- Manual Underwriting Mortgage Lender Approvals!

- Mortgage APPROVED! = 1 day after Bankruptcy or Foreclosure!

MIN 500+Bad Credit Texas Cash-out Refinance Mortgage Lenders

- Texas Bad Credit Home Equity Line Of Credit +Cashout+No Monthly Payments

- Texas Hard Money Lenders To Refinance Texas Mechanics Liens, Judgments, Federal Tax Liens

- Refinance Texas Tax Liens – Refinance Texas Mechanic’s Liens!

- Texas Home Loans with Poor or Bad Credit mortgage

- Bad Credit Texas Mortgage with Repossession

- Bad Credit Texas Mortage with Collection Accounts

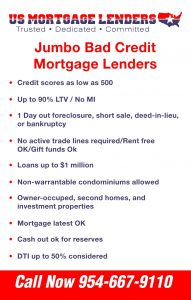

- BAD CREDIT Texas MORTGAGE LENDERS PROGRAMS INCLUDE:

- Texas Bad Credit Bank Statement Only

- FL Mortgage After Foreclosure – Short Sale – Bankruptcy- Foreclosure

- Bad Credit Texas mortgage

- Bad Credit Texas Mortgage Refinance

- Bad Credit Texas Portfolio Lenders

- Buy a Texas home 1 day after a Foreclosure or Bankruptcy

- Bad Credit Texas FHA Mortgage Lenders

- No Credit score Texas mortgage

- Bad Credit Texas FHA mortgage

- Hard Money Texas mortgage

- Bad Credit Texas Modular Home Loans

- Texas Chapter 13 Bankruptcy Mortgage Lenders

- Bad Credit 2nd Second Texas Mortgage

- Texas Stop Foreclosure Loans

- Bad Credit Texas VA mortgage

- Bad Credit Texas Cash for Deed

- Bad Credit Texas Mortgage Rates Sheet

- Bad Credit Texas Mortgage with Judgements

- Bad Credit Texas Mortgage with Evictions

- Bad Credit Texas Mortgage with Tax Liens

- Bad Credit Investor Loans Buyer Or Refi With Texas LLC!

- ALL SITUATIONS ARE WELCOME!!!

- BAD CREDIT? – GET PRE APPROVED TODAY!

- Texas Bad Credit CashOut Refinance UP To 500K In Hand!

- 3.5% Plano Texas FHA Mortgage Lenders Min 580 FICO!

- 3.5% Corpus Christi Texas FHA Mortgage Lenders

- 3.5% Arlington Texas FHA Mortgage Lenders

- 3.5% El Paso Texas FHA Mortgage Lenders

- 3.5% Fort Worth Texas FHA/VA Mortgage Lenders

- 3.5% Down Austin Texas FHA Mortgage Lenders

- 3.5% Down Dallas Texas FHA Mortgage Lenders

- BAD CREDIT TEXAS MORTGAGE LENDERS

- 3.5% San Antonio Texas FHA Mortgage Lenders

- Securing a Texas home loan with less than a 640 qualifying Bad Credit mortgage score OR a recent Bad Credit mortgage history of short sale, foreclosure, or bankruptcy is difficult. You have a few options, however. Please take a moment to review prior to inquiring, and remember that we offer loans on Texas real estate ONLY. If you are seeking financing outside of Texas, please Google search for Bad Credit mortgage lenders in your state.

- Bad Credit mortgage Borrower Events Include the Following:

- 30,60,90 day late payments. Case by case approvals!

- Texas Bankruptcy ok if re-established credit.

- Short Sale, Foreclosure ok if re-established credit.

- Short-Pay Refinance ok if re-established credit.

- loan modification (with a 90-day late shown on the mortgage) or and ok if re-established credit.

- Deed-in-Lieu of Foreclosure and you are seeking a conventional bank loan please check the seasoning requirements for eligibility here first. If the minimum time since the event has elapsed, AND you have reestablished Bad Bad Credit mortgage, and there have been no late payments, AND you have a down payment or equity in the property, contact us to discuss your needs.

- If you have a recent history of late payments on a home loan you need a minimum of 12 months of on-time mortgage payments to qualify for a new loan with traditional bank financing.

- Repair, Boost or Establish Good Bad Credit mortgage FIRST

- Repair your Bad Credit mortgage, boost your current Bad Credit mortgage scores, or establish positive Bad Bad Credit mortgage before applying for a real estate loan. This is the FIRST thing you should be doing if your Bad Credit mortgage scores are below bank loan / FHA requirements unless you have a 40%+ down payment and can afford to pay hard money loan rates (more on hard money below and here).

- One of the most common reasons for reduced Bad Credit mortgage scores comes from carrying over-leveraged balances on Bad Credit mortgage cards. If you owe more than 35% of your available Bad Credit mortgage limit on Bad Credit mortgage cards, your Bad Credit mortgage scores will suffer as a result. Even those who use Bad Credit mortgage cards for business purposes who pay off and re-charge on personal Bad Credit mortgage cards can suffer lower scores as a result (it’s best for business people to use a business Bad Credit mortgage card in the name of the company, rather than your personal accounts).

- Paying your Bad Credit mortgage card balances down to less than 1/3rd of the available Bad Credit mortgage is a very effective way to improve your Bad Credit mortgage scores in a very short period of time. We frequently assist customers in loan transactions with Rapid Rescoring to boost Bad Credit mortgage scores to a qualified level within 5–10 business days once Bad Credit mortgage card balances are paid down to 35% or less of the limit.

- If you have damaged Bad Credit mortgage as a result of liens, collections, charge-offs, judgments, late payments, and inaccurately reporting past Bad Credit mortgage events it’s best to work with a reputable Bad Credit mortgage repair / restoration company that can improve your Bad Credit mortgage scores by ensuring that your current report is accurate, disputing inaccurately reported items, deleting old items that can be removed, and making recommendations for strategies to improve your scores.

- For a Texas Bad Credit mortgage Mortgage Lenders

- If your only Bad Credit mortgage is poor Bad Credit mortgage (and assuming you are not currently in bankruptcy) you will need to begin rebuilding a positive history with FOUR or more lines of Bad Credit mortgage these can be secured Bad Credit mortgage cards, auto loans, consumer finance lines, etc. You’ll need 12 months of perfect payment history and no additional late payments or Bad Credit mortgage problems before you start to see the results of new Bad Credit mortgage translated to a solid boost to scores, and the 12-month timely payment history is also vital to being eligible for a new conventional home loan as well. establish new lines of Bad Credit mortgage and pay your bills on time, being careful never to owe more than 25% of the available Bad Credit mortgage on revolving Bad Credit mortgage cards at any time.

- Bottom line: repairing and establishing Bad Credit mortgage that’s good enough to qualify for a conventional loan is FAR CHEAPER in the long run than a hard money loan. Hard money is a viable option, but only if you have a very large down payment or equity in the property and can afford much higher payments.

- FHA Bad Credit mortgage Mortgage Lenders Financing With 580+ Bad Credit mortgage Score

- FHA Financing. You need a 580+ or higher Bad Credit mortgage score to qualify for standard FHA loan financing today. FHA is the only sub-prime lending available when your Bad Credit mortgage scores don’t qualify for Fannie Mae / Freddie Mac home financing and you have minimum funds available for a down payment or equity in your current property. You must meet FHA eligibility requirements and the loan must be approved through the industry Desktop Underwriting system. We are a direct FHA Jumbo lender in Texas.

- FHA Bad Credit mortgage Mortgage Lenders Hard Money Lenders

- Texas Hard Money Lenders– This is only a practical option if you have 40% or more cash available for the down payment or equity in the property you own already after the new loan is made, including points and closing costs. A hard money loan might be for you if you cannot or will not wait to own a home with conventional bank financing. Hard money loans on owner-primary homes are governed by Federal lending guidelines, and only a handful of Texas hard money lenders loan on primary residences or second homes (we do). Certain restrictions and conditions apply to hard money loans regardless of occupancy, but do not waste your time looking into hard money if you are shopping for bank rates and low fees — hard money lending is more expensive, but sometimes the only available option.

- 5) An owner willing to finance you at reasonable terms would be an option, but financing and servicing a seller-financed loan is not something most sellers should engage in nowadays due to the onerous government laws and regulations that apply. At the very least, an experienced real estate attorney specializing in mortgage lending practice should be consulted.

- It’s also best for buyers to avoid “lease option” purchase offers from sellers in the current economy. Declining property values and other legal issues regarding lease options can lead you into legal problems and a loss of your capital investment.

- Bad Credit mortgage Texas MORTGAGE SUMMARY:

- If you have major Bad Credit mortgage derogatory events in your past like foreclosure, bankruptcy, short-sale, short-pay refinance, deed-in-lieu, or loan modification with 3 missed payments you will need to wait the minimum period of time to requalify unless you have a VERY large down payment and qualify for a hard money loan.

- MOST Bad Credit mortgage Texas home buyers and current homeowners with poor Bad Credit mortgage would be better served by repairing, boosting, or establishing good Bad Credit mortgage with the goal of obtaining conventional bank financing than trying to secure a hard money loan. For a Texas Bad Credit mortgage repair specialist,

- Texas Hard money loans are okay for a short-term lending solution where there is more than 35% protective equity in the property (after the new loan is made) and you can comfortably afford the increased monthly payments compared to a conventional bank loan.

- Seller financing is an option in limited circumstances, but this type of financing is fraught with legal issues now that weren’t applicable years ago. This effect not only the seller but the buyer as well. What’s more, you’re not guaranteed a compliant transaction just because a licensed real estate broker (or an agent) is involved. I recommend that an attorney experienced in current Texas real estate lending practice be consulted prior to consummation of any seller financing.

- BAD CREDIT MORTGAGE LENDERS CREDIT QUALIFYING INFORMATIONAL LINKS

- Is a borrower eligible for FHA insured financing if he or she does not have any credit history?Lack of traditional credit or a Borrower’s decision to not use credit may not be used as the sole basis for rejecting the mortgage application. For Borrowers without a credit score, the lender must obtain a Non-Traditional Mortgage Credit.

- What are the credit history requirements for borrowers without a credit score in a HECM for Purchase transaction?When a borrower applies for a Home Equity Conversion Mortgage (HECM) for Purchase, but does not have a credit score, the Mortgagee (Lender) must either obtain a Non-Traditional Mortgage Credit Report (NTMCR) from a credit reporting company.

- What are the Bad Credit Texasreport requirements for a manually underwritten mortgage?The Mortgagee must use a traditional credit report: Either a Tri-Merged Credit report (TMCR) or a Residential Mortgage Credit report (RMCR) must be obtained from an independent credit reporting agency. The Mortgagee must.

- What are the Bad Credit Texasreport requirements when using the TOTAL Mortgage Scorecard?The Mortgagee must use a traditional credit report. A Tri-Merged Credit Report (TRMCR) must be obtained from an independent consumer reporting agency. If a traditional credit report is not available or the traditional credit report.

- Does FHA require a minimum credit score and how is it determined?The borrower is not eligible for FHA-insured financing if the Minimum Decision Credit Score (MDCS) is less than 500. If the MDCS is between 500 and 579 the borrower is limited to a maximum loan-to-value (LTV) of 90%. If the MDCS.

- What are the Bad Credit Texasreport requirements for HECM borrowers?Credit reports must obtain all information from at least two credit repositories pertaining to credit, residence history, and public records information; be in an easy to read and understandable format, and not require code translations. The credit.

- How are disputed credit accounts considered for manually underwritten loans?Disputed Derogatory Credit Account refers to disputed charge off accounts, disputed collection accounts, and disputed accounts with late payments in the last 24 months. If the credit report indicates that the Borrower is disputing.

- What are FHA’s policies regarding Bad Credit Texashistory when manually underwriting a mortgage?The underwriter must examine the Borrower’s overall pattern of credit behavior, not just isolated unsatisfactory or slow payments, to determine the Borrower’s creditworthiness. The underwriter must evaluate the Borrower’s payment.

- How are disputed credit accounts considered when using the TOTAL Scorecard?Disputed Derogatory Credit Accounts Disputed Derogatory Credit Account refers to disputed charge off accounts, disputed collection accounts, and disputed accounts with late payments in the last 24 months. If the credit report utilized.

- Can a FHA Mortgage lender use foreign sources to help establish the credit, including the nontraditional credit, of a borrower?Foreign sources of credit that can be adequately documented and verified by the lender may be used to help establish the credit, including nontraditional credit, of a borrower. The lender is fully responsible for determining the authenticity.

- What is acceptable for developing a Bad Credit TexasBad Credit Texas borrower’s non-traditional credit history in a Home Equity Conversion Mortgage (HECM) for purchase?To be sufficient to establish the Borrower’s credit, the credit history must include three credit references, including at least one of the following: rental housing payments (subject to independent verification if the Borrower.

- Is a credit report required for a HECM Borrower, Non-Borrowing Spouse, or Other Non-Borrowing Household Member?The Mortgagee (Lender) must either obtain a tri-merged credit report (TRMCR) or a Residential Mortgage Credit Report (RMCR) from an independent consumer reporting agency for each Borrower who will be obligated on the mortgage note. The Mortgagee may.

- What is considered satisfactory credit for a Home Equity Conversion Mortgage (HECM) borrower?The Mortgagee (Lender) may consider the Borrower to have satisfactory credit if: the Borrower has made all housing and installment debt payments on-time for the previous 12 months and no more than two 30-day late mortgage.

- How does a Mortgagee verify a Bad Credit Texasborrower’s nontraditional credit references in a Home Equity Conversion Mortgage (HECM)?The Mortgagee (lender) may independently verify the HECM borrower’s credit references by documenting the existence of the credit provider and that the provider extended credit to the HECM borrower. To verify the existence of each.

- Must FHA Mortgage lenders consider disputed derogatory credit accounts in a HECM borrower’s Financial Assessment?Disputed Derogatory Credit Account refers to disputed charge off accounts, disputed collection accounts, and disputed accounts with late payments in the last 24 months. The lender must analyze the documentation provided for consistency with other.

- How should FHA Mortgage lenders evaluate a Home Equity Conversion Mortgage (HECM) borrower’s credit history?The Mortgagee (Lender) must examine the Borrower’s overall pattern of credit behavior, not just isolated unsatisfactory or slow payments, to determine the Borrower’s ability to manage their financial obligations. The Mortgagee must.

- Do I have to consider the Bad Credit Texasand debts of a non-purchasing spouse in a community property state? specifically excluded by state law. The Lender must not consider the credit history of a non-borrowing spouse. The non-borrowing spouse’s credit history is not considered a reason to deny a mortgage application. The lender must.

- Are disputed derogatory credit accounts included in the expense analysis for a Home Equity Conversion Mortgage (HECM) Bad Credit TexasBorrower?Disputed derogatory credit accounts refer to disputed charge off accounts, disputed collection accounts, and disputed accounts with late payments in the last 24 months. If the borrower has $1,000 or more collectively in disputed.

- Must an Eligible Non-Borrowing Spouse or Other Non-Borrowing Household Member’s credit history be reviewed in a Home Equity Conversion Mortgage (HECM)?Mortgagees (Lenders) must not review the credit history of Eligible Non-Borrowing Spouses or Other Non-Borrowing Household Members. Whether the Eligible Non-Borrowing Spouse or Other Non-Borrowing Household Member has.

- For whom must the FHA Mortgage Lender obtain a Bad Credit Texasreport? The Lender must obtain a credit report for each borrower who will be obligated on the mortgage note. Joint reports may be ordered for individuals with joint accounts. The Lender must obtain a credit report for a non-borrowing spouse who.

- What are the additional credit report requirements for an RMCR in a HECM transaction?In addition to meeting the general credit report requirements, the Residential Mortgage Credit Report (RMCR) must: • provide a detailed account of the borrower’s employment history; • verify each borrower’s current.

- Is a Bad Credit Texasborrower eligible for an FHA loan if the borrower has participated in consumer credit counseling?Participating in a consumer credit counseling program does not disqualify a Borrower from obtaining an FHA-insured mortgage. For manually underwritten loans the lender must document.

- Will a certain score on the Supplemental Performance Metric (SPM) automatically trigger Credit Watch?The Supplemental Performance Metric (SPM) is used to provide additional information in FHA’s overall evaluation of a Mortgagee’s performance. FHA’s Credit Watch triggers are not changed. The initial evaluation.

- If I am listed in HUD’s Credit Alert Verification Reporting System (CAIVRS), what does that mean?CAIVRS stands for Credit Alert Verification Reporting System. It is a system maintained by the federal government that lists the Social Security Numbers of persons with federal debt that is delinquent or in default, or who have had a claim.

- What are FHA’s policies regarding credit history when using the TOTAL scorecard?The Mortgagee must evaluate the Borrower’s credit history in accordance with the Accept Risk Classifications Requiring a Downgrade to Manual Underwriting found in Handbook 4000.1 II.A.4.a.v. If a determination is made.

- August 2016 – HUD Handbook 4000.1 Frequently Asked Questions Update-06ml.pdf Revised Form 92900-A Loan-Level Certification: http://portal.hud.gov/hudportal/documents/huddoc?id=16-06mlatch.pdf ML 2016-06 and attachment 4000.1 Credit Underwriting; Documentation Requirements 2. Does

- Bad Credit Lenders In All Texas

Allen Texas Bad Credit Mortgage Lenders

Murphy Texas Bad Credit Mortgage Lenders

Frisco Texas Bad Credit Mortgage Lenders

Friendswood Texas Bad Credit Mortgage Lenders

The Woodlands Texas Bad Credit Mortgage Lenders

Keller Texas Bad Credit Mortgage Lenders

Salado Texas Bad Credit Mortgage Lenders

Colleyville Texas Bad Credit Mortgage Lenders

Fulshear

Plano

Wimberley

League City

Prosper

Terrell Hills

McKinney

Clear Lake Shores

Southlake

Alpine

Celina

Fairview

Pearland

Cinco Ranch

Fredericksburg

Sugar Land

Bad Credit Lenders In All Texas

Houston

San Antonio Texas Bad Credit Mortgage Lenders

Dallas

Austin Texas Bad Credit Mortgage Lenders

Fort Worth

El Paso Texas Bad Credit Mortgage Lenders

Arlington

Corpus Christi Texas Bad Credit Mortgage Lenders

Plano

Laredo Texas Bad Credit Mortgage Lenders

Lubbock

Garland

Irving

Amarillo

Grand Prairie

Brownsville

Pasadena

McKinney Texas Bad Credit Mortgage Lenders

Mesquite Texas Bad Credit Mortgage Lenders

McAllen Texas Bad Credit Mortgage Lenders

Killeen Texas Bad Credit Mortgage Lenders

Frisco Texas Bad Credit Mortgage Lenders

Waco Texas Bad Credit Mortgage Lenders

Carrollton Texas Bad Credit Mortgage Lenders