BANK STATEMENT ONLY GEORGIA MORTGAGE LENDERS

GEORGIA SELF EMPLOYED MORTGAGE LENDERS

GEORGIA SELF EMPLOYED MORTGAGE LENDERS Georgia No Tax Return Land Lenders

Georgia No Tax Return Land Lenders

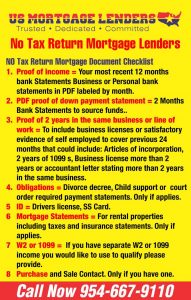

NO TAX RETURN GEORGIA MORTGAGE LENDERS DOCUMENT CHECKLIST

NO TAX RETURN GEORGIA MORTGAGE LENDERS DOCUMENT CHECKLIST

Many Georgia Self-employed business owners agree that their tax returns do not accurately show their ability to make a mortgage payment. The Georgia self-employed borrower tends to write off and or deduct many expenses that a salaried / W2 employee is not able to.The result of the extensive write-offs, the income on their tax returns may not qualify for a traditional Georgia bank mortgage to purchase and or get the loan amount they need to purchase the Georgia home of their dream. Georgia Bank statement mortgage lenders provide an alternative income solution offered by certain Georgia bank statement only mortgage lenders to help self-employed borrowers qualify for a Georgia mortgage with NO TAX RETURNS!

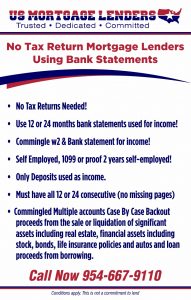

GEORGIA BANK STATEMENT ONLY MORTGAGE LENDERS DETAILS INCLUDE:

- 2 Years Self Employed Required!

- Bank statement deposits used to qualify!

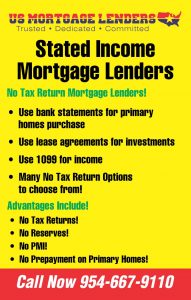

- No tax returns required

- 12 months personal bank statements or 24 months Business Statements used for income

- Loans up to $3 million

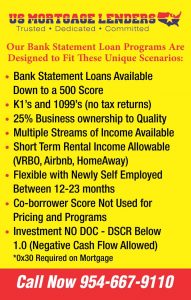

- Credit scores down to 600

- Rates starting in the 5-6% range.

- Up to 85% LTV

- DTI up to 50% Debt To Income Ratio

- Owner-occupied, 2nd homes, and investment properties

- 2 years seasoning for foreclosure, short sale, BK, DIL

- Non-warrantable condos considered

- Jumbo loans down to 600 score

- 5/1 ARM or 30-year fixed

- No pre-payment penalty for owner-occ and 2nd homes

- SFRs, town homes, condos, 2-4 units

- Seller concessions to 6% (2% for investment)

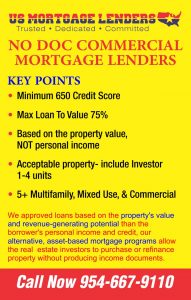

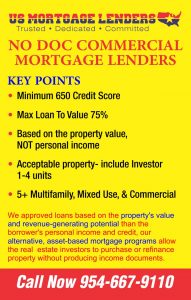

75% GEORGIA NO DOC COMMERCIAL MORTGAGE LENDERS

-

- BANK STATEMENT ONLY-GEORGIA STATED SELF EMPLOYED MORTGAGE LENDERS!

- 12-24 MONTH GEORGIA SELF EMPLOYED MORTGAGE LENDERS

- GEORGIA BANK STATEMENT ONLY SELF EMPLOYED MORTGAGE LENDERS

- GEORGIA SELF EMPLOYED MORTGAGE LENDERS

- 24 Months + GEORGIA BANK STATEMENT ONLY MORTGAGE …

- GEORGIA BANK STATEMENT FL MORTGAGE LENDERS

- Self-Employed Mortgage Approvals Using Bank Statements Only

- Georgia Mortgage Lenders: For Self Employed

-

- GEORGIA BANK STATEMENT ONLY MORTGAGE– NO TAX RETURNS REQUIRED.

- Georgia self-employed mortgage lenders bank statement only loan

- 12 Months of Personal Bank Statement Loan Program – Georgia mortgage applicants the Bank Statement Lender their most recent 12 months of personal bank statements showing deposits from work. Update:

- 24 Months Business Bank Statement Lenders Program – Georgia mortgage applicants will need to provide 24 months of bank statements business bank statements year to date and provide a borrower signed profit and loss. The bank statement lender will use this income for qualifying. Georgia self-employed bank Statement Only Lenders Approvals varies Case By Case from lender to lender.

- QUALIFYING WITH- NO TAX RETURNS NEEDED!

- Qualifying for the Georgia Self employed Bank Statement Only Mortgage Loan

- Available only to the Georgia self-employed business owners, or for two or more borrowers where one or more of the Georgia borrowers is self-employed for at least the last (2) two years. This is a great solution for commissioned and 1099 Georgia mortgage applicants who don’t want to provide tax returns or sign IRS form 4506-T. You simply need to show proof of income by providing 12 to 24 consecutive months of bank statements. Georgia self-employed Bank Statement Only Lenders Approvals varies Case By Case from lender to lender.

- BANK STATEMENT DEPOSITS USED TO CALCULATE INCOME:

- MAXIMUM INCOME USED FOR PERSONAL BANK STATEMENTS – A Georgia self-employed borrower’s income is calculated by averaging 100% of personal bank statement related deposits from their most recent 12 months of personal bank statements. If your statements show low deposits for two or three months, then a large deposit the following month, the underwriter may request an additional 12 months to confirm your monthly income normally fluctuates. Georgia Bank Statement Only Lenders Approvals varies Case By Case from lender to lender.

- MAXIMUM INCOME USED FOR BUSINESS BANK STATEMENTS – For Georgia business bank statements only lenders will allow as much as 90% of the job-related deposits can be used for income qualifying, not 100%. Georgia self-employed Bank Statement Only Lenders Approvals varies Case By Case from lender to lender.

- The maximum “Debt to Income”(DTI) ratio is 55% case by case determined by market conditions. Georgia Self-employed borrowers with a lower debt to income ratio may receive better a better rate & pricing. Georgia self-employed Bank Statement Only Lenders Approvals varies Case By Case from Georgia lender to lender.

- MINIMUM BANK STATEMENT ONLY CREDIT SCORE NEEDED

- 600 or higher middle FICO scores. As much as 80% financing depending on appraised value

- Georgia Bank statement only lenders require a credit Score of 640-679 are acceptable at lower LTV up to 85% and slightly higher interest rates occur with low down payment options.

- Georgia Refinance with cash back: 680+ credit = 75% financing;

- REQUIRED GEORGIA SELF EMPLOYMENT DOCUMENTATION

- All Georgia self-employed mortgage lenders are required to prove stability in the line of employment by providing a copy of their Georgia business license or “Articles of Incorporation” showing they have been Georgia self-employed in the most recent (2) two years OR have a licensed CPA or enrolled IRS agent draft a letter confirming the same. Georgia self-employed Mortgage Lenders using Bank Statement Only varies Case By Case from lender to lender.

- BANK STATEMENT ONLY REQUIRES MONTHLY RESERVES = MONIES IN ACCOUNT AFTER CLOSING REQUIRED BY GEORGIA SELF EMPLOYED MORTGAGE LENDERS-

- Case By Case 1 -12 months of P.I.T.I future payments required in the account at closing.

- If the loan amount is over $1 million, then 12 months. IF over $2M, then 18 months. Bank Statement Only Approvals varies Case By Case from lender to lender.

- ACCEPTABLE BANK STATEMENT ONLY GEORGIA LENDERS LENDER ON PROPERTIES THAT INCLUDE: Condos, Georgia Townhomes, Georgia single family homes, condotel, Georgia duplex, triplex or four-plex all qualify on various Georgia programs. Property can be as a Georgia primary residence, Georgia second home, or Georgia rental property. Georgia self-employed Bank Statement Only Lenders Approvals varies Case By Case from Georgia lender to lender.

- BANK STATEMENT ONLY LENDERS TERMS INCLUDE – This Georgia self-employed loan type is offered on a 30 year fixed-rate or adjustable-rate mortgages with 5, 7, or 30 years fixed terms then it becomes adjustable. Georgia Bank Statement Only Lenders Approvals varies Case By Case from lender to lender.

-

GEORGIA BANK STATEMENT ONLY MORTGAGE INFO PAGES INCLUDE–

Georgia Self Employed Mortgage Lenders – WE SAY YES!

https://www.Self Employedmortgageprograms.com/georgia-self-employed-mortgage-lenders/ Bank Statement Only Georgia Mortgage Lenders. Have a self–employed client who has had difficulty obtaining a mortgage? Georiga Mortgage Lenders Bank Statement Program allows self–employedborrowers the ability to qualify based on a 12 or 24 month average of deposits using their personal or Georiga business bank account …

-

Georgia Self Employed Mortgage Lenders Bank Statements!

https://www.Self Employedmortgageprograms.com/georgia-self-employed-mortgage-lenders-usi…

STATED INCOME GEORGIA MORTGAGE LENDERS. Self–employed borrowers are required a minimum FICO score of 600 is considered other terms associated with bank statement only Georgia Mortgage forself–employed . They include: 15

% Down Payment! -

Georgia Self Employed Mortgage Lenders Archives – Self Employed …

https://www.Self Employedmortgageprograms.com › Self Employed › FloridaGeorgia Self Employed Mortgage Lenders Are you Self Employed? Having a difficult time difficulty obtaining a mortgage? Our Georgia Mortgage Lenders Bank Statement Program allows Georgia self–employed borrowers the ability to qualify based on 24 month average of deposits using their personal or business bank …

-

Stated Income Georgia Mortgage Lenders+Easy Approvals!

https://www.Self Employedmortgageprograms.com/stated-income-georgia-mortgage-lenderseasy-..

Georgia Mortgage Lenders.com we structure customized no-tax return stated income Georgia mortgage loan programs for both self–employed Georgia mortgage applicants who have trouble documentation their income. We have helped many self–employed Georgia real estate professionals, recently divorced and retired …You’ve visited this page 3 times. Last visit: 1/10/18

-

Georgia No Income Verification Mortgage Lenders-Get Approved Now!

https://www.Self Employedmortgageprograms.com/georgia-no-income-verification-mortgage-len…Non-self–employed lump sum retirement. The Fannie Facts: Down Payment Required: 30%; Minimum Credit Score: 620; Loan Purpose: Purchase or No Cash-Out Refinance; Type of Home: Primary Residence or Second Home; Acceptable Property Type: 1-4 Units. General Freddie Mac Asset Guides. Whomever is listed on …

-

6 GEORGIA STATED INCOME MORTGAGE LENDERS PROGRAMS …

https://www.Self Employedmortgageprograms.com/6-georgia-stated-income-mortgage-lenders-pr…Georgia Mortgage Lenders.com we structure customized no-tax return stated income Georgiamortgageloan programs for both self–employed Georgia mortgage … Georgia Self Employed Mortgage Lenders – PENDINGGA LICENSING APPROVAL Self Employed loans have been helping Georgia residents since 1934 A Georgia Self Employed …

-

SELF EMPLOYED MORTGAGE LENDERS! MIN 600 FICO

https://www.Self Employedmortgageprograms.com/self-employed-mortgage-lenders-min-600-fico/STATED INCOME PRIMARY HOMES AND INVESTOR LOANS Call NOW 954-

667-9110. … So, if you’re one of those millions of self employed borrowers out there who’s income varies throughout the year, this is the loan for you. … www. Self Employedmortgageprograms.com/bank-statment-only-georgia–mortgage–lenders/.Georgia … -

NO INCOME VERIFICATION GEORGIA MORTGAGE LENDERS

https://www.Self Employedmortgageprograms.com/no-income-verification-georgia-mortgage-len…US Mortgage Lenders is rising as the best choice for no income tax verification Georgia self employed mortgage applicants looking for No Income tax check mortgages. Our private Georgia mortgage lenders now offer stated Income mortgage loans with specific requirements in order to get that type of no income mortgage.

-

Bank Statement Only Georgia Mortgage Lenders Self Employed!

https://www.Self Employedmortgageprograms.com/bank-statement-georgia-mortgage-lenders/The bank statement only mortgage loan program is for home buyers and home owners that have recently turned down by a local bank for lack of income reported. Self Employed Georgia mortgageapplicants can document their income by providing 12 months personal or 24 months business bank statements in lieu of …

Georgia 3 | Internal Revenue Service – IRS.gov

https://www.irs.gov/businesses/small-businesses-self-employed/georgia-3

Oct 12, 2017 – Georgia State Links. … Small Business Administration – Georgia · State Agencies and Organizations · Department of Administrative Services · Georgia Code · Cities and Counties · First Stop Business Information Center. SBA.gov’s Business Licenses … Rate the Small Business and Self–Employed Website …

-

GEORGIA

ZEBULON GEORGIA Self Employed MORTGAGE LENDERSYOUNG HARRIS GEORGIA Self Employed MORTGAGE LENDERSYATESVILLE GEORGIA Self Employed MORTGAGE LENDERSWRIGHTSVILLE GEORGIA Self Employed MORTGAGE LENDERSWRENS GEORGIA Self Employed MORTGAGE LENDERSWOOLSEY GEORGIA Self Employed MORTGAGE LENDERSWOODVILLE GEORGIA Self Employed MORTGAGE LENDERSWOODSTOCK GEORGIA Self Employed MORTGAGE LENDERSWOODLAND GEORGIA Self Employed MORTGAGE LENDERSWOODBURY GEORGIA Self Employed MORTGAGE LENDERSWOODBINE GEORGIA Self Employed MORTGAGE LENDERSWINTERVILLE GEORGIA Self Employed MORTGAGE LENDERSWINDER GEORGIA Self Employed MORTGAGE LENDERSWILLIAMSON GEORGIA Self Employed MORTGAGE LENDERSWILLACOOCHEE GEORGIA Self Employed MORTGAGE LENDERSWHITESBURG GEORGIA Self Employed MORTGAGE LENDERSWHITE PLAINS GEORGIA Self Employed MORTGAGE LENDERSWHITE GEORGIA Self Employed MORTGAGE LENDERSWHIGHAM GEORGIA Self Employed MORTGAGE LENDERSWEST POINT GEORGIA Self Employed MORTGAGE LENDERSWAYNESBORO GEORGIA Self Employed MORTGAGE LENDERSWAYCROSS GEORGIA Self Employed MORTGAGE LENDERSWAVERLY HALL GEORGIA Self Employed MORTGAGE LENDERSWATKINSVILLE GEORGIA Self Employed MORTGAGE LENDERSWASHINGTON GEORGIA Self Employed MORTGAGE LENDERSWARWICK GEORGIA Self Employed MORTGAGE LENDERSWARRENTON GEORGIA Self Employed MORTGAGE LENDERSWARNER ROBINS GEORGIA Self Employed MORTGAGE LENDERSWARM SPRINGS GEORGIA Self Employed MORTGAGE LENDERSWALTHOURVILLE GEORGIA Self Employed MORTGAGE LENDERSWALNUT GROVE GEORGIA Self Employed MORTGAGE LENDERSWALESKA GEORGIA Self Employed MORTGAGE LENDERSWADLEY GEORGIA Self Employed MORTGAGE LENDERSWACO GEORGIA Self Employed MORTGAGE LENDERSVILLA RICA GEORGIA Self Employed MORTGAGE LENDERSVIENNA GEORGIA Self Employed MORTGAGE LENDERSVIDALIA GEORGIA Self Employed MORTGAGE LENDERSVERNONBURG GEORGIA Self Employed MORTGAGE LENDERSVARNELL GEORGIA Self Employed MORTGAGE LENDERSVALDOSTA GEORGIA Self Employed MORTGAGE LENDERSUVALDA GEORGIA Self Employed MORTGAGE LENDERSUNION POINT GEORGIA Self Employed MORTGAGE LENDERSUNION CITY GEORGIA Self Employed MORTGAGE LENDERSUNADILLA GEORGIA Self Employed MORTGAGE LENDERSTYRONE GEORGIA Self Employed MORTGAGE LENDERSTYBEE ISLAND GEORGIA Self Employed MORTGAGE LENDERSTY TY GEORGIA Self Employed MORTGAGE LENDERSTWIN CITY GEORGIA Self Employed MORTGAGE LENDERSTURIN GEORGIA Self Employed MORTGAGE LENDERSTUNNEL HILL GEORGIA Self Employed MORTGAGE LENDERSTRION GEORGIA Self Employed MORTGAGE LENDERSTRENTON GEORGIA Self Employed MORTGAGE LENDERSTOOMSBORO GEORGIA Self Employed MORTGAGE LENDERSTOCCOA GEORGIA Self Employed MORTGAGE LENDERSTIGNALL GEORGIA Self Employed MORTGAGE LENDERSTIFTON GEORGIA Self Employed MORTGAGE LENDERSTHUNDERBOLT GEORGIA Self Employed MORTGAGE LENDERSTHOMSON GEORGIA Self Employed MORTGAGE LENDERSTHOMASVILLE GEORGIA Self Employed MORTGAGE LENDERSTHOMASTON GEORGIA Self Employed MORTGAGE LENDERSTENNILLE GEORGIA Self Employed MORTGAGE LENDERSTEMPLE GEORGIA Self Employed MORTGAGE LENDERSTAYLORSVILLE GEORGIA Self Employed MORTGAGE LENDERSTARRYTOWN GEORGIA Self Employed MORTGAGE LENDERSTALMO GEORGIA Self Employed MORTGAGE LENDERSTALLULAH FALLS GEORGIA Self Employed MORTGAGE LENDERSTALLAPOOSA GEORGIA Self Employed MORTGAGE LENDERSTALKING ROCK GEORGIA Self Employed MORTGAGE LENDERSTALBOTTON GEORGIA Self Employed MORTGAGE LENDERSSYLVESTER GEORGIA Self Employed MORTGAGE LENDERSSYLVANIA GEORGIA Self Employed MORTGAGE LENDERSSYCAMORE GEORGIA Self Employed MORTGAGE LENDERSSWAINSBORO GEORGIA Self Employed MORTGAGE LENDERSSUWANEE GEORGIA Self Employed MORTGAGE LENDERSSURRENCY GEORGIA Self Employed MORTGAGE LENDERSSUMNER GEORGIA Self Employed MORTGAGE LENDERSSUMMERVILLE GEORGIA Self Employed MORTGAGE LENDERSSUGAR HILL GEORGIA Self Employed MORTGAGE LENDERSSTONE MOUNTAIN GEORGIA Self Employed MORTGAGE LENDERSSTOCKBRIDGE GEORGIA Self Employed MORTGAGE LENDERSSTILLMORE GEORGIA Self Employed MORTGAGE LENDERSSTATHAM GEORGIA Self Employed MORTGAGE LENDERSSTATESBORO GEORGIA Self Employed MORTGAGE LENDERSSTATENVILLE GEORGIA Self Employed MORTGAGE LENDERSSTAPLETON GEORGIA Self Employed MORTGAGE LENDERSST. MARYS GEORGIA Self Employed MORTGAGE LENDERSSPRINGFIELD GEORGIA Self Employed MORTGAGE LENDERSSPARTA GEORGIA Self Employed MORTGAGE LENDERSSPARKS GEORGIA Self Employed MORTGAGE LENDERSSOPERTON GEORGIA Self Employed MORTGAGE LENDERSSOCIAL CIRCLE GEORGIA Self Employed MORTGAGE LENDERSSNELLVILLE GEORGIA Self Employed MORTGAGE LENDERSSMYRNA GEORGIA Self Employed MORTGAGE LENDERSSMITHVILLE GEORGIA Self Employed MORTGAGE LENDERSSKY VALLEY GEORGIA Self Employed MORTGAGE LENDERSSILOAM GEORGIA Self Employed MORTGAGE LENDERSSHILOH GEORGIA Self Employed MORTGAGE LENDERSSHELLMAN GEORGIA Self Employed MORTGAGE LENDERSSHARPSBURG GEORGIA Self Employed MORTGAGE LENDERSSHARON GEORGIA Self Employed MORTGAGE LENDERSSHADY DALE GEORGIA Self Employed MORTGAGE LENDERSSENOIA GEORGIA Self Employed MORTGAGE LENDERSSCREVEN GEORGIA Self Employed MORTGAGE LENDERSSCOTLAND GEORGIA Self Employed MORTGAGE LENDERSSAVANNAH GEORGIA Self Employed MORTGAGE LENDERSSASSER GEORGIA Self Employed MORTGAGE LENDERSSARDIS GEORGIA Self Employed MORTGAGE LENDERSSANTA CLAUS GEORGIA Self Employed MORTGAGE LENDERSSANDY SPRINGS GEORGIA Self Employed MORTGAGE LENDERSSANDERSVILLE GEORGIA Self Employed MORTGAGE LENDERSSALE CITY GEORGIA Self Employed MORTGAGE LENDERSRUTLEDGE GEORGIA Self Employed MORTGAGE LENDERSROYSTON GEORGIA Self Employed MORTGAGE LENDERSROSWELL GEORGIA Self Employed MORTGAGE LENDERSROSSVILLE GEORGIA Self Employed MORTGAGE LENDERSROME GEORGIA Self Employed MORTGAGE LENDERSROCKY FORD GEORGIA Self Employed MORTGAGE LENDERSROCKMART GEORGIA Self Employed MORTGAGE LENDERSROCHELLE GEORGIA Self Employed MORTGAGE LENDERSROBERTA GEORGIA Self Employed MORTGAGE LENDERSRIVERSIDE GEORGIA Self Employed MORTGAGE LENDERSRIVERDALE GEORGIA Self Employed MORTGAGE LENDERSRINGGOLD GEORGIA Self Employed MORTGAGE LENDERSRINCON GEORGIA Self Employed MORTGAGE LENDERSRIDDLEVILLE GEORGIA Self Employed MORTGAGE LENDERSRICHMOND HILL GEORGIA Self Employed MORTGAGE LENDERSRICHLAND GEORGIA Self Employed MORTGAGE LENDERSRICEBORO GEORGIA Self Employed MORTGAGE LENDERSRHINE GEORGIA Self Employed MORTGAGE LENDERSREYNOLDS GEORGIA Self Employed MORTGAGE LENDERSRESACA GEORGIA Self Employed MORTGAGE LENDERSRENTZ GEORGIA Self Employed MORTGAGE LENDERSREMERTON GEORGIA Self Employed MORTGAGE LENDERSREIDSVILLE GEORGIA Self Employed MORTGAGE LENDERSREGISTER GEORGIA Self Employed MORTGAGE LENDERSREBECCA GEORGIA Self Employed MORTGAGE LENDERSRAYLE GEORGIA Self Employed MORTGAGE LENDERSRAY CITY GEORGIA Self Employed MORTGAGE LENDERSRANGER GEORGIA Self Employed MORTGAGE LENDERSQUITMAN GEORGIA Self Employed MORTGAGE LENDERSPULASKI GEORGIA Self Employed MORTGAGE LENDERSPRESTON GEORGIA Self Employed MORTGAGE LENDERSPOWDER SPRINGS GEORGIA Self Employed MORTGAGE LENDERSPOULAN GEORGIA Self Employed MORTGAGE LENDERSPORTERDALE GEORGIA Self Employed MORTGAGE LENDERSPORTAL GEORGIA Self Employed MORTGAGE LENDERSPORT WENTWORTH GEORGIA Self Employed MORTGAGE LENDERSPOOLER GEORGIA Self Employed MORTGAGE LENDERSPLAINVILLE GEORGIA Self Employed MORTGAGE LENDERSPLAINS GEORGIA Self Employed MORTGAGE LENDERSPITTS GEORGIA Self Employed MORTGAGE LENDERSPINEVIEW GEORGIA Self Employed MORTGAGE LENDERSPINEHURST GEORGIA Self Employed MORTGAGE LENDERSPINE MOUNTAIN GEORGIA Self Employed MORTGAGE LENDERSPINE LAKE GEORGIA Self Employed MORTGAGE LENDERSPERRY GEORGIA Self Employed MORTGAGE LENDERSPENDERGRASS GEORGIA Self Employed MORTGAGE LENDERSPEMBROKE GEORGIA Self Employed MORTGAGE LENDERSPEACHTREE CORNERS GEORGIA Self Employed MORTGAGE LENDERSPEACHTREE CITY GEORGIA Self Employed MORTGAGE LENDERSPAYNE CITY GEORGIA Self Employed MORTGAGE LENDERSPAVO GEORGIA Self Employed MORTGAGE LENDERSPATTERSON GEORGIA Self Employed MORTGAGE LENDERSPALMETTO GEORGIA Self Employed MORTGAGE LENDERSOXFORD GEORGIA Self Employed MORTGAGE LENDERSORCHARD HILL GEORGIA Self Employed MORTGAGE LENDERSOMEGA GEORGIA Self Employed MORTGAGE LENDERSOLIVER GEORGIA Self Employed MORTGAGE LENDERSOGLETHORPE GEORGIA Self Employed MORTGAGE LENDERSOFFERMAN GEORGIA Self Employed MORTGAGE LENDERSODUM GEORGIA Self Employed MORTGAGE LENDERSOCONEE GEORGIA Self Employed MORTGAGE LENDERSOCILLA GEORGIA Self Employed MORTGAGE LENDERSOCHLOCKNEE GEORGIA Self Employed MORTGAGE LENDERSOAKWOOD GEORGIA Self Employed MORTGAGE LENDERSOAK PARK GEORGIA Self Employed MORTGAGE LENDERSPELHAM GEORGIA Self Employed MORTGAGE LENDERSPEARSON GEORGIA Self Employed MORTGAGE LENDERSPARROTT GEORGIA Self Employed MORTGAGE LENDERSNORWOOD GEORGIA Self Employed MORTGAGE LENDERSNORTH HIGH SHOALS GEORGIA Self Employed MORTGAGE LENDERSNORMAN PARK GEORGIA Self Employed MORTGAGE LENDERSNORCROSS GEORGIA Self Employed MORTGAGE LENDERSNICHOLLS GEORGIA Self Employed MORTGAGE LENDERSNEWTON GEORGIA Self Employed MORTGAGE LENDERSNEWNAN GEORGIA Self Employed MORTGAGE LENDERSNEWINGTON GEORGIA Self Employed MORTGAGE LENDERSNEWBORN GEORGIA Self Employed MORTGAGE LENDERSNELSON GEORGIA Self Employed MORTGAGE LENDERSNASHVILLE GEORGIA Self Employed MORTGAGE LENDERSNAHUNTA GEORGIA Self Employed MORTGAGE LENDERSMOUNTAIN CITY GEORGIA Self Employed MORTGAGE LENDERSMOUNT ZION GEORGIA Self Employed MORTGAGE LENDERSMOUNT VERNON GEORGIA Self Employed MORTGAGE LENDERSMOUNT AIRY GEORGIA Self Employed MORTGAGE LENDERSMOULTRIE GEORGIA Self Employed MORTGAGE LENDERSMORVEN GEORGIA Self Employed MORTGAGE LENDERSMORROW GEORGIA Self Employed MORTGAGE LENDERSMORGANTON GEORGIA Self Employed MORTGAGE LENDERSMORGAN GEORGIA Self Employed MORTGAGE LENDERSMORELAND GEORGIA Self Employed MORTGAGE LENDERSMONTROSE GEORGIA Self Employed MORTGAGE LENDERSMOLENA GEORGIA Self Employed MORTGAGE LENDERSMITCHELL GEORGIA Self Employed MORTGAGE LENDERSMILNER GEORGIA Self Employed MORTGAGE LENDERSMILLEN GEORGIA Self Employed MORTGAGE LENDERSMILLEDGEVILLE GEORGIA Self Employed MORTGAGE LENDERSMILAN GEORGIA Self Employed MORTGAGE LENDERSMILTON GEORGIA Self Employed MORTGAGE LENDERSNICHOLSON GEORGIA Self Employed MORTGAGE LENDERSMOUNTAIN PARK GEORGIA Self Employed MORTGAGE LENDERSMONTICELLO GEORGIA Self Employed MORTGAGE LENDERSMONTEZUMA GEORGIA Self Employed MORTGAGE LENDERSMONROE GEORGIA Self Employed MORTGAGE LENDERSMIDWAY GEORGIA Self Employed MORTGAGE LENDERSMIDVILLE GEORGIA Self Employed MORTGAGE LENDERSMETTER GEORGIA Self Employed MORTGAGE LENDERSMENLO GEORGIA Self Employed MORTGAGE LENDERSMEIGS GEORGIA Self Employed MORTGAGE LENDERSMEANSVILLE GEORGIA Self Employed MORTGAGE LENDERSMCRAE-HELENA GEORGIA Self Employed MORTGAGE LENDERSMCINTYRE GEORGIA Self Employed MORTGAGE LENDERSMCDONOUGH GEORGIA Self Employed MORTGAGE LENDERSMCCAYSVILLE GEORGIA Self Employed MORTGAGE LENDERSMAYSVILLE GEORGIA Self Employed MORTGAGE LENDERSMAXEYS GEORGIA Self Employed MORTGAGE LENDERSMARTIN GEORGIA Self Employed MORTGAGE LENDERSMARSHALLVILLE GEORGIA Self Employed MORTGAGE LENDERSMARIETTA GEORGIA Self Employed MORTGAGE LENDERSMANSFIELD GEORGIA Self Employed MORTGAGE LENDERSMANCHESTER GEORGIA Self Employed MORTGAGE LENDERSMANASSAS GEORGIA Self Employed MORTGAGE LENDERSMADISON GEORGIA Self Employed MORTGAGE LENDERSMACON GEORGIA Self Employed MORTGAGE LENDERSLYONS GEORGIA Self Employed MORTGAGE LENDERSLYERLY GEORGIA Self Employed MORTGAGE LENDERSLUTHERSVILLE GEORGIA Self Employed MORTGAGE LENDERSLUMPKIN GEORGIA Self Employed MORTGAGE LENDERSLUMBER CITY GEORGIA Self Employed MORTGAGE LENDERSLULA GEORGIA Self Employed MORTGAGE LENDERSLUDOWICI GEORGIA Self Employed MORTGAGE LENDERSLOVEJOY GEORGIA Self Employed MORTGAGE LENDERSLOUISVILLE GEORGIA Self Employed MORTGAGE LENDERSLOOKOUT MOUNTAIN GEORGIA Self Employed MORTGAGE LENDERSLONE OAK GEORGIA Self Employed MORTGAGE LENDERSLOGANVILLE GEORGIA Self Employed MORTGAGE LENDERSLOCUST GROVE GEORGIA Self Employed MORTGAGE LENDERSLITHONIA GEORGIA Self Employed MORTGAGE LENDERSLINCOLNTON GEORGIA Self Employed MORTGAGE LENDERSLILLY GEORGIA Self Employed MORTGAGE LENDERSLILBURN GEORGIA Self Employed MORTGAGE LENDERSLEXINGTON GEORGIA Self Employed MORTGAGE LENDERSLESLIE GEORGIA Self Employed MORTGAGE LENDERSLENOX GEORGIA Self Employed MORTGAGE LENDERSLEESBURG GEORGIA Self Employed MORTGAGE LENDERSLEARY GEORGIA Self Employed MORTGAGE LENDERSLAWRENCEVILLE GEORGIA Self Employed MORTGAGE LENDERSLAVONIA GEORGIA Self Employed MORTGAGE LENDERSLAKELAND GEORGIA Self Employed MORTGAGE LENDERSLAKE PARK GEORGIA Self Employed MORTGAGE LENDERSLAKE CITY GEORGIA Self Employed MORTGAGE LENDERSLAGRANGE GEORGIA Self Employed MORTGAGE LENDERSLAFAYETTE GEORGIA Self Employed MORTGAGE LENDERSKITE GEORGIA Self Employed MORTGAGE LENDERSKINGSTON GEORGIA Self Employed MORTGAGE LENDERSKINGSLAND GEORGIA Self Employed MORTGAGE LENDERSKEYSVILLE GEORGIA Self Employed MORTGAGE LENDERSKENNESAW GEORGIA Self Employed MORTGAGE LENDERSJUNCTION CITY GEORGIA Self Employed MORTGAGE LENDERSJONESBORO GEORGIA Self Employed MORTGAGE LENDERSJOHNS CREEK GEORGIA Self Employed MORTGAGE LENDERSJESUP GEORGIA Self Employed MORTGAGE LENDERSJERSEY GEORGIA Self Employed MORTGAGE LENDERSJENKINSBURG GEORGIA Self Employed MORTGAGE LENDERSJEFFERSONVILLE GEORGIA Self Employed MORTGAGE LENDERSJEFFERSON GEORGIA Self Employed MORTGAGE LENDERSJASPER GEORGIA Self Employed MORTGAGE LENDERSJAKIN GEORGIA Self Employed MORTGAGE LENDERSJACKSONVILLE GEORGIA Self Employed MORTGAGE LENDERSJACKSON GEORGIA Self Employed MORTGAGE LENDERSIVEY GEORGIA Self Employed MORTGAGE LENDERSIRWINTON GEORGIA Self Employed MORTGAGE LENDERSIRON CITY GEORGIA Self Employed MORTGAGE LENDERSILA GEORGIA Self Employed MORTGAGE LENDERSIDEAL GEORGIA Self Employed MORTGAGE LENDERSHULL GEORGIA Self Employed MORTGAGE LENDERSHOSCHTON GEORGIA Self Employed MORTGAGE LENDERSHOMERVILLE GEORGIA Self Employed MORTGAGE LENDERSHOMER GEORGIA Self Employed MORTGAGE LENDERSHOMELAND GEORGIA Self Employed MORTGAGE LENDERSHOLLY SPRINGS GEORGIA Self Employed MORTGAGE LENDERSHOGANSVILLE GEORGIA Self Employed MORTGAGE LENDERSHOBOKEN GEORGIA Self Employed MORTGAGE LENDERSHIRAM GEORGIA Self Employed MORTGAGE LENDERSHINESVILLE GEORGIA Self Employed MORTGAGE LENDERSHILTONIA GEORGIA Self Employed MORTGAGE LENDERSHIGGSTON GEORGIA Self Employed MORTGAGE LENDERSHIAWASSEE GEORGIA Self Employed MORTGAGE LENDERSHEPHZIBAH GEORGIA Self Employed MORTGAGE LENDERSHELEN GEORGIA Self Employed MORTGAGE LENDERSHAZLEHURST GEORGIA Self Employed MORTGAGE LENDERSHAWKINSVILLE GEORGIA Self Employed MORTGAGE LENDERSHARTWELL GEORGIA Self Employed MORTGAGE LENDERSHARRISON GEORGIA Self Employed MORTGAGE LENDERSHARLEM GEORGIA Self Employed MORTGAGE LENDERSHARALSON GEORGIA Self Employed MORTGAGE LENDERSHAPEVILLE GEORGIA Self Employed MORTGAGE LENDERSHAMPTON GEORGIA Self Employed MORTGAGE LENDERSHAMILTON GEORGIA Self Employed MORTGAGE LENDERSHAHIRA GEORGIA Self Employed MORTGAGE LENDERSHAGAN GEORGIA Self Employed MORTGAGE LENDERSGUYTON GEORGIA Self Employed MORTGAGE LENDERSGUMBRANCH GEORGIA Self Employed MORTGAGE LENDERSGROVETOWN GEORGIA Self Employed MORTGAGE LENDERSGRIFFIN GEORGIA Self Employed MORTGAGE LENDERSGREENVILLE GEORGIA Self Employed MORTGAGE LENDERSGREENSBORO GEORGIA Self Employed MORTGAGE LENDERSGRAYSON GEORGIA Self Employed MORTGAGE LENDERSGRAY GEORGIA Self Employed MORTGAGE LENDERSGRANTVILLE GEORGIA Self Employed MORTGAGE LENDERSGRAHAM GEORGIA Self Employed MORTGAGE LENDERSGORDON GEORGIA Self Employed MORTGAGE LENDERSGOOD HOPE GEORGIA Self Employed MORTGAGE LENDERSGLENWOOD GEORGIA Self Employed MORTGAGE LENDERSGLENNVILLE GEORGIA Self Employed MORTGAGE LENDERSGIRARD GEORGIA Self Employed MORTGAGE LENDERSGILLSVILLE GEORGIA Self Employed MORTGAGE LENDERSGIBSON GEORGIA Self Employed MORTGAGE LENDERSGEORGETOWN GEORGIA Self Employed MORTGAGE LENDERSGENEVA GEORGIA Self Employed MORTGAGE LENDERSGAY GEORGIA Self Employed MORTGAGE LENDERSGARFIELD GEORGIA Self Employed MORTGAGE LENDERSGARDEN CITY GEORGIA Self Employed MORTGAGE LENDERSGAINESVILLE GEORGIA Self Employed MORTGAGE LENDERSFUNSTON GEORGIA Self Employed MORTGAGE LENDERSFRANKLIN SPRINGS GEORGIA Self Employed MORTGAGE LENDERSFRANKLIN GEORGIA Self Employed MORTGAGE LENDERSFORT VALLEY GEORGIA Self Employed MORTGAGE LENDERSFORT OGLETHORPE GEORGIA Self Employed MORTGAGE LENDERSFORT GAINES GEORGIA Self Employed MORTGAGE LENDERSFORSYTH GEORGIA Self Employed MORTGAGE LENDERSFOREST PARK GEORGIA Self Employed MORTGAGE LENDERSFOLKSTON GEORGIA Self Employed MORTGAGE LENDERSFLOWERY BRANCH GEORGIA Self Employed MORTGAGE LENDERSFLOVILLA GEORGIA Self Employed MORTGAGE LENDERSFLEMINGTON GEORGIA Self Employed MORTGAGE LENDERSFITZGERALD GEORGIA Self Employed MORTGAGE LENDERSFAYETTEVILLE GEORGIA Self Employed MORTGAGE LENDERSFARGO GEORGIA Self Employed MORTGAGE LENDERSFAIRMOUNT GEORGIA Self Employed MORTGAGE LENDERSFAIRBURN GEORGIA Self Employed MORTGAGE LENDERSEUHARLEE GEORGIA Self Employed MORTGAGE LENDERSETON GEORGIA Self Employed MORTGAGE LENDERSEPHESUS GEORGIA Self Employed MORTGAGE LENDERSENIGMA GEORGIA Self Employed MORTGAGE LENDERSEMERSON GEORGIA Self Employed MORTGAGE LENDERSELLIJAY GEORGIA Self Employed MORTGAGE LENDERSELLENTON GEORGIA Self Employed MORTGAGE LENDERSELLAVILLE GEORGIA Self Employed MORTGAGE LENDERSELBERTON GEORGIA Self Employed MORTGAGE LENDERSEDISON GEORGIA Self Employed MORTGAGE LENDERSEDGE HILL GEORGIA Self Employed MORTGAGE LENDERSEATONTON GEORGIA Self Employed MORTGAGE LENDERSEASTMAN GEORGIA Self Employed MORTGAGE LENDERSEAST POINT GEORGIA Self Employed MORTGAGE LENDERSEAST ELLIJAY GEORGIA Self Employed MORTGAGE LENDERSEAST DUBLIN GEORGIA Self Employed MORTGAGE LENDERSDU PONT GEORGIA Self Employed MORTGAGE LENDERSDUNWOODY GEORGIA Self Employed MORTGAGE LENDERSDULUTH GEORGIA Self Employed MORTGAGE LENDERSDUDLEY GEORGIA Self Employed MORTGAGE LENDERSDUBLIN GEORGIA Self Employed MORTGAGE LENDERSDOUGLASVILLE GEORGIA Self Employed MORTGAGE LENDERSDOUGLAS GEORGIA Self Employed MORTGAGE LENDERSDORAVILLE GEORGIA Self Employed MORTGAGE LENDERSDOOLING GEORGIA Self Employed MORTGAGE LENDERSDONALSONVILLE GEORGIA Self Employed MORTGAGE LENDERSDOERUN GEORGIA Self Employed MORTGAGE LENDERSDILLARD GEORGIA Self Employed MORTGAGE LENDERSDEXTER GEORGIA Self Employed MORTGAGE LENDERSDEMOREST GEORGIA Self Employed MORTGAGE LENDERSDEEPSTEP GEORGIA Self Employed MORTGAGE LENDERSDECATUR GEORGIA Self Employed MORTGAGE LENDERSDEARING GEORGIA Self Employed MORTGAGE LENDERSDE SOTO GEORGIA Self Employed MORTGAGE LENDERSDAWSONVILLE GEORGIA Self Employed MORTGAGE LENDERSDAWSON GEORGIA Self Employed MORTGAGE LENDERSDAVISBORO GEORGIA Self Employed MORTGAGE LENDERSDASHER GEORGIA Self Employed MORTGAGE LENDERSDARIEN GEORGIA Self Employed MORTGAGE LENDERSDANVILLE GEORGIA Self Employed MORTGAGE LENDERSDANIELSVILLE GEORGIA Self Employed MORTGAGE LENDERSDAMASCUS GEORGIA Self Employed MORTGAGE LENDERSDAHLONEGA GEORGIA Self Employed MORTGAGE LENDERSDALTON GEORGIA Self Employed MORTGAGE LENDERSDALLAS GEORGIA Self Employed MORTGAGE LENDERSDACULA GEORGIA Self Employed MORTGAGE LENDERSCUTHBERT GEORGIA Self Employed MORTGAGE LENDERSCUSSETA GEORGIA Self Employed MORTGAGE LENDERSCUMMING GEORGIA Self Employed MORTGAGE LENDERSCULLODEN GEORGIA Self Employed MORTGAGE LENDERSCRAWFORDVILLE GEORGIA Self Employed MORTGAGE LENDERSCRAWFORD GEORGIA Self Employed MORTGAGE LENDERSCOVINGTON GEORGIA Self Employed MORTGAGE LENDERSCORNELIA GEORGIA Self Employed MORTGAGE LENDERSCORDELE GEORGIA Self Employed MORTGAGE LENDERSCOOLIDGE GEORGIA Self Employed MORTGAGE LENDERSCONYERS GEORGIA Self Employed MORTGAGE LENDERSCONCORD GEORGIA Self Employed MORTGAGE LENDERSCOMMERCE GEORGIA Self Employed MORTGAGE LENDERSCOMER GEORGIA Self Employed MORTGAGE LENDERSCOLUMBUS GEORGIA Self Employed MORTGAGE LENDERSCOLQUITT GEORGIA Self Employed MORTGAGE LENDERSCOLLINS GEORGIA Self Employed MORTGAGE LENDERSCOLLEGE PARK GEORGIA Self Employed MORTGAGE LENDERSCOLBERT GEORGIA Self Employed MORTGAGE LENDERSCOHUTTA GEORGIA Self Employed MORTGAGE LENDERSCOCHRAN GEORGIA Self Employed MORTGAGE LENDERSCOBBTOWN GEORGIA Self Employed MORTGAGE LENDERSCLIMAX GEORGIA Self Employed MORTGAGE LENDERSCLEVELAND GEORGIA Self Employed MORTGAGE LENDERSCLERMONT GEORGIA Self Employed MORTGAGE LENDERSCLAYTON GEORGIA Self Employed MORTGAGE LENDERSCLAXTON GEORGIA Self Employed MORTGAGE LENDERSCLARKSTON GEORGIA Self Employed MORTGAGE LENDERSCLARKESVILLE GEORGIA Self Employed MORTGAGE LENDERSCHICKAMAUGA GEORGIA Self Employed MORTGAGE LENDERSCHESTER GEORGIA Self Employed MORTGAGE LENDERSCHAUNCEY GEORGIA Self Employed MORTGAGE LENDERSCHATTAHOOCHEE HILLS GEORGIA Self Employed MORTGAGE LENDERSCHATSWORTH GEORGIA Self Employed MORTGAGE LENDERSCHAMBLEE GEORGIA Self Employed MORTGAGE LENDERSCENTRALHATCHEE GEORGIA Self Employed MORTGAGE LENDERSCENTERVILLE GEORGIA Self Employed MORTGAGE LENDERSCEDARTOWN GEORGIA Self Employed MORTGAGE LENDERSCECIL GEORGIA Self Employed MORTGAGE LENDERSCARTERSVILLE GEORGIA Self Employed MORTGAGE LENDERSCARROLLTON GEORGIA Self Employed MORTGAGE LENDERSCAVE SPRING GEORGIA Self Employed MORTGAGE LENDERSCARNESVILLE GEORGIA Self Employed MORTGAGE LENDERSCARLTON GEORGIA Self Employed MORTGAGE LENDERSCARL GEORGIA Self Employed MORTGAGE LENDERSCANTON GEORGIA Self Employed MORTGAGE LENDERSCANON GEORGIA Self Employed MORTGAGE LENDERSCAMILLA GEORGIA Self Employed MORTGAGE LENDERSCAMAK GEORGIA Self Employed MORTGAGE LENDERSCALHOUN GEORGIA Self Employed MORTGAGE LENDERSCAIRO GEORGIA Self Employed MORTGAGE LENDERSCADWELL GEORGIA Self Employed MORTGAGE LENDERSBYRON GEORGIA Self Employed MORTGAGE LENDERSBYROMVILLE GEORGIA Self Employed MORTGAGE LENDERSBUTLER GEORGIA Self Employed MORTGAGE LENDERSBUFORD GEORGIA Self Employed MORTGAGE LENDERSBUENA VISTA GEORGIA Self Employed MORTGAGE LENDERSBUCKHEAD GEORGIA Self Employed MORTGAGE LENDERSBUCHANAN GEORGIA Self Employed MORTGAGE LENDERSBRUNSWICK GEORGIA Self Employed MORTGAGE LENDERSBROXTON GEORGIA Self Employed MORTGAGE LENDERSBROOKS GEORGIA Self Employed MORTGAGE LENDERSBROOKLET GEORGIA Self Employed MORTGAGE LENDERSBROOKHAVEN GEORGIA Self Employed MORTGAGE LENDERSBRONWOOD GEORGIA Self Employed MORTGAGE LENDERSBRINSON GEORGIA Self Employed MORTGAGE LENDERSBREMEN GEORGIA Self Employed MORTGAGE LENDERSBRASWELL GEORGIA Self Employed MORTGAGE LENDERSBRASELTON GEORGIA Self Employed MORTGAGE LENDERSBOWMAN GEORGIA Self Employed MORTGAGE LENDERSBOWERSVILLE GEORGIA Self Employed MORTGAGE LENDERSBOWDON GEORGIA Self Employed MORTGAGE LENDERSBOSTWICK GEORGIA Self Employed MORTGAGE LENDERSBOSTON GEORGIA Self Employed MORTGAGE LENDERSBOGART GEORGIA Self Employed MORTGAGE LENDERSBLYTHE GEORGIA Self Employed MORTGAGE LENDERSBLUFFTON GEORGIA Self Employed MORTGAGE LENDERSBLUE RIDGE GEORGIA Self Employed MORTGAGE LENDERSBLOOMINGDALE GEORGIA Self Employed MORTGAGE LENDERSBLAKELY GEORGIA Self Employed MORTGAGE LENDERSBLAIRSVILLE GEORGIA Self Employed MORTGAGE LENDERSBLACKSHEAR GEORGIA Self Employed MORTGAGE LENDERSBISHOP GEORGIA Self Employed MORTGAGE LENDERSBETHLEHEM GEORGIA Self Employed MORTGAGE LENDERSBERLIN GEORGIA Self Employed MORTGAGE LENDERSBERKELEY LAKE GEORGIA Self Employed MORTGAGE LENDERSBAXLEY GEORGIA Self Employed MORTGAGE LENDERSBARWICK GEORGIA Self Employed MORTGAGE LENDERSBARTOW GEORGIA Self Employed MORTGAGE LENDERSBARNESVILLE GEORGIA Self Employed MORTGAGE LENDERSBALL GROUND GEORGIA Self Employed MORTGAGE LENDERSBALDWIN GEORGIA Self Employed MORTGAGE LENDERSBAINBRIDGE GEORGIA Self Employed MORTGAGE LENDERSBACONTON GEORGIA Self Employed MORTGAGE LENDERSAVONDALE ESTATES GEORGIA Self Employed MORTGAGE LENDERASHBURN GEORGIA Self Employed MORTGAGE LENDERSAVERA GEORGIA Self Employed MORTGAGE LENDERSAUSTELL GEORGIA Self Employed MORTGAGE LENDERSAUGUSTA GEORGIA Self Employed MORTGAGE LENDERSAUBURN GEORGIA Self Employed MORTGAGE LENDERSATTAPULGUS GEORGIA Self Employed MORTGAGE LENDERSATLANTA GEORGIA Self Employed MORTGAGE LENDERSARLINGTON GEORGIA Self Employed MORTGAGE LENDERSARGYLE GEORGIA Self Employed MORTGAGE LENDERSARCADE GEORGIA Self Employed MORTGAGE LENDERSARAGON GEORGIA Self Employed MORTGAGE LENDERSARABI GEORGIA Self Employed MORTGAGE LENDERSANDERSONVILLE GEORGIA Self Employed MORTGAGE LENDERSAMBROSE GEORGIA Self Employed MORTGAGE LENDERSALTO GEORGIA Self Employed MORTGAGE LENDERSALSTON GEORGIA Self Employed MORTGAGE LENDERSALLENTOWN GEORGIA Self Employed MORTGAGE LENDERSALLENHURST GEORGIA Self Employed MORTGAGE LENDERSALDORA GEORGIA Self Employed MORTGAGE LENDERSALAPAHA GEORGIA Self Employed MORTGAGE LENDERSALAMO GEORGIA Self Employed MORTGAGE LENDERSAILEY GEORGIA Self Employed MORTGAGE LENDERSATHENS GEORGIA Self Employed MORTGAGE LENDERSAMERICUS GEORGIA Self Employed MORTGAGE LENDERSALPHARETTA GEORGIA Self Employed MORTGAGE LENDERSALMA GEORGIA Self Employed MORTGAGE LENDERSALBANY GEORGIA Self Employed MORTGAGE LENDERSADRIAN GEORGIA Self Employed MORTGAGE LENDERSADEL GEORGIA Self Employed MORTGAGE LENDERSADAIRSVILLE GEORGIA Self Employed MORTGAGE LENDERSACWORTH GEORGIA Self Employed MORTGAGE LENDERSABBEVILLE GEORGIA Self Employed MORTGAGE LENDERS