TEXAS NO TAX RETURN MORTGAGE LENDERS+PURCHASE OR REFINANCE

Texas Mortgage 2 homes 1 Parcel or Lot or Acres No Tax Return Mortgage Lenders

SELF EMPLOYED MORTGAGE LENDERS QUESTIONS AND ANSWERS

- Do self employed mortgage lenders allow w2 co-borrowers income to qualify? asked by Thomas Martin

- If my account has overdrafts or NFS can i still qualify for a bank statment only mortgage? asked by Thomas Martin

- Do I need tax returns to qualify for a mortgage? asked by Thomas Martin

- Do no doc mortgage loans still exist for primary homes? asked by Thomas Martin

- Can I use 1 YEAR bonus overtime commission to qualify for a FHA mortgage? asked by Thomas Martin

- How can i get approved for a mortgage if I am Self Employed? asked by Thomas Martin

- Are Stated Income loans still available? asked by Thomas Martin

- Why should i apply for a bank statement only loan instead of a conventional mortgage if i’m self employed? asked by Thomas Martin

- Whats The Minimum Down payment For a self employed no tax return mortgage? asked by Thomas Martin

- TEXAS SELF EMPLOYED-BANK STATEMENT MORTGAGE LENDERS

SELF EMPLOYED TEXAS CASH-OUT REFINANCE UP TO 500K! - SERVING ALL TEXAS INCLUDING FORT WORTH TEXAS, AUSTIN TEXAS, DALLAS TEXAS, SAN ANTONIO TEXAS, HOUSTON TEXAS

Texas Self Employed Mortgage Lenders

Definition: A business that legally has no separate existence from its owner. self-employed income and losses are taxed on the individual’s personal self-employed income tax return. Multiple banks account statements + Separate W2 self-employed income OK!

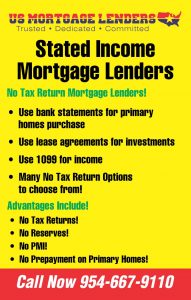

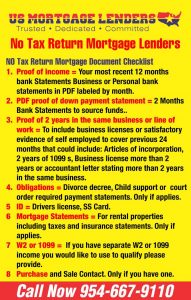

No Tax Return Texas bank statement Mortgage Lenders

Texas Self Employed mortgage lenders 12 Months Texas bank statements for self-employed income with NO TAX RETURNS NEEDED!

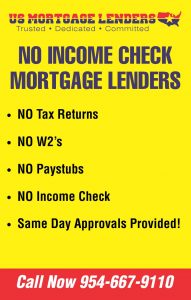

NO TAX RETURNS NEEDED! QUALIFY USING BANK STATEMENT ONLY QUESTIONS AND ANSWERS PAGE

No Tax Return Mortgage Employment Types

- 1099

- Sole Proprietor

- Must provide proof of self-employment including business license, Tax Preparer’s letter or corporate paperwork. Self-employed mortgage lenders will accept Personal or Business Texas bank statements. However, qualifying Texas Self Employed income will be calculated differently.

PERSONAL TEXAS BANK STATEMENT MORTGAGE LENDERS USE 100% OF DEPOSITS IF THE DEPOSITS COME FROM A BUSINESS BANK ACCOUNT

Add all deposits for all 12 months and divide that amount by 12 to receive the monthly Texas Self Employed income amount we will apply as the self-employed mortgage applicants qualifying Texas Self Employed income.

- Ex. 24 months Texas bank statement deposits total = $200,000 / 24 = $8,333 a month Texas Self Employed income.

- Ex. 12 months Texas bank statement deposits total = $100,000 / 12 = $8,333 a month Texas Self Employed income.

Business Texas bank statements: 50% of Deposits

Add all deposits for all 12 or 24 months, divide by 2, and then divide by 12 or 24 respectively to receive the monthly Texas Self Employed income amount we will allow for the self-employed mortgage applicants.

Ex. 24 month deposit total = $500,000 / 2 = $250,000 / 24 = $10,333 per month Texas Self Employed income. Only 50% is used because we have to assume the business has overhead.

Self-Employed Mortgage Lenders Program Details:

- Must have 12 consecutive Texas bank statements months of statements (no gaps)

- Only Texas bank statement deposits can be used

- Transfers are NOT counted on personal and case-by-case for business*

- Must provide All pages (even the last pages with advertising)

- Multiple bank accounts statements + W2 Texas Self Employed income OK!

- If the account was used and closed and new account for the remainder of statements must show the closing of old account and the opening of the new account

Texas bank statement Transfers may be accepted for business statements when they come from credit card clearing houses (examples: Paypal, Square, AMEX, etcetera). Reviewed for acceptance on a case-by-case basis, and must be considered normal for the company.

Multiple Texas bank statement deposits and accounts are considered on a case-by-case basis when one account is closing and reopening the new account, or (b) for Business accounts that are two different and autonomous businesses.

Texas Self Employed income & Texas Self Employed Mortgage- Texas bank statement Only Documentation

Texas bank statement Texas Self Employed income Documentation is available for self-employed borrowers only. Three Texas bank statement

documentation options are available.

24-month personal Texas bank statements

12-month business Texas bank statements

12-month personal Texas bank statements

24-month business Texas bank statements

General Requirements for all Texas bank statement Documented Loans:

Borrowers must be self-employed at the same business for at least 2 years.

All parties listed on each bank account must also be borrowers on the loan.

Statements must be the most recent months available and must be consecutive.

Statements must support stable and generally predictable deposits.

1. Unusual deposits must be documented.

2. Deposits/earnings trend should not be declining.

Up to 3 NSF checks and overdraft protection transfers in the most recent 12-month period are allowed with an

explanation from the borrower.

Additional Texas Self Employed income deposited into the bank accounts but derived from a source other than the self-employed

business may not be included in the Texas bank statement average.

1. W-2 earnings or other Texas Self Employed income sources not associated with self-employment, such as a spouse employed

as a wage earner, must be documented using Full Doc.

2. When wage Texas Self Employed income is combined with Texas bank statement documentation, a tax return is not required for the

full Texas Self Employed income documentation, as this would invalidate the Texas bank statements.

3. The 4506T is still required; however, box 8 should be checked to obtain a transcript of W-2 earnings

only.

4. Rental Texas Self Employed income must be documented using Full Doc. Rental Texas Self Employed income is not eligible for Texas bank statement

documentation.

If the Texas bank statements provided reflect payments being made on obligations not listed on the credit report

additional information must be obtained to determine if the liability should be included in the borrower’s debt-to-

Texas Self Employed income ratio.

1. If the obligation does not belong to the borrower, supporting documentation is required.

No Tax Return Texas bank statement Mortgage Lenders Program summary

Texas Self Employed Mortgage Lenders offer Non-Qualified Mortgages on fully amortizing 15 & 30-Year Fixed Rate and 5/1 & 7/1 ARM products and interest-only 40-year Fixed Rate and 5/1 & 7/1 ARM products. Loan amounts from $100,000 to $5,000,000 are eligible.

Full Documentation with DTI to 55% including Asset Utilization for qualifying Texas Self Employed income

Texas bank statement Only Mortgage Lenders Texas Self Employed income Documentation

o 24 Month Texas bank statement Only Mortgage Lenders Personal Texas bank statements

o 12 Month Texas bank statement Only Mortgage Lenders Personal Texas bank statements

o 24 Month Texas bank statement Only Mortgage Lenders Business Texas bank statements

Interest-only and fully amortized Texas bank statement Only Mortgage Lenders products

LTVsTexas bank statement Only Mortgage Lenders to 90% (80% max for IO)

Non-warrantable condominiums Texas bank statement Only Mortgage Lenders

Texas Self Employed Mortgage Lenders Purchase Or Rate & Term Refinance:

The new loan amount is limited to the payoff of the present first lien mortgage, any seasoned non-first lien mortgages,

closing costs and prepays.

A seasoned non-first lien mortgage is a purchase money mortgage or a mortgage that has been in place for

12 months.

A seasoned equity line is defined as not having total draws greater than $2,000 in the past 12 months.

Cash to the Texas Self Employed mortgage applicants is limited to the lesser of 2% or $2,000.

Properties currently listed for sale at time of loan application are not eligible for a rate/term to refinance transaction. If the property was listed within the last 6 months, the following is required:

o Proof of canceled listing prior to closing.

o Acceptable letter of explanation from the self-employed mortgage applicants detailing the rationale for changing the intention to sell.

Prior refinances: At least 6 months, note date to note date, must have elapsed since any prior cash-out

refinances on the subject property.

Title must be in the self-employed mortgage applicants ’name at time of application and on the closing date.

Texas Self Employed Mortgage Lenders Cashout Refinance

Cash-Out Refinance Using Texas bank statements For Texas Self Employed income:

A signed letter from the self-employed mortgage applicants disclosing the purpose of the cash-out must be obtained on all cash-out

transactions.

There must be seasoning of at least 6 months (and title must be in the self-employed mortgage applicants’ name for at least 6

months) since any prior financing (purchase or refinance) was obtained. Note date to note date is used to

determine to the season.

Properties purchased entirely with cash within the last 6 months do not qualify for cash-out but may be

eligible for Delayed Financing. Refer to the Delayed Purchase Refinance section. Other than as provided for

in Delayed Financing, a mortgage taken out on a property previously owned free and clear is always

considered a cash-out refinance.

Properties that have been listed for sale within the past 6 months of loan application are not eligible for a

cash-out refinance transaction.

Maximum cash-out limitations include the payoff of any unsecured debt, unseasoned liens, and any cash in

hand.

Loan-to-Value (LTV) Calculations For Texas Self Employed Texas bank statement Mortgage Applicants:

If the borrower has less than 12 months ownership of the property, the LTV/CLTV for a refinance transaction

is calculated on the lesser of the purchase price or appraised value.

o For homes where capital improvements have been made to the property after purchase, LTV/CLTV can

be based on the lesser of the current appraised value or original purchase price plus the documented

improvements. Receipts are required to document cost of improvements.

If the borrower has owned the property for 12 months, the LTV/CLTV is based on the appraised value.

Underwriting Method For Sefl Employed Mortgage Applicants

All loans must be manually underwritten and fully documented per these self-employed mortgage lenders Program Guidelines. If a requirement is not addressed in these Guidelines, refer to the more restrictive of self-employed mortgage lenders.

Texas Self Employed Mortgage LendersCredit Guidelines

All loans are subject to a second level review. Please allow five business days of additional review time of timeof initial approval. self-employed mortgage lenders underwriters must refer to Texas Self Employed mortgage lenders Non-conforming Underwriting Procedures for second level review requirements and procedures.

Underwriters must complete the Alternative Loan Analysis Form – FM-383 to ensure the loan is processed on the most an appropriate program for the applicant.

All loans should contain an Ability to Repay (ATR) Borrower Certification Form signed by the borrower. self-employed mortgage lenders’ disclosures include an ATR borrower certification form.SeflEmployed Mortgage Lenders Information For…

Texas Self Employed income & Texas Self Employed Mortgage Lenders Documentation

Full Doc is available for salary, wage, hourly and self-employed Texas Self Employed income sources.

All Loans Require 4506-T, Tax Transcripts and a Verbal Verification of Employment in addition to the Texas Self Employed income

documentation requirements listed in this section. Note: 4506-T is not required for Texas bank statement Documentation.

4506-T/Tax Transcripts: Must be completed and signed by all borrowers both at application and closing. The

4506-T will be processed and tax transcripts obtained for all years in which Texas Self Employed income was used in the underwriting

decision. Transcripts are not required for business returns.

Verbal Verification of Employment: Verbal Verification of Employment is required prior to closing for all

borrowers with qualifying Texas Self Employed income.

Wage Texas Self Employed income: A verbal verification to confirm the borrower’s current employment status is required for all

borrowers within 10 calendar days prior to the Note date.

Self-Employed Texas Self Employed income:

o Verification of the existence of the borrower’s business from a third party, such as a CPA, regulatory

agency, or applicable licensing bureau. A borrower’s website is not acceptable as third party verification

o Listing and address of the borrower’s business using a telephone book, internet, or directory assistance

o Name and title of the person completing the verification

o Verification must be obtained within 30 calendar days prior to the Note date

Texas Self Employed Mortgage Lenders Documentation Standards:

Paystubs: Paystubs must meet the following requirements:

Clearly identify the borrower as the employee.

Show the borrower’s current pay period and year-to-date earnings.

If the borrower is paid hourly, the number of hours must be shown on the paystub.

Paystubs must be computer generated.

Paystubs issued electronically via email or downloaded from the Internet must show the URL address, date

and time printed, and identifying information on place of origin and/or author of the documentation.

W-2 Forms: W-2 Forms must be complete and be a copy provided by the employer.

Verification of Employment (VOE): A written VOE is required for a borrower’s Texas Self Employed income sourced from

commissions, bonus, overtime, or other Texas Self Employed income when the Texas Self Employed income detail is not clearly documented on W-2 Forms

or paystubs. Written VOEs cannot be used as a sole source for verification of employment, paystubs and W-2s

are still required. Written VOE must include:

Borrower’s date of employment

Borrower’s employment status and job title

Name, phone number and title of person completing the VOE

Name of employer

Base pay amount and frequency

Additional salary information, which itemizes bonus, commission, overtime, or other variable Texas Self Employed income

VOE must be sent directly to the employer, the attention of the personnel department. The VOE must be

returned directly to self-employed mortgage lenders.

Tax Returns: The following standards apply when using Texas Self Employed income Tax Returns to verify Texas Self Employed income:

Personal Texas Self Employed income Tax Returns

o Must be complete with all schedules (W-2 forms, 1099 Forms, K-1 schedules, etc.)

o Signed and dated by each borrower on or before the closing date

Business Texas Self Employed income Tax Returns

o Must be complete with all schedules (K-1 schedules, Form 1120, 1065, etc.)

o Signed and dated by each borrower on or before the closing date

Unfiled Tax Returns for the prior year’s tax return

o Between Jan 1 and the tax filing date (typically April 15), borrowers must provide:

IRS form 1099 and W-2 forms from the previous year

Loans closing in January prior to receipt of W-2s may use the prior year year-end paystub. For

borrowers using 1099s, evidence of receipt of 1099 Texas Self Employed income must be provided.

o Between the tax filing date (April 16) and the extension expiration date (typically October 15), borrowers

must provide (as applicable):

Copy of the filed extension.

Evidence of payment of any tax liability identified on the federal tax extension form.

W-2 forms.

Form 1099, when applicable.

Year-end profit and loss for prior year.

Current year profit & loss.

Balance sheet for prior calendar year.

o After the extension expiration date,loan is not eligible without prior year tax returns.

Credit Standards For Texas Self Employed Mortgage Applicants:

A tri-merged credit report is required. Unless otherwise addressed below, Fannie Mae underwriting guidelines must be

followed for evaluating a borrower’s credit history. Credit reports with bureaus identified as “frozen” are required to be

unfrozen and a current credit report with all bureaus unfrozen is required.

Credit Scores: The lowest qualifying score of all applicants is used to qualify. The qualifying score is the lower of 2 or

middle of 3 scores for each borrower.

Trade Lines:

3 trade lines – Each trade line must have activity in the last 12 months and may be open or closed.

OR

2 trade lines – Each trade line must have been reported for 24 months and have activity in the last 12

months and may be open or closed.

Trade lines used to qualify may not exceed 0x60 in the most recent 12 months.

Authorized User accounts may not be used to satisfy the trade line requirements.

Non-traditional credit or trade lines with derogatory credit may not be used to satisfy the trade line

requirements.

Credit Evaluation:

All accounts, revolving andinstallment, reported by the borrower on the application must be verified directly by a credit

reference or verified on the credit report. The balance, rating and terms of the account must be verified. If the account

has not been updated on the credit report within 90 days of the date of the credit report, a supplement to the credit

report or a separate written verification form must be obtained.

Must be current at closing

Maximum 2 x 30 and 0 x 60 in most recent 12 months

Maximum 1 x 60 in months 12 – 24

Housing Payment History:

0 x 30 mortgage/rental delinquency in the past 24 months.

This applies to all mortgages and all borrowers on the loan.

Mortgage/rent must be rated up to and including the month of the new loan closing.

The subject mortgage must be current at application and closing.

Mortgage history and/or rental history must be verified for the most recent 24 months if this information does not appear

on the credit report. Acceptable sources include institutional VOM, institutional VOR or canceled checks. The underwriter

must obtain the current balance, current status, monthly payment amount and a payment history for the last 24 months.

Directly written verification of rent is acceptable in lieu of canceled checks when the landlord is a large professional

management company.

Borrowers Living Rent Free:

If the borrower has been living with a relative rent free:

Full Documentation only (Texas bank statement Texas Self Employed income Documentation is not allowed)

Acceptable documentation to evidence borrowers have not had a housing obligation must be provided.

Payment History on any other Property (Regardless of Occupancy):

All payment ratings on properties will be considered mortgage credit for grading purposes. Payments on a manufactured

home, timeshare, or second mortgage are considered to be mortgage debt, even if reported as an installment loan. Any

late payment in the last 24 months on a manufactured home, timeshare, second mortgage, will be considered ineligible

for the program.

Bankruptcy / Foreclosure / NOD / Short Sale / Deed-in-Lieu / Restructured (Modified) Loan: Four years

seasoning is required.

Texas Self Employed Mortgage With Collections, Charge-offs, Judgments, Garnishments & Liens:

Delinquent credit including taxes, judgments, charged-off accounts, collection accounts, past-due accounts, tax liens,

mechanics’liens,and any other liens that have the potential to affect the first lien position or diminish the borrower ’s equity must be paid off at or prior to closing.

Collection Accounts that meet the following requirements may remain open.

Collections and charge-offs < 24 months old with a maximum cumulative balance of $2,000 may remain open

Collections and charge-offs ≥ 24 months old with a maximum of $2,500 per occurrence may remain open

Cash-out proceeds may not be used to satisfy accounts paid off at closing.

Any adverse credit, including disputed accounts, on the borrower’s credit report, must be sufficiently explained

by the borrower in writing.

Medical collection accounts do not have to be paid off.

Inquires: A detailed explanation letter that specifically addresses both the purpose and outcome of each inquiry in the

last 120 days is required. If additional credit was obtained, a verification of that debt must be obtained and the borrower re-qualified with the additional debt.

Stability of Texas Self Employed Mortgage Applicants Texas Self Employed income:

Stable monthly Texas Self Employed income is the borrower’s verified gross monthly Texas Self Employed income from all acceptable and verifiable

sources that can reasonably be expected to continue for at least the next 3 years. A 2-year history of

receiving Texas Self Employed income is required in order for the Texas Self Employed income to be considered stable and used for qualifying. While

the sources of Texas Self Employed income may vary, the borrower should have a consistent level of Texas Self Employed income despite changes in

the sources of Texas Self Employed income.

Texas Self Employed income from self-employment is considered stable if the borrower has been self-employed for 2 or more

years.

Frequent job changes to advance within the same line of work may be considered favorable. Job changes

without advancement or in different fields of work should be carefully reviewed to ensure consistent or

increasing Texas Self Employed income levels and the likelihood of continued stable employment.

Borrowers should provide a signed, written explanation for any employment gaps that exceed 30 days in the

most recent 12-month period, or that exceed 60 days in months 13-24.

Recent graduates and borrowers re-entering the workforce after an extended period are allowed.

Documentation must support that the borrower was either attending school or in a training program

immediately prior to their current employment history. School transcripts must be provided to document.

Texas Self Employed income may not be used for qualification purposes if it comes from any source that cannot be verified, is not

stable, or will not continue.

All Texas Self Employed income sources must be legal in accordance with all applicable federal, state, and local laws, rulesandregulations, without conflict.

Specific Texas Self Employed income Documentation Requirements:

Texas Self Employed income Type Documentation Requirement

Hourly/Salary

Wage-Earners

All of the following are required

W-2 forms for the most recent 2 years

Year-to-date paystub up through and including the most current pay period at the time of

application and not earlier than 90 days prior to the Note date

Part-Time Texas Self Employed income

2 years uninterrupted history in the same part-time job required

Texas Self Employed income must be likely to continue

Texas Self Employed income should not be declining. If the Texas Self Employed income shows a decline, written sound

the rationalization for using the Texas Self Employed income to qualify must be provided, or Texas Self Employed income should not be

used. If the Texas Self Employed income is deemed stable and usable the most recent lower Texas Self Employed income over the

prior 2-year period must be used and may not be averaged.

W-2 forms for the most recent 2 years

Year-to-date paystub up through and including the most current pay period at the time of

application and not earlier than 90 days prior to the Note date Commission

Tax returns for the most recent 2 years if commission >= 25% of annual Texas Self Employed income

W-2s for the most recent 2 years if commission < 25% of annual Texas Self Employed income

Most recent year to date paystub reflecting commission earnings

Commission Texas Self Employed income must be averaged over the previous 2 years

Texas Self Employed income should not be declining. If the Texas Self Employed income shows a decline, written sound

the rationalization for using the Texas Self Employed income to qualify must be provided, or Texas Self Employed income should not be

used. If the Texas Self Employed income is deemed stable and usable the most recent lower Texas Self Employed income over the

prior 2-year period must be used and may not be averaged.

Overtime & Bonus Texas Self Employed income

2 years uninterrupted history of bonus or overtime Texas Self Employed income required

Texas Self Employed income must be likely to continue

Texas Self Employed income should not be declining. If the Texas Self Employed income shows a decline, written sound

rationalization for using the Texas Self Employed income to qualify must be provided, or Texas Self Employed income should not be

used. If the Texas Self Employed income is deemed stable and usable the most recent lower Texas Self Employed income over the

prior 2-year period must be used and may not be averaged.

Written VOE providing a breakdown of Texas Self Employed income for past 2 years

W-2 forms for the most recent 2 years

Year-to-date paystub up through and including the most current pay period at the time of

application and not earlier than 90 days prior to the Note date

2106 Expenses

Employee business expenses must be deducted from the adjusted gross Texas Self Employed income

The expenses should be averaged for the prior 2 years. If the borrower’s employment

situation has changed, the expense deduction should be adjusted to reflect the borrower’s

present earnings situation

Sole Proprietorship

Tax returns, including all schedules, for the prior 2 years signed and dated by each

borrower on or before the closing date

Year-to-date through current quarter’s P&L

Balance Sheet

The P&L and Balance Sheet:

May be borrower prepared or may be prepared by a qualified individual

Must be signed by the preparer and the borrower

Partnerships

Corporations

S Corporations

Tax returns, including all schedules, for the prior 2 years signed and dated by each

borrower on or before the closing date

Year-to-date through current quarter’s P&L

Balance Sheet

The P&L and Balance Sheet:

Must be prepared or reviewed by an unrelated and qualified individual (e.g. accountant

/ bookkeeper)

May be prepared by the borrower as long as they are reviewed by a qualified third

party

Must be signed by the preparer/reviewer and the borrower

W-2s for the prior 2 years if applicable

Business tax returns (1065/1120), including all schedules and K-1s, for the prior 2 years

signed and dated by each borrower on or before the closing date are required. If the

borrower has an ownership percentage < 25% then the business/partner returns are not

required.

Alimony,

Maintenance &

Child Support

Texas Self Employed income

A divorce decree, court ordered separation agreement, court decree, or other legal

agreement providing the payment terms confirming that Texas Self Employed income will continue for at least 3

years

Documentation evidencing that the borrower has been receiving full, regular, and timely

payments for the past 6 months

If payments are not regular, are partial, or not timely the Texas Self Employed income cannot be used

Annuity Texas Self Employed income

12-month history of receipt verified by 1099s, tax returns, or Texas bank statements

Annuities established < 12 months must be in a non-revocable trust with a minimum 40

month distribution term remaining

Letter from issuer indicating:

o Terms of periodic withdrawal

o Amount of withdrawal

o Duration of withdrawal

o Balance of annuity

Account balance must be sufficient to sustain continuance for a minimum of 3 years

Asset Utilization

Purchase or Rate/Term refi only.

Maximum 80% LTV/CLTV, minimum 680 Credit Score.

Minimum Asset Requirement:

o Lesser of 1.5 times the loan amount or $1,000,000 after down payment, loan costs

and required reserves.

o Assets must be seasoned minimum 6 months.

Eligible Assets:

o Stocks, bonds, mutual funds. 70% of value.

o Vested amount of retirement accounts. 60% of vested value. Retirement

accounts are only eligible if the borrower is of retirement age (at least 59 1⁄2).

o Bank accounts – savings, checking, money market. 100% of balances.

Texas Self Employed income Calculation: Net Qualified Assets / 120 = Monthly Texas Self Employed income

Capital Gains

Tax returns for the prior 2 years documenting a 2 year history of capital gains

Gains must be recurring and cannot be used if appears to be a one time occurrence

If the Texas Self Employed income is declining it cannot be used

Assets must be sufficient to sustain the gain for a minimum of 3 years

Departing

Residence

If the borrower is converting their current primary residence to a rental property and using

rental Texas Self Employed income to offset the payment the following requirements apply:

Borrower must have documented equity in departure residence of 25%.

Documented equity may be evidenced by:

o an exterior appraisal or a full appraisal dated within six (6) months of subject

transaction, or

o the original sales price and the current unpaid principal balance

Copy of current lease agreement

Copy of security deposit and evidence of deposit to borrower’s account

Disability Texas Self Employed income

(Long-term and

Short-term)

Documentation from either the insurance company or employer verifying:

o Payment amount

o Conditions for termination of payment

o Likelihood of the Texas Self Employed income continuing for at least 3 years

Copy of most recent check or Texas bank statement verifying receipt of payment

Short-term disability also requires, in addition to the above requirements:

o Signed letter from borrower indicating intent to return to work

o Verification from employer that the borrower will be allowed to return to work

once the disability no longer exists. The letter must identify the borrower’s position

and rate of pay upon return. If the future employment Texas Self Employed income will be less than the

disability Texas Self Employed income, the lower self employed income amount must be used to qualify for the loan.

Dividend/Interest

Texas Self Employed income

Tax returns for the prior 2 years supporting a 2 year history of receipt

Verification of stock asset values no older than 30 days prior to the note date

Documentation verifying asset(s) to support the continuation of Texas Self Employed income for a minimum of

3 years

Foreign Texas Self Employed income

Tax returns for the prior 2 years reflecting the foreign Texas Self Employed income

Texas Self Employed income must be converted to U.S. currency

Standard Texas Self Employed income stability and continuance requirements are met

Standard documentation requirements apply based on the type of Texas Self Employed income

Texas Self Employed income from sanctioned countries administered by OFAC is not allowed.

Foster Care Texas Self Employed income

Allowed if there is a 2 year history of receipt and likelihood of continuance for 3 years

May not be considered for children who will reach the age of 19 within 3 years

Documentation from the organization must be provided that clearly verifies:

o Number of foster children

o Age of foster children

o Length of foster care

Copy of most recent check or Texas bank statement verifying receipt of payment

Non-Taxable Texas Self Employed income

Non-Taxable Texas Self Employed income may be grossed up 25% to determine qualifying Texas Self Employed income; however,

non-taxable Texas Self Employed income may not be grossed up for calculating residual Texas Self Employed income.

Federal Tax returns may be required to determine the non-taxable Texas Self Employed income

Note Texas Self Employed income

Tax returns for the prior 2 years supporting a 2 year history of receipt

A copy of the note confirming the amount, frequency and duration of payments

The note must verify the remaining term of a minimum of 3 years

Retirement

Texas Self Employed income (pension,

401(k) and IRA

distributions)

Verify Texas Self Employed income and Source using one of the following:

o Letters from the organization providing the Texas Self Employed income

o Copy of retirement award letters

o Tax returns for the most recent 2 years

o W-2 forms or 1099 forms for the most recent 2 years

o Texas bank statements reflecting regular deposits for the most recent 2 months

Assets supporting distributions must be sufficient to sustain continuance for a minimum of

3 years. Documentation must clearly indicate Texas Self Employed income will continue for a minimum of 3

years.

If the borrower is of retirement age and the Texas Self Employed income is received from corporate,

government, or military retirement/pension, proof of continuance is not required.

Forthcoming

Retirement

Any borrower presently employed but anticipating retirement within 3 years from note date

must be evaluated upon the verified anticipated retirement Texas Self Employed income.

Rental Texas Self Employed income

Tax returns for the prior 2 years, including all schedules

Net rental Texas Self Employed income must be added to the borrower’s total monthly Texas Self Employed income

Net rental losses must be added to the borrower’s total monthly obligations

Rental Texas Self Employed income is calculated using the most recent two year average Cash Flow Analysis of

Schedule E

For properties owned less than 2 years, use the lesser of

o 75% of the current lease minus PITIA, or

o Cash flow analysis of Schedule E from the most recent year

For rental Texas Self Employed income on the subject property purchase, use the lesser of

o 75% of the current lease minus PITIA (evidence of deposit required), or

o 75% of the appraiser’s opinion of rent (1007/216) minus PITIA

o Evidence of the lease deposit must be provided or 3 month’s additional PITIA

reserves is required

For properties listed on Schedule E of the borrower’s tax returns, net rental Texas Self Employed income should

be calculated as: (((Rents received – Total expenses) + (depreciation + interest + taxes +

insurance + HOA)) / # applicable months) – PITIA.

If the subject property is the borrower’s primary residence and generating rental Texas Self Employed income,

the full PITIA must be included in the borrower’s total monthly obligations.

Social Security

Texas Self Employed income

Social Security Texas Self Employed income must be verified by a Social Security Administration benefit

verification letter

Proof of current receipt

Benefits with a defined expiration date (children or surviving spouse) must have a

remaining term of at least three (3) years or the Texas Self Employed income may not be used

Trust Texas Self Employed income

A copy of the Trust Agreement or Trustee Statement showing:

o Total amount of borrower-designated trust funds

o Terms of payment

o Duration of trust

o Trust is irrevocable

Regular receipt of trust Texas Self Employed income for the past 3 months must be documented.

Texas Self Employed income must continue for a minimum of 3 years

If trust funds are being used for down payment or closing costs, the loan file must contain

adequate documentation to indicate the withdrawal of the assets will not negatively affect

Texas Self Employed income and the withdrawal of the trust funds must be documented

Unacceptable

Texas Self Employed income

Illegal Texas Self Employed income

Deferred compensation or Stock options

Retained earnings

Education benefits

Refunds of federal, state, or local taxes

Trailing spouse Texas Self Employed income

Rental Texas Self Employed income from the borrower’s single family primary residence or second home

Foreign shell banks

Medical marijuana dispensaries or any business or activity related to marijuana use, growing,

selling or supplying, even if legally permitted under state or local law

Gambling winnings (except lottery continuing for 5 years) or businesses engaged in any type

of internet gambling

Texas Self Employed Mortgage Lenders

Being Texas Self Employed is the simplest business form under which one can operate a business. The Texas Self Employed mortgage applicants is not a legal entity. It simply refers to a person who owns the business and is personally responsible for its debts. A Texas Self Employed mortgage applicants can operate under the name of its owner or it can do business under a fictitious name, such as Nancy’s Nail Salon. The fictitious name is simply a trade name and it does not create a legal entity separate from the sole proprietor owner.

The advantages of a Texas Self Employed mortgage applicants include:

-

- Owners may freely mix business or personal assets.

-

- Owners can establish a Texas Self Employed mortgage applicants instantly, easily and inexpensively.

-

- Texas Self Employed mortgage applicants carry little, if any, ongoing formalities.

- A sole proprietor need not pay unemployment tax on himself or herself (although he or she must pay unemployment tax on employees).

The owner of a Texas Self Employed mortgage applicants typically signs contracts in his or her own name, because the Texas Self Employed mortgage applicants has no separate identity under the law. The sole proprietor owner will typically have customers write checks in the owner’s name, even if the business uses a fictitious name. Sole proprietor owners can, and often do, commingle personal and business property and funds, something that partnerships, LLCs and corporations cannot do. Texas Self Employed mortgage applicants often have their bank accounts in the name of the owner. Sole proprietors need not observe formalities such as voting and meetings associated with the more complex business forms. Texas Self Employed mortgage applicants can bring lawsuits (and can be sued) using the name of the sole proprietor owner. Many businesses begin as Texas Self Employed mortgage applicants and graduate to more complex business forms as the business develops.

The Texas Self Employed mortgage applicants is a popular business form due to its simplicity, ease of setup, and nominal cost. A sole proprietor need only to register his or her name and secure local licenses, and the sole proprietor is ready for business. A distinct disadvantage, however, is that the owner of a Texas Self Employed mortgage applicants remains personally liable for all the business’s debts. So, if a sole proprietor business runs into financial trouble, creditors can bring lawsuits against the business owner. If such suits are successful, the owner will have to pay the business debts with his or her own money.

Because a Texas Self Employed mortgage applicants is indistinguishable from its owner, Texas Self Employed mortgage applicants taxation is quite simple. The income earned by a Texas Self Employed mortgage applicants is income earned by its owner. A sole proprietor reports the Texas Self Employed mortgage applicants income and/or losses and expenses by filling out and filing a Schedule C, along with the standard Form 1040. Your profits and losses are first recorded on a tax form called Schedule C, which is filed along with your 1040. Then the “bottom-line amount” from Schedule C is transferred to your personal tax return. This aspect is attractive because business losses you suffer may offset income earned from other sources.

As a sole proprietor, you must also file a Schedule SE with Form 1040. You use Schedule SE to calculate how much self-employment tax you owe. You need not pay unemployment tax on yourself, although you must pay unemployment tax on any employees of the business. Of course, you won’t enjoy unemployment benefits should the business suffer.

Sole proprietors are personally liable for all debts of a Texas Self Employed mortgage applicants business. Let’s examine this more closely because the potential liability can be alarming. Assume that a sole proprietor borrows money to operate but the business loses its major customer, goes out of business, and is unable to repay the loan. The sole proprietor is liable for the amount of the loan, which can potentially consume all her personal assets.

The sole proprietor (or even one her employees) is involved in a business-related accident in which someone is injured or killed. The resulting negligence case can be brought against the sole proprietor owner and against her personal assets, such as her bank account, her retirement accounts, and even her home.

Consider the preceding paragraphs carefully before selecting a Texas Self Employed mortgage applicants as your business form. Accidents do happen, and businesses go out of business all the time. Any Texas Self Employed mortgage applicants that suffers such an unfortunate circumstance is likely to quickly become a nightmare for its owner.

If a sole proprietor is wronged by another party, he can bring a lawsuit in his own name. Conversely, if a corporation or LLC is wronged by another party, the entity must bring its claim under the name of the company.

The disadvantages of a Texas Self Employed mortgage applicants include:

-

- Owners are subject to unlimited personal liability for the debts, losses and liabilities of the business.

-

- Owners cannot raise capital by selling an interest in the business.

- Texas Self Employed mortgage applicants rarely survive the death or incapacity of their owners and so do not retain value.

One of the great features of a Texas Self Employed mortgage applicants is the simplicity of formation. Little more than buying and selling goods or services is needed. In fact, no formal filing or event is required to form a Texas Self Employed mortgage applicants; it is a status that arises automatically from one’s business activity.

Texas Tax Forms, Instructions & Publications

Texas tax Form 1040

US Individual Income Tax Return

Annual income tax return filed by citizens or residents of the United States.

For Tax Year 2018, you will no longer use Form 1040A or Form 1040EZ, but instead will use the redesigned Form 1040. Many people will only need to file Form 1040 and no schedules.

Texas tax Form W-9

Request for Taxpayer Identification Number (TIN) and Certification

Used to request a taxpayer identification number (TIN) for reporting on an information return the amount paid.

Texas tax Form 1040-ES

Estimated Tax for Individuals

Form 1040-ES is used by persons with income not subject to tax withholding to figure and pay estimated tax.

Texas tax Form 941

Employer’s Quarterly Federal Tax Return.

Employers who withhold income taxes, social security tax, or Medicare tax from employee’s paychecks or who must pay the employer’s portion of social security or Medicare tax.

Related:

Instructions for Form 941

Texas tax Form SS-4

Application for Employer Identification Number (EIN)

Use this form to apply for an employer identification number (EIN).

Related:

Instructions for Form SS-4

Texas tax Form W-4

Employee’s Withholding Allowance Certificate.

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

Related:

Withholding Calculator

Texas tax Form W-2

Wage and Tax Statement.

Employers must file a Form W-2 for each employee from whom Income, social security, or Medicare tax was withheld.

Texas tax Form W-7

Application for IRS Individual Taxpayer Identification Number.

Get or renew an individual taxpayer identification number (ITIN) for federal tax purposes if you are not eligible for a social

security number.

Related:

Instructions for Form W-7

Spanish Versions:

Form W-7(SP)

Instructions for Form W-7(SP)

Related:

Instructions for Form W-9

Related:

Instructions for 1040 Tax Table

Schedules for Form 1040