TEXAS NO TAX RETURN MORTGAGE LENDERS+ –TEXAS SELF EMPLOYED-BANK STATEMENT MORTGAGE LENDERS –

SELF EMPLOYED TEXAS CASH-OUT REFINANCE UP TO 500K! – TEXAS BANK STATEMENT MORTGAGE LENDERS

SERVING ALL TEXAS INCLUDING FORT WORTH TEXAS, AUSTIN TEXAS, DALLAS TEXAS, SAN ANTONIO TEXAS, HOUSTON TEXAS

Texas Self Employed Mortgage Lenders. Definition: A business that legally has no separate existence from its owner. self-employed income and losses are taxed on the individual’s personal self-employed income tax return. Multiple banks account statements + Separate W2 self-employed income OK

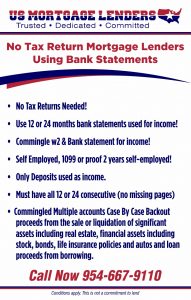

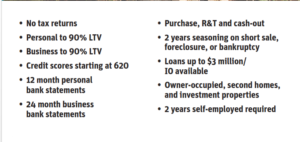

No Tax Return Texas bank statement Mortgage Lenders Program summary

Texas Self Employed Mortgage Lenders offer Non-Qualified Mortgages on fully amortizing 15 & 30-Year Fixed Rate and 5/1 & 7/1 ARM products and interest-only 40-year Fixed Rate and 5/1 & 7/1 ARM products. Loan amounts from $100,000 to $5,000,000 are eligible.

Full Documentation with DTI to 55% including Asset Utilization for qualifying Texas Self Employed income

Texas bank statement Only Mortgage Lenders Texas Self Employed income Documentation

o 24 Month Texas bank statement Only Mortgage Lenders Personal Texas bank statements

o 12 Month Texas bank statement Only Mortgage Lenders Personal Texas bank statements

o 24 Month Texas bank statement Only Mortgage Lenders Business Texas bank statements

Interest-only and fully amortized Texas bank statement Only Mortgage Lenders products

LTVsTexas bank statement Only Mortgage Lenders to 90% (80% max for IO)

Non-warrantable condominiums Texas bank statement Only Mortgage Lenders

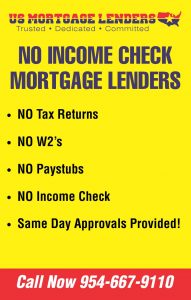

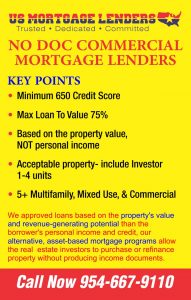

- NO INCOME VERIFICATION TEXAS COMMERCIAL MORTGAGE LENDERS

- Self Employed Texas Mortgage Lenders

- TEXAS SELF EMPLOYED-BANK STATEMENT MORTGAGE LENDERS

- 10% DOWN+TEXAS SELF EMPLOYED MORTGAGE LENDERS

- SELF EMPLOYED TEXAS-BANK STATEMENT MORTGAGE LENDERS

Texas Bank Statement only loans for self-employed Texas mortgage applicants who cannot qualify for a traditional Texas bank loan because of Texas business expenses. Self-employed Texas mortgage Lenders are perfect because while most Texas self-employed borrowers earn a solid income, they show a smaller net income on their tax returns. Our Texas mortgage team is well-versed in these bank statement only loans and placing the borrowers where they can get the optimal loan to fit their needs.

NO Tax Return-Texas Cash-Out Refinance Lenders

Cashout Refinance Using Bank Statement Loans – Explained

- SELF EMPLOYED TEXAS CASH-OUT REFINANCE UP TO 500K!

- 10% DOWN+TEXAS BANK STATEMENT MORTGAGE LENDERS

- Texas-Bank Statement Only Mortgage Lenders – FHA mortgage lender

- TEXAS BANK STATEMENT MORTGAGE LENDERS

- TEXAS BANK STATEMENT ONLY MORTGAGE LENDERS

NO INCOME VERIFICATION TEXAS COMMERCIAL MORTGAGE LENDERS

Texas Self Employed Mortgage Advantages Include

| 600 mid score for 85% | 660 mid score for 90% |

- Purchase and R/T

- Must be self-employed for 24 months

- Minimum loan amount 150k

- 12 months Personal OR 24 months Business bank statements

- Cash-out available

- No tax returns Needed

TEXAS BANK STATEMENT ONLY MORTGAGE LENDERS DETAILS INCLUDE:

- 2 Years Self Employed Required!

- Bank statement deposits used to qualify!

- No tax returns required!

- 24 months personal bank statements (Personal and Business)

- Loans up to $3 million

- Credit scores down to 600

- Rates starting in the 5’s

- Up to 90% LTV

- DTI up to 50% considered

- Owner-occupied, 2nd homes, and investment properties

- 2 years seasoning for foreclosure, short sale, BK, DIL

- Non-warrantable condos considered

- Jumbo Bank Statment Only!

- 5/1 ARM or 30-year fixed

- No pre-payment penalty for owner-occ and 2nd homes

- SFRs, townhomes, condos, 2-4 units

- Seller concessions to 6% (2% for investment)

Our 24-month business or personal bank statement Texas Loan Program

KEYPOINTS

- Up To 90% OF TOTAL TEXAS BUSINESS DEPOSITS = Texas Bank Statement Mortgage Lenders will use 90% of the total deposits over a 24 month period if using Texas business bank statements.

OR

- 100% OF TOTAL PERSONAL DEPOSITS = Texas Bank Statement Mortgage Lenders also will accept 100% personal bank statements for the sole proprietor borrowers or 1099 wage earner. 24 months of personal and we will count 100% of the deposits.

IMPORTANT TO NOTE:

Texas Bank statement loan to value and rate will vary depending on score and loan size.

From a 600 to 640the LTV available is 80%.

Greater than 650 the LTV goes up to 90% with a very beneficial price break for those with scores over 700.

To learn more about the Texas bank statement loan program or any of the other alternative financing programs available through Texas Bank Statment Only Mortgage Lenders.

About Texas Self Employed Mortgage Lenders

If you’re one of the 1000’s of Texas self-employed workers that write off to much income to qualify for a Texas mortgage? it is now easier than ever to be self-employed get approved for a Texas mortgage if you are self-employed and have sufficient income and payment history you can now qualify for a bank statement only Texas mortgage. Fannie Mae has relaxed some of their guidelines for documenting Texas self-employed income. Even today Texas self-employed mortgage applicants are having trouble betting approve for their Texas dream home. Here we have provided the much-needed information to help you get approved for a Texas self-employed mortgage loan using bank statements only to document your income and ability to make the Texas mortgage payments.

Qualifying For Bank Statment Only Mortgage Loan

Available only to the Texas self-employed borrower(s) and Texas business owners, or for Texas self-employed borrowers where one or more of the borrowers are self-employed for the last two years. This is a great solution for Texas commissioned and 1099 borrowers who don’t want to provide tax returns or sign IRS form 4506-T. You simply need to show proof of income by providing 12 to 24 consecutive months of bank statements.

How Long Must You Be Self Employed In Texas To Qualify?

Most Texas mortgage lenders that provide self-employed mortgage loans want to see proof of at least 2 years business history. Some Texas self-employed mortgage lenders only require 12 months personal bank statements but still want proof of stability for at least 2 years. For self-employed Texas business owners using business bank statements 24 months business bank statements are required and a Texas profit and loss statement signed by the Texas business. NO Tax Returns Needed!

Texas Self Employed Income Using Tax Returns

A borrower’s income is still probably the single most important factor in qualifying for a Texas mortgage. For traditional Texas mortgage lenders to know what you earn, they will want to see at least the last two-years of a self-employed borrower’s Schedule C from an IRS Form 1040. Schedule C is the tax form that represents the income or loss from your Texas business. If income increases between year one and year two, Texas mortgage lenders will take an average of the two years. However, if the second year’s most recent income is lower than the first year, Texas mortgage lenders are required to use the lower number. With our bank statement only mortgage program this is not an issue because the lender will add up your most recent 12 or 24 months bank statements and average out your income.

Texas Self Employed Mortgage Loans

If you’re going to mortgage your Texas home purchase with traditional financing that is conforming to Fannie Mae and Freddie Mac guidelines you will be required to fully document your Texas self-employment income via adjusted income on your 1040 tax returns. It is standard that Fannie Mae will want a full 2 years worth of tax returns to document your net income after expenses. For many Texas self-employed mortgage applicants to provide this requirement can be difficult for self-employed Texas business owners.

If you’re purchasing a new Texas home or refinancing your existing Texas mortgage there is a specific process Texas self-employed must go through to get approved for a Texas mortgage. Under the old guidelines, Texas self-employed works had difficulty qualifying based on proof of income. This happens for a variety of reasons including how a Texas business is structured most importantly how much income you write off as a Texas self-employed mortgage applicant.

Texas self-employed workers have no history of paychecks that can be documented because the employer usually pays the w2 employee expenses. They take may take distributions with no regular amount or frequency making qualifying based on income difficult even with bank statements and tax returns. If your Texas business is new and you don’t have documented sources of revenue or even two years of federal tax returns this can make qualifying for a traditional mortgage difficult, if not impossible.

If you have a history of paying yourself from your Texas business, Fannie Mae’s guidelines state that your Texas business only needs to have adequate income to support your future distributions. Most Texas mortgage lenders will require documentation that yourTexas business is legitimate and stable. This could be provided in the form of your Texas letters of incorporation or the K-1 filing which highlights your percent Texas business ownership.

The underwriting process is still going to be more complicated for Texas self-employed mortgage applicants. Fannie Mae and Freddie Mac have similar processes to verify income from Texas self-employment.These requirements follow the ability to repay guidelines to ensure that you have adequate income from Texas business owners ability to repay the loan. Texas mortgage lenders adhere strictly to these guidelines so that the loans can be sold to Fannie Mae and Freddie Mac.

If you don’t have two years of Texas business tax returns the guidelines you may be able to qualify for a bank statement program using your personal bank statements as an alternative to a conventional Texas mortgage. These types of programs are available from Texas portfolio mortgage lenders and offer reasonable rates and fees.

Roadblocks for Texas Self Employed Mortgage Applicants

The most common roadblock self-employed workers face is proving how much your net income is from the business based on tax returns and deductions. You may have significant cash flow in your business but could be in for a shock when you learn your qualified net income based on tax write-offs and expenses for your business. If you cannot demonstrate sufficient net income from your business it still may be possible to qualify for a bank statement program using income on your personal statements.

Texas Business Tax Deductions Lower Documented Income

Running a business as a self-employed mortgage applicant can be very expensive and often comes with significant tax liability. The temptation can be to lower your taxable income with deductions. These deductions include business expenses for things like equipment, expense accounts, and annual depreciation.

Taking business deductions may save you money on your taxes but it could make it more difficult to qualify for a mortgage. As a self-employed worker, you are qualified for a mortgage based on your net income, not gross income for a traditional worker.

Most self-employed business owners claim as many tax deductions as the law allows which significantly lowers your net income and therefore your ability to qualify for self-employed home loans.

Debt to Income Ratio for the Texas Self Employed

Maintaining a low debt to income ratio is important in qualifying for any mortgage loan. As a self-employed worker, your debt to income ratio is calculated differently from traditional workers.

Your debt ratio is calculated by your average net income from the most recent tax returns along with current year income and expenses. In order to be approved for a self-employment mortgage, your debt-to-income ratio cannot be more than 43 percent.

If you’re considering purchasing a new home or refinancing your existing mortgage you might want to consider taking fewer tax deductions to reduce your debt-to-income rate with the highest possible net income.

Texas Mortgage Documentation Makes a Difference

The loan process you’ll go through as a self-employed business owner is the same as everyone else. Where it gets sticky is providing your income documentation. The more you have to prove that business income is sustainable and able to pay the easier the process becomes to qualify as a self-employed Texas business owner.

Keeping accurate records of income and expenses will make it easier to prove that you are a sustainable business as well as documenting net income which is required for maintaining a favorable debt ratio.

Mortgages for Texas Self Employed Business Owners

Texas Mortgage lenders generally consider self-employed business owners to be higher risk than those who work for a traditional paycheck. Higher risk Self-employed Texas business owners pay more at closing and over the life the loan with higher interest rates. If you’re accepting a higher interest rate when you purchase your Texas home you may be able to lower that rate down the road by demonstrating a reliable payment history and refinancing.

Texas Business Structure Matters

There are several different ways to be self-employed and underwriters treat them all differently. The most common business structures include sole proprietorship, partnerships, LLCs and S corporations.

Under a sole proprietorship, your business income is reported on schedule c of your tax return. With a partnership profits in the business are split between partners based on their respective percent of ownership. Limited Liability Corporations are considered pass-through entities for tax purposes. S corporations follow strict guidelines for distributions. Depending on how you structure your business you could potentially pay yourself on a w-2 and avoid the hurdles of a self-employed mortgage completely. Your accountant can help you choose the optimal business structure for your company.

No matter how you choose to structure your business there are steps you can take to maximize your income from self-employment and maintain an optimal debt ratio. All of these factors are under your control and are part of maintaining healthy finances as a self-employed worker.

BANK STATEMENT ONLY TEXAS MORTGAGE LENDERS LINKS:

- Bank Statement Only Texas Mortgage Lenders

- bank statement only – Texas-Mortgage-Lenders.com

- Texas -Bank Statement Only Mortgage Lenders

- BANK STATEMENT LOAN PROGRAM DETAILS – Texas-Mortgage …

JUMBO TEXAS BAD CREDIT MORTGAGE LENDERS

TEXAS BAD CREDIT JUMBO MORTGAGE LENDERS

Bad Credit Texas Mortgage Lenders- Min 500 FICO

Texas Jumbo Mortgage Lenders – Texas FHA Mortgage Lenders

Search Results

JUMBO TEXAS BAD CREDIT MORTGAGE LENDERS

TEXAS BAD CREDIT JUMBO MORTGAGE LENDERS

Bad Credit Texas Mortgage Lenders- Min 500 FICO

Texas Jumbo Mortgage Lenders – Texas FHA Mortgage Lenders

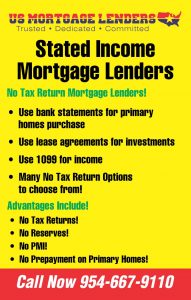

TEXAS STATED INCOME MORTGAGE LENDERS PROGRAMS

Texas Bank Statement Only Mortgage Lenders – FHA mortgage lender

https://www.fhamortgageprograms.com/texas-bank-statement-only-mortgage-lenders-…

Texas Bank Statement Only Mortgage Lenders Archives – FHA …

https://www.fhamortgageprograms.com › FHA › Texas

TEXAS STATED INCOME MORTGAGE LENDERS PROGRAMS

https://www.fhamortgageprograms.com/6-texas-stated-income-mortgage-lenders-prog…

Texas Bank Statement Only Lenders 12 or 24 Month Bank Statement

https://www.fhamortgageprograms.com/bank-statement-12-24-month-bank-statement/

15 DOWN+SELF EMPLOYED TEXAS MORTGAGE LENDERS

- https://www.fhamortgageprograms.com/self-employed-texas-mortgage-lenders/+&cd=7&hl=en&ct=clnk&gl=us”

| Texas Mortgage Lenders Coverage Areas Include | ||||

| Texas | Zip Code | City | County | Zip Code Map |

| Texas | 73301 | Austin | Travis | View Map |

| Texas | 73344 | Austin | Travis | View Map |

| Texas | 75001 | Addison | Dallas | View Map |

| Texas | 75002 | Allen | Collin | View Map |

| Texas | 75006 | Carrollton | Dallas | View Map |

| Texas | 75007 | Carrollton | Denton | View Map |

| Texas | 75009 | Celina | Collin | View Map |

| Texas | 75010 | Carrollton | Denton | View Map |

| Texas | 75011 | Carrollton | Dallas | View Map |

| Texas | 75013 | Allen | Collin | View Map |

| Texas | 75014 | Irving | Dallas | View Map |

| Texas | 75015 | Irving | Dallas | View Map |

| Texas | 75016 | Irving | Dallas | View Map |

| Texas | 75017 | Irving | Dallas | View Map |

| Texas | 75019 | Coppell | Dallas | View Map |

| Texas | 75020 | Denison | Grayson | View Map |

| Texas | 75021 | Denison | Grayson | View Map |

| Texas | 75022 | Flower Mound | Denton | View Map |

| Texas | 75023 | Plano | Collin | View Map |

| Texas | 75024 | Plano | Collin | View Map |

| Texas | 75025 | Plano | Collin | View Map |

| Texas | 75026 | Plano | Collin | View Map |

| Texas | 75027 | Flower Mound | Denton | View Map |

| Texas | 75028 | Flower Mound | Denton | View Map |

| Texas | 75029 | Lewisville | Denton | View Map |

| Texas | 75030 | Rowlett | Dallas | View Map |

| Texas | 75032 | Rockwall | Rockwall | View Map |

| Texas | 75034 | Frisco | Denton | View Map |

| Texas | 75035 | Frisco | Collin | View Map |

| Texas | 75037 | Irving | Dallas | View Map |

| Texas | 75038 | Irving | Dallas | View Map |

| Texas | 75039 | Irving | Dallas | View Map |

| Texas | 75040 | Garland | Dallas | View Map |

| Texas | 75041 | Garland | Dallas | View Map |

| Texas | 75042 | Garland | Dallas | View Map |

| Texas | 75043 | Garland | Dallas | View Map |

| Texas | 75044 | Garland | Dallas | View Map |

| Texas | 75045 | Garland | Dallas | View Map |

| Texas | 75046 | Garland | Dallas | View Map |

| Texas | 75047 | Garland | Dallas | View Map |

| Texas | 75048 | Sachse | Dallas | View Map |

| Texas | 75049 | Garland | Dallas | View Map |

| Texas | 75050 | Grand Prairie | Dallas | View Map |

| Texas | 75051 | Grand Prairie | Dallas | View Map |

| Texas | 75052 | Grand Prairie | Dallas | View Map |

| Texas | 75053 | Grand Prairie | Dallas | View Map |

| Texas | 75054 | Grand Prairie | Dallas | View Map |

| Texas | 75056 | The Colony | Denton | View Map |

| Texas | 75057 | Lewisville | Denton | View Map |

| Texas | 75058 | Gunter | Grayson | View Map |

| Texas | 75060 | Irving | Dallas | View Map |

| Texas | 75061 | Irving | Dallas | View Map |

| Texas | 75062 | Irving | Dallas | View Map |

| Texas | 75063 | Irving | Dallas | View Map |

| Texas | 75065 | Lake Dallas | Denton | View Map |

| Texas | 75067 | Lewisville | Denton | View Map |

| Texas | 75068 | Little Elm | Denton | View Map |

| Texas | 75069 | Mckinney | Collin | View Map |

| Texas | 75070 | Mckinney | Collin | View Map |

| Texas | 75071 | Mckinney | Collin | View Map |

| Texas | 75074 | Plano | Collin | View Map |

| Texas | 75075 | Plano | Collin | View Map |

| Texas | 75076 | Pottsboro | Grayson | View Map |

| Texas | 75077 | Lewisville | Denton | View Map |

| Texas | 75078 | Prosper | Collin | View Map |

| Texas | 75080 | Richardson | Dallas | View Map |

| Texas | 75081 | Richardson | Dallas | View Map |

| Texas | 75082 | Richardson | Dallas | View Map |

| Texas | 75083 | Richardson | Dallas | View Map |

| Texas | 75085 | Richardson | Dallas | View Map |

| Texas | 75086 | Plano | Collin | View Map |

| Texas | 75087 | Rockwall | Rockwall | View Map |

| Texas | 75088 | Rowlett | Dallas | View Map |

| Texas | 75089 | Rowlett | Dallas | View Map |

| Texas | 75090 | Sherman | Grayson | View Map |

| Texas | 75091 | Sherman | Grayson | View Map |

| Texas | 75092 | Sherman | Grayson | View Map |

| Texas | 75093 | Plano | Collin | View Map |

| Texas | 75094 | Plano | Collin | View Map |

| Texas | 75097 | Weston | Collin | View Map |

| Texas | 75098 | Wylie | Collin | View Map |

| Texas | 75099 | Coppell | Dallas | View Map |

| Texas | 75101 | Bardwell | Ellis | View Map |

| Texas | 75102 | Barry | Navarro | View Map |

| Texas | 75103 | Canton | Van Zandt | View Map |

| Texas | 75104 | Cedar Hill | Dallas | View Map |

| Texas | 75105 | Chatfield | Navarro | View Map |

| Texas | 75106 | Cedar Hill | Dallas | View Map |

| Texas | 75109 | Corsicana | Navarro | View Map |

| Texas | 75110 | Corsicana | Navarro | View Map |

| Texas | 75114 | Crandall | Kaufman | View Map |

| Texas | 75115 | Desoto | Dallas | View Map |

| Texas | 75116 | Duncanville | Dallas | View Map |

| Texas | 75117 | Edgewood | Van Zandt | View Map |

| Texas | 75118 | Elmo | Kaufman | View Map |

| Texas | 75119 | Ennis | Ellis | View Map |

| Texas | 75120 | Ennis | Ellis | View Map |

| Texas | 75121 | Copeville | Collin | View Map |

| Texas | 75123 | Desoto | Dallas | View Map |

| Texas | 75124 | Eustace | Henderson | View Map |

| Texas | 75125 | Ferris | Ellis | View Map |

| Texas | 75126 | Forney | Kaufman | View Map |

| Texas | 75127 | Fruitvale | Van Zandt | View Map |

| Texas | 75132 | Fate | Rockwall | View Map |

| Texas | 75134 | Lancaster | Dallas | View Map |

| Texas | 75135 | Caddo Mills | Hunt | View Map |

| Texas | 75137 | Duncanville | Dallas | View Map |

| Texas | 75138 | Duncanville | Dallas | View Map |

| Texas | 75140 | Grand Saline | Van Zandt | View Map |

| Texas | 75141 | Hutchins | Dallas | View Map |

| Texas | 75142 | Kaufman | Kaufman | View Map |

| Texas | 75143 | Kemp | Kaufman | View Map |

| Texas | 75144 | Kerens | Navarro | View Map |

| Texas | 75146 | Lancaster | Dallas | View Map |

| Texas | 75147 | Mabank | Kaufman | View Map |

| Texas | 75148 | Malakoff | Henderson | View Map |

| Texas | 75149 | Mesquite | Dallas | View Map |

| Texas | 75150 | Mesquite | Dallas | View Map |

| Texas | 75151 | Corsicana | Navarro | View Map |

| Texas | 75152 | Palmer | Ellis | View Map |

| Texas | 75153 | Powell | Navarro | View Map |

| Texas | 75154 | Red Oak | Ellis | View Map |

| Texas | 75155 | Rice | Navarro | View Map |

| Texas | 75156 | Mabank | Henderson | View Map |

| Texas | 75157 | Rosser | Kaufman | View Map |

| Texas | 75158 | Scurry | Kaufman | View Map |

| Texas | 75159 | Seagoville | Dallas | View Map |

| Texas | 75160 | Terrell | Kaufman | View Map |

| Texas | 75161 | Terrell | Kaufman | View Map |

| Texas | 75163 | Trinidad | Henderson | View Map |

| Texas | 75164 | Josephine | Collin | View Map |

| Texas | 75165 | Waxahachie | Ellis | View Map |

| Texas | 75166 | Lavon | Collin | View Map |

| Texas | 75167 | Waxahachie | Ellis | View Map |

| Texas | 75168 | Waxahachie | Ellis | View Map |

| Texas | 75169 | Wills Point | Van Zandt | View Map |

| Texas | 75172 | Wilmer | Dallas | View Map |

| Texas | 75173 | Nevada | Collin | View Map |

| Texas | 75180 | Mesquite | Dallas | View Map |

| Texas | 75181 | Mesquite | Dallas | View Map |

| Texas | 75182 | Sunnyvale | Dallas | View Map |

| Texas | 75185 | Mesquite | Dallas | View Map |

| Texas | 75187 | Mesquite | Dallas | View Map |

| Texas | 75189 | Royse City | Rockwall | View Map |

| Texas | 75201 | Dallas | Dallas | View Map |

| Texas | 75202 | Dallas | Dallas | View Map |

| Texas | 75203 | Dallas | Dallas | View Map |

| Texas | 75204 | Dallas | Dallas | View Map |

| Texas | 75205 | Dallas | Dallas | View Map |

| Texas | 75206 | Dallas | Dallas | View Map |

| Texas | 75207 | Dallas | Dallas | View Map |

| Texas | 75208 | Dallas | Dallas | View Map |

| Texas | 75209 | Dallas | Dallas | View Map |

| Texas | 75210 | Dallas | Dallas | View Map |

| Texas | 75211 | Dallas | Dallas | View Map |

| Texas | 75212 | Dallas | Dallas | View Map |

| Texas | 75214 | Dallas | Dallas | View Map |

| Texas | 75215 | Dallas | Dallas | View Map |

| Texas | 75216 | Dallas | Dallas | View Map |

| Texas | 75217 | Dallas | Dallas | View Map |

| Texas | 75218 | Dallas | Dallas | View Map |

| Texas | 75219 | Dallas | Dallas | View Map |

| Texas | 75220 | Dallas | Dallas | View Map |

| Texas | 75221 | Dallas | Dallas | View Map |

| Texas | 75222 | Dallas | Dallas | View Map |

| Texas | 75223 | Dallas | Dallas | View Map |

| Texas | 75224 | Dallas | Dallas | View Map |

| Texas | 75225 | Dallas | Dallas | View Map |

| Texas | 75226 | Dallas | Dallas | View Map |

| Texas | 75227 | Dallas | Dallas | View Map |

| Texas | 75228 | Dallas | Dallas | View Map |

| Texas | 75229 | Dallas | Dallas | View Map |

| Texas | 75230 | Dallas | Dallas | View Map |

| Texas | 75231 | Dallas | Dallas | View Map |

| Texas | 75232 | Dallas | Dallas | View Map |

| Texas | 75233 | Dallas | Dallas | View Map |

| Texas | 75234 | Dallas | Dallas | View Map |

| Texas | 75235 | Dallas | Dallas | View Map |

| Texas | 75236 | Dallas | Dallas | View Map |

| Texas | 75237 | Dallas | Dallas | View Map |

| Texas | 75238 | Dallas | Dallas | View Map |

| Texas | 75240 | Dallas | Dallas | View Map |

| Texas | 75241 | Dallas | Dallas | View Map |

| Texas | 75242 | Dallas | Dallas | View Map |

| Texas | 75243 | Dallas | Dallas | View Map |

| Texas | 75244 | Dallas | Dallas | View Map |

| Texas | 75245 | Dallas | Dallas | View Map |

| Texas | 75246 | Dallas | Dallas | View Map |

| Texas | 75247 | Dallas | Dallas | View Map |

| Texas | 75248 | Dallas | Dallas | View Map |

| Texas | 75249 | Dallas | Dallas | View Map |

| Texas | 75250 | Dallas | Dallas | View Map |

| Texas | 75251 | Dallas | Dallas | View Map |

| Texas | 75252 | Dallas | Collin | View Map |

| Texas | 75253 | Dallas | Dallas | View Map |

| Texas | 75254 | Dallas | Dallas | View Map |

| Texas | 75258 | Dallas | Dallas | View Map |

| Texas | 75260 | Dallas | Dallas | View Map |

| Texas | 75261 | Dallas | Dallas | View Map |

| Texas | 75262 | Dallas | Dallas | View Map |

| Texas | 75263 | Dallas | Dallas | View Map |

| Texas | 75264 | Dallas | Dallas | View Map |

| Texas | 75265 | Dallas | Dallas | View Map |

| Texas | 75266 | Dallas | Dallas | View Map |

| Texas | 75267 | Dallas | Dallas | View Map |

| Texas | 75270 | Dallas | Dallas | View Map |

| Texas | 75275 | Dallas | Dallas | View Map |

| Texas | 75277 | Dallas | Dallas | View Map |

| Texas | 75283 | Dallas | Dallas | View Map |

| Texas | 75284 | Dallas | Dallas | View Map |

| Texas | 75285 | Dallas | Dallas | View Map |

| Texas | 75286 | Dallas | Dallas | View Map |

| Texas | 75287 | Dallas | Collin | View Map |

| Texas | 75301 | Dallas | Dallas | View Map |

| Texas | 75303 | Dallas | Dallas | View Map |

| Texas | 75310 | Dallas | Dallas | View Map |

| Texas | 75312 | Dallas | Dallas | View Map |

| Texas | 75313 | Dallas | Dallas | View Map |

| Texas | 75315 | Dallas | Dallas | View Map |

| Texas | 75320 | Dallas | Dallas | View Map |

| Texas | 75323 | Dallas | Dallas | View Map |

| Texas | 75326 | Dallas | Dallas | View Map |

| Texas | 75334 | Dallas | Dallas | View Map |

| Texas | 75336 | Dallas | Dallas | View Map |

| Texas | 75339 | Dallas | Dallas | View Map |

| Texas | 75340 | Dallas | Dallas | View Map |

| Texas | 75342 | Dallas | Dallas | View Map |

| Texas | 75343 | Dallas | Dallas | View Map |

| Texas | 75344 | Dallas | Dallas | View Map |

| Texas | 75353 | Dallas | Dallas | View Map |

| Texas | 75354 | Dallas | Dallas | View Map |

| Texas | 75355 | Dallas | Dallas | View Map |

| Texas | 75356 | Dallas | Dallas | View Map |

| Texas | 75357 | Dallas | Dallas | View Map |

| Texas | 75358 | Dallas | Dallas | View Map |

| Texas | 75359 | Dallas | Dallas | View Map |

| Texas | 75360 | Dallas | Dallas | View Map |

| Texas | 75363 | Dallas | Dallas | View Map |

| Texas | 75364 | Dallas | Dallas | View Map |

| Texas | 75367 | Dallas | Dallas | View Map |

| Texas | 75368 | Dallas | Dallas | View Map |

| Texas | 75370 | Dallas | Dallas | View Map |

| Texas | 75371 | Dallas | Dallas | View Map |

| Texas | 75372 | Dallas | Dallas | View Map |

| Texas | 75373 | Dallas | Dallas | View Map |

| Texas | 75374 | Dallas | Dallas | View Map |

| Texas | 75376 | Dallas | Dallas | View Map |

| Texas | 75378 | Dallas | Dallas | View Map |

| Texas | 75379 | Dallas | Dallas | View Map |

| Texas | 75380 | Dallas | Dallas | View Map |

| Texas | 75381 | Dallas | Dallas | View Map |

| Texas | 75382 | Dallas | Dallas | View Map |

| Texas | 75386 | Dallas | Dallas | View Map |

| Texas | 75387 | Dallas | Dallas | View Map |

| Texas | 75388 | Dallas | Dallas | View Map |

| Texas | 75389 | Dallas | Dallas | View Map |

| Texas | 75390 | Dallas | Dallas | View Map |

| Texas | 75391 | Dallas | Dallas | View Map |

| Texas | 75392 | Dallas | Dallas | View Map |

| Texas | 75393 | Dallas | Dallas | View Map |

| Texas | 75394 | Dallas | Dallas | View Map |

| Texas | 75395 | Dallas | Dallas | View Map |

| Texas | 75396 | Dallas | Dallas | View Map |

| Texas | 75397 | Dallas | Dallas | View Map |

| Texas | 75398 | Dallas | Dallas | View Map |

| Texas | 75401 | Greenville | Hunt | View Map |

| Texas | 75402 | Greenville | Hunt | View Map |

| Texas | 75403 | Greenville | Hunt | View Map |

| Texas | 75404 | Greenville | Hunt | View Map |

| Texas | 75407 | Princeton | Collin | View Map |

| Texas | 75409 | Anna | Collin | View Map |

| Texas | 75410 | Alba | Wood | View Map |

| Texas | 75411 | Arthur City | Lamar | View Map |

| Texas | 75412 | Bagwell | Red River | View Map |

| Texas | 75413 | Bailey | Fannin | View Map |

| Texas | 75414 | Bells | Grayson | View Map |

| Texas | 75415 | Ben Franklin | Delta | View Map |

| Texas | 75416 | Blossom | Lamar | View Map |

| Texas | 75417 | Bogata | Red River | View Map |

| Texas | 75418 | Bonham | Fannin | View Map |

| Texas | 75420 | Brashear | Hopkins | View Map |

| Texas | 75421 | Brookston | Lamar | View Map |

| Texas | 75422 | Campbell | Hunt | View Map |

| Texas | 75423 | Celeste | Hunt | View Map |

| Texas | 75424 | Blue Ridge | Collin | View Map |

| Texas | 75425 | Chicota | Lamar | View Map |

| Texas | 75426 | Clarksville | Red River | View Map |

| Texas | 75428 | Commerce | Hunt | View Map |

| Texas | 75429 | Commerce | Hunt | View Map |

| Texas | 75431 | Como | Hopkins | View Map |

| Texas | 75432 | Cooper | Delta | View Map |

| Texas | 75433 | Cumby | Hopkins | View Map |

| Texas | 75434 | Cunningham | Lamar | View Map |

| Texas | 75435 | Deport | Lamar | View Map |

| Texas | 75436 | Detroit | Red River | View Map |

| Texas | 75437 | Dike | Hopkins | View Map |

| Texas | 75438 | Dodd City | Fannin | View Map |

| Texas | 75439 | Ector | Fannin | View Map |

| Texas | 75440 | Emory | Rains | View Map |

| Texas | 75441 | Enloe | Delta | View Map |

| Texas | 75442 | Farmersville | Collin | View Map |

| Texas | 75443 | Gober | Fannin | View Map |

| Texas | 75444 | Golden | Wood | View Map |

| Texas | 75446 | Honey Grove | Fannin | View Map |

| Texas | 75447 | Ivanhoe | Fannin | View Map |

| Texas | 75448 | Klondike | Delta | View Map |

| Texas | 75449 | Ladonia | Fannin | View Map |

| Texas | 75450 | Lake Creek | Delta | View Map |

| Texas | 75451 | Leesburg | Camp | View Map |

| Texas | 75452 | Leonard | Fannin | View Map |

| Texas | 75453 | Lone Oak | Hunt | View Map |

| Texas | 75454 | Melissa | Collin | View Map |

| Texas | 75455 | Mount Pleasant | Titus | View Map |

| Texas | 75456 | Mount Pleasant | Titus | View Map |

| Texas | 75457 | Mount Vernon | Franklin | View Map |

| Texas | 75458 | Merit | Hunt | View Map |

| Texas | 75459 | Howe | Grayson | View Map |

| Texas | 75460 | Paris | Lamar | View Map |

| Texas | 75461 | Paris | Lamar | View Map |

| Texas | 75462 | Paris | Lamar | View Map |

| Texas | 75468 | Pattonville | Lamar | View Map |

| Texas | 75469 | Pecan Gap | Delta | View Map |

| Texas | 75470 | Petty | Lamar | View Map |

| Texas | 75471 | Pickton | Hopkins | View Map |

| Texas | 75472 | Point | Rains | View Map |

| Texas | 75473 | Powderly | Lamar | View Map |

| Texas | 75474 | Quinlan | Hunt | View Map |

| Texas | 75475 | Randolph | Fannin | View Map |

| Texas | 75476 | Ravenna | Fannin | View Map |

| Texas | 75477 | Roxton | Lamar | View Map |

| Texas | 75478 | Saltillo | Hopkins | View Map |

| Texas | 75479 | Savoy | Fannin | View Map |

| Texas | 75480 | Scroggins | Franklin | View Map |

| Texas | 75481 | Sulphur Bluff | Hopkins | View Map |

| Texas | 75482 | Sulphur Springs | Hopkins | View Map |

| Texas | 75483 | Sulphur Springs | Hopkins | View Map |

| Texas | 75485 | Westminster | Collin | View Map |

| Texas | 75486 | Sumner | Lamar | View Map |

| Texas | 75487 | Talco | Franklin | View Map |

| Texas | 75488 | Telephone | Fannin | View Map |

| Texas | 75489 | Tom Bean | Grayson | View Map |

| Texas | 75490 | Trenton | Fannin | View Map |

| Texas | 75491 | Whitewright | Grayson | View Map |

| Texas | 75492 | Windom | Fannin | View Map |

| Texas | 75493 | Winfield | Titus | View Map |

| Texas | 75494 | Winnsboro | Wood | View Map |

| Texas | 75495 | Van Alstyne | Grayson | View Map |

| Texas | 75496 | Wolfe City | Hunt | View Map |

| Texas | 75497 | Yantis | Wood | View Map |

| Texas | 75501 | Texarkana | Bowie | View Map |

| Texas | 75503 | Texarkana | Bowie | View Map |

| Texas | 75504 | Texarkana | Bowie | View Map |

| Texas | 75505 | Texarkana | Bowie | View Map |

| Texas | 75507 | Texarkana | Bowie | View Map |

| Texas | 75550 | Annona | Red River | View Map |

| Texas | 75551 | Atlanta | Cass | View Map |

| Texas | 75554 | Avery | Red River | View Map |

| Texas | 75555 | Bivins | Cass | View Map |

| Texas | 75556 | Bloomburg | Cass | View Map |

| Texas | 75558 | Cookville | Titus | View Map |

| Texas | 75559 | De Kalb | Bowie | View Map |

| Texas | 75560 | Douglassville | Cass | View Map |

| Texas | 75561 | Hooks | Bowie | View Map |

| Texas | 75562 | Kildare | Cass | View Map |

| Texas | 75563 | Linden | Cass | View Map |

| Texas | 75564 | Lodi | Marion | View Map |

| Texas | 75565 | Mc Leod | Cass | View Map |

| Texas | 75566 | Marietta | Cass | View Map |

| Texas | 75567 | Maud | Bowie | View Map |

| Texas | 75568 | Naples | Morris | View Map |

| Texas | 75569 | Nash | Bowie | View Map |

| Texas | 75570 | New Boston | Bowie | View Map |

| Texas | 75571 | Omaha | Morris | View Map |

| Texas | 75572 | Queen City | Cass | View Map |

| Texas | 75573 | Redwater | Bowie | View Map |

| Texas | 75574 | Simms | Bowie | View Map |

| Texas | 75599 | Texarkana | Bowie | View Map |

| Texas | 75601 | Longview | Gregg | View Map |

| Texas | 75602 | Longview | Gregg | View Map |

| Texas | 75603 | Longview | Gregg | View Map |

| Texas | 75604 | Longview | Gregg | View Map |

| Texas | 75605 | Longview | Gregg | View Map |

| Texas | 75606 | Longview | Gregg | View Map |

| Texas | 75607 | Longview | Gregg | View Map |

| Texas | 75608 | Longview | Gregg | View Map |

| Texas | 75615 | Longview | Gregg | View Map |

| Texas | 75630 | Avinger | Cass | View Map |

| Texas | 75631 | Beckville | Panola | View Map |

| Texas | 75633 | Carthage | Panola | View Map |

| Texas | 75636 | Cason | Morris | View Map |

| Texas | 75637 | Clayton | Panola | View Map |

| Texas | 75638 | Daingerfield | Morris | View Map |

| Texas | 75639 | De Berry | Panola | View Map |

| Texas | 75640 | Diana | Upshur | View Map |

| Texas | 75641 | Easton | Gregg | View Map |

| Texas | 75642 | Elysian Fields | Harrison | View Map |

| Texas | 75643 | Gary | Panola | View Map |

| Texas | 75644 | Gilmer | Upshur | View Map |

| Texas | 75645 | Gilmer | Upshur | View Map |

| Texas | 75647 | Gladewater | Gregg | View Map |

| Texas | 75650 | Hallsville | Harrison | View Map |

| Texas | 75651 | Harleton | Harrison | View Map |

| Texas | 75652 | Henderson | Rusk | View Map |

| Texas | 75653 | Henderson | Rusk | View Map |

| Texas | 75654 | Henderson | Rusk | View Map |

| Texas | 75656 | Hughes Springs | Cass | View Map |

| Texas | 75657 | Jefferson | Marion | View Map |

| Texas | 75658 | Joinerville | Rusk | View Map |

| Texas | 75659 | Jonesville | Harrison | View Map |

| Texas | 75660 | Judson | Gregg | View Map |

| Texas | 75661 | Karnack | Harrison | View Map |

| Texas | 75662 | Kilgore | Gregg | View Map |

| Texas | 75663 | Kilgore | Gregg | View Map |

| Texas | 75666 | Laird Hill | Rusk | View Map |

| Texas | 75667 | Laneville | Rusk | View Map |

| Texas | 75668 | Lone Star | Morris | View Map |

| Texas | 75669 | Long Branch | Panola | View Map |

| Texas | 75670 | Marshall | Harrison | View Map |

| Texas | 75671 | Marshall | Harrison | View Map |

| Texas | 75672 | Marshall | Harrison | View Map |

| Texas | 75680 | Minden | Rusk | View Map |

| Texas | 75681 | Mount Enterprise | Rusk | View Map |

| Texas | 75682 | New London | Rusk | View Map |

| Texas | 75683 | Ore City | Upshur | View Map |

| Texas | 75684 | Overton | Rusk | View Map |

| Texas | 75685 | Panola | Panola | View Map |

| Texas | 75686 | Pittsburg | Camp | View Map |

| Texas | 75687 | Price | Rusk | View Map |

| Texas | 75688 | Scottsville | Harrison | View Map |

| Texas | 75689 | Selman City | Rusk | View Map |

| Texas | 75691 | Tatum | Rusk | View Map |

| Texas | 75692 | Waskom | Harrison | View Map |

| Texas | 75693 | White Oak | Gregg | View Map |

| Texas | 75694 | Woodlawn | Harrison | View Map |

| Texas | 75701 | Tyler | Smith | View Map |

| Texas | 75702 | Tyler | Smith | View Map |

| Texas | 75703 | Tyler | Smith | View Map |

| Texas | 75704 | Tyler | Smith | View Map |

| Texas | 75705 | Tyler | Smith | View Map |

| Texas | 75706 | Tyler | Smith | View Map |

| Texas | 75707 | Tyler | Smith | View Map |

| Texas | 75708 | Tyler | Smith | View Map |

| Texas | 75709 | Tyler | Smith | View Map |

| Texas | 75710 | Tyler | Smith | View Map |

| Texas | 75711 | Tyler | Smith | View Map |

| Texas | 75712 | Tyler | Smith | View Map |

| Texas | 75713 | Tyler | Smith | View Map |

| Texas | 75750 | Arp | Smith | View Map |

| Texas | 75751 | Athens | Henderson | View Map |

| Texas | 75752 | Athens | Henderson | View Map |

| Texas | 75754 | Ben Wheeler | Van Zandt | View Map |

| Texas | 75755 | Big Sandy | Upshur | View Map |

| Texas | 75756 | Brownsboro | Henderson | View Map |

| Texas | 75757 | Bullard | Smith | View Map |

| Texas | 75758 | Chandler | Henderson | View Map |

| Texas | 75759 | Cuney | Cherokee | View Map |

| Texas | 75760 | Cushing | Nacogdoches | View Map |

| Texas | 75762 | Flint | Smith | View Map |

| Texas | 75763 | Frankston | Anderson | View Map |

| Texas | 75764 | Gallatin | Cherokee | View Map |

| Texas | 75765 | Hawkins | Wood | View Map |

| Texas | 75766 | Jacksonville | Cherokee | View Map |

| Texas | 75770 | Larue | Henderson | View Map |

| Texas | 75771 | Lindale | Smith | View Map |

| Texas | 75772 | Maydelle | Cherokee | View Map |

| Texas | 75773 | Mineola | Wood | View Map |

| Texas | 75778 | Murchison | Henderson | View Map |

| Texas | 75779 | Neches | Anderson | View Map |

| Texas | 75780 | New Summerfield | Cherokee | View Map |

| Texas | 75782 | Poynor | Henderson | View Map |

| Texas | 75783 | Quitman | Wood | View Map |

| Texas | 75784 | Reklaw | Cherokee | View Map |

| Texas | 75785 | Rusk | Cherokee | View Map |

| Texas | 75788 | Sacul | Nacogdoches | View Map |

| Texas | 75789 | Troup | Smith | View Map |

| Texas | 75790 | Van | Van Zandt | View Map |

| Texas | 75791 | Whitehouse | Smith | View Map |

| Texas | 75792 | Winona | Smith | View Map |

| Texas | 75797 | Big Sandy | Upshur | View Map |

| Texas | 75798 | Tyler | Smith | View Map |

| Texas | 75799 | Tyler | Smith | View Map |

| Texas | 75801 | Palestine | Anderson | View Map |

| Texas | 75802 | Palestine | Anderson | View Map |

| Texas | 75803 | Palestine | Anderson | View Map |

| Texas | 75831 | Buffalo | Leon | View Map |

| Texas | 75832 | Cayuga | Anderson | View Map |

| Texas | 75833 | Centerville | Leon | View Map |

| Texas | 75834 | Centralia | Trinity | View Map |

| Texas | 75835 | Crockett | Houston | View Map |

| Texas | 75838 | Donie | Freestone | View Map |

| Texas | 75839 | Elkhart | Anderson | View Map |

| Texas | 75840 | Fairfield | Freestone | View Map |

| Texas | 75844 | Grapeland | Houston | View Map |

| Texas | 75845 | Groveton | Trinity | View Map |

| Texas | 75846 | Jewett | Leon | View Map |

| Texas | 75847 | Kennard | Houston | View Map |

| Texas | 75848 | Kirvin | Freestone | View Map |

| Texas | 75849 | Latexo | Houston | View Map |

| Texas | 75850 | Leona | Leon | View Map |

| Texas | 75851 | Lovelady | Houston | View Map |

| Texas | 75852 | Midway | Madison | View Map |

| Texas | 75853 | Montalba | Anderson | View Map |

| Texas | 75855 | Oakwood | Leon | View Map |

| Texas | 75856 | Pennington | Trinity | View Map |

| Texas | 75858 | Ratcliff | Houston | View Map |

| Texas | 75859 | Streetman | Freestone | View Map |

| Texas | 75860 | Teague | Freestone | View Map |

| Texas | 75861 | Tennessee Colony | Anderson | View Map |

| Texas | 75862 | Trinity | Trinity | View Map |

| Texas | 75865 | Woodlake | Trinity | View Map |

| Texas | 75880 | Tennessee Colony | Anderson | View Map |

| Texas | 75882 | Palestine | Anderson | View Map |

| Texas | 75884 | Tennessee Colony | Anderson | View Map |

| Texas | 75886 | Tennessee Colony | Anderson | View Map |

| Texas | 75901 | Lufkin | Angelina | View Map |

| Texas | 75902 | Lufkin | Angelina | View Map |

| Texas | 75903 | Lufkin | Angelina | View Map |

| Texas | 75904 | Lufkin | Angelina | View Map |

| Texas | 75915 | Lufkin | Angelina | View Map |

| Texas | 75925 | Alto | Cherokee | View Map |

| Texas | 75926 | Apple Springs | Trinity | View Map |

| Texas | 75928 | Bon Wier | Newton | View Map |

| Texas | 75929 | Broaddus | San Augustine | View Map |

| Texas | 75930 | Bronson | Sabine | View Map |

| Texas | 75931 | Brookeland | Jasper | View Map |

| Texas | 75932 | Burkeville | Newton | View Map |

| Texas | 75933 | Call | Newton | View Map |

| Texas | 75934 | Camden | Polk | View Map |

| Texas | 75935 | Center | Shelby | View Map |

| Texas | 75936 | Chester | Tyler | View Map |

| Texas | 75937 | Chireno | Nacogdoches | View Map |

| Texas | 75938 | Colmesneil | Tyler | View Map |

| Texas | 75939 | Corrigan | Polk | View Map |

| Texas | 75941 | Diboll | Angelina | View Map |

| Texas | 75942 | Doucette | Tyler | View Map |

| Texas | 75943 | Douglass | Nacogdoches | View Map |

| Texas | 75944 | Etoile | Nacogdoches | View Map |

| Texas | 75946 | Garrison | Nacogdoches | View Map |

| Texas | 75948 | Hemphill | Sabine | View Map |

| Texas | 75949 | Huntington | Angelina | View Map |

| Texas | 75951 | Jasper | Jasper | View Map |

| Texas | 75954 | Joaquin | Shelby | View Map |

| Texas | 75956 | Kirbyville | Jasper | View Map |

| Texas | 75958 | Martinsville | Nacogdoches | View Map |

| Texas | 75959 | Milam | Sabine | View Map |

| Texas | 75960 | Moscow | Polk | View Map |

| Texas | 75961 | Nacogdoches | Nacogdoches | View Map |

| Texas | 75962 | Nacogdoches | Nacogdoches | View Map |

| Texas | 75963 | Nacogdoches | Nacogdoches | View Map |

| Texas | 75964 | Nacogdoches | Nacogdoches | View Map |

| Texas | 75965 | Nacogdoches | Nacogdoches | View Map |

| Texas | 75966 | Newton | Newton | View Map |

| Texas | 75968 | Pineland | Sabine | View Map |

| Texas | 75969 | Pollok | Angelina | View Map |

| Texas | 75972 | San Augustine | San Augustine | View Map |

| Texas | 75973 | Shelbyville | Shelby | View Map |

| Texas | 75974 | Tenaha | Shelby | View Map |

| Texas | 75975 | Timpson | Shelby | View Map |

| Texas | 75976 | Wells | Cherokee | View Map |

| Texas | 75977 | Wiergate | Newton | View Map |

| Texas | 75978 | Woden | Nacogdoches | View Map |

| Texas | 75979 | Woodville | Tyler | View Map |

| Texas | 75980 | Zavalla | Angelina | View Map |

| Texas | 75990 | Woodville | Tyler | View Map |

| Texas | 76001 | Arlington | Tarrant | View Map |

| Texas | 76002 | Arlington | Tarrant | View Map |

| Texas | 76003 | Arlington | Tarrant | View Map |

| Texas | 76004 | Arlington | Tarrant | View Map |

| Texas | 76005 | Arlington | Tarrant | View Map |

| Texas | 76006 | Arlington | Tarrant | View Map |

| Texas | 76007 | Arlington | Tarrant | View Map |

| Texas | 76008 | Aledo | Parker | View Map |

| Texas | 76009 | Alvarado | Johnson | View Map |

| Texas | 76010 | Arlington | Tarrant | View Map |

| Texas | 76011 | Arlington | Tarrant | View Map |

| Texas | 76012 | Arlington | Tarrant | View Map |

| Texas | 76013 | Arlington | Tarrant | View Map |

| Texas | 76014 | Arlington | Tarrant | View Map |

| Texas | 76015 | Arlington | Tarrant | View Map |

| Texas | 76016 | Arlington | Tarrant | View Map |

| Texas | 76017 | Arlington | Tarrant | View Map |

| Texas | 76018 | Arlington | Tarrant | View Map |

| Texas | 76019 | Arlington | Tarrant | View Map |

| Texas | 76020 | Azle | Tarrant | View Map |

| Texas | 76021 | Bedford | Tarrant | View Map |

| Texas | 76022 | Bedford | Tarrant | View Map |

| Texas | 76023 | Boyd | Wise | View Map |

| Texas | 76028 | Burleson | Johnson | View Map |

| Texas | 76031 | Cleburne | Johnson | View Map |

| Texas | 76033 | Cleburne | Johnson | View Map |

| Texas | 76034 | Colleyville | Tarrant | View Map |

| Texas | 76035 | Cresson | Hood | View Map |

| Texas | 76036 | Crowley | Tarrant | View Map |

| Texas | 76039 | Euless | Tarrant | View Map |

| Texas | 76040 | Euless | Tarrant | View Map |

| Texas | 76041 | Forreston | Ellis | View Map |

| Texas | 76043 | Glen Rose | Somervell | View Map |

| Texas | 76044 | Godley | Johnson | View Map |

| Texas | 76048 | Granbury | Hood | View Map |

| Texas | 76049 | Granbury | Hood | View Map |

| Texas | 76050 | Grandview | Johnson | View Map |

| Texas | 76051 | Grapevine | Tarrant | View Map |

| Texas | 76052 | Haslet | Tarrant | View Map |

| Texas | 76053 | Hurst | Tarrant | View Map |

| Texas | 76054 | Hurst | Tarrant | View Map |

| Texas | 76055 | Itasca | Hill | View Map |

| Texas | 76058 | Joshua | Johnson | View Map |

| Texas | 76059 | Keene | Johnson | View Map |

| Texas | 76060 | Kennedale | Tarrant | View Map |

| Texas | 76061 | Lillian | Johnson | View Map |

| Texas | 76063 | Mansfield | Tarrant | View Map |

| Texas | 76064 | Maypearl | Ellis | View Map |

| Texas | 76065 | Midlothian | Ellis | View Map |

| Texas | 76066 | Millsap | Parker | View Map |

| Texas | 76067 | Mineral Wells | Palo Pinto | View Map |

| Texas | 76068 | Mineral Wells | Palo Pinto | View Map |

| Texas | 76070 | Nemo | Somervell | View Map |

| Texas | 76071 | Newark | Wise | View Map |

| Texas | 76073 | Paradise | Wise | View Map |

| Texas | 76077 | Rainbow | Somervell | View Map |

| Texas | 76078 | Rhome | Wise | View Map |

| Texas | 76082 | Springtown | Parker | View Map |

| Texas | 76084 | Venus | Johnson | View Map |

| Texas | 76085 | Weatherford | Parker | View Map |

| Texas | 76086 | Weatherford | Parker | View Map |

| Texas | 76087 | Weatherford | Parker | View Map |

| Texas | 76088 | Weatherford | Parker | View Map |

| Texas | 76092 | Southlake | Tarrant | View Map |

| Texas | 76093 | Rio Vista | Johnson | View Map |

| Texas | 76094 | Arlington | Tarrant | View Map |

| Texas | 76095 | Bedford | Tarrant | View Map |

| Texas | 76096 | Arlington | Tarrant | View Map |

| Texas | 76097 | Burleson | Johnson | View Map |

| Texas | 76098 | Azle | Parker | View Map |

| Texas | 76099 | Grapevine | Tarrant | View Map |

| Texas | 76101 | Fort Worth | Tarrant | View Map |

| Texas | 76102 | Fort Worth | Tarrant | View Map |

| Texas | 76103 | Fort Worth | Tarrant | View Map |

| Texas | 76104 | Fort Worth | Tarrant | View Map |

| Texas | 76105 | Fort Worth | Tarrant | View Map |

| Texas | 76106 | Fort Worth | Tarrant | View Map |

| Texas | 76107 | Fort Worth | Tarrant | View Map |

| Texas | 76108 | Fort Worth | Tarrant | View Map |

| Texas | 76109 | Fort Worth | Tarrant | View Map |

| Texas | 76110 | Fort Worth | Tarrant | View Map |

| Texas | 76111 | Fort Worth | Tarrant | View Map |

| Texas | 76112 | Fort Worth | Tarrant | View Map |

| Texas | 76113 | Fort Worth | Tarrant | View Map |

| Texas | 76114 | Fort Worth | Tarrant | View Map |

| Texas | 76115 | Fort Worth | Tarrant | View Map |

| Texas | 76116 | Fort Worth | Tarrant | View Map |

| Texas | 76117 | Haltom City | Tarrant | View Map |

| Texas | 76118 | Fort Worth | Tarrant | View Map |

| Texas | 76119 | Fort Worth | Tarrant | View Map |

| Texas | 76120 | Fort Worth | Tarrant | View Map |

| Texas | 76121 | Fort Worth | Tarrant | View Map |

| Texas | 76122 | Fort Worth | Tarrant | View Map |

| Texas | 76123 | Fort Worth | Tarrant | View Map |

| Texas | 76124 | Fort Worth | Tarrant | View Map |

| Texas | 76126 | Fort Worth | Tarrant | View Map |

| Texas | 76127 | Naval Air Station/ Jrb | Tarrant | View Map |

| Texas | 76129 | Fort Worth | Tarrant | View Map |

| Texas | 76130 | Fort Worth | Tarrant | View Map |

| Texas | 76131 | Fort Worth | Tarrant | View Map |

| Texas | 76132 | Fort Worth | Tarrant | View Map |

| Texas | 76133 | Fort Worth | Tarrant | View Map |

| Texas | 76134 | Fort Worth | Tarrant | View Map |

| Texas | 76135 | Fort Worth | Tarrant | View Map |

| Texas | 76136 | Fort Worth | Tarrant | View Map |

| Texas | 76137 | Fort Worth | Tarrant | View Map |

| Texas | 76140 | Fort Worth | Tarrant | View Map |

| Texas | 76147 | Fort Worth | Tarrant | View Map |

| Texas | 76148 | Fort Worth | Tarrant | View Map |

| Texas | 76150 | Fort Worth | Tarrant | View Map |

| Texas | 76155 | Fort Worth | Tarrant | View Map |

| Texas | 76161 | Fort Worth | Tarrant | View Map |

| Texas | 76162 | Fort Worth | Tarrant | View Map |

| Texas | 76163 | Fort Worth | Tarrant | View Map |

| Texas | 76164 | Fort Worth | Tarrant | View Map |

| Texas | 76177 | Fort Worth | Tarrant | View Map |

| Texas | 76179 | Fort Worth | Tarrant | View Map |

| Texas | 76180 | North Richland Hills | Tarrant | View Map |

| Texas | 76181 | Fort Worth | Tarrant | View Map |

| Texas | 76182 | North Richland Hills | Tarrant | View Map |

| Texas | 76185 | Fort Worth | Tarrant | View Map |

| Texas | 76191 | Fort Worth | Tarrant | View Map |

| Texas | 76192 | Fort Worth | Tarrant | View Map |

| Texas | 76193 | Fort Worth | Tarrant | View Map |

| Texas | 76195 | Fort Worth | Tarrant | View Map |

| Texas | 76196 | Fort Worth | Tarrant | View Map |

| Texas | 76197 | Fort Worth | Tarrant | View Map |

| Texas | 76198 | Fort Worth | Tarrant | View Map |

| Texas | 76199 | Fort Worth | Tarrant | View Map |

| Texas | 76201 | Denton | Denton | View Map |

| Texas | 76202 | Denton | Denton | View Map |

| Texas | 76203 | Denton | Denton | View Map |

| Texas | 76204 | Denton | Denton | View Map |

| Texas | 76205 | Denton | Denton | View Map |

| Texas | 76206 | Denton | Denton | View Map |

| Texas | 76207 | Denton | Denton | View Map |

| Texas | 76208 | Denton | Denton | View Map |

| Texas | 76209 | Denton | Denton | View Map |

| Texas | 76210 | Denton | Denton | View Map |

| Texas | 76225 | Alvord | Wise | View Map |

| Texas | 76226 | Argyle | Denton | View Map |

| Texas | 76227 | Aubrey | Denton | View Map |

| Texas | 76228 | Bellevue | Clay | View Map |

| Texas | 76230 | Bowie | Montague | View Map |

| Texas | 76233 | Collinsville | Grayson | View Map |

| Texas | 76234 | Decatur | Wise | View Map |

| Texas | 76238 | Era | Cooke | View Map |

| Texas | 76239 | Forestburg | Montague | View Map |

| Texas | 76240 | Gainesville | Cooke | View Map |

| Texas | 76241 | Gainesville | Cooke | View Map |

| Texas | 76244 | Keller | Tarrant | View Map |

| Texas | 76245 | Gordonville | Grayson | View Map |

| Texas | 76246 | Greenwood | Wise | View Map |

| Texas | 76247 | Justin | Denton | View Map |

| Texas | 76248 | Keller | Tarrant | View Map |

| Texas | 76249 | Krum | Denton | View Map |

| Texas | 76250 | Lindsay | Cooke | View Map |

| Texas | 76251 | Montague | Montague | View Map |

| Texas | 76252 | Muenster | Cooke | View Map |

| Texas | 76253 | Myra | Cooke | View Map |

| Texas | 76255 | Nocona | Montague | View Map |

| Texas | 76258 | Pilot Point | Denton | View Map |

| Texas | 76259 | Ponder | Denton | View Map |

| Texas | 76261 | Ringgold | Montague | View Map |

| Texas | 76262 | Roanoke | Denton | View Map |

| Texas | 76263 | Rosston | Cooke | View Map |

| Texas | 76264 | Sadler | Grayson | View Map |

| Texas | 76265 | Saint Jo | Montague | View Map |

| Texas | 76266 | Sanger | Denton | View Map |

| Texas | 76267 | Slidell | Wise | View Map |

| Texas | 76268 | Southmayd | Grayson | View Map |

| Texas | 76270 | Sunset | Montague | View Map |

| Texas | 76271 | Tioga | Grayson | View Map |

| Texas | 76272 | Valley View | Cooke | View Map |

| Texas | 76273 | Whitesboro | Grayson | View Map |

| Texas | 76299 | Roanoke | Denton | View Map |

| Texas | 76301 | Wichita Falls | Wichita | View Map |

| Texas | 76302 | Wichita Falls | Wichita | View Map |

| Texas | 76305 | Wichita Falls | Wichita | View Map |

| Texas | 76306 | Wichita Falls | Wichita | View Map |

| Texas | 76307 | Wichita Falls | Wichita | View Map |

| Texas | 76308 | Wichita Falls | Wichita | View Map |

| Texas | 76309 | Wichita Falls | Wichita | View Map |

| Texas | 76310 | Wichita Falls | Wichita | View Map |

| Texas | 76311 | Sheppard Afb | Wichita | View Map |

| Texas | 76351 | Archer City | Archer | View Map |

| Texas | 76352 | Bluegrove | Clay | View Map |

| Texas | 76354 | Burkburnett | Wichita | View Map |

| Texas | 76357 | Byers | Clay | View Map |

| Texas | 76360 | Electra | Wichita | View Map |

| Texas | 76363 | Goree | Knox | View Map |

| Texas | 76364 | Harrold | Wilbarger | View Map |

| Texas | 76365 | Henrietta | Clay | View Map |

| Texas | 76366 | Holliday | Archer | View Map |

| Texas | 76367 | Iowa Park | Wichita | View Map |

| Texas | 76369 | Kamay | Wichita | View Map |

| Texas | 76370 | Megargel | Archer | View Map |

| Texas | 76371 | Munday | Knox | View Map |

| Texas | 76372 | Newcastle | Young | View Map |

| Texas | 76373 | Oklaunion | Wilbarger | View Map |

| Texas | 76374 | Olney | Young | View Map |

| Texas | 76377 | Petrolia | Clay | View Map |

| Texas | 76379 | Scotland | Archer | View Map |

| Texas | 76380 | Seymour | Baylor | View Map |

| Texas | 76384 | Vernon | Wilbarger | View Map |

| Texas | 76385 | Vernon | Wilbarger | View Map |

| Texas | 76388 | Weinert | Haskell | View Map |

| Texas | 76389 | Windthorst | Archer | View Map |

| Texas | 76401 | Stephenville | Erath | View Map |

| Texas | 76402 | Stephenville | Erath | View Map |

| Texas | 76424 | Breckenridge | Stephens | View Map |

| Texas | 76426 | Bridgeport | Wise | View Map |

| Texas | 76427 | Bryson | Jack | View Map |

| Texas | 76429 | Caddo | Stephens | View Map |

| Texas | 76430 | Albany | Shackelford | View Map |

| Texas | 76431 | Chico | Wise | View Map |

| Texas | 76432 | Blanket | Brown | View Map |

| Texas | 76433 | Bluff Dale | Erath | View Map |

| Texas | 76435 | Carbon | Eastland | View Map |

| Texas | 76436 | Carlton | Hamilton | View Map |

| Texas | 76437 | Cisco | Eastland | View Map |

| Texas | 76439 | Dennis | Parker | View Map |

| Texas | 76442 | Comanche | Comanche | View Map |

| Texas | 76443 | Cross Plains | Callahan | View Map |

| Texas | 76444 | De Leon | Comanche | View Map |

| Texas | 76445 | Desdemona | Eastland | View Map |

| Texas | 76446 | Dublin | Erath | View Map |

| Texas | 76448 | Eastland | Eastland | View Map |

| Texas | 76449 | Graford | Palo Pinto | View Map |

| Texas | 76450 | Graham | Young | View Map |

| Texas | 76452 | Energy | Comanche | View Map |

| Texas | 76453 | Gordon | Palo Pinto | View Map |

| Texas | 76454 | Gorman | Eastland | View Map |

| Texas | 76455 | Gustine | Comanche | View Map |

| Texas | 76457 | Hico | Hamilton | View Map |

| Texas | 76458 | Jacksboro | Jack | View Map |

| Texas | 76459 | Jermyn | Jack | View Map |

| Texas | 76460 | Loving | Young | View Map |

| Texas | 76461 | Lingleville | Erath | View Map |

| Texas | 76462 | Lipan | Hood | View Map |

| Texas | 76463 | Mingus | Palo Pinto | View Map |

| Texas | 76464 | Moran | Shackelford | View Map |

| Texas | 76465 | Morgan Mill | Erath | View Map |

| Texas | 76466 | Olden | Eastland | View Map |

| Texas | 76467 | Paluxy | Hood | View Map |

| Texas | 76468 | Proctor | Comanche | View Map |

| Texas | 76469 | Putnam | Callahan | View Map |

| Texas | 76470 | Ranger | Eastland | View Map |

| Texas | 76471 | Rising Star | Eastland | View Map |

| Texas | 76472 | Santo | Palo Pinto | View Map |

| Texas | 76474 | Sidney | Comanche | View Map |

| Texas | 76475 | Strawn | Palo Pinto | View Map |

| Texas | 76476 | Tolar | Hood | View Map |

| Texas | 76481 | South Bend | Young | View Map |

| Texas | 76483 | Throckmorton | Throckmorton | View Map |

| Texas | 76484 | Palo Pinto | Palo Pinto | View Map |

| Texas | 76485 | Peaster | Parker | View Map |

| Texas | 76486 | Perrin | Jack | View Map |

| Texas | 76487 | Poolville | Parker | View Map |

| Texas | 76490 | Whitt | Parker | View Map |

| Texas | 76491 | Woodson | Throckmorton | View Map |

| Texas | 76501 | Temple | Bell | View Map |

| Texas | 76502 | Temple | Bell | View Map |

| Texas | 76503 | Temple | Bell | View Map |

| Texas | 76504 | Temple | Bell | View Map |

| Texas | 76505 | Temple | Bell | View Map |

| Texas | 76508 | Temple | Bell | View Map |

| Texas | 76511 | Bartlett | Bell | View Map |

| Texas | 76513 | Belton | Bell | View Map |

| Texas | 76518 | Buckholts | Milam | View Map |

| Texas | 76519 | Burlington | Milam | View Map |

| Texas | 76520 | Cameron | Milam | View Map |

| Texas | 76522 | Copperas Cove | Coryell | View Map |

| Texas | 76523 | Davilla | Milam | View Map |

| Texas | 76524 | Eddy | Mclennan | View Map |

| Texas | 76525 | Evant | Coryell | View Map |

| Texas | 76526 | Flat | Coryell | View Map |

| Texas | 76527 | Florence | Williamson | View Map |

| Texas | 76528 | Gatesville | Coryell | View Map |

| Texas | 76530 | Granger | Williamson | View Map |

| Texas | 76531 | Hamilton | Hamilton | View Map |

| Texas | 76533 | Heidenheimer | Bell | View Map |

| Texas | 76534 | Holland | Bell | View Map |

| Texas | 76537 | Jarrell | Williamson | View Map |

| Texas | 76538 | Jonesboro | Coryell | View Map |

| Texas | 76539 | Kempner | Lampasas | View Map |

| Texas | 76540 | Killeen | Bell | View Map |

| Texas | 76541 | Killeen | Bell | View Map |

| Texas | 76542 | Killeen | Bell | View Map |

| Texas | 76543 | Killeen | Bell | View Map |

| Texas | 76544 | Killeen | Bell | View Map |

| Texas | 76545 | Killeen | Bell | View Map |

| Texas | 76546 | Killeen | Bell | View Map |

| Texas | 76547 | Killeen | Bell | View Map |

| Texas | 76548 | Harker Heights | Bell | View Map |

| Texas | 76549 | Killeen | Bell | View Map |

| Texas | 76550 | Lampasas | Lampasas | View Map |

| Texas | 76554 | Little River Academy | Bell | View Map |

| Texas | 76556 | Milano | Milam | View Map |

| Texas | 76557 | Moody | Mclennan | View Map |

| Texas | 76558 | Mound | Coryell | View Map |

| Texas | 76559 | Nolanville | Bell | View Map |

| Texas | 76561 | Oglesby | Coryell | View Map |

| Texas | 76564 | Pendleton | Bell | View Map |

| Texas | 76565 | Pottsville | Hamilton | View Map |

| Texas | 76566 | Purmela | Coryell | View Map |

| Texas | 76567 | Rockdale | Milam | View Map |

| Texas | 76569 | Rogers | Bell | View Map |

| Texas | 76570 | Rosebud | Falls | View Map |

| Texas | 76571 | Salado | Bell | View Map |

| Texas | 76573 | Schwertner | Williamson | View Map |

| Texas | 76574 | Taylor | Williamson | View Map |

| Texas | 76577 | Thorndale | Milam | View Map |

| Texas | 76578 | Thrall | Williamson | View Map |

| Texas | 76579 | Troy | Bell | View Map |

| Texas | 76596 | Gatesville | Coryell | View Map |

| Texas | 76597 | Gatesville | Coryell | View Map |

| Texas | 76598 | Gatesville | Coryell | View Map |

| Texas | 76599 | Gatesville | Coryell | View Map |

| Texas | 76621 | Abbott | Hill | View Map |

| Texas | 76622 | Aquilla | Hill | View Map |

| Texas | 76623 | Avalon | Ellis | View Map |

| Texas | 76624 | Axtell | Mclennan | View Map |

| Texas | 76626 | Blooming Grove | Navarro | View Map |

| Texas | 76627 | Blum | Hill | View Map |

| Texas | 76628 | Brandon | Hill | View Map |

| Texas | 76629 | Bremond | Robertson | View Map |

| Texas | 76630 | Bruceville | Mclennan | View Map |

| Texas | 76631 | Bynum | Hill | View Map |

| Texas | 76632 | Chilton | Falls | View Map |

| Texas | 76633 | China Spring | Mclennan | View Map |

| Texas | 76634 | Clifton | Bosque | View Map |

| Texas | 76635 | Coolidge | Limestone | View Map |

| Texas | 76636 | Covington | Hill | View Map |

| Texas | 76637 | Cranfills Gap | Bosque | View Map |

| Texas | 76638 | Crawford | Mclennan | View Map |

| Texas | 76639 | Dawson | Navarro | View Map |

| Texas | 76640 | Elm Mott | Mclennan | View Map |

| Texas | 76641 | Frost | Navarro | View Map |

| Texas | 76642 | Groesbeck | Limestone | View Map |

| Texas | 76643 | Hewitt | Mclennan | View Map |

| Texas | 76644 | Laguna Park | Bosque | View Map |

| Texas | 76645 | Hillsboro | Hill | View Map |

| Texas | 76648 | Hubbard | Hill | View Map |

| Texas | 76649 | Iredell | Bosque | View Map |

| Texas | 76650 | Irene | Hill | View Map |

| Texas | 76651 | Italy | Ellis | View Map |

| Texas | 76652 | Kopperl | Bosque | View Map |

| Texas | 76653 | Kosse | Limestone | View Map |

| Texas | 76654 | Leroy | Mclennan | View Map |

| Texas | 76655 | Lorena | Mclennan | View Map |

| Texas | 76656 | Lott | Falls | View Map |

| Texas | 76657 | Mc Gregor | Mclennan | View Map |

| Texas | 76660 | Malone | Hill | View Map |

| Texas | 76661 | Marlin | Falls | View Map |

| Texas | 76664 | Mart | Mclennan | View Map |

| Texas | 76665 | Meridian | Bosque | View Map |

| Texas | 76666 | Mertens | Hill | View Map |

| Texas | 76667 | Mexia | Limestone | View Map |

| Texas | 76670 | Milford | Ellis | View Map |

| Texas | 76671 | Morgan | Bosque | View Map |

| Texas | 76673 | Mount Calm | Hill | View Map |

| Texas | 76676 | Penelope | Hill | View Map |

| Texas | 76678 | Prairie Hill | Limestone | View Map |

| Texas | 76679 | Purdon | Navarro | View Map |

| Texas | 76680 | Reagan | Falls | View Map |

| Texas | 76681 | Richland | Navarro | View Map |

| Texas | 76682 | Riesel | Mclennan | View Map |

| Texas | 76684 | Ross | Mclennan | View Map |

| Texas | 76685 | Satin | Falls | View Map |

| Texas | 76686 | Tehuacana | Limestone | View Map |

| Texas | 76687 | Thornton | Limestone | View Map |

| Texas | 76689 | Valley Mills | Bosque | View Map |

| Texas | 76690 | Walnut Springs | Bosque | View Map |

| Texas | 76691 | West | Mclennan | View Map |

| Texas | 76692 | Whitney | Hill | View Map |

| Texas | 76693 | Wortham | Freestone | View Map |

| Texas | 76701 | Waco | Mclennan | View Map |

| Texas | 76702 | Waco | Mclennan | View Map |

| Texas | 76703 | Waco | Mclennan | View Map |

| Texas | 76704 | Waco | Mclennan | View Map |

| Texas | 76705 | Waco | Mclennan | View Map |

| Texas | 76706 | Waco | Mclennan | View Map |

| Texas | 76707 | Waco | Mclennan | View Map |

| Texas | 76708 | Waco | Mclennan | View Map |

| Texas | 76710 | Waco | Mclennan | View Map |

| Texas | 76711 | Waco | Mclennan | View Map |

| Texas | 76712 | Woodway | Mclennan | View Map |

| Texas | 76714 | Waco | Mclennan | View Map |

| Texas | 76715 | Waco | Mclennan | View Map |

| Texas | 76716 | Waco | Mclennan | View Map |

| Texas | 76795 | Waco | Mclennan | View Map |

| Texas | 76797 | Waco | Mclennan | View Map |

| Texas | 76798 | Waco | Mclennan | View Map |

| Texas | 76799 | Waco | Mclennan | View Map |

| Texas | 76801 | Brownwood | Brown | View Map |

| Texas | 76802 | Early | Brown | View Map |

| Texas | 76803 | Brownwood | Brown | View Map |

| Texas | 76804 | Brownwood | Brown | View Map |

| Texas | 76820 | Art | Mason | View Map |

| Texas | 76821 | Ballinger | Runnels | View Map |

| Texas | 76823 | Bangs | Brown | View Map |

| Texas | 76824 | Bend | San Saba | View Map |

| Texas | 76825 | Brady | Mcculloch | View Map |

| Texas | 76827 | Brookesmith | Brown | View Map |

| Texas | 76828 | Burkett | Coleman | View Map |

| Texas | 76831 | Castell | Llano | View Map |

| Texas | 76832 | Cherokee | San Saba | View Map |

| Texas | 76834 | Coleman | Coleman | View Map |

| Texas | 76836 | Doole | Mcculloch | View Map |

| Texas | 76837 | Eden | Concho | View Map |

| Texas | 76841 | Fort Mc Kavett | Menard | View Map |

| Texas | 76842 | Fredonia | Mason | View Map |

| Texas | 76844 | Goldthwaite | Mills | View Map |

| Texas | 76845 | Gouldbusk | Coleman | View Map |

| Texas | 76848 | Hext | Menard | View Map |

| Texas | 76849 | Junction | Kimble | View Map |

| Texas | 76852 | Lohn | Mcculloch | View Map |

| Texas | 76853 | Lometa | Lampasas | View Map |

| Texas | 76854 | London | Kimble | View Map |

| Texas | 76855 | Lowake | Concho | View Map |

| Texas | 76856 | Mason | Mason | View Map |

| Texas | 76857 | May | Brown | View Map |

| Texas | 76858 | Melvin | Mcculloch | View Map |

| Texas | 76859 | Menard | Menard | View Map |

| Texas | 76861 | Miles | Runnels | View Map |

| Texas | 76862 | Millersview | Concho | View Map |

| Texas | 76864 | Mullin | Mills | View Map |

| Texas | 76865 | Norton | Runnels | View Map |

| Texas | 76866 | Paint Rock | Concho | View Map |

| Texas | 76869 | Pontotoc | Mason | View Map |

| Texas | 76870 | Priddy | Mills | View Map |

| Texas | 76871 | Richland Springs | San Saba | View Map |

| Texas | 76872 | Rochelle | Mcculloch | View Map |

| Texas | 76873 | Rockwood | Coleman | View Map |

| Texas | 76874 | Roosevelt | Kimble | View Map |

| Texas | 76875 | Rowena | Runnels | View Map |

| Texas | 76877 | San Saba | San Saba | View Map |

| Texas | 76878 | Santa Anna | Coleman | View Map |

| Texas | 76880 | Star | Mills | View Map |

| Texas | 76882 | Talpa | Coleman | View Map |

| Texas | 76883 | Telegraph | Edwards | View Map |

| Texas | 76884 | Valera | Coleman | View Map |

| Texas | 76885 | Valley Spring | Llano | View Map |

| Texas | 76886 | Veribest | Tom Green | View Map |

| Texas | 76887 | Voca | Mcculloch | View Map |

| Texas | 76888 | Voss | Coleman | View Map |

| Texas | 76890 | Zephyr | Brown | View Map |

| Texas | 76901 | San Angelo | Tom Green | View Map |

| Texas | 76902 | San Angelo | Tom Green | View Map |

| Texas | 76903 | San Angelo | Tom Green | View Map |

| Texas | 76904 | San Angelo | Tom Green | View Map |

| Texas | 76905 | San Angelo | Tom Green | View Map |

| Texas | 76906 | San Angelo | Tom Green | View Map |

| Texas | 76908 | Goodfellow Afb | Tom Green | View Map |

| Texas | 76909 | San Angelo | Tom Green | View Map |

| Texas | 76930 | Barnhart | Irion | View Map |

| Texas | 76932 | Big Lake | Reagan | View Map |

| Texas | 76933 | Bronte | Coke | View Map |

| Texas | 76934 | Carlsbad | Tom Green | View Map |

| Texas | 76935 | Christoval | Tom Green | View Map |

| Texas | 76936 | Eldorado | Schleicher | View Map |

| Texas | 76937 | Eola | Concho | View Map |

| Texas | 76939 | Knickerbocker | Tom Green | View Map |

| Texas | 76940 | Mereta | Tom Green | View Map |

| Texas | 76941 | Mertzon | Irion | View Map |

| Texas | 76943 | Ozona | Crockett | View Map |

| Texas | 76945 | Robert Lee | Coke | View Map |

| Texas | 76949 | Silver | Coke | View Map |

| Texas | 76950 | Sonora | Sutton | View Map |

| Texas | 76951 | Sterling City | Sterling | View Map |

| Texas | 76953 | Tennyson | Coke | View Map |

| Texas | 76955 | Vancourt | Tom Green | View Map |

| Texas | 76957 | Wall | Tom Green | View Map |

| Texas | 76958 | Water Valley | Tom Green | View Map |

| Texas | 77001 | Houston | Harris | View Map |

| Texas | 77002 | Houston | Harris | View Map |

| Texas | 77003 | Houston | Harris | View Map |

| Texas | 77004 | Houston | Harris | View Map |

| Texas | 77005 | Houston | Harris | View Map |

| Texas | 77006 | Houston | Harris | View Map |

| Texas | 77007 | Houston | Harris | View Map |

| Texas | 77008 | Houston | Harris | View Map |

| Texas | 77009 | Houston | Harris | View Map |

| Texas | 77010 | Houston | Harris | View Map |

| Texas | 77011 | Houston | Harris | View Map |

| Texas | 77012 | Houston | Harris | View Map |

| Texas | 77013 | Houston | Harris | View Map |

| Texas | 77014 | Houston | Harris | View Map |

| Texas | 77015 | Houston | Harris | View Map |

| Texas | 77016 | Houston | Harris | View Map |

| Texas | 77017 | Houston | Harris | View Map |

| Texas | 77018 | Houston | Harris | View Map |

| Texas | 77019 | Houston | Harris | View Map |

| Texas | 77020 | Houston | Harris | View Map |

| Texas | 77021 | Houston | Harris | View Map |

| Texas | 77022 | Houston | Harris | View Map |

| Texas | 77023 | Houston | Harris | View Map |

| Texas | 77024 | Houston | Harris | View Map |

| Texas | 77025 | Houston | Harris | View Map |

| Texas | 77026 | Houston | Harris | View Map |

| Texas | 77027 | Houston | Harris | View Map |

| Texas | 77028 | Houston | Harris | View Map |

| Texas | 77029 | Houston | Harris | View Map |

| Texas | 77030 | Houston | Harris | View Map |

| Texas | 77031 | Houston | Harris | View Map |

| Texas | 77032 | Houston | Harris | View Map |

| Texas | 77033 | Houston | Harris | View Map |

| Texas | 77034 | Houston | Harris | View Map |

| Texas | 77035 | Houston | Harris | View Map |

| Texas | 77036 | Houston | Harris | View Map |

| Texas | 77037 | Houston | Harris | View Map |

| Texas | 77038 | Houston | Harris | View Map |

| Texas | 77039 | Houston | Harris | View Map |

| Texas | 77040 | Houston | Harris | View Map |

| Texas | 77041 | Houston | Harris | View Map |

| Texas | 77042 | Houston | Harris | View Map |

| Texas | 77043 | Houston | Harris | View Map |

| Texas | 77044 | Houston | Harris | View Map |

| Texas | 77045 | Houston | Harris | View Map |

| Texas | 77046 | Houston | Harris | View Map |

| Texas | 77047 | Houston | Harris | View Map |

| Texas | 77048 | Houston | Harris | View Map |

| Texas | 77049 | Houston | Harris | View Map |

| Texas | 77050 | Houston | Harris | View Map |

| Texas | 77051 | Houston | Harris | View Map |

| Texas | 77052 | Houston | Harris | View Map |

| Texas | 77053 | Houston | Fort Bend | View Map |

| Texas | 77054 | Houston | Harris | View Map |

| Texas | 77055 | Houston | Harris | View Map |

| Texas | 77056 | Houston | Harris | View Map |

| Texas | 77057 | Houston | Harris | View Map |

| Texas | 77058 | Houston | Harris | View Map |

| Texas | 77059 | Houston | Harris | View Map |

| Texas | 77060 | Houston | Harris | View Map |

| Texas | 77061 | Houston | Harris | View Map |

| Texas | 77062 | Houston | Harris | View Map |

| Texas | 77063 | Houston | Harris | View Map |

| Texas | 77064 | Houston | Harris | View Map |

| Texas | 77065 | Houston | Harris | View Map |

| Texas | 77066 | Houston | Harris | View Map |

| Texas | 77067 | Houston | Harris | View Map |

| Texas | 77068 | Houston | Harris | View Map |

| Texas | 77069 | Houston | Harris | View Map |

| Texas | 77070 | Houston | Harris | View Map |

| Texas | 77071 | Houston | Harris | View Map |

| Texas | 77072 | Houston | Harris | View Map |

| Texas | 77073 | Houston | Harris | View Map |

| Texas | 77074 | Houston | Harris | View Map |

| Texas | 77075 | Houston | Harris | View Map |

| Texas | 77076 | Houston | Harris | View Map |

| Texas | 77077 | Houston | Harris | View Map |

| Texas | 77078 | Houston | Harris | View Map |

| Texas | 77079 | Houston | Harris | View Map |

| Texas | 77080 | Houston | Harris | View Map |

| Texas | 77081 | Houston | Harris | View Map |

| Texas | 77082 | Houston | Harris | View Map |

| Texas | 77083 | Houston | Harris | View Map |

| Texas | 77084 | Houston | Harris | View Map |

| Texas | 77085 | Houston | Harris | View Map |

| Texas | 77086 | Houston | Harris | View Map |

| Texas | 77087 | Houston | Harris | View Map |

| Texas | 77088 | Houston | Harris | View Map |

| Texas | 77089 | Houston | Harris | View Map |

| Texas | 77090 | Houston | Harris | View Map |

| Texas | 77091 | Houston | Harris | View Map |

| Texas | 77092 | Houston | Harris | View Map |

| Texas | 77093 | Houston | Harris | View Map |

| Texas | 77094 | Houston | Harris | View Map |

| Texas | 77095 | Houston | Harris | View Map |

| Texas | 77096 | Houston | Harris | View Map |

| Texas | 77097 | Houston | Harris | View Map |

| Texas | 77098 | Houston | Harris | View Map |

| Texas | 77099 | Houston | Harris | View Map |

| Texas | 77201 | Houston | Harris | View Map |

| Texas | 77202 | Houston | Harris | View Map |

| Texas | 77203 | Houston | Harris | View Map |

| Texas | 77204 | Houston | Harris | View Map |

| Texas | 77205 | Houston | Harris | View Map |

| Texas | 77206 | Houston | Harris | View Map |

| Texas | 77207 | Houston | Harris | View Map |

| Texas | 77208 | Houston | Harris | View Map |

| Texas | 77209 | Houston | Harris | View Map |

| Texas | 77210 | Houston | Harris | View Map |

| Texas | 77212 | Houston | Harris | View Map |

| Texas | 77213 | Houston | Harris | View Map |

| Texas | 77215 | Houston | Harris | View Map |

| Texas | 77216 | Houston | Harris | View Map |