GEORGIA FHA MORTGAGE LENDERS– The Federal Housing Administration (FHA) is the largest Georgia mortgage insurer , insuring both single- and multi-family and Georgia manufactured homes. Roughly 30 percent of home loans are made by Georgia FHA mortgage lenders. We do a lot of FHA mortgage loans here in Georgia.

FHA MORTGAGE HAS MANY BENEFITS FOR GEORGIA HOME BUYERS-

- Georgia First-time home buyers.

- Bad 580 and 620.

- Clients who want to make a low-down payment.

You can qualify more easily for an loan, because Georgia FHA mortgage guarantees the loan for the Georgia lender by issuing mortgage insurance. If you put down 3.5 percent of the purchase price of the home, it is NOT POSSIBLE for you to get the monthly mortgage insurance removed from your loan, unless, of course, you refinance. So please do not be misled!

First-time home buyers may use the Georgia FHA mortgage option to secure their first home, improve their credit score, and build equity in a home. Then the home buyer should consider refinancing in the future with a conventional mortgage with a better credit score and a similar or lower rate without mortgage insurance.

It is interesting to note the Georgia FHA mortgage the only government agency self-funded through the homeowners it insures. It costs the taxpayer nothing! And, the GEORGIA FHA MORTGAGE has been around since 1934.

GEORGIA FHA MORTGAGE TYPES:

GEORGIA FHA MORTGAGE LOAN: 5-YEAR ADJUSTABLE RATE

The Georgia FHA mortgage adjustable rate mortgage is specifically designed for low and moderate-income Georgia families who are trying to make the transition into home ownership. The 5-year ARM starts with a lower interest rate, and that rate will not change until the end of five years. This GA mortgage generally comes with an interest rate that is about 1 percent lower than the interest rate on a 30-year fixed rate Georgia FHA mortgage loan.

GEORGIA FHA MORTGAGE LENDERS: FIXED RATE- An Georgia FHA mortgage loan benefits those who would like to purchase a home but haven’t been able to put money away for the purchase, like recent college graduates, newlyweds, or people who are still trying to complete their education.

GEORGIA FHA MORTGAGE LENDERS FOR : FHA APPROVED CONDOMINIUMS UNIT- FHA Condominium Loans are specifically geared toward those who purchase Georgia condo units in a condominium building. Condominium ownership, in which separate owners of individual units jointly own the development’s common areas and facilities, is for some a very popular alternative to Georgia home ownership. Insurance for this type of housing is provided through FHA Section 234C.

FHA MORTGAGE WELL WORTH THE VALUE FOR GA HOME BUYERS- On a $200,000 home with 3.5 percent down, the FHA mortgage program would charge an upfront insurance premium of 1.75 percent, or $3,377 financed into the loan. In addition, the monthly mortgage insurance would add $201 to the monthly mortgage payment. In contrast, if you qualify for a conventional loan with 5 percent down, the private mortgage insurance would not charge an upfront fee and the monthly premium would be about $175, depending on credit scores.

GEORGIA FHA MORTGAGE LOAN LIMITS VERY FROM COUNTY TO COUNTY- The Georgia FHA mortgage loan limit the amount of money you can borrow for a home in each of Georgia ’s counties. The limits range from a current low of $271.050 to a high of over $600,000 with the average being closer to $280,000. Keep in mind that you can buy a house for less but no more than the limit.

Hint: If you qualify, a conventional mortgage will typically be a better mortgage option than FHA. There are pluses and minuses to an Georgia FHA MORTGAGE loan, so it is important to talk to a loan officer that you can trust. Read further by visiting the Georgia FHA MORTGAGE website,

WILL I QUALIFY FOR AN FHA MORTGAGE? If you are a Georgia first-time home buyer or have a credit score of 620 or above, your best option is to work with an experienced loan officer you can trust to guide you. We don’t automatically encourage a borrower to obtain an GEORGIA FHA MORTGAGEloan. It is almost always better to get a conventional mortgage if you qualify. If you are not sure if you will qualify, we have expert loan officers who have worked with GEORGIA FHA MORTGAGEloans for many years. They are anxious to help you improve your credit and find your first home.

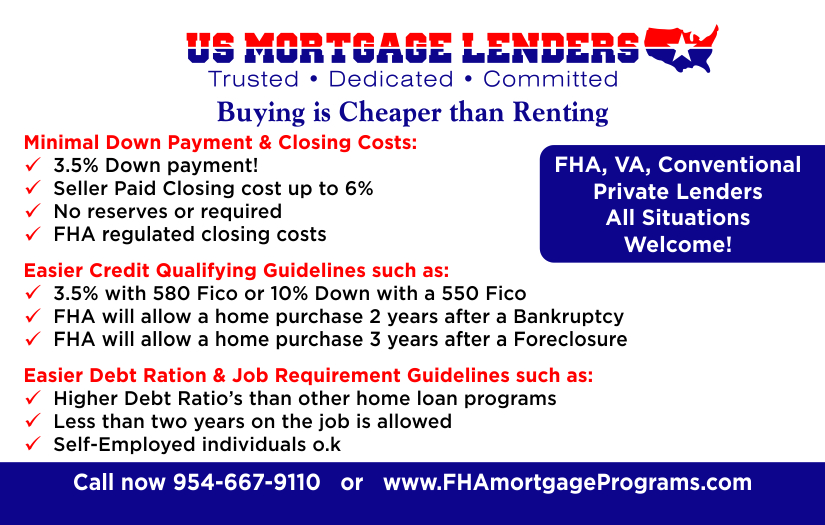

GET APPROVED WITH US MORTGAGE LENDERS- Us Mortgage Lenders is an FHA Approved mortgage lenders. You’ll find our rates are low if you do the comparison. For 15 years we have helped clients become our neighbors. You don’t get to do that unless you offer quality and client-centered service.

GEORGIA FHA MORTGAGE PROGRAMS

- FIRST TIME HOME BUYER GEORGIA FHA MORTGAGE LENDERS – The FHA mortgage is not only for first time home buyers. Anyone purchasing a primary home can use the FHA loan. The FHA mortgage is popular with first time home buyers because of the with a low down payment requirement. In additions, bad credit, no credit mortgage applicants will find the FHA mortgage program is the only option to purchase a home. Read more »

- BAD CREDIT GEORGIA FHA MORTGAGE LENDERS – Bad Credit FHA mortgage loan approvals are approved based on a more common sense approach to mortgage lending meaning bad credit borrowers with past foreclosure or Bankruptcy, tax liens, and collections or judgments can still qualify can qualify to purchase a home. Read more »

- NO CREDIT SCORE GEORGIA FHA MORTGAGE LENDERS – FHA loan applicants with no credit score lack of trade lines can still qualify for an FHA mortgage loan using alternate trade lines to build a credit or payment history.Read more »

- CONDO GEORGIA FHA MORTGAGE LENDERS– Search and purchase an FHA approved condo using the FHA mortgage program. Read more »

- TOWNHOUSE GEORGIA FHA MORTGAGE LENDERS – The FHA mortgage program was created to help increase home ownership. The FHA program makes buying a townhouse home easier and less expensive than any other types of real estate mortgage home loan programs Read more »

- VILLA GEORGIA FHA MORTGAGE LENDERS– This FHA loan program was created to help increase home ownership. The FHA program makes buying a villa easier and less expensive than any other types of real estate mortgage home loan programs Read more »

- MULTIFAMILY GEORGIA FHA MORTGAGE LENDERS– This FHA loan program was created to help increase home ownership. The FHA program makes buying a multifamily duplex, triplex or four unit easier and less expensive than any other types of real estate mortgage home loan programs. Read more »

- JUMBO GEORGIA FHA MORTGAGE LENDERS– The Jumbo FHA mortgage loan can be used in higher cost areas over 417,000 to help borrowers qualify for a Jumbo low down payment FHA mortgage option.Read more »

- GIFTS ALLOWED GEORGIA FHA MORTGAGE LENDERS – When apply with an FHA mortgage lender you must document where your down payment came from. If you are getting a gift from a family member you must document the transfer, the documenation is very precise. Make sure the follow the FHA rules for a gift step by step, otherwise you may not be able to use the gift funds! Read more »

- MODULAR HOME GEORGIA FHA MORTGAGE LENDERS – The FHA Title I modular home loan mortgage may be used for the purchase or refinancing of a manufactured home and land built after 1977, a developed lot on which to place a manufactured home, or a manufactured home and lot in combination. The home must be used as the principal residence and never moved from its original location. In addition you must own or buy the land with home. Read more »

- INVESTMENT PROPERTY GEORGIA FHA MORTGAGE LENDERS– The idea of owning a multi family real estate investment property can be a very good idea for those who prepare the tenants to make the FHA mortgage payments.

- FORECLOSURE OR BANKRUPTCY GEORGIA FHA MORTGAGE LENDERS – People with recent foreclosure or bankruptcy us the FHA mortgage to purchase or refinance a home every day! Read more »

- STREAMLINE REFINANCE GEORGIA FHA MORTGAGE LENDERS– Lowering your monthly mortgage payment is easier than ever with an FHA streamline refinance mortgage you do not even need a new appraisal! Read more »

- DEBT CONSOLIDATION GEORGIA FHA MORTGAGE LENDERS– An FHA Debt Consolidation Mortgage Refinance can lower your total monthly payment obligations. Contact us now to show you how much money you can save! Read more »

- COLLECTION AND JUDGMENTS GEORGIA FHA MORTGAGE LENDERS – The Federal Housing Administration (FHA) offers mortgage applicants to the opportunity to purchase a home even with collections and judgements. Read more »

- MANUAL UNDERWRITING GEORGIA FHA MORTGAGE LENDERS– If our local bank does not approve you for an FHA mortgage its still possible to qualify for an FHA mortgage using compensating factors and manual underwriting to qualify. Read more »

- LOAN LIMITS FOR GEORGIA FHA MORTGAGE LENDERS – FHA mortgage loan limits very by county. You can purchase above the FHA mortgage loan limit but you would have to come up with the difference. Read more »

- DEBT TO INCOME RATIOS FOR GEORGIA FHA MORTGAGE LENDERS– The FHA mortgage program will allow higher debt to income ratios than any other first time home buyer programs. Read more »

- EXCLUSION LIST FOR GEORGIA FHA MORTGAGE LENDERS – If you have a past Foreclosure or Student loan in default you may not quality for an FHA mortgage. Read more »

- SELLER PAID CLOSING GEORGIA FHA MORTGAGE LENDERS– Many FHA mortgage applicants find that the FHA mortgage is one of the most affordable mortgage programs allowing the seller to pay the buyers closing cost. Read more »

- OCCUPANCY RULES FOR GEORGIA FHA MORGAGE LENDERS – FHA mortgage loans are for primary home use only. Read more »

- VA BAD CREDIT GEORGIA FHA MORTGAGE LENDERS– VA loan applicants will find that the VA loan has the most flexible loan requirements available to purchase or refinance a home up to 100% loan to value even if you have your a veteran with a foreclosure or bankruptcy. Contact US mortgage lenders to learn how to put your (COE) certificate of eligibility to good use. Read more »

- USDA GEORGIA BAD CREDIT FHA MORTGAGE LENDERS – US mortgage lenders has access to USDA mortgage lenders approving borrowers all the way down to a 550 middle credit score. If you can prove the ability to pay your bills on time then we may have a USDA mortgage lender for you. Read more »

- JUMBO GEORGIA BAD CREDIT MORTGAGE LENDERS–US Mortgage lenders has access to jumbo mortgage lenders and jumbo portolio lenders approving jumbo loan applicants for loan amounts over 417,000 with credit down all the way down to a 600 middle credit score! Read more »

- HARD MONEY GEORGIA BAD CREDIT MORTGAGE LENDERS– If you have large enough down payment and can prove the ability and willingness to pay your bills on time then we may have a hard money lender for you. US Mortgage lenders has access to private lenders and portfolio hard money lenders approving borrowers for loans that your bank will never consider. Read more »

Popular Georgia mortgage links