5% Down Miami Florida Jumbo Mortgage Lenders

Can you get a Jumbo Loan with only a 5% Down Payment?

Yes, you can for primary residence purchases!

Whats the minimum credit score for a low down Miami Florida Jumbo Mortgage?

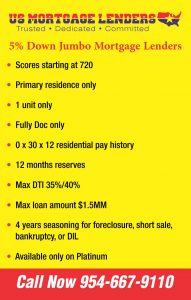

For a 5% down jumbo borrowers must have a minimum 720 credit score. 10% down with over a 660 credit score. Credit and down payment subject to change contact us for updated minimum down payment and credit score requirements.

Jumbo Mortgage Lenders Down Payment Options for Florida

- 720 minimum credit for 5% Down for Primary Residences, Second Homes , Miami Florida Condos.

- 660 minimum credit score for 10% Down for Primary Residences, Second Homes , Miami Florida Condos.

- 680 minimum credit score for 15% Down Payment for Miami Florida Investment Properties.

- VA Jumbo Miami Florida mortgage lenders.

- Credit and down payment subject to change contact us for updated minimum down payment and credit score requirements.

US MORTGAGE LENDERS JUMBO MORTGAGE ADVANTAGE!

- Bad Credit Florida Jumbo Mortgage approvals down to 500!

- Maximum DTI 50%.

- First Time Miami Florida Home-Buyers Ok.

- Prior Foreclosure, short sales, bankruptcies are ok.

- Bank Statements No Tax Return Jumbo mortgage Approvals!

Why Should You Choose Us For Your Jumbo Mortgage?

- Fast same day approvals as soon as we get all your information.

- US Mortgage Lenders 5 star zillows and 5 start google review.

- Personal service you will never get at your local bank

- Specialty Jumbo bank statment only mortgage options for self employed Miami Florida business owners and contractors.

- Loan Options for All situations!

Are You Having Trouble Getting Approved for A Miami Jumbo?

- Bad Credit? Low Credit Scores, we can do a Rapid Re-score to get you approved faster!

- Debt to Income Ratio is too High.

- Don’t have Enough Reserves.

- Past Foreclosures, Short Sales or Bankruptcies.

- Past Mortgage Late Payments.

Do Miami Florida low down payment Miami Florida Jumbo Mortgage Lenders require (PMI) on a Jumbo Mortgage?

No, mortgage insurance is not required for our low 5% or 10% down maim Florida jumbo Loans even though most jumbo lenders do!

Whats is A Jumbo Miami Florida Mortgage Lender?

The median value of a home in Miami Florida is greater than the median values of homes for homes in Florida as a whole, even though the median income is only slightly higher. Certain Miami Florida home loans are secured by government-sponsored entities if they conform to Miami Florida loan limits, but higher Miami Florida jumbo loan amounts are called jumbo loans and are not secured. A few counties in Miami Florida have higher jumbo loan limits than others due to the high cost of the average Miami Florida homes around south Florida.

Miami Florida Conforming Loans vs. Jumbo Florida Mortgage Lenders

Fannie Mae and Freddie Mac only purchase loans that they deem as “conforming.” Fannie Mae and Freddie Mac have various qualifications that a Miami Florida mortgage loan has to meet to conform to the rules, but one of the most important is the actual Jumbo loan amount. At the time of publication, the conforming Miami Florida loan limits were set at $484,350 per the www.fhfa.gov for Miami Florida single-family residence, and as much as $931,600 according to Fannie mae loan limits for a four-unit property. Mimai Florida loans in amounts greater than these are called “jumbo loans,” and loans greater than $1 million, on average, are considered “Miami Florida super jumbo mortgage loans.”

Miami Florida Jumbo Florida Mortgage Lenders Qualifications

Even though there’s a higher risk involved when approving Miami Florida jumbo loans, many Florida lenders still fund them. Your Miami Florida jumbo mortgage approval criteria is scrutinized in more detail, and you’ll also pay slightly higher interest rate and a larger down payment to offset the risk of the larger loan amount. We offer low down payment jumbo loan with only 5-10% down. But most Miami Florida banks and credit unions require -20 -30 % down compared compared to our private Miami Florida low down payment options. To qualify for a jumbo mortgage loan, first you’ll need to earn enough income to support the Miami FL Jumbo mortgage payments. Furthermore, you you should have a good payment history. Low down payment Miami Florida mortgage lenders will also want to see a lower than usual debt to income ratio.

l