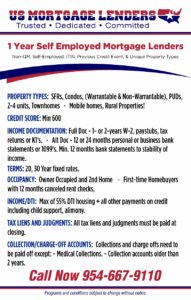

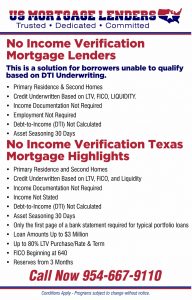

Self-Employed Florida Mortgage Lenders —No Income Verification Florida Mortgage Lenders

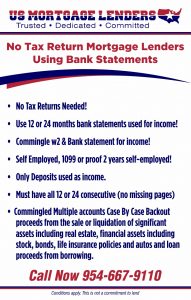

24 Months Bank Statement Florida Mortgage Lenders —12 Months Bank Statement Florida Mortgage Lenders

No Tax Return Florida Mortgage Lenders Options

-

- Use Personal Bank Statements: You can qualify using 12 or 24 months Personal bank statements and use Up To 100 percent of deposits!

- Use Business Bank Statements: You can qualify with 12 or 24 months of bank statements and count up to 90% percent of the deposits. A Florida self-employment business questionnaire is required to determine your income. For example, if you are a 1099 realtor with no money for rent, or cost you can use up to 90% of your income to qualify.

- Use 1099s For Income: No Tax return Florida 1099 lenders will allow you to average 2 years of 1099s and 2 months of recent bank statements for income.

- Use Lease Agreements: As long as the lease agreements are enough to cover the Florida mortgage payments lenders will lend up to 80% loan to value with no income verification needed.

- Stated Florida Mortgage Lenders– Based on LTV, FICO, and Liquidity Read More »

Who Qualifies For A Bank Statement Mortgage?

Our bank statement mortgage lenders provide funding for business owners throughout Florida. You must have a good payment history and good deposits to qualify. Below we have provided a list of other qualifying factors including:

- Minimum of the 1-year same line of work 2+ years.

- Minimum 550 middle credit score.

- Minimum 10% down payment+ Closing Cost + Reserves. reserves are defined as the total mortgage payment PITI in your account after closing.

- Minimum 3-6 Months Reserves.

- Minimum 12 months since any housing events ( Foreclosure, Bankruptcy Discharge, Short Sale )

- Maximum DTI 55% Bank statement only mortgage lenders will allow the self-employed to qualify up to 55% of their total income for housing and all other monthly payments on their credit report.

NO INCOME VERIFICATION FL MORTGAGE LENDERS – NO TAX RETURN FLORIDA MORTGAGE LENDERS

No Tax Return Florida Mortgage Coverage Areas

| View Map | Alachua | Florida | Alachua | 32615 |

| View Map | Alachua | Florida | Alachua | 32616 |

| View Map | Alford | Florida | Jackson | 32420 |

| View Map | Altamonte Springs | Florida | Seminole | 32701 |

| View Map | Altamonte Springs | Florida | Seminole | 32714 |

| View Map | Altamonte Springs | Florida | Seminole | 32715 |

| View Map | Altamonte Springs | Florida | Seminole | 32716 |

| View Map | Altha | Florida | Calhoun | 32421 |

| View Map | Altoona | Florida | Lake | 32702 |

| View Map | Alturas | Florida | Polk | 33820 |

| View Map | Alva | Florida | Lee | 33920 |

| View Map | Anna Maria | Florida | Manatee | 34216 |

| View Map | Anthony | Florida | Marion | 32617 |

| View Map | Apalachicola | Florida | Franklin | 32320 |

| View Map | Apalachicola | Florida | Franklin | 32329 |

| View Map | Apollo Beach | Florida | Hillsborough | 33572 |

| View Map | Apopka | Florida | Orange | 32703 |

| View Map | Apopka | Florida | Orange | 32704 |

| View Map | Apopka | Florida | Orange | 32712 |

| View Map | Arcadia | Florida | De Soto | 34265 |

| View Map | Arcadia | Florida | De Soto | 34266 |

| View Map | Arcadia | Florida | De Soto | 34269 |

| View Map | Archer | Florida | Alachua | 32618 |

| View Map | Argyle | Florida | Walton | 32422 |

| View Map | Aripeka | Florida | Pasco | 34679 |

| View Map | Astatula | Florida | Lake | 34705 |

| View Map | Astor | Florida | Lake | 32102 |

| View Map | Atlantic Beach | Florida | Duval | 32233 |

| View Map | Auburndale | Florida | Polk | 33823 |

| View Map | Avon Park | Florida | Highlands | 33825 |

| View Map | Avon Park | Florida | Highlands | 33826 |

| View Map | Babson Park | Florida | Polk | 33827 |

| View Map | Bagdad | Florida | Santa Rosa | 32530 |

| View Map | Baker | Florida | Okaloosa | 32531 |

| View Map | Balm | Florida | Hillsborough | 33503 |

| View Map | Barberville | Florida | Volusia | 32105 |

| View Map | Bartow | Florida | Polk | 33830 |

| View Map | Bartow | Florida | Polk | 33831 |

| View Map | Bascom | Florida | Jackson | 32423 |

| View Map | Bay Pines | Florida | Pinellas | 33744 |

| View Map | Bell | Florida | Gilchrist | 32619 |

| View Map | Belle Glade | Florida | Palm Beach | 33430 |

| View Map | Belleair Beach | Florida | Pinellas | 33786 |

| View Map | Belleview | Florida | Marion | 34420 |

| View Map | Belleview | Florida | Marion | 34421 |

| View Map | Beverly Hills | Florida | Citrus | 34464 |

| View Map | Beverly Hills | Florida | Citrus | 34465 |

| View Map | Big Pine Key | Florida | Monroe | 33043 |

| View Map | Blountstown | Florida | Calhoun | 32424 |

| View Map | Boca Grande | Florida | Lee | 33921 |

| View Map | Boca Raton | Florida | Palm Beach | 33427 |

| View Map | Boca Raton | Florida | Palm Beach | 33428 |

| View Map | Boca Raton | Florida | Palm Beach | 33429 |

| View Map | Boca Raton | Florida | Palm Beach | 33431 |

| View Map | Boca Raton | Florida | Palm Beach | 33432 |

| View Map | Boca Raton | Florida | Palm Beach | 33433 |

| View Map | Boca Raton | Florida | Palm Beach | 33434 |

| View Map | Boca Raton | Florida | Palm Beach | 33464 |

| View Map | Boca Raton | Florida | Palm Beach | 33481 |

| View Map | Boca Raton | Florida | Palm Beach | 33486 |

| View Map | Boca Raton | Florida | Palm Beach | 33487 |

| View Map | Boca Raton | Florida | Palm Beach | 33488 |

| View Map | Boca Raton | Florida | Palm Beach | 33496 |

| View Map | Boca Raton | Florida | Palm Beach | 33497 |

| View Map | Boca Raton | Florida | Palm Beach | 33498 |

| View Map | Boca Raton | Florida | Palm Beach | 33499 |

| View Map | Bokeelia | Florida | Lee | 33922 |

| View Map | Bonifay | Florida | Holmes | 32425 |

| View Map | Bonita Springs | Florida | Lee | 34133 |

| View Map | Bonita Springs | Florida | Lee | 34134 |

| View Map | Bonita Springs | Florida | Lee | 34135 |

| View Map | Bonita Springs | Florida | Lee | 34136 |

| View Map | Bostwick | Florida | Putnam | 32007 |

| View Map | Bowling Green | Florida | Hardee | 33834 |

| View Map | Boynton Beach | Florida | Palm Beach | 33424 |

| View Map | Boynton Beach | Florida | Palm Beach | 33425 |

| View Map | Boynton Beach | Florida | Palm Beach | 33426 |

| View Map | Boynton Beach | Florida | Palm Beach | 33435 |

| View Map | Boynton Beach | Florida | Palm Beach | 33436 |

| View Map | Boynton Beach | Florida | Palm Beach | 33437 |

| View Map | Boynton Beach | Florida | Palm Beach | 33474 |

| View Map | Bradenton | Florida | Manatee | 34201 |

| View Map | Bradenton | Florida | Manatee | 34202 |

| View Map | Bradenton | Florida | Manatee | 34203 |

| View Map | Bradenton | Florida | Manatee | 34204 |

| View Map | Bradenton | Florida | Manatee | 34205 |

| View Map | Bradenton | Florida | Manatee | 34206 |

| View Map | Bradenton | Florida | Manatee | 34207 |

| View Map | Bradenton | Florida | Manatee | 34208 |

| View Map | Bradenton | Florida | Manatee | 34209 |

| View Map | Bradenton | Florida | Manatee | 34210 |

| View Map | Bradenton | Florida | Manatee | 34211 |

| View Map | Bradenton | Florida | Manatee | 34212 |

| View Map | Bradenton | Florida | Manatee | 34280 |

| View Map | Bradenton | Florida | Manatee | 34281 |

| View Map | Bradenton | Florida | Manatee | 34282 |

| View Map | Bradenton Beach | Florida | Manatee | 34217 |

| View Map | Bradley | Florida | Polk | 33835 |

| View Map | Brandon | Florida | Hillsborough | 33508 |

| View Map | Brandon | Florida | Hillsborough | 33509 |

| View Map | Brandon | Florida | Hillsborough | 33510 |

| View Map | Brandon | Florida | Hillsborough | 33511 |

| View Map | Branford | Florida | Suwannee | 32008 |

| View Map | Bristol | Florida | Liberty | 32321 |

| View Map | Bronson | Florida | Levy | 32621 |

| View Map | Brooker | Florida | Bradford | 32622 |

| View Map | Brooksville | Florida | Hernando | 34601 |

| View Map | Brooksville | Florida | Hernando | 34602 |

| View Map | Brooksville | Florida | Hernando | 34603 |

| View Map | Brooksville | Florida | Hernando | 34604 |

| View Map | Brooksville | Florida | Hernando | 34605 |

| View Map | Brooksville | Florida | Hernando | 34613 |

| View Map | Brooksville | Florida | Hernando | 34614 |

| View Map | Bryant | Florida | Palm Beach | 33439 |

| View Map | Bryceville | Florida | Nassau | 32009 |

| View Map | Bunnell | Florida | Flagler | 32110 |

| View Map | Bushnell | Florida | Sumter | 33513 |

| View Map | Callahan | Florida | Nassau | 32011 |

| View Map | Campbellton | Florida | Jackson | 32426 |

| View Map | Canal Point | Florida | Palm Beach | 33438 |

| View Map | Candler | Florida | Marion | 32111 |

| View Map | Cantonment | Florida | Escambia | 32533 |

| View Map | Cape Canaveral | Florida | Brevard | 32920 |

| View Map | Cape Coral | Florida | Lee | 33904 |

| View Map | Cape Coral | Florida | Lee | 33909 |

| View Map | Cape Coral | Florida | Lee | 33910 |

| View Map | Cape Coral | Florida | Lee | 33914 |

| View Map | Cape Coral | Florida | Lee | 33915 |

| View Map | Cape Coral | Florida | Lee | 33990 |

| View Map | Cape Coral | Florida | Lee | 33991 |

| View Map | Cape Coral | Florida | Lee | 33993 |

| View Map | Captiva | Florida | Lee | 33924 |

| View Map | Carrabelle | Florida | Franklin | 32322 |

| View Map | Caryville | Florida | Washington | 32427 |

| View Map | Cassadaga | Florida | Volusia | 32706 |

| View Map | Casselberry | Florida | Seminole | 32707 |

| View Map | Casselberry | Florida | Seminole | 32718 |

| View Map | Casselberry | Florida | Seminole | 32730 |

| View Map | Cedar Key | Florida | Levy | 32625 |

| View Map | Center Hill | Florida | Sumter | 33514 |

| View Map | Century | Florida | Escambia | 32535 |

| View Map | Chattahoochee | Florida | Gadsden | 32324 |

| View Map | Chiefland | Florida | Levy | 32626 |

| View Map | Chiefland | Florida | Levy | 32644 |

| View Map | Chipley | Florida | Washington | 32428 |

| View Map | Chokoloskee | Florida | Collier | 34138 |

| View Map | Christmas | Florida | Orange | 32709 |

| View Map | Citra | Florida | Marion | 32113 |

| Zip | City | State | County | Zip Code |

| View Map | Clarcona | Florida | Orange | 32710 |

| View Map | Clarksville | Florida | Calhoun | 32430 |

| View Map | Clearwater | Florida | Pinellas | 33755 |

| View Map | Clearwater | Florida | Pinellas | 33756 |

| View Map | Clearwater | Florida | Pinellas | 33757 |

| View Map | Clearwater | Florida | Pinellas | 33758 |

| View Map | Clearwater | Florida | Pinellas | 33759 |

| View Map | Clearwater | Florida | Pinellas | 33760 |

| View Map | Clearwater | Florida | Pinellas | 33761 |

| View Map | Clearwater | Florida | Pinellas | 33762 |

| View Map | Clearwater | Florida | Pinellas | 33763 |

| View Map | Clearwater | Florida | Pinellas | 33764 |

| View Map | Clearwater | Florida | Pinellas | 33765 |

| View Map | Clearwater | Florida | Pinellas | 33766 |

| View Map | Clearwater | Florida | Pinellas | 33769 |

| View Map | Clearwater Beach | Florida | Pinellas | 33767 |

| View Map | Clermont | Florida | Lake | 34711 |

| View Map | Clermont | Florida | Lake | 34712 |

| View Map | Clermont | Florida | Lake | 34713 |

| View Map | Clermont | Florida | Lake | 34714 |

| View Map | Clermont | Florida | Lake | 34715 |

| View Map | Clewiston | Florida | Hendry | 33440 |

| View Map | Cocoa | Florida | Brevard | 32922 |

| View Map | Cocoa | Florida | Brevard | 32923 |

| View Map | Cocoa | Florida | Brevard | 32924 |

| View Map | Cocoa | Florida | Brevard | 32926 |

| View Map | Cocoa | Florida | Brevard | 32927 |

| View Map | Cocoa Beach | Florida | Brevard | 32931 |

| View Map | Cocoa Beach | Florida | Brevard | 32932 |

| View Map | Coconut Creek | Florida | Broward | 33093 |

| View Map | Coleman | Florida | Sumter | 33521 |

| View Map | Copeland | Florida | Collier | 34137 |

| View Map | Cortez | Florida | Manatee | 34215 |

| View Map | Cottondale | Florida | Jackson | 32431 |

| View Map | Crawfordville | Florida | Wakulla | 32326 |

| View Map | Crawfordville | Florida | Wakulla | 32327 |

| View Map | Crescent City | Florida | Putnam | 32112 |

| View Map | Crestview | Florida | Okaloosa | 32536 |

| View Map | Crestview | Florida | Okaloosa | 32539 |

| View Map | Cross City | Florida | Dixie | 32628 |

| View Map | Crystal Beach | Florida | Pinellas | 34681 |

| View Map | Crystal River | Florida | Citrus | 34423 |

| View Map | Crystal River | Florida | Citrus | 34428 |

| View Map | Crystal River | Florida | Citrus | 34429 |

| View Map | Crystal Springs | Florida | Pasco | 33524 |

| View Map | Cypress | Florida | Jackson | 32432 |

| View Map | Dade City | Florida | Pasco | 33523 |

| View Map | Dade City | Florida | Pasco | 33525 |

| View Map | Dade City | Florida | Pasco | 33526 |

| View Map | Dania | Florida | Broward | 33004 |

| View Map | Davenport | Florida | Polk | 33836 |

| View Map | Davenport | Florida | Polk | 33837 |

| View Map | Davenport | Florida | Polk | 33896 |

| View Map | Davenport | Florida | Polk | 33897 |

| View Map | Day | Florida | Lafayette | 32013 |

| View Map | Daytona Beach | Florida | Volusia | 32114 |

| View Map | Daytona Beach | Florida | Volusia | 32115 |

| View Map | Daytona Beach | Florida | Volusia | 32116 |

| View Map | Daytona Beach | Florida | Volusia | 32117 |

| View Map | Daytona Beach | Florida | Volusia | 32118 |

| View Map | Daytona Beach | Florida | Volusia | 32119 |

| View Map | Daytona Beach | Florida | Volusia | 32120 |

| View Map | Daytona Beach | Florida | Volusia | 32121 |

| View Map | Daytona Beach | Florida | Volusia | 32122 |

| View Map | Daytona Beach | Florida | Volusia | 32124 |

| View Map | Daytona Beach | Florida | Volusia | 32125 |

| View Map | Daytona Beach | Florida | Volusia | 32126 |

| View Map | Daytona Beach | Florida | Volusia | 32198 |

| View Map | De Leon Springs | Florida | Volusia | 32130 |

| View Map | Debary | Florida | Volusia | 32713 |

| View Map | Debary | Florida | Volusia | 32753 |

| View Map | Deerfield Beach | Florida | Broward | 33441 |

| View Map | Deerfield Beach | Florida | Broward | 33442 |

| View Map | Deerfield Beach | Florida | Broward | 33443 |

| View Map | Defuniak Springs | Florida | Walton | 32433 |

| View Map | Defuniak Springs | Florida | Walton | 32435 |

| View Map | Deland | Florida | Volusia | 32720 |

| View Map | Deland | Florida | Volusia | 32721 |

| View Map | Deland | Florida | Volusia | 32723 |

| View Map | Deland | Florida | Volusia | 32724 |

| View Map | Delray Beach | Florida | Palm Beach | 33444 |

| View Map | Delray Beach | Florida | Palm Beach | 33445 |

| View Map | Delray Beach | Florida | Palm Beach | 33446 |

| View Map | Delray Beach | Florida | Palm Beach | 33447 |

| View Map | Delray Beach | Florida | Palm Beach | 33448 |

| View Map | Delray Beach | Florida | Palm Beach | 33482 |

| View Map | Delray Beach | Florida | Palm Beach | 33483 |

| View Map | Delray Beach | Florida | Palm Beach | 33484 |

| View Map | Deltona | Florida | Volusia | 32725 |

| View Map | Deltona | Florida | Volusia | 32728 |

| View Map | Deltona | Florida | Volusia | 32738 |

| View Map | Deltona | Florida | Volusia | 32739 |

| View Map | Des | Florida | Okaloosa | 32540 |

| View Map | Des | Florida | Okaloosa | 32541 |

| View Map | Doctors Inlet | Florida | Clay | 32030 |

| View Map | Dover | Florida | Hillsborough | 33527 |

| View Map | Dundee | Florida | Polk | 33838 |

| View Map | Dunedin | Florida | Pinellas | 34697 |

| View Map | Dunedin | Florida | Pinellas | 34698 |

| View Map | Dunnellon | Florida | Marion | 34430 |

| View Map | Dunnellon | Florida | Marion | 34431 |

| View Map | Dunnellon | Florida | Marion | 34432 |

| View Map | Dunnellon | Florida | Citrus | 34433 |

| View Map | Dunnellon | Florida | Citrus | 34434 |

| View Map | Durant | Florida | Hillsborough | 33530 |

| View Map | Eagle Lake | Florida | Polk | 33839 |

| View Map | Earleton | Florida | Alachua | 32631 |

| View Map | East Palatka | Florida | Putnam | 32131 |

| View Map | Eastlake Weir | Florida | Marion | 32133 |

| View Map | Eastpoint | Florida | Franklin | 32328 |

| View Map | Eaton Park | Florida | Polk | 33840 |

| View Map | Ebro | Florida | Washington | 32437 |

| View Map | Edgar | Florida | Putnam | 32149 |

| View Map | Edgewater | Florida | Volusia | 32132 |

| View Map | Edgewater | Florida | Volusia | 32141 |

| View Map | Eglin Afb | Florida | Okaloosa | 32542 |

| View Map | El Jobean | Florida | Charlotte | 33927 |

| View Map | Elfers | Florida | Pasco | 34680 |

| View Map | Elkton | Florida | Saint Johns | 32033 |

| View Map | Ellenton | Florida | Manatee | 34222 |

| View Map | Englewood | Florida | Sarasota | 34223 |

| View Map | Englewood | Florida | Charlotte | 34224 |

| View Map | Englewood | Florida | Sarasota | 34295 |

| View Map | Estero | Florida | Lee | 33928 |

| View Map | Eustis | Florida | Lake | 32726 |

| View Map | Eustis | Florida | Lake | 32727 |

| View Map | Eustis | Florida | Lake | 32736 |

| View Map | Everglades City | Florida | Collier | 34139 |

| View Map | Evinston | Florida | Alachua | 32633 |

| View Map | Fairfield | Florida | Marion | 32634 |

| View Map | Fedhaven | Florida | Polk | 33854 |

| View Map | Felda | Florida | Hendry | 33930 |

| View Map | Fellsmere | Florida | Indian River | 32948 |

| View Map | Fernandina Beach | Florida | Nassau | 32034 |

| View Map | Fernandina Beach | Florida | Nassau | 32035 |

| View Map | Ferndale | Florida | Lake | 34729 |

| View Map | Flagler Beach | Florida | Flagler | 32136 |

| View Map | Fleming Island | Florida | Clay | 32006 |

| View Map | Florahome | Florida | Putnam | 32140 |

| View Map | Floral City | Florida | Citrus | 34436 |

| View Map | Fort Lauderdale | Florida | Broward | 33301 |

| View Map | Fort Lauderdale | Florida | Broward | 33302 |

| View Map | Fort Lauderdale | Florida | Broward | 33303 |

| View Map | Fort Lauderdale | Florida | Broward | 33304 |

| View Map | Fort Lauderdale | Florida | Broward | 33305 |

| View Map | Fort Lauderdale | Florida | Broward | 33306 |

| View Map | Fort Lauderdale | Florida | Broward | 33307 |

| View Map | Fort Lauderdale | Florida | Broward | 33308 |

| View Map | Fort Lauderdale | Florida | Broward | 33309 |

| View Map | Fort Lauderdale | Florida | Broward | 33310 |

| View Map | Fort Lauderdale | Florida | Broward | 33311 |

| View Map | Fort Lauderdale | Florida | Broward | 33312 |

| View Map | Fort Lauderdale | Florida | Broward | 33313 |

| View Map | Fort Lauderdale | Florida | Broward | 33314 |

| View Map | Fort Lauderdale | Florida | Broward | 33315 |

| View Map | Fort Lauderdale | Florida | Broward | 33316 |

| View Map | Fort Lauderdale | Florida | Broward | 33317 |

| View Map | Fort Lauderdale | Florida | Broward | 33318 |

| View Map | Fort Lauderdale | Florida | Broward | 33319 |

| View Map | Fort Lauderdale | Florida | Broward | 33320 |

| View Map | Fort Lauderdale | Florida | Broward | 33321 |

| View Map | Fort Lauderdale | Florida | Broward | 33322 |

| View Map | Fort Lauderdale | Florida | Broward | 33323 |

| View Map | Fort Lauderdale | Florida | Broward | 33324 |

| View Map | Fort Lauderdale | Florida | Broward | 33325 |

| View Map | Fort Lauderdale | Florida | Broward | 33326 |

| View Map | Fort Lauderdale | Florida | Broward | 33327 |

| View Map | Fort Lauderdale | Florida | Broward | 33328 |

| View Map | Fort Lauderdale | Florida | Broward | 33329 |

| View Map | Fort Lauderdale | Florida | Broward | 33330 |

| View Map | Fort Lauderdale | Florida | Broward | 33331 |

| View Map | Fort Lauderdale | Florida | Broward | 33332 |

| View Map | Fort Lauderdale | Florida | Broward | 33334 |

| View Map | Fort Lauderdale | Florida | Broward | 33335 |

| View Map | Fort Lauderdale | Florida | Broward | 33336 |

| View Map | Fort Lauderdale | Florida | Broward | 33337 |

| View Map | Fort Lauderdale | Florida | Broward | 33338 |

| View Map | Fort Lauderdale | Florida | Broward | 33339 |

| View Map | Fort Lauderdale | Florida | Broward | 33340 |

| View Map | Fort Lauderdale | Florida | Broward | 33345 |

| View Map | Fort Lauderdale | Florida | Broward | 33346 |

| View Map | Fort Lauderdale | Florida | Broward | 33348 |

| View Map | Fort Lauderdale | Florida | Broward | 33349 |

| View Map | Fort Lauderdale | Florida | Broward | 33351 |

| View Map | Fort Lauderdale | Florida | Broward | 33355 |

| View Map | Fort Lauderdale | Florida | Broward | 33359 |

| View Map | Fort Lauderdale | Florida | Broward | 33388 |

| View Map | Fort Lauderdale | Florida | Broward | 33394 |

| View Map | Fort Mc Coy | Florida | Marion | 32134 |

| View Map | Fort Meade | Florida | Polk | 33841 |

| View Map | Fort Myers | Florida | Lee | 33901 |

| View Map | Fort Myers | Florida | Lee | 33902 |

| View Map | Fort Myers | Florida | Lee | 33905 |

| View Map | Fort Myers | Florida | Lee | 33906 |

| View Map | Fort Myers | Florida | Lee | 33907 |

| View Map | Fort Myers | Florida | Lee | 33908 |

| View Map | Fort Myers | Florida | Lee | 33911 |

| View Map | Fort Myers | Florida | Lee | 33912 |

| View Map | Fort Myers | Florida | Lee | 33913 |

| View Map | Fort Myers | Florida | Lee | 33916 |

| View Map | Fort Myers | Florida | Lee | 33919 |

| View Map | Fort Myers | Florida | Lee | 33965 |

| View Map | Fort Myers | Florida | Lee | 33966 |

| View Map | Fort Myers | Florida | Lee | 33967 |

| View Map | Fort Myers | Florida | Lee | 33994 |

| View Map | Fort Myers Beach | Florida | Lee | 33931 |

| View Map | Fort Myers Beach | Florida | Lee | 33932 |

| View Map | Fort Ogden | Florida | De Soto | 34267 |

| View Map | Fort Pierce | Florida | Saint Lucie | 34945 |

| View Map | Fort Pierce | Florida | Saint Lucie | 34946 |

| View Map | Fort Pierce | Florida | Saint Lucie | 34947 |

| View Map | Fort Pierce | Florida | Saint Lucie | 34948 |

| View Map | Fort Pierce | Florida | Saint Lucie | 34949 |

| View Map | Fort Pierce | Florida | Saint Lucie | 34950 |

| View Map | Fort Pierce | Florida | Saint Lucie | 34951 |

| View Map | Fort Pierce | Florida | Saint Lucie | 34954 |

| View Map | Fort Pierce | Florida | Saint Lucie | 34979 |

| View Map | Fort Pierce | Florida | Saint Lucie | 34981 |

| View Map | Fort Pierce | Florida | Saint Lucie | 34982 |

| View Map | Fort Walton Beach | Florida | Okaloosa | 32547 |

| View Map | Fort Walton Beach | Florida | Okaloosa | 32548 |

| View Map | Fort Walton Beach | Florida | Okaloosa | 32549 |

| View Map | Fort White | Florida | Columbia | 32038 |

| View Map | Fountain | Florida | Bay | 32438 |

| View Map | Freeport | Florida | Walton | 32439 |

| View Map | Frostproof | Florida | Polk | 33843 |

| View Map | Fruitland Park | Florida | Lake | 34731 |

| View Map | Gainesville | Florida | Alachua | 32601 |

| View Map | Gainesville | Florida | Alachua | 32602 |

| View Map | Gainesville | Florida | Alachua | 32603 |

| View Map | Gainesville | Florida | Alachua | 32604 |

| View Map | Gainesville | Florida | Alachua | 32605 |

| View Map | Gainesville | Florida | Alachua | 32606 |

| View Map | Gainesville | Florida | Alachua | 32607 |

| View Map | Gainesville | Florida | Alachua | 32608 |

| View Map | Gainesville | Florida | Alachua | 32609 |

| View Map | Gainesville | Florida | Alachua | 32610 |

| View Map | Gainesville | Florida | Alachua | 32611 |

| View Map | Gainesville | Florida | Alachua | 32612 |

| View Map | Gainesville | Florida | Alachua | 32613 |

| View Map | Gainesville | Florida | Alachua | 32614 |

| View Map | Gainesville | Florida | Alachua | 32627 |

| View Map | Gainesville | Florida | Alachua | 32635 |

| View Map | Gainesville | Florida | Alachua | 32641 |

| View Map | Gainesville | Florida | Alachua | 32653 |

| View Map | Geneva | Florida | Seminole | 32732 |

| View Map | Georgetown | Florida | Putnam | 32139 |

| View Map | Gibsonton | Florida | Hillsborough | 33534 |

| View Map | Glen Saint Mary | Florida | Baker | 32040 |

| View Map | Glenwood | Florida | Volusia | 32722 |

| View Map | Goldenrod | Florida | Seminole | 32733 |

| View Map | Gonzalez | Florida | Escambia | 32560 |

| View Map | Goodland | Florida | Collier | 34140 |

| View Map | Gotha | Florida | Orange | 34734 |

| View Map | Graceville | Florida | Jackson | 32440 |

| View Map | Graham | Florida | Bradford | 32042 |

| View Map | Grand Island | Florida | Lake | 32735 |

| View Map | Grand Ridge | Florida | Jackson | 32442 |

| View Map | Grandin | Florida | Putnam | 32138 |

| View Map | Grant | Florida | Brevard | 32949 |

| View Map | Green Cove Springs | Florida | Clay | 32043 |

| View Map | Greensboro | Florida | Gadsden | 32330 |

| View Map | Greenville | Florida | Madison | 32331 |

| View Map | Greenwood | Florida | Jackson | 32443 |

| View Map | Gretna | Florida | Gadsden | 32332 |

| View Map | Groveland | Florida | Lake | 34736 |

| View Map | Gulf Breeze | Florida | Santa Rosa | 32561 |

| View Map | Gulf Breeze | Florida | Santa Rosa | 32562 |

| View Map | Gulf Breeze | Florida | Santa Rosa | 32563 |

| View Map | Gulf Hammock | Florida | Levy | 32639 |

| View Map | Haines City | Florida | Polk | 33844 |

| View Map | Haines City | Florida | Polk | 33845 |

| View Map | Hallandale | Florida | Broward | 33008 |

| View Map | Hallandale | Florida | Broward | 33009 |

| View Map | Hampton | Florida | Bradford | 32044 |

| View Map | Hasgs | Florida | Saint Johns | 32145 |

| View Map | Havana | Florida | Gadsden | 32333 |

| View Map | Hawthorne | Florida | Alachua | 32640 |

| View Map | Hernando | Florida | Citrus | 34442 |

| View Map | Hialeah | Florida | Miami-dade | 33002 |

| View Map | Hialeah | Florida | Miami-dade | 33010 |

| View Map | Hialeah | Florida | Miami-dade | 33011 |

| View Map | Hialeah | Florida | Miami-dade | 33012 |

| View Map | Hialeah | Florida | Miami-dade | 33013 |

| View Map | Hialeah | Florida | Miami-dade | 33014 |

| View Map | Hialeah | Florida | Miami-dade | 33015 |

| View Map | Hialeah | Florida | Miami-dade | 33016 |

| View Map | Hialeah | Florida | Miami-dade | 33017 |

| View Map | Hialeah | Florida | Miami-dade | 33018 |

| View Map | High Springs | Florida | Alachua | 32643 |

| View Map | High Springs | Florida | Alachua | 32655 |

| View Map | Highland City | Florida | Polk | 33846 |

| View Map | Hilliard | Florida | Nassau | 32046 |

| View Map | Hobe Sound | Florida | Martin | 33455 |

| View Map | Hobe Sound | Florida | Martin | 33475 |

| View Map | Holder | Florida | Citrus | 34445 |

| View Map | Holiday | Florida | Pasco | 34690 |

| View Map | Holiday | Florida | Pasco | 34691 |

| View Map | Holiday | Florida | Pasco | 34692 |

| View Map | Hollister | Florida | Putnam | 32147 |

| View Map | Hollywood | Florida | Broward | 33019 |

| View Map | Hollywood | Florida | Broward | 33020 |

| View Map | Hollywood | Florida | Broward | 33021 |

| View Map | Hollywood | Florida | Broward | 33022 |

| View Map | Hollywood | Florida | Broward | 33023 |

| View Map | Hollywood | Florida | Broward | 33024 |

| View Map | Hollywood | Florida | Broward | 33025 |