NO TAX RETURN FLORIDA MORTGAGE LENDER’S

How Do I get a Mortgage In Florida With No Tax Returns? MIAMI FL NO TAX RETURN MORTGAGE LENDERS How Do I get a Mortgage In Florida With No Tax Returns? If you are looking for a Florida Read More »

Who Qualifies For A Miami FL Bank Statement Mortgage?

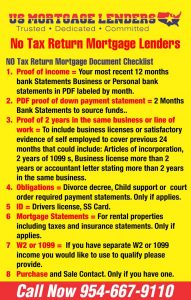

Our bank statement mortgage lenders provide funding for business owners throughout Florida. You must have a good payment history and good deposits but don’t have traditional income and wouldn’t qualify for standard bank loan financing. To qualify for our No Tax return bank statement mortgage you’ll need the following:

- Minimum of 1 year same line but usually 2+ years in the same line of work.

- Minimum 550 middle credit score.

- Minimum 10% down payment+ Closing Cost + Reserves. reserves are defined as the total mortgage payment PITI in your account after closing.

- Minimum 3-6 Months Reserves.

- Minimum 12 months since any housing events ( Foreclosure, Bankruptcy Discharge, Short Sale )

- Maximum DTI 55% Bank statement only mortgage lenders will allow the self-employed to qualify up to 55% of their total income for housing and all other monthly payments on their credit report.

Call Now Free Consultation 954-667-9110

Miami FL Bank Statement Self Employed Florida Mortgage Lenders

When determining the appropriate qualifying income for a self-employed borrower, it is important to note that business income reported on an individual IRS Form 1040 may not necessarily represent income that has actually been distributed to the borrower. No Tax return bank statement Florida mortgage lenders use bank statements along with a questionnaire to determine the amount of income that can be relied on by the borrower in qualifying for their personal mortgage obligation. When underwriting these borrowers, it is important to review business income distributions on the bank statements to determine the the viability of the underlying business. This analysis includes assessing the stability of business income and the ability of the business to continue to generate sufficient income to enable self employed mortgage applicants to meet their monthly payment obligations.

Allowable Miami Properties Types Include:

- Single-family homes /Townhomes / Villas

- Condos / Condominiums

- Condotels

- Multifamily Up To 8 Units

No Tax Return Miami FL Mortgage Lenders Options

-

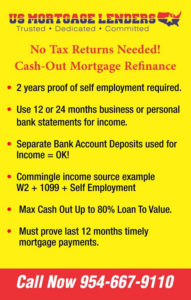

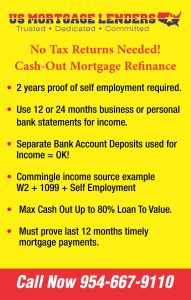

- Use Personal Bank Statements: You can qualify using 12 or 24 months bank statements and use Up To 100 percent of deposits if they came from a Business Bank Account.

- Use Business Bank Statements: You can qualify with 12 or 24 months of bank statements and count up to 90% percent of the deposits. A self-employment questionnaire is usually required to determine your income. For example if you are a 1099 realtor with no money rent, or cost you can use up to 90% of your income to qualify.

- Use 1099s For Income: Some lenders will allow 2 years 1099s and 2 months of recent bank statements along with a bank statement questionnaire to understand your expenses.

- Use Lease Agreements: As long as the lease agreements are enough to cover the mortgage payments lenders will lend up to 80% loan to value with no income verification needed.

How Do I get a Mortgage In Miami Florida With No Tax Returns?

FLORIDA NO TAX RETURN MORTGAGE LENDERS How Do I get a Mortgage In Florida With No Tax Returns? If you are looking for a Florida Read More »

Self-Employed Florida Mortgage Lenders

Self-Employed Florida Mortgage Lenders As the economy for self-employed and other small-business economies more, business owners are in need of self-employed financing but are often Read More » No Doc And Stated Florida Mortgage Lenders

No Doc And Stated Florida Mortgage Lenders

Florida No Doc, No Income verification mortgage programs. No No Doc, Florida No income verification mortgage program used to purchase a primary residence home or Read More »

No Income Verification Florida Mortgage Lenders

24 Months Bank Statement Florida Mortgage Lenders

24 Months Bank Statement Florida Mortgage Lenders Personal Statements: Qualify using 24 avg bank statements. We use 100% of the deposits as income. Business Statements: Read More »

12 Months Bank Statement Florida Mortgage Lenders

12 Months Bank Statement Florida Mortgage Lenders Business Statements: Qualify 12 months’ Avg Deposits. Up to 90% are subject to a Business bank statement questionnaire. Read More »

MIAMI FLORIDA BANK STATEMENT ONLY MORTGAGE LENDERS DETAILS INCLUDE:

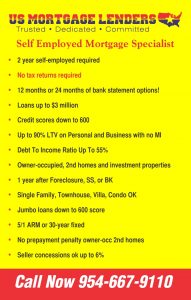

- 2 Years Self Employed Required!

- Bank statement deposits are used to qualify!

- No tax returns required

- 12 months of personal bank statements (Personal and Business)

- Loans up to $2 million

- Credit scores down to 500

- Low-Interest Rates

- Up to 90% LTV = Only 10% downpayment to purchase a Miami Home!

- DTI up to 50% considered

- Owner-occupied, 2nd homes, and investment properties

- 2 years seasoning for foreclosure, short sale, BK, DIL

- Non-warrantable condos considered

- Jumbo loans down to 660 score

- 5/1 ARM or 30-year fixed

- No pre-payment penalty for owner-occ and 2nd homes

- SFRs, townhomes, condos, 2-4 units

- Seller concessions to 6% (2% for investment)

BANK STATEMENT ONLY MORTGAGE LENDER’S KEYPOINTS

- UP TO 95% OF TOTAL MIAMI BUSINESS DEPOSITS = Florida Bank Statement Mortgage Lenders will use 90% of the total deposits over a 24-month period if using business bank statements.

OR

- 100% OF TOTAL PERSONAL MIAMI FL BANK STATEMENT DEPOSITS = Florida Bank Statement Mortgage Lenders also will accept 100% personal bank statements for the sole proprietor borrowers or 1099 wage earner. 24 months of personal and we will count 100% of the deposits.

IMPORTANT TO NOTE:

Bank statement loan to value and rate will vary depending on score and loan size.

From a 600 to 649 the LTV available is 85%.

Greater than 660 the LTV goes up to 90% with a very beneficial price break for those with scores over 700.

To learn more about the bank statement loan program or any of the other alternative financing programs available through Florida Mortgage Lenders.

www.Florida-Mortgage-Lenders.com

- Miami FL Bank Statement Only Mortgage Lenders+No Tax Returns links!

- Miami FL No Tax Return-Florida Bank Statement Only Mortgage Lenders

- FLORIDA BANK STATEMENT ONLY MORTGAGE LENDERS

- 15% Down Bank Statement Only FL Mortgage Lenders

- Bank Statement Only Florida Mortgage Lenders Min 600+FICO!

- bank statement only – Florida-Mortgage-Lenders.com

- Florida -Bank Statement Only Mortgage Lenders

- Bank statement Only Lenders For Self-Employed Homebuyer

- 15%DOWN+BANK STATEMENT FL MORTGAGE LENDERS

- FL Bank Statement Only Mortgage Lenders