Palm beach Florida Bank Statement Mortgage Lenders –No Tax Return Palm Beach Florida Mortgage Lenders

NO TAX RETURN PALM BEACH FLORIDA MORTGAGE LENDERS

- Palm Beach Florida-Bad Credit Bank Statement Only Jumbo Mortgage Lenders

- Palm Beach Florida No Income Verification Mortgage Lenders

- NO INCOME VERIFICATION Palm Beach FLORIDA MORTGAGE LENDERS

- NO TAX RETURNS Palm Beach FLORIDA MORTGAGE LENDERS

- NO INCOME VERIFICATION COMMERCIAL Palm Beach FLORIDA MORTGAGE LENDERS

10% DOWN PALM BEACH STATED INCOME Palm Beach Florida MORTGAGE LENDERS-

- STATED FL Palm Beach Florida MORTGAGE LENDERS- STATED FL HOME LOANS

- Stated Income FL Stated Investor Loans

- FL Stated Income 10% Down using Palm Beach Bank Statements as Income

10%DOWN + SELF EMPLOYED FLORIDA MORTGAGE LENDERS

10%DOWN + SELF EMPLOYED FLORIDA MORTGAGE LENDERS Palm Beach Bank Statement Only borrowers that can document their income by providing the following:

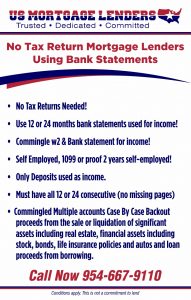

Palm Beach Bank Statement Only borrowers that can document their income by providing the following:

- Palm Beach Bank Statement Lenders Worksheet

- Palm Beach Bank Statement Lenders 24 Month Profit and Loss Statement Request

- NO TAX RETURNS NEEDED!!!

https://www.Palm Beach Florida -mortgage-lenders.com

QUALIFY USING Palm Beach Bank Statement ONLY

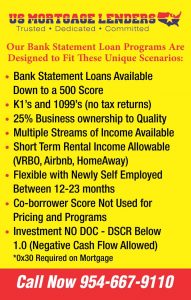

Self-Employed Mortgage Lenders Program Highlights Summary

25% DOWN STATED FL Stated Income Palm Beach Florida INVESTOR LOANS!

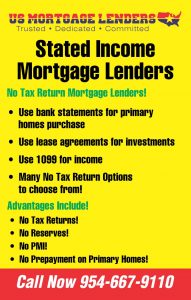

STATED INCOME FL Stated Income Palm Beach Florida MORTGAGE PROGRAMS

FL Stated Income Palm Beach Florida mortgage lenders offer three stated Documentation Programs:

1.Full Documentation (“Full Doc”)

2. Alternative Income (“Alt Doc Palm Beach Bank Statements”) for Owner Occupied properties

3.Alternative Documentation (“Alt-Doc Cash FL Stated Income ow”) for Non-Owner Occupied or Second Home properties and Business Loan requests.

The below information is a summary of the minimum FL Stated Income Palm Beach Florida stated loandocumentation requirements for each Income Documentation Program. For additional documentation requirements, refer to the Income Doc Charts in this section of the Guide.

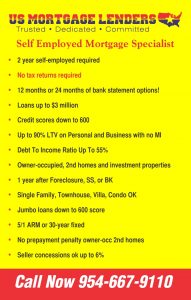

Self-employed ONLY

(Must be able to verify self-employment income)

1. Last twenty-four (24) months personal or business Palm Beach Bank Statements with all pages required for all months.

2. Stated FL Stated Income Palm Beach Florida Borrower Income is determined by using the gross monthly amount of deposits with a deduction of any itemized debts or other expenses that are verified by a tri-bureau merged credit report.

3. Max six (6) NSF checks in the last twelve (12) months.

4. Acceptable documentation supporting the existence of the business for the most recent two (2) years must be obtained. (Refer to the Acceptable Evidence of Self-employed Business).

FULL DOC / WAGE EARNER

1. VOE completed in full by employer verifying most recent two (2) years (Verbal verification of VOE required) and current year-to-date earnings on a current pay stub OR

2. W-2 for most recent two (2) years & current pay stub reFL Stated Income acting year-to-date earnings OR

3. Signed 1040’s for most recent two (2) years & current pay stub reFL Stated Income acting year-to-date earnings

Fixed & Other Sources

Current award/retirement letter; AND

Copy of the most recent Palm Beach Bank Statement showing automatic deposit (deposit must specifically reference the source of the deposit); OR

1099 for most recent year

Self-employed

Acceptable documentation supporting the existence of the business (“Refer to the Acceptable Evidence of Self-employed Business”)AND

Verification of income covering the most recent two (2) years and year-to-date earnings with signed 1040’s as well as other applicable supporting documentation (i.e. 1120’s, K-1s etc.)

100% Commission / Bonus

Verbal VOE, to confirm borrower’s employment and commission/bonus AND

Signed 1040’s for most recent two (2) years with current pay stub reFL Stated Income acting year-to-date earnings (if not pay stub no applicable, obtain Palm Beach Bank Statements covering year-to-date)

Salaried + > 25% Commission / Bonus

· Signed 1040’s for most recent two (2) years AND current pay stub reFL Stated Income acting year-to-date earnings (pay stub must reFL Stated Income ect salaried wage + commission/bonus)

- Boca Raton, FL

- Boynton Beach, FL

- Coconut Creek, FL

- Coral Springs, FL

- Deerfield Beach, FL

- Delray Beach, FL

- Greenacres, FL

- Hobe Sound, FL

- Jupiter, FL

- Lake Worth, FL

- Loxahatchee, FL

- Margate, FL

- North Palm Beach, FL

- Palm Beach Gardens, FL

- Palm City, FL

- Pompano Beach, FL

- Royal Palm Beach, FL

- Stuart, FL

- Wellington, FL

- West Palm Beach, FL

-STATED FL Stated Income Palm Beach Florida MORTGAGE LOANS Explained

If you are self-employed stated FL Stated Income Palm Beach Florida home loan applicant, you already know the benefits that come with making your own decisions and never having to report to a boss. However, there are some disadvantages to generating your own self-employed income when it comes to applying for a stated FL Stated Income Palm Beach Florida home loan.

“There are two main problems that self-employed FL Stated Income Palm Beach Florida borrowers face when qualifying for a FL Stated Income Palm Beach Florida mortgage,” “First, you need to prove their income with tax returns rather than using a ‘stated income’ loan. Second, the recent housing recession has caused declining income for many self-employed business owners. Even if their income has stabilized, the stated FL Stated Income Palm Beach Florida home loan will be based on the average of your last two years of tax returns, which could show reduced income.”

Stated income FL Stated Income Palm Beach Florida home loans were originally designed for self-employed people but were abused by too many FL Stated Income Palm Beach Florida business owners that were buying homes they could not afford.

“Stated FL Stated Income Palm Beach Florida income loans are starting to make a small comeback on the secondary market, but only for FL Stated Income Palm Beach Florida Mortgage applicants with good credit scores of at least 640 or above, a down payment of 25 percent of the sales price or more and at least six months of future cash payment reserves to cover all monthly obligations.

“In the mid-1990s we FL Stated Income Palm Beach Florida stated lenders started using Palm Beach Bank Statements to show cash FL Stated Income ow for self-employed people and was a good way to get a lot of FL Stated Income Palm Beach Florida homebuyers approved for Stated FL Stated Income Palm Beach Florida home loans.

– SELF EMPLOYED BORROWERS INCOME AND TAXES

Self-employed stated FL Stated Income Palm Beach Florida mortgage applicants must complete Internal Revenue Service Form 4506-T, which allows stated FL Stated Income Palm Beach Florida mortgage lenders to request tax transcripts. FL Stated Income Palm Beach Florida stated mortgage lenders are required to wait until the tax returns have been recorded by the IRS and must receive them directly from the IRS to verify legitimate returns.

Many self-employed individuals report expenses on their taxes in order to reduce their tax liability, but this can backfire when they apply for a mortgage.

“Self-employed stated FL Stated Income Palm Beach Florida mortgage applicants people typically report their gross income minus expenses to generate a net income,”. “For tax purposes, it may be beneficial to have net income as low as possible, but the net income is the number used for income qualification.”

For example, a FL Stated Income Palm Beach Florida business owner that claims $100,000 in income and $80,000 in expenses will find it nearly impossible to qualify for a traditional FL Stated Income Palm Beach Florida mortgage. At this point, a self-employed FL Stated Income Palm Beach Florida homebuyers has no other option but to apply using a stated FL Stated Income Palm Beach Florida mortgage lender.

Serving All Florida Palm Beach Cities

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|