10%DOWN -TEXAS STATED INCOME MORTGAGE LENDERS

Serving All Texas Including And Not Limited To: Fort Worth Texas, Austin Texas, Dallas Texas, San Antonio Texas, Houston Texas

SAN ANTONIO TEXAS FHA MORTGAGE LENDERS Good Credit – Bad Credit – No Credit + No Problem + We work with all San Antonio Texas FHA mortgage applicants towards home ownership! Whether you’re a San Antonio Texas first time home buyer, moving to a new San Antonio home, or want to FHA refinance you’re existing conventional or FHA mortgage, we will show you how to purchase or refinance a San Antonio Texas home using our full doc mortgage programs or bank statement only mortgage programs.

San Antonio TEXAS FHA MORTGAGE ADVANTAGES INCLUDE:

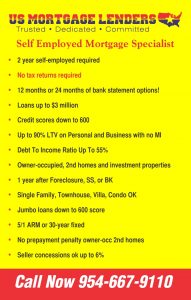

SAN ANTONIO TX SELF EMPLOYED MORTGAGE LENDERS

| FHA MORTGAGE LENDERS SERVING ALL San Antonio TEXAS – |

| San Antonio TEXAS MORTGAGE PROGRAMS FOR ALL TEXAS INCLUDING Major cities near San Antonio, TX

|

| San Antonio TEXAS CITY DATA Recent home sales, real estate maps, and home value estimator for zip codes: 78023, 78056, 78112, 78201, 78202, 78203, 78204, 78205, 78207, 78208, 78209, 78210, 78211, 78212, 78213, 78214, 78215, 78216, 78217, 78218, 78219, 78220, 78221, 78222, 78223, 78224, 78225, 78226, 78227, 78228, 78229, 78230, 78232, 78233, 78235, 78237, 78238, 78240, 78242, 78244, 78245, 78247, 78248, 78249, 78250, 78251, 78252, 78253, 78254, 78256, 78257, 78258, 78259, 78261, 78264. Population in 2016: 1,492,494 Males: 738,297 (49.5%) Females: 754,197 (50.5%) Median resident age: 33.5 years Texas median age: 34.5 years Zip codes: 78056, 78073, 78202, 78203, 78204, 78205, 78207, 78208, 78210, 78211, 78214, 78215, 78217, 78218, 78220, 78221, 78222, 78224, 78225, 78226, 78227, 78229, 78230, 78231, 78234, 78235, 78237, 78242, 78243, 78245, 78247, 78248, 78249, 78250, 78251, 78252, 78253, 78257, 78258, 78259, 78260, 78264. San Antonio Zip Code Map Estimated median household income in 2016: $49,268 (it was $36,214 in 2000) San Antonio: $49,268 TX: $56,565 Estimated per capita income in 2016: $23,921 (it was $17,487 in 2000) San Antonio city income, earnings, and wages data Estimated median house or condo value in 2016: $133,900 (it was $67,500 in 2000) San Antonio: $133,900 TX: $161,500 Mean prices in 2016: All housing units: $176,188; Detached houses: $179,344; Townhouses or other attached units: $139,380; In 2-unit structures: $166,494; In 3-to-4-unit structures: $149,085; In 5-or-more-unit structures: $162,992; Mobile homes: $54,366 Median gross rent in 2016: $924. |

San Antonio Texas FHA Mortgage Lenders Search Results

3.5% Down San Antonio Texas FHA Mortgage Lenders

https://www.fhamortgageprograms.com/San Antonio-texas-fha-mortgage-lenders-2/

In additions to the FHA mortgage, we offer a huge assortment of VA lenders including FHA, Conventional & Private San Antonio, Texas FHA mortgage programs built around San Antonio, Texas home buyers and homeowners. Whether you’re buying a first home using our great FHA mortgage program or refinancing a home you …

3.5% San Antonio Texas FHA Mortgage Lenders Min 580!

https://www.fhamortgageprograms.com/San Antonio-texas-fha-mortgage-lenders/

A San Antonio Texas FHA Mortgage Lenders can offer you a better Mortgage Deal including: Lower down payments (if … San Antonio TEXAS FHA LOANS ARE EASIER TO QUALIFY FOR BECAUSE: 12 months after a …. https://www.

10DOWN+San Antonio TX SELF EMPLOYED MORTGAGE LENDERS

https://www.fhamortgageprograms.com/San Antonio-tx-self-employed-mortgage-lenders/

https://www.fhamortgageprograms.com/14454-2/ Dec 27, 2017 – PORTFOLIO MORTGAGE LENDERS 10%DOWN+BANK STATEMENT TX MORTGAGE LENDERS San Antonio Texas–Bank Statement Only Jumbo Mortgage Lenders 12 or 24 Month San Antonio Texas Bank StatementHome Loan Program. For San Antonio Texas Self …

SELF EMPLOYED-San Antonio TEXAS MORTGAGE LENDERS

https://www.fhamortgageprograms.com/self-employed-texas-mortgage-lenders-3-2/

15 DOWN+SELF EMPLOYED TEXAS MORTGAGE LENDERS. https://www.

Texas-Bank Statement Only Mortgage Lenders – FHA mortgage lender

https://www.fhamortgageprograms.com/texas-bank-statement-mortgage-lenders/

https://www.fhamortgageprograms.com/6-texas-stated-income-mortgage-lenders

Texas Mortgage Lenders Allow Collections and Disputed Accounts

https://www.fhamortgageprograms.com/texas-mortgage-lenders-allow-collections-disp…

Texas Mortgage Lenders Allow Collections and Disputed Accounts- Texas FHA Mortgage Lenders Same say approvals! Call Now 954-667-9110. … Serving all Texas including – San Antonio,– San Antonio.– Dallas.– Austin …. https://www.

100% San Antonio Texas VA Mortgage Lenders – Min 580 FICO!!

https://www.fhamortgageprograms.com/San Antonio-texas-va-mortgage-lenders/

San Antonio VA Mortgage lenders down to 580 fico! Serving ALL TEXAS! San Antonio Texas VA Mortgage Key Points San Antonio Texas VA Mortgage loans are for Primary homes only. 100% financing up to 453100. Seller Paid Closing cost up to 4%. Bad Credit San Antonio Texas VA Mortgage with Fico Score 550! Please note we …

Cities within San Antonio, TX

- Adkins, TX

- Atascosa, TX

- Bergheim, TX

- Bigfoot, TX

- Boerne, TX

- Bulverde, TX

- Canyon Lake, TX

- Castroville, TX

- Center Point, TX

- Cibolo, TX

- Converse, TX

- Devine, TX

- Elmendorf, TX

- Floresville, TX

- Helotes, TX

- Jbsa Ft Sam Houston, TX

- Jbsa Lackland, TX

- Jbsa Randolph, TX

- La Coste, TX

- La Vernia, TX

- Leming, TX

- Lytle, TX

- Macdona, TX

- Marion, TX

- Mc Queeney, TX

- Mico, TX

- Natalia, TX

- New Braunfels, TX

- Pipe Creek, TX

- Poteet, TX

- Poth, TX

- Rio Medina, TX

- Saint Hedwig, TX

- Schertz, TX

- Somerset, TX

- Spring Branch, TX

- Sutherland Springs, TX

- Universal City, TX

- Von Ormy, TX