SAN ANTONIO TEXAS FHA MORTGAGE LENDERS Good Credit – Bad Credit – No Credit + No Problem + We work with all San Antonio Texas FHA mortgage applicants towards home ownership!

Whether you’re a San Antonio Texas first time home buyer, moving to a new San Antonio home, or want to FHA refinance you’re existing conventional or FHA mortgage, we will show you how to purchase or refinance a San Antonio Texas home using our full doc mortgage programs or bank statement only mortgage programs.

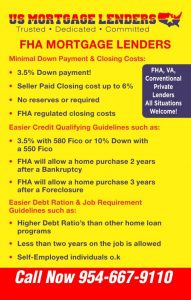

Florida FHA Mortgage Loans Have Minimal Down Payment & Fees:

- Down payment only 3.5% of the purchase price.

- Gifts from family or Grants for down payment assistance and closing costs OK!

- Seller can credit buyers up to 6% of sales price towards buyers costs.

- No reserves or future payments in account required.

- FHA regulated closing costs.

Florida FHA Mortgage Lenders Make it Easier To Qualify Because:

- Purchase a Florida home 12 months after a chapter 13 Bankruptcy

- Purchase a Florida 24 months after a chapter 7 Bankruptcy.

- FHA will allow a FHA mortgage 3 years after a Foreclosure.

- Minimum FICO credit score of 580 required for 96.5% financing.

- Bad credit Florida minimum FICO credit score of 500 required for 90% FHA financing.

- No Credit Score Florida mortgage loans & No Trade Line Florida FHA home loans.

FHA Mortgage Lenders Allow For Higher Debt To Income and Flexible Job Qualifying:

- FHA allows higher debt ratio’s than any other Florida home loan programs.

- Less than two years on the same job is OK!

- Self-employed buyers can also qualify for FHA.

- Check Florida FHA Mortgage Articles for more information.

CATEGORY: FHA MORTGAGE GUIDELINESCan I use an FHA mortgage to buy a Second Home?Secondary home refers to a dwelling that an FHA mortgage applicant occupies, in addition to their principal home, but less than a majority of the calendar year. A Secondary home does not include a vacation home. Secondary homes are only permitted with written approval from the FHA mortgage lenders approved jurisdictional Homeownership Center provided that: … Do FHA Mortgage Lenders Require Collections To Be Paid Off To Qualify For An FHA Mortgage?A Collection Account refers to a FHA mortgage applicants loan or debt that has been submitted to a collection agency by a creditor. If the credit reports used in the analysis show cumulative outstanding collection account balances of $2,000 or greater, the FHA mortgage lender must: • verify that the debt is paid in full… Are reserves required for FHA mortgage applicants with manually underwritten loans?Yes, the Mortgagee must verify and document Reserves equivalent to (1) one month’s Principal, Interest, Taxes, and Insurance (PITI) after closing for one- to two-unit Properties. The Mortgagee must verify and document Reserves equivalent to (3) three months’ PITI after closing for three- to four-unit properties. What are FHA mortgage reserves? FHA Mortgage reserves are… Do FHA Mortgage Lenders Allow Gift of Down payment To come from Friends?Do FHA Mortgage Lenders Allow Gift of Down payment To come from Friends? FHA mortgage lenders refer to gifts or contributions of cash or equity with no expectation of repayment. Gifts may be provided by: • a close friend with a clearly defined and documented interest in the Borrower; • the Borrower’s Family Member; … Do FHA Mortgage Lenders allow employers gift the borrower’s down payment?Do FHA Mortgage Lenders allow employers gift the FHA mortgage applicants down payment? Employer Assistance refers to benefits provided by an employer to relocate the FHA mortgage applicants or assist in the FHA mortgage applicants housing purchase, including closing costs, Mortgage Insurance Premiums (MIP), or any portion of the FHA mortgage applicants Minimum Required… Do FHA mortgage Lenders allow realtors to give a gift of their commission for the down payment?Do FHA mortgage Lenders allow realtors to give a gift of their commission for the down payment? Can A Realtors real estate Commission from Sale of Subject Property refers to the Borrower’s down payment portion of a real estate commission earned from the sale of the property being purchased. FHA mortgage lenders may consider Real… Do FHA Mortgage Lenders Allow Gifts for Down Payment And Closing Cost?Do FHA Mortgage Lenders Allow Gifts for Down Payment And Closing Cost? FHA Mortgage Lenders refer to Gifts as contributions of cash or equity with no expectation of repayment. FHA Mortgage Lenders Allow Gift Funds from the following approved sources • The FHA mortgage applicants Family Member; • The FHA mortgage applicants employer or labor… Will FHA Mortgage Lenders Allow More Than 1 FHA Mortgage?FHA mortgage lenders will not insure more than one Property as a Principal Residence for any FHA mortgage applicants, except as noted below. FHA mortgage lenders will not insure a Mortgage if it is determined that the transaction was designed to use FHA mortgage insurance as a vehicle for obtaining Investment Properties, even if the… FHA Mortgage Lenders Cash Out and Rate Term RefinanceFHA Mortgage Lenders Rate Term Refinance Properties owned > 12 months: The subject property must be owner occupied for at least 12 months at the time of case number assignment. Properties owned < 12 months: The subject property must be owner occupied for the entire period of ownership at the time of case number assignment. … FHA Mortgage Lenders Compensating FactorsFHA COMPENSATING FACTORS What are FHA compensating factors? (FHA compensating factors are the stronger elements of a credit application that it offsets something weaker in the application) but it’s more complicated than that. Different FHA Lenders manage the consideration of compensating factors in different ways. FHA’s written guidelines outline specific examples of what FHA compensating factors… FHA Mortgage Lenders Manual Underwriting ApprovalsFHA Manual Underwrite Lenders Specifications CREDIT SCORE RANGE MAXIMUM QUALIFYING RATIOS APPLICABLE GUIDELINE 500 – 579 ·31/43 ·Energy Efficient Homes may stretch ratios to 33/45 ·Max LTV 90% unless cash out (80%) ·No gifts ·No down payment assistance ·No streamlines ·One month in reserves for 1-2-unit Properties, three months in reserves for 3-4-unit properties (cannot be a… FHA Mortgage Lenders Allow Non Occupant Co BorrowersFHA Mortgage Lenders Non-Occupant co borrower 1-Unit properties only. Max mortgage is limited to 75% LTV unless non-occupying co- borrower’s meet FHA definition of ‘family member’. Seller cannot be non-occupant co-borrower. Non-occupant co-borrowers may be added to improve ratios. Non-occupant co-borrowers cannot be used to overcome or offset borrower’s derogatory credit. The non-occupying borrower arrangement… FHA Mortgage Lenders Source Of Down Payment And ReservesFHA Mortgage Lenders require a minimum cash investment from FHA mortgage applicants own funds and/or gift (no cash on hand allowed when FHA mortgage applicants uses traditional banking sources and has traditional credit history). Any deposit 1 % and greater of the sales price must be sourced and seasoned. An aggregate of deposits 1 °/o… FHA Mortgage Lenders Can Use Non Taxable Income To QualifyFHA Mortgage Lenders Allow Nontaxable income such as Social Security, Pension, Workers Comp and Disability Retirement income can be grossed up 115% of the income can be used to qualify for an FHA mortgage loan. Unacceptable Sources of Income Include: The following income sources are not acceptable for purposes of qualifying the borrower: Any unverified… |

| San Antonio TEXAS CITY DATA Recent home sales, real estate maps, and home value estimator for zip codes: 78023, 78056, 78112, 78201, 78202, 78203, 78204, 78205, 78207, 78208, 78209, 78210, 78211, 78212, 78213, 78214, 78215, 78216, 78217, 78218, 78219, 78220, 78221, 78222, 78223, 78224, 78225, 78226, 78227, 78228, 78229, 78230, 78232, 78233, 78235, 78237, 78238, 78240, 78242, 78244, 78245, 78247, 78248, 78249, 78250, 78251, 78252, 78253, 78254, 78256, 78257, 78258, 78259, 78261, 78264. Population in 2016: 1,492,494 Males: 738,297 (49.5%) Females: 754,197 (50.5%) Median resident age: 33.5 years Texas median age: 34.5 years Zip codes: 78056, 78073, 78202, 78203, 78204, 78205, 78207, 78208, 78210, 78211, 78214, 78215, 78217, 78218, 78220, 78221, 78222, 78224, 78225, 78226, 78227, 78229, 78230, 78231, 78234, 78235, 78237, 78242, 78243, 78245, 78247, 78248, 78249, 78250, 78251, 78252, 78253, 78257, 78258, 78259, 78260, 78264. San Antonio Zip Code Map Estimated median household income in 2016: $49,268 (it was $36,214 in 2000) San Antonio: $49,268 TX: $56,565 Estimated per capita income in 2016: $23,921 (it was $17,487 in 2000) San Antonio city income, earnings, and wages data Estimated median house or condo value in 2016: $133,900 (it was $67,500 in 2000) San Antonio: $133,900 TX: $161,500 Mean prices in 2016: All housing units: $176,188; Detached houses: $179,344; Townhouses or other attached units: $139,380; In 2-unit structures: $166,494; In 3-to-4-unit structures: $149,085; In 5-or-more-unit structures: $162,992; Mobile homes: $54,366 Median gross rent in 2016: $924. |

San Antonio Texas FHA Mortgage Lenders Search Results

3.5% Down San Antonio Texas FHA Mortgage Lenders

https://www.fhamortgageprograms.com/San Antonio-texas-fha-mortgage-lenders-2/

In additions to the FHA mortgage, we offer a huge assortment of VA lenders including FHA, Conventional & Private San Antonio, Texas FHA mortgage programs built around San Antonio, Texas home buyers and homeowners. Whether you’re buying a first home using our great FHA mortgage program or refinancing a home you …

3.5% San Antonio Texas FHA Mortgage Lenders Min 580!

https://www.fhamortgageprograms.com/San Antonio-texas-fha-mortgage-lenders/

A San Antonio Texas FHA Mortgage Lenders can offer you a better Mortgage Deal including: Lower down payments (if … San Antonio TEXAS FHA LOANS ARE EASIER TO QUALIFY FOR BECAUSE: 12 months after a …. https://www.

10DOWN+San Antonio TX SELF EMPLOYED MORTGAGE LENDERS

https://www.fhamortgageprograms.com/San Antonio-tx-self-employed-mortgage-lenders/

https://www.fhamortgageprograms.com/14454-2/ Dec 27, 2017 – PORTFOLIO MORTGAGE LENDERS 10%DOWN+BANK STATEMENT TX MORTGAGE LENDERS San Antonio Texas–Bank Statement Only Jumbo Mortgage Lenders 12 or 24 Month San Antonio Texas Bank StatementHome Loan Program. For San Antonio Texas Self …

SELF EMPLOYED-San Antonio TEXAS MORTGAGE LENDERS

https://www.fhamortgageprograms.com/self-employed-texas-mortgage-lenders-3-2/

15 DOWN+SELF EMPLOYED TEXAS MORTGAGE LENDERS. https://www.

Texas-Bank Statement Only Mortgage Lenders – FHA mortgage lender

https://www.fhamortgageprograms.com/texas-bank-statement-mortgage-lenders/

https://www.fhamortgageprograms.com/6-texas-stated-income-mortgage-lenders

Texas Mortgage Lenders Allow Collections and Disputed Accounts

https://www.fhamortgageprograms.com/texas-mortgage-lenders-allow-collections-disp…

Texas Mortgage Lenders Allow Collections and Disputed Accounts- Texas FHA Mortgage Lenders Same say approvals! Call Now 954-667-9110. … Serving all Texas including – San Antonio,– San Antonio.– Dallas.– Austin …. https://www.

100% San Antonio Texas VA Mortgage Lenders – Min 580 FICO!!

https://www.fhamortgageprograms.com/San Antonio-texas-va-mortgage-lenders/

San Antonio VA Mortgage lenders down to 580 fico! Serving ALL TEXAS! San Antonio Texas VA Mortgage Key Points San Antonio Texas VA Mortgage loans are for Primary homes only. 100% financing up to 453100. Seller Paid Closing cost up to 4%. Bad Credit San Antonio Texas VA Mortgage with Fico Score 550! Please note we …