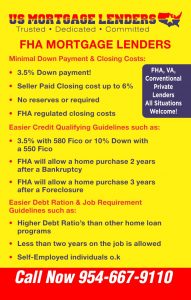

All FHA Mortgage Situations Welcome!

According to Zillow.com he median home value in Florida is $199,800. Florida home values have gone up 10.4% over the past year and all else being equal Zillow predicts they will continue up almost 4% per year. The median home list price per square foot in Florida is $148. The median price of homes currently listed in Florida is $260,000.

Good Credit – Bad Credit – No Credit + No Problem + As Florida FHA Mortgage Lenders we work with everyone towards home ownership! Whether you’re a first time Florida home buyer, moving to a new home, or want to FHA refinance your existing conventional or Florida FHA mortgage, we will show you how to utilize the FHA mortgage!

FLORIDA FHA MORTGAGE PROGRAM INFORMATION

SAME DAY PRE APPROVALS!

FHA Mortgage Buyers Initial Questions

- What is an FHA Mortgage loan? The FHA is a division of the Department of (HUD) Housing and Urban Development. An FHA mortgage loan is a mortgage that is insured by the Federal Housing Administration (FHA) and funded by private Florida FHA approved mortgage lenders.

- Are FHA mortgage for first time home buyers only? NO, FHA mortgage loans are NOT for first–time buyers only. FHA loans can be used by first time buyers and repeat buyers alike. The FHA mortgage is often marketed as a product for “first–time buyers” because of its low down payment and flexible qualifying requirements. FHA mortgage applicants can purchase an FHA approved investment property using and FHA mortgage loan.

- How Does The FHA Mortgage Insurance Work? Anyone who takes out an FHA mortgage finances the insurance into the FHA mortgage loan amount. This “Up Front Mortgage Insurance ” cost is called the “UFMIP”. The upfront mortgage insurance premium paid on all FHA mortgages is paid to the government and use the funding fee money to reimburse Florida FHA Mortgage lenderswho were forced to foreclose on mortgages that were financed to bad credit mortgage applicants. Think of the funding fee as the foreclosure “insurance fund” for the FHA Florida Mortgage Lenders. In addition to the upfront funding fee, the borrower is also required to pay a small monthly fee to the FHA as part of their monthly mortgage payment. The monthly fee is called monthly MIP or mortgage insurance premium.

- Do I have to be a first time mortgage buyer to use the FHA mortgage? No you do not have to be a first time Florida home buyer but the FHA mortgage is only for a Primary home purchase only.

- Can I roll all the closing costs into the FHA mortgage? You are permitted to finance the upfront FHA funding fee only. FHA mortgage closing costs can be paid by the seller up to 6% and must be negotiated up front in your purchase and sale agreement.

- Can I get an FHA Mortgage after a Foreclosure or Bankruptcy? YES! you can qualify for an FHA mortgage 3 years after the title was transferred out of your name.A borrower may also still qualify for an FHA insured loan after declaring Chapter 13 bankruptcy, if at least 1 year of the bankruptcy payout period has passed and the borrower has been making satisfactory payments. In these cases, the FHA mortgage applicant must also request permission from the court to enter into a new FHA mortgage loan. declaring Chapter 7 bankruptcy, if at least 2 years have passed since the bankruptcy discharge date. FHA mortgage applicants must also have re-established good credit or have opted to incur no new debts (this means you specifically chose to take out no new loans, credit cards, etc.)

- What is the minimum down payment for FHA Mortgage? Currently, 3.5% can from family gift or grant.

- Can my parents or other relatives give me money? Yes, provided the money is considered a gift and your relative sign and date the proper gift letter documentation.

- Is there a maximum FHA Mortgage Loan Amount? Yes, see maximum loan limits below based on the Florida county.

Learn All You Can About The FHA Mortgage Program:

FHA Mortgage Loan Approvals For

- Single family Homes

- Town House- check for lot and/or block legal descriptions.

- Villas- check for lot and/or block legal descriptions.

- Modular Homes

- Manufactured homes

- FHA Approved condominium – Search Florida FHA Approved Condos

FHA Mortgage Benefits

The FHA mortgage is so popular is because Florida mortgage applicants use them are able to take advantage of benefits and protections unavailable with any other mortgage loan program. Loans through the FHA are insured by the government, so the Florida mortgage lenders that approve these loans are more lenient. The advantages are outweigh any other mortgage program and include and include the following:

- Lower Cost & Fees- In addition to lower interest rates, FHA borrowers enjoy lower costs on other fees like closing costs, FHA mortgage insurance and govt regulated closing cost.

- Easier to Qualify- While most mortgage loans prohibit applicants with bad credit history and low credit scores, the FHA mortgage loans available with lower requirements so its easier for you to qualify.

- Lowest Interest Rates- You’ve heard the horror stories of subprime borrowers who couldn’t keep up with their mortgage interest rates. Well, FHA loans usually offer lower interest rates to help homeowners afford housing payments.

- Bankruptcy / Foreclosure- Even If you’ve filed for bankruptcy or suffered a foreclosure in the past few years doesn’t mean you’re excluded from qualifying for an FHA loan. As long as you meet other requirements that satisfy the FHA, such as re-establishment of good credit, solid payment history, etc., you can still qualify.

- No Credit Score/ No Trade Lines OK! – The FHA usually requires two lines of credit for qualifying applicants. If you don’t have a sufficient credit history, you can try to qualify through a substitute form.

For many Florida FHA mortgage applicants, using an FHA mortgage can really make the difference between owning your dream house affordability and getting out of the never ending rental trap. The FHA mortgage provides a wealth of benefits for Florida mortgage applicants that qualify, so please make full use of them.

- We provide free credit counseling to and work with everyone to get PRE APPROVED!

What Is The Importance Of Credit When You Apply For An FHA Loan?

I Heard The FHA Loan Is Only For 1st Time Buyers, Is That True?

My Mortgage Company Says I Should Not Consider The FHA Program. Why Should I Listen To You And Not Them?

I Want To Improve My Mortgage Term. Can I Refinance My FHA Loan Now?

How Soon Can I Refinance To A New Home Loan?

How Often Can I Refinance My Home?

How Can I Refinance My Home When I Have Credit Problems?

Where Can I Refinance My Home If I’m Late On My Mortgage?

Am I eligible for FHA mortgage loan if i have no credit score?

Do deferred student loan obligations be included in the FHA mortgage applicants liabilities?

Do FHA mortgage loans allow gifts of equity?

Does FHA require collections to be paid off for a FHA mortgage approval?

How do FHA Mortgage Lenders determine the monthly payment on a student loan?

What are the FHA guidelines for FHA mortgage applicants with a previous foreclosure or deed-in-lieu of foreclosure?

Can a real estate agent gift me their commission for the FHA mortgage down payment?

Are copies of tax returns required for an FHA mortgage for a borrower with self-employment or commission income?

How are disputed credit accounts considered for manually FHA mortgage approvals?

How can FHA help me qualify for a mortgage?

What are the basic requirements for FHA mortgage loan?

What’s the Minimum Credit Score required for FHA mortgage approval?

Florida FHA Mortgage Lenders Limits By County

| COUNTY | LIMITS | PROVIDING FHA LOANS IN EVERY CITY IN FLORIDA |

| ALACHUA | $271,050 | Alachua, Archer, Gainesville, Hawthorne, High Springs, LaCrosse, Micanopy, Newberry, Waldo, Campville |

| BAKER | $316,250 | Macclenny, Glen St. Mary, Baxter, Eddy, Olustee, Sanderson, Taylor |

| BAY | $271,050 | Callaway, Lynn Haven, Mexico Beach, Panama City, Panama City Beach, Parker, Springfield, Cedar Grove, Laguna Beach, Lower Grand Lagoon |

| BRADFORD | $271,050 | Hampton, Lawtey, Starke, Brooker |

| BREVARD | $271,050 | Cape Canaveral, Cocoa, Cocoa Beach, Indian Harbour Beach, Melbourne, Palm Bay, Rockledge, Satellite Beach, Titusville, West Melbourne |

| BROWARD | $345,000 | Coconut City, Cooper City, Coral Springs, Dania Beach, Davie, Deerfield Beach, Fort Lauderdale, Hallandale Beach, Hillsboro Beach, Hollywood |

| CALHOUN | $271,050 | Blountstown, Altha, Abe Springs, Broad Branch, Carr Community, Chipola, Chipola Park, Clarksville, Cox, Eufala |

| CHARLOTTE | $271,050 | Punta Gorda, Babcock Ranch, Boca Grande, Cape Haze, Adrian Town, Charlotte Harbor, Charlotte Park, Cleveland, Deep Creek, Englewood |

| CITRUS | $271,050 | Crystal River, Inverness, Beverly Hills, Black Diamond, Chassahowitzka, Citrus Hills, Citrus Springs, Floral City, Hernando, Holder |

| CLAY | $316,250 | Green Cove Springs, Keystone Heights, Orange Park, Penney Farms, Lake Asbury, Bellair-Meadowbrook Terrace, Belmore, Clay Hill, Doctors Inlet, Fleming Island |

| COLLIER | $448,500 | Everglades City, Marco Island, Naples, Ave Maria, Chokoloskee, East Naples, Golden Gate, Goodland, Immokalee, Island Walk |

| COLUMBIA | $271,050 | Lake City, Fort White, Columbia City, Five Points, Lulu, Mikesville, Newco, Watertown |

| DE SOTO | $271,050 | Arcadia, Southeast Arcadia, Brownville, Fort Ogden, Hull, Lake Suzy, Nocatee, Hidden Acres |

| DIXIE | $271,050 | Cross City, Horseshoe Beach, Old Town, Steinhatchee, Clara, Eugene, Hines, Jena, Jonesboro, Old Town |

| DUVAL | $316,250 | Jacksonville, Jacksonville Beach, Atlantic Beach, Neptune Beach, Baldwin |

| ESCAMBIA | $271,050 | Pensacola, Century, Barrineau Park, Barth, Bellview, Beulah, Bluff Springs, Bogia, Bratt, Brent |

| FLAGLER | $218,500 | Bunnell, Flagler Beach, Palm Coast, Marineland, Beverly Beach, Flagler Estates, Hammock, Painters Hill, Espanola, Bimini |

| FRANKLIN | $271,050 | Apalachicola, Carrabelle, Eastpoint, Alligator Point, Bald Point, Lanark Village, St. Teresa |

| GADSDEN | $271,050 | Chattahoochee, Gretna, Midway, Quincy, Greensboro, Havana |

| GILCHRIST | $271,050 | Bell, Fanning Springs, Trenton |

| GLADES | $271,050 | Brighton Seminole Indian Reservation, Buckhead Ridge, Lakeport, Moore Haven, Muse, Palmdale |

| GULF | $271,050 | Port St. Joe, Wewahitchka, Cape San Blas, Dalkeith, Highland View, Honeyville, Indian Pass, Overstreet, White City |

| HAMILTON | $271,050 | Jasper, White Springs, Jennings, Avoca, Bakers Mill, Blue Springs, Crossroads, Cypress Creek, Hillcoat, Marion |

| HARDEE | $271,050 | Bowling Green, Wauchula, Zolfo Springs, Crewsville, Fort Green, Ona, Popash, Sweetwater, Limestone, Village of Charlie Creek |

| HENDRY | $271,050 | Clewiston, LaBelle, Fort Denaud, Harlem, Port LaBelle, Felda, Pioneer Plantation, Montura Ranch Estates, Flaghole, Ladeca Acres |

| HERNANDO | $271,050 | Spring Hill, Brooksville, Weeki Wachee, Aripeka, Bayport, Brookridge, Garden Grove, Hernando Beach, High Point, Hill ‘n Dale |

| HIGHLANDS | $271,050 | Avon Park, Sebring, Lake Placid, Avon Park Lakes, Brighton, Cornwell, DeSoto City, Fort Basinger, Fort Kissimmee, Hicoria |

| HILLSBOROUGH | $271,050 | Plant City, Tampa, Temple Terrace, Apollo Beach, Balm, Bloomingdale, Boyette, Brandon, Carrollwood, Carrollwood Village |

| HOLMES | $271,050 | Bonifay, Ponce De Leon, Westville, Esto, Noma, Bethlehem, Prosperity, Gritney, Cerrogordo, Pittman |

| INDIAN RIVER | $271,050 | Fellsmere, Sebastian, Vero Beach, Indian River Shores, Orchid, Blue Cypress Village, Cummings, Florida Ridge, Gifford, Nevins |

| JACKSON | $271,050 | Graceville, Jacob City, Marianna, Alford, Bascom, Campbellton, Cottondale, Grand Ridge, Greenwood, Malone |

| JEFFERSON | $271,050 | Monticello, Alma, Ashville, Aucilla, Capps, Casa Blanco, Cody, Dills, Drifton, Fanlew |

| LAFAYETTE | $271,050 | Mayo, Airline, Alton, Cooks Hammock, Day, Hatchbend, Midway |

| LAKE | $274,850 | Clermont, Eustis, Fruitland Park, Groveland, Leesburg, Mascotte, Minneola, Mount Dora, Tavares, Umatilla |

| LEE | $270,750 | Bonita Springs, Cape Coral, Estero, Fort Myers, Fort Myers Beach, Sanibel, Alva, Boca Grande, Bokeelia, Buckingham |

| LEON | $271,050 | Tallahassee, Black Creek, Baum, Bloxham, Bradfordville, Capitola, Centerville, Chaires, Chaires Crossroads, Gardner |

| LEVY | $271,050 | Cedar Key, Chiefland, Fanning Springs, Otter Creek, Williston, Yankeetown, Bronson, Inglis, Andrews, East Bronson |

| LIBERTY | $271,050 | Bristol, Estiffanulga, Hosford, Orange, Rock Bluff, Sumatra, Telogia, White Springs, Wilma, Woods |

| MADISON | $271,050 | Madison, Greenville, Lee, Cherry Lake, Hamburg, Hanson, Hopewell, Lamont, Lee, Lovett |

| MANATEE | $285,200 | Anna Maria, Bradenton, Bradenton Beach, Holmes Beach, Palmetto, Longboat Key, Bayshore Gardens, Cortez, Ellenton, Memphis |

| MARION | $271,050 | Belleview, Dunnellon, Ocala, McIntosh, Reddick, Anthony, Citra, Early Bird, Fort McCoy, Marion Oaks |

| MARTIN | $316,250 | Stuart, Jupiter, Ocean Breeze, Sewall’s Point, Hobe Sound, Hutchinson, Indiantown, Jensen Beach, North River Shores, Palm City |

| MIAMI-DADE | $345,000 | Aventura, Bal Harbour, Bay Harbor Islands, Biscayne Park, Coral Gables, Cutler Bay, Doral, El Portal, Florida City, Golden Beach |

| MONROE | $529,000 | Key West, Marathon, Key Colony Beach, Layton, Islamorada, Stock Island, Big Coppitt Key, Cudjoe Key, Big Pine Key, Duck Key |

| NASSAU | $316,250 | Fernandina Beach, Callahan, Hilliard, Amelia City, American Beach, Andrews, Becker, Boulogne, Bryceville, Chester |

| OKALOOSA | $327,750 | Crestview, Destin, Fort Walton Beach, Laurel Hill, Mary Esther, Niceville, Valparaiso, Cinco Bayou, Shalimar, Baker |

| OKEECHOBEE | $271,050 | Okeechobee, Ancient Oaks, Barber Quarters, Basinger, Basswood Estates, Country Hills Estates, Cypress Quarters, Deans Court, Dixie Ranch Acres, Duberry Gardens |

| ORANGE | $274,850 | Apopka, Bay Lake, Belle Isle, Edgewood, Lake Buena Vista, Maitland, Ocoee, Orlando, Winter Garden, Winter Park |

| OSCEOLA | $274,850 | Kissimmee, St. Cloud, Buenaventura Lakes, Bull Creek, Campbell, Celebration, Deer Park, Harmony, Holopaw, Kenansville |

| PALM BEACH | $345,000 | Atlantis, Belle Glade, Boca Raton, Boynton Beach, Briny Breezes, Cloud Lake, Delray Beach, Glen Ridge, Golf, Greenacres |

| PASCO | $271,050 | Dade City, New Port Richey, Port Richey, San Antonio, Zephyrhills, St. Leo, Aripeka, Bayonet Point, Beacon Square, Connerton |

| PINELLAS | $347,000 | Belleair Beach, Belleair Bluffs, Clearwater, Dunedin, Gulfport, Indian Rocks Beach, Largo, Madeira Beach, Oldsmar, Pinellas Park |

| POLK | $271,050 | Auburndale, Bartow, Davenport, Eagle Lake, Fort Meade, Frostproof, Haines City, Lake Alfred, Lakeland, Lake Wales |

| PUTNAM | $271,050 | Crescent City, Palatka, Interlachen, Pomona Park, Welaka, Bardin, Bostwick, Carraway, East Palatka, Edgar |

| SANTA ROSA | $271,050 | Gulf Breeze, Milton, Jay, Allentown, Avalon, Bagdad, Berrydale, Chumuckla, East Milton, Holley |

| SARASOTA | $285,200 | Sarasota, North Port, Venice, Longboat Key, Bee Ridge, Desoto Lakes, Englewood, Fruitville, Gulf Gate Estates, Kensington Park |

| SEMINOLE | $274,850 | Sanford, Oviedo, Altamonte Springs, Winter Springs, Casselberry, Lake Mary, Longwood, Chuluota, Fern Park, Forest City |

| ST. JOHNS | $316,250 | St. Augustine, St. Augustine Beach, Hastings, Marineland, Butler Beach, Bakersville, Crescent Beach, Elkton, Flagler Estates, Fruit Cove |

| ST. LUCIE | $316,250 | Fort Pierce, Port St. Lucie, St. Lucie Village, Tradition, Fort Pierce North, Fort Pierce South, South Hutchinson Island, Indian River Estates, Lakewood Park, River Park |

| SUMTER | $287,500 | Bushnell, Center Hill, Coleman, Webster, Wildwood, Lake Panasoffkee, Linden, Mabel, Orange Home, Oxford |

| SUWANNEE | $271,050 | Live Oak, Branford, Beachville, Dickert, Dowling Park, Ellaville, Falmouth, Fort Union, Hildreth, Houston |

| TAYLOR | $271,050 | City of Perry, Athena, Bucell Junction, Clara, Dekle Beach, Eridu, Fenholloway, Fish Creek, Foley, Hampton Springs |

| UNION | $271,050 | Lake Butler, Raiford, Worthington Springs |

| VOLUSIA | $271,050 | Daytona Beach, Daytona Beach Shores, DeBary, DeLand, Deltona, Edgewater, Holly Hill, Lake Helen, New Smyrna Beach, Oak Hill |

| WAKULLA | $271,050 | Sopchoppy, St. Marks, Arran, Buckhorn, Crawfordville, Curtis Mills, Hyde Park, Medart, Panacea, Port Leon |

| WALTON | $327,750 | DeFuniak Springs, Freeport, Paxton, Argyle, Bruce, Eucheanna (Euchee Valley), Glendale, Grayton Beach, Miramar Beach, Mossy Head |

| WASHINGTON | $271,050 | Chipley, Vernon, Caryville, Ebro, Wausau, Crow, Five Points, Gilberts Mill, Greenhead, Hinson’s Crossroads |

FLORIDA FHA MORTGAGE LENDERS

- ABE SPRINGS FL FHA MORTGAGE LENDERS

- ADAMSVILLE, HILLSBOROUGH COUNTY FL FHA MORTGAGE LENDERS

- ADAMSVILLE, SUMTER COUNTY FL FHA MORTGAGE LENDERS

- ALACHUA COUNTY FL FHA MORTGAGE LENDERS

- ALACHUA FL FHA MORTGAGE LENDERS

- ALAFAYA FL FHA MORTGAGE LENDERS

- ALAFIA FL FHA MORTGAGE LENDERS

- ALAMANA FL FHA MORTGAGE LENDERS

- ALLANDALE FL FHA MORTGAGE LENDERS

- ALLIGATOR POINT FL FHA MORTGAGE LENDERS

- ALTAMONTE SPRINGS FL FHA MORTGAGE LENDERS

- ALTON FL FHA MORTGAGE LENDERS

- ALTURAS FL FHA MORTGAGE LENDERS

- AMELIA CITY FL FHA MORTGAGE LENDERS

- AMERICAN BEACH FL FHA MORTGAGE LENDERS

- ANGLERS PARK FL FHA MORTGAGE LENDERS

- ANNA MARIA FL FHA MORTGAGE LENDERS

- ANTHONY FL FHA MORTGAGE LENDERS

- ANTIOCH FL FHA MORTGAGE LENDERS

- APALACHICOLA FL FHA MORTGAGE LENDERS

- APOPKA FL FHA MORTGAGE LENDERS

- ARGYLE FL FHA MORTGAGE LENDERS

- ARIPEKA FL FHA MORTGAGE LENDERS

- ARMSTRONG FL FHA MORTGAGE LENDERS

- ATLANTIC BEACH FL FHA MORTGAGE LENDERS

- AUBURNDALE FL FHA MORTGAGE LENDERS

- AUCILLA FL FHA MORTGAGE LENDERS

- AURANTIA FL FHA MORTGAGE LENDERS

- AVENTURA FL FHA MORTGAGE LENDERS

- AVON PARK FL FHA MORTGAGE LENDERS

- AZALEA PARK FL FHA MORTGAGE LENDERS

- BAKER COUNTY FL FHA MORTGAGE LENDERS

- BAKER FL FHA MORTGAGE LENDERS

- BAL HARBOUR FL FHA MORTGAGE LENDERS

- BALD POINT FL FHA MORTGAGE LENDERS

- BANANA FL FHA MORTGAGE LENDERS

- BARBER QUARTERS FL FHA MORTGAGE LENDERS

- BARBERVILLE FL FHA MORTGAGE LENDERS

- BARDIN FL FHA MORTGAGE LENDERS

- BARDMOOR FL FHA MORTGAGE LENDERS

- BAREFOOT BAY FL FHA MORTGAGE LENDERS

- BARRINEAU PARK FL FHA MORTGAGE LENDERS

- BARTOW FL FHA MORTGAGE LENDERS

- BAY COUNTY FL FHA MORTGAGE LENDERS

- BAY CREST PARK FL FHA MORTGAGE LENDERS

- BAY HARBOR ISLANDS FL FHA MORTGAGE LENDERS

- BAY PINES FL FHA MORTGAGE LENDERS

- BAY POINT, MONROE COUNTY FL FHA MORTGAGE LENDERS

- BAYOU GEORGE FL FHA MORTGAGE LENDERS

- BEALSVILLE FL FHA MORTGAGE LENDERS

- BEAR CREEK FL FHA MORTGAGE LENDERS

- BECKER FL FHA MORTGAGE LENDERS

- BELAIR, LEON COUNTY FL FHA MORTGAGE LENDERS

- BELLAIR, CLAY COUNTY FL FHA MORTGAGE LENDERS

- BENSON JUNCTION FL FHA MORTGAGE LENDERS

- BETHLEHEM FL FHA MORTGAGE LENDERS

- BETHUNE BEACH FL FHA MORTGAGE LENDERS

- BIG COPPITT KEY FL FHA MORTGAGE LENDERS

- BIG PINE KEY FL FHA MORTGAGE LENDERS

- BIMINI FL FHA MORTGAGE LENDERS

- BISCAYNE GARDENS FL FHA MORTGAGE LENDERS

- BITHLO FL FHA MORTGAGE LENDERS

- BOARDMAN FL FHA MORTGAGE LENDERS

- BOCA GRANDE FL FHA MORTGAGE LENDERS

- BOCA RATON FL FHA MORTGAGE LENDERS

- BOCA WEST FL FHA MORTGAGE LENDERS

- BODEN FL FHA MORTGAGE LENDERS

- BONITA SPRINGS FL FHA MORTGAGE LENDERS

- BOSTWICK FL FHA MORTGAGE LENDERS

- BOULOGNE FL FHA MORTGAGE LENDERS

- BOYETTE FL FHA MORTGAGE LENDERS

- BOYNTON BEACH FL FHA MORTGAGE LENDERS

- BRADENTON FL FHA MORTGAGE LENDERS

- BRADFORD COUNTY FL FHA MORTGAGE LENDERS

- BRADFORDVILLE FL FHA MORTGAGE LENDERS

- BRADLEY JUNCTION FL FHA MORTGAGE LENDERS

- BREVARD COUNTY FL FHA MORTGAGE LENDERS

- BROAD BRANCH FL FHA MORTGAGE LENDERS

- BROOKSVILLE FL FHA MORTGAGE LENDERS

- BROWARD COUNTY FL FHA MORTGAGE LENDERS

- BROWNSVILLE FL FHA MORTGAGE LENDERS

- BROWNSVILLE, ESCAMBIA COUNTY FL FHA MORTGAGE LENDERS

- BROWNVILLE FL FHA MORTGAGE LENDERS

- BRYANT FL FHA MORTGAGE LENDERS

- BRYCEVILLE FL FHA MORTGAGE LENDERS

- BULL CREEK FL FHA MORTGAGE LENDERS

- CALHOUN COUNTY FL FHA MORTGAGE LENDERS

- CANAVERAL GROVES FL FHA MORTGAGE LENDERS

- CANDLER FL FHA MORTGAGE LENDERS

- CAPE CANAVERAL FL FHA MORTGAGE LENDERS

- CAPE CORAL FL FHA MORTGAGE LENDERS

- CAPE SAN BLAS FL FHA MORTGAGE LENDERS

- CAPITOLA FL FHA MORTGAGE LENDERS

- CAPPS FL FHA MORTGAGE LENDERS

- CARNESTOWN FL FHA MORTGAGE LENDERS

- CARROLLWOOD FL FHA MORTGAGE LENDERS

- CARROLLWOOD VILLAGE FL FHA MORTGAGE LENDERS

- CASSADAGA FL FHA MORTGAGE LENDERS

- CASSELBERRY FL FHA MORTGAGE LENDERS

- CELEBRATION FL FHA MORTGAGE LENDERS

- CENTERVILLE FL FHA MORTGAGE LENDERS

- CHAIRES FL FHA MORTGAGE LENDERS

- CHARLOTTE COUNTY FL FHA MORTGAGE LENDERS

- CHARLOTTE HARBOR FL FHA MORTGAGE LENDERS

- CHASON FL FHA MORTGAGE LENDERS

- CHATHAM FL FHA MORTGAGE LENDERS

- CHIPLEY FL FHA MORTGAGE LENDERS

- CHRISTMAS FL FHA MORTGAGE LENDERS

- CINCO BAYOU FL FHA MORTGAGE LENDERS

- CITRA FL FHA MORTGAGE LENDERS

- CITRUS CENTER FL FHA MORTGAGE LENDERS

- CITRUS COUNTY FL FHA MORTGAGE LENDERS

- CLAIR-MEL CITY FL FHA MORTGAGE LENDERS

- CLARCONA FL FHA MORTGAGE LENDERS

- CLARKSVILLE FL FHA MORTGAGE LENDERS

- CLAY COUNTY FL FHA MORTGAGE LENDERS

- CLAY HILL FL FHA MORTGAGE LENDERS

- CLEARWATER FL FHA MORTGAGE LENDERS

- CLEWISTON FL FHA MORTGAGE LENDERS

- COCOA BEACH FL FHA MORTGAGE LENDERS

- COCOA FL FHA MORTGAGE LENDERS

- COCONUT CREEK FL FHA MORTGAGE LENDERS

- CODY FL FHA MORTGAGE LENDERS

- CODY’S CORNER FL FHA MORTGAGE LENDERS

- COLLIER COUNTY FL FHA MORTGAGE LENDERS

- COLUMBIA COUNTY FL FHA MORTGAGE LENDERS

- CONCH KEY FL FHA MORTGAGE LENDERS

- CONWAY FL FHA MORTGAGE LENDERS

- COOPERTOWN FL FHA MORTGAGE LENDERS

- COPELAND FL FHA MORTGAGE LENDERS

- CORAL GABLES FL FHA MORTGAGE LENDERS

- CORAL SPRINGS FL FHA MORTGAGE LENDERS

- CORAL TERRACE FL FHA MORTGAGE LENDERS

- CORAL WAY VILLAGE FL FHA MORTGAGE LENDERS

- COUNTRY CLUB FL FHA MORTGAGE LENDERS

- COURTENAY FL FHA MORTGAGE LENDERS

- COW CREEK FL FHA MORTGAGE LENDERS

- COX FL FHA MORTGAGE LENDERS

- CRAGGS FL FHA MORTGAGE LENDERS

- CRAWFORD FL FHA MORTGAGE LENDERS

- CRAWFORDVILLE FL FHA MORTGAGE LENDERS

- CREIGHTON FL FHA MORTGAGE LENDERS

- CROOM-A-COOCHEE FL FHA MORTGAGE LENDERS

- CROSS CREEK FL FHA MORTGAGE LENDERS

- CRYSTAL BEACH FL FHA MORTGAGE LENDERS

- CRYSTAL RIVER FL FHA MORTGAGE LENDERS

- CUBITIS FL FHA MORTGAGE LENDERS

- CUDJOE KEY FL FHA MORTGAGE LENDERS

- CURTIS FL FHA MORTGAGE LENDERS

- CYPRESS FL FHA MORTGAGE LENDERS

- DAHLBERG FL FHA MORTGAGE LENDERS

- DAHOMA FL FHA MORTGAGE LENDERS

- DALKEITH FL FHA MORTGAGE LENDERS

- DANIA BEACH FL FHA MORTGAGE LENDERS

- DAVIE FL FHA MORTGAGE LENDERS

- DAY FL FHA MORTGAGE LENDERS

- DAYTONA BEACH FL FHA MORTGAGE LENDERS

- DAYTONA NORTH FL FHA MORTGAGE LENDERS

- DEEM CITY FL FHA MORTGAGE LENDERS

- DEEP CREEK FL FHA MORTGAGE LENDERS

- DEER PARK FL FHA MORTGAGE LENDERS

- DEERFIELD BEACH FL FHA MORTGAGE LENDERS

- DEERING BAY FL FHA MORTGAGE LENDERS

- DEERLAND FL FHA MORTGAGE LENDERS

- DEFUNIAK SPRINGS FL FHA MORTGAGE LENDERS

- DEL RIO FL FHA MORTGAGE LENDERS

- DELAND FL FHA MORTGAGE LENDERS

- DELRAY BEACH FL FHA MORTGAGE LENDERS

- DELTONA FL FHA MORTGAGE LENDERS

- DESOTO COUNTY FL FHA MORTGAGE LENDERS

- DESTIN FL FHA MORTGAGE LENDERS

- DIXIE COUNTY FL FHA MORTGAGE LENDERS

- DOCTORS INLET FL FHA MORTGAGE LENDERS

- DOGTOWN FL FHA MORTGAGE LENDERS

- DOWLING PARK FL FHA MORTGAGE LENDERS

- DR. PHILLIPS FL FHA MORTGAGE LENDERS

- DRIFTON FL FHA MORTGAGE LENDERS

- DUCK KEY FL FHA MORTGAGE LENDERS

- DUNEDIN FL FHA MORTGAGE LENDERS

- DUPONT FL FHA MORTGAGE LENDERS

- DURANT FL FHA MORTGAGE LENDERS

- DUVAL COUNTY FL FHA MORTGAGE LENDERS

- DYAL FL FHA MORTGAGE LENDERS

- EAGLE LAKE FL FHA MORTGAGE LENDERS

- EARLETON FL FHA MORTGAGE LENDERS

- EAST LAKE WEIR FL FHA MORTGAGE LENDERS

- EAST LAKE, HILLSBOROUGH COUNTY FL FHA MORTGAGE LENDERS

- EAST LAKE, PINELLAS COUNTY FL FHA MORTGAGE LENDERS

- EAST NAPLES FL FHA MORTGAGE LENDERS

- EAST TAMPA FL FHA MORTGAGE LENDERS

- EATON PARK FL FHA MORTGAGE LENDERS

- EDGAR FL FHA MORTGAGE LENDERS

- EDGEVILLE FL FHA MORTGAGE LENDERS

- EDGEWATER FL FHA MORTGAGE LENDERS

- EDGEWOOD FL FHA MORTGAGE LENDERS

- EGYPT LAKE FL FHA MORTGAGE LENDERS

- EL CHICO FL FHA MORTGAGE LENDERS

- EL JOBEAN FL FHA MORTGAGE LENDERS

- ELKTON FL FHA MORTGAGE LENDERS

- EMATHLA FL FHA MORTGAGE LENDERS

- EMPORIA FL FHA MORTGAGE LENDERS

- ENTERPRISE FL FHA MORTGAGE LENDERS

- ESCAMBIA COUNTY FL FHA MORTGAGE LENDERS

- ESCAMBIA FARMS FL FHA MORTGAGE LENDERS

- ESPANOLA FL FHA MORTGAGE LENDERS

- ESTIFFANULGA FL FHA MORTGAGE LENDERS

- EUFALA FL FHA MORTGAGE LENDERS

- EUSTIS FL FHA MORTGAGE LENDERS

- EVERGREEN FL FHA MORTGAGE LENDERS

- EVINSTON FL FHA MORTGAGE LENDERS

- FAIRFIELD FL FHA MORTGAGE LENDERS

- FAIRVIEW SHORES FL FHA MORTGAGE LENDERS

- FAIRVILLA FL FHA MORTGAGE LENDERS

- FALMOUTH FL FHA MORTGAGE LENDERS

- FANLEW FL FHA MORTGAGE LENDERS

- FARMTON FL FHA MORTGAGE LENDERS

- FAVORETTA FL FHA MORTGAGE LENDERS

- FEATHER SOUND FL FHA MORTGAGE LENDERS

- FEDERAL POINT FL FHA MORTGAGE LENDERS

- FELDA FL FHA MORTGAGE LENDERS

- FELKEL FL FHA MORTGAGE LENDERS

- FELLOWSHIP FL FHA MORTGAGE LENDERS

- FERN CREST VILLAGE FL FHA MORTGAGE LENDERS

- FERN PARK FL FHA MORTGAGE LENDERS

- FISH CREEK FL FHA MORTGAGE LENDERS

- FISHER CORNER FL FHA MORTGAGE LENDERS

- FIVE POINTS, WASHINGTON COUNTY FL FHA MORTGAGE LENDERS

- FLAGLER COUNTY FL FHA MORTGAGE LENDERS

- FLAGLER ESTATES FL FHA MORTGAGE LENDERS

- FLEMING ISLAND FL FHA MORTGAGE LENDERS

- FLORAHOME FL FHA MORTGAGE LENDERS

- FLORIDA FHA MORTGAGE LENDERS

- FLORIDA FHA MORTGAGE LENDERS FOR ALL FLORIDA

- FLORIDANA BEACH FL FHA MORTGAGE LENDERS

- FORT BRADEN FL FHA MORTGAGE LENDERS

- FORT FLORIDA FL FHA MORTGAGE LENDERS

- FORT LAUDERDALE FL FHA MORTGAGE LENDERS

- FORT MASON FL FHA MORTGAGE LENDERS

- FORT MCCOY FL FHA MORTGAGE LENDERS

- FORT MEADE FL FHA MORTGAGE LENDERS

- FORT MYERS BEACH FL FHA MORTGAGE LENDERS

- FORT MYERS FL FHA MORTGAGE LENDERS

- FORT OGDEN FL FHA MORTGAGE LENDERS

- FORT PIERCE FL FHA MORTGAGE LENDERS

- FORT WALTON BEACH FL FHA MORTGAGE LENDERS

- FORTYMILE BEND FL FHA MORTGAGE LENDERS

- FOUNTAIN FL FHA MORTGAGE LENDERS

- FOWLER’S BLUFF FL FHA MORTGAGE LENDERS

- FRANKLIN COUNTY FL FHA MORTGAGE LENDERS

- FRANKLINTOWN FL FHA MORTGAGE LENDERS

- FRINK FL FHA MORTGAGE LENDERS

- FROG CITY FL FHA MORTGAGE LENDERS

- FRUITLAND PARK FL FHA MORTGAGE LENDERS

- GADSDEN COUNTY FL FHA MORTGAGE LENDERS

- GAINESVILLE FL FHA MORTGAGE LENDERS

- GANDY FL FHA MORTGAGE LENDERS

- GARDEN COVE FL FHA MORTGAGE LENDERS

- GARDEN GROVE FL FHA MORTGAGE LENDERS

- GARDNER FL FHA MORTGAGE LENDERS

- GASKINS FL FHA MORTGAGE LENDERS

- GEORGETOWN FL FHA MORTGAGE LENDERS

- GIBSONIA FL FHA MORTGAGE LENDERS

- GILCHRIST COUNTY FL FHA MORTGAGE LENDERS

- GLADES COUNTY FL FHA MORTGAGE LENDERS

- GLENWOOD HEIGHTS FL FHA MORTGAGE LENDERS

- GRAHAM FL FHA MORTGAGE LENDERS

- GRAND ISLAND FL FHA MORTGAGE LENDERS

- GRANDIN FL FHA MORTGAGE LENDERS

- GRAYTON BEACH FL FHA MORTGAGE LENDERS

- GRAYVIK FL FHA MORTGAGE LENDERS

- GREEN COVE SPRINGS FL FHA MORTGAGE LENDERS

- GREEN-MAR ACRES FL FHA MORTGAGE LENDERS

- GREENACRES FL FHA MORTGAGE LENDERS

- GREENBRIAR FL FHA MORTGAGE LENDERS

- GREENHEAD FL FHA MORTGAGE LENDERS

- GULF BREEZE FL FHA MORTGAGE LENDERS

- GULF COUNTY FL FHA MORTGAGE LENDERS

- GULF HAMMOCK FL FHA MORTGAGE LENDERS

- GULF HARBORS FL FHA MORTGAGE LENDERS

- GULFPORT FL FHA MORTGAGE LENDERS

- HAGUE FL FHA MORTGAGE LENDERS

- HAILE FL FHA MORTGAGE LENDERS

- HAILE PLANTATION FL FHA MORTGAGE LENDERS

- HAINES CITY FL FHA MORTGAGE LENDERS

- HALLANDALE BEACH FL FHA MORTGAGE LENDERS

- HAMILTON COUNTY FL FHA MORTGAGE LENDERS

- HARBOR BLUFFS FL FHA MORTGAGE LENDERS

- HARDEE COUNTY FL FHA MORTGAGE LENDERS

- HARMONY FL FHA MORTGAGE LENDERS

- HASAN FL FHA MORTGAGE LENDERS

- HAWLEY HEIGHTS FL FHA MORTGAGE LENDERS

- HAWTHORNE FL FHA MORTGAGE LENDERS

- HENDERSON MILL FL FHA MORTGAGE LENDERS

- HENDRY COUNTY FL FHA MORTGAGE LENDERS

- HERNANDO COUNTY FL FHA MORTGAGE LENDERS

- HIALEAH FL FHA MORTGAGE LENDERS

- HIALEAH GARDENS FL FHA MORTGAGE LENDERS

- HIBERNIA FL FHA MORTGAGE LENDERS

- HIGHLAND BEACH FL FHA MORTGAGE LENDERS

- HIGHLAND LAKES FL FHA MORTGAGE LENDERS

- HIGHLAND VIEW FL FHA MORTGAGE LENDERS

- HIGHLANDS COUNTY FL FHA MORTGAGE LENDERS

- HIGHPOINT FL FHA MORTGAGE LENDERS

- HILLIARDVILLE FL FHA MORTGAGE LENDERS

- HILLSBOROUGH COUNTY FL FHA MORTGAGE LENDERS

- HINSON FL FHA MORTGAGE LENDERS

- HOLDEN HEIGHTS FL FHA MORTGAGE LENDERS

- HOLDER FL FHA MORTGAGE LENDERS

- HOLLISTER FL FHA MORTGAGE LENDERS

- HOLLY HILL FL FHA MORTGAGE LENDERS

- HOLLYWOOD FL FHA MORTGAGE LENDERS

- HOLMES BEACH FL FHA MORTGAGE LENDERS

- HOLMES COUNTY FL FHA MORTGAGE LENDERS

- HOLMES VALLEY FL FHA MORTGAGE LENDERS

- HOLOPAW FL FHA MORTGAGE LENDERS

- HOLT FL FHA MORTGAGE LENDERS

- HOMELAND FL FHA MORTGAGE LENDERS

- HOMESTEAD FL FHA MORTGAGE LENDERS

- HOPEWELL GARDENS FL FHA MORTGAGE LENDERS

- HOPEWELL, HILLSBOROUGH COUNTY FL FHA MORTGAGE LENDERS

- HOPEWELL, MADISON COUNTY FL FHA MORTGAGE LENDERS

- HORIZON WEST FL FHA MORTGAGE LENDERS

- HOSFORD FL FHA MORTGAGE LENDERS

- HOWARD FL FHA MORTGAGE LENDERS

- HUDSON BEACH FL FHA MORTGAGE LENDERS

- HULL FL FHA MORTGAGE LENDERS

- HUNTER’S CREEK FL FHA MORTGAGE LENDERS

- HUNTINGTON, MARION COUNTY FL FHA MORTGAGE LENDERS

- HUNTINGTON, PUTNAM COUNTY FL FHA MORTGAGE LENDERS

- HYPOLUXO FL FHA MORTGAGE LENDERS

- IAMONIA FL FHA MORTGAGE LENDERS

- INDIALANTIC FL FHA MORTGAGE LENDERS

- INDIAN LAKE ESTATES FL FHA MORTGAGE LENDERS

- INDIAN MOUND VILLAGE FL FHA MORTGAGE LENDERS

- INDIAN RIVER COUNTY FL FHA MORTGAGE LENDERS

- INDIANOLA FL FHA MORTGAGE LENDERS

- INGLE FL FHA MORTGAGE LENDERS

- INNERARITY POINT FL FHA MORTGAGE LENDERS

- INTERCESSION CITY FL FHA MORTGAGE LENDERS

- IOLEE FL FHA MORTGAGE LENDERS

- IRVINE FL FHA MORTGAGE LENDERS

- ISLAND GROVE FL FHA MORTGAGE LENDERS

- ISLANDIA FL FHA MORTGAGE LENDERS

- ISLEWORTH FL FHA MORTGAGE LENDERS

- ITALIA FL FHA MORTGAGE LENDERS

- JACKSON COUNTY FL FHA MORTGAGE LENDERS

- JACKSONVILLE FL FHA MORTGAGE LENDERS

- JEFFERSON COUNTY FL FHA MORTGAGE LENDERS

- JEROME FL FHA MORTGAGE LENDERS

- JEWFISH FL FHA MORTGAGE LENDERS

- JONESVILLE FL FHA MORTGAGE LENDERS

- JOSHUA FL FHA MORTGAGE LENDERS

- JULINGTON CREEK PLANTATION FL FHA MORTGAGE LENDERS

- JUNO BEACH FL FHA MORTGAGE LENDERS

- JUPITER FL FHA MORTGAGE LENDERS

- KALAMAZOO FL FHA MORTGAGE LENDERS

- KENANSVILLE FL FHA MORTGAGE LENDERS

- KENDALL FL FHA MORTGAGE LENDERS

- KENDALL WEST FL FHA MORTGAGE LENDERS

- KENT FL FHA MORTGAGE LENDERS

- KEY BISCAYNE FL FHA MORTGAGE LENDERS

- KEY HAVEN FL FHA MORTGAGE LENDERS

- KEY WEST FL FHA MORTGAGE LENDERS

- KEYSVILLE FL FHA MORTGAGE LENDERS

- KILLARNEY FL FHA MORTGAGE LENDERS

- KINARD FL FHA MORTGAGE LENDERS

- KINGS FERRY FL FHA MORTGAGE LENDERS

- KISSIMMEE FL FHA MORTGAGE LENDERS

- KNIGHTS FL FHA MORTGAGE LENDERS

- KORONA FL FHA MORTGAGE LENDERS

- LABELLE FL FHA MORTGAGE LENDERS

- LADY LAKE FL FHA MORTGAGE LENDERS

- LAFAYETTE COUNTY FL FHA MORTGAGE LENDERS

- LAKE ALFRED FL FHA MORTGAGE LENDERS

- LAKE BUTLER, ORANGE COUNTY FL FHA MORTGAGE LENDERS

- LAKE COMO FL FHA MORTGAGE LENDERS

- LAKE COUNTY FL FHA MORTGAGE LENDERS

- LAKE FERN FL FHA MORTGAGE LENDERS

- LAKE GENEVA FL FHA MORTGAGE LENDERS

- LAKE HART FL FHA MORTGAGE LENDERS

- LAKE MARY FL FHA MORTGAGE LENDERS

- LAKE MARY JANE FL FHA MORTGAGE LENDERS

- LAKE MONROE FL FHA MORTGAGE LENDERS

- LAKE PARK FL FHA MORTGAGE LENDERS

- LAKE SUZY FL FHA MORTGAGE LENDERS

- LAKE TALLAVANA FL FHA MORTGAGE LENDERS

- LAKE WALES FL FHA MORTGAGE LENDERS

- LAKE WORTH FL FHA MORTGAGE LENDERS

- LAKELAND FL FHA MORTGAGE LENDERS

- LAKEPORT FL FHA MORTGAGE LENDERS

- LAKESHORE FL FHA MORTGAGE LENDERS

- LAKEWOOD FL FHA MORTGAGE LENDERS

- LAKEWOOD RANCH FL FHA MORTGAGE LENDERS

- LAMONT FL FHA MORTGAGE LENDERS

- LANARK VILLAGE FL FHA MORTGAGE LENDERS

- LANIER FL FHA MORTGAGE LENDERS

- LANSING FL FHA MORTGAGE LENDERS

- LANTANA FL FHA MORTGAGE LENDERS

- LARGO FL FHA MORTGAGE LENDERS

- LAUDERDALE BY THE SEA FL FHA MORTGAGE LENDERS

- LAUDERHILL FL FHA MORTGAGE LENDERS

- LEE COUNTY FL FHA MORTGAGE LENDERS

- LEESBURG FL FHA MORTGAGE LENDERS

- LEMON BLUFF FL FHA MORTGAGE LENDERS

- LEON COUNTY FL FHA MORTGAGE LENDERS

- LEONARDS FL FHA MORTGAGE LENDERS

- LESSIE FL FHA MORTGAGE LENDERS

- LETO FL FHA MORTGAGE LENDERS

- LEVY COUNTY FL FHA MORTGAGE LENDERS

- LIBERTY COUNTY FL FHA MORTGAGE LENDERS

- LIGHTHOUSE POINT FL FHA MORTGAGE LENDERS

- LILLIBRIDGE FL FHA MORTGAGE LENDERS

- LINDEN FL FHA MORTGAGE LENDERS

- LITHIA FL FHA MORTGAGE LENDERS

- LITTLE LAKE CITY FL FHA MORTGAGE LENDERS

- LLOYD FL FHA MORTGAGE LENDERS

- LOCHLOOSA FL FHA MORTGAGE LENDERS

- LONGBOAT KEY FL FHA MORTGAGE LENDERS

- LONGWOOD FL FHA MORTGAGE LENDERS

- LORIDA FL FHA MORTGAGE LENDERS

- LOTTIEVILLE FL FHA MORTGAGE LENDERS

- LOWELL FL FHA MORTGAGE LENDERS

- LOXAHATCHEE FL FHA MORTGAGE LENDERS

- LUDLAM FL FHA MORTGAGE LENDERS

- LULU FL FHA MORTGAGE LENDERS

- MABEL FL FHA MORTGAGE LENDERS

- MADISON COUNTY FL FHA MORTGAGE LENDERS

- MAITLAND FL FHA MORTGAGE LENDERS

- MANATEE COUNTY FL FHA MORTGAGE LENDERS

- MARCO ISLAND FL FHA MORTGAGE LENDERS

- MARGATE FL FHA MORTGAGE LENDERS

- MARION COUNTY FL FHA MORTGAGE LENDERS

- MARION OAKS FL FHA MORTGAGE LENDERS

- MARTIN COUNTY FL FHA MORTGAGE LENDERS

- MARTIN FL FHA MORTGAGE LENDERS

- MARYSVILLE FL FHA MORTGAGE LENDERS

- MAYTOWN FL FHA MORTGAGE LENDERS

- MCALPIN FL FHA MORTGAGE LENDERS

- MCDAVID FL FHA MORTGAGE LENDERS

- MCNEAL FL FHA MORTGAGE LENDERS

- MCRAE FL FHA MORTGAGE LENDERS

- MEADOWBROOK TERRACE FL FHA MORTGAGE LENDERS

- MEADOWCREST FL FHA MORTGAGE LENDERS

- MEDART FL FHA MORTGAGE LENDERS

- MELBOURNE BEACH FL FHA MORTGAGE LENDERS

- MELBOURNE FL FHA MORTGAGE LENDERS

- MELBOURNE SHORES FL FHA MORTGAGE LENDERS

- MELROSE FL FHA MORTGAGE LENDERS

- MERIDIAN FL FHA MORTGAGE LENDERS

- MIAMI BEACH FL FHA MORTGAGE LENDERS

- MIAMI FL FHA MORTGAGE LENDERS

- MIAMI-DADE COUNTY FL FHA MORTGAGE LENDERS

- MICCOSUKEE FL FHA MORTGAGE LENDERS

- MIDWAY, SANTA ROSA COUNTY FL FHA MORTGAGE LENDERS

- MIKESVILLE FL FHA MORTGAGE LENDERS

- MILES CITY FL FHA MORTGAGE LENDERS

- MILLIGAN FL FHA MORTGAGE LENDERS

- MILLVILLE FL FHA MORTGAGE LENDERS

- MILTON FL FHA MORTGAGE LENDERS

- MINNEOLA FL FHA MORTGAGE LENDERS

- MIRAMAR FL FHA MORTGAGE LENDERS

- MONKEY BOX FL FHA MORTGAGE LENDERS

- MONROE COUNTY FL FHA MORTGAGE LENDERS

- MOUNT DORA FL FHA MORTGAGE LENDERS

- MOUNT PLEASANT FL FHA MORTGAGE LENDERS

- MOUNTAIN LAKE FL FHA MORTGAGE LENDERS

- MUCE FL FHA MORTGAGE LENDERS

- MYAKKA CITY FL FHA MORTGAGE LENDERS

- NALCREST FL FHA MORTGAGE LENDERS

- NAPLES FL FHA MORTGAGE LENDERS

- NARCOOSSEE FL FHA MORTGAGE LENDERS

- NASSAU COUNTY FL FHA MORTGAGE LENDERS

- NASSAUVILLE FL FHA MORTGAGE LENDERS

- NAVARRE BEACH FL FHA MORTGAGE LENDERS

- NAVARRE FL FHA MORTGAGE LENDERS

- NEALS FL FHA MORTGAGE LENDERS

- NEPTUNE BEACH FL FHA MORTGAGE LENDERS

- NEW HOPE FL FHA MORTGAGE LENDERS

- NEW PORT RICHEY FL FHA MORTGAGE LENDERS

- NEW SMYRNA BEACH FL FHA MORTGAGE LENDERS

- NEWPORT, MONROE COUNTY FL FHA MORTGAGE LENDERS

- NEWPORT, WAKULLA COUNTY FL FHA MORTGAGE LENDERS

- NICEVILLE FL FHA MORTGAGE LENDERS

- NICHOLS FL FHA MORTGAGE LENDERS

- NOCATEE, DESOTO COUNTY FL FHA MORTGAGE LENDERS

- NOCATEE, ST. JOHNS COUNTY FL FHA MORTGAGE LENDERS

- NORTH MEADOWBROOK TERRACE FL FHA MORTGAGE LENDERS

- NORTH MIAMI BEACH FL FHA MORTGAGE LENDERS

- NORTH MIAMI FL FHA MORTGAGE LENDERS

- NORTH NAPLES FL FHA MORTGAGE LENDERS

- NORTH PORT FL FHA MORTGAGE LENDERS

- NORTH RUSKIN FL FHA MORTGAGE LENDERS

- NOWATNEY FL FHA MORTGAGE LENDERS

- O’BRIEN FL FHA MORTGAGE LENDERS

- O’NEIL FL FHA MORTGAGE LENDERS

- OAK RIDGE FL FHA MORTGAGE LENDERS

- OAKLAND PARK FL FHA MORTGAGE LENDERS

- OCALA FL FHA MORTGAGE LENDERS

- OCEAN RIDGE FL FHA MORTGAGE LENDERS

- OCHEESEE LANDING FL FHA MORTGAGE LENDERS

- OCHEESEULGA FL FHA MORTGAGE LENDERS

- OCHLOCKONEE FL FHA MORTGAGE LENDERS

- OCHOPEE FL FHA MORTGAGE LENDERS

- OCKLAWAHA FL FHA MORTGAGE LENDERS

- OCOEE FL FHA MORTGAGE LENDERS

- OJUS FL FHA MORTGAGE LENDERS

- OKALOOSA COUNTY FL FHA MORTGAGE LENDERS

- OKEECHOBEE COUNTY FL FHA MORTGAGE LENDERS

- OKEECHOBEE FL FHA MORTGAGE LENDERS

- OKEELANTA FL FHA MORTGAGE LENDERS

- OLD MYAKKA FL FHA MORTGAGE LENDERS

- OLD TOWN FL FHA MORTGAGE LENDERS

- OLDSMAR FL FHA MORTGAGE LENDERS

- OLUSTEE FL FHA MORTGAGE LENDERS

- ONA FL FHA MORTGAGE LENDERS

- ONECO FL FHA MORTGAGE LENDERS

- ORANGE BEND FL FHA MORTGAGE LENDERS

- ORANGE COUNTY FL FHA MORTGAGE LENDERS

- ORANGE LAKE FL FHA MORTGAGE LENDERS

- ORANGE PARK FL FHA MORTGAGE LENDERS

- ORANGE SPRINGS FL FHA MORTGAGE LENDERS

- ORIENT PARK FL FHA MORTGAGE LENDERS

- ORIOLE BEACH FL FHA MORTGAGE LENDERS

- ORLANDO FL FHA MORTGAGE LENDERS

- ORLO VISTA FL FHA MORTGAGE LENDERS

- ORMOND BEACH FL FHA MORTGAGE LENDERS

- ORTONA, GLADES COUNTY FL FHA MORTGAGE LENDERS

- OSCEOLA COUNTY FL FHA MORTGAGE LENDERS

- OSLO FL FHA MORTGAGE LENDERS

- OSTEEN FL FHA MORTGAGE LENDERS

- OVIEDO FL FHA MORTGAGE LENDERS

- OXFORD FL FHA MORTGAGE LENDERS

- OZELLO FL FHA MORTGAGE LENDERS

- OZONA FL FHA MORTGAGE LENDERS

- PAINTERS HILL FL FHA MORTGAGE LENDERS

- PALATKA FL FHA MORTGAGE LENDERS

- PALM BAY FL FHA MORTGAGE LENDERS

- PALM BEACH COUNTY FL FHA MORTGAGE LENDERS

- PALM BEACH FARMS FL FHA MORTGAGE LENDERS

- PALM BEACH FL FHA MORTGAGE LENDERS

- PALM BEACH GARDENS FL FHA MORTGAGE LENDERS

- PALM COAST FL FHA MORTGAGE LENDERS

- PALM HARBOR FL FHA MORTGAGE LENDERS

- PALM RIVER FL FHA MORTGAGE LENDERS

- PALMA SOLA FL FHA MORTGAGE LENDERS

- PALMDALE FL FHA MORTGAGE LENDERS

- PALMETTO FL FHA MORTGAGE LENDERS

- PANACEA FL FHA MORTGAGE LENDERS

- PANAMA CITY BEACH FL FHA MORTGAGE LENDERS

- PANAMA CITY FL FHA MORTGAGE LENDERS

- PARRISH FL FHA MORTGAGE LENDERS

- PASCO COUNTY FL FHA MORTGAGE LENDERS

- PELICAN LAKE FL FHA MORTGAGE LENDERS

- PEMBROKE PINES FL FHA MORTGAGE LENDERS

- PENNICHAW FL FHA MORTGAGE LENDERS

- PENSACOLA BEACH FL FHA MORTGAGE LENDERS

- PENSACOLA FL FHA MORTGAGE LENDERS

- PERDIDO KEY FL FHA MORTGAGE LENDERS

- PETERS FL FHA MORTGAGE LENDERS

- PICNIC FL FHA MORTGAGE LENDERS

- PINE ISLAND, CALHOUN COUNTY FL FHA MORTGAGE LENDERS

- PINECREST FL FHA MORTGAGE LENDERS

- PINECREST, HILLSBOROUGH COUNTY FL FHA MORTGAGE LENDERS

- PINELLAS COUNTY FL FHA MORTGAGE LENDERS

- PINELLAS PARK FL FHA MORTGAGE LENDERS

- PINEOLA FL FHA MORTGAGE LENDERS

- PINETTA FL FHA MORTGAGE LENDERS

- PLANT CITY FL FHA MORTGAGE LENDERS

- PLANTATION FL FHA MORTGAGE LENDERS

- POLK COUNTY FL FHA MORTGAGE LENDERS

- POMPANO BEACH FL FHA MORTGAGE LENDERS

- PONCE INLET FL FHA MORTGAGE LENDERS

- PORT ORANGE FL FHA MORTGAGE LENDERS

- PORT ST. LUCIE FL FHA MORTGAGE LENDERS

- PUNTA GORDA FL FHA MORTGAGE LENDERS

- PUTNAM COUNTY FL FHA MORTGAGE LENDERS

- RAINBOW LAKES ESTATES FL FHA MORTGAGE LENDERS

- RED HEAD FL FHA MORTGAGE LENDERS

- REDLAND FL FHA MORTGAGE LENDERS

- RESTON FL FHA MORTGAGE LENDERS

- RIDGECREST FL FHA MORTGAGE LENDERS

- RIO PINAR FL FHA MORTGAGE LENDERS

- ROCHELLE FL FHA MORTGAGE LENDERS

- ROCK HARBOR FL FHA MORTGAGE LENDERS

- ROCKLEDGE FL FHA MORTGAGE LENDERS

- ROCKY CREEK FL FHA MORTGAGE LENDERS

- ROLLINS CORNER FL FHA MORTGAGE LENDERS

- ROSEMARY BEACH FL FHA MORTGAGE LENDERS

- ROTONDA WEST FL FHA MORTGAGE LENDERS

- ROUND LAKE FL FHA MORTGAGE LENDERS

- ROYAL PALM BEACH FL FHA MORTGAGE LENDERS

- RUNYON FL FHA MORTGAGE LENDERS

- RUTLAND FL FHA MORTGAGE LENDERS

- SAFETY HARBOR FL FHA MORTGAGE LENDERS

- SALEM FL FHA MORTGAGE LENDERS

- SALT SPRINGS FL FHA MORTGAGE LENDERS

- SAMPSON CITY FL FHA MORTGAGE LENDERS

- SAN CASTLE FL FHA MORTGAGE LENDERS

- SAN MATEO FL FHA MORTGAGE LENDERS

- SANDERSON FL FHA MORTGAGE LENDERS

- SANFORD FL FHA MORTGAGE LENDERS

- SANIBEL FL FHA MORTGAGE LENDERS

- SANLANDO SPRINGS FL FHA MORTGAGE LENDERS

- SANTA MONICA FL FHA MORTGAGE LENDERS

- SANTA ROSA BEACH FL FHA MORTGAGE LENDERS

- SANTA ROSA COUNTY FL FHA MORTGAGE LENDERS

- SARASOTA COUNTY FL FHA MORTGAGE LENDERS

- SARASOTA FL FHA MORTGAGE LENDERS

- SATELLITE BEACH FL FHA MORTGAGE LENDERS

- SATSUMA FL FHA MORTGAGE LENDERS

- SCOTLAND FL FHA MORTGAGE LENDERS

- SCOTTOWN FL FHA MORTGAGE LENDERS

- SCOTTS FERRY FL FHA MORTGAGE LENDERS

- SCOTTSMOOR FL FHA MORTGAGE LENDERS

- SEACREST FL FHA MORTGAGE LENDERS

- SEASIDE FL FHA MORTGAGE LENDERS

- SEASIDE FL FHA MORTGAGE LENDERS

- SEBASTIAN FL FHA MORTGAGE LENDERS

- SELMAN FL FHA MORTGAGE LENDERS

- SEMINOLE COUNTY FL FHA MORTGAGE LENDERS

- SENYAH FL FHA MORTGAGE LENDERS

- SEWALL’S POINT FL FHA MORTGAGE LENDERS

- SHADEVILLE FL FHA MORTGAGE LENDERS

- SHADY GROVE, JACKSON COUNTY FL FHA MORTGAGE LENDERS

- SHADY GROVE, TAYLOR COUNTY FL FHA MORTGAGE LENDERS

- SHALIMAR FL FHA MORTGAGE LENDERS

- SHELL POINT FL FHA MORTGAGE LENDERS

- SILVER PALM FL FHA MORTGAGE LENDERS

- SILVER SPRINGS FL FHA MORTGAGE LENDERS

- SLAVIA FL FHA MORTGAGE LENDERS

- SOUTHFORT FL FHA MORTGAGE LENDERS

- SOUTHPORT FL FHA MORTGAGE LENDERS

- SPARR FL FHA MORTGAGE LENDERS

- SPRING LAKE, HIGHLANDS COUNTY FL FHA MORTGAGE LENDERS

- SPUDS FL FHA MORTGAGE LENDERS

- ST. AUGUSTINE BEACH FL FHA MORTGAGE LENDERS

- ST. AUGUSTINE FL FHA MORTGAGE LENDERS

- ST. CATHERINE FL FHA MORTGAGE LENDERS

- ST. CLOUD FL FHA MORTGAGE LENDERS

- ST. HEBRON FL FHA MORTGAGE LENDERS

- ST. JOHN FL FHA MORTGAGE LENDERS

- ST. JOHNS COUNTY FL FHA MORTGAGE LENDERS

- ST. JOHNS FL FHA MORTGAGE LENDERS

- ST. JOSEPH, PASCO COUNTY FL FHA MORTGAGE LENDERS

- ST. LUCIE COUNTY FL FHA MORTGAGE LENDERS

- ST. PETE BEACH FL FHA MORTGAGE LENDERS

- ST. PETERSBURG FL FHA MORTGAGE LENDERS

- ST. TERESA FL FHA MORTGAGE LENDERS

- STOCK ISLAND FL FHA MORTGAGE LENDERS

- STUART FL FHA MORTGAGE LENDERS

- SUGARLOAF SHORES FL FHA MORTGAGE LENDERS

- SUMATRA FL FHA MORTGAGE LENDERS

- SUMMERFIELD FL FHA MORTGAGE LENDERS

- SUMMERLAND KEY FL FHA MORTGAGE LENDERS

- SUMNER FL FHA MORTGAGE LENDERS

- SUMTER COUNTY FL FHA MORTGAGE LENDERS

- SUMTERVILLE FL FHA MORTGAGE LENDERS

- SUN ‘N LAKE OF SEBRING FL FHA MORTGAGE LENDERS

- SUN CITY FL FHA MORTGAGE LENDERS

- SUNNY HILLS FL FHA MORTGAGE LENDERS

- SUNNYSIDE FL FHA MORTGAGE LENDERS

- SUNSET POINT FL FHA MORTGAGE LENDERS

- SUNTREE FL FHA MORTGAGE LENDERS

- SURFSIDE FL FHA MORTGAGE LENDERS

- SUWANNEE COUNTY FL FHA MORTGAGE LENDERS

- SUWANNEE FL FHA MORTGAGE LENDERS

- SVEA FL FHA MORTGAGE LENDERS

- SWEET GUM HEAD FL FHA MORTGAGE LENDERS

- SWEETWATER CREEK FL FHA MORTGAGE LENDERS

- SWEETWATER, HARDEE COUNTY FL FHA MORTGAGE LENDERS

- SWITZERLAND FL FHA MORTGAGE LENDERS

- SYDNEY FL FHA MORTGAGE LENDERS

- TAFT FL FHA MORTGAGE LENDERS

- TAINTSVILLE FL FHA MORTGAGE LENDERS

- TALLAHASSEE FL FHA MORTGAGE LENDERS

- TALLEVAST FL FHA MORTGAGE LENDERS

- TAMARAC FL FHA MORTGAGE LENDERS

- TAMPA FL FHA MORTGAGE LENDERS

- TANGELO PARK FL FHA MORTGAGE LENDERS

- TARPON SPRINGS FL FHA MORTGAGE LENDERS

- TARRYTOWN FL FHA MORTGAGE LENDERS

- TAVARES FL FHA MORTGAGE LENDERS

- TAVERNIER FL FHA MORTGAGE LENDERS

- TAYLOR COUNTY FL FHA MORTGAGE LENDERS

- TELOGIA FL FHA MORTGAGE LENDERS

- TEMPLE TERRACE FL FHA MORTGAGE LENDERS

- TERRA CEIA FL FHA MORTGAGE LENDERS

- THE ACREAGE FL FHA MORTGAGE LENDERS

- THOMPSON FL FHA MORTGAGE LENDERS

- TITUSVILLE FL FHA MORTGAGE LENDERS

- TRAIL CENTER FL FHA MORTGAGE LENDERS

- TREASURE ISLAND FL FHA MORTGAGE LENDERS

- TRILACOOCHEE FL FHA MORTGAGE LENDERS

- TRILBY FL FHA MORTGAGE LENDERS

- TURKEY CREEK FL FHA MORTGAGE LENDERS

- TWO EGG FL FHA MORTGAGE LENDERS

- TYLER FL FHA MORTGAGE LENDERS

- UNION COUNTY FL FHA MORTGAGE LENDERS

- UNIVERSITY, ORANGE COUNTY FL FHA MORTGAGE LENDERS

- UPTHEGROVE BEACH FL FHA MORTGAGE LENDERS

- VALDEZ FL FHA MORTGAGE LENDERS

- VALPARAISO FL FHA MORTGAGE LENDERS

- VANDERBILT BEACH ESTATES FL FHA MORTGAGE LENDERS

- VANDERBILT BEACH FL FHA MORTGAGE LENDERS

- VENICE FL FHA MORTGAGE LENDERS

- VENUS FL FHA MORTGAGE LENDERS

- VERDIE FL FHA MORTGAGE LENDERS

- VERMONT HEIGHTS FL FHA MORTGAGE LENDERS

- VERO BEACH FL FHA MORTGAGE LENDERS

- VERO LAKE ESTATES FL FHA MORTGAGE LENDERS

- VIERA FL FHA MORTGAGE LENDERS

- VIKING FL FHA MORTGAGE LENDERS

- VINELAND FL FHA MORTGAGE LENDERS

- VIRGINIA VILLAGE FL FHA MORTGAGE LENDERS

- VOLUSIA COUNTY FL FHA MORTGAGE LENDERS

- VOLUSIA FL FHA MORTGAGE LENDERS

- WACISSA FL FHA MORTGAGE LENDERS

- WADESBORO FL FHA MORTGAGE LENDERS

- WAKULLA BEACH FL FHA MORTGAGE LENDERS

- WAKULLA COUNTY FL FHA MORTGAGE LENDERS

- WALNUT HILL FL FHA MORTGAGE LENDERS

- WALTON COUNTY FL FHA MORTGAGE LENDERS

- WANNEE FL FHA MORTGAGE LENDERS

- WASHINGTON COUNTY FL FHA MORTGAGE LENDERS

- WATERCOLOR FL FHA MORTGAGE LENDERS

- WATERS LAKE FL FHA MORTGAGE LENDERS

- WATERSOUND FL FHA MORTGAGE LENDERS

- WAUKEENAH FL FHA MORTGAGE LENDERS

- WEIRSDALE FL FHA MORTGAGE LENDERS

- WELCOME FL FHA MORTGAGE LENDERS

- WELLBORN FL FHA MORTGAGE LENDERS

- WELLINGTON FL FHA MORTGAGE LENDERS

- WEST KENDALL FL FHA MORTGAGE LENDERS

- WEST MELBOURNE FL FHA MORTGAGE LENDERS

- WEST PALM BEACH FL FHA MORTGAGE LENDERS

- WESTCHESTER FL FHA MORTGAGE LENDERS

- WESTON FL FHA MORTGAGE LENDERS

- WHISPERING PINES FL FHA MORTGAGE LENDERS

- WHITE CITY, GULF COUNTY FL FHA MORTGAGE LENDERS

- WILBUR-BY-THE-SEA FL FHA MORTGAGE LENDERS

- WILCOX FL FHA MORTGAGE LENDERS

- WILCOX JUNCTION FL FHA MORTGAGE LENDERS

- WILLIFORD FL FHA MORTGAGE LENDERS

- WILLIS FL FHA MORTGAGE LENDERS

- WILTON MANORS FL FHA MORTGAGE LENDERS

- WINDSOR, ALACHUA COUNTY FL FHA MORTGAGE LENDERS

- WINSTON FL FHA MORTGAGE LENDERS

- WINTER GARDEN FL FHA MORTGAGE LENDERS

- WINTER HAVEN FL FHA MORTGAGE LENDERS

- WINTER PARK FL FHA MORTGAGE LENDERS

- WINTER SPRINGS FL FHA MORTGAGE LENDERS

- YELVINGTON FL FHA MORTGAGE LENDERS

- YOUNGSTOWN FL FHA MORTGAGE LENDERS

- ZELLWOOD FL FHA MORTGAGE LENDERS

- ZUBER FL FHA MORTGAGE LENDERS