US Mortgage Lenders

exclude(954) 667-9110

STATED INCOME TEXAS MORTGAGE LENDERS – STATED INCOME TEXAS MORTGAGE

NO DOC TEXAS COMMERCIAL MORTGAGE LENDERS – STATED INCOME TEXAS MORTGAGE – Houston city in Texas. San Antonio. Dallas.Austin, capital of Texas.Fort Worth. El Paso. Arlington. Corpus Christi. Plano, Lubbock, Garland, Irving, Amarillo, Grand Prairie, Brownsville, McKinney, Frisco, Pasadena, Mesquite STATED INCOME TEXAS MORTGAGE LENDERS- STATED TEXAS HOME LOANS

texas Mortgage Lenders offers a 24-Month Bank Statement Loan Program.

Texas Bank Statement Only borrowers that can document their income by providing the following:

- Bank Statement Lenders Worksheet

- Bank Statement Lenders 24 Month Profit and Loss Statement Request

- NO TAX RETURNS NEEDED!!!

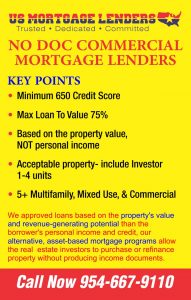

75% NO DOC TEXAS COMMERCIAL MORTGAGE LENDERS

JUMBO BANK STATEMENT – STATED MORTGAGE LENDERS UP TO 5 MILLION

TEXAS STATED HOME LOANS- BASED ON BANK STATEMENTS

- Borrower must be Self Employed

- Personal or Business Statement Accepted

- 50% MAXIMUM DTI FOR BANK STATEMENTS

- 24 months to qualify / Mortgage Late Payments, Short Sales, BK = OK!!

- Bank statement lenders minimum 580 FICO!

25% DOWN STATED TEXAS INVESTOR LOANS!

STATED INCOME TEXAS MORTGAGE PROGRAMS

Florida mortgage lenders offer three stated Documentation Programs:

1.Full Documentation (“Full Doc”)

2. Alternative Income (“Alt Doc Bank Statements”) for Owner Occupied properties

3.Alternative Documentation (“Alt-Doc Cash Flow”) for Non-Owner Occupied or Second Home properties and Business Loan requests.

The below information is a summary of the minimum Florida stated loan documentation requirements for each Income Documentation Program. For additional documentation requirements, refer to the Income Doc Charts in this section of the Guide.

-ALTERNATIVE DOCUMENTATION / BANK STATEMENTS- STATED INCOME FLORIDA MORTGAGE LENDERS

Self-employed ONLY

(Must be able to verify self-employment income)

1. Last twenty-four (24) months personal or business bank statements with all pages required for all months.

2. Stated Florida Borrower Income is determined by using the gross monthly amount of deposits with a deduction of any itemized debts or other expenses that are verified by a tri-bureau merged credit report.

3. Max six (6) NSF checks in the last twelve (12) months.

4. Acceptable documentation supporting the existence of the business for the most recent two (2) years must be obtained. (Refer to the Acceptable Evidence of Self-employed Business).

FULL DOC / WAGE EARNER

1. VOE completed in full by employer verifying most recent two (2) years (Verbal verification of VOE required) and current year-to-date earnings on a current pay stub OR

2. W-2 for most recent two (2) years & current pay stub reflecting year-to-date earnings OR

3. Signed 1040’s for most recent two (2) years & current pay stub reflecting year-to-date earnings

Fixed & Other Sources

Current award/retirement letter; AND

Copy of the most recent bank statement showing automatic deposit (deposit must specifically reference the source of the deposit); OR

1099 for most recent year

Self-employed

Acceptable documentation supporting existence of the business (“Refer to the Acceptable Evidence of Self-employed Business”)AND

Verification of income covering the most recent two (2) years and year-to-date earnings with signed 1040’s as well as other applicable supporting documentation (i.e. 1120’s, K-1s etc.)

100% Commission / Bonus

Verbal VOE, to confirm borrower’s employment and commission/bonus AND

Signed 1040’s for most recent two (2) years with current pay stub reflecting year-to-date earnings (if not pay stub no applicable, obtain bank statements covering year-to-date)

Salaried + > 25% Commission / Bonus

· Signed 1040’s for most recent two (2) years AND current pay stub reflecting year-to-date earnings (pay stub must reflect salaried wage + commission/bonus)

-STATED FLORIDA MORTGAGE LOANS EXPLAINED

If you are self-employed stated Florida home loan applicant, you already know the benefits that come with making your own decisions and never having to report to a boss. However, there are some disadvantages to generating your own self-employed income when it comes to applying for a stated Florida home loan.

“There are two main problems that self-employed Florida borrowers face when qualifying for a Florida mortgage,” “First, you need to prove their income with tax returns rather than using a ‘stated income’ loan. Second, the recent housing recession has caused declining income for many self-employed business owners. Even if their income has stabilized, the stated Florida home loan will be based on the average of your last two years of tax returns, which could show reduced income.”

Stated income Florida home loans were originally designed for self-employed people but were abused by too many Florida business owners that were buying homes they could not afford.

“Stated Florida income loans are starting to make a small comeback on the secondary market, but only for Florida Mortgage applicants with good credit scores of at least 640 or above, a down payment of 25 percent of the sales price or more and at least six months of future cash payment reserves to cover all monthly obligations.

“In the mid-1990s we Florida stated lenders started using bank statements to show cash flow for self-employed people and was a good way to get a lot of Florida homebuyers approved for Stated Florida home loans.

– SELF EMPLOYED BORROWERS INCOME AND TAXES

Self-employed stated Florida mortgage applicants must complete Internal Revenue Service Form 4506-T, which allows stated Florida mortgage lenders to request tax transcripts. Florida stated mortgage lenders are required to wait until the tax returns have been recorded by the IRS and must receive them directly from the IRS to verify legitimate returns.

Many self-employed individuals report expenses on their taxes in order to reduce their tax liability, but this can backfire when they apply for a mortgage.

“Self-employed stated Florida mortgage applicants people typically report their gross income minus expenses to generate a net income,”. “For tax purposes, it may be beneficial to have net income as low as possible, but the net income is the number used for income qualification.”

For example, a Florida business owner that claims $100,000 in income and $80,000 in expenses will find it nearly impossible to qualify for a traditional Florida mortgage. At this point, a self-employed Florida homebuyers has no other option but to apply using a stated Florida mortgage lender.

BANK STATEMENT ONLY MORTGAGE LENDERS LINKS

Bank Statement Only Florida Mortgage Lenders

bank statement only – Florida-Mortgage-Lenders.com

Florida -Bank Statement Only Mortgage Lenders

BANK STATEMENT LOAN PROGRAM DETAILS – Florida-Mortgage …

Serving All Texas Stated Income Including And Not Limited To: Fort Worth Texas Stated Income , Austin Texas Stated Income , Dallas Texas Stated Income , San Antonio Texas Stated Income , Houston Texas Stated Income

SERVING EVERY CITY AND COUNTY IN TEXAS INCLUDING:

Rank Place name 2015 population 2010 Census % Change

1 Houston Texas Self Employed Mortgage Lenders 2,296,224 2,100,389 9.34%

2 San Antonio Texas Self Employed Mortgage Lenders 1,469,845 1,327,407 10.73%

3 Dallas Texas Self Employed Mortgage Lenders 1,317,929 1,197,816 8.53%

4 Austin Texas Self Employed Mortgage Lenders 931,820 790,390 17.89%

5 Fort Worth Self Employed Mortgage Lenders 833,319 741,206 12.42%

6 El Paso Self Employed Mortgage Lenders 681,124 649,121 4.93%

7 Arlington Self Employed Mortgage Lenders 388,125 365,438 6.20%

8 Corpus Christi Self Employed Mortgage Lenders 324,074 305,215 6.17%

9 Plano Self Employed Mortgage Lenders 283,558 259,841 9.12%

10 Laredo Self Employed Mortgage Lenders 255,473 236,091 8.20%

11 Lubbock Self Employed Mortgage Lenders 249,042 229,573 8.48%

12 Garland Self Employed Mortgage Lenders 236,897 226,876 4.41%

13 Irving Self Employed Mortgage Lenders 236,607 216,290 9.39%

14 Amarillo Self Employed Mortgage Lenders 198,645 190,695 4.21%

15 Grand Prairie Self Employed Mortgage Lenders 187,809 175,396 7.07%

16 Brownsville Self Employed Mortgage Lenders 183,887 175,023 5.06%

17 McKinney Self Employed Mortgage Lenders 162,898 131,117 24.23%

18 Frisco Self Employed Mortgage Lenders 154,407 116,989 31.98%

19 Pasadena Self Employed Mortgage Lenders 153,784 149,043 3.18%

20 Mesquite Self Employed Mortgage Lenders 144,788 139,824 3.55%

21 Killeen Self Employed Mortgage Lenders 140,806 127,921 10.07%

22 McAllen Texas Self Employed Mortgage Lenders 140,269 130,242 7.69%

23 Carrollton Texas Self Employed Mortgage Lenders 133,168 119,097 11.81%

24 Midland Texas Self Employed Mortgage Lenders 132,950 111,147 19.61%

25 Waco Texas Self Employed Mortgage Lenders 132,356 124,805 6.05%

26 Denton Texas Self Employed Mortgage Lenders 131,044 113,383 13.24%

27 Abilene Texas Self Employed Mortgage Lenders 121,721 117,063 3.97%

28 Odessa Texas Self Employed Mortgage Lenders 118,968 99,940 19.03%

29 Beaumont Texas Self Employed Mortgage Lenders 118,129 118,296 –0.14%

30 Round Rock Texas Self Employed Mortgage Lenders 115,997 99,887 16.12%

31 The WoodlandsTexas Self Employed Mortgage Lenders 112,505 93,847 19.88%

32 Richardson Texas Self Employed Mortgage Lenders 110,815 99,223 11.68%

33 Pearland Texas Self Employed Mortgage Lenders 108,821 91,252 19.25%

34 College Station Texas Self Employed Mortgage Lenders 107,889 93,857 14.95%

35 Wichita Falls Texas Self Employed Mortgage Lenders 104,710 104,553 0.15%

36 Lewisville Texas Self Employed Mortgage Lenders 104,039 95,290 9.18%

37 Tyler Texas Self Employed Mortgage Lenders 103,700 96,500 7.46%

38 San Angelo Texas Self Employed Mortgage Lenders 100,450 93,200 7.77%

39 League City Texas Self Employed Mortgage Lenders 98,312 83,560 17.65%

40 Allen Texas Self Employed Mortgage Lenders 98,143 84,246 16.49%

41 Sugar Land Texas Self Employed Mortgage Lenders 88,156 78,817 11.84%

42 Edinburg Texas Self Employed Mortgage Lenders 84,497 77,100 9.59%

43 Mission Texas Self Employed Mortgage Lenders 83,298 77,058 8.09%

44 Longview Texas Self Employed Mortgage Lenders 82,287 80,455 2.27%

45 Bryan Texas Self Employed Mortgage Lenders 82,118 76,201 7.76%

46 Pharr Texas Self Employed Mortgage Lenders 76,538 70,400 8.71%

47 Baytown Texas Self Employed Mortgage Lenders 76,335 71,802 6.31%

48 Missouri City Texas Self Employed Mortgage Lenders 74,139 67,358 10.06%

49 Temple Texas Self Employed Mortgage Lenders 72,277 66,102 9.34%

50 Flower Mound Texas Self Employed Mortgage Lenders 71,253 64,669 10.18%

51 New Braunfels Texas Self Employed Mortgage Lenders 70,543 57,740 22.17%

52 North Richland Hills Texas Self Employed Mortgage Lenders 69,204 63,343 9.25%

53 Conroe Texas Self Employed Mortgage Lenders 68,602 56,207 22.05%

54 Victoria Texas Self Employed Mortgage Lenders 67,574 62,592 7.95%

55 Cedar Park Texas Self Employed Mortgage Lenders 65,945 48,937 34.75%

56 Harlingen Texas Self Employed Mortgage Lenders 65,774 64,849 1.42%

57 Atascocita Texas Self Employed Mortgage Lenders 65,844 65,844 0.00%

58 Mansfield Texas Self Employed Mortgage Lenders 64,274 56,368 14.02%

59 Georgetown Texas Self Employed Mortgage Lenders 63,716 47,400 34.42%

60 San Marcos Texas Self Employed Mortgage Lenders 60,684 44,894 35.17%

61 Rowlett Texas Self Employed Mortgage Lenders 60,236 56,199 7.18%

62 Pflugerville Texas Self Employed Mortgage Lenders 57,122 46,936 21.70%

63 Port Arthur Texas Self Employed Mortgage Lenders 55,340 53,818 2.82%

64 Spring Texas Self Employed Mortgage Lenders 54,298 54,298 0.00%

65 Euless Texas Self Employed Mortgage Lenders 54,219 51,277 5.73%

66 DeSoto Texas Self Employed Mortgage Lenders 52,486 49,047 7.01%

67 Grapevine Texas Self Employed Mortgage Lenders 51,404 46,334 10.94%

68 Galveston Texas Self Employed Mortgage Lenders 50,180 47,743 5.10%

15 %DOWN+SELF EMPLOYED TEXAS MORTGAGE LENDERS

texas self employed-bank statement mortgage lenders

https://www.fhamortgageprograms.com/texas-self-employed-bank-statement-mortgag…

TEXAS SELF EMPLOYED-BANK STATEMENT MORTGAGE LENDERS– Same Day approvals Call now 954-667-9110. … Texas self–employed bank Statement Only Lenders Approvals varies Case By Case fromlender to lender. … https://

15 %DOWN+SELF EMPLOYED TEXAS MORTGAGE LENDERS

https://www.fhamortgageprograms.com/self-employed-texas-mortgage-lenders/

15% DOWN+TEXAS BANK STATEMENT MORTGAGE LENDERS. Texas-Bank Statement Only Mortgage Lenders – FHA mortgage lender. 12-24 month texas bank statement mortgage lenders program. 6TEXAS STATED INCOME MORTGAGE LENDERS PROGRAMS. BANK STATEMENT TX MORTGAGE LENDERS Archives – FHA … TEXAS STATED INCOME MORTGAGE LENDERS PROGRAMS.

15% DOWN+TEXAS BANK STATEMENT MORTGAGE LENDERS

https://www.fhamortgageprograms.com/bank-statement-tx-mortgage-lenders/

PORTFOLIO MORTGAGE LENDERS 10%DOWN+BANK STATEMENT TX MORTGAGE LENDERS Texas-Bank Statement Only Jumbo Mortgage Lenders 12 or 24 Month Texas Bank Statement Home LoanProgram. For Texas Self Employed Texas Bank Statement Only (Personal or Business) No Tax Returns No Tax …

Texas-Bank Statement Only Mortgage Lenders – FHA mortgage lender

https://www.fhamortgageprograms.com/texas-bank-statement-mortgage-lenders/

TEXAS BANK STATEMENT ONLY MORTGAGE LENDERS DETAILS INCLUDE: 2 Years Self EmployedRequired! Bank statement deposits used to qualify! No tax returns required. 24 months personal bank statements (Personal and Business) Loans up to $2 million. Credit scores down to 500. Rates starting in the 5’s. Up to 85% LTV.

SELF EMPLOYED TEXAS MORTGAGE LENDERS Archives – FHA …

https://www.fhamortgageprograms.com › FHA › Florida

15 DOWN + SELF EMPLOYED FLORIDA MORTGAGE LENDERS self-em·ployed adjective: self–employed= working for oneself as a freelancer or the owner of a business rather than for an employer. Most self–employed Texas mortgage applicants cannot get approved because they take advantage of to many write-

12-24 month texas bank statement mortgage lenders program

https://www.fhamortgageprograms.com/12-24-month-texas-bank-statement-mortgage…

Our Stated and Texas Bank Statement Only Mortgage Lenders Loan Approvals Up to $3,000,000 LoanAmounts. Texas Bank Statement Only Mortgage Lenders MORTGAGE LENDERS REQUIREMENTS. Min 500 FICO! 24 Months of Statements; Owner Occ. w/ 600 Fico, Non Owner & 2nd Homes w/500 Fico; Self Employed …

3.5% DOWN BAD CREDIT TEXAS MORTGAGE LENDERS

https://www.fhamortgageprograms.com/3-5-down-bad-credit-texas-mortgage-lenders/

BAD CREDIT FHA TEXAS LENDERS ALLOW HIGHER DEBT TO INCOME & EASIER JOB QUALIFYING. FHA allows higher debt ratio’s than any conventional mortgage loan programs. Less than two years on the same job is OK! Self–

TEXAS SELF EMPLOYMENT LINKS

Small Business Events in Your Area

Doing Business in the State

Secretary of State – Corporations

Economic Development and Tourism

Department of Licensing and Regulation

Taxation

Texas Comptroller of Public Accounts – Texas Taxes

Employer Links

Texas Workforce

Unemployment Claim Management and Appeals

New Hire Registry

General

Small Business Administration – Texas

TxSmartBuy – State and Local Bid Opportunities

Administrative Code

City Codes

Statutes

SBA.gov’s Business Licenses and Permits Search Tool allows you to get a listing of federal, state and local permits, licenses, and registrations you’ll need to run a business.