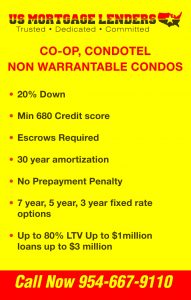

Panama City Panama City Florida CondoTel Mortgage Lenders

Panama City Florida CondoTel Mortgage – Panama City Florida CondoTel Refinance – CondoTel Panama City Florida Purchase or Refinance

Panama City Florida Condotel Details Product Description

Panama City Florida Condotel Details Product Description

The Portfolio Panama City Florida Condotel ARM loan program is a 1st mortgage condotel adjustable rate loan with principal and interest payments amortized over 30 years.

- 3/1 ARM: Rate is fixed for 3 years, and then every year thereafter.

- 5/1 ARM: Rate is fixed for 5 years, and then every year thereafter.

- 7/1 ARM: Rate is fixed for 7 years, and then every year thereafter.

- 30 Year Fixed Rate is fixed for 30 years

Product Features – Panama City Florida Condotel

- No prepayment penalty

- 2/2/6 caps

- Index: 1 Year CMT

- Margin: 3.0%

- Floor Rate = Start Rate

- PITI Qualification

- 3/1 ARM = Start Rate

- 5/1 ARM = Start Rate

- 7/1 ARM = Start Rate

Panama City Florida Condo-tel Cash-Out Refinance Mortgage Lenders

- Maximum 80% LTV with 740+ credit score, otherwise 75%

- Up to $3,000,000 cash-in-hand permitted less any mortgage payoffs

- Paying off a non-purchase money 2nd mortgage is defined as cash-out

- No ownership seasoning required but must have settlement statement from purchase

- Source and seasoning required if purchased within the prior 6 months

- Proceeds from cash-out can be used to meet reserve requirement

- Power of Attorney not allowed for cash-out refinances

Escrows Waiver Requirements For Panama City Florida Condotel Mortgage Lenders

- Escrows waived as an exception and when the following is met:

- 740+ credit score

- Loan must pass HPML test

- Escrow waiver = Available

Minimum & Maximum Panama City Florida Condotel Mortgage Lenders Loan Amounts

$100,000 minimum loan amount. • Loan amount exceptions over $3,000,000 available. Please contact Panama City Florida Condotel mortgage lenders for details.

Occupancy Permitted- Panama City Florida Condotel Mortgage Lenders

- Primary Panama City Florida condotel Residence

- Second Home Panama City Florida condotel (minimal rental income allowed)

- Investment Panama City Florida condotel mortgage lenders for Panama City Florida condotel (non-owner occupied) permitted at maximum 60% condotel loan to value.

Condotel Panama City Florida Mortgage Lenders Debt To Income Qualifying Ratios

As described below, with 43% DTI max:

- Employment contract or offer letter from U.S. based employer showing annual income, start date and HR/Supervisor

contact person.

- Most recent pay stub is normally required for funding

- If first pay stub will not be available before funding, Panama City Florida CondoTel Mortgage Lenders may permit this for inbound international assignees

within large corporations. Borrowers beginning work for a new employer can be considered case-by-case with a letter from the new employer stating the borrower has passed all pre-employment screening and has been placed on payroll.

- Foreign REO rental income may be considered on an exception basis with 3 months canceled checks and a current

lease agreement (must be translated to English and Dollars). Use 75% of rental income received as gross rental income on 1003.

-4 Unit Residential – Panama City Florida CondoTel Mortgage Lenders

- 1 Unit condotel Panama City Florida condotels

- – Panama City Florida condotel

- – PUD

- – condotel

- – Non-Warrantable condo tel

- – Condotel (75% LTV max)

- – Co-op condotel

- – condotel with Hobby Farm (70% LTV max)

- – condotel on over 10 Acres (70% LTV max)

- – Unique condotel or Condo (70% LTV max, but may be reduced further case-by-case)

- 2 Unit Residential Panama City Florida condotel , 75% LTV max (see Rental Income Section)

- 3-4 Unit Residential Panama City Florida condotel, 70% LTV max (see Rental Income Section)

Acreage, Hobby Farm & Unique Property

- Panama City Florida condotel on over 10 Acres is permitted up to 70% LTV, and no acreage maximum has been defined

(subject to case-by-case qualification)

- Panama City Florida condotel with Hobby Farm is permitted up to 70% LTV, but no farming income can be used to qualify

- Unique Panama City Florida condotel or Condo is permitted, up to 70% LTV, but LTV may be reduced further case-by-case

Warrantable Condo Florida CondoTel Mortgage Lenders

- Maximum 80% LTV

- Panama City Florida CondoTel Mortgage Lenders questionnaire must be 100% complete for Approval Commitment. No blanks or questions answered “n/a”

or “unknown,” and questionnaire must pass underwriter review.

- Pending litigation, when permitted by underwriting, is priced as Non-Warrantable

- Must have a full kitchen and at least one separate bedroom. Minimum 500 square feet generally required. Efficiency or studio units are not permitted.

Panama City Florida Condotel Cash-Out Refinance Mortgage Lenders

- Maximum 80% LTV with 740+ credit score, otherwise 75%

- Up to $3,000,000 cash-in-hand permitted less any mortgage payoffs

- Paying off a non-purchase money 2nd mortgage is defined as cash-out

- No ownership seasoning required but must have settlement statement from purchase

- Source and seasoning required if purchased within the prior 6 months

- Proceeds from cash-out can be used to meet reserve requirement

- Power of Attorney not allowed for cash-out refinances

Delayed Financing – Panama City Florida CondoTel Mortgage Lenders

- Cash-out allowed if Panama City Florida CondoTel Mortgage Lenders loan funds within 6 months of cash purchase without LTV reduction or rate adjustment

Subordinate Financing- Panama City Florida CondoTel Mortgage Lenders

- Permitted; however, CLTV limits are the same as LTV limits, except for >80% – 90% CLTV

- Second lien terms must be provided at loan submission

- Seller Carryback & Private Party 2nd Lien can be considered for Primary Residence, SFR only

Refinance of a Property Listed For Sale – Panama City Florida CondoTel Mortgage Lenders

- No Off-MLS seasoning requirement for borrower-paid compensation. Panama City Florida CondoTel Mortgage Lenders 1.0% discount point fee is required. Home

can remain listed For Sale.

- 90-days off the MLS required for lender-paid compensation

Number of Financed Properties – Panama City Florida CondoTel Mortgage Lenders

- Number of financed limited to 10 with some exceptions made for very high net worth borrowers. Please note reserve

requirement applies to all properties owned (see Reserve Requirement & Rental Income sections).

Seller Credits – Panama City Florida CondoTel Mortgage Lenders & Escrow Holdbacks

- Seller credit permitted up to 6% for non-recurring closing costs, plus escrow establishment or HOA dues. All other

credits must be deducted from the purchase price.

- Escrow holdbacks for repairs or future renovations are not allowed

Non-Arm’s Length Transaction- Panama City Florida CondoTel Mortgage Lenders

- Typically permitted on a regular purchase transaction. Circumstances related to a “bailout” are not allowed.

New Appraised Value vs. Purchase Price- Panama City Florida CondoTel Mortgage Lenders

- 6 months seasoning required to use new appraised value. Large value increase must be justified.

- If property was purchased within last 6 months, LTV is based on the lesser of the purchase price or new appraised

value. HUD from purchase is required. Exceptions made on a case-by-case basis for remodeled properties. Acceptable

documentation is required.

Credit Requirements For Panama City Florida CondoTel Mortgage Lenders

Minimum & Qualifying Credit Score

- 680 mid-score required with some exceptions allowed if the lower score is due to a lack of credit or unestablished credit.

- For co-borrowers and co-mortgagers, the lowest mid-score is used for pricing and qualification.

- Meeting the minimum credit score requirement does not automatically constitute a credit approval. A pattern ofadverse credit or overextended credit may disqualify borrower from financing, even if the minimum credit score is met.

- Broker credit report is used for Pre-Approval and Panama City Florida CondoTel Mortgage Lenders will also pull credit before issuing a conditional

approval. Mid-score from Panama City Florida condotel mortgage lenders credit pull is used for pricing and qualification.

No Credit or Panama City Florida CondoTel Mortgage Lenders Limited Credit

- No credit or limited credit profiles are allowed on a case-by-case basis for U.S. citizens. Contact your AE for pricing.

- No U.S. credit or credit score is required for the Work Visa/Expatriate/Immigrant Program or Foreign National Program

Adverse Panama City Florida CondoTel Mortgage Lenders Credit

- Late payments on any mortgage, installment or revolving account of 2×30, 1×60 or more will typically disqualify aborrower from financing. Exceptions will be reviewed on a case-by-case basis at a lower LTV.

- A pattern of adverse credit or overextended credit may disqualify borrower from financing, even if minimum credit scoreis met. Borrowers with 3x monthly income amount in unsecured consumer debt are generally disqualified.

Non-Qualifying Spouse

- Joint accounts shared with a non-qualifying spouse can be used if an “Authorization Letter” is signed.

- If the non-qualifying spouse is not on the loan and the assets are in the spouse’s name only see Gift Guidelines.

Bankruptcy, Foreclosure/Short Sale

- Four year seasoning from BK discharge date or sale of property

- Maximum 60% LTV

- No derogatory credit allowed since event

- Strong extenuating circumstance and signed LOX from borrower detailing event required

Condotel Panama City Florida Mortgage Lenders Maximum Loan To Value

- Maximum 75% LTV

- Leaseholds allowed if remaining term on land lease is 30 years or longer

Not allowed:

– Blackout dates not permitting year-round owner occupancy

– Structural deficiencies and certain pending litigation (please contact your AE if litigation is not related

to a structural issue)

– Incomplete construction of the subject phase

Approved/Evaluated Case-by-Case:

– Low HOA budget reserves

– HOA delinquencies exceeding 15%

- Panama City Florida CondoTel Mortgage Lenders questionnaire must be 100% complete for Approval Commitment. No blanks or questions answered “n/a”

or “unknown,” and questionnaire must pass underwriter review.

- Must have a full kitchen and at least one separate bedroom. Minimum 500 square feet generally required. Efficiency or studio units are not permitted.

- Coinsurance is considered case-by-case if no agreed amount endorsement is available. Co-op

- Maximum 75% LTV

- Title Insurance policy issued through a title company or closing attorney must be issued on Co-op certificate

- Leaseholds allowed on a case-by-case basis Not allowed:

– Structural deficiencies and certain pending litigation (please contact your AE if litigation is not related to a structural issue)

– Incomplete construction of the subject phase

Approved/Evaluated Case-by-Case:

– Low HOA budget reserves

– HOA delinquencies exceeding 15%

- Panama City Florida CondoTel Mortgage Lenders Co-op Questionnaire must be 100% complete for Approval Commitment. No blanks or questions answered

“n/a” or “unknown,” and questionnaire must pass underwriter review.

- Co-ops are priced as Non-Warrantable Condos, regardless of loan size or questionnaire findings

- Must have a full kitchen and at least one separate bedroom. Minimum 500 square feet generally required. Efficiency or studio units are not permitted.

- Coinsurance is considered case-by-case if no agreed amount endorsement is available

Condotel reserve Panama City Florida Condotel requirements:

- Current reserve balance meets or exceeds 2 months of the subject property’s HOA dues in reserves multiplied by all units in the project or 10% or more reserve allocation designated in the most recent budget.

Second Home Panama City Florida Condotel

- Panama City Florida CondoTel Mortgage Lenders will typically define a property as a second home if it is (1) located in a vacation or resort area 30 or more

miles from the primary residence or (2) used a college housing for enrolled dependent within 5 miles of campus)

- Short-term rental income is allowed on second homes, and generally does not constitute an investment property designation. Rental income cannot be used to qualify. An evaluation of the 1040 Schedule E is required.

Investment Panama City Florida Condotel

- Property titled in LLC allowed (see Borrower and Title section for details)

- Maximum 60% LTV

- Gross rental income is calculated by using a 12 month average of the net Schedule E income (Line 21) plus depreciation, mortgage interest paid to banks, taxes and insurance, and HOA dues.

- Rental income not appearing on Schedule E may be considered case-by-case with 3 months canceled checks and a current lease agreement. Use 75% of gross rent as gross rental income.

- Immediate rental income on the purchase of an investment property is allowed using 75% of the monthly rent schedule as documented by Form 1007 or 1025.

- Cash-out is allowed up to $3,000,000 with no seasoning required.

Down Payment Requirements Panama City Florida Condotel:

Most recent two months of personal asset statements with all pages included (no screenshots allowed)Foreign asset accounts must be approved by Underwriting for down payment and reserves (see Reserve Requirement section). Panama City Florida CondoTel Mortgage Lenders prefers funds to be transferred to a U.S. bank account and will require any money transfer from a foreign account to be sourced.

- Convert all foreign assets to U.S. Dollars on 1003. Panama City Florida CondoTel Mortgage Lenders uses assets as a key qualifier – the more listed the better.

- Deposits that cannot be properly sourced are not allowed.

- Business assets allowed on a case-by-case basis at lower LTV’s.

- Gift Funds allowed up to 80% LTV (see Gift Funds section)

- Joint accounts shared with a non-qualifying spouse can be used if an “100% Access Letter” is signed.

- If the non-qualifying spouse is not on the loan and the assets are in the spouse’s name only see gift funds section.

- Foreign REO: 6 months PITI in reserves is required for each foreign property owned.

DEBT-TO-INCOME REQUIREMENTS- Panama City Florida CONDOTEL MORTGAGE LENDERS

Maximum DTI Ratio

- 43% maximum back end ratio.

Paying Off Debt to Qualify

- Paying off debt to qualify can be viewed as an overextended credit situation and case-by-case evaluation is required.

Business Debt in Borrower’s Name

- Monthly obligations paid by the borrower’s business can be excluded from DTI, case-by-case

- 12 months canceled checks are required, late payments are not allowed, and the debt must be accounted for in the business cash flow.

Deferred Student Loans

- Use 1% of the deferred balance owed as an estimated monthly liability.

American Express Account (AMEX)

- Assets are required beyond Panama City Florida condotel mortgage lenders minimum reserve requirement for the full monthly balance owed, unless thestatement shows a minimum monthly payment due that carries over month-to-month.

Trailing Primary Residence

- Property can be excluded from DTI ratio and reserve requirement if listed for sale prior to closing date.

- Minimum 30% equity required verified by Panama City Florida CondoTel Mortgage Lenders (typically a borrower paid BPO or 2055 appraisal).

Co-signed Debt

- Co-signed debt where the monthly obligation is paid by another can be eliminated from the debt to income ratio

on a case by case basis with 12 months canceled checks showing on time payments from the co-signed party.

Alimony, Child Support, and Separate Maintenance

- Alimony, Child Support, and Separate Maintenance can be deducted from a borrower’s income and is not shown as a liability on the 1003.

Non-Occupying Co-Borrowers & Co-Signers

- Non-occupying co-borrowers to a max of 75% LTV

Permitted Title Vesting

- Revocable Trusts (subject to underwriting approval)

- LLC’s for investment properties

Individual Titled Panama City Florida CondoTel Mortgage Lenders

– Maximum 60% LTV

– Gross rental income is calculated by using a 12 month average of the net Schedule E income (Line 21) plus depreciation, mortgage interest paid to banks, taxes and insurance, and HOA dues (if declining, the last 12 months income will be used)

– Rental income not appearing on Schedule E may be considered case-by-case with 3 months canceled checks and a current lease agreement. Use 75% of gross rent as gross rental income.

– Immediate rental income on the purchase of an investment property is allowed using 75% of the monthly rent schedule as documented by Form 1007 or 1025. – Cash-out is allowed.

LLC Titled CondoTel Panama City Florida Mortgage Lenders

Entity: For Title held in an Entity provide the documents listed below:

– Filed Articles of Organization/Certificate of Formation, including all amendments (or equivalent document required by the state to register a LLC).

– Certificate of Good Standing (or equivalent document) issued from the state in which the LLC is organized. The certificate cannot be dated more than 60 days prior to closing

– Signed Operating Agreement, including all amendments, attachments and schedules, if any. The Operating

Agreement must provide the term of the LLC and have a stated purpose that will allow ownership of property, the right to borrower and the right to mortgage property. [NOTE: should the LLC not have an operating agreement pursuant to its state law, a Member Certificate shall be required.]

– Resolution of Unanimous Consent of the Member(s) of the LLC. The resolution must specifically identify the property, approve the mortgaging of said property and the execution of documents to effect said mortgage.

The resolution must also designate a member who shall execute all documents on behalf of the LLC and include a witnessed incumbency signature section (designated member provides sample of his/her signature).

– A complete Member List showing all Members and their respective ownership interests.

– If the property is located in a state other than the state in which the Limited Partnership is organized, the following documents issued from the state in which the property is located shall also be provided:

– A filed Certificate of Authority (or equivalent document) showing the LLC is properly registered in that state.

– If the LLC’s ownership includes a non-natural person, documents concerning that entity may also be required to be submitted for review.

– An attorney opinion letter could be requested for an LLC, Corporation or Partnership, if the complexity of the situation warrants. The opinion shall be addressed directly to Panama City Florida CondoTel Mortgage Lenders and its successors and assigns. (Sample Available)