach, FL Jasper, FL Jay, FL Jennings, FL Jensen Beach, FL Jupiter, FL

(L) No Tax Return Florida Mortgage Coverage in Cities in Florida that begin with the letter “L”. La Crosse, FL Labelle, FL Lacoochee, FL Lady Lake, FL Lake Alfred, FL Lake Butler, FL Lake Butter, FL Lake Florida , FL Lake Como, FL Lake Geneva, FL Lake Hamilton, FL Lake Harbor, FL Lake Helen, FL Lake Lucerne, FL Lake Mary, FL Lake Monroe, FL Lake Panasoffkee, FL Lake Placid, FL Lake Wales, FL Lake Worth, FL Lakeland, FL Lamont, FL Lanark Village, FL Land O Lakes, FL Lantana, FL Largo, FL Laurel, FL Laurel Hill, FL Lawtey, FL Lecanto, FL Lee, FL Leesburg, FL Lehigh Acres, FL Lithia, FL Live Oak, FL Lloyd, FL Lochloosa, FL Long Key, FL Longboat Key, FL Longwood, FL Lorida, FL Loughman, FL Lowell, FL Loxahatchee, FL Lulu, FL Lutz, FL Lynn Haven, FL

(M) No Tax Return Florida Mortgage Coverage in Cities in Florida that begin with the letter “M”. Macclenny, FL Madison, FL Maitland, FL Malabar, FL Malone, FL Manasota, FL Mango, FL Marathon, FL Marathon Shores, FL Marco Island, FL Marianna, FL Mary Esther, FL Mascotte, FL Mayo, FL McAlpin, FL McDavid, FL McIntosh, FL Melbourne, FL Melbourne Beach, FL Melrose, FL Memphis, FL Merritt Island, FL Mexico Beach, FL Miami, FL Miami Beach, FL Micanopy, FL Miccosukee Cpo, FL Mid Florida, FL Middleburg, FL Midway, FL Milligan, FL Milton, FL Mims, FL Minneola, FL Miramar Beach, FL Molino, FL Monticello, FL Montverde, FL Moore Haven, FL Morriston, FL Mossy Head, FL Mount Dora, FL Mount Pleasant, FL Mulberry, FL Murdock, FL Myakka Florida , FL Myrtle Grove, FL

(N) No Tax Return Florida Mortgage Coverage in Cities in Florida that begin with the letter “N”. Nalcrest, FL Naples, FL Neptune Beach, FL New Port Richey, FL New Smyrna Beach, FL Newberry, FL Niceville, FL Nichols, FL Nobleton, FL Nocatee, FL Nokomis, FL Noma, FL North Fort Myers, FL North Miami Beach, FL North Palm Beach, FL North Port, FL

(O) No Tax Return Florida Mortgage Coverage in Cities in Florida that begin with the letter “O”. O Brien, FL Oak Hill, FL Oakland, FL Ocala, FL Ochopee, FL Ocklawaha, FL Ocoee, FL Odessa, FL Okahumpka, FL Okeechobee, FL Old Town, FL Oldsmar, FL Olustee, FL Ona, FL Oneco, FL Opa Locka, FL Orange Florida , FL Orange Lake, FL Orange Park, FL Orange Springs, FL Orlando, FL Ormond Beach, FL Osprey, FL Osteen, FL Otter Creek, FL Oviedo, FL Oxford, FL Ozona, FL

(P) No Tax Return Florida Mortgage Coverage in Cities in Florida that begin with the letter “P”. Pahokee, FL Paisley, FL Palatka, FL Palm Bay, FL Palm Beach, FL Palm Florida , FL Palm Coast, FL Palm Harbor, FL Palm River-Clair Mel, FL Palm Valley, FL Palmdale, FL Palmetto, FL Panacea, FL Panama Florida , FL Panama Florida Beach, FL Parrish, FL Patrick AFB, FL Paxton, FL Pembroke Pines, FL Penney Farms, FL Pensacola, FL Perry, FL Pierson, FL Pine Island Ridge, FL Pine Ridge, FL Pineland, FL Pinellas Park, FL Pinetta, FL Placida, FL Plant Florida , FL Plymouth, FL Point Washington, FL Polk Florida , FL Pomona Park, FL Pompano Beach, FL Ponce De Leon, FL Ponte Vedra Beach, FL Port Charlotte, FL Port Orange, FL Port Richey, FL Port Saint Joe, FL Port Saint Lucie, FL Port Salerno, FL Port St. Lucie, FL Punta Gorda, FL Putnam Hall, FL

(Q) No Tax Return Florida Mortgage Coverage in Cities in Florida that begin with the letter “Q”. Quincy, FL

(R) No Tax Return Florida Mortgage Coverage in Cities in Florida that begin with the letter “R”. Raiford, FL Reddick, FL River Ranch, FL Riverview, FL Rockledge, FL Roseland, FL Rotonda West, FL Ruskin, FL

(S) No Tax Return Florida Mortgage Coverage in Cities in Florida that begin with the letter “S”. Safety Harbor, FL Saint Augustine, FL Saint Cloud, FL Saint James Florida , FL Saint Leo, FL Saint Marks, FL Saint Petersburg, FL Salem, FL San Antonio, FL San Mateo, FL Sanderson, FL Sanford, FL Sanibel, FL Santa Rosa Beach, FL Sarasota, FL Satellite Beach, FL Satsuma, FL Scottsmoor, FL Sebastian, FL Sebring, FL Seffner, FL Seminole, FL Seville, FL Shady Grove, FL Shalimar, FL Sharpes, FL Silver Springs, FL Sneads, FL Sopchoppy, FL Sorrento, FL South Bay, FL Sparr, FL Spring Hill, FL St. Augustine, FL St. Leo, FL Starke, FL Steinhatchee, FL Stuart, FL Sugarloaf Shores, FL Sumatra, FL Summerfield, FL Summerland Key, FL Sumterville, FL Sun Florida , FL Sun Florida Center, FL Sunnyside, FL Suwannee, FL Sydney, FL

(T) No Tax Return Florida Mortgage Coverage in Cities in Florida that begin with the letter “T”. Tallahassee, FL Tallevast, FL Tampa, FL Tangerine, FL Tarpon Springs, FL Tavares, FL Tavernier, FL Telogia, FL Terra Ceia, FL The Villages, FL Thonotosassa, FL Titusville, FL Trenton, FL Trilby, FL

(U) No Tax Return Florida Mortgage Coverage in Cities in Florida that begin with the letter “U”. Umatilla, FL

(V) No Tax Return Florida Mortgage Coverage in Cities in Florida that begin with the letter “V”. Valparaiso, FL Valrico, FL Vanderbilt Beach, FL Venice, FL Venus, FL Vernon, FL Vero Beach, FL

(W) No Tax Return Florida Mortgage Coverage in Cities in Florida that begin with the letter “W”. Wabasso, FL Wacissa, FL Wakulla Springs, FL Waldo, FL Wauchula, FL Wausau, FL Waverly, FL Webster, FL Weirsdale, FL Welaka, FL Wellborn, FL West Little River, FL West Palm Beach, FL Weston, FL Westville, FL Wewahitchka, FL White Springs, FL Wildwood, FL Williston, FL Wimauma, FL Windermere, FL Winter Beach, FL Winter Garden, FL Winter Haven, FL Winter Park, FL Winter Springs, FL Woodville, FL Worthington Springs, FL

(Y) No Tax Return Florida Mortgage Coverage in Cities in Florida that being with the letter Y. Ybor Florida –

(Z ) No Tax Return Florida Mortgage Coverage in Cities in Florida that being with the letter Y-Zephyrhills –

Palm Beach Acacia Villas

Alachua Alachua Florida

Orange Alafaya

Jackson Alford town

Santa Rosa Allentown

Seminole Altamonte Springs Florida

Calhoun Altha town

Lake Altoona

Polk Alturas

Lee Alva

Levy Andrews

Manatee Anna Maria Florida

Franklin Apalachicola Florida

Hillsborough Apollo Beach

Orange Apopka Florida

Desoto Arcadia Florida

Alachua Archer Florida

Hernando Aripeka

Pasco Aripeka

Clay Asbury Lake

Lake Astatula town

Lake Astor

Duval Atlantic Beach Florida

Palm Beach Atlantis Florida

Polk Auburndale Florida

Jefferson Aucilla

Santa Rosa Avalon

Miami-Dade Aventura Florida

Highlands Avon Park Florida

Orange Azalea Park

Polk Babson Park

Santa Rosa Bagdad

Miami-Dade Bal Harbour village

Duval Baldwin town

Hillsborough Balm

Pinellas Bardmoor

Polk Bartow Florida

Jackson Bascom town

Miami-Dade Bay Harbor Islands town

Orange Bay Hill

Orange Bay Lake Florida

Pinellas Bay Pines

Pasco Bayonet Point

Hernando Bayport

Manatee Bayshore Gardens

Pasco Beacon Square

Pinellas Bear Creek

Sarasota Bee Ridge

Gilchrist Bell town

Clay Bellair-Meadowbrook

Palm Beach Belle Glade Florida

Orange Belle Isle Florida

Pinellas Belleair town

Pinellas Belleair Beach Florida

Pinellas Belleair Bluffs Florida

Pinellas Belleair Shore town

Marion Belleview Florida

Escambia Bellview

Santa Rosa Berrydale

Flagler Beverly Beach town

Citrus Beverly Hills

Monroe Big Coppitt Key

Monroe Big Pine Key

Miami-Dade Biscayne Park village

Orange Bithlo

Citrus Black Diamond

Seminole Black Hammock

Hillsborough Bloomingdale

Calhoun Blountstown Florida

Palm Beach Boca Raton Florida

Lee Bokeelia

Holmes Bonifay Florida

Lee Bonita Springs Florida

Broward Boulevard Gardens

Hardee Bowling Green Florida

Palm Beach Boynton Beach Florida

Manatee Bradenton Florida

Manatee Bradenton Beach Florida

Polk Bradley Junction

Hillsborough Brandon

Suwannee Branford town

Escambia Brent

Palm Beach Briny Breezes town

Liberty Bristol Florida

Broward Broadview Park

Levy Bronson town

Bradford Brooker Florida

Hernando Brookridge

Hernando Brooksville Florida

Santa Rosa Brownsdale

Miami-Dade Brownsville

Glades Buckhead Ridge

Lee Buckingham

Osceola Buenaventura Lakes

Flagler Bunnell Florida

Lee Burnt Store Marina

Sumter Bushnell Florida

Saint Johns Butler Beach

Palm Beach Cabana Colony

Nassau Callahan town

Bay Callaway Florida

Osceola Campbell

Jackson Campbellton town

Palm Beach Canal Point

Brevard Cape Canaveral Florida

Lee Cape Coral Florida

Lee Captiva

Franklin Carrabelle Florida

Hillsborough Carrollwood

Holmes Caryville town

Seminole Casselberry Florida

Bay Cedar Grove town

Levy Cedar Key Florida

Osceola Celebration

Sumter Center Hill Florida

Escambia Century town

Lee Charleston Park

Charlotte Charlotte Harbor

Charlotte Charlotte Park

Gadsden Chattahoochee Florida

Hillsborough Cheval

Levy Chiefland Florida

Washington Chipley Florida

Collier Chokoloskee

Orange Christmas

Seminole Chuluota populated place

Santa Rosa Chumuckla populated place

Okaloosa Cinco Bayou town

Citrus Citrus Hills

Hillsborough Citrus Park

Citrus Citrus Springs

Orange Clarcona

Pinellas Clearwater Florida

Lake Clermont Florida

Charlotte Cleveland

Glades Clewiston Florida

Hendry Clewiston Florida

Palm Beach Cloud Lake town

Santa Rosa Cobbtown

Brevard Cocoa Florida

Brevard Cocoa Beach Florida

Brevard Cocoa West populated place

Broward Coconut Creek Florida

Sumter Coleman Florida

Polk Combee Settlement

Pasco Connerton

Orange Conway

Broward Cooper Florida Florida

Miami-Dade Coral Gables Florida

Broward Coral Springs Florida

Miami-Dade Coral Terrace

Manatee Cortez

Jackson Cottondale town

Miami-Dade Country Club

Miami-Dade Country Walk

Wakulla Crawfordville

Saint Johns Crescent Beach

Putnam Crescent Florida Florida

Okaloosa Crestview Florida

Polk Crooked Lake Park

Dixie Cross Florida town

Polk Crystal Lake

Citrus Crystal River Florida

Pasco Crystal Springs

Monroe Cudjoe Key

Miami-Dade Cutler Bay town

Polk Cypress Gardens

Lee Cypress Lake

Okeechobee Cypress Quarters

Pasco Dade Florida Florida

Pasco Dade Florida North

Broward Dania Beach Florida

Polk Davenport Florida

Broward Davie town

Lafayette Day

Volusia Daytona Beach Florida

Volusia Daytona Beach Shores Florida

Walton De Funiak Springs Florida

Volusia De Leon Springs

Volusia DeBary populated place

Broward Deerfield Beach Florida

Volusia DeLand Florida

Volusia DeLand Southwest

Palm Beach Delray Beach Florida

Volusia Deltona populated place

Sarasota Desoto Lakes

Okaloosa Destin Florida

Santa Rosa Dickerson Florida

Santa Rosa Dixonville populated place

Orange Doctor Phillips

Miami-Dade Doral Florida

Hillsborough Dover

Monroe Duck Key

Polk Dundee town

Pinellas Dunedin Florida

Marion Dunnellon Florida

Polk Eagle Lake Florida

Levy East Bronson

Hillsborough East Lake-Orient Park

Pinellas East Lake

Santa Rosa East Milton

Putnam East Palatka

Levy East Williston

Franklin Eastpoint

Orange Eatonville town

Washington Ebro town

Volusia Edgewater Florida

Orange Edgewood Florida

Okaloosa Eglin Air Force Base

Hillsborough Egypt Lake-Leto

Miami-Dade El Portal village

Pasco Elfers

Manatee Ellenton

Charlotte Englewood

Sarasota Englewood

Escambia Ensley

Lee Estero village

Holmes Esto town

Lake Eustis Florida

Collier Everglades Florida

Marion Fairfield populated place

Orange Fairview Shores

Gilchrist Fanning Springs Florida

Levy Fanning Springs Florida

Pinellas Feather Sound

Indian River Fellsmere Florida

Seminole Fern Park populated place

Nassau Fernandina Beach Florida

Lake Ferndale

Escambia Ferry Pass

Santa Rosa Fidelis

Hillsborough Fish Hawk

Miami-Dade Fisher Island

Columbia Five Points

Flagler Flagler Beach Florida

Volusia Flagler Beach Florida

St. Johns Flagler Estates

Clay Fleming Island

Citrus Floral Florida

Miami-Dade Florida Florida Florida

Indian River Florida Ridge

St. Lucie Florida Ridge

Santa Rosa Floridatown

Seminole Forest Florida

Hendry Fort Denaud

Hardee Fort Green

Hardee Fort Green Springs

Broward Fort Lauderdale Florida

Polk Fort Meade Florida

Lee Fort Myers Florida

Lee Fort Myers Beach Florida

Lee Fort Myers Shores

Saint Lucie Fort Pierce Florida

Saint Lucie Fort Pierce North

Saint Lucie Fort Pierce South

Okaloosa Fort Walton Beach Florida

Columbia Fort White town

Miami-Dade Fountainbleau

Lake Four Corners populated place

Polk Four Corners populated place

Orange Four Corners populated place

Osceola Four Corners populated place

Broward Franklin Park populated place

Walton Freeport Florida

Polk Frostproof Florida

Saint Johns Fruit Cove

Lake Fruitland Park Florida

Sarasota Fruitville

Polk Fuller Heights

Polk Fussels Corner

Alachua Gainesville Florida

Santa Rosa Garcon Point

Hernando Garden Grove

Hardee Gardner

Lee Gateway

Seminole Geneva

Hillsborough Gibsonton

Indian River Gifford

Miami-Dade Gladeview

Palm Beach Glen Ridge town

Baker Glen Saint Mary town

Miami-Dade Glencoe

Miami-Dade Glenvar Heights

Miami-Dade Golden Beach town

Collier Golden Gate

Miami-Dade Golden Glades

Orange Goldenrod

Seminole Goldenrod

Palm Beach Golf village

Escambia Gonzalez

Collier Goodland

Orange Gotha

Escambia Goulding

Miami-Dade Goulds

Jackson Graceville Florida

Jackson Grand Ridge town

Brevard Grant-Valkaria town

Clay Green Cove Springs Florida

Palm Beach Greenacres Florida

Pinellas Greenbriar

Gadsden Greensboro town

Madison Greenville town

Jackson Greenwood Florida

Polk Grenelefe

Gadsden Gretna Florida

Charlotte Grove Florida

Lake Groveland Florida

Santa Rosa Gulf Breeze Florida

Sarasota Gulf Gate Estates

Palm Beach Gulf Stream town

Pinellas Gulfport Florida

Hillsborough Gun Club Estates

Polk Haines Florida Florida

Broward Hallandale Beach Florida

Bradford Hampton Florida

Pinellas Harbor Bluffs

Charlotte Harbour Heights

Hendry Harlem

Lee Harlem Heights populated place

Santa Rosa Harold

Saint Johns Hastings town

Gadsden Havana town

Palm Beach Haverhill town

Alachua Hawthorne Florida

Seminole Heathrow

Pasco Heritage Pines

Citrus Hernando

Hernando Hernando Beach

Miami-Dade Hialeah Florida

Miami-Dade Hialeah Gardens Florida

Hernando High Point

Alachua High Springs town

Palm Beach Highland Beach town

Polk Highland Florida

Polk Highland Park village

Hernando Hill ‘n Dale

Polk Hillcrest Heights town

Nassau Hilliard town

Broward Hillsboro Beach town

Broward Hillsboro Pines

Martin Hobe Sound

Orange Holden Heights

Pasco Holiday

Santa Rosa Holley

Volusia Holly Hill Florida

Broward Hollywood Florida

Manatee Holmes Beach Florida

Polk Homeland

Miami-Dade Homestead Florida

Miami-Dade Homestead Base military

Citrus Homosassa

Citrus Homosassa Springs

Orange Horizon West

Dixie Horseshoe Beach town

Liberty Hosford

Lake Howey-in-the-Hills town

Pasco Hudson

Orange Hunters Creek

St. Lucie Hutchinson Island South

Palm Beach Hypoluxo town

Collier Immokalee

Brevard Indialantic town

Miami-Dade Indian Creek village

Brevard Indian Harbour Beach Florida

St. Lucie Indian River Estates

Indian River Indian River Shores town

Pinellas Indian Rocks Beach Florida

Pinellas Indian Shores town

Martin Indiantown populated place

Levy Inglis town

Putnam Interlachen town

Citrus Inverness Florida

Citrus Inverness Highlands North

Citrus Inverness Highlands South

Polk Inwood

Lee Iona

Monroe Islamorada, Village of Islands village

Collier Island Walk

Hernando Istachatta

Broward Ives Estates

Miami-Dade Ives Estates

Duval Jacksonville Florida

Duval Jacksonville Beach Florida

Jackson Jacob Florida Florida

Polk Jan Phyl Village

Pasco Jasmine Estates

Hamilton Jasper Florida

Santa Rosa Jay town

Hamilton Jennings town

Martin Jensen Beach

Brevard June Park

Palm Beach Juno Beach town

Palm Beach Juno Ridge

Palm Beach Jupiter town

Palm Beach Jupiter Farms

Palm Beach Jupiter Inlet Colony town

Martin Jupiter Island town

Polk Kathleen

Miami-Dade Kendale Lakes

Miami-Dade Kendall

Miami-Dade Kendall West

Pinellas Kenneth Florida town

Sarasota Kensington Park

Palm Beach Kenwood Estates

Miami-Dade Key Biscayne village

Monroe Key Colony Beach Florida

Monroe Key Largo

Pasco Key Vista

Monroe Key West Florida

Hillsborough Keystone

Clay Keystone Heights Florida

Osceola Kissimmee Florida

Alachua La Crosse town

Hendry LaBelle Florida

Pasco Lacoochee

Lake Lady Lake town

Bay Laguna Beach

Polk Lake Alfred Florida

Palm Beach Lake Belvedere Estates

Orange Lake Buena Vista Florida

Orange Lake Butler

Union Lake Butler Florida

Columbia Lake Florida Florida

Palm Beach Lake Clarke Shores town

Polk Lake Hamilton town

Palm Beach Lake Harbor

Orange Lake Hart

Volusia Lake Helen Florida

Lake Lake Kathryn

Hernando Lake Lindsey

Okaloosa Lake Lorraine

Lake Lake Mack-Forest Hills

Hillsborough Lake Magdalene

Seminole Lake Mary Florida

Orange Lake Mary Jane

Liberty Lake Mystic

Sumter Lake Panasoffkee

Palm Beach Lake Park town

Highlands Lake Placid town

Sarasota Lake Sarasota

Polk Lake Wales Florida

Palm Beach Lake Worth Florida

Polk Lakeland Florida

Polk Lakeland Highlands

Clay Lakeside

Saint Lucie Lakewood Park

Jefferson Lamont

Pasco Land O’ Lakes

Palm Beach Lantana town

Pinellas Largo Florida

Broward Lauderdale Lakes Florida

Broward Lauderdale-by-the-Sea town

Broward Lauderhill Florida

Sarasota Laurel

Okaloosa Laurel Hill Florida

Bradford Lawtey Florida

Monroe Layton Florida

Broward Lazy Lake village

Pinellas Lealman

Citrus Lecanto

Madison Lee town

Lake Leesburg Florida

Lee Lehigh Acres

Miami-Dade Leisure Florida

Collier Lely

Collier Lely Resort

Hardee Lemon Grove

Broward Lighthouse Point Florida

Hardee Limestone

Palm Beach Limestone Creek

Lake Lisbon

Suwannee Live Oak Florida

Jefferson Lloyd

Lee Lochmoor Waterway Estates

Orange Lockhart census designatedplace

Manatee Longboat Key town

Sarasota Longboat Key town

Seminole Longwood Florida

Polk Loughman

Bay Lower Grand Lagoon

Palm Beach Loxahatchee Groves town

Hillsborough Lutz

Bay Lynn Haven Florida

Baker Macclenny Florida

Pinellas Madeira Beach Florida

Madison Madison Florida

Orange Maitland Florida

Brevard Malabar town

Jackson Malone town

Palm Beach Manalapan town

Charlotte Manasota Key

Levy Manatee Road

Hillsborough Mango

Palm Beach Mangonia Park town

Monroe Marathon Florida

Collier Marco Island Florida

Broward Margate Florida

Jackson Marianna Florida

Flagler Marineland town

St. Johns Marineland town

Okaloosa Mary Esther Florida

Hernando Masaryktown

Lake Mascotte Florida

Lee Matlacha

Lee Matlacha Isles-Matlacha Shores

Lafayette Mayo town

Lee McGregor

Marion McIntosh town

Pasco Meadow Oaks

Orange Meadow Woods

Miami-Dade Medley town

Polk Medulla

Brevard Melbourne Florida

Brevard Melbourne Beach town

Brevard Melbourne Village town

Manatee Memphis

Brevard Merrit Island

Bay Mexico Beach Florida

Miami-Dade Miami Florida

Miami-Dade Miami Beach Florida

Miami-Dade Miami Gardens Florida

Miami-Dade Miami Lakes town

Miami-Dade Miami Shores village

Miami-Dade Miami Springs Florida

Alachua Micanopy town

Brevard Micco

Clay Middleburg

Gadsden Midway Florida

Seminole Midway

Santa Rosa Midway

Santa Rosa Milton Florida

Brevard Mims

Lake Minneola Florida

Broward Miramar Florida

Walton Miramar Beach

Escambia Molino

Jefferson Monticello Florida

Hendry Montura

Lake Montverde town

Pasco Moon Lake

Glades Moore Haven Florida

Levy Morriston

Santa Rosa Mount Carmel

Lake Mount Dora Florida

Lake Mount Plymouth

Santa Rosa Mulat

Polk Mulberry Florida

Santa Rosa Munson

Escambia Myrtle Grove

Collier Naples Florida

Collier Naples Manor

Collier Naples Park

Miami-Dade Naranja

Nassau Nassau Village-Ratliff

Santa Rosa Navarre

Santa Rosa Navarre Beach

Duval Neptune Beach Florida

Pasco New Port Richey Florida

Pasco New Port Richey East

Volusia New Smyrna Beach Florida

Alachua Newberry Florida

Okaloosa Niceville Florida

Hernando Nobleton

Desoto Nocatee populated place

Sarasota Nokomis

Holmes Noma town

Miami-Dade North Bay Village Florida

Hernando North Brooksville

Volusia North DeLand

Lee North Fort Myers

Monroe North Key Largo

Broward North Lauderdale Florida

Miami-Dade North Miami Florida

Miami-Dade North Miami Beach Florida

Palm Beach North Palm Beach village

Sarasota North Port Florida

Pinellas North Redington Beach town

Martin North River Shores

Sarasota North Sarasota

Hernando North Weeki Wachee

Hillsborough Northdale

Volusia Oak Hill Florida

Orange Oak Ridge

Orange Oakland town

Broward Oakland Park Florida

Clay Oakleaf Plantation

Marion Ocala Florida

Martin Ocean Breeze town

Okaloosa Ocean Florida

Palm Beach Ocean Ridge town

Orange Ocoee Florida

Pasco Odessa

Miami-Dade Ojus

Lake Okahumpka

Okeechobee Okeechobee Florida

Pinellas Oldsmar Florida

Lee Olga

Miami-Dade Olympia Heights

Hardee Ona

Miami-Dade Opa-locka Florida

Volusia Orange Florida Florida

Clay Orange Park town

Collier Orangetree

Indian River Orchid town

Santa Rosa Oriole Beach

Orange Orlando Florida

Orange Orlovista

Volusia Ormond Beach Florida

Volusia Ormond-by-the-Sea

Sarasota Osprey

Levy Otter Creek town

Seminole Oviedo Florida

Santa Rosa Pace

Lee Page Park

Palm Beach Pahokee Florida

Lake Paisley

Putnam Palatka Florida

Brevard Palm Bay Florida

Palm Beach Palm Beach town

Palm Beach Palm Beach Gardens Florida

Palm Beach Palm Beach Shores town

Martin Palm Florida

Flagler Palm Coast Florida

Pinellas Palm Harbor

Hillsborough Palm River-Clair Mel

Brevard Palm Shores town

Palm Beach Palm Springs village

Miami-Dade Palm Springs North

Saint Johns Palm Valley

Manatee Palmetto Florida

Miami-Dade Palmetto Bay village

Miami-Dade Palmetto Estates

Lee Palmona Park

Wakulla Panacea

Bay Panama Florida Florida

Bay Panama Florida Beach Florida

Orange Paradise Heights

Bay Parker Florida

Broward Parkland Florida

Pasco Pasadena Hills

Brevard Patrick Air Force Base

Walton Paxton town

Santa Rosa Pea Ridge

Hillsborough Pebble Creek

Collier Pelican Bay designated place

Broward Pembroke Park town

Broward Pembroke Pines Florida

Clay Penney Farms town

Escambia Pensacola Florida

Taylor Perry Florida

Volusia Pierson town

Palm Beach Pine Air

Orange Pine Castle

Orange Pine Hills

Hernando Pine Island

Lee Pine Island Center

Lake Pine Lakes

Santa Rosa Pine Level

Lee Pine Manor

Citrus Pine Ridge

Collier Pine Ridge

Miami-Dade Pinecrest village

Lee Pineland

Pinellas Pinellas Park Florida

Miami-Dade Pinewood

Hendry Pioneer

Lake Pittman

Hillsborough Plant Florida Florida

Broward Plantation Florida

Sarasota Plantation

Collier Plantation Island

Palm Beach Plantation Mobile Home Park

Polk Poinciana

Osceola Poinciana

Santa Rosa Point Baker

Polk Polk Florida town

Putnam Pomona Park town

Broward Pompano Beach Florida

Holmes Ponce de Leon town

Volusia Ponce Inlet town

Charlotte Port Charlotte

Hendry Port La Belle

Volusia Port Orange Florida

Pasco Port Richey Florida

Gulf Port Saint Joe Florida

Brevard Port Saint John

Saint Lucie Port Saint Lucie Florida

Martin Port Salerno

Bay Pretty Bayou

Miami-Dade Princeton

Hillsborough Progress Village

Charlotte Punta Gorda Florida

Lee Punta Rassa

Pasco Quail Ridge

Gadsden Quincy Florida

Union Raiford town

Levy Raleigh

Marion Reddick town

Pinellas Redington Beach town

Pinellas Redington Shores town

Miami-Dade Richmond Heights

Miami-Dade Richmond West

Hernando Ridge Manor

Sarasota Ridge Wood Heights

Pinellas Ridgecrest

Martin Rio

Orange Rio Pinar

Saint Lucie River Park

Pasco River Ridge

Hillsborough Riverview

Palm Beach Riviera Beach Florida

Brevard Rockledge Florida

Santa Rosa Roeville

Broward Roosevelt Gardens

Indian River Roseland

Charlotte Rotonda

Palm Beach Royal Palm Beach village

Palm Beach Royal Palm Estates

Hillsborough Ruskin

Pinellas Safety Harbor Florida

Saint Johns Saint Augustine Florida

Saint Johns Saint Augustine Beach Florida

Saint Johns Saint Augustine Shores

Saint Johns Saint Augustine South

Osceola Saint Cloud Florida

Franklin Saint George Island

Lee Saint James Florida

Pasco Saint Leo town

Saint Lucie Saint Lucie Village town

Wakulla Saint Marks Florida

Pinellas Saint Pete Beach populated place

Pinellas Saint Petersburg Florida

Manatee Samoset

Volusia Samsula-Spruce Creek

Pasco San Antonio Florida

Lee San Carlos Park

Palm Beach San Castle

Seminole Sanford Florida

Lee Sanibel Florida

Sarasota Sarasota Florida

Sarasota Sarasota Springs

Brevard Satellite Beach Florida

Saint Johns Sawgrass

Palm Beach Schall Circle

Broward Sea Ranch Lakes village

Indian River Sebastian Florida

Highlands Sebring Florida

Hillsborough Seffner

Pinellas Seminole Florida

Palm Beach Seminole Manor

Volusia Seville

Martin Sewall’s Point town

Pasco Shady Hills

Okaloosa Shalimar town

Brevard Sharpes

Sarasota Siesta Key

Lake Silver Lake

Marion Silver Springs Shores

Orange Sky Lake

Jackson Sneads town

Charlotte Solana

Wakulla Sopchoppy Florida

Lake Sorrento

Orange South Apopka

Palm Beach South Bay Florida

Indian River South Beach

Manatee South Bradenton

Hernando South Brooksville

Volusia South Daytona Florida

Sarasota South Gate Ridge

Pinellas South Highpoint

Miami-Dade South Miami Florida

Miami-Dade South Miami Heights

Palm Beach South Palm Beach town

Pinellas South Pasadena Florida

Brevard South Patrick Shores

Sarasota South Sarasota

Sarasota South Venice

Orange Southchase

Osceola Southchase

Desoto Southeast Arcadia

Sarasota Southgate

Orange Southchase

Broward Southwest Ranches town

Hernando Spring Hill

Hernando Spring Lake

Gilchrist Spring Ridge

Bay Springfield Florida

Santa Rosa Springhill

Palm Beach Stacey Street

Bradford Starke Florida

Taylor Steinhatchee

Monroe Stock Island

Martin Stuart Florida

Citrus Sugarmill woods

Liberty Sumatra

Hillsborough Sun Florida Center

Lee Suncoast Estates

Miami-Dade Sunny Isles Beach Florida

Broward Sunrise Florida

Miami-Dade Sunset

Miami-Dade Surfside town

Miami-Dade Sweetwater Florida

Orange Taft

Leon Tallahassee Florida

Broward Tamarac Florida

Miami-Dade Tamiami

Hillsborough Tampa Florida

Orange Tangelo Park

Orange Tangerine

Pinellas Tarpon Springs Florida

Lake Tavares Florida

Monroe Tavernier

Okeechobee Taylor Creek

Hillsborough Temple Terrace Florida

Palm Beach Tequesta village

Palm Beach The Acreage

Miami-Dade The Crossings

Miami-Dade The Hammocks

Sarasota The Meadows

Marion The Villages

Sumter The Villages

Hillsborough Thonotosassa

Miami-Dade Three Lakes

Lee Three Oaks

Lee Tice

Pinellas Tierra Verde

Santa Rosa Tiger Point

Orange Tildenville

Hernando Timber Pines

Brevard Titusville Florida

Hillsborough Town ‘n’ Country populated place

Pinellas Treasure Island Florida

Gilchrist Trenton Florida

Pasco Trilby

Pasco Trinity

Bay Tyndall Air Force Base

Lake Umatilla Florida

Orange Union Park

Hillsborough University

Orange University

Miami-Dade University Park

Bay Upper Grand Lagoon

Okaloosa Valparaiso Florida

Hillsborough Valrico

Sarasota Vamo

Sarasota Venice Florida

Sarasota Venice Gardens

Washington Vernon Florida

Indian River Vero Beach Florida

Indian River Vero Beach South

Collier Verona Walk

Brevard Viera East

Brevard Viera West

Saint Johns Villano Beach

Lee Villas

Collier Vineyards

Miami-Dade Virginia Gardens village

Indian River Wabasso

Indian River Wabasso Beach

Jefferson Wacissa

Polk Wahneta

Alachua Waldo Florida

Santa Rosa Wallace

Sarasota Warm Mineral Springs

Escambia Warrington

Broward Washington Park

Palm Beach Watergate

Columbia Watertown

Hardee Wauchula Florida

Jefferson Waukeenah

Washington Wausau town

Polk Waverly

Sumter Webster Florida

Orange Wedgefield

Hernando Weeki Wachee Florida

Hernando Weeki Wachee Gardens

Seminole Wekiwa Springs

Putnam Welaka town

Palm Beach Wellington village

Pasco Wesley Chapel

Manatee West Bradenton

Volusia West DeLand

Pinellas West Lealman

Miami-Dade West Little River

Brevard West Melbourne Florida

Miami-Dade West Miami Florida

Palm Beach West Palm Beach Florida

Broward West Park Florida

Escambia West Pensacola

Miami-Dade West Perrine

Manatee West Samoset

Indian River West Vero Corridor

Hillsborough Westchase

Miami-Dade Westchester

Palm Beach Westgate

Palm Beach Westlake Florida

Broward Weston Florida

Miami-Dade Westview

Holmes Westville town

Miami-Dade Westwood Lakes

Gulf Wewahitchka Florida

Lee Whiskey Creek

Saint Lucie White Florida

Hamilton White Springs town

Manatee Whitfield

Santa Rosa Whitfield

Sumter Wildwood Florida

Orange Williamsburg

Levy Williston Florida

Levy Williston Highlands

Polk Willow Oak

Broward Wilton Manors Florida

Hillsborough Wimauma

Orange Windermere town

Indian River Windsor

Indian River Winter Beach

Orange Winter Garden Florida

Polk Winter Haven Florida

Orange Winter Park Florida

Seminole Winter Springs Florida

Hernando Wiscon

Santa Rosa Woodlawn Beach

Leon Woodville

Union Worthington Springs town

Saint Johns World Golf Village

Okaloosa Wright

Lake Yalaha

Levy Yankeetown town

Osceola Yeehaw Junction

Nassau Yulee

Martin Zellwood

Pasco Zephyrhills Florida

Pasco Zephyrhills North

Pasco Zephyrhills South

Pasco Zephyrhills West

Hardee Zolfo Springs town