Georgia Mortgage Lenders After Bankruptcy – Foreclosure – Short Sale

PORTFOLIO- PRIVATE GEORGIA MORTGAGE LENDER APPROVALS!

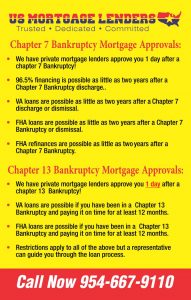

- Purchase 1 day after bankruptcy, foreclosure, short sale and deed in lieu of Georgia foreclosure up to 2.5 million. These are not subprime loans, but they do often have higher interest rates, and higher closing costs.

- Georgia Portfolio mortgage lender offer private Georgia mortgage loan approvals are looking at other compensating factors to approve these loans. Examples include 12 months timely rental history, high credit scores, lower loan to value (larger down payments), and reserves (future Georgia mortgage payments in the account at closing).

A minimum 500 credit score For Georgia Portfolio Mortgage Lenders Programs!!

- Down payment only 3.5% of the purchase price.

- Gifts from family or BANKRUPTCY OR FORECLOSURE Grants for down payment assistance and closing costs OK!

- Sellers can credit the buyer’s up to 6% of sales price towards buyers costs and pre-paid.

- No reserves or future payments in account required.

- BANKRUPTCY OR FORECLOSURE regulated closing costs.

- Read more about buying a home with a BANKRUPTCY OR FORECLOSURE mortgage Bad Credit –No Credit – Investment –Second Home –Multi Family –

- 12 months after a chapter 13 Bankruptcy BANKRUPTCY OR FORECLOSURE mortgage Lender approvals!

- 24 months after a chapter 7 Bankruptcy BANKRUPTCY OR FORECLOSURE mortgage Lender approvals!

- 3 years after a Foreclosure BANKRUPTCY OR FORECLOSURE mortgage Lender approvals!

- No Credit Score BANKRUPTCY OR FORECLOSURE mortgage Lender approvals!

- 580 required for 96.5% financing or 3.5% down payment BANKRUPTCY OR FORECLOSURE mortgage Lender approvals.

- 500 required for 90% financing or 10% down payment BANKRUPTCY OR FORECLOSURE mortgage Lender approvals.

- Bad Credit with minimum 500 FICO credit score with 10% Down Payment BANKRUPTCY OR FORECLOSURE. For BANKRUPTCY OR FORECLOSURE mortgage applicants with credit scores between 500 and 579 must make down payments of at least 10% down!

- Read more about BANKRUPTCY OR FORECLOSURE Qualifying Qualification Summary – Manual Underwrite – Collections-Judgement’s – Bankruptcy or Foreclosure – Compensating Factors –

- BANKRUPTCY OR FORECLOSURE allows higher debt ratio’s than any conventional mortgage loan programs.

- Less than two years on the same job is OK!

- Self-employed buyers can also qualify with BANKRUPTCY OR FORECLOSURE Mortgage Lenders.

- Read More about Gifts For Down Payment – Documents Checklist – Debt To Income – Student Loans –

SAME DAY GEORGIA PRE-APPROVALS!

BANKRUPTCY OR FORECLOSURE- BANKRUPTCY OR FORECLOSURE MORTGAGE AFTER GEORGIA BANKRUPTCY APPROVALS!

- Chapter 13 Bankruptcy- You may apply for a BANKRUPTCY OR FORECLOSURE mortgage after your bankruptcy has been discharged for 12 Months or (1) year with a Chapter 13 Bankruptcy. You must have 0 x 30 day late payments, and permission from the chapter 13 trustee.

- Chapter 7 Bankruptcy- You may apply for a BANKRUPTCY OR FORECLOSURE mortgage after your bankruptcy has been discharged for TWO (2) years with a Chapter 7 Bankruptcy. You may apply for a BANKRUPTCY OR FORECLOSURE insured loan after your bankruptcy has been discharged for ONE (1) year with a Chapter 13 Bankruptcy

- Foreclosure – You may apply for a BANKRUPTCY OR FORECLOSURE insured loan THREE (3) years after the Georgia Foreclosure sale/deed transfer date. You may have to search county records office to locate the deed in order to count a full 3 years.

- Short Sale / Deed in Lieu – You may apply for a BANKRUPTCY OR FORECLOSURE insured loan THREE (3) years after the sale date of your foreclosure. BANKRUPTCY OR FORECLOSURE treats a short sale the same as a Foreclosure for now.You may have to search county records office to locate the deed in order to count a full 3 years.

- Credit must be re-established no late payments in past 12-24 months, depending on hardship

- Application Date must be after the above waiting period to be eligible for BANKRUPTCY OR FORECLOSURE financing after hardship.You may have to search county records office to locate the deed transfer out of your name fin order to count a full 3 years.

Georgia BANKRUPTCY OR FORECLOSURE Mortgage Lenders Require A minimum 580 credit score.

VA- GEORGIA MORTGAGE LENDERS APPROVALS!

- Chapter 13 Bankruptcy – Once you have finished making all payments satisfactorily, the Georgia mortgage lender may conclude that you have reestablished satisfactory credit.

- If you have made at least 12 months of timely payments and the Trustee or the Georgia Bankruptcy Judge approves of the new home purchase, the Georgia mortgage lender will approve financing after a chapter 13 bankruptcy.

- Chapter 7 Bankruptcy – You may apply for a VA mortgage loan TWO (2) years after a Georgia chapter 7 Bankruptcy.

- Foreclosure / Deed in Lieu – You may apply for a VA mortgage loan TWO (2) years after a Georgia foreclosure.

- Short Sale – VA does not recognize a short sale as a derogatory event however most Georgia mortgage lenders do. Most lenders will require a full 2 years after the deed was transferred out of your name and you re establish credit.

- Credit must be re-established with a minimum 550 credit score

- Application Date must be after the above waiting period to be eligible for VA mortgage after hardship.

Georgia VA Mortgage Lenders Require A minimum 550 credit score.

USDA- GEORGIA MORTGAGE APPROVALS!

- Foreclosure – You may apply for a USDA rural loan THREE (3) years after a Georgia Foreclosure.

- Bankruptcy – You may apply for a USDA rural loan THREE (3) years after the discharge of a Chapter 7 or 13 Georgia Bankruptcy.

- Short Sale / Deed in Lieu of Foreclosure – Georgia mortgage lenders require 3 years after a Georgia foreclosure.

Georgia USDA Lenders Require A minimum 550 credit score.

CONVENTIONAL– GEORGIA MORTGAGE APPROVALS!

- Foreclosure – You may apply for a Georgia Conventional mortgage, Fannie Mae loan (7) SEVEN years after the sale date of your Georgia foreclosure.

- Bankruptcy – You may apply for a Conventional, Fannie Mae loan after your Chapter 7 bankruptcy has been discharged for FOUR (4) years, TWO (2) years from the discharge of a Chapter 13

- Short Sale / Deed in Lieu of Foreclosure –Waiting period for Georgia foreclosure that was included in Bankruptcy If mortgage is included in Bankruptcy, waiting period defaults to FOUR (4) from the discharge date. Georgia Short Sale or Deed in Lieu of Georgia Foreclosure not included in a Bankruptcy has a new Waiting Period of FOUR (4) years from date your name is removed from title. This replaces the ability to buy in 24 months with 20% down payment and minimum 680 credit score.

Georgia Conventional Lenders Require A minimum 620 credit score.

- Bank Statement Only Bad Credit Georgia Mortgage Lenders

- BANKRUPTCY OR FORECLOSURE Bad Credit Mortgage Lenders

- VA Bad Credit Georgia Mortgage Lenders

- USDA Bad Credit Georgia Mortgage Lenders

- Jumbo Bad Credit Georgia Mortgage Lenders

- Hard Money Bad Credit Hard Money Lenders

- No Credit Score – Previous Bad Credit Georgia Mortgage Lenders

- Condominium Georgia Bad Credit Mortgage Lenders

- Town House Georgia Bad Credit Mortgage Lenders

- Modular Home Georgia Bad Credit Mortgage Lenders

- Chapter 13 BANKRUPTCY OR FORECLOSURE Mortgage Lenders

- Non Warrant-able Condo Georgia Bad Credit Mortgage Lenders

OTHER SITES OF INTEREST REGARDING THIS TOPIC:

- GEORGIA MORTGAGE 1 DAY AFTER BANKRUPTCY

- Georgia Mortgage after Bankruptcy =OK!!!

- Georgia Mortgage1 day after Bankruptcy or Foreclosure Approvals!

GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ABBEVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ACWORTH GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ADAIRSVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ADEL GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ADRIAN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- AILEY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ALAMO GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ALAPAHA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ALBANY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ALDORA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ALLENHURST GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ALLENTOWN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ALMA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ALPHARETTA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ALSTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ALTO GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- AMBROSE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- AMERICUS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ANDERSONVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ARABI GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ARAGON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ARCADE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ARGYLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ARLINGTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ASHBURN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ATHENS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ATLANTA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ATTAPULGUS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- AUBURN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- AUGUSTA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- AUSTELL GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- AVERA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- AVONDALE ESTATES GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDER

- BACONTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BAINBRIDGE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BALDWIN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BALL GROUND GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BARNESVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BARTOW GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BARWICK GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BAXLEY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BERKELEY LAKE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BERLIN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BETHLEHEM GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BISHOP GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BLACKSHEAR GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BLAIRSVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BLAKELY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BLOOMINGDALE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BLUE RIDGE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BLUFFTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BLYTHE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BOGART GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BOSTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BOSTWICK GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BOWDON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BOWERSVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BOWMAN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BRASELTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BRASWELL GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BREMEN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BRINSON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BRONWOOD GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BROOKHAVEN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BROOKLET GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BROOKS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BROXTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BRUNSWICK GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BUCHANAN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BUCKHEAD GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BUENA VISTA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BUFORD GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BUTLER GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BYROMVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- BYRON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CADWELL GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CAIRO GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CALHOUN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CAMAK GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CAMILLA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CANON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CANTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CARL GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CARLTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CARNESVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CARROLLTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CARTERSVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CAVE SPRING GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CECIL GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CEDARTOWN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CENTERVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CENTRALHATCHEE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CHAMBLEE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CHATSWORTH GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CHATTAHOOCHEE HILLS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CHAUNCEY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CHESTER GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CHICKAMAUGA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CLARKESVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CLARKSTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CLAXTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CLAYTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CLERMONT GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CLEVELAND GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CLIMAX GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- COBBTOWN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- COCHRAN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- COHUTTA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- COLBERT GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- COLLEGE PARK GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- COLLINS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- COLQUITT GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- COLUMBUS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- COMER GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- COMMERCE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CONCORD GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CONYERS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- COOLIDGE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CORDELE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CORNELIA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- COVINGTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CRAWFORD GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CRAWFORDVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CULLODEN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CUMMING GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CUSSETA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- CUTHBERT GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DACULA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DAHLONEGA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DALLAS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DALTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DAMASCUS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DANIELSVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DANVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DARIEN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DASHER GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DAVISBORO GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DAWSON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DAWSONVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DE SOTO GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DEARING GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DECATUR GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DEEPSTEP GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DEMOREST GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DEXTER GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DILLARD GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DOERUN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DONALSONVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DOOLING GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DORAVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DOUGLAS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DOUGLASVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DU PONT GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DUBLIN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DUDLEY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DULUTH GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- DUNWOODY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- EAST DUBLIN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- EAST ELLIJAY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- EAST POINT GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- EASTMAN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- EATONTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- EDGE HILL GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- EDISON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ELBERTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ELLAVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ELLENTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ELLIJAY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- EMERSON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ENIGMA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- EPHESUS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ETON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- EUHARLEE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- FAIRBURN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- FAIRMOUNT GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- FARGO GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- FAYETTEVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- FITZGERALD GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- FLEMINGTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- FLOVILLA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- FLOWERY BRANCH GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- FOLKSTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- FOREST PARK GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- FORSYTH GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- FORT GAINES GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- FORT OGLETHORPE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- FORT VALLEY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- FRANKLIN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- FRANKLIN SPRINGS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- FUNSTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GAINESVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GARDEN CITY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GARFIELD GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GAY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GENEVA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GEORGETOWN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GIBSON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GILLSVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GIRARD GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GLENNVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GLENWOOD GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GOOD HOPE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GORDON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GRAHAM GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GRANTVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GRAY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GRAYSON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GREENSBORO GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GREENVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GRIFFIN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GROVETOWN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GUMBRANCH GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- GUYTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HAGAN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HAHIRA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HAMILTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HAMPTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HAPEVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HARALSON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HARLEM GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HARRISON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HARTWELL GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HAWKINSVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HAZLEHURST GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HELEN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HEPHZIBAH GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HIAWASSEE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HIGGSTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HILTONIA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HINESVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HIRAM GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HOBOKEN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HOGANSVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HOLLY SPRINGS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HOMELAND GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HOMER GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HOMERVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HOSCHTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- HULL GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- IDEAL GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ILA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- IRON CITY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- IRWINTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- IVEY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- JACKSON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- JACKSONVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- JAKIN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- JASPER GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- JEFFERSON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- JEFFERSONVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- JENKINSBURG GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- JERSEY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- JESUP GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- JOHNS CREEK GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- JONESBORO GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- JUNCTION CITY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- KENNESAW GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- KEYSVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- KINGSLAND GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- KINGSTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- KITE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LAFAYETTE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LAGRANGE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LAKE CITY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LAKE PARK GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LAKELAND GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LAVONIA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LAWRENCEVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LEARY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LEESBURG GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LENOX GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LESLIE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LEXINGTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LILBURN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LILLY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LINCOLNTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LITHONIA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LOCUST GROVE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LOGANVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LONE OAK GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LOOKOUT MOUNTAIN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LOUISVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LOVEJOY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LUDOWICI GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LULA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LUMBER CITY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LUMPKIN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LUTHERSVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LYERLY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- LYONS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MACON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MADISON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MANASSAS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MANCHESTER GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MANSFIELD GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MARIETTA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MARSHALLVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MARTIN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MAXEYS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MAYSVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MCCAYSVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MCDONOUGH GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MCINTYRE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MCRAE-HELENA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MEANSVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MEIGS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MENLO GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- METTER GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MIDVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MIDWAY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MILAN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MILLEDGEVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MILLEN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MILNER GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MILTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MITCHELL GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MOLENA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MONROE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MONTEZUMA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MONTICELLO GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MONTROSE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MORELAND GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MORGAN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MORGANTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MORROW GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MORVEN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MOULTRIE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MOUNT AIRY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MOUNT VERNON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MOUNT ZION GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MOUNTAIN CITY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- MOUNTAIN PARK GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- NAHUNTA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- NASHVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- NELSON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- NEWBORN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- NEWINGTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- NEWNAN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- NEWTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- NICHOLLS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- NICHOLSON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- NORCROSS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- NORMAN PARK GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- NORTH HIGH SHOALS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- NORWOOD GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- OAK PARK GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- OAKWOOD GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- OCHLOCKNEE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- OCILLA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- OCONEE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ODUM GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- OFFERMAN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- OGLETHORPE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- OLIVER GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- OMEGA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ORCHARD HILL GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- OXFORD GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PALMETTO GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PARROTT GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PATTERSON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PAVO GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PAYNE CITY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PEACHTREE CITY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PEACHTREE CORNERS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PEARSON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PELHAM GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PEMBROKE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PENDERGRASS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PERRY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PINE LAKE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PINE MOUNTAIN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PINEHURST GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PINEVIEW GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PITTS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PLAINS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PLAINVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- POOLER GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PORT WENTWORTH GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PORTAL GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PORTERDALE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- POULAN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- POWDER SPRINGS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PRESTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- PULASKI GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- QUITMAN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- RANGER GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- RAY CITY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- RAYLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- REBECCA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- REGISTER GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- REIDSVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- REMERTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- RENTZ GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- RESACA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- REYNOLDS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- RHINE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- RICEBORO GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- RICHLAND GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- RICHMOND HILL GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- RIDDLEVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- RINCON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- RINGGOLD GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- RIVERDALE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- RIVERSIDE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ROBERTA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ROCHELLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ROCKMART GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ROCKY FORD GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ROME GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ROSSVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ROSWELL GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ROYSTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- RUTLEDGE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SALE CITY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SANDERSVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SANDY SPRINGS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SANTA CLAUS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SARDIS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SASSER GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SAVANNAH GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SCOTLAND GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SCREVEN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SENOIA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SHADY DALE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SHARON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SHARPSBURG GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SHELLMAN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SHILOH GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SILOAM GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SKY VALLEY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SMITHVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SMYRNA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SNELLVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SOCIAL CIRCLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SOPERTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SPARKS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SPARTA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SPRINGFIELD GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ST. MARYS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- STAPLETON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- STATENVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- STATESBORO GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- STATHAM GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- STILLMORE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- STOCKBRIDGE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- STONE MOUNTAIN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SUGAR HILL GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SUMMERVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SUMNER GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SURRENCY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SUWANEE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SWAINSBORO GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SYCAMORE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SYLVANIA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- SYLVESTER GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- TALBOTTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- TALKING ROCK GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- TALLAPOOSA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- TALLULAH FALLS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- TALMO GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- TARRYTOWN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- TAYLORSVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- TEMPLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- TENNILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- THOMASTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- THOMASVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- THOMSON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- THUNDERBOLT GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- TIFTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- TIGNALL GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- TOCCOA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- TOOMSBORO GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- TRENTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- TRION GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- TUNNEL HILL GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- TURIN GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- TWIN CITY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- TY TY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- TYBEE ISLAND GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- TYRONE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- UNADILLA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- UNION CITY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- UNION POINT GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- UVALDA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- VALDOSTA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- VARNELL GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- VERNONBURG GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- VIDALIA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- VIENNA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- VILLA RICA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WACO GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WADLEY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WALESKA GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WALNUT GROVE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WALTHOURVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WARM SPRINGS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WARNER ROBINS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WARRENTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WARWICK GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WASHINGTON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WATKINSVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WAVERLY HALL GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WAYCROSS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WAYNESBORO GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WEST POINT GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WHIGHAM GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WHITE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WHITE PLAINS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WHITESBURG GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WILLACOOCHEE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WILLIAMSON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WINDER GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WINTERVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WOODBINE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WOODBURY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WOODLAND GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WOODSTOCK GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WOODVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WOOLSEY GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WRENS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- WRIGHTSVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- YATESVILLE GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- YOUNG HARRIS GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS

- ZEBULON GEORGIA BANKRUPTCY OR FORECLOSURE MORTGAGE LENDERS