Alabama FHA Mortgage Lenders- Alabama FHA Home Loans!

ALABAMA FHA MORTGAGE QUESTIONS AND ANSWERS!

- Do FHA Mortgage Lenders require that collections be paid off to qualify for an FHA mortgage?

- How can i qualify for a mortgage with late payments on my credit report?

- What are the FHA mortgage payment history requirements to FHA Streamline Refinance?

- Do FHA mortgage lenders require a social security number to obtain an FHA loan?

- What are the maximum debt to income qualifying ratio requirements for FHA loans?

- BAD CREDIT Whats the minimum credit score for bad credit mortgage approval?

- Whats the Maximum Debt To Income Ratio For An FHA Mortgage?

- What is an manually underwrite for mortgage qualifying?

- Do Mortgage Lenders require repossessions to be paid off Mortgage Qualifying?

- What debts are not considered when qualifying for a mortgage?

- Are FHA mortgage loan amounts restricted when the purchase involves a Family member?

- Get Approved For A Mortgage With Collection Accounts!

- How To Qualify For FHA/VA Mortgage After 12 months After Bankruptcy!

- Can someone have more than one FHA loan at a time?

- I Need A FHA Mortgage Lender. Why Should I Do Business With You?

- How can FHA Mortgage Lenders help me buy a home?

- How are Tax Liens considered for FHA financing when manually underwriting a mortgage?

- What are the basic requirements for FHA mortgage loan?

- What Is A Broker? Should I Use A Mortgage Broker?

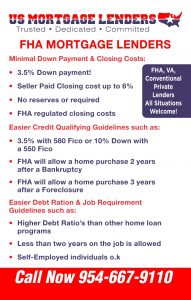

- Lower down payments (if any)

- Lower closing costs

- Easier credit qualifying

- Same Day Pre Approvals!

- Down payment only 3.5% of the purchase price.

- Gifts from family or FHA Grants for down payment assistance and closing costs OK!

- Sellers can credit the buyer’s up to 6% of sales price towards buyers costs and pre-paid.

- No reserves or future payments in account required.

- FHA regulated closing costs.

- Read more about buying a home with an FHA mortgage Bad Credit –No Credit – Investment –Second Home –Multi Family –

Alabama FHA MORTGAGE LOANS ARE EASIER BECAUSE:

- 12 months after a chapter 13 Bankruptcy FHA mortgage Lender approvals!

- 24 months after a chapter 7 Bankruptcy FHA mortgage Lender approvals!

- 3 years after a Foreclosure FHA mortgage Lender approvals!

- No Credit Score FHA mortgage Lender approvals!

- 580 required for 96.5% financing or 3.5% down payment FHA mortgage Lender approvals.

- 500 required for 90% financing or 10% down payment FHA mortgage Lender approvals.

- BAD CREDIT GEORGIA with minimum 500 FICO credit score with 10% Down Payment FHA. For FHA mortgage applicants with credit scores between 500 and 579 must make down payments of at least 10% down!

- Read more about FHA Qualifying Qualification Summary – Manual Underwrite – Collections-Judgement’s – Bankruptcy or Foreclosure – Compensating Factors –

Alabama FHA MORTGAGE DEBT TO INCOME & EASIER JOB QUALIFYING

- FHA allows higher debt ratio’s than any conventional mortgage loan programs.

- Less than two years on the same job is OK!

- Self-employed buyers can also qualify with FHA Mortgage Lenders.

- Read More about Gifts For Down Payment – Documents Checklist – Debt To Income – Student Loans –

Whether you’re a first time Georgia home buyer, moving to a new home, or want to FHA refinance your existing conventional or Florida mortgage, we will show you how to purchase or refinance a home with flexible guidelines. Good Credit – Bad Credit – No Credit + No Problem + We work with everyone towards home ownership!

Alabama FHA MORTGAGE TOPICS OF INTEREST

When you decide to apply for a Alabama FHA mortgage you need to know you’re dealing with experienced full-time mortgage lending professionals who know GA real estate. We offer a huge assortment of Alabama FHA, VA, Conventional & Private Alabama mortgage programs built around Georgia home buyers and homeowners.

Whether you’re buying a first Alabama home using our great FHA mortgage program or refinancing a home you already own using traditional FHA mortgage financing, nothing helps more than having a seasoned Alabama FHA mortgage lender working hard answer all your Florida FHA mortgage questions!

Alabama Home Buyer Initial Questions

- What is the minimum down payment for FHA Mortgage? Currently, 3.5% can from family gift or grant.

- Can my parents or other relatives give me money? Yes, provided the money is considered a gift and your relative sign and date the proper gift letter documentation.

- Is there a maximum FHA Mortgage Loan Amount? Yes, see maximum loan limits below based on the Georgia county.

- What is an FHA Mortgage loan? The FHA is a division of the Department of (HUD) Housing and Urban Development. An FHA mortgage loan is a mortgage that is insured by the Federal Housing Administration (FHA) and funded by private Georgia FHA approved mortgage lenders.

- Are FHA mortgage for Georgia first time home buyers only? NO, FHA mortgage loans are NOT only for Georgia first–time buyers only. FHA loans can be used by first time buyers and repeat buyers alike. The FHA mortgage is often marketed as a product for “first–time buyers” because of its low down payment and flexible qualifying requirements. FHA mortgage applicants can purchase an FHA approved investment property using and FHA mortgage loan.

- How Does The FHA Mortgage Insurance Work? Anyone who takes out an FHA mortgage finances the insurance into the FHA mortgage loan amount. This “Up Front Mortgage Insurance ” cost is called the “UFMIP”. The upfront mortgage insurance premium paid on all FHA mortgages is paid to the government and use the funding fee money to reimburse Georgia FHA Mortgage lenders who were forced to foreclose on mortgages that were financed to bad credit mortgage applicants. Think of the funding fee as the foreclosure “insurance fund” for the FHA Georgia Mortgage Lenders. In addition to the upfront funding fee, the borrower is also required to pay a small monthly fee to the FHA as part of their monthly mortgage payment. The monthly fee is called monthly MIP or mortgage insurance premium.

- Do I have to be a Georgia first time mortgage buyer to use the FHA mortgage? No you do not have to be a first time Georgia home buyer but the FHA mortgage is only for a Primary Georgia home purchase only.

- Can I roll all the closing costs into the FHA mortgage? You are permitted to finance the upfront FHA funding fee only. FHA mortgage closing costs can be paid by the seller up to 6% and must be negotiated up front in your purchase and sale agreement.

- Can I get an FHA Mortgage after a Foreclosure or Bankruptcy? YES! you can qualify for an FHA mortgage 3 years after the title was transferred out of your name.A borrower may also still qualify for an FHA insured loan after declaring Chapter 13 bankruptcy, if at least 1 year of the bankruptcy payout period has passed and the borrower has been making satisfactory payments. In these cases, the FHA mortgage applicant must also request permission from the court to enter into a new FHA mortgage loan. declaring Chapter 7 bankruptcy, if at least 2 years have passed since the bankruptcy discharge date. FHA mortgage applicants must also have re-established good credit or have opted to incur no new debts (this means you specifically chose to take out no new loans, credit cards, etc.)

Alabama FHA Mortgage Programs:

All Alabama Property Types Including:

- Single family Homes

- Town House- check for lot and/or block legal descriptions.

- Villas- check for lot and/or block legal descriptions.

- Modular Homes

- Manufactured homes

- FHA Approved condominium – Search Florida FHA Approved Condos

FHA Mortgage Loans Make It Easier to Buyer A Alabama Home

The FHA mortgage is so popular is because Georgia mortgage applicants use them are able to take advantage of benefits and protections unavailable with any other mortgage loan program. Loans through the FHA are insured by the government, so the Georgia mortgage lenders that approve these loans are more lenient. The advantages are outweigh any other mortgage program and include and include the following:

- Lower Cost & Fees- In addition to lower interest rates, FHA borrowers enjoy lower costs on other fees like closing costs, FHA mortgage insurance and govt regulated closing cost.

- Easier to Qualify- While most mortgage loans prohibit applicants with bad credit history and low credit scores, the FHA mortgage loans available with lower requirements so its easier for you to qualify.

- Lowest Interest Rates- You’ve heard the horror stories of subprime borrowers who couldn’t keep up with their mortgage interest rates. Well, FHA loans usually offer lower interest rates to help homeowners afford housing payments.

- Bankruptcy / Foreclosure- Even If you’ve filed for bankruptcy or suffered a foreclosure in the past few years doesn’t mean you’re excluded from qualifying for an FHA loan. As long as you meet other requirements that satisfy the FHA, such as re-establishment of good credit, solid payment history, etc., you can still qualify.

- No Credit Score/ No Trade Lines OK! – The FHA usually requires two lines of credit for qualifying applicants. If you don’t have a sufficient credit history, you can try to qualify through a substitute form.

For many Georgia FHA mortgage applicants, using an FHA mortgage can really make the difference between owning your dream house affordability and getting out of the never ending rental trap. The FHA mortgage provides a wealth of benefits for Georgia mortgage applicants that qualify, so please make full use of them.

- We provide free credit counseling to and work with everyone to get PRE APPROVED!

Can a real estate agent gift me their commission for the FHA mortgage down payment?

Are copies of tax returns required for an FHA mortgage for a borrower with self-employment or commission income?

How are disputed credit accounts considered for manually FHA mortgage approvals?

How can FHA help me qualify for a mortgage?

What are the basic requirements for FHA mortgage loan?

What’s the Minimum Credit Score required for FHA mortgage approval?

What Is The Importance Of Credit When You Apply For An FHA Loan?

I Heard The FHA Loan Is Only For 1st Time Buyers, Is That True?

My Mortgage Company Says I Should Not Consider The FHA Program. Why Should I Listen To You And Not Them?

I Want To Improve My Mortgage Term. Can I Refinance My FHA Loan Now?

How Soon Can I Refinance To A New Home Loan?

How Often Can I Refinance My Home?

How Can I Refinance My Home When I Have Credit Problems?

Where Can I Refinance My Home If I’m Late On My Mortgage?

Am I eligible for FHA mortgage loan if i have no credit score?

Do deferred student loan obligations be included in the FHA mortgage applicants liabilities?

Do FHA mortgage loans allow gifts of equity?

Does FHA require collections to be paid off for a FHA mortgage approval?

How do FHA Mortgage Lenders determine the monthly payment on a student loan?

What are the FHA guidelines for FHA mortgage applicants with a previous foreclosure or deed-in-lieu of foreclosure?

POPULAR ALAMBAMA PAGES INCLUDE

3.5% Alabama FHA Mortgage Lenders Min 580 FICO!!

3.5% Alabama FHA Mortgage Lenders Min 580 FICO!! Same Day FHA, VA, Bad Credit Alabama Mortgage Loans Pre Approvals Call Now 954-667-9110.

Alabama – FHA MORTGAGE LENDERS

Alabama Cities by Population List, City, Population. 1, Birmingham, 212,157. 2, Montgomery, 200,022. 3, Huntsville, 193,079. 4, Mobile, 192,904. 5, Tuscaloosa

3.5% Down Alabama FHA Mortgage Lenders Min 580 FICO!!

3.5% Georgia FHA Mortgage Lenders Min 580 FICO!! Same Day FHA, VA, Bad Credit GeorgiaMortgage Loans Pre Approvals Call Now 954-667-9110.

3.5% Alabama FHA,VA, Bank Statement Only Mortgage Lenders

VILLA ALABAMA FHA MORTGAGE LENDERS– This FHA loan program was …. ://www.fhamortgageprograms.com/alabama-stated-income-mortgage–lenders/.

Birmingham Alabama FHA Mortgage Lenders

Birmingham, AL FHA Mortgage Lenders– Serving ALL Alabama -CALL NOW! … VILLA ALABAMA FHA MORTGAGE LENDERS– This FHA loan program was …. ://www.fhamortgageprograms.com/alabama-stated-income-mortgage–lenders/.

Tag: Alabama FHA Mortgage Lenders

Alabama FHA Mortgage Lenders– Alabama FHA Home Loans! SAME DAY APPROVALSFHA loanshave been helping Alabama residents since 1934.

6 alabama stated income mortgage lenders programs – fha mortgage …

ALABAMA STATED MORTGAGE LENDERS SUMMARY! No tax returns required.

Alabama Mortgage Lenders Archives – FHA MORTGAGE LENDERS

Alabama BAD CREDIT JUMBO MORTGAGE LENDERS Our bad credit and jumbo bank … Alabama FHA Mortgage Lenders – Bad Credit – No Credit OK! bad credit … At FHA mortgage programs.comwe go the extra mile to help find secure an …

bad credit Alabama FHA mortgage guidelines – FHA mortgage lenders

Alabama BAD CREDIT JUMBO MORTGAGE LENDERS. … Please note Bad Credit Alabama FHA loan guidelines are a moving target and are subject … https

10%down -alabama stated income mortgage lenders – FHA mortgage …

Bank Statements Only Alabama Mortgage Lenders have a LOWER Minimum Score and … ASSET ASSIST ALABAMA MORTGAGE LENDERS LOAN PROGRAM … https://www.fhamortgageprograms.com/6-Alabama-stated-income-

Alabama Cities by Population

1 Birmingham Alabama 212,157

2 Montgomery 200,022

3 Huntsville 193,079

4 Mobile 192,904

5 Tuscaloosa 99,543

6 Hoover Alabama 84,978

7 Dothan 68,468

8 Auburn 63,118

9 Decatur 55,072

10 Madison 47,959

11 Florence Alabama 39,959

12 Phenix City 37,132

13 Gadsden 35,837

14 Prattville 35,606

15 Vestavia Hills 34,688

16 Alabaster 32,948

17 Opelika 29,869

18 Enterprise 28,024

19 Bessemer 26,511

20 Daphne 25,913

21 Homewood 25,613

22 Athens 25,393

23 Northport 25,045

24 Pelham 23,050

25 Prichard 22,185

26 Anniston 22,112

27 Albertville Alabama 21,525

28 Trussville 21,422

29 Oxford 21,120

30 Mountain Brook 20,590

31 Fairhope 19,421

32 Troy 19,191

33 Selma 18,983

34 Helena 18,673

35 Tillmans Corner 18,620

36 Foley 17,607

37 Center Point 16,496

38 Hueytown 15,561

39 Cullman 15,496

40 Talladega 15,451

41 Millbrook 15,413

42 Alexander City 14,773

43 Scottsboro Alabama 14,677

44 Ozark 14,610

45 Hartselle 14,471

46 Fort Payne 14,099

47 Jasper 14,003

48 Saraland 13,942

49 Muscle Shoals 13,831

50 Pell City 13,794

51 Gardendale 13,783

52 Calera 13,489

53 Moody 12,823

54 Jacksonville 12,657

55 Sylacauga 12,540

56 Eufaula 12,404

57 Irondale 12,359

58 Chelsea 12,341

59 Leeds 11,940

60 Gulf Shores 11,689

61 Fairfield 10,807

62 Saks 10,777

63 Pleasant Grove 10,177

64 Atmore 10,022

65 Russellville 9,815

66 Boaz 9,710

67 Forestdale 9,679

68 Clay 9,587

69 Rainbow City 9,531

70 Valley 9,377

71 Bay Minette 9,312

72 Fultondale 9,084

73 Sheffield Alabama 9,025

74 Andalusia 8,968

75 Clanton 8,846

76 Pike Road 8,777

77 Tuskegee 8,722

78 Southside 8,600

79 Meadowbrook 8,534

80 Guntersville 8,437

81 Tuscumbia 8,434

82 Arab 8,340

83 Spanish Fort 8,327

84 Wetumpka 8,219

85 Greenville 7,781

86 Pinson 7,426

87 Demopolis 7,019

88 Hamilton 6,739

89 Montevallo 6,723

90 Oneonta 6,699

91 Brook Highland 6,604

92 Opp 6,586

93 Meridianville 6,568

94 Moores Mill 6,493

95 Lincoln 6,491

96 Lanett 6,393

97 Tarrant 6,268

98 Theodore 6,221

99 Satsuma 6,193

100 Monroeville 6,072

101 Robertsdale 5,990

102 Roanoke 5,984

103 Orange Beach 5,981

104 Chickasaw 5,908

105 Attalla 5,865

106 Brewton 5,432

107 Smiths Station 5,341

108 Midfield 5,171

109 Glencoe 5,135

110 Daleville 5,101

111 Harvest 5,080

112 Rainsville 5,015

113 Childersburg 4,997

114 Brent 4,919

115 Jackson 4,907

116 Grayson Valley 4,872

117 Highland Lakes 4,860

118 Tallassee 4,759

119 Headland 4,741

120 Fort Rucker 4,681

121 Piedmont 4,666

122 Margaret 4,633

123 Columbiana Alabama 4,539

124 Winfield 4,531

125 Fayette 4,432

126 Geneva 4,424

127 Adamsville 4,360

128 Hokes Bluff 4,277

129 Holtville 4,271

130 Springville 4,251

131 Mount Olive CDP 4,237

132 Argo 4,213

133 Semmes 4,155

134 Redland 4,112

135 Haleyville 4,074

136 Thomasville 4,002

137 Alexandria 3,980

138 Pine Level 3,918

139 Elba 3,893

140 Citronelle 3,885

141 Grand Bay 3,841

142 Union Springs 3,749

143 Odenville 3,743

144 Valley Grande 3,741

145 Holt 3,728

146 Underwood-Petersville 3,723

147 Evergreen 3,693

148 Centre 3,555

149 West End-Cobb Town 3,550

150 Cottondale 3,546

151 Heflin 3,474

152 Livingston 3,454

153 Marion 3,432

154 Moulton 3,343

155 Priceville 3,297

156 Hanceville 3,288

157 Warrior 3,192

158 Hazel Green 3,188

159 Emerald Mountain 3,134

160 Dadeville 3,128

161 Red Bay 3,119

162 Weaver 3,076

163 Ladonia 3,036

164 La Fayette 2,968

165 Kimberly 2,964

166 Clayton 2,904

167 Brighton 2,833

168 Luverne 2,825

169 New Hope 2,803

170 Eutaw 2,749

171 Centreville 2,708

172 Choccolocco 2,663

173 Carlisle-Rockledge 2,646

174 Hartford 2,638

175 Jemison 2,616

176 Abbeville 2,603

177 Smoke Rise 2,556

178 Indian Springs Village 2,544

179 Bayou La Batre 2,513

180 Moundville 2,436

181 East Brewton 2,415

182 Sumiton 2,407

183 Taylor 2,393

184 Uniontown 2,388

185 York 2,373

186 Midland City 2,366

187 Greensboro 2,365

188 Aliceville 2,357

189 Henagar 2,339

190 Bridgeport 2,337

191 Selmont-West Selmont 2,335

192 Riverside Alabama 2,316

193 Lineville 2,306

194 Guin 2,305

195 Whitesboro 2,290

196 Good Hope 2,288

197 Ashville 2,275

198 Point Clear 2,272

199 Huguley 2,257

200 Lake View 2,247

201 Kinsey 2,187

202 Trinity 2,164

203 Ashford 2,149

204 Lipscomb 2,133

205 Vincent 2,118

206 Graysville 2,107

207 Thorsby 2,052

208 Loxley 2,017

209 Cordova 2,014

210 Level Plains 2,006

211 Cowarts 1,994

212 Marbury 1,989

213 Linden 1,988

214 Wilsonville 1,987

215 Stevenson 1,977

216 Brundidge 1,972

217 Ashland 1,971

218 Carbon Hill 1,964

219 Collinsville 1,963

220 Creola 1,961

221 Slocomb 1,956

222 Florala 1,952

223 Dora 1,946

224 Morris 1,933

225 Camden 1,919

226 Samson 1,912

227 Vernon 1,896

228 Owens Cross Roads 1,852

229 Sylvania 1,850

230 Sulligent 1,849

231 Crossville 1,841

232 Concord 1,837

233 Brookwood 1,827

234 Coats Bend 1,811

235 Cedar Bluff 1,790

236 Butler 1,773

237 Sardis City 1,771

238 Stewartville 1,765

239 Ballplay 1,748

240 Ragland 1,697

241 Blountsville 1,694

242 Harpersville 1,680

243 Elberta 1,679

244 Gordo 1,672

245 Georgiana 1,653

246 Coaling 1,642

247 Reform 1,616

248 Redstone Arsenal 1,584

249 Woodstock 1,569

250 Westover 1,542

251 Stapleton 1,538

252 Lookout Mountain 1,513

253 Mount Vernon 1,510

254 Sylvan Springs 1,509

255 Vance 1,501

256 Rehobeth 1,482

257 Grove Hill 1,478

258 Hackleburg 1,477

259 Clio 1,470

260 Newton 1,459

261 Shoal Creek 1,448

262 Fayetteville and Malvern 1,437

263 Rock Creek 1,430

264 Blue Ridge 1,414

265 Flomaton 1,408

266 Webb 1,396

267 Ardmore 1,382

268 Shelby 1,374

269 Hayden 1,338

270 Goodwater 1,324

271 Brookside 1,323

272 Cleveland 1,313

273 Elmore 1,307

274 Lillian 1,298

275 Phil Campbell Alabama 1,273

276 Tidmore Bend 1,266

277 West Blocton 1,263

278 Dauphin Island 1,261

279 Falkville 1,260

280 Cottonwood 1,255

281 Munford 1,249

282 Coosada and Summerdale 1,244

283 Chatom 1,231

284 Fort Deposit 1,228

285 Rogersville 1,220

286 Frisco City 1,212

287 New Market 1,201

288 Locust Fork 1,192

289 Deatsville and New Brockton 1,157

290 Minor 1,140

291 Ohatchee and New Union 1,138

292 Brantleyville 1,110

293 Berry 1,099

294 Steele 1,086

295 Town Creek 1,069

296 Dunnavant 1,063

297 Double Springs Alabama 1,051

298 Bear Creek 1,041

299 Mignon 1,032

300 Eclectic 1,026

301 Fyffe 1,017

302 Cherokee 1,009

303 Leesburg 1,008

304 Millport 999

305 Axis 992

306 Coker 985

307 Littleville 981

308 Carrollton 980

309 Killen 977

310 Camp Hill 975

311 Hollywood 970

312 Parrish 960

313 Powell and Vandiver 954

314 Mosses 945

315 Altoona 919

316 White Plains 915

317 Pine Hill 912

318 Grant 907

319 Edgewater 899

320 Geraldine 898

321 Gallant 896

322 Egypt 885

323 Brilliant 879

324 Sterrett 865

325 Autaugaville 854

326 Hayneville 853

327 Notasulga 850

328 Snead 841

329 Hollins 834

330 Skyline 833

331 Mulga 822

332 Holly Pond 815

333 Wedowee 806

334 White Hall 804

335 Silverhill and Magnolia Springs 802

336 Jacksons’ Gap and Brantley 801

337 Gurley 786

338 Hollis Crossroads 774

339 Susan Moore 769

340 Douglas and Hobson City 761

341 South Vinemont and Ivalee 758

342 Section, New Site, Hissop, and Oakman 754

343 Ariton 741

344 Addison 738

345 Wadley 737

346 Woodville 730

347 Columbia 729

348 Lexington 718

349 Somerville 712

350 Ider and Calvert 711

351 Pisgah and Leighton 707

352 Maplesville 703

353 Leroy 700

354 Stockton 687

355 Wilton 682

356 Walnut Grove and Bellamy 681

357 Perdido 669

358 Excel 665

359 Bon Secour 650

360 Belle Fontaine 649

361 Perdido Beach 641

362 Lynn 638

363 Reece City 628

364 Pinckard, Trafford, Baileyton, and Allgood 627

365 North Courtland 614

366 Dodge City 606

367 Babbie 600

368 Courtland 599

369 Forkland 597

370 West Point 596

371 Hurtsboro 593

372 St. Florian 591

373 Pickensville 574

374 Clayhatchee 573

375 Rock Mills 558

376 Sand Rock 555

377 Castleberry 551

378 Valley Head 550

379 Grimes 542

380 Kinston 539

381 Triana 529

382 River Falls 523

383 Millry 522

384 Hillsboro 521

385 McDonald Chapel 519

386 Newville 517

387 Lockhart 514

388 Oak Grove 511

389 Eva and McKenzie 508

390 Avon 505

391 Lisman and Garden City 498

392 Glen Allen 492

393 Red Level and Hammondville 485

394 Louisville 477

395 Midway 476

396 Bristow Cove 475

397 Elkmont 469

398 Joppa 467

399 Fairview and Rutledge 458

400 Our Town 447

401 Rockford 444

402 Kennedy 429

403 Shorter 427

404 Silas 426

405 Highland Lake 425

406 Sipsey 424

407 Pleasant Groves and Ray 411

408 Ranburne 407

409 Fredonia 392

410 Thomaston 391

411 Twin 387

412 St. Stephens 382

413 Maytown 371

414 Mentone 366

415 Reeltown 363

416 Eunola 362

417 Vina 356

418 Arley 350

419 Hytop 346

420 Nectar, Napier Field, and Vinegar Bend 344

421 Madrid and Hackneyville 338

422 Akron and Coffeeville 334

423 Dozier and West Jefferson 331

424 Gordon 327

425 Nances Creek 321

426 Rosa 318

427 Cuba 317

428 Weogufka 315

429 Dutton 308

430 Boligee 306

431 Gordonville and Morrison Crossroads 302

432 Malcolm 300

433 Carolina 296

434 Vredenburgh 293

435 Hodges 284

436 Beatrice 283

437 Pine Ridge 282

438 Fruithurst 280

439 Millerville 277

440 Waldo and Anderson 276

441 Mount Olive 275

442 Colony and Shiloh 274

443 Repton 266

444 Langston 264

445 Bakerhill 261

446 County Line and Delta 260

447 Fulton 258

448 Goshen and Heath 255

449 Boykin 247

450 Sanford 245

451 Sweet Water and Gulfcrest 242

452 Graham 232

453 Horn Hill, Detroit, and Coffee Springs 227

454 McIntosh 225

455 Fruitdale, Gantt, and Union 221

456 Uriah 220

457 Kansas 219

458 Nauvoo 211

459 Providence 210

460 Peterman and Daviston 209

461 Belk, Black, and Pennington 207

462 Paint Rock 205

463 Gilbertown 203

464 Edwardsville 202

465 Loachapoka 199

466 Waterloo 198

467 Kellyton 197

468 Gainesville 195

469 Deer Park and Chunchula 192

470 Glenwood 188

471 Beaverton 187

472 Orrville 186

473 Woodland and Onycha 183

474 Riverview 182

475 Epes 181

476 Newbern 178

477 Yellow Bluff 176

478 Banks 173

479 Penton 172

480 Gu-Win 170

481 Talladega Springs 162

482 Geiger 159

483 Macedonia 155

484 Spruce Pine 152

485 Abanda 151

486 Waverly 148

487 Lakeview and Gaylesville 143

488 Billingsley and North Johns 141

489 Five Points and Hobson 140

490 Pollard 135

491 East Point 133

492 Franklin 132

493 Toxey 129

494 Eldridge 127

495 Pine Apple 125

496 Cusseta 123

497 Lester, Myrtlewood, and Broomtown 122

498 Spring Garden 120

499 Cullomburg 116

500 Libertyville 114

501 Bon Air 113

502 Movico 111

503 Putnam and Lowndesboro 107

504 Ridgeville 105

505 Haleburg 101

506 Faunsdale 92

507 Blue Springs 91

508 Hatton 90

509 Needham 89

510 Fairford 88

511 Belgreen 82

512 Union Grove 79

513 Ethelsville and Sims Chapel 73

514 Standing Rock 71

515 Fitzpatrick 70

516 Megargel 63

517 Mooresville and Petrey 58

518 Cardiff 54

519 Goldville 53

520 Bucks 51

521 Emelle 50

522 Dayton 49

523 Rockville 48

524 Benton 46

525 Nanafalia 41

526 Natural Bridge 36

527 Memphis 28

528 Tibbie 26

529 Oak Hill 25

530 Carlton 24

531 Whatley 23

532 Catherine 17

533 McMullen 9

534 Panola 5