Alabama No Tax Return Mortgage Lenders

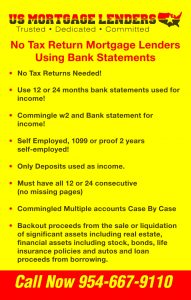

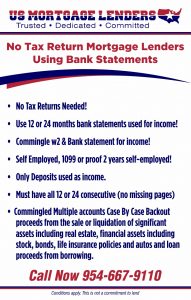

ALABAMA SELF EMPLOYED MORTGAGE LENDERS- NO TAX RETURNS NEEDED! Alabama Bank Statement Mortgage Lenders

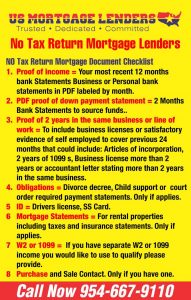

Alabama Bank Statement Mortgage Lenders NO TAX RETURN ALABAMA MORTGAGE LENDERS CHECKLIST

NO TAX RETURN ALABAMA MORTGAGE LENDERS CHECKLIST

- 10% DOWN-ALABAMA SELF EMPLOYED MORTGAGE LENDERS

- 6 ALABAMA STATED INCOME MORTGAGE LENDERS PROGRAMS

- ALABAMA SELF EMPLOYED MORTGAGE LENDERS-WE SAY YES!

- ALABAMA SELF EMPLOYED MORTGAGE LENDERS

ALABAMA SELF EMPLOYED MORTGAGE LENDERS + NO TAX RETURNS NEEDED!

- 2 Years Self Employed Required!

- Bank statement deposits used to qualify!

- No tax returns required

- 12 months personal bank statements or 12 months Business Statements used for income

- Loans up to $3 million

- Credit scores down to 600

- Rates starting in the 5-6% range.

- Up to 90% Loan to Value!

- DTI up to 50% Debt To Income Ratio

- Owner-occupied, 2nd homes, and investment properties

- 2 years seasoning for foreclosure, short sale, BK, DIL

- Non-warrantable condos considered

- Jumbo loans down to 640 score

- 5/1 ARM or 30-year fixed

- No pre-payment penalty for owner-occ and 2nd homes

- SFRs, townhomes, condos, 2-4 units

- Seller concessions to 6% (2% for investment)

Self-employed ALABAMA Business Owner? And having trouble getting approved for an ALABAMA mortgage?

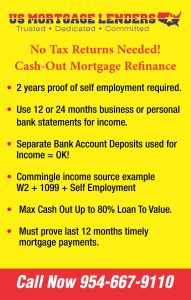

NO TAX RETURN ALABAMA CASH -OUT MORTGAGE LENDERS:

Debt-to-Income Ratio The most important factor in your qualification is your debt-to-income ratio. This can make it harder to get a mortgage if you’re self-employed. Why? Because you likely take several tax deductions, which reduces your overall taxable qualifying income. This makes it seem as if your earnings are much lower than what you actually bring home. In turn, it reduces the loan amount you qualify for. There is a way around this. You can claim fewer deductions in the two years leading up to your home purchase. The result is a higher net income, making your application more attractive to lenders. It’s a good idea to speak to your accountant about the benefits and drawbacks of this approach in your situation. Just remember that your debt-to-income ratio can be no higher than about 40% in order to receive approval.

BANK STATEMENT DEPOSITS USED TO CALCULATE INCOME:

- MAXIMUM INCOME USED FOR PERSONAL BANK STATEMENTS – A self-employed borrower’s income is calculated by averaging 100% of personal bank statement related deposits from their most recent 12 months of personal bank statements. If your statements show low deposits for two or three months, then a large deposit the following month, the underwriter may request an additional 12 months to confirm your monthly income normally fluctuates. ALABAMA SELF EMPLOYEDBank Statement Only Lenders Approvals varies Case By Case from lender to lender.

- MAXIMUM INCOME USED FOR BUSINESS BANK STATEMENTS – For business bank statements only lenders will allow as much as 90% of the job-related deposits can be used for income qualifying, not 100%. ALABAMA self-employed Bank Statement Only Lenders Approvals varies Case By Case from lender to lender.

The maximum “Debt to Income”(DTI) ratio is 55%. Self-employed borrowers with a lower debt to income ratio may receive better a better rate & pricing. ALABAMA self-employed Bank Statement Only Lenders Approvals varies Case By Case from lender to lender.

MINIMUM BANK STATEMENT ONLY CREDIT SCORE NEEDED

600 or higher middle FICO scores. As much as 80% financing depending on appraised value

Bank statement only lenders require a credit Score of 640-679 are acceptable at lower LTV up to 85% and slightly higher interest rates occur with low down payment options.

Refinance with cash back: 680+ credit = 75% financing;

REQUIRED SELF EMPLOYMENT DOCUMENTATION

All self-employed mortgage lenders are required to prove stability in the line of employment by providing a copy of their business license or “Articles of Incorporation” showing they have been self-employed in the most recent (2) two years OR have a licensed CPA or enrolled IRS agent draft a letter confirming the same. ALABAMA self-employed Mortgage Lenders using Bank Statement Only varies Case By Case from lender to lender.

BANK STATEMENT ONLY REQUIRES MONTHLY RESERVES = MONIES IN ACCOUNT AFTER CLOSING REQUIRED BY ALABAMA SELF EMPLOYEDMORTGAGE LENDERS-

Case By Case 1 -12 months of P.I.T.I future payments required in the account at closing.

If the loan amount is over $1 million, then 12 months. IF over $2M, then 18 months. Bank Statement Only Approvals varies Case By Case from lender to lender.

ACCEPTABLE BANK STATEMENT ONLY LENDERS LENDER ON PROPERTIES THAT INCLUDE: Condos, Townhomes, single family homes, condotel, duplex, triplex or four-plex all qualify on various programs. Property can be as a primary residence, second home, or rental property. ALABAMA self-employed Bank Statement Only Lenders Approvals varies Case By Case from lender to lender.

BANK STATEMENT ONLY LENDERS TERMS INCLUDE – This self-employed loan type is offered on a 30 year fixed-rate or adjustable-rate mortgages with 5, 7, or 30 years fixed terms then it becomes adjustable. ALABAMA SELF EMPLOYED Bank Statement Only Lenders Approvals varies Case By Case from lender to lender.

- 2 Years Self Employed Required!

- Bank statement deposits used to qualify!

- No tax returns required.

- 24 months personal bank statements (Personal and Business)

- Loans up to $2 million.

- Credit scores down to 500.

- Rates starting in the 5’s.

- Up to 85% LTV.

10% DOWN ALABAMA SELF EMPLOYED MORTGAGE LENDERS

Apr 4, 2018 – ALABAMA SELF EMPLOYED MORTGAGE LENDERS 12 or 24 Months Business or personal BS only! When your bank says … https://www.fhamortgageprograms.

10% DOWN-ALABAMA SELF EMPLOYED MORTGAGE LENDERS

Self Employed ALABAMA Mortgage Lenders qualifying Alabama borrowers with 12 or 24 months Bank statements. NO TAX RETURNS NEEDED! same day …

ALABAMA SELF EMPLOYED MORTGAGE LENDERS Archives – FHA …

10% DOWN + SELF EMPLOYED ALABAMA MORTGAGE LENDERS 6 ALABAMA STATED INCOMEMORTGAGE LENDERS PROGRAMS ALABAMA SELF …

NO TAX RETURNS+GA SELF EMPLOYED MORTGAGE LENDERS

GEORGIA SELF EMPLOYED-BANK STATEMENT MORTGAGE LENDERS-No Tax Returns Needed! Same Day approvals Call now 954-667-9110 – Use 12 …

alabama self employed mortgage lenders-we say yes! – FHA mortgage …

Bank Statement Only ALABAMA Mortgage Lenders. Have a self–employed client who has had difficulty obtaining a mortgage? Georiga Mortgage Lenders Bank …

10%DOWN+SELF EMPLOYED FLORIDA MORTGAGE LENDERS

Self Employed Texas Bank Statment Only Mortgage Lenders qualifying Texas Self Employed …ALABAMA Self Employed Jumbo Mortgage Lenders Key Points.

10%DOWN -ALABAMA STATED INCOME MORTGAGE LENDERS

Bank Statements Only Alabama Mortgage Lenders have a LOWER Minimum Score … If you are self–employed stated Alabama home loan applicant, you already … https://www.fhamortgageprograms.com/6-Alabama-stated-income-

10% DOWN SELF EMPLOYED MORTGAGE LENDERS USING BS

10% Down – Texas bank statement only Self Employed Mortgage Lenders– Min 600 fico using Bank Statements only. No Tax Returns Needed! Same Day Pre …

10%DOWN+Georgia Self Employed Mortgage Lenders – WE SAY YES!

https://www.fhamortgageprograms.com/georgia-self-employed-mortgage-lenders/

10% Down Georgia Self Employed Mortgage Lenders! SERVING ALL GEORGIA! Bank Statement Only Georgia mortgage loans down to 600 Fico. Use 12 or 24 …

self employed mortgage lenders+no tax returns needed

https://www.fhamortgageprograms.com/self-employed-mortgage-lenders/

Jun 1, 2018 – SELF EMPLOYED MORTGAGE LENDERS-NO TAX RETURNS NEEDED TO PURCHASE OR REFINANCE A HOME- Min 580 FICO Loan …

ALABAMA MORTGAGE LENDERS COVERAGE AREAS BY ZIP CODE

| Zip Code | City | County | State | Zip Code Map |

| 35004 | Moody | Saint Clair | Alabama | View Map |

| 35005 | Adamsville | Jefferson | Alabama | View Map |

| 35006 | Adger | Jefferson | Alabama | View Map |

| 35007 | Alabaster | Shelby | Alabama | View Map |

| 35010 | Alexander City | Tallapoosa | Alabama | View Map |

| 35011 | Alexander City | Tallapoosa | Alabama | View Map |

| 35013 | Allgood | Blount | Alabama | View Map |

| 35014 | Alpine | Talladega | Alabama | View Map |

| 35015 | Alton | Jefferson | Alabama | View Map |

| 35016 | Arab | Marshall | Alabama | View Map |

| 35019 | Baileyton | Cullman | Alabama | View Map |

| 35020 | Bessemer | Jefferson | Alabama | View Map |

| 35021 | Bessemer | Jefferson | Alabama | View Map |

| 35022 | Bessemer | Jefferson | Alabama | View Map |

| 35023 | Bessemer | Jefferson | Alabama | View Map |

| 35031 | Blountsville | Blount | Alabama | View Map |

| 35032 | Bon Air | Talladega | Alabama | View Map |

| 35033 | Bremen | Cullman | Alabama | View Map |

| 35034 | Brent | Bibb | Alabama | View Map |

| 35035 | Brierfield | Bibb | Alabama | View Map |

| 35036 | Brookside | Jefferson | Alabama | View Map |

| 35038 | Burnwell | Walker | Alabama | View Map |

| 35040 | Calera | Shelby | Alabama | View Map |

| 35041 | Cardiff | Jefferson | Alabama | View Map |

| 35042 | Centreville | Bibb | Alabama | View Map |

| 35043 | Chelsea | Shelby | Alabama | View Map |

| 35044 | Childersburg | Talladega | Alabama | View Map |

| 35045 | Clanton | Chilton | Alabama | View Map |

| 35046 | Clanton | Chilton | Alabama | View Map |

| 35048 | Clay | Jefferson | Alabama | View Map |

| 35049 | Cleveland | Blount | Alabama | View Map |

| 35051 | Columbiana | Shelby | Alabama | View Map |

| 35052 | Cook Springs | Saint Clair | Alabama | View Map |

| 35053 | Crane Hill | Cullman | Alabama | View Map |

| 35054 | Cropwell | Saint Clair | Alabama | View Map |

| 35055 | Cullman | Cullman | Alabama | View Map |

| 35056 | Cullman | Cullman | Alabama | View Map |

| 35057 | Cullman | Cullman | Alabama | View Map |

| 35058 | Cullman | Cullman | Alabama | View Map |

| 35060 | Docena | Jefferson | Alabama | View Map |

| 35061 | Dolomite | Jefferson | Alabama | View Map |

| 35062 | Dora | Jefferson | Alabama | View Map |

| 35063 | Empire | Walker | Alabama | View Map |

| 35064 | Fairfield | Jefferson | Alabama | View Map |

| 35068 | Fultondale | Jefferson | Alabama | View Map |

| 35070 | Garden City | Cullman | Alabama | View Map |

| 35071 | Gardendale | Jefferson | Alabama | View Map |

| 35072 | Goodwater | Coosa | Alabama | View Map |

| 35073 | Graysville | Jefferson | Alabama | View Map |

| 35074 | Green Pond | Bibb | Alabama | View Map |

| 35077 | Hanceville | Cullman | Alabama | View Map |

| 35078 | Harpersville | Shelby | Alabama | View Map |

| 35079 | Hayden | Blount | Alabama | View Map |

| 35080 | Helena | Shelby | Alabama | View Map |

| 35082 | Hollins | Clay | Alabama | View Map |

| 35083 | Holly Pond | Cullman | Alabama | View Map |

| 35085 | Jemison | Chilton | Alabama | View Map |

| 35087 | Joppa | Cullman | Alabama | View Map |

| 35089 | Kellyton | Coosa | Alabama | View Map |

| 35091 | Kimberly | Jefferson | Alabama | View Map |

| 35094 | Leeds | Jefferson | Alabama | View Map |

| 35096 | Lincoln | Talladega | Alabama | View Map |

| 35097 | Locust Fork | Blount | Alabama | View Map |

| 35098 | Logan | Cullman | Alabama | View Map |

| 35111 | Mc Calla | Jefferson | Alabama | View Map |

| 35112 | Margaret | Saint Clair | Alabama | View Map |

| 35114 | Maylene | Shelby | Alabama | View Map |

| 35115 | Montevallo | Shelby | Alabama | View Map |

| 35116 | Morris | Jefferson | Alabama | View Map |

| 35117 | Mount Olive | Jefferson | Alabama | View Map |

| 35118 | Mulga | Jefferson | Alabama | View Map |

| 35119 | New Castle | Jefferson | Alabama | View Map |

| 35120 | Odenville | Saint Clair | Alabama | View Map |

| 35121 | Oneonta | Blount | Alabama | View Map |

| 35123 | Palmerdale | Jefferson | Alabama | View Map |

| 35124 | Pelham | Shelby | Alabama | View Map |

| 35125 | Pell City | Saint Clair | Alabama | View Map |

| 35126 | Pinson | Jefferson | Alabama | View Map |

| 35127 | Pleasant Grove | Jefferson | Alabama | View Map |

| 35128 | Pell City | Saint Clair | Alabama | View Map |

| 35130 | Quinton | Walker | Alabama | View Map |

| 35131 | Ragland | Saint Clair | Alabama | View Map |

| 35133 | Remlap | Blount | Alabama | View Map |

| 35135 | Riverside | Saint Clair | Alabama | View Map |

| 35136 | Rockford | Coosa | Alabama | View Map |

| 35137 | Saginaw | Shelby | Alabama | View Map |

| 35139 | Sayre | Jefferson | Alabama | View Map |

| 35142 | Shannon | Jefferson | Alabama | View Map |

| 35143 | Shelby | Shelby | Alabama | View Map |

| 35144 | Siluria | Shelby | Alabama | View Map |

| 35146 | Springville | Saint Clair | Alabama | View Map |

| 35147 | Sterrett | Shelby | Alabama | View Map |

| 35148 | Sumiton | Walker | Alabama | View Map |

| 35149 | Sycamore | Talladega | Alabama | View Map |

| 35150 | Sylacauga | Talladega | Alabama | View Map |

| 35151 | Sylacauga | Talladega | Alabama | View Map |

| 35160 | Talladega | Talladega | Alabama | View Map |

| 35161 | Talladega | Talladega | Alabama | View Map |

| 35171 | Thorsby | Chilton | Alabama | View Map |

| 35172 | Trafford | Jefferson | Alabama | View Map |

| 35173 | Trussville | Jefferson | Alabama | View Map |

| 35175 | Union Grove | Marshall | Alabama | View Map |

| 35176 | Vandiver | Shelby | Alabama | View Map |

| 35178 | Vincent | Shelby | Alabama | View Map |

| 35179 | Vinemont | Cullman | Alabama | View Map |

| 35180 | Warrior | Jefferson | Alabama | View Map |

| 35181 | Watson | Jefferson | Alabama | View Map |

| 35182 | Wattsville | Saint Clair | Alabama | View Map |

| 35183 | Weogufka | Coosa | Alabama | View Map |

| 35184 | West Blocton | Bibb | Alabama | View Map |

| 35185 | Westover | Shelby | Alabama | View Map |

| 35186 | Wilsonville | Shelby | Alabama | View Map |

| 35187 | Wilton | Shelby | Alabama | View Map |

| 35188 | Woodstock | Bibb | Alabama | View Map |

| 35201 | Birmingham | Jefferson | Alabama | View Map |

| 35202 | Birmingham | Jefferson | Alabama | View Map |

| 35203 | Birmingham | Jefferson | Alabama | View Map |

| 35204 | Birmingham | Jefferson | Alabama | View Map |

| 35205 | Birmingham | Jefferson | Alabama | View Map |

| 35206 | Birmingham | Jefferson | Alabama | View Map |

| 35207 | Birmingham | Jefferson | Alabama | View Map |

| 35208 | Birmingham | Jefferson | Alabama | View Map |

| 35209 | Birmingham | Jefferson | Alabama | View Map |

| 35210 | Birmingham | Jefferson | Alabama | View Map |

| 35211 | Birmingham | Jefferson | Alabama | View Map |

| 35212 | Birmingham | Jefferson | Alabama | View Map |

| 35213 | Birmingham | Jefferson | Alabama | View Map |

| 35214 | Birmingham | Jefferson | Alabama | View Map |

| 35215 | Birmingham | Jefferson | Alabama | View Map |

| 35216 | Birmingham | Jefferson | Alabama | View Map |

| 35217 | Birmingham | Jefferson | Alabama | View Map |

| 35218 | Birmingham | Jefferson | Alabama | View Map |

| 35219 | Birmingham | Jefferson | Alabama | View Map |

| 35220 | Birmingham | Jefferson | Alabama | View Map |

| 35221 | Birmingham | Jefferson | Alabama | View Map |

| 35222 | Birmingham | Jefferson | Alabama | View Map |

| 35223 | Birmingham | Jefferson | Alabama | View Map |

| 35224 | Birmingham | Jefferson | Alabama | View Map |

| 35225 | Birmingham | Jefferson | Alabama | View Map |

| 35226 | Birmingham | Jefferson | Alabama | View Map |

| 35228 | Birmingham | Jefferson | Alabama | View Map |

| 35229 | Birmingham | Jefferson | Alabama | View Map |

| 35230 | Birmingham | Jefferson | Alabama | View Map |

| 35231 | Birmingham | Jefferson | Alabama | View Map |

| 35232 | Birmingham | Jefferson | Alabama | View Map |

| 35233 | Birmingham | Jefferson | View Map | |

| 35234 | Birmingham | Jefferson | View Map | |

| 35235 | Birmingham | Jefferson | Alabama | View Map |

| 35236 | Birmingham | Jefferson | Alabama | View Map |

| 35237 | Birmingham | Jefferson | Alabama | View Map |

| 35238 | Birmingham | Jefferson | Alabama | View Map |

| 35240 | Birmingham | Jefferson | Alabama | View Map |

| 35242 | Birmingham | Shelby | Alabama | View Map |

| 35243 | Birmingham | Jefferson | Alabama | View Map |

| 35244 | Birmingham | Jefferson | Alabama | View Map |

| 35245 | Birmingham | Jefferson | Alabama | View Map |

| 35246 | Birmingham | Jefferson | Alabama | View Map |

| 35249 | Birmingham | Jefferson | Alabama | View Map |

| 35253 | Birmingham | Jefferson | Alabama | View Map |

| 35254 | Birmingham | Jefferson | Alabama | View Map |

| 35255 | Birmingham | Jefferson | Alabama | View Map |

| 35259 | Birmingham | Jefferson | Alabama | View Map |

| 35260 | Birmingham | Jefferson | Alabama | View Map |

| 35261 | Birmingham | Jefferson | Alabama | View Map |

| 35263 | Birmingham | Jefferson | Alabama | View Map |

| 35266 | Birmingham | Jefferson | Alabama | View Map |

| 35277 | Birmingham | Jefferson | Alabama | View Map |

| 35278 | Birmingham | Jefferson | Alabama | View Map |

| 35279 | Birmingham | Jefferson | Alabama | View Map |

| 35280 | Birmingham | Jefferson | Alabama | View Map |

| 35281 | Birmingham | Jefferson | Alabama | View Map |

| 35282 | Birmingham | Jefferson | Alabama | View Map |

| 35283 | Birmingham | Jefferson | Alabama | View Map |

| 35285 | Birmingham | Jefferson | Alabama | View Map |

| 35286 | Birmingham | Jefferson | Alabama | View Map |

| 35287 | Birmingham | Jefferson | Alabama | View Map |

| 35288 | Birmingham | Jefferson | Alabama | View Map |

| 35289 | Birmingham | Jefferson | Alabama | View Map |

| 35290 | Birmingham | Jefferson | Alabama | View Map |

| 35291 | Birmingham | Jefferson | Alabama | View Map |

| 35292 | Birmingham | Jefferson | Alabama | View Map |

| 35293 | Birmingham | Jefferson | Alabama | View Map |

| 35294 | Birmingham | Jefferson | Alabama | View Map |

| 35295 | Birmingham | Jefferson | Alabama | View Map |

| 35296 | Birmingham | Jefferson | Alabama | View Map |

| 35297 | Birmingham | Jefferson | Alabama | View Map |

| 35298 | Birmingham | Jefferson | Alabama | View Map |

| 35299 | Birmingham | Jefferson | Alabama | View Map |

| 35401 | Tuscaloosa | Tuscaloosa | Alabama | View Map |

| 35402 | Tuscaloosa | Tuscaloosa | Alabama | View Map |

| 35403 | Tuscaloosa | Tuscaloosa | Alabama | View Map |

| 35404 | Tuscaloosa | Tuscaloosa | Alabama | View Map |

| 35405 | Tuscaloosa | Tuscaloosa | Alabama | View Map |

| 35406 | Tuscaloosa | Tuscaloosa | Alabama | View Map |

| 35407 | Tuscaloosa | Tuscaloosa | Alabama | View Map |

| 35440 | Abernant | Tuscaloosa | Alabama | View Map |

| 35441 | Akron | Hale | Alabama | View Map |

| 35442 | Aliceville | Pickens | Alabama | View Map |

| 35443 | Boligee | Greene | Alabama | View Map |

| 35444 | Brookwood | Tuscaloosa | Alabama | View Map |

| 35446 | Buhl | Tuscaloosa | Alabama | View Map |

| 35447 | Carrollton | Pickens | Alabama | View Map |

| 35448 | Clinton | Greene | Alabama | View Map |

| 35449 | Coaling | Tuscaloosa | Alabama | View Map |

| 35452 | Coker | Tuscaloosa | Alabama | View Map |

| 35453 | Cottondale | Tuscaloosa | Alabama | View Map |

| 35456 | Duncanville | Tuscaloosa | Alabama | View Map |

| 35457 | Echola | Tuscaloosa | Alabama | View Map |

| 35458 | Elrod | Tuscaloosa | Alabama | View Map |

| 35459 | Emelle | Sumter | Alabama | View Map |

| 35460 | Epes | Sumter | Alabama | View Map |

| 35461 | Ethelsville | Pickens | Alabama | View Map |

| 35462 | Eutaw | Greene | Alabama | View Map |

| 35463 | Fosters | Tuscaloosa | Alabama | View Map |

| 35464 | Gainesville | Sumter | Alabama | View Map |

| 35466 | Gordo | Pickens | Alabama | View Map |

| 35468 | Kellerman | Tuscaloosa | Alabama | View Map |

| 35469 | Knoxville | Greene | Alabama | View Map |

| 35470 | Livingston | Sumter | Alabama | View Map |

| 35471 | Mc Shan | Pickens | Alabama | View Map |

| 35473 | Northport | Tuscaloosa | Alabama | View Map |

| 35474 | Moundville | Hale | Alabama | View Map |

| 35475 | Northport | Tuscaloosa | Alabama | View Map |

| 35476 | Northport | Tuscaloosa | Alabama | View Map |

| 35477 | Panola | Sumter | Alabama | View Map |

| 35478 | Peterson | Tuscaloosa | Alabama | View Map |

| 35480 | Ralph | Tuscaloosa | Alabama | View Map |

| 35481 | Reform | Pickens | Alabama | View Map |

| 35482 | Samantha | Tuscaloosa | Alabama | View Map |

| 35485 | Tuscaloosa | Tuscaloosa | Alabama | View Map |

| 35486 | Tuscaloosa | Tuscaloosa | Alabama | View Map |

| 35487 | Tuscaloosa | Tuscaloosa | Alabama | View Map |

| 35490 | Vance | Tuscaloosa | Alabama | View Map |

| 35491 | West Greene | Greene | Alabama | View Map |

| 35501 | Jasper | Walker | Alabama | View Map |

| 35502 | Jasper | Walker | Alabama | View Map |

| 35503 | Jasper | Walker | Alabama | View Map |

| 35504 | Jasper | Walker | Alabama | View Map |

| 35540 | Addison | Winston | Alabama | View Map |

| 35541 | Arley | Winston | Alabama | View Map |

| 35542 | Bankston | Fayette | Alabama | View Map |

| 35543 | Bear Creek | Marion | Alabama | View Map |

| 35544 | Beaverton | Lamar | Alabama | View Map |

| 35545 | Belk | Fayette | Alabama | View Map |

| 35546 | Berry | Fayette | Alabama | View Map |

| 35548 | Brilliant | Marion | Alabama | View Map |

| 35549 | Carbon Hill | Walker | Alabama | View Map |

| 35550 | Cordova | Walker | Alabama | View Map |

| 35551 | Delmar | Winston | Alabama | View Map |

| 35552 | Detroit | Lamar | Alabama | View Map |

| 35553 | Double Springs | Winston | Alabama | View Map |

| 35554 | Eldridge | Walker | Alabama | View Map |

| 35555 | Fayette | Fayette | Alabama | View Map |

| 35559 | Glen Allen | Fayette | Alabama | View Map |

| 35560 | Goodsprings | Walker | Alabama | View Map |

| 35563 | Guin | Marion | Alabama | View Map |

| 35564 | Hackleburg | Marion | Alabama | View Map |

| 35565 | Haleyville | Winston | Alabama | View Map |

| 35570 | Hamilton | Marion | Alabama | View Map |

| 35571 | Hodges | Franklin | Alabama | View Map |

| 35572 | Houston | Winston | Alabama | View Map |

| 35573 | Kansas | Walker | Alabama | View Map |

| 35574 | Kennedy | Lamar | Alabama | View Map |

| 35575 | Lynn | Winston | Alabama | View Map |

| 35576 | Millport | Lamar | Alabama | View Map |

| 35577 | Natural Bridge | Winston | Alabama | View Map |

| 35578 | Nauvoo | Walker | Alabama | View Map |

| 35579 | Oakman | Walker | Alabama | View Map |

| 35580 | Parrish | Walker | Alabama | View Map |

| 35581 | Phil Campbell | Franklin | Alabama | View Map |

| 35582 | Red Bay | Franklin | Alabama | View Map |

| 35584 | Sipsey | Walker | Alabama | View Map |

| 35585 | Spruce Pine | Franklin | Alabama | View Map |

| 35586 | Sulligent | Lamar | Alabama | View Map |

| 35587 | Townley | Walker | Alabama | View Map |

| 35592 | Vernon | Lamar | Alabama | View Map |

| 35593 | Vina | Franklin | Alabama | View Map |

| 35594 | Winfield | Marion | Alabama | View Map |

| 35601 | Decatur | Morgan | Alabama | View Map |

| 35602 | Decatur | Morgan | Alabama | View Map |

| 35603 | Decatur | Morgan | Alabama | View Map |

| 35609 | Decatur | Morgan | Alabama | View Map |

| 35610 | Anderson | Lauderdale | Alabama | View Map |

| 35611 | Athens | Limestone | Alabama | View Map |

| 35612 | Athens | Limestone | Alabama | View Map |

| 35613 | Athens | Limestone | Alabama | View Map |

| 35614 | Athens | Limestone | Alabama | View Map |

| 35615 | Belle Mina | Limestone | Alabama | View Map |

| 35616 | Cherokee | Colbert | Alabama | View Map |

| 35617 | Cloverdale | Lauderdale | Alabama | View Map |

| 35618 | Courtland | Lawrence | Alabama | View Map |

| 35619 | Danville | Morgan | Alabama | View Map |

| 35620 | Elkmont | Limestone | Alabama | View Map |

| 35621 | Eva | Morgan | Alabama | View Map |

| 35622 | Falkville | Morgan | Alabama | View Map |

| 35630 | Florence | Lauderdale | Alabama | View Map |

| 35631 | Florence | Lauderdale | Alabama | View Map |

| 35632 | Florence | Lauderdale | Alabama | View Map |

| 35633 | Florence | Lauderdale | Alabama | View Map |

| 35634 | Florence | Lauderdale | Alabama | View Map |

| 35640 | Hartselle | Morgan | Alabama | View Map |

| 35643 | Hillsboro | Lawrence | Alabama | View Map |

| 35645 | Killen | Lauderdale | Alabama | View Map |

| 35646 | Leighton | Colbert | Alabama | View Map |

| 35647 | Lester | Limestone | Alabama | View Map |

| 35648 | Lexington | Lauderdale | Alabama | View Map |

| 35649 | Mooresville | Limestone | Alabama | View Map |

| 35650 | Moulton | Lawrence | Alabama | View Map |

| 35651 | Mount Hope | Lawrence | Alabama | View Map |

| 35652 | Rogersville | Lauderdale | Alabama | View Map |

| 35653 | Russellville | Franklin | Alabama | View Map |

| 35654 | Russellville | Franklin | Alabama | View Map |

| 35660 | Sheffield | Colbert | Alabama | View Map |

| 35661 | Muscle Shoals | Colbert | Alabama | View Map |

| 35662 | Muscle Shoals | Colbert | Alabama | View Map |

| 35670 | Somerville | Morgan | Alabama | View Map |

| 35671 | Tanner | Limestone | Alabama | View Map |

| 35672 | Town Creek | Lawrence | Alabama | View Map |

| 35673 | Trinity | Morgan | Alabama | View Map |

| 35674 | Tuscumbia | Colbert | Alabama | View Map |

| 35677 | Waterloo | Lauderdale | Alabama | View Map |

| 35699 | Decatur | Morgan | Alabama | View Map |

| 35739 | Ardmore | Limestone | Alabama | View Map |

| 35740 | Bridgeport | Jackson | Alabama | View Map |

| 35741 | Brownsboro | Madison | Alabama | View Map |

| 35742 | Capshaw | Limestone | Alabama | View Map |

| 35744 | Dutton | Jackson | Alabama | View Map |

| 35745 | Estillfork | Jackson | Alabama | View Map |

| 35746 | Fackler | Jackson | Alabama | View Map |

| 35747 | Grant | Marshall | Alabama | View Map |

| 35748 | Gurley | Madison | Alabama | View Map |

| 35749 | Harvest | Madison | Alabama | View Map |

| 35750 | Hazel Green | Madison | Alabama | View Map |

| 35751 | Hollytree | Jackson | Alabama | View Map |

| 35752 | Hollywood | Jackson | Alabama | View Map |

| 35754 | Laceys Spring | Morgan | Alabama | View Map |

| 35755 | Langston | Jackson | Alabama | View Map |

| 35756 | Madison | Limestone | Alabama | View Map |

| 35757 | Madison | Madison | Alabama | View Map |

| 35758 | Madison | Madison | Alabama | View Map |

| 35759 | Meridianville | Madison | Alabama | View Map |

| 35760 | New Hope | Madison | Alabama | View Map |

| 35761 | New Market | Madison | Alabama | View Map |

| 35762 | Normal | Madison | Alabama | View Map |

| 35763 | Owens Cross Roads | Madison | Alabama | View Map |

| 35764 | Paint Rock | Jackson | Alabama | View Map |

| 35765 | Pisgah | Jackson | Alabama | View Map |

| 35766 | Princeton | Jackson | Alabama | View Map |

| 35767 | Ryland | Madison | Alabama | View Map |

| 35768 | Scottsboro | Jackson | Alabama | View Map |

| 35769 | Scottsboro | Jackson | Alabama | View Map |

| 35771 | Section | Jackson | Alabama | View Map |

| 35772 | Stevenson | Jackson | Alabama | View Map |

| 35773 | Toney | Madison | Alabama | View Map |

| 35774 | Trenton | Jackson | Alabama | View Map |

| 35775 | Valhermoso Springs | Morgan | Alabama | View Map |

| 35776 | Woodville | Jackson | Alabama | View Map |

| 35801 | Huntsville | Madison | Alabama | View Map |

| 35802 | Huntsville | Madison | Alabama | View Map |

| 35803 | Huntsville | Madison | Alabama | View Map |

| 35804 | Huntsville | Madison | Alabama | View Map |

| 35805 | Huntsville | Madison | Alabama | View Map |

| 35806 | Huntsville | Madison | Alabama | View Map |

| 35807 | Huntsville | Madison | Alabama | View Map |

| 35808 | Huntsville | Madison | Alabama | View Map |

| 35809 | Huntsville | Madison | Alabama | View Map |

| 35810 | Huntsville | Madison | Alabama | View Map |

| 35811 | Huntsville | Madison | Alabama | View Map |

| 35812 | Huntsville | Madison | Alabama | View Map |

| 35813 | Huntsville | Madison | Alabama | View Map |

| 35814 | Huntsville | Madison | Alabama | View Map |

| 35815 | Huntsville | Madison | Alabama | View Map |

| 35816 | Huntsville | Madison | Alabama | View Map |

| 35824 | Huntsville | Madison | Alabama | View Map |

| 35893 | Huntsville | Madison | Alabama | View Map |

| 35894 | Huntsville | Madison | Alabama | View Map |

| 35895 | Huntsville | Madison | Alabama | View Map |

| 35896 | Huntsville | Madison | Alabama | View Map |

| 35897 | Huntsville | Madison | Alabama | View Map |

| 35898 | Huntsville | Madison | Alabama | View Map |

| 35899 | Huntsville | Madison | Alabama | View Map |

| 35901 | Gadsden | Etowah | Alabama | View Map |

| 35902 | Gadsden | Etowah | Alabama | View Map |

| 35903 | Gadsden | Etowah | Alabama | View Map |

| 35904 | Gadsden | Etowah | Alabama | View Map |

| 35905 | Gadsden | Etowah | Alabama | View Map |

| 35906 | Rainbow City | Etowah | Alabama | View Map |

| 35907 | Gadsden | Etowah | Alabama | View Map |

| 35950 | Albertville | Marshall | Alabama | View Map |

| 35951 | Albertville | Marshall | Alabama | View Map |

| 35952 | Altoona | Etowah | Alabama | View Map |

| 35953 | Ashville | Saint Clair | Alabama | View Map |

| 35954 | Attalla | Etowah | Alabama | View Map |

| 35956 | Boaz | Etowah | Alabama | View Map |

| 35957 | Boaz | Marshall | Alabama | View Map |

| 35958 | Bryant | Jackson | Alabama | View Map |

| 35959 | Cedar Bluff | Cherokee | Alabama | View Map |

| 35960 | Centre | Cherokee | Alabama | View Map |

| 35961 | Collinsville | De Kalb | Alabama | View Map |

| 35962 | Crossville | De Kalb | Alabama | View Map |

| 35963 | Dawson | De Kalb | Alabama | View Map |

| 35964 | Douglas | Marshall | Alabama | View Map |

| 35966 | Flat Rock | Jackson | Alabama | View Map |

| 35967 | Fort Payne | De Kalb | Alabama | View Map |

| 35968 | Fort Payne | De Kalb | Alabama | View Map |

| 35971 | Fyffe | De Kalb | Alabama | View Map |

| 35972 | Gallant | Etowah | Alabama | View Map |

| 35973 | Gaylesville | Cherokee | Alabama | View Map |

| 35974 | Geraldine | De Kalb | Alabama | Alabama |

| 35975 | Groveoak | De Kalb | Alabama | Alabama |

| 35976 | Guntersville | Marshall | Alabama | Alabama |

| 35978 | Henagar | De Kalb | Alabama | Alabama |

| 35979 | Higdon | Jackson | Alabama | Alabama |

| 35980 | Horton | Marshall | Alabama | Alabama |

| 35981 | Ider | De Kalb | Alabama | Alabama |

| 35983 | Leesburg | Cherokee | Alabama | Alabama |

| 35984 | Mentone | De Kalb | Alabama | Alabama |

| 35986 | Rainsville | De Kalb | Alabama | Alabama |

| 35987 | Steele | Saint Clair | Alabama | Alabama |

| 35988 | Sylvania | De Kalb | Alabama | Alabama |

| 35989 | Valley Head | De Kalb | Alabama | Alabama |

| 35990 | Walnut Grove | Etowah | Alabama | Alabama |

| 36003 | Autaugaville | Autauga | Alabama | Alabama |

| 36005 | Banks | Pike | Alabama | Alabama |

| 36006 | Billingsley | Autauga | Alabama | Alabama |

| 36008 | Booth | Autauga | Alabama | Alabama |

| 36009 | Brantley | Crenshaw | Alabama | Alabama |

| 36010 | Brundidge | Pike | Alabama | Alabama |

| 36013 | Cecil | Montgomery | Alabama | Alabama |

| 36015 | Chapman | Butler | Alabama | Alabama |

| 36016 | Clayton | Barbour | Alabama | Alabama |

| 36017 | Clio | Barbour | Alabama | Alabama |

| 36020 | Coosada | Elmore | Alabama | Alabama |

| 36022 | Deatsville | Elmore | Alabama | Alabama |

| 36023 | East Tallassee | Tallapoosa | Alabama | Alabama |

| 36024 | Eclectic | Elmore | Alabama | Alabama |

| 36025 | Elmore | Elmore | Alabama | Alabama |

| 36026 | Equality | Coosa | Alabama | View Map |

| 36027 | Eufaula | Barbour | Alabama | View Map |

| 36028 | Dozier | Crenshaw | Alabama | View Map |

| 36029 | Fitzpatrick | Bullock | Alabama | View Map |

| 36030 | Forest Home | Butler | Alabama | View Map |

| 36031 | Fort Davis | Macon | Alabama | View Map |

| 36032 | Fort Deposit | Lowndes | Alabama | View Map |

| 36033 | Georgiana | Butler | Alabama | View Map |

| 36034 | Glenwood | Crenshaw | Alabama | View Map |

| 36035 | Goshen | Pike | Alabama | View Map |

| 36036 | Grady | Montgomery | Alabama | View Map |

| 36037 | Greenville | Butler | Alabama | View Map |

| 36038 | Gantt | Covington | Alabama | View Map |

| 36039 | Hardaway | Macon | Alabama | View Map |

| 36040 | Hayneville | Lowndes | Alabama | View Map |

| 36041 | Highland Home | Crenshaw | Alabama | View Map |

| 36042 | Honoraville | Crenshaw | Alabama | View Map |

| 36043 | Hope Hull | Montgomery | Alabama | View Map |

| 36045 | Kent | Elmore | Alabama | View Map |

| 36046 | Lapine | Montgomery | Alabama | View Map |

| 36047 | Letohatchee | Lowndes | Alabama | View Map |

| 36048 | Louisville | Barbour | Alabama | View Map |

| 36049 | Luverne | Crenshaw | Alabama | View Map |

| 36051 | Marbury | Autauga | Alabama | View Map |

| 36052 | Mathews | Montgomery | Alabama | View Map |

| 36053 | Midway | Bullock | Alabama | View Map |

| 36054 | Millbrook | Elmore | Alabama | View Map |

| 36057 | Mount Meigs | Montgomery | Alabama | View Map |

| 36061 | Perote | Bullock | Alabama | View Map |

| 36062 | Petrey | Crenshaw | Alabama | View Map |

| 36064 | Pike Road | Montgomery | Alabama | View Map |

| 36065 | Pine Level | Montgomery | Alabama | View Map |

| 36066 | Prattville | Autauga | Alabama | View Map |

| 36067 | Prattville | Autauga | Alabama | View Map |

| 36068 | Prattville | Autauga | Alabama | View Map |

| 36069 | Ramer | Montgomery | Alabama | View Map |

| 36071 | Rutledge | Crenshaw | Alabama | View Map |

| 36072 | Eufaula | Barbour | Alabama | View Map |

| 36075 | Shorter | Macon | Alabama | View Map |

| 36078 | Tallassee | Elmore | Alabama | View Map |

| 36079 | Troy | Pike | Alabama | View Map |

| 36080 | Titus | Elmore | Alabama | View Map |

| 36081 | Troy | Pike | Alabama | View Map |

| 36082 | Troy | Pike | Alabama | View Map |

| 36083 | Tuskegee | Macon | Alabama | View Map |

| 36087 | Tuskegee Institute | Macon | Alabama | View Map |

| 36088 | Tuskegee Institute | Macon | Alabama | View Map |

| 36089 | Union Springs | Bullock | Alabama | View Map |

| 36091 | Verbena | Chilton | Alabama | View Map |

| 36092 | Wetumpka | Elmore | Alabama | View Map |

| 36093 | Wetumpka | Elmore | Alabama | View Map |

| 36101 | Montgomery | Montgomery | Alabama | View Map |

| 36102 | Montgomery | Montgomery | Alabama | View Map |

| 36103 | Montgomery | Montgomery | Alabama | View Map |

| 36104 | Montgomery | Montgomery | Alabama | View Map |

| 36105 | Montgomery | Montgomery | Alabama | View Map |

| 36106 | Montgomery | Montgomery | Alabama | View Map |

| 36107 | Montgomery | Montgomery | Alabama | View Map |

| 36108 | Montgomery | Montgomery | Alabama | View Map |

| 36109 | Montgomery | Montgomery | Alabama | View Map |

| 36110 | Montgomery | Montgomery | Alabama | View Map |

| 36111 | Montgomery | Montgomery | Alabama | View Map |

| 36112 | Montgomery | Montgomery | Alabama | View Map |

| 36113 | Montgomery | Montgomery | Alabama | View Map |

| 36114 | Montgomery | Montgomery | Alabama | View Map |

| 36115 | Montgomery | Montgomery | Alabama | View Map |

| 36116 | Montgomery | Montgomery | Alabama | View Map |

| 36117 | Montgomery | Montgomery | Alabama | View Map |

| 36118 | Montgomery | Montgomery | Alabama | View Map |

| 36119 | Montgomery | Montgomery | Alabama | View Map |

| 36120 | Montgomery | Montgomery | Alabama | View Map |

| 36121 | Montgomery | Montgomery | Alabama | View Map |

| 36123 | Montgomery | Montgomery | Alabama | View Map |

| 36124 | Montgomery | Montgomery | Alabama | View Map |

| 36125 | Montgomery | Montgomery | Alabama | View Map |

| 36130 | Montgomery | Montgomery | Alabama | View Map |

| 36131 | Montgomery | Montgomery | Alabama | View Map |

| 36132 | Montgomery | Montgomery | Alabama | View Map |

| 36133 | Montgomery | Montgomery | Alabama | View Map |

| 36134 | Montgomery | Montgomery | Alabama | View Map |

| 36135 | Montgomery | Montgomery | Alabama | View Map |

| 36140 | Montgomery | Montgomery | Alabama | View Map |

| 36141 | Montgomery | Montgomery | Alabama | View Map |

| 36142 | Montgomery | Montgomery | Alabama | View Map |

| 36177 | Montgomery | Montgomery | Alabama | View Map |

| 36191 | Montgomery | Montgomery | Alabama | View Map |

| 36201 | Anniston | Calhoun | Alabama | View Map |

| 36202 | Anniston | Calhoun | Alabama | View Map |

| 36203 | Oxford | Calhoun | Alabama | View Map |

| 36204 | Anniston | Calhoun | Alabama | View Map |

| 36205 | Anniston | Calhoun | Alabama | View Map |

| 36206 | Anniston | Calhoun | Alabama | View Map |

| 36207 | Anniston | Calhoun | Alabama | View Map |

| 36210 | Anniston | Calhoun | Alabama | View Map |

| 36250 | Alexandria | Calhoun | Alabama | View Map |

| 36251 | Ashland | Clay | Alabama | View Map |

| 36253 | Bynum | Calhoun | Alabama | View Map |

| 36254 | Choccolocco | Calhoun | Alabama | View Map |

| 36255 | Cragford | Clay | Alabama | View Map |

| 36256 | Daviston | Tallapoosa | Alabama | View Map |

| 36257 | De Armanville | Calhoun | Alabama | View Map |

| 36258 | Delta | Clay | Alabama | View Map |

| 36260 | Eastaboga | Calhoun | Alabama | View Map |

| 36261 | Edwardsville | Cleburne | Alabama | View Map |

| 36262 | Fruithurst | Cleburne | Alabama | View Map |

| 36263 | Graham | Randolph | Alabama | View Map |

| 36264 | Heflin | Cleburne | Alabama | View Map |

| 36265 | Jacksonville | Calhoun | Alabama | View Map |

| 36266 | Lineville | Clay | Alabama | View Map |

| 36267 | Millerville | Clay | Alabama | View Map |

| 36268 | Munford | Talladega | Alabama | View Map |

| 36269 | Muscadine | Cleburne | Alabama | View Map |

| 36271 | Ohatchee | Calhoun | Alabama | View Map |

| 36272 | Piedmont | Calhoun | Alabama | View Map |

| 36273 | Ranburne | Cleburne | Alabama | View Map |

| 36274 | Roanoke | Randolph | Alabama | View Map |

| 36275 | Spring Garden | Cherokee | Alabama | View Map |

| 36276 | Wadley | Randolph | Alabama | View Map |

| 36277 | Weaver | Calhoun | Alabama | View Map |

| 36278 | Wedowee | Randolph | Alabama | View Map |

| 36279 | Wellington | Calhoun | Alabama | View Map |

| 36280 | Woodland | Randolph | Alabama | View Map |

| 36301 | Dothan | Houston | Alabama | View Map |

| 36302 | Dothan | Houston | Alabama | View Map |

| 36303 | Dothan | Houston | Alabama | View Map |

| 36304 | Dothan | Houston | Alabama | View Map |

| 36305 | Dothan | Houston | Alabama | View Map |

| 36310 | Abbeville | Henry | Alabama | View Map |

| 36311 | Ariton | Dale | Alabama | View Map |

| 36312 | Ashford | Houston | Alabama | View Map |

| 36313 | Bellwood | Geneva | Alabama | View Map |

| 36314 | Black | Geneva | Alabama | View Map |

| 36316 | Chancellor | Geneva | Alabama | View Map |

| 36317 | Clopton | Henry | Alabama | View Map |

| 36318 | Coffee Springs | Geneva | Alabama | View Map |

| 36319 | Columbia | Houston | Alabama | View Map |

| 36320 | Cottonwood | Houston | Alabama | View Map |

| 36321 | Cowarts | Houston | Alabama | View Map |

| 36322 | Daleville | Dale | Alabama | View Map |

| 36323 | Elba | Coffee | Alabama | View Map |

| 36330 | Enterprise | Coffee | Alabama | View Map |

| 36331 | Enterprise | Coffee | Alabama | View Map |

| 36340 | Geneva | Geneva | Alabama | View Map |

| 36343 | Gordon | Houston | Alabama | View Map |

| 36344 | Hartford | Geneva | Alabama | View Map |

| 36345 | Headland | Henry | Alabama | View Map |

| 36346 | Jack | Coffee | Alabama | View Map |

| 36349 | Malvern | Geneva | Alabama | View Map |

| 36350 | Midland City | Dale | Alabama | View Map |

| 36351 | New Brockton | Coffee | Alabama | View Map |

| 36352 | Newton | Dale | Alabama | View Map |

| 36353 | Newville | Henry | Alabama | View Map |

| 36360 | Ozark | Dale | Alabama | View Map |

| 36361 | Ozark | Dale | Alabama | View Map |

| 36362 | Fort Rucker | Dale | Alabama | View Map |

| 36370 | Pansey | Houston | Alabama | View Map |

| 36371 | Pinckard | Dale | Alabama | View Map |

| 36373 | Shorterville | Henry | Alabama | View Map |

| 36374 | Skipperville | Dale | Alabama | View Map |

| 36375 | Slocomb | Geneva | Alabama | View Map |

| 36376 | Webb | Houston | Alabama | View Map |

| 36401 | Evergreen | Conecuh | Alabama | View Map |

| 36420 | Andalusia | Covington | Alabama | View Map |

| 36421 | Andalusia | Covington | Alabama | View Map |

| 36425 | Beatrice | Monroe | Alabama | View Map |

| 36426 | Brewton | Escambia | Alabama | View Map |

| 36427 | Brewton | Escambia | Alabama | View Map |

| 36429 | Brooklyn | Conecuh | Alabama | View Map |

| 36432 | Castleberry | Conecuh | Alabama | View Map |

| 36435 | Coy | Wilcox | Alabama | View Map |

| 36436 | Dickinson | Clarke | Alabama | View Map |

| 36439 | Excel | Monroe | Alabama | View Map |

| 36441 | Flomaton | Escambia | Alabama | View Map |

| 36442 | Florala | Covington | Alabama | View Map |

| 36444 | Franklin | Monroe | Alabama | View Map |

| 36445 | Frisco City | Monroe | Alabama | View Map |

| 36446 | Fulton | Clarke | Alabama | View Map |

| 36449 | Goodway | Monroe | Alabama | View Map |

| 36451 | Grove Hill | Clarke | Alabama | View Map |

| 36453 | Kinston | Coffee | Alabama | View Map |

| 36454 | Lenox | Conecuh | Alabama | View Map |

| 36455 | Lockhart | Covington | Alabama | View Map |

| 36456 | Mc Kenzie | Butler | Alabama | View Map |

| 36457 | Megargel | Monroe | Alabama | View Map |

| 36458 | Mexia | Monroe | Alabama | View Map |

| 36460 | Monroeville | Monroe | Alabama | View Map |

| 36461 | Monroeville | Monroe | Alabama | View Map |

| 36462 | Monroeville | Monroe | Alabama | View Map |

| 36467 | Opp | Covington | Alabama | View Map |

| 36470 | Perdue Hill | Monroe | Alabama | View Map |

| 36471 | Peterman | Monroe | Alabama | View Map |

| 36473 | Range | Conecuh | Alabama | View Map |

| 36474 | Red Level | Covington | Alabama | View Map |

| 36475 | Repton | Conecuh | Alabama | View Map |

| 36476 | River Falls | Covington | Alabama | View Map |

| 36477 | Samson | Geneva | Alabama | View Map |

| 36480 | Uriah | Monroe | Alabama | View Map |

| 36481 | Vredenburgh | Monroe | Alabama | View Map |

| 36482 | Whatley | Clarke | Alabama | View Map |

| 36483 | Wing | Covington | Alabama | View Map |

| 36501 | Alma | Clarke | Alabama | View Map |

| 36502 | Atmore | Escambia | Alabama | View Map |

| 36503 | Atmore | Escambia | Alabama | View Map |

| 36504 | Atmore | Escambia | Alabama | View Map |

| 36505 | Axis | Mobile | Alabama | View Map |

| 36507 | Bay Minette | Baldwin | Alabama | View Map |

| 36509 | Bayou La Batre | Mobile | Alabama | View Map |

| 36511 | Bon Secour | Baldwin | Alabama | View Map |

| 36512 | Bucks | Mobile | Alabama | View Map |

| 36513 | Calvert | Washington | Alabama | View Map |

| 36515 | Carlton | Clarke | Alabama | View Map |

| 36518 | Chatom | Washington | Alabama | View Map |

| 36521 | Chunchula | Mobile | Alabama | View Map |

| 36522 | Citronelle | Mobile | Alabama | View Map |

| 36523 | Coden | Mobile | Alabama | View Map |

| 36524 | Coffeeville | Clarke | Alabama | View Map |

| 36525 | Creola | Mobile | Alabama | View Map |

| 36526 | Daphne | Baldwin | Alabama | View Map |

| 36527 | Spanish Fort | Baldwin | Alabama | View Map |

| 36528 | Dauphin Island | Mobile | Alabama | View Map |

| 36529 | Deer Park | Washington | Alabama | View Map |

| 36530 | Elberta | Baldwin | Alabama | View Map |

| 36532 | Fairhope | Baldwin | Alabama | View Map |

| 36533 | Fairhope | Baldwin | Alabama | View Map |

| 36535 | Foley | Baldwin | Alabama | View Map |

| 36536 | Foley | Baldwin | Alabama | View Map |

| 36538 | Frankville | Washington | Alabama | View Map |

| 36539 | Fruitdale | Washington | Alabama | View Map |

| 36540 | Gainestown | Clarke | Alabama | View Map |

| 36541 | Grand Bay | Mobile | Alabama | View Map |

| 36542 | Gulf Shores | Baldwin | Alabama | View Map |

| 36543 | Huxford | Escambia | Alabama | View Map |

| 36544 | Irvington | Mobile | Alabama | View Map |

| 36545 | Jackson | Clarke | Alabama | View Map |

| 36547 | Gulf Shores | Baldwin | Alabama | View Map |

| 36548 | Leroy | Washington | Alabama | View Map |

| 36549 | Lillian | Baldwin | Alabama | View Map |

| 36550 | Little River | Baldwin | Alabama | View Map |

| 36551 | Loxley | Baldwin | Alabama | View Map |

| 36553 | Mc Intosh | Washington | Alabama | View Map |

| 36555 | Magnolia Springs | Baldwin | Alabama | View Map |

| 36556 | Malcolm | Washington | Alabama | View Map |

| 36558 | Millry | Washington | Alabama | View Map |

| 36559 | Montrose | Baldwin | Alabama | View Map |

| 36560 | Mount Vernon | Mobile | Alabama | View Map |

| 36561 | Orange Beach | Baldwin | Alabama | View Map |

| 36562 | Perdido | Baldwin | Alabama | View Map |

| 36564 | Point Clear | Baldwin | Alabama | View Map |

| 36567 | Robertsdale | Baldwin | Alabama | View Map |

| 36568 | Saint Elmo | Mobile | Alabama | View Map |

| 36569 | Saint Stephens | Washington | Alabama | View Map |

| 36571 | Saraland | Mobile | Alabama | View Map |

| 36572 | Satsuma | Mobile | Alabama | View Map |

| 36574 | Seminole | Baldwin | Alabama | View Map |

| 36575 | Semmes | Mobile | Alabama | View Map |

| 36576 | Silverhill | Baldwin | Alabama | View Map |

| 36577 | Spanish Fort | Baldwin | Alabama | View Map |

| 36578 | Stapleton | Baldwin | Alabama | View Map |

| 36579 | Stockton | Baldwin | Alabama | View Map |

| 36580 | Summerdale | Baldwin | Alabama | View Map |

| 36581 | Sunflower | Washington | Alabama | View Map |

| 36582 | Theodore | Mobile | Alabama | View Map |

| 36583 | Tibbie | Washington | Alabama | View Map |

| 36584 | Vinegar Bend | Washington | Alabama | View Map |

| 36585 | Wagarville | Washington | Alabama | View Map |

| 36587 | Wilmer | Mobile | Alabama | View Map |

| 36590 | Theodore | Mobile | Alabama | View Map |

| 36601 | Mobile | Mobile | Alabama | View Map |

| 36602 | Mobile | Mobile | Alabama | View Map |

| 36603 | Mobile | Mobile | Alabama | View Map |

| 36604 | Mobile | Mobile | Alabama | View Map |

| 36605 | Mobile | Mobile | Alabama | View Map |

| 36606 | Mobile | Mobile | Alabama | View Map |

| 36607 | Mobile | Mobile | Alabama | View Map |

| 36608 | Mobile | Mobile | Alabama | View Map |

| 36609 | Mobile | Mobile | Alabama | View Map |

| 36610 | Mobile | Mobile | Alabama | View Map |

| 36611 | Mobile | Mobile | Alabama | View Map |

| 36612 | Mobile | Mobile | Alabama | View Map |

| 36613 | Eight Mile | Mobile | Alabama | View Map |

| 36615 | Mobile | Mobile | Alabama | View Map |

| 36616 | Mobile | Mobile | Alabama | View Map |

| 36617 | Mobile | Mobile | Alabama | View Map |

| 36618 | Mobile | Mobile | Alabama | View Map |

| 36619 | Mobile | Mobile | Alabama | View Map |

| 36621 | Mobile | Mobile | Alabama | View Map |

| 36622 | Mobile | Mobile | Alabama | View Map |

| 36625 | Mobile | Mobile | Alabama | View Map |

| 36628 | Mobile | Mobile | Alabama | View Map |

| 36630 | Mobile | Mobile | Alabama | View Map |

| 36633 | Mobile | Mobile | Alabama | View Map |

| 36640 | Mobile | Mobile | Alabama | View Map |

| 36641 | Mobile | Mobile | Alabama | View Map |

| 36644 | Mobile | Mobile | Alabama | View Map |

| 36652 | Mobile | Mobile | Alabama | View Map |

| 36660 | Mobile | Mobile | Alabama | View Map |

| 36663 | Mobile | Mobile | Alabama | View Map |

| 36670 | Mobile | Mobile | Alabama | View Map |

| 36671 | Mobile | Mobile | Alabama | View Map |

| 36675 | Mobile | Mobile | Alabama | View Map |

| 36685 | Mobile | Mobile | Alabama | View Map |

| 36688 | Mobile | Mobile | Alabama | View Map |

| 36689 | Mobile | Mobile | Alabama | View Map |

| 36690 | Mobile | Mobile | Alabama | View Map |

| 36691 | Mobile | Mobile | Alabama | View Map |

| 36693 | Mobile | Mobile | Alabama | View Map |

| 36695 | Mobile | Mobile | Alabama | View Map |

| 36701 | Selma | Dallas | Alabama | View Map |

| 36702 | Selma | Dallas | Alabama | View Map |

| 36703 | Selma | Dallas | Alabama | View Map |

| 36720 | Alberta | Wilcox | Alabama | View Map |

| 36721 | Annemanie | Wilcox | Alabama | View Map |

| 36722 | Arlington | Wilcox | Alabama | View Map |

| 36723 | Boykin | Wilcox | Alabama | View Map |

| 36726 | Camden | Wilcox | Alabama | View Map |

| 36727 | Campbell | Clarke | Alabama | View Map |

| 36728 | Catherine | Wilcox | Alabama | View Map |

| 36732 | Demopolis | Marengo | Alabama | View Map |

| 36736 | Dixons Mills | Marengo | Alabama | View Map |

| 36738 | Faunsdale | Marengo | Alabama | View Map |

| 36740 | Forkland | Greene | Alabama | View Map |

| 36741 | Furman | Wilcox | Alabama | View Map |

| 36742 | Gallion | Marengo | Alabama | View Map |

| 36744 | Greensboro | Hale | Alabama | View Map |

| 36745 | Jefferson | Marengo | Alabama | View Map |

| 36748 | Linden | Marengo | Alabama | View Map |

| 36749 | Jones | Autauga | Alabama | View Map |

| 36750 | Maplesville | Chilton | Alabama | View Map |

| 36751 | Lower Peach Tree | Wilcox | Alabama | View Map |

| 36752 | Lowndesboro | Lowndes | Alabama | View Map |

| 36753 | Mc Williams | Wilcox | Alabama | View Map |

| 36754 | Magnolia | Marengo | Alabama | View Map |

| 36756 | Marion | Perry | Alabama | View Map |

| 36758 | Plantersville | Dallas | Alabama | View Map |

| 36759 | Marion Junction | Dallas | Alabama | View Map |

| 36761 | Minter | Dallas | Alabama | View Map |

| 36762 | Morvin | Clarke | Alabama | View Map |

| 36763 | Myrtlewood | Marengo | Alabama | View Map |

| 36764 | Nanafalia | Marengo | Alabama | View Map |

| 36765 | Newbern | Hale | Alabama | View Map |

| 36766 | Oak Hill | Wilcox | Alabama | View Map |

| 36767 | Orrville | Dallas | Alabama | View Map |

| 36768 | Pine Apple | Wilcox | Alabama | View Map |

| 36769 | Pine Hill | Wilcox | Alabama | View Map |

| 36773 | Safford | Dallas | Alabama | View Map |

| 36775 | Sardis | Dallas | Alabama | View Map |

| 36776 | Sawyerville | Hale | Alabama | View Map |

| 36782 | Sweet Water | Marengo | Alabama | View Map |

| 36783 | Thomaston | Marengo | Alabama | View Map |

| 36784 | Thomasville | Clarke | Alabama | View Map |

| 36785 | Tyler | Lowndes | Alabama | View Map |

| 36786 | Uniontown | Perry | Alabama | View Map |

| 36790 | Stanton | Chilton | Alabama | View Map |

| 36792 | Randolph | Bibb | Alabama | View Map |

| 36793 | Lawley | Bibb | Alabama | View Map |

| 36801 | Opelika | Lee | Alabama | View Map |

| 36802 | Opelika | Lee | Alabama | View Map |

| 36803 | Opelika | Lee | Alabama | View Map |

| 36804 | Opelika | Lee | Alabama | View Map |

| 36830 | Auburn | Lee | Alabama | View Map |

| 36831 | Auburn | Lee | Alabama | View Map |

| 36832 | Auburn | Lee | Alabama | View Map |

| 36849 | Auburn University | Lee | Alabama | View Map |

| 36850 | Camp Hill | Tallapoosa | Alabama | View Map |

| 36851 | Cottonton | Russell | Alabama | View Map |

| 36852 | Cusseta | Lee | Alabama | View Map |

| 36853 | Dadeville | Tallapoosa | Alabama | View Map |

| 36854 | Valley | Chambers | Alabama | View Map |

| 36855 | Five Points | Chambers | Alabama | View Map |

| 36856 | Fort Mitchell | Russell | Alabama | View Map |

| 36858 | Hatchechubbee | Russell | Alabama | View Map |

| 36859 | Holy Trinity | Russell | Alabama | View Map |

| 36860 | Hurtsboro | Russell | Alabama | View Map |

| 36861 | Jacksons Gap | Tallapoosa | Alabama | View Map |

| 36862 | Lafayette | Chambers | Alabama | View Map |

| 36863 | Lanett | Chambers | Alabama | View Map |

| 36865 | Loachapoka | Lee | Alabama | View Map |

| 36866 | Notasulga | Macon | Alabama | View Map |

| 36867 | Phenix City | Russell | Alabama | View Map |

| 36868 | Phenix City | Russell | Alabama | View Map |

| 36869 | Phenix City | Russell | Alabama | View Map |

| 36870 | Phenix City | Lee | Alabama | View Map |

| 36871 | Pittsview | Russell | Alabama | View Map |

| 36872 | Valley | Lee | Alabama | View Map |

| 36874 | Salem | Lee | Alabama | View Map |

| 36875 | Seale | Russell | Alabama | View Map |

| 36877 | Smiths Station | Lee | Alabama | View Map |

| 36879 | Waverly | Lee | Alabama | View Map |

| 36901 | Bellamy | Sumter | Alabama | View Map |

| 36904 | Butler | Choctaw | Alabama | View Map |

| 36907 | Cuba | Sumter | Alabama | View Map |

| 36908 | Gilbertown | Choctaw | Alabama | View Map |

| 36910 | Jachin | Choctaw | Alabama | View Map |

| 36912 | Lisman | Choctaw | Alabama | View Map |

| 36913 | Melvin | Choctaw | Alabama | View Map |

| 36915 | Needham | Choctaw | Alabama | View Map |

| 36916 | Pennington | Choctaw | Alabama | View Map |

| 36919 | Silas | Choctaw | Alabama | View Map |

| 36921 | Toxey | Choctaw | Alabama | View Map |

| 36922 | Ward | Choctaw | Alabama | View Map |

| 36925 | York | Sumter | Alabama | View Map |

Alabama Bank Statement Mortgage Lenders

Alabama Bank Statement Mortgage Lenders NO TAX RETURN ALABAMA MORTGAGE LENDERS CHECKLIST

NO TAX RETURN ALABAMA MORTGAGE LENDERS CHECKLIST