How To Use Bonus Overtime As Income When Less than 2 years!

The written Verification of Employment box that says is overtime income likely to continue must be marked YES!

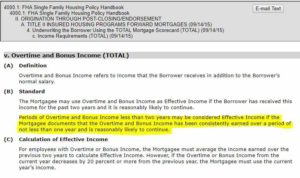

Overtime and bonus income can be used to qualify the FHA Mortgage Applicants if he/she has

received this income for the past two years, and it will likely continue. If the

employment verification states that the overtime and bonus income is unlikely

to continue, it may not be used in qualifying.

The FHA mortgage lenders must develop an average of bonus or overtime income for the past

two years. Periods of overtime and bonus income less than two years may be

acceptable, provided the FHA mortgage lenders can justify and document in writing the reason

for using the income for qualifying purposes.

The FHA mortgage lenders must establish and document an earnings trend for overtime and

bonus income. If either type of income shows a continual decline, the FHA mortgage lenders

must document in writing a sound rationalization for including the income

when qualifying the FHA Mortgage Applicants.

A period of more than two years must be used in calculating the average

overtime and bonus income if the income varies significantly from year to

year.

Part-time and seasonal income can be used to qualify the FHA Mortgage Applicants if the

FHA mortgage lenders documents that the FHA Mortgage Applicants has worked the part-time job

uninterrupted for the past two years, and plans to continue. Many low and

moderate-income families rely on part-time and seasonal income for day to

day needs, and FHA Mortgage FHA Mortgage FHA mortgage lenders should not restrict consideration of such income when qualifying these FHA Mortgage Applicants.

Part-time income received for less than two years may be included as

effective income provided that the FHA mortgage lenders justify and documents that the

income is likely to continue.

Part-time income not meeting the qualifying requirements may be considered

as a compensating factor only.

Note: For qualifying purposes, “part-time” income refers to employment

taken to supplement the FHA Mortgage Applicants’ income from regular employment; parttime

employment is not a primary job and it is worked less than 40 hours.

Seasonal income is considered uninterrupted and may be used to qualify the

FHA Mortgage Applicants, if the FHA mortgage lenders documents that the FHA Mortgage Applicants

has worked the same job for the past two years, and

expects to be rehired the next season.

Seasonal employment includes

umpiring baseball games in the summer, or

working at a department store during the holiday shopping season.

When an FHA Mortgage Applicants’ primary employment is less than a typical 40-hour work

week, the FHA mortgage lenders should evaluate the stability of that income as regular, ongoing

primary employment.

Example: A registered nurse may have worked 24 hours per week for the last

year. Although this job is less than the 40-hour work week, it is the

FHA Mortgage Applicants’ primary employment, and should be considered effective income.

Commission income must be averaged over the previous two years. To

qualify with commission income, the FHA Mortgage Applicants must provide

copies of signed tax returns for the last two years, and

the most recent pay stub.

Commission income showing a decrease from one year to the next requires

significant compensating factors before an FHA Mortgage Applicants can be approved for the

loan.

An FHA Mortgage Applicants whose commission income was received for more than one year,

but less than two years may be considered favorably if the underwriter can

document the likelihood that the income will continue, and

soundly rationalize accepting the commission income.

Notes:

Unreimbursed business expenses must be subtracted from gross income.

A commissioned FHA Mortgage Applicants is one who receives more than 25% of his/her

annual income from commissions.

A tax transcript obtained directly from the Internal Revenue Service (IRS)

may be used in lieu of signed tax returns, and the cost of the transcript may

be charged to the FHA Mortgage Applicants.

Commission income earned for less than one year is not considered effective

income. Exceptions may be made for situations in which the FHA Mortgage Applicants’

compensation was changed from salary to commission within a similar

position with the same employer.

An FHA Mortgage Applicants may also qualify when the portion of earnings not attributed to

commissions would be sufficient to qualify the FHA Mortgage Applicants for the mortgage.