Mortgage 1 day after Bankruptcy or Foreclosure

Bad Credit Florida Mortgage Lenders – Bad Credit Florida Home Loans— Read More »

Note Bad Credit Florida Mortgage Lenders Make Approvals based on payment history are not credit score driven!

Florida Mortgage After Bankruptcy Foreclosure Program Highlights

- Up To 70% Loan to Value

- Minimum 350 Credit Score Required!

- Full Doc Only-43% DTI

- 1 day after Bankruptcy, Foreclosure And Short Sales Are Ok

- Deferred Maintenance Is Acceptable On Purchases

- Up To 6% Seller Help Allowed

- Gift Funds Are Acceptable

- Reserves Change based case by case.

About No Tax Return Bad Credit Bankruptcy Foreclosure Mortgage Lenders

The Manual Underwriting of the Borrower section of the borrowers and overview of the requirements to determine a borrower’s ability to obtain bad credit single-family financing considering:– Creditworthiness;– Effective income; and

– Assets. Bad Credit mortgage lenders determine the Borrower’s creditworthiness:– Credit history; – Liabilities; and– Debts.

Fannie Mae Bankruptcy Foreclosure Waiting Times

| Derogatory Event | Waiting Period Requirements | Waiting Period with Extenuating Circumstances |

| Bankruptcy — Chapter 7 or 11 | 4 years | 2 years |

| Bankruptcy — Chapter 13 |

|

|

| Multiple Bankruptcy Filings | 5 years if more than one filing within the past 7 years | 3 years from the most recent discharge or dismissal date |

| Foreclosure

Deed-in-Lieu of Foreclosure, Preforeclosure Sale, or Charge-Off of Mortgage Account |

7 years

4 years |

3 yearsAdditional requirements after 3 years up to 7 years:

|

Florida mortgage after bankruptcy foreclosure Requirements for Re-establishing Credit

A Florida bankruptcy, foreclosure, deed-in-lieu of foreclosure, preforeclosure sale, or charge-off of a mortgage account, the borrower’s credit will be considered re-established if all of the following are met:

- The waiting period and the related additional requirements are met.

- The loan receives a recommendation from DU that is acceptable for delivery to Fannie Mae or, if manually underwritten, meets the minimum credit score requirements based on the parameters of the loan and the established eligibility requirements.

- The borrower has traditional credit as outlined in Section B3–5.3, Traditional Credit History. Nontraditional credit or “thin files” are not acceptable.

Bad Credit Bankruptcy Foreclosure Florida Mortgage Lenders

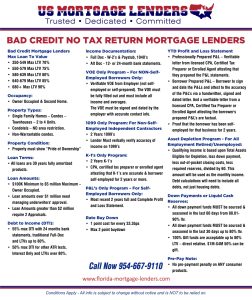

Bad Credit Mortgage Lenders Max Loan To Value:

•350-549 Max LTV 70% •550-579 Max LTV 75%

Income Documentation:

Full Doc – W-2’s & Paystub, 1040’s

Alt Doc – 12- or 24-month bank statements.

Occupancy:

• Owner Occupied & Second Home.

Property Types:

• Single Family Homes – Condos – Townhouses – 2 to 4 Units.

• Condotels – NO area restriction.

• Non-Warrantable condos.

Property Condition:

• Property must show “Pride of Ownership”.

Loan Terms:

• All loans are 30 years fully amortized products.

Loan Amounts:

• $100K Minimum to $5 million Maximum – Owner Occupied.

• Loan amounts over $1 million need managing underwriters’ approval.

• Loan Amounts greater than $2 million require 2 Appraisals.

Debt to Income (DTI):

• 55% max DTI with 24 months bank statements, traditional Full-Doc and LTVs up to 80%.

• 50% max DTI for other ATR tests, Interest Only and LTVs over 80%.

VOE Only Program – For NON-Self-Employed Borrowers Only:

• Verifiable VOE from Employer (not self-employed or self-prepared). The VOE must be fully filled out and must include all income and averages.

The VOE must be signed and dated by the employer with accurate contact info.

1099 Only Program: For Non-Self-Employed Independent Contractors

• 2 Years 1099’s

• Lender Must verbally verify accuracy of income on 1099’s

K-1’s Only Program:

• 2 Years K-1’s

• CPA, certified tax preparer or enrolled agent attesting that K-1’s are accurate & borrower self-employed for 2 years or more.

P&L’s Only Program – For Self-Employed Borrowers Only:

•Most recent 2 years full and Complete Profit and Loss Statement.

YTD Profit and Loss Statement

• Professionally Prepared P&L – Verifiable letter from licensed CPA, Certified Tax Preparer or Enrolled Agent attesting that they prepared the P&L statements.

• Borrower Prepared P&L – Borrower to sign and date the P&Ls and attest to the accuracy of the P&L’s via a handwritten, signed and dated

letter. And a verifiable letter from a licensed CPA, Certified Tax Preparer or Enrolled Agent attesting to the borrower’s prepared P&L’s are factual.

• Proof that the borrower has been self-employed for that business for 2 years.

Asset Depletion Program – For All Employment Retired/Unemployed:

• Qualifying income is based upon Total Assets Eligible for Depletion, less down payment, less out-of-pocket closing costs, less required reserves,

divided by 60. This amount will be used as the monthly income. Debt calculations will need to include all debts, not just housing debts.

Down Payments or Liquid Cash Reserves:

• All down payment funds MUST be sourced & seasoned in the last 60 days from 80.01-90% ltv.

• All down payment funds MUST be sourced & seasoned in the last 30 days up to 80% ltv.

• 100% Gift funds are acceptable up to 80% LTV – direct relative. $1M-$4M 50% can be gift.

Pre-Pay Note:

• No pre-payment penalty on ANY consumer products. Rate Buy Down – 1 point cost for every 33.3bps – Max 2 point buydown. Conditions Apply – All info is subject to change without notice and is NOT to be relied on.

PORTFOLIO- PRIVATE MORTGAGE LENDER APPROVALS!

- Purchase 1 day after bankruptcy, foreclosure, short sale, and deed in lieu of foreclosure up to 2.5 million. These are not subprime loans, but they do often have higher interest rates and higher closing costs.

- Portfolio mortgage lenders offer private mortgage loan approvals and are looking at other compensating factors to approve these loans. Examples include 12-month timely rental history, high credit scores, lower loan to value (larger down payments), and reserves (future mortgage payments in the account at closing).

A minimum 350 credit score For Florida Portfolio Mortgage Lenders Programs!!

BAD CREDIT FHA MORTGAGE AFTER BANKRUPTCY FORECLOSURE:

- The down payment is only 3.5% of the purchase price.

- Gifts from family or Bankruptcy or Foreclosure Grants for down payment assistance and closing costs are OK!

- Sellers can credit the buyer up to 6% of the sales price towards buyers’ costs and pre-paid.

- No reserves or future payments in the account are required.

- Bankruptcy or Foreclosure regulated closing costs.

- Read more about buying a home with a Bankruptcy or Foreclosure mortgage Bad Credit –No Credit – Investment –Second Home –Multi-Family –

BAD CREDIT MORTGAGE AFTER FORECLOSURE BANKRUPTCY:

- 12 months after a chapter 13 Bankruptcy Bankruptcy or Foreclosure mortgage Lender approvals!

- 24 months after a chapter 7 Bankruptcy Bankruptcy or Foreclosure mortgage Lender approvals!

- 3 years after a Foreclosure Bankruptcy or Foreclosure mortgage Lender approvals!

- No Credit Score Bankruptcy or Foreclosure mortgage Lender approvals!

- 580 required for 96.5% financing or 3.5% down payment Bankruptcy or Foreclosure mortgage Lender approvals.

- 500 required for 90% financing or 10% down payment Bankruptcy or Foreclosure mortgage Lender approvals.

- Bad Credit with a minimum 500 FICO credit score with 10% Down Payment Bankruptcy or Foreclosure. For Bankruptcy or Foreclosure mortgage applicants with credit scores between 500 and 579 must make down payments of at least 10% down!

- Read more about Bankruptcy or Foreclosure Qualifying Qualification Summary – Manual Underwrite – Collections-Judgement’s – Bankruptcy or Foreclosure – Compensating Factors –

JOB QUALIFYING WITH FORECLOSURE AND BANKRUPTCY

- Bankruptcy or Foreclosure allows higher debt ratios than any conventional mortgage loan program.

- Less than two years on the same job is OK!

- Self-employed buyers can also qualify with Bankruptcy or Foreclosure Mortgage Lenders.

- Read More about Gifts For Down Payment – Documents Checklist – Debt To Income – Student Loans –

Bankruptcy or Foreclosure- Bankruptcy or Foreclosure MORTGAGE AFTER BANKRUPTCY APPROVALS!

- Chapter 13 Bankruptcy- You may apply for a Bankruptcy or Foreclosure mortgage after your bankruptcy has been discharged for 12 Months or (1) year with a Chapter 13 Bankruptcy. You must have 0 x 30-day late payments, and permission from the chapter 13 trustee.

- Chapter 7 Bankruptcy- You may apply for a Bankruptcy or Foreclosure mortgage after your bankruptcy has been discharged for TWO (2) years with a Chapter 7 Bankruptcy. You may apply for a Bankruptcy or Foreclosure insured loan after your bankruptcy has been discharged for ONE (1) year with a Chapter 13 Bankruptcy

- Foreclosure – You may apply for a Bankruptcy or Foreclosure insured loan THREE (3) years after the Foreclosure sale/deed transfer date. You may have to search the county records office to locate the deed in order to count a full 3 years.

- Short Sale / Deed in Lieu – You may apply for a Bankruptcy or Foreclosure insured loan THREE (3) years after the sale date of your foreclosure. Bankruptcy or Foreclosure treats a short sale the same as a Foreclosure for now. You may have to search the county records office to locate the deed in order to count a full 3 years.

- Credit must be re-established no late payments in the past 12-24 months, depending on hardship

- Application Date must be after the above waiting period to be eligible for Bankruptcy or Foreclosure financing after hardship. You may have to search the county records office to locate the deed transfer out of your name in order to count a full 3 years.

Bankruptcy or Foreclosure Mortgage Lenders Require A minimum 580 credit score.

VA- MORTGAGE LENDERS APPROVALS!

- Chapter 13 Bankruptcy – Once you have finished making all payments satisfactorily, the mortgage lender may conclude that you have reestablished satisfactory credit.

- If you have made at least 12 months of timely payments and the Trustee or the Bankruptcy Judge approves of the new home purchase, the mortgage lender will approve financing after a chapter 13 bankruptcy.

- Chapter 7 Bankruptcy – You may apply for a VA mortgage loan TWO (2) years after a chapter 7 Bankruptcy.

- Foreclosure / Deed in Lieu – You may apply for a VA mortgage loan TWO (2) years after a foreclosure.

- Short Sale – VA does not recognize a short sale as a derogatory event, however, most mortgage lenders do. Most lenders will require a full 2 years after the deed was transferred out of your name and you re-establish credit.

- Credit must be re-established with a minimum 550 credit score

- Application Date must be after the above waiting period to be eligible for VA mortgage after hardship.

VA Mortgage Lenders Require A minimum 550 credit score.

USDA- MORTGAGE APPROVALS!

- Foreclosure – You may apply for a USDA rural loan THREE (3) years after a Foreclosure.

- Bankruptcy – You may apply for a USDA rural loan THREE (3) years after the discharge of Chapter 7 or 13 Bankruptcy.

- Short Sale / Deed in Lieu of Foreclosure – mortgage lenders require 3 years after a foreclosure.

USDA Lenders Require A minimum 550 credit score.

CONVENTIONAL– MORTGAGE APPROVALS!

- Foreclosure – You may apply for a Conventional mortgage, Fannie Mae loan (7) SEVEN years after the sale date of your foreclosure.

- Bankruptcy – You may apply for a Conventional, Fannie Mae loan after your Chapter 7 bankruptcy has been discharged for FOUR (4) years, TWO (2) years from the discharge of Chapter 13

- Short Sale / Deed in Lieu of Foreclosure –Waiting period for foreclosure that was included in Bankruptcy If the mortgage is included in Bankruptcy, the waiting period defaults to FOUR (4) from the discharge date. Florida Short Sale or Deed in Lieu of Foreclosure not included in a Bankruptcy has a new Waiting Period of FOUR (4) years from the date your name is removed from the title. This replaces the ability to buy in 24 months with 20% down payment and a minimum 680 credit score.

Bad Credit Florida No Tax Return Mortgage Lenders

Bad Credit Florida No Tax Return Mortgage Lenders About No Tax Return Bad Credit Mortgage Lenders Bad credit Florida Bank statement mortgage lenders were Read More »

Florida Bad Credit Mortgage Lenders Coverage Areas

Jacksonville

Miami

Tampa

Orlando

St. Petersburg

Port St. Lucie

Tallahassee

Cape Coral

Fort Lauderdale

Pembroke Pines

Hollywood

Miramar

Gainesville

Coral Springs

Lehigh Acres

Clearwater

Brandon

Palm Bay

Spring Hill

Pompano Beach

West Palm Beach

Miami Gardens

Lakeland

Davie

Boca Raton

Jacksonville FL

Miami FL

Riverview

Sunrise

Plantation

Deltona

Alafaya

Town ‘n’ Country

Miami Beach

Palm Coast

Largo

Fort Myers

Melbourne

The Villages

Pine Hills

Deerfield Beach

Boynton Beach

Kendall

Kissimmee

Lauderhill

Weston

Homestead

Delray Beach

North Port

Daytona Beach

Poinciana

Tamarac

Jupiter

Wellington

Port Charlotte

Port Orange

The Hammocks

North Miami

Doral

Palm Harbor

Coconut Creek

Wesley Chapel

Sanford

Ocala

Fountainebleau

Margate

Sarasota

Bonita Springs

Bradenton

Palm Beach Gardens

Tamiami

Kendale Lakes

Westchester

Pinellas Park

St. Cloud

Pensacola

Apopka

Country Club

Coral Gables

University CDP

Ocoee

Titusville

Horizon West

Four Corners

Fort Pierce

Oakland Park

Winter Garden

North Lauderdale

Altamonte Springs

Cutler Bay

Ormond Beach

Winter Haven

North Miami Beach

North Fort Myers

Greenacres

Oviedo

Valrico

The Acreage

Hallandale Beach

Royal Palm Beach

Plant City

Meadow Woods

Land O’ Lakes

Lake Worth Beach

Kendall West

Egypt Lake-Leto

Navarre

Aventura

Richmond West

Winter Springs

Clermont

University

Dunedin

Lauderdale Lakes

Panama City

Cooper City

South Miami Heights

Princeton

Carrollwood

Buenaventura Lakes

Riviera Beach

Merritt Island

Golden Glades

DeLand

Estero

Fruit Cove

Parkland

East Lake

West Little River

Lake Magdalene

Dania Beach

Ferry Pass

Lakeside

Miami Lakes

Winter Park

Fleming Island

Golden Gate

East Lake-Orient Park

Vero Beach South

Casselberry

Oakleaf Plantation

Immokalee

Rockledge

Citrus Park

New Smyrna Beach

Temple Terrace

Leisure City

Bayonet Point

Lakewood Ranch

Sun City Center

Ruskin

Sebastian

Coral Terrace

Tarpon Springs

Keystone

Haines City

Palm Springs

Bloomingdale

Palm City

Silver Springs Shores

South Bradenton

Ives Estates

Crestview

Wright

Northdale

Palm River-Clair Mel

Key West

Palmetto Bay

Wekiwa Springs

Port St. John

Edgewater

Oak Ridge

Venice

Jacksonville Beach

Fish Hawk

Hialeah Gardens

Apollo Beach

West Melbourne

Westchase

Leesburg

The Crossings

Lutz

Jasmine Estates

West Pensacola

Fort Walton Beach

Pace

Sunny Isles Beach

Brent

Naples

Lealman

Ensley

Bellview

Florida Ridge

DeBary

Eustis

Holiday

Liberty Triangle

Lynn Haven

Sweetwater

Palm Valley

Bayshore Gardens

Cocoa

Punta Gorda

Hunters Creek

Belle Glade

Bartow

Englewood

Midway CDP

Bradfordville

Pinecrest

Marion Oaks

World Golf Village

Seminole

Country Walk

San Carlos Park

Upper Grand Lagoon

Gibsonton

Marco Island

Safety Harbor

Maitland

Lake Butler CDP

Glenvar Heights

Brownsville

Tavares

Vero Beach

Myrtle Grove

Pinewood

Lake Mary

Ojus

Nocatee

South Venice

New Port Richey

Lake Wales

Palmetto Estates

Stuart

Southchase

Auburndale

Zephyrhills

Opa-locka

Warrington

Lady Lake

Niceville

Longwood

Azalea Park

Three Lakes

Bellair-Meadowbrook Terrace

Groveland

St. Augustine

West Park

Lockhart

Sunset

Oldsmar

Hobe Sound

Callaway

Homosassa Springs

Thonotosassa

Destin

Villas

East Milton

West Lealman

Olympia Heights

Gonzalez

Lakewood Park

Viera West

Mount Dora

Fruitville

Miami Springs

Atlantic Beach

Palmer Ranch

Palmetto

Jensen Beach and Forest City

Iona

Gladeview

Yulee

Conway

South Daytona

North Palm Beach

Sarasota Springs

Jupiter Farms

Elfers

Key Biscayne

Cypress Lake

Trinity

Panama City Beach

Fernandina Beach

Wilton Manors

Middleburg

Goldenrod

Gulfport

Viera East

Naranja

Holly Hill

Orange City

Minneola

Lake City

Laurel

Shady Hills

Port Salerno

Cheval

Fuller Heights

South Miami and Lantana

Westview

Florida City

Cocoa Beach

Mango

Lakeland Highlands

Pine Castle

Highland City

Medulla

Pasadena Hills

Hudson

Lighthouse Point

Goulds

Pebble Creek

Westwood Lakes

Celebration

Doctor Phillips

Satellite Beach

On Top of the World

Asbury Lake

Union Park

Memphis

New Port Richey East

Gateway

Avon Park

West Vero Corridor

Sebring

Sugarmill Woods

Cape Canaveral

Palatka

Progress Village

Miami Shores

Fairview Shores

Bee Ridge

Milton

Rotonda

Bithlo

Cypress Gardens

Westgate

Wimauma

Alachua

St. Augustine Shores

Key Largo

West Perrine

Bardmoor

Richmond Heights

St. Pete Beach

Pine Ridge CDP

Beverly Hills

Fruitland Park

Citrus Springs

Springfield

Micco

Hernando

Southeast Arcadia

Miramar Beach

Palm Beach

Orange Park

Marathon

Fern Park

Lake Park

Gulf Gate

Indian Harbour Beach

Brooksville

North Merritt Island

Green Cove Springs

Seffner

Arcadia

Broadview Park

West Miami

North Bay Village

Southwest Ranches

Clewiston

McGregor

Odessa

Citrus Hills

Wedgefield

North Weeki Wachee

Williamsburg

Lake Lorraine

Orlovista

Inverness

Sanibel

Wildwood

Longboat Key

Dade City

Quincy

South Apopka

Lecanto

Neptune Beach

Sky Lake

Fort Pierce North

Inwood

West Samoset

Willow Oak

Mims

Belle Isle and River Park

Indiantown

South Patrick Shores

Inverness Highlands South

Fort Myers Beach

Beacon Square

St. Augustine Beach

Ormond-by-the-Sea

Vero Lake Estates

Live Oak

Treasure Island

Heathrow

Perry

Loughman

Fort Myers Shores

Macclenny

Gulf Breeze

Pembroke Park

Lauderdale-by-the-Sea

DeFuniak Springs

South Bay

Southgate

Marianna

Lely Resort

Indian River Estates

Kathleen

Naples Manor

Islamorada, Village of Islands

Pahokee

Pelican Bay

Osprey

Crystal Lake

Jan Phyl Village

Combee Settlement

Fort Meade

Naples Park

Tequesta

South Gate Ridge

Newberry

Mascotte

Lake Alfred

Ocean City

Cocoa West

High Springs

South Highpoint

Bay Harbor Islands

Ellenton

Palm Springs North

Fellsmere

Valparaiso

Surfside

Rio Pinar

Siesta Key

Okeechobee

Whiskey Creek

Davenport

Starke

Zephyrhills West

Tice

Three Oaks and River Ridge

Warm Mineral Springs

Zephyrhills South

The Meadows

Port LaBelle

LaBelle

Floral City

Pensacola Station

Kenneth City

South Brooksville

White City

South Pasadena

Cortez

Timber Pines

Flagler Beach

Belleview

Hutchinson Island South

Samsula-Spruce Creek

Lochmoor Waterway Estates

St. Augustine South

South Sarasota

June Park

Brookridge

Connerton

Plantation

Ridge Wood Heights

Big Pine Key

Pea Ridge

Bay Hill

Butler Beach

Mount Plymouth

Wauchula

Nassau Village-Ratliff

Fussels Corner

Suncoast Estates

Dundee

Samoset

Lower Grand Lagoon

Rainbow Springs and Stock Island

Clarcona

Charlotte Harbor

Pine Manor

Ridge Manor

Daytona Beach Shores

Gifford

Fort Pierce South

Parker

Whitfield CDP

Mary Esther

Taylor Creek

Madeira Beach

Holmes Beach

Laguna Beach

Indian Rocks Beach and Buckingham

Indian River Shores

Grant-Valkaria

Moon Lake

Orangetree

Belleair

Jasper

Lake Sarasota

Mulberry

Crawfordville

Ave Maria

Sawgrass

Nokomis

Woodville

San Castle

Lake Panasoffkee

Tierra Verde

Wahneta

Balm

High Point

Highland Beach

Goulding

North River Shores

Ridgecrest

Harbour Heights

Umatilla

Alturas

West Bradenton

Watergate

Bagdad

Zephyrhills North

Lake Clarke Shores

Juno Beach

Chipley

Rainbow Lakes Estates

Loxahatchee Groves

Lely

Tiger Point

Montura

St. James City

Holden Heights

Port St. Joe

Cedar Grove

Windermere

Kensington Park

Venice Gardens

Feather Sound

Ocala Estates

Vineyards

Winter Beach

Silver Springs

Flagler Estates

South Beach

Woodlawn Beach

Blountstown

Ponce Inlet

West DeLand

Melbourne Beach

North Brooksville

Frostproof

Hilliard

Bushnell

Geneva

Crystal River

Midway city and Hill ‘n Dale

Chattahoochee

Malabar

Harbor Bluffs

Dover

Biscayne Park

Grenelefe

Point Baker

Oakland

Alva

De Leon Springs

Bal Harbour

Edgewood

Seminole Manor

Tangerine

Bowling Green

Pretty Bayou

Port Richey

Tangelo Park

Indialantic

Zellwood

Bunnell

Meadow Oaks

Island Walk

Hypoluxo

Quail Ridge

Madison

Lake Helen

Olga

Greenbriar

Eagle Lake

Bay Pines

Sharpes

Inverness Highlands North

Williston

Harlem

Bonifay

Cleveland

Carrabelle

Vamo

Cabana Colony

Big Coppitt Key

Wallace

Verona Walk

Cross City

Apalachicola

Dade City North

Eastpoint

Florida Gulf Coast University

Hernando Beach

Pine Air

Hurlburt Field

Berkshire Lakes

Vilano Beach

Eglin AFB

Freeport

Haverhill

Lake Mack-Forest Hills

Williston Highlands

Polk City

Eatonville

Watertown

Dunnellon

Virginia Gardens

Chiefland

Belleair Bluffs

Lake Placid

Moore Haven

North Sarasota

Astatula

Campbell

Monticello

Pelican Marsh

Pine Island Center

Mangonia Park

Silver Lake

Holley

Havana

Graceville

Cudjoe Key

Zolfo Springs

Sewall’s Point

Burnt Store Marina

Sneads

Redington Shores

Bear Creek

Manatee Road

Malone

Lake Belvedere Estates

Tyndall AFB

Roosevelt Gardens

El Portal

Tropical Park

Trenton

Oak Hill

Washington Park

Gotha

Fort Denaud

Grove City

Century

Tavernier

Hillsboro Beach

Chuluota

Lake Mary Jane and Montverde

Desoto Lakes

Atlantis

Charlotte Park

Wabasso Beach

South Palm Beach

Lake Kerr

Interlachen

Howey-in-the-Hills

Homosassa

Heritage Pines

Pine Ridge

Inglis

Wewahitchka

Crescent City and Limestone Creek

Lacoochee

Oriole Beach

Key Vista

Plantation Mobile Home Park

Boulevard Gardens

Patrick AFB and Ocean Ridge

East Palatka

Palm Shores

Royal Palm Estates

Christmas

Manasota Key

Crooked Lake Park

Navarre Beach

Taft

Punta Rassa

Baldwin

Roseland

Franklin Park

Yalaha

Bokeelia

Mayo

Lake Hamilton

Rainbow Park

Cypress Quarters

Ocklawaha

Hawthorne

Lake Butler

Pierson

Keystone Heights

Old Miakka

East Bronson

Belleair Beach

Buckhead Ridge

Babson Park

Glencoe

Midway

Callahan

DeLand Southwest

Mexico Beach

Molino

Harlem Heights

Greenville

Solana

Hastings

Paisley

Verandah

St. Leo

Five Points

Heritage Bay

North Redington Beach

Astor

Redington Beach

Indian Shores

Juno Ridge

Fanning Springs

Pomona Park

San Antonio

Gretna

Kenwood Estates

Desoto Acres and Weeki Wachee Gardens

Palm Beach Shores

Chokoloskee

Webster

Pine Lakes

North DeLand

Black Diamond

Archer

Bronson

Gun Club Estates

Anna Maria

Crescent Beach

Black Hammock

Harold

Bristol

Lawtey

Medley

Silver Springs Shores East

Masaryktown

Center Hill

Garden Grove

St. George Island

White Springs

Chumuckla

Welaka

Andrews

Waldo

Coleman

Seville

Bradenton Beach

Raleigh

Gulf Stream

North Key Largo

Westlake

Crystal Springs

Scottsmoor

Branford

Jupiter Island

Fort Braden

Matlacha

Cedar Key

Shalimar

Melbourne Village

Cottondale

Grand Ridge

Wiscon

Allentown

Jennings

St. Lucie Village

Duck Key

Palmona Park

Panacea

Briny Breezes

Lake Kathryn

Waverly

Homestead Base

Marco Shores-Hammock Bay

Rio

Bradley Junction and Fort White

Greensboro

Wabasso

Ponce de Leon

Indian Lake Estates

Cinco Bayou

Glen St. Mary

Roeville

Paxton

Ona

Penney Farms

Acacia Villas

Vernon

Hosford

Hillsboro Pines

Whitfield

Page Park

Stacey Street

Greenwood

Lake Mystic

Pinecraft

Avalon

Schall Circle

Golden Beach

Laurel Hill

Yankeetown

Bell and Lee

Alford

Beverly Beach

Steinhatchee

Paradise Heights

Fort Green Springs

Key Colony Beach

Hampton

Jay

Sea Ranch Lakes

Ferndale

Reddick

Spring Lake

Garcon Point

Micanopy

Lemon Grove

Sopchoppy

Altha

Orchid

Lisbon

Canal Point

Jupiter Inlet Colony

East Williston

Chaires

Winding Cypress

Cloud Lake

Wausau

Lake Hart

Windsor and Pioneer

Brownsdale

Gardner

Fisher Island

Wacissa

La Crosse

St. Marks

McIntosh and Matlacha Isles-Matlacha Shores

Westville

Manalapan

Limestone

Brooker

Floridatown

Hillcrest Heights

Miccosukee

Esto

Capitola

Spring Ridge

Worthington Springs and Munson

Trilby

Noma

Ocean Breeze

Golf

Waukeenah

Pineland

Jacob City

Caryville

Pittman

Yeehaw Junction

Homeland

Everglades

Ebro

Raiford

Goodland

Campbellton

Glen Ridge and Highland Park

Nobleton

Fort Green

Berrydale

Fidelis

Captiva

Aucilla

Charleston Park

Morriston

Day

Aripeka

Okahumpka

Sorrento

Mount Carmel

Otter Creek

West Canaveral Groves

Pine Level

Lloyd

Mulat

Sumatra

Layton

Bascom

Belleair Shore

Springhill

Horseshoe Beach

Altoona

Dickerson City

Istachatta

Lake Harbor

Pine Island

Cobbtown

Tildenville and Bay Lake

Indian Creek and Dixonville

Lamont

Lazy Lake

Plantation Island

Marineland

Lake Buena Vista

Weeki Wachee

A

Acacia Village

Alafaya

Allentown

Altoona

Alturas

Alva

Andrews

Apollo Beach

Aripeka

Asbury Lake

Astor

Aucilla

Avalon

Azalea Park

B

Babson Park

Bagdad

Balm

Bardmoor

Bay Hill

Bayonet Point

Bay Pines

Bayport

Bayshore Gardens

Beacon Square

Bear Creek

Bee Ridge

Bellair-Meadowbrook Terrace

Bellview

Berrydale

Beverly Hills

Big Coppitt Key

Big Pine Key

Bithlo

Black Diamond

Black Hammock

Bloomingdale

Bokeelia

Boulevard Gardens

Bradley Junction

Brandon

Brent

Brewster

Broadview Park

Brookridge

Brownsdale

Brownsville

Buckhead Ridge

Buckingham

Buenaventura Lakes

Burnt Store Marina

Butler Beach

C

Cabana Colony

Campbell

Canal Point

Captiva

Carrollwood

Cedar Grove

Celebration

Charleston Park

Charlotte Harbor

Charlotte Park

Cheval

Chokoloskee

Christmas

Chuluota

Chumuckla

Citrus Hills

Citrus Park

Citrus Springs

Clarcona

Cleveland

Cobbtown

Cocoa West

Combee Settlement

Connerton

Conway

Coral Terrace

Cortez

Country Club

Country Walk

Crawfordville

Crescent Beach

Crooked Lake Park

Crystal Lake

Crystal Springs

Cudjoe Key

Cypress Gardens

Cypress Lake

Cypress Quarters

D

Dade City North

Day

DeLand Southwest

De Leon Springs

Desoto Lakes

Dickerson City

Dixonville

Doctor Phillips

Dover

Duck Key

E

East Bronson

East Lake

East Lake-Orient Park

East Milton

East Palatka

East Williston

Eastpoint

Eglin AFB

Egypt Lake-Leto

Elfers

Ellenton

Englewood

Ensley

F

Fairview Shores

Feather Sound

Ferndale

Fern Park

Ferry Pass

Fidelis

Fisher Island

Fish Hawk

Five Points

Flagler Estates

Fleming Island

Floral City

Florida Ridge

Floridatown

Forest City

Fort Denaud

Fort Green

Fort Green Springs

Fort Myers Shores

Fort Pierce North

Fort Pierce South

Fontainebleau

Four Corners

Franklin Park

Fruit Cove

Fruitville

Fuller Heights

Fussels Corner

G

Garcon Point

Garden Grove

Gardner

Gateway

Geneva

Gibsonton

Gifford

Gladeview

Glencoe

Glenvar Heights

Golden Gate

Golden Glades

Goldenrod

Gonzalez

Goodland

Gotha

Goulding

Goulds

Greenbriar

Grenelefe

Grove City

Gulf Gate Estates

Gun Club Estates

H

Harbor Bluffs

Harbour Heights

Harlem

Harlem Heights

Harold

Heathrow

Heritage Pines

Hernando

Hernando Beach

Highland City

High Point

Hill ‘n Dale

Hillsboro Pines

Hobe Sound

Holden Heights

Holiday

Holley

Homeland

Homestead Base

Homosassa

Homosassa Springs

Horizon West

Hosford

Hudson

Hunters Creek

Hutchinson Island South

I

Immokalee

Indian River Estates

Indiantown

Inverness Highlands North

Inverness Highlands South

Inwood

Iona

Island Walk

Istachatta

Ives Estates

J

Jan Phyl Village

Jasmine Estates

Jensen Beach

June Park

Juno Ridge

Jupiter Farms

K

Kathleen

Kendale Lakes

Kendall

Kendall West

Kensington Park

Kenwood Estates

Key Largo

Keystone

Key Vista

L

Lacoochee

Laguna Beach

Lake Belvedere Estates

Lake Butler

Lake Harbor

Lake Hart

Lake Kathryn

Lakeland Highlands

Lake Lindsey

Lake Lorraine

Lake Mack-Forest Hills

Lake Magdalene

Lake Mary Jane

Lake Mystic

Lake Panasoffkee

Lake Sarasota

Lakeside

Lakewood Park

Lamont

Land o’ Lakes

Laurel

Lealman

Lecanto

Lehigh Acres

Leisure City

Lely

Lely Resort

Lemon Grove

Limestone

Limestone Creek

Lisbon

Lloyd

Lochmoor Waterway Estates

Lockhart

Loughman

Lower Grand Lagoon

Lutz

M

Manasota Key

Manatee Road

Mango

Masaryktown

Matlacha

Matlacha Isles-Matlacha Shores

McGregor

Meadow Oaks

Meadow Woods

Medulla

Memphis

Merritt Island

Micco

Middleburg

Midway, Santa Rosa County

Midway, Seminole County

Mims

Miramar Beach

Molino

Montura

Moon Lake

Morriston

Mount Carmel

Mount Plymouth

Mulat

Munson

Myrtle Grove

N

Naples Manor

Naples Park

Naranja

Nassau Village-Ratliff

Navarre

Navarre Beach

New Port Richey East

Nobleton

Nocatee

Nokomis

North Brooksville

North DeLand

North Fort Myers

North Key Largo

North River Shores

North Sarasota

North Weeki Wachee

Northdale

O

Oakleaf Plantation

Oak Ridge

Ocean City

Odessa

Ojus

Okahumpka

Olga

Olympia Heights

Ona

Orangetree

Oriole Beach

Orlovista

Ormond-by-the-Sea

Osprey

P

Pace

Page Park

Paisley

Palm City

Palm Harbor

Palm River-Clair Mel

Palm Springs North

Palm Valley

Palmetto Estates

Palmona Park

Panacea

Paradise Heights

Pasadena Hills

Patrick SFB

Pea Ridge

Pebble Creek

Pelican Bay

Pine Air

Pine Castle

Pine Hills

Pine Island

Pine Island Center

Pine Lakes

Pine Level

Pine Manor

Pine Ridge, Citrus County

Pine Ridge, Collier County

Pineland

Pinewood

Pioneer

Pittman

Plantation

Plantation Island

Plantation Mobile Home Park

Poinciana

Point Baker

Port Charlotte

Port LaBelle

Port St. John

Port Salerno

Pretty Bayou

Princeton

Progress Village

Punta Rassa

Q

Quail Ridge

R

Raleigh

Richmond Heights

Richmond West

Ridge Manor

Ridge Wood Heights

Ridgecrest

Rio

Rio Pinar

River Park

River Ridge

Riverview

Roeville

Roosevelt Gardens

Roseland

Rotonda

Royal Palm Estates

Ruskin

S

Samoset

Samsula-Spruce Creek

San Carlos Park

San Castle

Sarasota Springs

Sawgrass

Schall Circle

Seffner

Seminole Manor

Seville

Shady Hills

Sharpes

Siesta Key

Silver Lake

Silver Springs Shores

Sky Lake

Solana

Sorrento

South Apopka

South Beach

South Bradenton

South Brooksville

South Gate Ridge

South Highpoint

South Miami Heights

South Patrick Shores

South Sarasota

South Venice

Southchase

Southeast Arcadia

Southgate

Spring Hill

Spring Lake

Spring Ridge

Springhill

St. Augustine Shores

St. Augustine South

St. James City

Stacey Street

Steinhatchee

Stock Island

Sugarmill Woods

Sumatra

Sun City Center

Suncoast Estates

Sunset

T

Taft

Tamiami

Tangelo Park

Tangerine

Tavernier

Taylor Creek

The Acreage

The Crossings

The Hammocks

The Meadows

The Villages

Thonotosassa

Three Lakes

Three Oaks

Tice

Tierra Verde

Tiger Point

Tildenville

Timber Pines

Town ‘n’ Country

Trilby

Trinity

Tyndall AFB

U

Union Park

University, Hillsborough County

University, Orange County

University Park

Upper Grand Lagoon

V

Valrico

Vamo

Venice Gardens

Vero Beach South

Verona Walk

Viera East

Viera West

Villano Beach

Villas

Vineyards

W

Wabasso

Wabasso Beach

Wacissa

Wahneta

Wallace

Warm Mineral Springs

Warrington

Washington Park

Watergate

Watertown

Waukeenah

Waverly

Wedgefield

Weeki Wachee Gardens

Wekiwa Springs

Wesley Chapel

West Bradenton

West DeLand

West Lealman

West Little River

West Pensacola

West Perrine

West Samoset

West Vero Corridor

Westchase

Westchester

Westgate

Westview

Westwood Lakes

Whiskey Creek

White City

Whitfield, Manatee County

Whitfield, Santa Rosa County

Williamsburg

Williston Highlands

Willow Oak

Wimauma

Windsor

Winter Beach

Wiscon

Woodlawn Beach

Woodville

World Golf Village

Wright

Y

Yalaha

Yeehaw Junction

Yulee

Z

Zellwood

Zephyrhills North

Zephyrhills South

Zephyrhills West