FHA Mortgage With Charge Offs, Collections, Judgments?

Must a collection reported as a charge off be included with the FHA mortgage applicants debt to income ratios?

If a previously reported Charge Off Account is subsequently reported as an open collection account, the debt must be considered for credit and capacity analysis in accordance with Collection Account.

If the credit reports used in the FHA mortgage approval analysis show cumulative outstanding collection account balances of $2,000 or greater, the FHA mortgage lender must:

1. verify that the debt is paid in full at the time of or prior to settlement using acceptable sources of funds;

2. verify that the FHA mortgage applicant has made payment arrangements with the creditor and include the monthly payment in the FHA mortgage applicant’s debt-to-income (DTI); or

3. if a payment arrangement is not available, calculate the monthly payment using 5% percent of the outstanding balance of each collection and include the monthly payment in the FHA mortgage applicant’s Debt to income ratios.

Collection accounts of a non-borrowing spouse in a community property state must be included in the $2,000 cumulative balance and analyzed as part of the FHA mortgage applicant’s ability to pay all collection accounts unless excluded by state law.

The FHA mortgage lender must provide the following documentation:

1. Provide evidence of payment in full, if paid prior to settlement;

2. the payoff statement, if paid at settlement; or

3. the payment arrangement with the creditor, if not paid prior to or at settlement.

If the FHA mortgage lender uses 5%percent of the outstanding balance, no documentation is required.

Does FHA require collections to be paid off for an FHA mortgage qualifying?

Does FHA require collections to be paid off for an FHA mortgage qualifying?

A Collection Account refers to an FHA mortgage applicant’s loan or debt that has been submitted to a collection agency by a creditor.

If the credit reports used in the analysis show cumulative outstanding collection account balances of $2,000 or greater, the lender must:

1. FHA mortgage lenders must verify that the debt is paid in full at the time of or prior to settlement using an acceptable source of funds;

2. FHA mortgage lenders must verify that the FHA mortgage applicant has made payment arrangements with the creditor and include the monthly payment in the FHA mortgage applicant’s Debt-to-Income ratio (DTI); or

3. FHA mortgage lenders must if a payment arrangement is not available, calculate the monthly payment using 5%percent of the total outstanding balance of each collection and include the monthly payment in the FHA mortgage applicant’s Debt to income ratios. Collection accounts of a non-borrowing spouse in a community property state must be included in the $2,000 cumulative balance and analyzed as part of the FHA mortgage applicant’s ability to pay all collection accounts unless excluded by state law. Unless the lender uses 5 percent of the outstanding balance, the lender must provide the following documentation:

• evidence of payment in full, if paid prior to settlement;

• the payoff statement, if paid at settlement; or

• the payment arrangement with the creditor, if not paid prior to or at the closing of the FHA mortgage. For manually underwritten loans, the lender must determine if collection accounts were a result of:

• the FHA mortgage applicant’s disregard for financial obligations;

• the FHA mortgage applicant’s inability to manage debt; or

• extenuating circumstances. The lender must document reasons for approving a mortgage when the FHA mortgage applicant has any collection accounts. The FHA mortgage applicant must provide a letter of explanation, which is supported by documentation, for each outstanding collection account. The explanation and supporting documentation must be consistent with other credit information in the file.

1. the FHA mortgage applicant’s disregard for financial obligations;

2. the FHA mortgage applicant’s inability to manage debt; or

3. extenuating circumstances. EXCEPTION

A Judgment is considered resolved if the FHA mortgage applicant has entered into a valid agreement with the creditor to make regular payments on the debt, the FHA mortgage applicant has made timely payments for at least (3) three months of scheduled payments and the Judgment will not supersede the FHA mortgage lien. The FHA mortgage applicant can NOT prepay scheduled payments in order to meet the required minimum of 3 three months of payments. The payment amount in the agreement must be included in the FHA mortgage applicant’s monthly liabilities and debt. The FHA mortgage lender must obtain a copy of the agreement and evidence that payments were made on time in accordance with the agreement. The FHA mortgage lender must provide the following documentation:

1. Evidence of payment in full, if paid prior to settlement;

2. The payoff statement, if paid at settlement; or

3. the payment arrangement with the creditor, if not paid prior to or at settlement, and a subordination agreement for any liens existing on title.

YES!!GET A FLORIDA MORTGAGE WITH COLLECTIONS!!

GET A FLORIDA MORTGAGE WITH COLLECTIONS? YES!!@

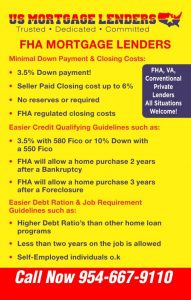

BAD CREDIT FLORIDA MORTGAGE LENDERS PROGRAMS INCLUDE:

- Florida Bad Credit Bank Statement Only

- FL Mortgage After Foreclosure – Short Sale – Bankruptcy- Foreclosure

- Bad Credit Florida mortgage

- Bad Credit Florida Mortgage Refinance

- Bad Credit Florida Portfolio Lenders

- Buy a Florida home 1 day after a Foreclosure or Bankruptcy

- Bad Credit Florida FHA Mortgage Lenders

- No Credit score Florida mortgage

- Bad Credit Florida FHA mortgage

- Hard Money Florida mortgage

- Bad Credit Florida Modular Home Loans

- Florida Chapter 13 Bankruptcy Mortgage Lenders

- Bad Credit 2nd Second Florida Mortgage

- Florida Stop Foreclosure Loans

- Bad Credit Florida VA mortgage

- Bad Credit Florida Cash for Deed

- Bad Credit Florida Mortgage Rates Sheet

- Bad Credit Florida Mortgage with Judgements

- Bad Credit Florida Mortgage with Evictions

- Bad Credit Florida Mortgage with Tax Liens

- Bad Credit Investor Loans Buyer Or Refi With Florida LLC!

- ALL SITUATIONS ARE WELCOME!!!