US Mortgage Lenders is dedicated to provide current Georgia home owners and First Time Home Buyers so they can Buy A Home with less than 3.5% down and/or FHA Mortgage Refinance up to 96.5% of the home’s value. Explore FHA Loan Programs including Bad Credit Mortgage Lenders or No Credit Lenders that allow you with buying a home little or No Money Down. You can also learn about the FHA qualifications and requirements.

GEORGIA FHA MORTGAGE LENDERS APPROVALS WITH MINIMAL DOWN PAYMENT AND CLOSING FEES:

- Down payment only 3.5% of the purchase price.

- Gifts from family or FHA Grants for down payment assistance and closing costs OK!

- Sellers can credit the buyer’s up to 6% of sales price towards buyers costs and pre-paid.

- No reserves or future payments in account required.

- FHA regulated closing costs.

- Read more about buying a home with an FHA mortgage Bad Credit –No Credit – Investment –Second Home –Multi Family –

GET APPROVED NOW!

GEORGIA FHA MORTGAGE LENDERS MAKE QUALIFYING EASIER BECAUSE YOU CAN PURCHASE:

- 12 months after a chapter 13 Bankruptcy FHA mortgage Lender approvals!

- 24 months after a chapter 7 Bankruptcy FHA mortgage Lender approvals!

- 3 years after a Foreclosure FHA mortgage Lender approvals!

- No Credit Score FHA mortgage Lender approvals!

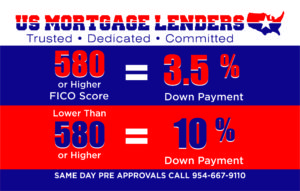

- 580 required for 96.5% financing or 3.5% down payment FHA mortgage Lender approvals.

- 500 required for 90% financing or 10% down payment FHA mortgage Lender approvals.

- Bad Credit with minimum 500 FICO credit score with 10% Down Payment FHA. For FHA mortgage applicants with credit scores between 500 and 579 must make down payments of at least 10% down!

- Read more about FHA Qualifying Qualification Summary – Manual Underwrite – Collections-Judgement’s – Bankruptcy or Foreclosure – Compensating Factors –

GEORGIA FHA MORTGAGE LENDERS ALLOW HIGHER DEBT TO INCOME & EASIER JOB QUALIFYING

- FHA allows higher debt ratio’s than any conventional mortgage loan programs.

- Less than two years on the same job is OK!

- Self-employed buyers can also qualify with FHA Mortgage Lenders.

- Read More about Gifts For Down Payment – Documents Checklist – Debt To Income – Student Loans –

FHA MORTGAGE LOAN ARE EASIER TO QUALIFY FOR- FHA mortgage guidelines tend to be more lenient in areas such as credit, debt to income ratios and cash to close. Because of this FHA mortgage insurance borrowers will find that FHA mortgage rates are better than a conventional mortgage rates. The FHA mortgage provides all these benefits while protecting Georgia FHA Mortgage Lenders from loss.

INCOME RESTRICTIONS- Georgia FHA Mortgage Lenders do not set mandatory minimum or maximum income restrictions. But the private Georgia FHA Mortgage Lendersthat provide these loans in some cases have minimum loan amounts. FHA does set the maximum loan amounts per city county and state. See our FHA loans limits page for the most update FHA loan limits.

DOWN PAYMENT REQUIREMENTS- FHA’s required down payment is 3.5 percent of the sale price when purchasing a single family home, condo or duplex. If you need help with a down payment FHA allows gifts for down payment. If you are purchasing from a family member FHA will allow a gift of equity.FHA is very strict about the source of the gift funds. Under no circumstance may the gift funds come from any one person involved in the sale or purchase of your future home.FHA is very specific about the source of the gift funds so be sure and discuss the details with an FHA mortgage lender.

EMPLOYMENT- Georgia FHA Mortgage Lenderslike to see stable predictable income. FHA qualifying guidelines require applicants have at least (2) two-year history in the same line or type of work or schooling in the same industry.

CREDIT REQUIREMENTS- Georgia FHA Mortgage Lendersrequire a minimum 580 fico as the minimum score with a 3.5 percent down payment requirement. FHA lenders do not always require Collections and Judgments to be paid off. In addition, under the right circumstances Georgia FHA Mortgage Lenderswill approve borrowers down to a 500 credit score.

DEBT TO INCOME RATIOS- Georgia FHA Mortgage Lenders analyze your Debt-to-Income ratios to account all of the monthly debts (only monthly payments on the credit report), and your monthly income and the monthly mortgage payment of your new home in order to determine your debt to income ratios. Georgia FHA Mortgage Lenders suggest a back ratio no higher than 43 percent; But, FHA is more flexible with higher credit scores and FHA compensating factors FHA mortgage applicants can be approved up to 56.9%.

CITIZENSHIP STATUS- In order obtain an FHA mortgage, United States (U .S.) citizenship is not required for eligibility.A borrower who is a non-permanent resident alien may meet the FHA eligibility requirements for an FHA mortgage.

RESERVE REQUIREMENTS– FHA defines reserves as funds or savings you will be left with after your down payment and closing costs. FHA does NOT require reserves. However, if your loan must be manually underwritten the FHA mortgage lender will require at least 1 month’s reserves is equivalent to one month’s mortgage payment (principal, interest, taxes, insurance and FHA mortgage insurance) after closing.While FHA does not require you have reserves when purchasing either a single family home or condominium, if you are purchasing a duplex or multi-family two–three months reserves will typically be required.

HOME CONDITIONS-The home must meet FHA’s minimum standards and be move in ready for the safety, quality and condition. Any defects found by the FHA appraiser which fall outside of FHA’s standards will need to be repaired prior to closing.

GEORGIA FHA MORTGAGE LENDERS LOAN PROGRAMS:

- BUY A HOME WITH GEORGIA FHA MORTGAGE LENDERS-The FHA, or Federal Housing Administration, provides FHA mortgage insurance on loans made by FHA-approved lenders. FHA insures these loans on single family and multi-family homes in every city and county in USA subject to FHA loan limits and qualifications. The FHA is the largest insurer of residential mortgages in the world, insuring tens of millions of homes for borrowers with low down payment, or riskier FHA loan applicants with No Credit or Bad Credit.

- VA GEORGIA MORTGAGE LENDERS-100% VA loan financing with a minimum 550 credit score. Seller paid closing cost up to 4%. Purchase a Florida home using VA certificate of eligibility or/and DD214 waiting only 2 years after a foreclosure or bankruptcy.

- FHA REFINANCE YOUR MORTGAGE WITH GEORGIA FHA MORTGAGE LENDERS! Refinancing with an FHA mortgage gives you the opportunity to lower your monthly FHA mortgage payments, pay less interest or change your mortgage terms or cash out refinance. To FHA refinance basically means that you are taking out a completely new mortgage, with a new term and interest rate to replace your current mortgage.

- 30 YEAR FIXED RATE GEORGIA FHA MORTGAGE LENDERS-The 30-year fixed rate Florida mortgage is one of the most popular and secure options available for Florida home buyers and home owners who want your monthly payments to be low and never change.

- 15 YEAR FIXED RATE GEORGIA FHA MORTGAGE LENDERS–If you’re looking to save thousands in interest expense and you want to own your home quicker versus a 30-year fixed rate mortgage, a 15 year fixed rate mortgage could be good for you. Plus, your payment and interest rate will never change during the term of this mortgage.

- LOW DOWN + NO DOWN PAYMENT FHA MORTGAGE LENDERS- FHA mortgages offer the most flexibility and rate security with it. An FHA mortgage is an easy way to get a new Florida home loan. Down payments can be as low as 3.5%.

- BAD CREDIT GEORGIA FHA MORTGAGE LENDERS-We get borrowers approved every day to purchase a Florida home with a bad credit past. FHA mortgage and VA mortgage approvals are among the easiest loan programs for Florida bad credit mortgage applicants.

- NO CREDIT SCORE GEORGIA FHA MORTGAGE LENDERS-mortgage applicants with no credit score get approved every day to purchase a Florida home with no credit score or lack of credit using alternate trade lines.

- BANK STATEMENT ONLY GEORGIA MORTGAGE LENDERS-Must be self employed a minimum 2 years. Must have verified timely payment history on a few trade lines. Business or Personal bank accounts will work! Transfers from business account OK! All persons listed on bank statements must be used on the loan application. No tax returns needed. 24 months personal bank statements used to qualify. Up to 85% LTV up to 50% DTI and a Minimum 580 credit score.

- JUMBO GEORGIA FHA MORTGAGE LENDERS-Your mortgage amount exceeds the current conforming home loan limit (in most cases $424,100), a Jumbo loan is likely the best choice for you. Jumbo loans can be of the fixed or adjustable variety.

- ADJUSTABLE GEORGIA FHA MORTGAGE LENDERS(ARM)- Savvy borrowers will want to take advantage of the lowest rate available with an adjustable rate mortgage! It’s a great loan option if rates are on the decline or you’re staying in your home for a short time.

- STATED GEORGIA MORTGAGE LENDERS-Stated mortgage applicants must beself employed a minimum 2 years. Must have a few timely trade lines for 12 months on the credit report. Transfers from business account OK! All persons listed on bank statements must be used on the stated loan application. Stated loan appllicants do not need tax returns needed. 24 months personal bank statements used to qualify. Minimum 580 Fico and Up to 85% LTV up to 50% DTI.

- GEORGIA FHA MORTGAGE LENDERS MANUFACTURED AND MODULAR HOMES-We get borrowers approved every day to purchase a Florida home with a bad credit past. FHA mortgage and VA mortgage approvals are among the easiest loan programs for Florida bad credit mortgage applicants

- CONDO GEORGIA FHA MORTGAGE LENDERS–Purchase an FHA condo that meets FHA/hud minimum property standards and get all the same advantages us using the FHA 203b mortgage program to purchase a home.

- VILLA FHA MORTGAGE LENDERS-Purchase a Villa with an FHA mortgage that meets FHA/hud minimum property standards. and get all the same advantages us using the FHA 203b mortgage program to purchase a home.

- TOWNHOUSEFHA MORTGAGE LENDERS-Purchase a Villa with an FHA mortgage that meets FHA/hud minimum property standards. and get all the same advantages us using the FHA 203b mortgage program to purchase a home.

- DUPLEX-TRIPLEX- FOUR-UNIT FHA MORTGAGE LENDERS-Investors can purchase multifamily homes up to 4 units that meet FHA hud minim property standards.

OTHER GEORGIA RELATED PAGES CATEGORY: GEORGIA

Non-Warrantable Georgia Condo Lenders

Non-Warrantable Georgia Condo Lenders We offer Non-Warrantable Georgia Condo Loans in Florida! Non-Warrantable Georgia Condo Guidelines: Min 15% Down! Non-Warrantable Lender Purchase or Refinance a Georgia Non Warrantable condo! Full Documentation Only 600 FICO Minimum Fixed 30 & 15; ARM: 3/1, 5/1, 7/1 80% LTV to $5 million max loan amt Primary Vacation/Second Home w/…

24 Month Georgia Bank Statement Lenders

24 Month Georgia Bank Statement Lenders Self Employed Bank Statement Only Georgia Mortgage Lenders For Purchase | Rate/Term refi | Cash Out refinance! Georgia Mortgage Lenders offers a 24-Month Bank Statement Loan Program. Georgia Bank Statement Only Mortgage Lenders For Self Employed Borrowers Min FICO 600 Loan Amount $100K to $3M Max cash out $1.5M…

GEORGIA FHA HOME LOAN PROVIDERS

3.5% GEORGIA FHA HOME LOAN LENDERS MIN 580 FICO!! Georgia FHA HOME LOAN Lenders- Georgia FHA Home Loans! All Georgia Mortgage Situations Welcome! No APPLICATION FEES AND NO LENDER FEES! SAME DAY APPROVALSFHA loans have been helping Georgia residents since 1934. A Georgia FHA HOME LOAN Lender can offer you a better Mortgage Deal including:…

GEORGIA BANK STATEMENT ONLY + FOR SELF EMPLOYED

GEORGIA BANK STATEMENT ONLY+GA MORTGAGE FOR SELF EMPLOYED STATED INCOME GEORGIA MORTGAGE LENDERS Self Employed Bank Statement Only Georgia Bank statement program: Ideal for the Georgia self-employed mortgage applicants Self-employed borrowers are required a minimum FICO score of 600 is considered other terms associated with bank statement only Georgia Mortgage for self-employed . They include:…

Bad Credit Georgia Mortgage Lenders – Apply Now!

Bad Credit Georgia Mortgage Lenders Getting a Georgia Mortgage with bad credit isn’t as easy as it was a year or two ago. However, it isn’t as impossible as some news reports make it seem. Even Floridians with bad credit reports which reveal past financial sins still sometimes get to the promised land of mortgage approval. Most Home…

GEORGIA BANK STATEMENT ONLY+FOR SELF EMPLOYED

GEORGIA BANK STATEMENT ONLY+GA MORTGAGE FOR SELF EMPLOYED Self Employed Bank Statement Only Georgia Bank statement program: Ideal for the Georgia self-employed mortgage applicants Self-employed borrowers are required a minimum FICO score of 600 is considered other terms associated with bank statement only Georgia Mortgage for self-employed . They include: 15% Down Payment! Min 600…

BECOME A GEORGIA HOMEOWNER WITH AN FHA MORTGAGE!

BECOME A GEORGIA HOMEOWNER WITH AN FHA MORTGAGE! Federal Housing Authority (FHA) loans are great for Georgia first-time home buyers with low down payment and bad credit! Georgia FHA mortgage lenders have relaxed qualifying standards and offer reasonable terms to people with lower credit scores, and even foreclosure or bankruptcy, because they are insured…

Georgia Mortgage Lenders Allows Collections-Judgements-OK!

Georgia Mortgage Lenders Allows Collections-Judgements-OK! COLLECTIONS- FHA Mortgage applicants are not required to pay off all collection accounts. However, outstanding collections will reflect on your credit worthiness overall and may be held against you. In this case, one or more of the collections may need to be paid off in order to improve your credit score…

15% DOWN+NO INCOME VERIFICATION GEORGIA MORTGAGE LENDERS

NO INCOME VERIFICATION GEORGIA MORTGAGE LENDERS No Income Verification highlights include: Primary Home and Investment home = OK! NO Tax Returns + NO W2’s + Pay stubs = OK! Mortgage loans amounts all they way up to $3 Million 1-4 residential Units and Condos 5+ Unit Multifamily and Mixed-Use Properties Retail, Office, , Warehouse, Self-Storage,…

Georgia No Income Verification Mortgage Lenders-Get Approved Now!

Georgia No Income Verification Mortgage Lenders NO INCOME VERIFICATION GEORGIA MORTGAGE LENDERS Whether buying or refinancing, flipping or renting Georgia property, we’ve designed our no income verification home loans to help you maximize your investment opportunities. Georgia No Tax Returns Credit Score Reserves 600 6 Month Max Loan Amount Min Down $2,000,000 15% No income…

Georgia Mortgage Lenders After-Bankruptcy-Foreclosure-Short Sale

Georgia Mortgage Lenders 1 Day After Bankruptcy Or Foreclosure BAD CREDIT GEORGIA MORTGAGE LENDERS Bad Credit Bank Statement Only Bad Credit Jumbo Georgia Mortgage Lenders PORTFOLIO- PRIVATE GEORGIA MORTGAGE LENDER APPROVALS! Purchase 1 day after bankruptcy, foreclosure, short sale and deed in lieu of Georgia foreclosure up to 2.5 million. These are not subprime loans, but they do…

GEORGIA VA MORTGAGE LENDERS

GEORGIA VA MORTGAGE LENDERS Are you in need of a Georgia VA mortgage lender? Then you’ve found the right VA mortgage website. We have helped countless VA mortgage applicants across GA utilize their unique VA Mortgage Benefits to get into the GA home of their dreams! Get pre-qualified today by a Georgia VA mortgage lender…

Georgia Mortgage Lenders 1 Day After Foreclosure-Short Sale-Bankruptcy!!

Georgia Mortgage 1 Day After Foreclosure – Short Sale – Bankruptcy- Foreclosure PORTFOLIO- PRIVATE GEORGIA MORTGAGE LENDER APPROVALS! Purchase 1 day after bankruptcy, foreclosure, short sale and deed in lieu of Georgia foreclosure up to 2.5 million. These are not subprime loans, but they do often have higher interest rates, and higher closing costs. Georgia Portfolio mortgage lender…

STATED ATLANTA GA MORTGAGE LENDERS<>STATED GA HOME LOANS

STATED ATLANTA GA MORTGAGE LENDERS-PRIMARY HOME GEORGIA STATED STATED MORTGAGE LENDERS SUMMARY! No tax returns required Bank statement deposits used to qualify 24 months’ personal bank statements (Personal and Business) Loans up to $2 million Credit scores down to 600’s Rates starting in the low 5’s Up to 85% LTV DTI up to 50% considered…

BAD CREDIT GEORGIA VA MORTGAGE LENDERS

CAN I STILL GET A VA MORTGAGE WITH BAD CREDIT? The VA does not have a minimum credit score requirement. The VA simply requires that Georgia mortgage applicants represent a satisfactory credit risk. But ultimately VA Georgia mortgage lenders issue VA loans with a minimum 580 credit score. It’s up to the VA Georgia mortgage lender to…

Georgia Mortgage 1 Day After Bankruptcy Or Foreclosure

Georgia Mortgage Lenders After Bankruptcy – Foreclosure – Short Sale PORTFOLIO- PRIVATE GEORGIA MORTGAGE LENDER APPROVALS! Purchase 1 day after bankruptcy, foreclosure, short sale and deed in lieu of Georgia foreclosure up to 2.5 million. These are not subprime loans, but they do often have higher interest rates, and higher closing costs. Georgia Portfolio mortgage lender offer private…

GEORGIA BAD CREDIT JUMBO MORTGAGE LENDERS

Our bad credit and jumbo bank statement only Georgia mortgage lenders offer a full range of the best Bad Credit Jumbo Georgia Lenders Mortgage Programs including Super Jumbo Georgia Bad Credit Mortgage programs for high-income Georgia Jumbo mortgage applicants who want to own a home in Georgia. Whether you’re purchasing a home to be a primary residence, a vacation home, or…

GEORIGA NON-WARRANTABLE CONDO LENDERS

GEORIGA NON-WARRANTABLE CONDO LENDERS Program Description: Non-warrantable condo lenders Products and Terms: 5/1 ARM: Fully Amortizing 5/1 ARM: With 7 or 10 year Interest Only period 7/1 ARM: Fully Amortizing 7/1 ARM: With 10 year Interest Only period Eligible Georgia borrowers: Borrowers must have been continuously employed for 2 years, self-employed Georgia borrowers must have been…

GEORGIA CONDOTEL MORTGAGE LENDERS

GEORGIA CONDOTEL MORTGAGE LENDERS Georgia Condotel Program Number Program Description Georgia Condotel Lenders Program Overview Eligible Product Georgia Condotels 5/1 ARM 7/1 ARM 30 year fixed Caps: 2% each year and 5% lifetime (5/2/5 caps are permitted on loans that close prior to February 28, 2017) Margin: 3.99 Index: 1 YR Libor Floor: Initial…

GEORGIA FHA MORTGAGE LENDERS / FHA MORTGAGE REQUIREMENTS/ GEORIGA FHA LOAN LIMITS

GEORGIA FHA MORTGAGE LENDERS / FHA MORTGAGE REQUIREMENTS/ GEORGIA FHA LOAN LIMITS Our goal as Georgia FHA mortgage lenders to provide you with all of the information and tools you need in order to determine if a FHA mortgage will work for your situation. On this page, you can view the 2017 Georgia FHA mortgage loan limits…

Georgia FHA Mortgage Lenders-Same Day Approvals!

Georgia FHA Mortgage Lenders Considering a Mortgage? Consider FHA Mortgage Lenders! What exactly is the Georgia FHA mortgage lender? The FHA or Federal Housing Administration was set up as a result of the Great Depression to support the Georgia housing market. FHA mortgage lenders continues to assist home buyers who do not meet traditional financing…

STATED GEORGIA MORTGAGE LENDERS – PRIMARY HOMES!

STATED GEORGIA MORTGAGE LENDERS Florida Mortgage Lenders seeks to approve investment non-owner occupied loans that will be designated for business purposes only. All borrowers will be required to sign a Business Purpose & Occupancy Statement prior to close to declare that the property is, or will be, for commercial business or investment purpose only. STATED GEORGIA MORTGAGE…

VA Mortgage Lenders in Georgia – VA GA Home Loans

VA Mortgage Lenders in Georgia Georgia Mortgage Lenders is your primary resource for VA Mortgage Lenders in Georgia. You may contact us for your free Georgia VA Mortgage Lenders rates quote by simply filling out the “ Apply Now”link below. . We will obtain your Certificate of Eligibility and one of our qualified Georiga VA…

Georiga FHA Mortgage Lenders Provide The Best Option For Buyers!

One of the best decisions you can make when selecting a FHA mortgage lender in Georgia that specialize in FHA mortgage loans. Why? Well, for starters, FHA mortgage lenders have access to both conventional and FHA mortgages, so they can present you with a full range of GA mortgage loan options. FHA Mortgage Lenders Georgia…

Georgia FHA Mortgage Lenders – FHA Home Loans Georgia

Georgia FHA Mortgage Lenders – FHA Home Loans Georgia Welcome to our Georgia FHA Mortgage Lenders page a Georgia FHA home loan information resource. We proudly serve all new Georgia home buyers and existing Georgia home owners serving every city and county in Georgia. Georgia FHA Home Loans from Georgia FHA Mortgage Lenders FHA MORTGAGE LENDERS…

Stated Income Georgia Mortgage Lenders+Easy Approvals!

No Tax return Georgia Mortgage Lenders for your loan means a QUICK loan approval and fast turnaround time for your funds. Call us and speak with our loan agents today, we can get your loan approved within 72 hours at no upfront cost! Stated Income Georgia Income Georgia Mortgage Lenders is a professional mortgage loan brokerage dedicated to…

FIRST TIME GEORGIA HOME BUYER LOANS

FIRST TIME GEORGIA HOME BUYER LOANS First time Georgia home loan programs are for home buyers seeking a home as primary residence. First time Georgia loan applicants with not much money for a down payment will find that the FHA government insured or VA guaranteed Georgia home loans are easier and less expensive for many first…

NO CREDIT SCORE GEORGIA MORTGAGE LENDERS

Finding a Georgia FHA mortgage lender that offers approvals with no credit score or a short credit history can be frustrating. The Catch-22 for most Georgia FHA mortgage applicants with no credit score is that they usually cannot get a Georgia mortgage no credit history, and you cannot get a credit history without credit score. Many would…

GEORGIA FHA MORTGAGE LENDERS PROGRAMS

GEORGIA FHA MORTGAGE LENDERS PROGRAMS The most important part of squiring an GEORGIA FHA mortgage is to get a pre-approval letter from and GEORGIA FHA mortgage lender. The peace of mind that comes with knowing that your mortgage loan and credit report have been approved will allow you to shop for your new home with…

GEORGIA FHA MORTGAGE LENDERS

GEORGIA FHA MORTGAGE LENDERS– The Federal Housing Administration (FHA) is the largest Georgia mortgage insurer , insuring both single- and multi-family and Georgia manufactured homes. Roughly 30 percent of home loans are made by Georgia FHA mortgage lenders. We do a lot of FHA mortgage loans here in Georgia. Georgia First-time home buyers. Bad 580 and…

MIN580FICO GEORIGA VA MORTGAGE LENDERS

GEORIGA VA MORTGAGE LENDERS The Georgia VA Mortgage Program Offers Eligible Veterans Both Georgia home Purchase and Home Refinance Programs. Georgia VA Mortgage lenders along with our Federal Government has taken to benefit Georgia home buyers, and specifically, those who are Veterans and Active Duty personnel. The Mission of Georgia VA Mortgage Lenders is to…

BANK STATEMENT ONLY GEORGIA MORTGAGE LENDERS

STATED GA MORTGAGE LENDERS+STATED GA HOME LOANS Georgia Mortgage Lenders 24-Month Bank Statement Loan Program. Georgia Bank Statement Only Mortgage Lenders Summary No tax returns required! 12 or 24 months bank statements now available (Personal and Business) Loans up to $3 million Credit scores down to 600 Rates starting in the low 5’s Up to 90%…

Georgia Mortgage Programs

Our Georgia Mortgage team is committed to providing our Georgia clients with the highest quality financial services, combined with the lowest rates available. Our Georgia loan officers will work with you one-on-one to tailor a financial solution that is specifically suited to meet your financing needs. Whether you are purchasing a Georgia dream home, refinancing an…

Georgia FHA Mortgage Lenders Home Loan Options

Georgia FHA Mortgage Lenders FHA Mortgage Lenders offers FHA Mortgage loans in Georgia, and would be happy to be your Georgia lender or choice. Get a quote to get our best Georgia mortgage rate offer for your FHA purchase or refinance. Simply fill out the form above and one of our qualified team members will…

Georgia Bank Statement Only Mortgage Lenders

Georgia Bank Statement Only Mortgage Lenders It’s a simple but sometimes unfortunate truth of the post-recession Georgia mortgage market: Self-employed borrowers whose incomes are less documented have a more difficult time qualifying for a traditional Georgia mortgage. The terms of the Qualified Mortgage rule and other regulatory measures have necessitated that most Georgia mortgage lenders…

STATED GA MORTGAGE LENDERS<>STATED GA HOME LOANS

STATED GA MORTGAGE LENDERS-PRIMARY HOME GEORGIA STATED MORTGAGE LENDERS SUMMARY! No tax returns required Bank statement deposits used to qualify 24 months’ personal bank statements (Personal and Business) Loans up to $2 million Credit scores down to 600’s Rates starting in the low 5’s Up to 85% LTV DTI up to 50% considered Owner-occupied, 2nd…

Georgia Mortgage Lenders Programs

Georgia Mortgage Programs- GA Mortgage Loans When you decide to apply for a Georgia home loan through GA mortgage lenders, you’re dealing with experienced full-time GA mortgage lending professionals who know GA real estate. We offer a huge assortment of GA mortgage loan programs built around Georgia home buyers and homeowners FHA MORTGAGE LENDERS APPROVALS WITH…

GEORGIA MORTGAGE LENDERS

SAME DAY GEORGIA PRE APPROVALS! Our team is committed to providing our Georgia mortgage loan clients with the highest quality financial services, combined with the lowest rates available. Our Georgia loan officers will work with you one-on-one to tailor a financial solution that is specifically suited to meet your financing needs. Whether you are purchasing a…

GEORGIA VA MORTGAGE LENDERS-MIN 580 FICO

Georgia FHA Mortgage Lenders – Same Day VA Loan Approvals! US Mortgage specializes in good and bad credit VA mortgage loans even no credit score Georgia VA loans in every city and county in Georgia VA Mortgage Lenders VA mortgages are guaranteed by the Department of Veterans Affairs (VA). These Georgia VA mortgage loans were established to provide transition assistance…

3.5% DOWN BAD CREDIT GEORGIA MORTGAGE LENDERS

BAD CREDIT GEORGIA MORTGAGE LENDERS Bad Credit Bank Statement Only Bad Credit Jumbo Georgia Mortgage Lenders We specialize in the following Bad Credit Georgia Mortgage Loans: Bad Credit GA Mortgage Lender Programs– Case By Case situational approvals! FHA Bad Credit Georgia Mortgage Lenders– Min 580 middle 3.5% Down min 550 With 10% Down. VA Bad Credit Georgia…

3.5% Georgia FHA Mortgage Lenders Min 580 FICO!!

Georgia FHA Mortgage Lenders- Georgia FHA Home Loans! All Georgia Mortgage Situations Welcome! No APPLICATION FEES AND NO LENDER FEES! SAME DAY APPROVALSFHA loans have been helping Georgia residents since 1934. A Georgia FHA Mortgage Lender can offer you a better Mortgage Deal including: Low er down payments (if any) Lower closing costs Easier credit…