Georgia bad credit Mortgage Lenders 12 or 24-Month Bank Statement Loan Program

BANK STATEMENT ONLY Georgia bad credit MORTGAGE LENDERS- The simple but sometimes unfortunate truth of the post-recession Georgia bad credit mortgage market is that Self-employed Georgia bad credit mortgage applicants whose incomes are less documented on their tax returns have a difficult time qualifying with most Georgia bad credit mortgage lenders. Our Georgia bad credit mortgage lenders bank statement only mortgage program is solving a common problem that most self employed GA mortgage applicants have that write off all their income. The new terms of the Qualified Mortgage regulation measures has constrained Georgia bad credit mortgage lenders to err on the side of caution marking it very hard for self employed Georgia bad credit mortgage applicants to qualify for a mortgage.

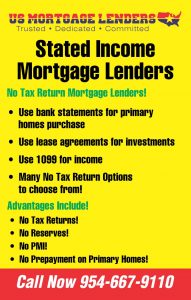

- STATED GA MORTGAGE LENDERS+STATED GA HOME LOANS

- Georgia bad credit SELF EMPLOYED MORTGAGE LENDERS

- Georgia bad credit Self Employed Mortgage Lenders – WE SAY YES!

- STATED INCOME – Georgia bad credit Mortgage Lenders

- Self-Employed Mortgage Approvals – Georgia bad credit SELF EMPLOYED mortgage lenders

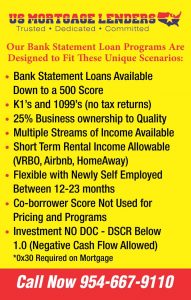

Georgia bad credit Bank Statement Only Mortgage Lenders Summary

- No tax returns required!

- 12 or 24 months bank statements now available (Personal and Business)

- Loans up to $3 million

- Credit scores down to 600

- Rates starting in the low 5’s

- Up to 90% LTV

- DTI up to 50% considered

- Owner-occupied, 2nd homes, and investment properties

- 2 years seasoning for foreclosure, short sale, BK, DIL

- Non-warrantable condos considered

- Jumbo loans down to 660 score

- 5/1 ARM or 30-year fixed

- No pre-payment penalty for owner-occ and 2nd homes

- SFRs, townhomes, condos, 2-4 units

- Seller concessions to 6% (2% for investment)

- 2 year self-employed required

SAME DAY PRE APPROVALS!

Self Employed GA mortgage applicants that write off all of their income can now use our bank statement only mortgage program to qualify their income using the following 2 documents:

Georgia bad credit Bank Statement Only Mortgage Lenders

Most suitable for GA borrowers who have irregular cash flows, want to reap a tax benefit while purchasing a home, or to free up cash for investment opportunities.

– Qualify based on a 24 month average of deposits in personal or business accounts

– 10 year interest only period

– Primary residences, 2nd homes and investment properties allowed

– Bank Statment only loan amounts to $2,000,000

Georgia bad credit BANK STATEMENT ONLY KEY POINTS:

- Business or Personal Statements to 90%LTV!!!

• 100% of Deposits for Personal Statements! or

• 100% of Deposits for Business Statements!

• Don’t look at Withdrawals!

• Don’t look at Overdrafts!

• No P&L!

• No Reserves!

Georgia bad credit BANK STATEMENT ONLY GENERAL LENDING CRITERIA

We have multiple private Bank statement only GA Lenders. Case by case business bank statment conditions subject to change without notice.

90% LTV – after Foreclosure, Short Sale or BK

Our Stated and Bank Statement Only Loan Approvals Up to $3,000,000 Loan Amounts

Georgia bad credit BANK STATEMENT ONLY MORTGAGE LENDERS REQUIREMENTS

- Min 500 FICO!

- 24 Months of Statement deposits

- Owner Occ. w/ 600 Fico, Non Owner & 2nd Homes w/500 Fico

- Self Employed and 1099 borrowers only

- Only 6 NSF’s in most recent 12 months

- P & L

FOR SAME DAY PRE APPROVAL! FREE NO OBLIGATION CONSOLATION

24 Months Georgia bad credit Bank Statement Only Mortgage Lenders Employment Types:

- Self Employed

- 1099

o Must provide business license, Tax Preparer’s NOT Audited letter or corporate paperwork.

US Mortgage Lenders will accept Personal or Business Bank Statements. However, qualifying income will be calculated differently.

Georgia bad credit Personal Bank Statements: 100% of Deposits- Add all deposits for all 24 months and divide that amount by 24 to receive the monthly income amount we will apply as the borrower’s qualifying income.

Ex. 24 months deposits total = $200,000 / 24 = $8,333 a month income.

Georgia bad credit Business Bank Statements: up to 90% of Deposits- Add all deposits for all 24 months, divide by 2, and then divide by 24 to receive the monthly income amount we will give to the borrower.

Ex. 24 month deposit total = $500,000 / 2 = $250,000 / 24 = $10,333 a month income. * Only 50% is used because we have to assume the business has overhead.

Details of Georgia bad credit Bank Statement Only Lenders Program:

Personal & Business Guidelines

- Only deposits can be used Transfers are NOT counted on personal and case-by-case for business*

- Must have 24 consecutive months of statements (no gaps)

- Must provide All pages (even the last pages with advertising)

- Can not commingle (use two different accounts) statements**

- If account was used and closed and new account for remainder of statements must show closing of old account and opening of new account

Georgia bad credit bank Transfers may be accepted for business statements when they come from credit card clearing houses (examples: Paypal, Square, AMEX, etcetera). Case-by-Case and must be considered normal for the Georgia bad credit company.

Georgia bad credit Multiple bank accounts are considered on a case-by-case when (a) one account is closing and reopening new account, or (b) for Business accounts that are two different and autonomous Georgia bad credit businesses.

BANK STATEMENT ONLY Georgia bad credit MORTGAGE LINKS

- Georgia bad credit MORTGAGE LENDERS – FL FHA MORTGAGE LENDERS

- Georgia bad credit Mortgage Lenders Programs -3.5 down with Min 580 Fico!

- 5% BAD CREDIT Georgia bad credit MORTGAGE LENDERS

- Georgia bad credit VA Mortgage Lenders Min 580 FICO! – Florida Mortgage Lender

- 5% Florida FHA Mortgage Lenders Min 580 FICO!!

- Bad Credit Home Loans – FL FHA MORTGAGE LENDERS

- 5% Georgia bad credit FHA Mortgage Lenders Min 580 FICO!!