Serving every city Georgia and County Georgia in GA including Atlanta city Georgia, Augusta-Richmond , Columbus city Georgia, Savannah city Georgia, Athens-Clarke, Sandy Springs city Georgia, Macon city Georgia, Roswell city Georgia, Albany city Georgia, Johns Creek city Georgia, Warner Robins city Georgia, Alpharetta city Georgia, Marietta city Georgia, Valdosta city Georgia, Smyrna city Georgia, Dunwoody city Georgia, Rome city Georgia, Peachtree city Georgia , Gainesville city Georgia, East Point city Georgia, Hinesville city Georgia, Dalton city Georgia, Newnan city Georgia, Milton city Georgia, Douglasville city Georgia, Kennesaw city Georgia, LaGrange city Georgia, Lawrenceville city Georgia,

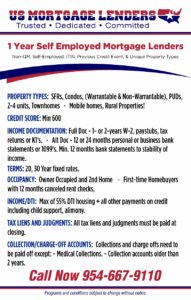

Are you Self-Employed and seeking a mortgage to purchase a home?Generally, you are self-employed if any of the following apply to you.

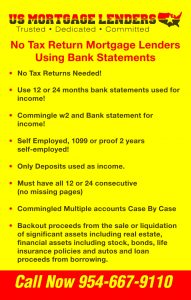

Bank Statement Only Georgia Mortgage Lenders

Have a self-employed client who has had difficulty obtaining a mortgage?

Georiga Mortgage Lenders Bank Statement Program allows self-employed borrowers the ability to qualify based on a 12 or 24 month average of deposits using their personal or Georiga business bank account.

– No Tax Returns Required – Personal Bank Statement qualified base 24 month average monthly deposits – Business Bank Statement qualified based on 24 month average monthly deposits. – 600 Minimum Credit Score – Up to 90% LTV (No MI) allowed on Personal and Business – Loans to $3 Million (Minimum $150,000) – 5/1 ARM or 30-year fixed – No Seasoning for Foreclosure, Short Sale, Bankruptcy, Deed In Lieu – Owner-Occupied, 2nd Homes, Investment Properties allowed – Non-Warrantable Georgia Condos Are OK! – Gift Funds OK! – No Pre-Pay Penalty for Primary Owner-Occupied and/or 2nd Homes – SFRs, Townhomes, Condos, 2-4 Units

Self-employed Georiga Business Owner? And having trouble getting approved for a Georiga mortgage?

There are many advantages of being self-employed including not answering to a “boss,” making your own decisions, hours, time off is all Great! Until it comes time to apply for a Georiga mortgage because Georiga mortgage lenders are very concerned about projecting your future income. which is hard for the Georiga self-employed homebuyers o verify when you write off all your income.

SELF EMPLOYED GEORGIA MORTGAGE APPROVALS

Self Employed Georiga borrowers are no more or less risky then salaried or W-2’d workers. The main challenge for the Self-Employed Georgia is documenting work history and income. This is the biggest difference between a conventional borrower and a Self-Employed Georiga borrower . How can Self Employed Georgia borrowers document their income and work history when they do not show any income on their taxes?

12 or 24 Months Business or personal bank statements only!

Last 2 years personal and business tax returns

Proof of 2 years Self Employed Georgia by showing either a business license or with a CPA letter

Personal and or Business Bank statements

Year to date profit and loss report

2 years of Credit references if needed for business

SELF EMPLOYED GEORGIA BORROWERS

Many Georiga business owners and self-employed borrowers face special challenges when seeking to finance for a Georiga home. There are a variety of programs available to self-employed borrowers and Mortgage lenders is proud to offer them all to all Georgia business owners. Working with Georgia business owners and entrepreneurs is very exciting. We take pride in being able to offer aggressive self-employed Georgia loan programs to our self-employed Georgia mortgage applicants . Please fill out our full mortgage applicants so we dig deeper into the choices and special circumstances of bank statement only Georgia mortgage programs.

On a fully documented loan such as this, the Georgia mortgage lenders lender will consider the “net” income of the individual after deductions. This can be a challenge for some small business owners. If documenting your income via tax returns is a problem don’t work we can offer a 12 or 24 months bank statement only Georgia mortgage program!

Other info of Georgia Self Employed

Generally, you are self-employed if any of the following apply to you.

What are My Georgia Self-Employed Tax Obligations?

the wording “self-employment tax” is used, it only refers to Social Security and Medicare taxes and not any other tax (like income tax).

Before you can determine if you are subject to self-employment tax and income tax, you must figure your net profit or net loss from your business. You do this by subtracting your business expenses from your business income. If your expenses are less than your income, the difference is net profit and becomes part of your income on page 1 of Form 1040. If your expenses are more than your income, the difference is a net loss. You usually can deduct your loss from gross income on page 1 of Form 1040. But in some situations your loss is limited. See Pub. 334, Tax Guide for Small Business (For Individuals Who Use Schedule C or C-EZ) for more information.

You have to file an income tax return if your net earnings from self-employment were $400 or more. If your net earnings from self-employment were less than $400, you still have to file an income tax return if you meet any other filing requirement listed in the Form 1040 instructions (PDF).

How Do I Make My Quarterly Payments?

Estimated tax is the method used to pay Social Security and Medicare taxes and income tax, because you do not have an employer withholding these taxes for you. Form 1040-ES, Estimated Tax for Individuals (PDF), is used to figure these taxes. Form 1040-ES contains a worksheet that is similar to Form 1040. You will need your prior year’s annual tax return in order to fill out Form 1040-ES.

Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax.

Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System (EFTPS) . If this is your first year being self-employed, you will need to estimate the amount of income you expect to earn for the year. If you estimated your earnings too high, simply complete another Form 1040-ES worksheet to refigure your estimated tax for the next quarter. If you estimated your earnings too low, again complete another Form 1040-ES worksheet to recalculate your estimated taxes for the next quarter.

See the Estimated Taxes page for more information. The Self-Employment Tax page has more information on Social Security and Medicare taxes.

How Do I File My Annual Return? To file your annual tax return, you will need to use Schedule C (PDF) or Schedule C-EZ (PDF) to report your income or loss from a business you operated or a profession you practiced as a sole proprietor. Schedule C Instructions (PDF) may be helpful in filling out this form.

Small businesses and statutory employees with expenses of $5,000 or less may be able to file Schedule C-EZ instead of Schedule C. To find out if you can use Schedule C-EZ, see the instructions in the Schedule C-EZ form.

In order to report your Social Security and Medicare taxes, you must file Schedule SE (Form 1040), Self-Employment Tax (PDF). Use the income or loss calculated on Schedule C or Schedule C-EZ to calculate the amount of Social Security and Medicare taxes you should have paid during the year. The Instructions (PDF) for Schedule SE may be helpful in filing out the form.

If you made or received a payment as a small business or self-employed (individual), you are most likely required to file an information return to the IRS.

Georgia Business Structures When beginning a business, you must decide what form of business entity to establish. Your form of business determines which income tax return form you have to file. The most common forms of business are the sole proprietorship, partnership, corporation, and S corporation. A Limited Liability Company (LLC) is a relatively new business structure allowed by state statute. Visit the Business Structures page to learn more about each type of entity and what forms to file.

Georgia Home Office Deduction If you use part of your home for business, you may be able to deduct expenses for the business use of your home. The home office deduction is available for homeowners and renters, and applies to all types of homes.

Married Couples Georgia Business – What is a Qualified Joint Venture? Married Couples Business The employment tax requirements for family employees may vary from those that apply to other employees. On this page we point out some issues to consider when operating a married couples business.

Election for Married Couples Unincorporated Businesses For tax years beginning after December 31, 2006, the Small Business and Work Opportunity Tax Act of 2007 (Public Law 110-28) provides that a “qualified joint venture,” whose only members are a married couples filing a joint return, can elect not to be treated as a partnership for Federal tax purposes.

Back to top

Considering a Georgia Tax Professional Tips for Choosing a Tax Return Preparer

Back to top

The Small Business Taxes: The Virtual Workshop is composed of nine interactive lessons designed to help new small business owners learn their tax rights and responsibilities. The IRS Video Portal contains video and audio presentations on topics of interest to small businesses, individuals, and tax professionals.

POPULAR GEORGIA SELF EMPLOYED BORROWER LINKS

Georgia mortgage lenders serving every city Georgia and County Georgia in GA!

Georgia Self Employed No Income Mortgage Mortgage Lenders Coverage Areas include

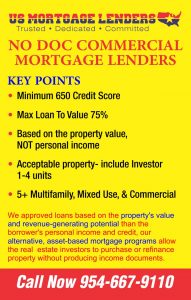

or 75% GEORGIA NO DOC COMMERCIAL MORTGAGE LENDERS

or 75% GEORGIA NO DOC COMMERCIAL MORTGAGE LENDERS