GEORGIA BANK STATEMENT ONLY+GA MORTGAGE FOR SELF EMPLOYED

- 10% Down Payment!

- Min 600 FICO Score!

- 12 Months Proof of Housing History Needed!

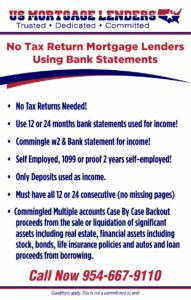

- No Tax Returns, No W2, No 1099s Required!

- Up to 50 percent debt-to-income ratio

- 5/1, 7/1 and 30 Year Fixed Options!

- Loan amounts of up to $2 million!

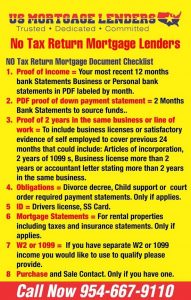

Georgia No Tax Return Bank Statement Mortgage Document Checklist

Self Employed Bank Statement Only Georgia Bank statement program: Ideal for the Georgia self-employed mortgage applicants. The truth is Georgia self-employed borrowers are having a hard time get approved for a Georgia Mortgage loans because they write off all their income.

BETTER TERMS FOR SELF EMPLOYED GEORGIA MORTGAGE APPLICANTS

Whether for a primary residence, a second home or an investment property, self-employed borrowers will be the most likely to benefit from the bank statement program. As its name would suggest, the concept is predicated on providing evidence of solvency, specifically in the form of bank statements from the past 12 months. These can serve as the means for a down payment, in addition to taking the place of a traditional employment history or the years of W -2 forms typically required of buyers during the application process.

Georgia Mortgage Lenders recently unveiled its innovative bank statement only mortgage program designed especially for self-employed Georgia mortgage applicants. . Both are designed specifically for the self-employed and others whose tax returns and employment history may not adequately express their ability to make the new mortgage payment. Georgia self-employed borrowers they can represent risk, these borrowers rarely meet ability to repay by the banks lending standards, leaving them to search elsewhere to fulfill their home buying dreams. The Georgia bank statement program is designed to create an alternative Georgia bank lending shortfall by determining an applicant’s ability to repay based on12 or 24-month bank statement only income qualifying.

POPULAR GEORGIA SELF EMPLOYED BORROWER LINKS

Georgia Bank Statement Only Mortgage Lenders

www.fhamortgageprograms.com/georgia-bank-statement-only-mortgage-lenders/

bank statement only – Georgia stated mortgage lenders! ga self

www.fhamortgageprograms.com/bank-statment-only-georgia-mortgage-lenders/

12/24 MONTHS ONLY GEORGIA BANK STATEMENT MORTGAGE …

https://plus.google.com/118328269799333608826/posts/Y9v8Z1rUNLB

Bank Statement Only Florida Mortgage Lenders Min 600+FICO!

www.fhamortgageprograms.com/bank-statement-only-florida-mortgage-lenders/

STATED GA MORTGAGE LENDERS+STATED GA HOME LOANS

www.fhamortgageprograms.com/stated-ga-mortgage-lenders-primary-homes/

Financing: Does anyone do Stated Income Loans in GA? I’m 20 years …

https://www.trulia.com/…/Does_anyone_do_Stated_Income_Loans_in_GA_I_m_-33…

Stated Income Georgia Mortgage Lenders+ Easy Approvals!

www.fhamortgageprograms.com/stated-income-georgia-mortgage-lenderseasy-appro…

STATED GA MORTGAGE LENDERS+STATED GA HOME LOANS

www.fhamortgageprograms.com/stated-ga-mortgage-lenders-primary-homes/

ATLANTA GEORGIA FHA MORTGAGE LENDERS+STATED INCOME!

https://plus.google.com/118328269799333608826/posts/CWPvtceXwpJ