Texas Mortgage Lenders After Texas Bankruptcy– Foreclosure – Short Sale

BAD CREDIT TEXAS MORTGAGE LENDERS Archive Include:

PRIVATE TEXAS BAD CREDIT MORTGAGE LENDER APPROVALS!

TEXAS DEBT CONSOLIDATION REFINANCE

- Purchase 1 day after Texas bankruptcy, foreclosure, short sale and deed in lieu of Texas foreclosure up to 2.5 million. These are not subprime loans, but they do often have higher interest rates, and higher closing costs.

- Texas Portfolio mortgage lender offer private Texas mortgage loan approvals are looking at other compensating factors to approve these loans. Examples include 12 months timely rental history, high credit scores, lower loan to value (larger down payments), and reserves (future Texas mortgage payments in the account at closing).

A minimum 500 credit score For Texas Portfolio Mortgage Lenders Programs!!

BAD CREDIT FHA MORTGAGE LENDERS APPROVALS WITH MINIMAL DOWN PAYMENT AND CLOSING FEES:

- Down payment only 3.5% of the purchase price.

- Gifts from family or FHA Grants for down payment assistance and closing costs OK!

- Sellers can credit the buyer’s up to 6% of sales price towards buyers costs and pre-paid.

- No reserves or future payments in account required.

- FHA regulated closing costs.

- Read more about buying a home with an FHA mortgage Bad Credit –No Credit – Investment –Second Home –Multi Family –

BAD CREDIT FHA MORTGAGE LENDERS MAKE QUALIFYING EASIER BECAUSE YOU CAN PURCHASE:

- 12 months after a chapter 13 Bankruptcy FHA mortgage Lender approvals!

- 24 months after a chapter 7 Bankruptcy FHA mortgage Lender approvals!

- 3 years after a Foreclosure FHA mortgage Lender approvals!

- No Credit Score FHA mortgage Lender approvals!

- 580 required for 96.5% financing or 3.5% down payment FHA mortgage Lender approvals.

- 500 required for 90% financing or 10% down payment FHA mortgage Lender approvals.

- Bad Credit with minimum 500 FICO credit score with 10% Down Payment FHA. For FHA mortgage applicants with credit scores between 500 and 579 must make down payments of at least 10% down!

- Read more about FHA Qualifying Qualification Summary – Manual Underwrite – Collections-Judgement’s – Texas Bankruptcy or Foreclosure – Compensating Factors –

BAD CREDIT FHA MORTGAGE LENDERS ALLOW HIGHER DEBT TO INCOME & EASIER JOB QUALIFYING

- FHA allows higher debt ratio’s than any conventional mortgage loan programs.

- Less than two years on the same job is OK!

- Self-employed buyers can also qualify with FHA Mortgage Lenders.

- Read More about Gifts For Down Payment – Documents Checklist – Debt To Income – Student Loans –

FHA- FHA MORTGAGE AFTER TEXAS Texas BankruptcyAPPROVALS!

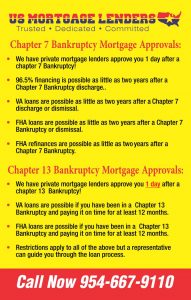

- Chapter 13 Bankruptcy- You may apply for a FHA mortgage after your Texas Bankruptcyhas been discharged for 12 Months or (1) year with a Chapter 13 Bankruptcy. You must have 0 x 30 day late payments, and permission from the chapter 13 trustee.

- Chapter 7 Bankruptcy- You may apply for a FHA mortgage after your Texas Bankruptcyhas been discharged for TWO (2) years with a Chapter 7 Bankruptcy. You may apply for a FHA insured loan after your Texas Bankruptcyhas been discharged for ONE (1) year with a Chapter 13 Bankruptcy

- Foreclosure – You may apply for a FHA insured loan THREE (3) years after the Texas Foreclosure sale/deed transfer date. You may have to search county records office to locate the deed in order to count a full 3 years.

- Short Sale / Deed in Lieu – You may apply for a FHA insured loan THREE (3) years after the sale date of your foreclosure. FHA treats a short sale the same as a Foreclosure for now.You may have to search county records office to locate the deed in order to count a full 3 years.

- Credit must be re-established no late payments in past 12-24 months, depending on hardship

- Application Date must be after the above waiting period to be eligible for FHA financing after hardship.You may have to search county records office to locate the deed transfer out of your name fin order to count a full 3 years.

Texas FHA Mortgage Lenders Require A minimum 580 credit score.

VA- TEXAS MORTGAGE LENDERS APPROVALS!

- Chapter 13 Bankruptcy – Once you have finished making all payments satisfactorily, the Texas mortgage lender may conclude that you have reestablished satisfactory credit.

- If you have made at least 12 months of timely payments and the Trustee or the Texas Texas BankruptcyJudge approves of the new home purchase, the Texas mortgage lender will approve financing after a chapter 13 bankruptcy.

- Chapter 7 Bankruptcy – You may apply for a VA mortgage loan TWO (2) years after a Texas chapter 7 Bankruptcy.

- Foreclosure / Deed in Lieu – You may apply for a VA mortgage loan TWO (2) years after a Texas foreclosure.

- Short Sale – VA does not recognize a short sale as a derogatory event however most Texas mortgage lenders do. Most lenders will require a full 2 years after the deed was transferred out of your name and you re establish credit.

- Credit must be re-established with a minimum 550 credit score

- Application Date must be after the above waiting period to be eligible for VA mortgage after hardship.

Texas VA Mortgage Lenders Require A minimum 550 credit score.

USDA- TEXAS MORTGAGE APPROVALS!

- Foreclosure – You may apply for a USDA rural loan THREE (3) years after a Texas Foreclosure.

- Bankruptcy – You may apply for a USDA rural loan THREE (3) years after the discharge of a Chapter 7 or 13 Texas Bankruptcy.

- Short Sale / Deed in Lieu of Foreclosure – Texas mortgage lenders require 3 years after a Texas foreclosure.

Texas USDA Lenders Require A minimum 550 credit score.

CONVENTIONAL– TEXAS MORTGAGE APPROVALS!

- Foreclosure – You may apply for a Texas Conventional mortgage, Fannie Mae loan (7) SEVEN years after the sale date of your Texas foreclosure.

- Bankruptcy – You may apply for a Conventional, Fannie Mae loan after your Chapter 7 Texas Bankruptcyhas been discharged for FOUR (4) years, TWO (2) years from the discharge of a Chapter 13

- Short Sale / Deed in Lieu of Foreclosure –Waiting period for Texas foreclosure that was included in Texas BankruptcyIf mortgage is included in Bankruptcy, waiting period defaults to FOUR (4) from the discharge date. Texas Short Sale or Deed in Lieu of Texas Foreclosure not included in a Texas Bankruptcyhas a new Waiting Period of FOUR (4) years from date your name is removed from title. This replaces the ability to buy in 24 months with 20% down payment and minimum 680 credit score.

Texas Conventional Lenders Require A minimum 620 credit score.

- Bank Statement Only Bad Credit Texas Mortgage Lenders

- FHA Bad Credit Texas Mortgage Lenders

- VA Bad Credit Texas Mortgage Lenders

- USDA Bad Credit Texas Mortgage Lenders

- Jumbo Bad Credit Texas Mortgage Lenders

- Hard Money Texas Bad Credit Hard Money Lenders

- No Credit Score – Previous Bad Credit Texas Mortgage Lenders

- Condominium Texas Bad Credit Mortgage Lenders

- Town House Texas Bad Credit Mortgage Lenders

- Modular Home Texas Bad Credit Mortgage Lenders

- Chapter 13 Texas FHA Mortgage Lenders

- Non Warrant-able Condo Texas Bad Credit Mortgage Lenders

Texas Bad Credit Mortgage Lenders By Coverage Area

| Texas | Zip Code | City | County | Zip Code Map |

| Texas | 73301 | Aus | Travis | View Map |

| Texas | 73344 | Aus | Travis | View Map |

| Texas | 75001 | Addison | Dallas | View Map |

| Texas | 75002 | Allen | Collin | View Map |

| Texas | 75006 | Carrollton | Dallas | View Map |

| Texas | 75007 | Carrollton | Denton | View Map |

| Texas | 75009 | Celina | Collin | View Map |

| Texas | 75010 | Carrollton | Denton | View Map |

| Texas | 75011 | Carrollton | Dallas | View Map |

| Texas | 75013 | Allen | Collin | View Map |

| Texas | 75014 | Irving | Dallas | View Map |

| Texas | 75015 | Irving | Dallas | View Map |

| Texas | 75016 | Irving | Dallas | View Map |

| Texas | 75017 | Irving | Dallas | View Map |

| Texas | 75019 | Coppell | Dallas | View Map |

| Texas | 75020 | Denison | Grayson | View Map |

| Texas | 75021 | Denison | Grayson | View Map |

| Texas | 75022 | Flower Mound | Denton | View Map |

| Texas | 75023 | Plano | Collin | View Map |

| Texas | 75024 | Plano | Collin | View Map |

| Texas | 75025 | Plano | Collin | View Map |

| Texas | 75026 | Plano | Collin | View Map |

| Texas | 75027 | Flower Mound | Denton | View Map |

| Texas | 75028 | Flower Mound | Denton | View Map |

| Texas | 75029 | Lewisville | Denton | View Map |

| Texas | 75030 | Rowlett | Dallas | View Map |

| Texas | 75032 | Rockwall | Rockwall | View Map |

| Texas | 75034 | Frisco | Denton | View Map |

| Texas | 75035 | Frisco | Collin | View Map |

| Texas | 75037 | Irving | Dallas | View Map |

| Texas | 75038 | Irving | Dallas | View Map |

| Texas | 75039 | Irving | Dallas | View Map |

| Texas | 75040 | Garland | Dallas | View Map |

| Texas | 75041 | Garland | Dallas | View Map |

| Texas | 75042 | Garland | Dallas | View Map |

| Texas | 75043 | Garland | Dallas | View Map |

| Texas | 75044 | Garland | Dallas | View Map |

| Texas | 75045 | Garland | Dallas | View Map |

| Texas | 75046 | Garland | Dallas | View Map |

| Texas | 75047 | Garland | Dallas | View Map |

| Texas | 75048 | Sachse | Dallas | View Map |

| Texas | 75049 | Garland | Dallas | View Map |

| Texas | 75050 | Grand Prairie | Dallas | View Map |

| Texas | 75051 | Grand Prairie | Dallas | View Map |

| Texas | 75052 | Grand Prairie | Dallas | View Map |

| Texas | 75053 | Grand Prairie | Dallas | View Map |

| Texas | 75054 | Grand Prairie | Dallas | View Map |

| Texas | 75056 | The Colony | Denton | View Map |

| Texas | 75057 | Lewisville | Denton | View Map |

| Texas | 75058 | Gunter | Grayson | View Map |

| Texas | 75060 | Irving | Dallas | View Map |

| Texas | 75061 | Irving | Dallas | View Map |

| Texas | 75062 | Irving | Dallas | View Map |

| Texas | 75063 | Irving | Dallas | View Map |

| Texas | 75065 | Lake Dallas | Denton | View Map |

| Texas | 75067 | Lewisville | Denton | View Map |

| Texas | 75068 | Little Elm | Denton | View Map |

| Texas | 75069 | Mckinney | Collin | View Map |

| Texas | 75070 | Mckinney | Collin | View Map |

| Texas | 75071 | Mckinney | Collin | View Map |

| Texas | 75074 | Plano | Collin | View Map |

| Texas | 75075 | Plano | Collin | View Map |

| Texas | 75076 | Pottsboro | Grayson | View Map |

| Texas | 75077 | Lewisville | Denton | View Map |

| Texas | 75078 | Prosper | Collin | View Map |

| Texas | 75080 | Richardson | Dallas | View Map |

| Texas | 75081 | Richardson | Dallas | View Map |

| Texas | 75082 | Richardson | Dallas | View Map |

| Texas | 75083 | Richardson | Dallas | View Map |

| Texas | 75085 | Richardson | Dallas | View Map |

| Texas | 75086 | Plano | Collin | View Map |

| Texas | 75087 | Rockwall | Rockwall | View Map |

| Texas | 75088 | Rowlett | Dallas | View Map |

| Texas | 75089 | Rowlett | Dallas | View Map |

| Texas | 75090 | Sherman | Grayson | View Map |

| Texas | 75091 | Sherman | Grayson | View Map |

| Texas | 75092 | Sherman | Grayson | View Map |

| Texas | 75093 | Plano | Collin | View Map |

| Texas | 75094 | Plano | Collin | View Map |

| Texas | 75097 | Weston | Collin | View Map |

| Texas | 75098 | Wylie | Collin | View Map |

| Texas | 75099 | Coppell | Dallas | View Map |

| Texas | 75101 | Bardwell | Ellis | View Map |

| Texas | 75102 | Barry | Navarro | View Map |

| Texas | 75103 | Canton | Van Zandt | View Map |

| Texas | 75104 | Cedar Hill | Dallas | View Map |

| Texas | 75105 | Chatfield | Navarro | View Map |

| Texas | 75106 | Cedar Hill | Dallas | View Map |

| Texas | 75109 | Corsicana | Navarro | View Map |

| Texas | 75110 | Corsicana | Navarro | View Map |

| Texas | 75114 | Crandall | Kaufman | View Map |

| Texas | 75115 | Desoto | Dallas | View Map |

| Texas | 75116 | Duncanville | Dallas | View Map |

| Texas | 75117 | Edgewood | Van Zandt | View Map |

| Texas | 75118 | Elmo | Kaufman | View Map |

| Texas | 75119 | Ennis | Ellis | View Map |

| Texas | 75120 | Ennis | Ellis | View Map |

| Texas | 75121 | Copeville | Collin | View Map |

| Texas | 75123 | Desoto | Dallas | View Map |

| Texas | 75124 | Eustace | Henderson | View Map |

| Texas | 75125 | Ferris | Ellis | View Map |

| Texas | 75126 | Forney | Kaufman | View Map |

| Texas | 75127 | Fruitvale | Van Zandt | View Map |

| Texas | 75132 | Fate | Rockwall | View Map |

| Texas | 75134 | Lancaster | Dallas | View Map |

| Texas | 75135 | Caddo Mills | Hunt | View Map |

| Texas | 75137 | Duncanville | Dallas | View Map |

| Texas | 75138 | Duncanville | Dallas | View Map |

| Texas | 75140 | Grand Saline | Van Zandt | View Map |

| Texas | 75141 | Hutchins | Dallas | View Map |

| Texas | 75142 | Kaufman | Kaufman | View Map |

| Texas | 75143 | Kemp | Kaufman | View Map |

| Texas | 75144 | Kerens | Navarro | View Map |

| Texas | 75146 | Lancaster | Dallas | View Map |

| Texas | 75147 | Mabank | Kaufman | View Map |

| Texas | 75148 | Malakoff | Henderson | View Map |

| Texas | 75149 | Mesquite | Dallas | View Map |

| Texas | 75150 | Mesquite | Dallas | View Map |

| Texas | 75151 | Corsicana | Navarro | View Map |

| Texas | 75152 | Palmer | Ellis | View Map |

| Texas | 75153 | Powell | Navarro | View Map |

| Texas | 75154 | Red Oak | Ellis | View Map |

| Texas | 75155 | Rice | Navarro | View Map |

| Texas | 75156 | Mabank | Henderson | View Map |

| Texas | 75157 | Rosser | Kaufman | View Map |

| Texas | 75158 | Scurry | Kaufman | View Map |

| Texas | 75159 | Seagoville | Dallas | View Map |

| Texas | 75160 | Terrell | Kaufman | View Map |

| Texas | 75161 | Terrell | Kaufman | View Map |

| Texas | 75163 | Trinidad | Henderson | View Map |

| Texas | 75164 | Josephine | Collin | View Map |

| Texas | 75165 | Waxahachie | Ellis | View Map |

| Texas | 75166 | Lavon | Collin | View Map |

| Texas | 75167 | Waxahachie | Ellis | View Map |

| Texas | 75168 | Waxahachie | Ellis | View Map |

| Texas | 75169 | Wills Point | Van Zandt | View Map |

| Texas | 75172 | Wilmer | Dallas | View Map |

| Texas | 75173 | Nevada | Collin | View Map |

| Texas | 75180 | Mesquite | Dallas | View Map |

| Texas | 75181 | Mesquite | Dallas | View Map |

| Texas | 75182 | Sunnyvale | Dallas | View Map |

| Texas | 75185 | Mesquite | Dallas | View Map |

| Texas | 75187 | Mesquite | Dallas | View Map |

| Texas | 75189 | Royse City | Rockwall | View Map |

| Texas | 75201 | Dallas | Dallas | View Map |

| Texas | 75202 | Dallas | Dallas | View Map |

| Texas | 75203 | Dallas | Dallas | View Map |

| Texas | 75204 | Dallas | Dallas | View Map |

| Texas | 75205 | Dallas | Dallas | View Map |

| Texas | 75206 | Dallas | Dallas | View Map |

| Texas | 75207 | Dallas | Dallas | View Map |

| Texas | 75208 | Dallas | Dallas | View Map |

| Texas | 75209 | Dallas | Dallas | View Map |

| Texas | 75210 | Dallas | Dallas | View Map |

| Texas | 75211 | Dallas | Dallas | View Map |

| Texas | 75212 | Dallas | Dallas | View Map |

| Texas | 75214 | Dallas | Dallas | View Map |

| Texas | 75215 | Dallas | Dallas | View Map |

| Texas | 75216 | Dallas | Dallas | View Map |

| Texas | 75217 | Dallas | Dallas | View Map |

| Texas | 75218 | Dallas | Dallas | View Map |

| Texas | 75219 | Dallas | Dallas | View Map |

| Texas | 75220 | Dallas | Dallas | View Map |

| Texas | 75221 | Dallas | Dallas | View Map |

| Texas | 75222 | Dallas | Dallas | View Map |

| Texas | 75223 | Dallas | Dallas | View Map |

| Texas | 75224 | Dallas | Dallas | View Map |

| Texas | 75225 | Dallas | Dallas | View Map |

| Texas | 75226 | Dallas | Dallas | View Map |

| Texas | 75227 | Dallas | Dallas | View Map |

| Texas | 75228 | Dallas | Dallas | View Map |

| Texas | 75229 | Dallas | Dallas | View Map |

| Texas | 75230 | Dallas | Dallas | View Map |

| Texas | 75231 | Dallas | Dallas | View Map |

| Texas | 75232 | Dallas | Dallas | View Map |

| Texas | 75233 | Dallas | Dallas | View Map |

| Texas | 75234 | Dallas | Dallas | View Map |

| Texas | 75235 | Dallas | Dallas | View Map |

| Texas | 75236 | Dallas | Dallas | View Map |

| Texas | 75237 | Dallas | Dallas | View Map |

| Texas | 75238 | Dallas | Dallas | View Map |

| Texas | 75240 | Dallas | Dallas | View Map |

| Texas | 75241 | Dallas | Dallas | View Map |

| Texas | 75242 | Dallas | Dallas | View Map |

| Texas | 75243 | Dallas | Dallas | View Map |

| Texas | 75244 | Dallas | Dallas | View Map |

| Texas | 75245 | Dallas | Dallas | View Map |

| Texas | 75246 | Dallas | Dallas | View Map |

| Texas | 75247 | Dallas | Dallas | View Map |

| Texas | 75248 | Dallas | Dallas | View Map |

| Texas | 75249 | Dallas | Dallas | View Map |

| Texas | 75250 | Dallas | Dallas | View Map |

| Texas | 75251 | Dallas | Dallas | View Map |

| Texas | 75252 | Dallas | Collin | View Map |

| Texas | 75253 | Dallas | Dallas | View Map |

| Texas | 75254 | Dallas | Dallas | View Map |

| Texas | 75258 | Dallas | Dallas | View Map |

| Texas | 75260 | Dallas | Dallas | View Map |

| Texas | 75261 | Dallas | Dallas | View Map |

| Texas | 75262 | Dallas | Dallas | View Map |

| Texas | 75263 | Dallas | Dallas | View Map |

| Texas | 75264 | Dallas | Dallas | View Map |

| Texas | 75265 | Dallas | Dallas | View Map |

| Texas | 75266 | Dallas | Dallas | View Map |

| Texas | 75267 | Dallas | Dallas | View Map |

| Texas | 75270 | Dallas | Dallas | View Map |

| Texas | 75275 | Dallas | Dallas | View Map |

| Texas | 75277 | Dallas | Dallas | View Map |

| Texas | 75283 | Dallas | Dallas | View Map |

| Texas | 75284 | Dallas | Dallas | View Map |

| Texas | 75285 | Dallas | Dallas | View Map |

| Texas | 75286 | Dallas | Dallas | View Map |

| Texas | 75287 | Dallas | Collin | View Map |

| Texas | 75301 | Dallas | Dallas | View Map |

| Texas | 75303 | Dallas | Dallas | View Map |

| Texas | 75310 | Dallas | Dallas | View Map |

| Texas | 75312 | Dallas | Dallas | View Map |

| Texas | 75313 | Dallas | Dallas | View Map |

| Texas | 75315 | Dallas | Dallas | View Map |

| Texas | 75320 | Dallas | Dallas | View Map |

| Texas | 75323 | Dallas | Dallas | View Map |

| Texas | 75326 | Dallas | Dallas | View Map |

| Texas | 75334 | Dallas | Dallas | View Map |

| Texas | 75336 | Dallas | Dallas | View Map |

| Texas | 75339 | Dallas | Dallas | View Map |

| Texas | 75340 | Dallas | Dallas | View Map |

| Texas | 75342 | Dallas | Dallas | View Map |

| Texas | 75343 | Dallas | Dallas | View Map |

| Texas | 75344 | Dallas | Dallas | View Map |

| Texas | 75353 | Dallas | Dallas | View Map |

| Texas | 75354 | Dallas | Dallas | View Map |

| Texas | 75355 | Dallas | Dallas | View Map |

| Texas | 75356 | Dallas | Dallas | View Map |

| Texas | 75357 | Dallas | Dallas | View Map |

| Texas | 75358 | Dallas | Dallas | View Map |

| Texas | 75359 | Dallas | Dallas | View Map |

| Texas | 75360 | Dallas | Dallas | View Map |

| Texas | 75363 | Dallas | Dallas | View Map |

| Texas | 75364 | Dallas | Dallas | View Map |

| Texas | 75367 | Dallas | Dallas | View Map |

| Texas | 75368 | Dallas | Dallas | View Map |

| Texas | 75370 | Dallas | Dallas | View Map |

| Texas | 75371 | Dallas | Dallas | View Map |

| Texas | 75372 | Dallas | Dallas | View Map |

| Texas | 75373 | Dallas | Dallas | View Map |

| Texas | 75374 | Dallas | Dallas | View Map |

| Texas | 75376 | Dallas | Dallas | View Map |

| Texas | 75378 | Dallas | Dallas | View Map |

| Texas | 75379 | Dallas | Dallas | View Map |

| Texas | 75380 | Dallas | Dallas | View Map |

| Texas | 75381 | Dallas | Dallas | View Map |

| Texas | 75382 | Dallas | Dallas | View Map |

| Texas | 75386 | Dallas | Dallas | View Map |

| Texas | 75387 | Dallas | Dallas | View Map |

| Texas | 75388 | Dallas | Dallas | View Map |

| Texas | 75389 | Dallas | Dallas | View Map |

| Texas | 75390 | Dallas | Dallas | View Map |

| Texas | 75391 | Dallas | Dallas | View Map |

| Texas | 75392 | Dallas | Dallas | View Map |

| Texas | 75393 | Dallas | Dallas | View Map |

| Texas | 75394 | Dallas | Dallas | View Map |

| Texas | 75395 | Dallas | Dallas | View Map |

| Texas | 75396 | Dallas | Dallas | View Map |

| Texas | 75397 | Dallas | Dallas | View Map |

| Texas | 75398 | Dallas | Dallas | View Map |

| Texas | 75401 | Greenville | Hunt | View Map |

| Texas | 75402 | Greenville | Hunt | View Map |

| Texas | 75403 | Greenville | Hunt | View Map |

| Texas | 75404 | Greenville | Hunt | View Map |

| Texas | 75407 | Princeton | Collin | View Map |

| Texas | 75409 | Anna | Collin | View Map |

| Texas | 75410 | Alba | Wood | View Map |

| Texas | 75411 | Arthur City | Lamar | View Map |

| Texas | 75412 | Bagwell | Red River | View Map |

| Texas | 75413 | Bailey | Fannin | View Map |

| Texas | 75414 | Bells | Grayson | View Map |

| Texas | 75415 | Ben Franklin | Delta | View Map |

| Texas | 75416 | Blossom | Lamar | View Map |

| Texas | 75417 | Bogata | Red River | View Map |

| Texas | 75418 | Bonham | Fannin | View Map |

| Texas | 75420 | Brashear | Hopkins | View Map |

| Texas | 75421 | Brookston | Lamar | View Map |

| Texas | 75422 | Campbell | Hunt | View Map |

| Texas | 75423 | Celeste | Hunt | View Map |

| Texas | 75424 | Blue Ridge | Collin | View Map |

| Texas | 75425 | Chicota | Lamar | View Map |

| Texas | 75426 | Clarksville | Red River | View Map |

| Texas | 75428 | Commerce | Hunt | View Map |

| Texas | 75429 | Commerce | Hunt | View Map |

| Texas | 75431 | Como | Hopkins | View Map |

| Texas | 75432 | Cooper | Delta | View Map |

| Texas | 75433 | Cumby | Hopkins | View Map |

| Texas | 75434 | Cunningham | Lamar | View Map |

| Texas | 75435 | Deport | Lamar | View Map |

| Texas | 75436 | Detroit | Red River | View Map |

| Texas | 75437 | Dike | Hopkins | View Map |

| Texas | 75438 | Dodd City | Fannin | View Map |

| Texas | 75439 | Ector | Fannin | View Map |

| Texas | 75440 | Emory | Rains | View Map |

| Texas | 75441 | Enloe | Delta | View Map |

| Texas | 75442 | Farmersville | Collin | View Map |

| Texas | 75443 | Gober | Fannin | View Map |

| Texas | 75444 | Golden | Wood | View Map |

| Texas | 75446 | Honey Grove | Fannin | View Map |

| Texas | 75447 | Ivanhoe | Fannin | View Map |

| Texas | 75448 | Klondike | Delta | View Map |

| Texas | 75449 | Ladonia | Fannin | View Map |

| Texas | 75450 | Lake Creek | Delta | View Map |

| Texas | 75451 | Leesburg | Camp | View Map |

| Texas | 75452 | Leonard | Fannin | View Map |

| Texas | 75453 | Lone Oak | Hunt | View Map |

| Texas | 75454 | Melissa | Collin | View Map |

| Texas | 75455 | Mount Pleasant | Titus | View Map |

| Texas | 75456 | Mount Pleasant | Titus | View Map |

| Texas | 75457 | Mount Vernon | Franklin | View Map |

| Texas | 75458 | Merit | Hunt | View Map |

| Texas | 75459 | Howe | Grayson | View Map |

| Texas | 75460 | Paris | Lamar | View Map |

| Texas | 75461 | Paris | Lamar | View Map |

| Texas | 75462 | Paris | Lamar | View Map |

| Texas | 75468 | Pattonville | Lamar | View Map |

| Texas | 75469 | Pecan Gap | Delta | View Map |

| Texas | 75470 | Petty | Lamar | View Map |

| Texas | 75471 | Pickton | Hopkins | View Map |

| Texas | 75472 | Point | Rains | View Map |

| Texas | 75473 | Powderly | Lamar | View Map |

| Texas | 75474 | Quinlan | Hunt | View Map |

| Texas | 75475 | Randolph | Fannin | View Map |

| Texas | 75476 | Ravenna | Fannin | View Map |

| Texas | 75477 | Roxton | Lamar | View Map |

| Texas | 75478 | Saltillo | Hopkins | View Map |

| Texas | 75479 | Savoy | Fannin | View Map |

| Texas | 75480 | Scroggins | Franklin | View Map |

| Texas | 75481 | Sulphur Bluff | Hopkins | View Map |

| Texas | 75482 | Sulphur Springs | Hopkins | View Map |

| Texas | 75483 | Sulphur Springs | Hopkins | View Map |

| Texas | 75485 | Westminster | Collin | View Map |

| Texas | 75486 | Sumner | Lamar | View Map |

| Texas | 75487 | Talco | Franklin | View Map |

| Texas | 75488 | Telephone | Fannin | View Map |

| Texas | 75489 | Tom Bean | Grayson | View Map |

| Texas | 75490 | Trenton | Fannin | View Map |

| Texas | 75491 | Whitewright | Grayson | View Map |

| Texas | 75492 | Windom | Fannin | View Map |

| Texas | 75493 | Winfield | Titus | View Map |

| Texas | 75494 | Winnsboro | Wood | View Map |

| Texas | 75495 | Van Alstyne | Grayson | View Map |

| Texas | 75496 | Wolfe City | Hunt | View Map |

| Texas | 75497 | Yantis | Wood | View Map |

| Texas | 75501 | Texarkana | Bowie | View Map |

| Texas | 75503 | Texarkana | Bowie | View Map |

| Texas | 75504 | Texarkana | Bowie | View Map |

| Texas | 75505 | Texarkana | Bowie | View Map |

| Texas | 75507 | Texarkana | Bowie | View Map |

| Texas | 75550 | Annona | Red River | View Map |

| Texas | 75551 | Atlanta | Cass | View Map |

| Texas | 75554 | Avery | Red River | View Map |

| Texas | 75555 | Bivins | Cass | View Map |

| Texas | 75556 | Bloomburg | Cass | View Map |

| Texas | 75558 | Cookville | Titus | View Map |

| Texas | 75559 | De Kalb | Bowie | View Map |

| Texas | 75560 | Douglassville | Cass | View Map |

| Texas | 75561 | Hooks | Bowie | View Map |

| Texas | 75562 | Kildare | Cass | View Map |

| Texas | 75563 | Linden | Cass | View Map |

| Texas | 75564 | Lodi | Marion | View Map |

| Texas | 75565 | Mc Leod | Cass | View Map |

| Texas | 75566 | Marietta | Cass | View Map |

| Texas | 75567 | Maud | Bowie | View Map |

| Texas | 75568 | Naples | Morris | View Map |

| Texas | 75569 | Nash | Bowie | View Map |

| Texas | 75570 | New Boston | Bowie | View Map |

| Texas | 75571 | Omaha | Morris | View Map |

| Texas | 75572 | Queen City | Cass | View Map |

| Texas | 75573 | Redwater | Bowie | View Map |

| Texas | 75574 | Simms | Bowie | View Map |

| Texas | 75599 | Texarkana | Bowie | View Map |

| Texas | 75601 | Longview | Gregg | View Map |

| Texas | 75602 | Longview | Gregg | View Map |

| Texas | 75603 | Longview | Gregg | View Map |

| Texas | 75604 | Longview | Gregg | View Map |

| Texas | 75605 | Longview | Gregg | View Map |

| Texas | 75606 | Longview | Gregg | View Map |

| Texas | 75607 | Longview | Gregg | View Map |

| Texas | 75608 | Longview | Gregg | View Map |

| Texas | 75615 | Longview | Gregg | View Map |

| Texas | 75630 | Avinger | Cass | View Map |

| Texas | 75631 | Beckville | Panola | View Map |

| Texas | 75633 | Carthage | Panola | View Map |

| Texas | 75636 | Cason | Morris | View Map |

| Texas | 75637 | Clayton | Panola | View Map |

| Texas | 75638 | Daingerfield | Morris | View Map |

| Texas | 75639 | De Berry | Panola | View Map |

| Texas | 75640 | Diana | Upshur | View Map |

| Texas | 75641 | Easton | Gregg | View Map |

| Texas | 75642 | Elysian Fields | Harrison | View Map |

| Texas | 75643 | Gary | Panola | View Map |

| Texas | 75644 | Gilmer | Upshur | View Map |

| Texas | 75645 | Gilmer | Upshur | View Map |

| Texas | 75647 | Gladewater | Gregg | View Map |

| Texas | 75650 | Hallsville | Harrison | View Map |

| Texas | 75651 | Harleton | Harrison | View Map |

| Texas | 75652 | Henderson | Rusk | View Map |

| Texas | 75653 | Henderson | Rusk | View Map |

| Texas | 75654 | Henderson | Rusk | View Map |

| Texas | 75656 | Hughes Springs | Cass | View Map |

| Texas | 75657 | Jefferson | Marion | View Map |

| Texas | 75658 | Joinerville | Rusk | View Map |

| Texas | 75659 | Jonesville | Harrison | View Map |

| Texas | 75660 | Judson | Gregg | View Map |

| Texas | 75661 | Karnack | Harrison | View Map |

| Texas | 75662 | Kilgore | Gregg | View Map |

| Texas | 75663 | Kilgore | Gregg | View Map |

| Texas | 75666 | Laird Hill | Rusk | View Map |

| Texas | 75667 | Laneville | Rusk | View Map |

| Texas | 75668 | Lone Star | Morris | View Map |

| Texas | 75669 | Long Branch | Panola | View Map |

| Texas | 75670 | Marshall | Harrison | View Map |

| Texas | 75671 | Marshall | Harrison | View Map |

| Texas | 75672 | Marshall | Harrison | View Map |

| Texas | 75680 | Minden | Rusk | View Map |

| Texas | 75681 | Mount Enterprise | Rusk | View Map |

| Texas | 75682 | New London | Rusk | View Map |

| Texas | 75683 | Ore City | Upshur | View Map |

| Texas | 75684 | Overton | Rusk | View Map |

| Texas | 75685 | Panola | Panola | View Map |

| Texas | 75686 | Pittsburg | Camp | View Map |

| Texas | 75687 | Price | Rusk | View Map |

| Texas | 75688 | Scottsville | Harrison | View Map |

| Texas | 75689 | Selman City | Rusk | View Map |

| Texas | 75691 | Tatum | Rusk | View Map |

| Texas | 75692 | Waskom | Harrison | View Map |

| Texas | 75693 | White Oak | Gregg | View Map |

| Texas | 75694 | Woodlawn | Harrison | View Map |

| Texas | 75701 | Tyler | Smith | View Map |

| Texas | 75702 | Tyler | Smith | View Map |

| Texas | 75703 | Tyler | Smith | View Map |

| Texas | 75704 | Tyler | Smith | View Map |

| Texas | 75705 | Tyler | Smith | View Map |

| Texas | 75706 | Tyler | Smith | View Map |

| Texas | 75707 | Tyler | Smith | View Map |

| Texas | 75708 | Tyler | Smith | View Map |

| Texas | 75709 | Tyler | Smith | View Map |

| Texas | 75710 | Tyler | Smith | View Map |

| Texas | 75711 | Tyler | Smith | View Map |

| Texas | 75712 | Tyler | Smith | View Map |

| Texas | 75713 | Tyler | Smith | View Map |

| Texas | 75750 | Arp | Smith | View Map |

| Texas | 75751 | Athens | Henderson | View Map |

| Texas | 75752 | Athens | Henderson | View Map |

| Texas | 75754 | Ben Wheeler | Van Zandt | View Map |

| Texas | 75755 | Big Sandy | Upshur | View Map |

| Texas | 75756 | Brownsboro | Henderson | View Map |

| Texas | 75757 | Bullard | Smith | View Map |

| Texas | 75758 | Chandler | Henderson | View Map |

| Texas | 75759 | Cuney | Cherokee | View Map |

| Texas | 75760 | Cushing | Nacogdoches | View Map |

| Texas | 75762 | Flint | Smith | View Map |

| Texas | 75763 | Frankston | Anderson | View Map |

| Texas | 75764 | Galla | Cherokee | View Map |

| Texas | 75765 | Hawkins | Wood | View Map |

| Texas | 75766 | Jacksonville | Cherokee | View Map |

| Texas | 75770 | Larue | Henderson | View Map |

| Texas | 75771 | Lindale | Smith | View Map |

| Texas | 75772 | Maydelle | Cherokee | View Map |

| Texas | 75773 | Mineola | Wood | View Map |

| Texas | 75778 | Murchison | Henderson | View Map |

| Texas | 75779 | Neches | Anderson | View Map |

| Texas | 75780 | New Summerfield | Cherokee | View Map |

| Texas | 75782 | Poynor | Henderson | View Map |

| Texas | 75783 | Quitman | Wood | View Map |

| Texas | 75784 | Reklaw | Cherokee | View Map |

| Texas | 75785 | Rusk | Cherokee | View Map |

| Texas | 75788 | Sacul | Nacogdoches | View Map |

| Texas | 75789 | Troup | Smith | View Map |

| Texas | 75790 | Van | Van Zandt | View Map |

| Texas | 75791 | Whitehouse | Smith | View Map |

| Texas | 75792 | Winona | Smith | View Map |

| Texas | 75797 | Big Sandy | Upshur | View Map |

| Texas | 75798 | Tyler | Smith | View Map |

| Texas | 75799 | Tyler | Smith | View Map |

| Texas | 75801 | Palese | Anderson | View Map |

| Texas | 75802 | Palese | Anderson | View Map |

| Texas | 75803 | Palese | Anderson | View Map |

| Texas | 75831 | Buffalo | Leon | View Map |

| Texas | 75832 | Cayuga | Anderson | View Map |

| Texas | 75833 | Centerville | Leon | View Map |

| Texas | 75834 | Centralia | Trinity | View Map |

| Texas | 75835 | Crockett | Houston | View Map |

| Texas | 75838 | Donie | Freestone | View Map |

| Texas | 75839 | Elkhart | Anderson | View Map |

| Texas | 75840 | Fairfield | Freestone | View Map |

| Texas | 75844 | Grapeland | Houston | View Map |

| Texas | 75845 | Groveton | Trinity | View Map |

| Texas | 75846 | Jewett | Leon | View Map |

| Texas | 75847 | Kennard | Houston | View Map |

| Texas | 75848 | Kirvin | Freestone | View Map |

| Texas | 75849 | Latexo | Houston | View Map |

| Texas | 75850 | Leona | Leon | View Map |

| Texas | 75851 | Lovelady | Houston | View Map |

| Texas | 75852 | Midway | Madison | View Map |

| Texas | 75853 | Montalba | Anderson | View Map |

| Texas | 75855 | Oakwood | Leon | View Map |

| Texas | 75856 | Pennington | Trinity | View Map |

| Texas | 75858 | Ratcliff | Houston | View Map |

| Texas | 75859 | Streetman | Freestone | View Map |

| Texas | 75860 | Teague | Freestone | View Map |

| Texas | 75861 | Tennessee Colony | Anderson | View Map |

| Texas | 75862 | Trinity | Trinity | View Map |

| Texas | 75865 | Woodlake | Trinity | View Map |

| Texas | 75880 | Tennessee Colony | Anderson | View Map |

| Texas | 75882 | Palese | Anderson | View Map |

| Texas | 75884 | Tennessee Colony | Anderson | View Map |

| Texas | 75886 | Tennessee Colony | Anderson | View Map |

| Texas | 75901 | Lufkin | Angelina | View Map |

| Texas | 75902 | Lufkin | Angelina | View Map |

| Texas | 75903 | Lufkin | Angelina | View Map |

| Texas | 75904 | Lufkin | Angelina | View Map |

| Texas | 75915 | Lufkin | Angelina | View Map |

| Texas | 75925 | Alto | Cherokee | View Map |

| Texas | 75926 | Apple Springs | Trinity | View Map |

| Texas | 75928 | Bon Wier | Newton | View Map |

| Texas | 75929 | Broaddus | San Auguse | View Map |

| Texas | 75930 | Bronson | Sabine | View Map |

| Texas | 75931 | Brookeland | Jasper | View Map |

| Texas | 75932 | Burkeville | Newton | View Map |

| Texas | 75933 | Call | Newton | View Map |

| Texas | 75934 | Camden | Polk | View Map |

| Texas | 75935 | Center | Shelby | View Map |

| Texas | 75936 | Chester | Tyler | View Map |

| Texas | 75937 | Chireno | Nacogdoches | View Map |

| Texas | 75938 | Colmesneil | Tyler | View Map |

| Texas | 75939 | Corrigan | Polk | View Map |

| Texas | 75941 | Diboll | Angelina | View Map |

| Texas | 75942 | Doucette | Tyler | View Map |

| Texas | 75943 | Douglass | Nacogdoches | View Map |

| Texas | 75944 | Etoile | Nacogdoches | View Map |

| Texas | 75946 | Garrison | Nacogdoches | View Map |

| Texas | 75948 | Hemphill | Sabine | View Map |

| Texas | 75949 | Hungton | Angelina | View Map |

| Texas | 75951 | Jasper | Jasper | View Map |

| Texas | 75954 | Joaquin | Shelby | View Map |

| Texas | 75956 | Kirbyville | Jasper | View Map |

| Texas | 75958 | Marsville | Nacogdoches | View Map |

| Texas | 75959 | Milam | Sabine | View Map |

| Texas | 75960 | Moscow | Polk | View Map |

| Texas | 75961 | Nacogdoches | Nacogdoches | View Map |

| Texas | 75962 | Nacogdoches | Nacogdoches | View Map |

| Texas | 75963 | Nacogdoches | Nacogdoches | View Map |

| Texas | 75964 | Nacogdoches | Nacogdoches | View Map |

| Texas | 75965 | Nacogdoches | Nacogdoches | View Map |

| Texas | 75966 | Newton | Newton | View Map |

| Texas | 75968 | Pineland | Sabine | View Map |

| Texas | 75969 | Pollok | Angelina | View Map |

| Texas | 75972 | San Auguse | San Auguse | View Map |

| Texas | 75973 | Shelbyville | Shelby | View Map |

| Texas | 75974 | Tenaha | Shelby | View Map |

| Texas | 75975 | Timpson | Shelby | View Map |

| Texas | 75976 | Wells | Cherokee | View Map |

| Texas | 75977 | Wiergate | Newton | View Map |

| Texas | 75978 | Woden | Nacogdoches | View Map |

| Texas | 75979 | Woodville | Tyler | View Map |

| Texas | 75980 | Zavalla | Angelina | View Map |

| Texas | 75990 | Woodville | Tyler | View Map |

| Texas | 76001 | Arlington | Tarrant | View Map |

| Texas | 76002 | Arlington | Tarrant | View Map |

| Texas | 76003 | Arlington | Tarrant | View Map |

| Texas | 76004 | Arlington | Tarrant | View Map |

| Texas | 76005 | Arlington | Tarrant | View Map |

| Texas | 76006 | Arlington | Tarrant | View Map |

| Texas | 76007 | Arlington | Tarrant | View Map |

| Texas | 76008 | Aledo | Parker | View Map |

| Texas | 76009 | Alvarado | Johnson | View Map |

| Texas | 76010 | Arlington | Tarrant | View Map |

| Texas | 76011 | Arlington | Tarrant | View Map |

| Texas | 76012 | Arlington | Tarrant | View Map |

| Texas | 76013 | Arlington | Tarrant | View Map |

| Texas | 76014 | Arlington | Tarrant | View Map |

| Texas | 76015 | Arlington | Tarrant | View Map |

| Texas | 76016 | Arlington | Tarrant | View Map |

| Texas | 76017 | Arlington | Tarrant | View Map |

| Texas | 76018 | Arlington | Tarrant | View Map |

| Texas | 76019 | Arlington | Tarrant | View Map |

| Texas | 76020 | Azle | Tarrant | View Map |

| Texas | 76021 | Bedford | Tarrant | View Map |

| Texas | 76022 | Bedford | Tarrant | View Map |

| Texas | 76023 | Boyd | Wise | View Map |

| Texas | 76028 | Burleson | Johnson | View Map |

| Texas | 76031 | Cleburne | Johnson | View Map |

| Texas | 76033 | Cleburne | Johnson | View Map |

| Texas | 76034 | Colleyville | Tarrant | View Map |

| Texas | 76035 | Cresson | Hood | View Map |

| Texas | 76036 | Crowley | Tarrant | View Map |

| Texas | 76039 | Euless | Tarrant | View Map |

| Texas | 76040 | Euless | Tarrant | View Map |

| Texas | 76041 | Forreston | Ellis | View Map |

| Texas | 76043 | Glen Rose | Somervell | View Map |

| Texas | 76044 | Godley | Johnson | View Map |

| Texas | 76048 | Granbury | Hood | View Map |

| Texas | 76049 | Granbury | Hood | View Map |

| Texas | 76050 | Grandview | Johnson | View Map |

| Texas | 76051 | Grapevine | Tarrant | View Map |

| Texas | 76052 | Haslet | Tarrant | View Map |

| Texas | 76053 | Hurst | Tarrant | View Map |

| Texas | 76054 | Hurst | Tarrant | View Map |

| Texas | 76055 | Itasca | Hill | View Map |

| Texas | 76058 | Joshua | Johnson | View Map |

| Texas | 76059 | Keene | Johnson | View Map |

| Texas | 76060 | Kennedale | Tarrant | View Map |

| Texas | 76061 | Lillian | Johnson | View Map |

| Texas | 76063 | Mansfield | Tarrant | View Map |

| Texas | 76064 | Maypearl | Ellis | View Map |

| Texas | 76065 | Midlothian | Ellis | View Map |

| Texas | 76066 | Millsap | Parker | View Map |

| Texas | 76067 | Mineral Wells | Palo Pinto | View Map |

| Texas | 76068 | Mineral Wells | Palo Pinto | View Map |

| Texas | 76070 | Nemo | Somervell | View Map |

| Texas | 76071 | Newark | Wise | View Map |

| Texas | 76073 | Paradise | Wise | View Map |

| Texas | 76077 | Rainbow | Somervell | View Map |

| Texas | 76078 | Rhome | Wise | View Map |

| Texas | 76082 | Springtown | Parker | View Map |

| Texas | 76084 | Venus | Johnson | View Map |

| Texas | 76085 | Weatherford | Parker | View Map |

| Texas | 76086 | Weatherford | Parker | View Map |

| Texas | 76087 | Weatherford | Parker | View Map |

| Texas | 76088 | Weatherford | Parker | View Map |

| Texas | 76092 | Southlake | Tarrant | View Map |

| Texas | 76093 | Rio Vista | Johnson | View Map |

| Texas | 76094 | Arlington | Tarrant | View Map |

| Texas | 76095 | Bedford | Tarrant | View Map |

| Texas | 76096 | Arlington | Tarrant | View Map |

| Texas | 76097 | Burleson | Johnson | View Map |

| Texas | 76098 | Azle | Parker | View Map |

| Texas | 76099 | Grapevine | Tarrant | View Map |

| Texas | 76101 | Fort Worth | Tarrant | View Map |

| Texas | 76102 | Fort Worth | Tarrant | View Map |

| Texas | 76103 | Fort Worth | Tarrant | View Map |

| Texas | 76104 | Fort Worth | Tarrant | View Map |

| Texas | 76105 | Fort Worth | Tarrant | View Map |

| Texas | 76106 | Fort Worth | Tarrant | View Map |

| Texas | 76107 | Fort Worth | Tarrant | View Map |

| Texas | 76108 | Fort Worth | Tarrant | View Map |

| Texas | 76109 | Fort Worth | Tarrant | View Map |

| Texas | 76110 | Fort Worth | Tarrant | View Map |

| Texas | 76111 | Fort Worth | Tarrant | View Map |

| Texas | 76112 | Fort Worth | Tarrant | View Map |

| Texas | 76113 | Fort Worth | Tarrant | View Map |

| Texas | 76114 | Fort Worth | Tarrant | View Map |

| Texas | 76115 | Fort Worth | Tarrant | View Map |

| Texas | 76116 | Fort Worth | Tarrant | View Map |

| Texas | 76117 | Haltom City | Tarrant | View Map |

| Texas | 76118 | Fort Worth | Tarrant | View Map |

| Texas | 76119 | Fort Worth | Tarrant | View Map |

| Texas | 76120 | Fort Worth | Tarrant | View Map |

| Texas | 76121 | Fort Worth | Tarrant | View Map |

| Texas | 76122 | Fort Worth | Tarrant | View Map |

| Texas | 76123 | Fort Worth | Tarrant | View Map |

| Texas | 76124 | Fort Worth | Tarrant | View Map |

| Texas | 76126 | Fort Worth | Tarrant | View Map |

| Texas | 76127 | Naval Air Station/ Jrb | Tarrant | View Map |

| Texas | 76129 | Fort Worth | Tarrant | View Map |

| Texas | 76130 | Fort Worth | Tarrant | View Map |

| Texas | 76131 | Fort Worth | Tarrant | View Map |

| Texas | 76132 | Fort Worth | Tarrant | View Map |

| Texas | 76133 | Fort Worth | Tarrant | View Map |

| Texas | 76134 | Fort Worth | Tarrant | View Map |

| Texas | 76135 | Fort Worth | Tarrant | View Map |

| Texas | 76136 | Fort Worth | Tarrant | View Map |

| Texas | 76137 | Fort Worth | Tarrant | View Map |

| Texas | 76140 | Fort Worth | Tarrant | View Map |

| Texas | 76147 | Fort Worth | Tarrant | View Map |

| Texas | 76148 | Fort Worth | Tarrant | View Map |

| Texas | 76150 | Fort Worth | Tarrant | View Map |

| Texas | 76155 | Fort Worth | Tarrant | View Map |

| Texas | 76161 | Fort Worth | Tarrant | View Map |

| Texas | 76162 | Fort Worth | Tarrant | View Map |

| Texas | 76163 | Fort Worth | Tarrant | View Map |

| Texas | 76164 | Fort Worth | Tarrant | View Map |

| Texas | 76177 | Fort Worth | Tarrant | View Map |

| Texas | 76179 | Fort Worth | Tarrant | View Map |

| Texas | 76180 | North Richland Hills | Tarrant | View Map |

| Texas | 76181 | Fort Worth | Tarrant | View Map |

| Texas | 76182 | North Richland Hills | Tarrant | View Map |

| Texas | 76185 | Fort Worth | Tarrant | View Map |

| Texas | 76191 | Fort Worth | Tarrant | View Map |

| Texas | 76192 | Fort Worth | Tarrant | View Map |

| Texas | 76193 | Fort Worth | Tarrant | View Map |

| Texas | 76195 | Fort Worth | Tarrant | View Map |

| Texas | 76196 | Fort Worth | Tarrant | View Map |

| Texas | 76197 | Fort Worth | Tarrant | View Map |

| Texas | 76198 | Fort Worth | Tarrant | View Map |

| Texas | 76199 | Fort Worth | Tarrant | View Map |

| Texas | 76201 | Denton | Denton | View Map |

| Texas | 76202 | Denton | Denton | View Map |

| Texas | 76203 | Denton | Denton | View Map |

| Texas | 76204 | Denton | Denton | View Map |

| Texas | 76205 | Denton | Denton | View Map |

| Texas | 76206 | Denton | Denton | View Map |

| Texas | 76207 | Denton | Denton | View Map |

| Texas | 76208 | Denton | Denton | View Map |

| Texas | 76209 | Denton | Denton | View Map |

| Texas | 76210 | Denton | Denton | View Map |

| Texas | 76225 | Alvord | Wise | View Map |

| Texas | 76226 | Argyle | Denton | View Map |

| Texas | 76227 | Aubrey | Denton | View Map |

| Texas | 76228 | Bellevue | Clay | View Map |

| Texas | 76230 | Bowie | Montague | View Map |

| Texas | 76233 | Collinsville | Grayson | View Map |

| Texas | 76234 | Decatur | Wise | View Map |

| Texas | 76238 | Era | Cooke | View Map |

| Texas | 76239 | Forestburg | Montague | View Map |

| Texas | 76240 | Gainesville | Cooke | View Map |

| Texas | 76241 | Gainesville | Cooke | View Map |

| Texas | 76244 | Keller | Tarrant | View Map |

| Texas | 76245 | Gordonville | Grayson | View Map |

| Texas | 76246 | Greenwood | Wise | View Map |

| Texas | 76247 | Jus | Denton | View Map |

| Texas | 76248 | Keller | Tarrant | View Map |

| Texas | 76249 | Krum | Denton | View Map |

| Texas | 76250 | Lindsay | Cooke | View Map |

| Texas | 76251 | Montague | Montague | View Map |

| Texas | 76252 | Muenster | Cooke | View Map |

| Texas | 76253 | Myra | Cooke | View Map |

| Texas | 76255 | Nocona | Montague | View Map |

| Texas | 76258 | Pilot Point | Denton | View Map |

| Texas | 76259 | Ponder | Denton | View Map |

| Texas | 76261 | Ringgold | Montague | View Map |

| Texas | 76262 | Roanoke | Denton | View Map |

| Texas | 76263 | Rosston | Cooke | View Map |

| Texas | 76264 | Sadler | Grayson | View Map |

| Texas | 76265 | Saint Jo | Montague | View Map |

| Texas | 76266 | Sanger | Denton | View Map |

| Texas | 76267 | Slidell | Wise | View Map |

| Texas | 76268 | Southmayd | Grayson | View Map |

| Texas | 76270 | Sunset | Montague | View Map |

| Texas | 76271 | Tioga | Grayson | View Map |

| Texas | 76272 | Valley View | Cooke | View Map |

| Texas | 76273 | Whitesboro | Grayson | View Map |

| Texas | 76299 | Roanoke | Denton | View Map |

| Texas | 76301 | Wichita Falls | Wichita | View Map |

| Texas | 76302 | Wichita Falls | Wichita | View Map |

| Texas | 76305 | Wichita Falls | Wichita | View Map |

| Texas | 76306 | Wichita Falls | Wichita | View Map |

| Texas | 76307 | Wichita Falls | Wichita | View Map |

| Texas | 76308 | Wichita Falls | Wichita | View Map |

| Texas | 76309 | Wichita Falls | Wichita | View Map |

| Texas | 76310 | Wichita Falls | Wichita | View Map |

| Texas | 76311 | Sheppard Afb | Wichita | View Map |

| Texas | 76351 | Archer City | Archer | View Map |

| Texas | 76352 | Bluegrove | Clay | View Map |

| Texas | 76354 | Burkburnett | Wichita | View Map |

| Texas | 76357 | Byers | Clay | View Map |

| Texas | 76360 | Electra | Wichita | View Map |

| Texas | 76363 | Goree | Knox | View Map |

| Texas | 76364 | Harrold | Wilbarger | View Map |

| Texas | 76365 | Henrietta | Clay | View Map |

| Texas | 76366 | Holliday | Archer | View Map |

| Texas | 76367 | Iowa Park | Wichita | View Map |

| Texas | 76369 | Kamay | Wichita | View Map |

| Texas | 76370 | Megargel | Archer | View Map |

| Texas | 76371 | Munday | Knox | View Map |

| Texas | 76372 | Newcastle | Young | View Map |

| Texas | 76373 | Oklaunion | Wilbarger | View Map |

| Texas | 76374 | Olney | Young | View Map |

| Texas | 76377 | Petrolia | Clay | View Map |

| Texas | 76379 | Scotland | Archer | View Map |

| Texas | 76380 | Seymour | Baylor | View Map |

| Texas | 76384 | Vernon | Wilbarger | View Map |

| Texas | 76385 | Vernon | Wilbarger | View Map |

| Texas | 76388 | Weinert | Haskell | View Map |

| Texas | 76389 | Windthorst | Archer | View Map |

| Texas | 76401 | Stephenville | Erath | View Map |

| Texas | 76402 | Stephenville | Erath | View Map |

| Texas | 76424 | Breckenridge | Stephens | View Map |

| Texas | 76426 | Bridgeport | Wise | View Map |

| Texas | 76427 | Bryson | Jack | View Map |

| Texas | 76429 | Caddo | Stephens | View Map |

| Texas | 76430 | Albany | Shackelford | View Map |

| Texas | 76431 | Chico | Wise | View Map |

| Texas | 76432 | Blanket | Brown | View Map |

| Texas | 76433 | Bluff Dale | Erath | View Map |

| Texas | 76435 | Carbon | Eastland | View Map |

| Texas | 76436 | Carlton | Hamilton | View Map |

| Texas | 76437 | Cisco | Eastland | View Map |

| Texas | 76439 | Dennis | Parker | View Map |

| Texas | 76442 | Comanche | Comanche | View Map |

| Texas | 76443 | Cross Plains | Callahan | View Map |

| Texas | 76444 | De Leon | Comanche | View Map |

| Texas | 76445 | Desdemona | Eastland | View Map |

| Texas | 76446 | Dublin | Erath | View Map |

| Texas | 76448 | Eastland | Eastland | View Map |

| Texas | 76449 | Graford | Palo Pinto | View Map |

| Texas | 76450 | Graham | Young | View Map |

| Texas | 76452 | Energy | Comanche | View Map |

| Texas | 76453 | Gordon | Palo Pinto | View Map |

| Texas | 76454 | Gorman | Eastland | View Map |

| Texas | 76455 | Guse | Comanche | View Map |

| Texas | 76457 | Hico | Hamilton | View Map |

| Texas | 76458 | Jacksboro | Jack | View Map |

| Texas | 76459 | Jermyn | Jack | View Map |

| Texas | 76460 | Loving | Young | View Map |

| Texas | 76461 | Lingleville | Erath | View Map |

| Texas | 76462 | Lipan | Hood | View Map |

| Texas | 76463 | Mingus | Palo Pinto | View Map |

| Texas | 76464 | Moran | Shackelford | View Map |

| Texas | 76465 | Morgan Mill | Erath | View Map |

| Texas | 76466 | Olden | Eastland | View Map |

| Texas | 76467 | Paluxy | Hood | View Map |

| Texas | 76468 | Proctor | Comanche | View Map |

| Texas | 76469 | Putnam | Callahan | View Map |

| Texas | 76470 | Ranger | Eastland | View Map |

| Texas | 76471 | Rising Star | Eastland | View Map |

| Texas | 76472 | Santo | Palo Pinto | View Map |

| Texas | 76474 | Sidney | Comanche | View Map |

| Texas | 76475 | Strawn | Palo Pinto | View Map |

| Texas | 76476 | Tolar | Hood | View Map |

| Texas | 76481 | South Bend | Young | View Map |

| Texas | 76483 | Throckmorton | Throckmorton | View Map |

| Texas | 76484 | Palo Pinto | Palo Pinto | View Map |

| Texas | 76485 | Peaster | Parker | View Map |

| Texas | 76486 | Perrin | Jack | View Map |

| Texas | 76487 | Poolville | Parker | View Map |

| Texas | 76490 | Whitt | Parker | View Map |

| Texas | 76491 | Woodson | Throckmorton | View Map |

| Texas | 76501 | Temple | Bell | View Map |

| Texas | 76502 | Temple | Bell | View Map |

| Texas | 76503 | Temple | Bell | View Map |

| Texas | 76504 | Temple | Bell | View Map |

| Texas | 76505 | Temple | Bell | View Map |

| Texas | 76508 | Temple | Bell | View Map |

| Texas | 76511 | Bartlett | Bell | View Map |

| Texas | 76513 | Belton | Bell | View Map |

| Texas | 76518 | Buckholts | Milam | View Map |

| Texas | 76519 | Burlington | Milam | View Map |

| Texas | 76520 | Cameron | Milam | View Map |

| Texas | 76522 | Copperas Cove | Coryell | View Map |

| Texas | 76523 | Davilla | Milam | View Map |

| Texas | 76524 | Eddy | Mclennan | View Map |

| Texas | 76525 | Evant | Coryell | View Map |

| Texas | 76526 | Flat | Coryell | View Map |

| Texas | 76527 | Florence | Williamson | View Map |

| Texas | 76528 | Gatesville | Coryell | View Map |

| Texas | 76530 | Granger | Williamson | View Map |

| Texas | 76531 | Hamilton | Hamilton | View Map |

| Texas | 76533 | Heidenheimer | Bell | View Map |

| Texas | 76534 | Holland | Bell | View Map |

| Texas | 76537 | Jarrell | Williamson | View Map |

| Texas | 76538 | Jonesboro | Coryell | View Map |

| Texas | 76539 | Kempner | Lampasas | View Map |

| Texas | 76540 | Killeen | Bell | View Map |

| Texas | 76541 | Killeen | Bell | View Map |

| Texas | 76542 | Killeen | Bell | View Map |

| Texas | 76543 | Killeen | Bell | View Map |

| Texas | 76544 | Killeen | Bell | View Map |

| Texas | 76545 | Killeen | Bell | View Map |

| Texas | 76546 | Killeen | Bell | View Map |

| Texas | 76547 | Killeen | Bell | View Map |

| Texas | 76548 | Harker Heights | Bell | View Map |

| Texas | 76549 | Killeen | Bell | View Map |

| Texas | 76550 | Lampasas | Lampasas | View Map |

| Texas | 76554 | Little River Academy | Bell | View Map |

| Texas | 76556 | Milano | Milam | View Map |

| Texas | 76557 | Moody | Mclennan | View Map |

| Texas | 76558 | Mound | Coryell | View Map |

| Texas | 76559 | Nolanville | Bell | View Map |

| Texas | 76561 | Oglesby | Coryell | View Map |

| Texas | 76564 | Pendleton | Bell | View Map |

| Texas | 76565 | Pottsville | Hamilton | View Map |

| Texas | 76566 | Purmela | Coryell | View Map |

| Texas | 76567 | Rockdale | Milam | View Map |

| Texas | 76569 | Rogers | Bell | View Map |

| Texas | 76570 | Rosebud | Falls | View Map |

| Texas | 76571 | Salado | Bell | View Map |

| Texas | 76573 | Schwertner | Williamson | View Map |

| Texas | 76574 | Taylor | Williamson | View Map |

| Texas | 76577 | Thorndale | Milam | View Map |

| Texas | 76578 | Thrall | Williamson | View Map |

| Texas | 76579 | Troy | Bell | View Map |

| Texas | 76596 | Gatesville | Coryell | View Map |

| Texas | 76597 | Gatesville | Coryell | View Map |

| Texas | 76598 | Gatesville | Coryell | View Map |

| Texas | 76599 | Gatesville | Coryell | View Map |

| Texas | 76621 | Abbott | Hill | View Map |

| Texas | 76622 | Aquilla | Hill | View Map |

| Texas | 76623 | Avalon | Ellis | View Map |

| Texas | 76624 | Axtell | Mclennan | View Map |

| Texas | 76626 | Blooming Grove | Navarro | View Map |

| Texas | 76627 | Blum | Hill | View Map |

| Texas | 76628 | Brandon | Hill | View Map |

| Texas | 76629 | Bremond | Robertson | View Map |

| Texas | 76630 | Bruceville | Mclennan | View Map |

| Texas | 76631 | Bynum | Hill | View Map |

| Texas | 76632 | Chilton | Falls | View Map |

| Texas | 76633 | China Spring | Mclennan | View Map |

| Texas | 76634 | Clifton | Bosque | View Map |

| Texas | 76635 | Coolidge | Limestone | View Map |

| Texas | 76636 | Covington | Hill | View Map |

| Texas | 76637 | Cranfills Gap | Bosque | View Map |

| Texas | 76638 | Crawford | Mclennan | View Map |

| Texas | 76639 | Dawson | Navarro | View Map |

| Texas | 76640 | Elm Mott | Mclennan | View Map |

| Texas | 76641 | Frost | Navarro | View Map |

| Texas | 76642 | Groesbeck | Limestone | View Map |

| Texas | 76643 | Hewitt | Mclennan | View Map |

| Texas | 76644 | Laguna Park | Bosque | View Map |

| Texas | 76645 | Hillsboro | Hill | View Map |

| Texas | 76648 | Hubbard | Hill | View Map |

| Texas | 76649 | Iredell | Bosque | View Map |

| Texas | 76650 | Irene | Hill | View Map |

| Texas | 76651 | Italy | Ellis | View Map |

| Texas | 76652 | Kopperl | Bosque | View Map |

| Texas | 76653 | Kosse | Limestone | View Map |

| Texas | 76654 | Leroy | Mclennan | View Map |

| Texas | 76655 | Lorena | Mclennan | View Map |

| Texas | 76656 | Lott | Falls | View Map |

| Texas | 76657 | Mc Gregor | Mclennan | View Map |

| Texas | 76660 | Malone | Hill | View Map |

| Texas | 76661 | Marlin | Falls | View Map |

| Texas | 76664 | Mart | Mclennan | View Map |

| Texas | 76665 | Meridian | Bosque | View Map |

| Texas | 76666 | Mertens | Hill | View Map |

| Texas | 76667 | Mexia | Limestone | View Map |

| Texas | 76670 | Milford | Ellis | View Map |

| Texas | 76671 | Morgan | Bosque | View Map |

| Texas | 76673 | Mount Calm | Hill | View Map |

| Texas | 76676 | Penelope | Hill | View Map |

| Texas | 76678 | Prairie Hill | Limestone | View Map |

| Texas | 76679 | Purdon | Navarro | View Map |

| Texas | 76680 | Reagan | Falls | View Map |

| Texas | 76681 | Richland | Navarro | View Map |

| Texas | 76682 | Riesel | Mclennan | View Map |

| Texas | 76684 | Ross | Mclennan | View Map |

| Texas | 76685 | Sa | Falls | View Map |

| Texas | 76686 | Tehuacana | Limestone | View Map |

| Texas | 76687 | Thornton | Limestone | View Map |

| Texas | 76689 | Valley Mills | Bosque | View Map |

| Texas | 76690 | Walnut Springs | Bosque | View Map |

| Texas | 76691 | West | Mclennan | View Map |

| Texas | 76692 | Whitney | Hill | View Map |

| Texas | 76693 | Wortham | Freestone | View Map |

| Texas | 76701 | Waco | Mclennan | View Map |

| Texas | 76702 | Waco | Mclennan | View Map |

| Texas | 76703 | Waco | Mclennan | View Map |

| Texas | 76704 | Waco | Mclennan | View Map |

| Texas | 76705 | Waco | Mclennan | View Map |

| Texas | 76706 | Waco | Mclennan | View Map |

| Texas | 76707 | Waco | Mclennan | View Map |

| Texas | 76708 | Waco | Mclennan | View Map |

| Texas | 76710 | Waco | Mclennan | View Map |

| Texas | 76711 | Waco | Mclennan | View Map |

| Texas | 76712 | Woodway | Mclennan | View Map |

| Texas | 76714 | Waco | Mclennan | View Map |

| Texas | 76715 | Waco | Mclennan | View Map |

| Texas | 76716 | Waco | Mclennan | View Map |

| Texas | 76795 | Waco | Mclennan | View Map |

| Texas | 76797 | Waco | Mclennan | View Map |

| Texas | 76798 | Waco | Mclennan | View Map |

| Texas | 76799 | Waco | Mclennan | View Map |

| Texas | 76801 | Brownwood | Brown | View Map |

| Texas | 76802 | Early | Brown | View Map |

| Texas | 76803 | Brownwood | Brown | View Map |

| Texas | 76804 | Brownwood | Brown | View Map |

| Texas | 76820 | Art | Mason | View Map |

| Texas | 76821 | Ballinger | Runnels | View Map |

| Texas | 76823 | Bangs | Brown | View Map |

| Texas | 76824 | Bend | San Saba | View Map |

| Texas | 76825 | Brady | Mcculloch | View Map |

| Texas | 76827 | Brookesmith | Brown | View Map |

| Texas | 76828 | Burkett | Coleman | View Map |

| Texas | 76831 | Castell | Llano | View Map |

| Texas | 76832 | Cherokee | San Saba | View Map |

| Texas | 76834 | Coleman | Coleman | View Map |

| Texas | 76836 | Doole | Mcculloch | View Map |

| Texas | 76837 | Eden | Concho | View Map |

| Texas | 76841 | Fort Mc Kavett | Menard | View Map |

| Texas | 76842 | Fredonia | Mason | View Map |

| Texas | 76844 | Goldthwaite | Mills | View Map |

| Texas | 76845 | Gouldbusk | Coleman | View Map |

| Texas | 76848 | Hext | Menard | View Map |

| Texas | 76849 | Junction | Kimble | View Map |

| Texas | 76852 | Lohn | Mcculloch | View Map |

| Texas | 76853 | Lometa | Lampasas | View Map |

| Texas | 76854 | London | Kimble | View Map |

| Texas | 76855 | Lowake | Concho | View Map |

| Texas | 76856 | Mason | Mason | View Map |

| Texas | 76857 | May | Brown | View Map |

| Texas | 76858 | Melvin | Mcculloch | View Map |

| Texas | 76859 | Menard | Menard | View Map |

| Texas | 76861 | Miles | Runnels | View Map |

| Texas | 76862 | Millersview | Concho | View Map |

| Texas | 76864 | Mullin | Mills | View Map |

| Texas | 76865 | Norton | Runnels | View Map |

| Texas | 76866 | Paint Rock | Concho | View Map |

| Texas | 76869 | Pontotoc | Mason | View Map |

| Texas | 76870 | Priddy | Mills | View Map |

| Texas | 76871 | Richland Springs | San Saba | View Map |

| Texas | 76872 | Rochelle | Mcculloch | View Map |

| Texas | 76873 | Rockwood | Coleman | View Map |

| Texas | 76874 | Roosevelt | Kimble | View Map |

| Texas | 76875 | Rowena | Runnels | View Map |

| Texas | 76877 | San Saba | San Saba | View Map |

| Texas | 76878 | Santa Anna | Coleman | View Map |

| Texas | 76880 | Star | Mills | View Map |

| Texas | 76882 | Talpa | Coleman | View Map |

| Texas | 76883 | Telegraph | Edwards | View Map |

| Texas | 76884 | Valera | Coleman | View Map |

| Texas | 76885 | Valley Spring | Llano | View Map |

| Texas | 76886 | Veribest | Tom Green | View Map |

| Texas | 76887 | Voca | Mcculloch | View Map |

| Texas | 76888 | Voss | Coleman | View Map |

| Texas | 76890 | Zephyr | Brown | View Map |

| Texas | 76901 | San Angelo | Tom Green | View Map |

| Texas | 76902 | San Angelo | Tom Green | View Map |

| Texas | 76903 | San Angelo | Tom Green | View Map |

| Texas | 76904 | San Angelo | Tom Green | View Map |

| Texas | 76905 | San Angelo | Tom Green | View Map |

| Texas | 76906 | San Angelo | Tom Green | View Map |

| Texas | 76908 | Goodfellow Afb | Tom Green | View Map |

| Texas | 76909 | San Angelo | Tom Green | View Map |

| Texas | 76930 | Barnhart | Irion | View Map |

| Texas | 76932 | Big Lake | Reagan | View Map |

| Texas | 76933 | Bronte | Coke | View Map |

| Texas | 76934 | Carlsbad | Tom Green | View Map |

| Texas | 76935 | Christoval | Tom Green | View Map |

| Texas | 76936 | Eldorado | Schleicher | View Map |

| Texas | 76937 | Eola | Concho | View Map |

| Texas | 76939 | Knickerbocker | Tom Green | View Map |

| Texas | 76940 | Mereta | Tom Green | View Map |

| Texas | 76941 | Mertzon | Irion | View Map |

| Texas | 76943 | Ozona | Crockett | View Map |

| Texas | 76945 | Robert Lee | Coke | View Map |

| Texas | 76949 | Silver | Coke | View Map |

| Texas | 76950 | Sonora | Sutton | View Map |

| Texas | 76951 | Sterling City | Sterling | View Map |

| Texas | 76953 | Tennyson | Coke | View Map |

| Texas | 76955 | Vancourt | Tom Green | View Map |

| Texas | 76957 | Wall | Tom Green | View Map |

| Texas | 76958 | Water Valley | Tom Green | View Map |

| Texas | 77001 | Houston | Harris | View Map |

| Texas | 77002 | Houston | Harris | View Map |

| Texas | 77003 | Houston | Harris | View Map |

| Texas | 77004 | Houston | Harris | View Map |

| Texas | 77005 | Houston | Harris | View Map |

| Texas | 77006 | Houston | Harris | View Map |

| Texas | 77007 | Houston | Harris | View Map |

| Texas | 77008 | Houston | Harris | View Map |

| Texas | 77009 | Houston | Harris | View Map |

| Texas | 77010 | Houston | Harris | View Map |

| Texas | 77011 | Houston | Harris | View Map |

| Texas | 77012 | Houston | Harris | View Map |

| Texas | 77013 | Houston | Harris | View Map |

| Texas | 77014 | Houston | Harris | View Map |

| Texas | 77015 | Houston | Harris | View Map |

| Texas | 77016 | Houston | Harris | View Map |

| Texas | 77017 | Houston | Harris | View Map |

| Texas | 77018 | Houston | Harris | View Map |

| Texas | 77019 | Houston | Harris | View Map |

| Texas | 77020 | Houston | Harris | View Map |

| Texas | 77021 | Houston | Harris | View Map |

| Texas | 77022 | Houston | Harris | View Map |

| Texas | 77023 | Houston | Harris | View Map |

| Texas | 77024 | Houston | Harris | View Map |

| Texas | 77025 | Houston | Harris | View Map |

| Texas | 77026 | Houston | Harris | View Map |

| Texas | 77027 | Houston | Harris | View Map |

| Texas | 77028 | Houston | Harris | View Map |

| Texas | 77029 | Houston | Harris | View Map |

| Texas | 77030 | Houston | Harris | View Map |

| Texas | 77031 | Houston | Harris | View Map |

| Texas | 77032 | Houston | Harris | View Map |

| Texas | 77033 | Houston | Harris | View Map |

| Texas | 77034 | Houston | Harris | View Map |

| Texas | 77035 | Houston | Harris | View Map |

| Texas | 77036 | Houston | Harris | View Map |

| Texas | 77037 | Houston | Harris | View Map |

| Texas | 77038 | Houston | Harris | View Map |

| Texas | 77039 | Houston | Harris | View Map |

| Texas | 77040 | Houston | Harris | View Map |

| Texas | 77041 | Houston | Harris | View Map |

| Texas | 77042 | Houston | Harris | View Map |

| Texas | 77043 | Houston | Harris | View Map |

| Texas | 77044 | Houston | Harris | View Map |

| Texas | 77045 | Houston | Harris | View Map |

| Texas | 77046 | Houston | Harris | View Map |

| Texas | 77047 | Houston | Harris | View Map |

| Texas | 77048 | Houston | Harris | View Map |

| Texas | 77049 | Houston | Harris | View Map |

| Texas | 77050 | Houston | Harris | View Map |

| Texas | 77051 | Houston | Harris | View Map |

| Texas | 77052 | Houston | Harris | View Map |

| Texas | 77053 | Houston | Fort Bend | View Map |

| Texas | 77054 | Houston | Harris | View Map |

| Texas | 77055 | Houston | Harris | View Map |

| Texas | 77056 | Houston | Harris | View Map |

| Texas | 77057 | Houston | Harris | View Map |

| Texas | 77058 | Houston | Harris | View Map |

| Texas | 77059 | Houston | Harris | View Map |

| Texas | 77060 | Houston | Harris | View Map |

| Texas | 77061 | Houston | Harris | View Map |

| Texas | 77062 | Houston | Harris | View Map |

| Texas | 77063 | Houston | Harris | View Map |

| Texas | 77064 | Houston | Harris | View Map |

| Texas | 77065 | Houston | Harris | View Map |

| Texas | 77066 | Houston | Harris | View Map |

| Texas | 77067 | Houston | Harris | View Map |

| Texas | 77068 | Houston | Harris | View Map |

| Texas | 77069 | Houston | Harris | View Map |

| Texas | 77070 | Houston | Harris | View Map |

| Texas | 77071 | Houston | Harris | View Map |

| Texas | 77072 | Houston | Harris | View Map |

| Texas | 77073 | Houston | Harris | View Map |

| Texas | 77074 | Houston | Harris | View Map |

| Texas | 77075 | Houston | Harris | View Map |

| Texas | 77076 | Houston | Harris | View Map |

| Texas | 77077 | Houston | Harris | View Map |

| Texas | 77078 | Houston | Harris | View Map |

| Texas | 77079 | Houston | Harris | View Map |

| Texas | 77080 | Houston | Harris | View Map |

| Texas | 77081 | Houston | Harris | View Map |

| Texas | 77082 | Houston | Harris | View Map |

| Texas | 77083 | Houston | Harris | View Map |

| Texas | 77084 | Houston | Harris | View Map |

| Texas | 77085 | Houston | Harris | View Map |

| Texas | 77086 | Houston | Harris | View Map |

| Texas | 77087 | Houston | Harris | View Map |

| Texas | 77088 | Houston | Harris | View Map |

| Texas | 77089 | Houston | Harris | View Map |

| Texas | 77090 | Houston | Harris | View Map |

| Texas | 77091 | Houston | Harris | View Map |

| Texas | 77092 | Houston | Harris | View Map |

| Texas | 77093 | Houston | Harris | View Map |

| Texas | 77094 | Houston | Harris | View Map |

| Texas | 77095 | Houston | Harris | View Map |

| Texas | 77096 | Houston | Harris | View Map |

| Texas | 77097 | Houston | Harris | View Map |

| Texas | 77098 | Houston | Harris | View Map |

| Texas | 77099 | Houston | Harris | View Map |

| Texas | 77201 | Houston | Harris | View Map |

| Texas | 77202 | Houston | Harris | View Map |

| Texas | 77203 | Houston | Harris | View Map |

| Texas | 77204 | Houston | Harris | View Map |

| Texas | 77205 | Houston | Harris | View Map |

| Texas | 77206 | Houston | Harris | View Map |

| Texas | 77207 | Houston | Harris | View Map |

| Texas | 77208 | Houston | Harris | View Map |

| Texas | 77209 | Houston | Harris | View Map |

| Texas | 77210 | Houston | Harris | View Map |

| Texas | 77212 | Houston | Harris | View Map |

| Texas | 77213 | Houston | Harris | View Map |

| Texas | 77215 | Houston | Harris | View Map |

| Texas | 77216 | Houston | Harris | View Map |

| Texas | 77217 | Houston | Harris | View Map |

| Texas | 77218 | Houston | Harris | View Map |

| Texas | 77219 | Houston | Harris | View Map |

| Texas | 77220 | Houston | Harris | View Map |

| Texas | 77221 | Houston | Harris | View Map |

| Texas | 77222 | Houston | Harris | View Map |

| Texas | 77223 | Houston | Harris | View Map |

| Texas | 77224 | Houston | Harris | View Map |

| Texas | 77225 | Houston | Harris | View Map |

| Texas | 77226 | Houston | Harris | View Map |

| Texas | 77227 | Houston | Harris | View Map |

| Texas | 77228 | Houston | Harris | View Map |

| Texas | 77229 | Houston | Harris | View Map |

| Texas | 77230 | Houston | Harris | View Map |

| Texas | 77231 | Houston | Harris | View Map |

| Texas | 77233 | Houston | Harris | View Map |

| Texas | 77234 | Houston | Harris | View Map |

| Texas | 77235 | Houston | Harris | View Map |

| Texas | 77236 | Houston | Harris | View Map |

| Texas | 77237 | Houston | Harris | View Map |

| Texas | 77238 | Houston | Harris | View Map |

| Texas | 77240 | Houston | Harris | View Map |

| Texas | 77241 | Houston | Harris | View Map |

| Texas | 77242 | Houston | Harris | View Map |

| Texas | 77243 | Houston | Harris | View Map |

| Texas | 77244 | Houston | Harris | View Map |

| Texas | 77245 | Houston | Harris | View Map |

| Texas | 77246 | Houston | Harris | View Map |

| Texas | 77247 | Houston | Harris | View Map |

| Texas | 77248 | Houston | Harris | View Map |

| Texas | 77249 | Houston | Harris | View Map |

| Texas | 77250 | Houston | Harris | View Map |

| Texas | 77251 | Houston | Harris | View Map |

| Texas | 77252 | Houston | Harris | View Map |

| Texas | 77253 | Houston | Harris | View Map |

| Texas | 77254 | Houston | Harris | View Map |

| Texas | 77255 | Houston | Harris | View Map |

| Texas | 77256 | Houston | Harris | View Map |

| Texas | 77257 | Houston | Harris | View Map |

| Texas | 77258 | Houston | Harris | View Map |

| Texas | 77259 | Houston | Harris | View Map |

| Texas | 77260 | Houston | Harris | View Map |

| Texas | 77261 | Houston | Harris | View Map |

| Texas | 77262 | Houston | Harris | View Map |

| Texas | 77263 | Houston | Harris | View Map |

| Texas | 77265 | Houston | Harris | View Map |

| Texas | 77266 | Houston | Harris | View Map |

| Texas | 77267 | Houston | Harris | View Map |

| Texas | 77268 | Houston | Harris | View Map |

| Texas | 77269 | Houston | Harris | View Map |

| Texas | 77270 | Houston | Harris | View Map |

| Texas | 77271 | Houston | Harris | View Map |

| Texas | 77272 | Houston | Harris | View Map |

| Texas | 77273 | Houston | Harris | View Map |

| Texas | 77274 | Houston | Harris | View Map |

| Texas | 77275 | Houston | Harris | View Map |

| Texas | 77276 | Houston | Harris | View Map |

| Texas | 77277 | Houston | Harris | View Map |

| Texas | 77278 | Houston | Harris | View Map |

| Texas | 77279 | Houston | Harris | View Map |

| Texas | 77280 | Houston | Harris | View Map |

| Texas | 77282 | Houston | Harris | View Map |

| Texas | 77284 | Houston | Harris | View Map |

| Texas | 77285 | Houston | Harris | View Map |

| Texas | 77286 | Houston | Harris | View Map |

| Texas | 77287 | Houston | Harris | View Map |

| Texas | 77288 | Houston | Harris | View Map |

| Texas | 77289 | Houston | Harris | View Map |

| Texas | 77290 | Houston | Harris | View Map |

| Texas | 77291 | Houston | Harris | View Map |

| Texas | 77292 | Houston | Harris | View Map |

| Texas | 77293 | Houston | Harris | View Map |

| Texas | 77294 | Houston | Harris | View Map |

| Texas | 77296 | Houston | Harris | View Map |

| Texas | 77297 | Houston | Harris | View Map |

| Texas | 77298 | Houston | Harris | View Map |

| Texas | 77299 | Houston | Harris | View Map |

| Texas | 77301 | Conroe | Montgomery | View Map |

| Texas | 77302 | Conroe | Montgomery | View Map |

| Texas | 77303 | Conroe | Montgomery | View Map |

| Texas | 77304 | Conroe | Montgomery | View Map |

| Texas | 77305 | Conroe | Montgomery | View Map |

| Texas | 77306 | Conroe | Montgomery | View Map |

| Texas | 77315 | North Houston | Harris | View Map |

| Texas | 77316 | Montgomery | Montgomery | View Map |

| Texas | 77318 | Willis | Montgomery | View Map |

| Texas | 77320 | Huntsville | Walker | View Map |

| Texas | 77325 | Kingwood | Harris | View Map |

| Texas | 77326 | Ace | Polk | View Map |

| Texas | 77327 | Cleveland | Liberty | View Map |

| Texas | 77328 | Cleveland | Liberty | View Map |

| Texas | 77331 | Coldspring | San Jacinto | View Map |

| Texas | 77332 | Dallardsville | Polk | View Map |

| Texas | 77333 | Dobbin | Montgomery | View Map |

| Texas | 77334 | Dodge | Walker | View Map |

| Texas | 77335 | Goodrich | Polk | View Map |

| Texas | 77336 | Huffman | Harris | View Map |

| Texas | 77337 | Hufsmith | Harris | View Map |

| Texas | 77338 | Humble | Harris | View Map |

| Texas | 77339 | Kingwood | Harris | View Map |

| Texas | 77340 | Huntsville | Walker | View Map |

| Texas | 77341 | Huntsville | Walker | View Map |

| Texas | 77342 | Huntsville | Walker | View Map |

| Texas | 77343 | Huntsville | Walker | View Map |

| Texas | 77344 | Huntsville | Walker | View Map |

| Texas | 77345 | Kingwood | Harris | View Map |

| Texas | 77346 | Humble | Harris | View Map |

| Texas | 77347 | Humble | Harris | View Map |

| Texas | 77348 | Huntsville | Walker | View Map |

| Texas | 77349 | Huntsville | Walker | View Map |

| Texas | 77350 | Leggett | Polk | View Map |

| Texas | 77351 | Livingston | Polk | View Map |

| Texas | 77353 | Magnolia | Montgomery | View Map |

| Texas | 77354 | Magnolia | Montgomery | View Map |

| Texas | 77355 | Magnolia | Montgomery | View Map |

| Texas | 77356 | Montgomery | Montgomery | View Map |

| Texas | 77357 | New Caney | Montgomery | View Map |

| Texas | 77358 | New Waverly | Walker | View Map |

| Texas | 77359 | Oakhurst | San Jacinto | View Map |

| Texas | 77360 | Onalaska | Polk | View Map |

| Texas | 77362 | Pinehurst | Montgomery | View Map |

| Texas | 77363 | Plantersville | Grimes | View Map |

| Texas | 77364 | Pointblank | San Jacinto | View Map |

| Texas | 77365 | Porter | Montgomery | View Map |

| Texas | 77367 | Riverside | Walker | View Map |

| Texas | 77368 | Romayor | Liberty | View Map |

| Texas | 77369 | Rye | Liberty | View Map |

| Texas | 77371 | Shepherd | San Jacinto | View Map |

| Texas | 77372 | Splendora | Montgomery | View Map |

| Texas | 77373 | Spring | Harris | View Map |

| Texas | 77374 | Thicket | Hardin | View Map |

| Texas | 77375 | Tomball | Harris | View Map |

| Texas | 77376 | Votaw | Hardin | View Map |

| Texas | 77377 | Tomball | Harris | View Map |

| Texas | 77378 | Willis | Montgomery | View Map |

| Texas | 77379 | Spring | Harris | View Map |

| Texas | 77380 | Spring | Montgomery | View Map |

| Texas | 77381 | Spring | Montgomery | View Map |

| Texas | 77382 | Spring | Montgomery | View Map |

| Texas | 77383 | Spring | Harris | View Map |

| Texas | 77384 | Conroe | Montgomery | View Map |

| Texas | 77385 | Conroe | Montgomery | View Map |

| Texas | 77386 | Spring | Montgomery | View Map |

| Texas | 77387 | Spring | Montgomery | View Map |

| Texas | 77388 | Spring | Harris | View Map |

| Texas | 77389 | Spring | Harris | View Map |

| Texas | 77391 | Spring | Harris | View Map |

| Texas | 77393 | Spring | Montgomery | View Map |

| Texas | 77396 | Humble | Harris | View Map |

| Texas | 77399 | Livingston | Polk | View Map |

| Texas | 77401 | Bellaire | Harris | View Map |

| Texas | 77402 | Bellaire | Harris | View Map |

| Texas | 77404 | Bay City | Matagorda | View Map |

| Texas | 77406 | Richmond | Fort Bend | View Map |

| Texas | 77410 | Cypress | Harris | View Map |

| Texas | 77411 | Alief | Harris | View Map |

| Texas | 77412 | Altair | Colorado | View Map |

| Texas | 77413 | Barker | Harris | View Map |

| Texas | 77414 | Bay City | Matagorda | View Map |

| Texas | 77415 | Cedar Lane | Matagorda | View Map |

| Texas | 77417 | Beasley | Fort Bend | View Map |