GET APPROVED WHILE IN A CHAPTER 13 BANKRUPTCY –

Alabama FHA mortgage applicants can qualify to purchase or refinance while in a chapter 13 bankruptcy under certain conditions. Check Alabama FHA mortgage credit requirements. To refinance or purchase an Alabama home while in a chapter 13 bankruptcy FHA mortgage applicants will need a minimum credit score of 580.

Alabama FHA mortgage applicants can qualify to purchase or refinance while in a chapter 13 bankruptcy under certain conditions. Check Alabama FHA mortgage credit requirements. To refinance or purchase an Alabama home while in a chapter 13 bankruptcy FHA mortgage applicants will need a minimum credit score of 580.

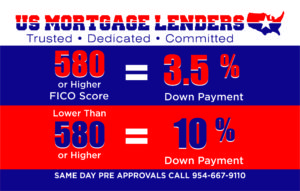

FHA mortgage applicants seeking to purchase an Alabama home will need a minimum 580 to qualify for a 3.5% down payment. The down payment funds can be a gift from a family member. In addition, FHA will allow the home seller to credit the buyer up to 6% of the sales price to cover your closing cost. Most Alabama FHA mortgage applicants with a credit score below a 620 will need to provide 12 months of rental history or reserves, 6 months of future payments in their account at closing.

- Alabama MORTGAGE AFTER BANKRUPTCY OR FORECLOSURE =OK

- Alabama Mortgage 1 day after Bankruptcy or Foreclosure Approvals!

- 3.5% DOWN BAD CREDIT Alabama MORTGAGE LENDERS

- Alabama mortgage approved in a chapter 13 bankruptcy

- Alabama Mortgage Approvals After Foreclosure, Bankruptcy=YES!!

- Alabama Jumbo Bad Credit Mortgage Lenders!

- BAD CREDIT Alabama MORTGAGE LENDERS Archive

BUY OR REFINANCE A Alabama HOME WHILE IN CHAPTER 13

AFTER 12 MONTHS TIMELY PAYMENT HISTORY.

For FHA mortgage applicants with credit scores below 580, FHA now requires a 10% down payment. All the buyers down payment, closing and reserves must be sourced from acceptable sources.

- For the FHA chapter 13 bankruptcy exception. Alabama FHA mortgage lenders will consider approving mortgage applicants who are currently paying on a Chapter 13 Bankruptcy if the borrower can verify timely payments for a full 12 months. Chapter 13 bankruptcy mortgage applicants must get the court trustee’s written approval. Furthermore, FHA applicants must provide full explanation about the chapter 13 bankruptcy; explain why chapter 13 will not happen again.

- FHA bankruptcy minimum credit score rules. To FHA mortgage refinance your Alabama mortgage you need a minimum credit score of 530.

FHA mortgage applicants with a credit score above 580 can FHA refinance up to a 97.5% loan-to-value on a rate and term refinance. And up to 85% FHA cash out mortgage refinance with a credit score above 580. If you have credit score below 580 under new FHA mortgage guidelines require a maximum loan-to-value of 90% for a rate and term FHA mortgage refinance. And up to 75% cash out FHA refinance with credit score below 580.

Most other Alabama FHA mortgage lenders now require a minimum credit score of 640 in 2012. We still provide Bad Credit FHA mortgage approvals down o 530.

Whether you’re planning to purchase your first home, FHA refinance, lower your monthly payments, buy a second home, consolidate debt or get pre-approved for a mortgage. A perfect credit score is not needed for an FHA home loan approval.

In fact, even if you have had bad credit problems, such as a bankruptcy or foreclosures, it’s a lot easier for you to qualify for an FHA mortgage loan than a for a conventional loan. Credit scores down to 530 are accepted if there are compensating factors that offset the credit risk.

BAD CREDIT Alabama MORTGAGE LENDERS PROGRAMS INCLUDE:

- Alabama Bad Credit Bank Statment Only Mortgage Lenders!

- Bad Credit Mortgage After Foreclosure – Short Sale – Bankruptcy- Foreclosure

- Bad Credit Alabama mortgage

- Bad Credit Alabama Mortgage Refinance

- Bad Credit Alabama Portfolio Lenders

- Buy a Alabama home 1 day aftter a Foreclosure or Bankruptcy

- Bad Credit Alabama FHA Mortgage Lenders

- No Credit score Alabama mortgage

- Bad Credit Alabama FHA mortgage

- Hard Money Alabama mortgage

- Bad Credit Alabama Modular Home Loans

- Alabama Chapter 13 Bankruptcy Mortgage Lenders

- Bad Credit 2nd Second Alabama Mortgage

- Alabama Stop Foreclosure Loans

- Bad Credit Alabama VA mortgage

- Bad Credit Alabama Cash For Deed

- Bad Credit Alabama Mortgage Rates Sheet

- Bad Credit Alabama Mortgage with Judgements

- Bad Credit Alabama Mortgage with Evictions

- Bad Credit Alabama Mortgage With Tax Liens

- ALL SITUATIONS ARE WELCOME!!!

Alabama Bad Credit FHA, VA, Bank Statement Only Mortgage Lenders

Many Bad Credit Alabama mortgage applicants don’t realize these Government guaranteed low-interest rate FHA, VA mortgage loans can help home buyers …

3.5% BAD CREDIT ALABAMA MORTGAGE LENDERS

3.5% DOWN BAD CREDIT ALL ALABAMA MORTGAGE LENDERS- … Alabama Bad Credit FHA / VA Mortgage Lenders- Bad credit lenders exclude … https://

3.5%DOWN+ BAD CREDIT ALABAMA MORTGAGE LENDERS

Alabama Bad Credit home loans are available for residents in Alabama. At FHA mortgage programs.com we go the extra mile to help find secure an Alabama …

bad credit Alabama FHA mortgage guidelines – FHA mortgage lenders

Alabama BAD CREDIT JUMBO MORTGAGE LENDERS. … Please note Bad Credit Alabama FHA loan guidelines are a moving target and are subject to …. https://www.fhamortgageprograms.com/500-fico-florida-bad–credit-jumbo-

ALABAMA BAD CREDIT JUMBO MORTGAGE LENDERS

Our bad credit and jumbo bank statment only Alabama mortgage lenders offer a full range of the bestBad Credit Jumbo Lenders Mortgage Programs including …

alabama bad credit mortgage lenders – FHA mortgage lender

Alabama Bad Credit Mortgage Lenders are available for residents in Alabama. At FHA mortgage programs.com we go the extra mile to help find secure a …

BAD CREDIT ALABAMA MORTGAGE LENDERS Archives – FHA …

BAD CREDIT ALABAMA MORTGAGE LENDERS Getting an Alabama Mortgage … At FHA mortgage programs.com we go the extra mile to help find secure an …

Bad Credit Florida Mortgage Lenders- Min 500 FICO

Getting a Florida Mortgage with bad credit isn’t as easy as it was a year or two ago. However, it isn’t as impossible as some news reports make it seem.

3.5% Down Alabama FHA Mortgage Lenders Min 580 FICO!!

BAD CREDIT ALABAMA with minimum 500 FICO credit score with 10% Down Payment FHA. For FHA mortgage applicants with credit scores between 500 and

3.5% Alabama FHA Mortgage Lenders Min 580 FICO!!

3.5% Alabama FHA Mortgage Lenders Min 580 FICO!! Same Day FHA, VA, Bad Credit AlabamaMortgage Loans Pre Approvals Call Now 954-667-9110.