DEBT CONSOLIDATION REFINANCE

Leverage the money you’ve already put into your home/mortgage to ease your financial burden.

Debt consolidation loans have helped many thousands of mortgage applicants get back on their feet. If you have equity in your home, you may be able to leverage it for your financial health. Get rid of looming bills and get those credit collectors off your back once and for all with FHA debt consolidation.

Here are the kinds of debts you may be able to consolidate with an FHA mortgage refinance:

- Medical Bills

- Cash Advance or Payday Loans

- Rent-to-own loan programs

- Other short-term debt

- Credit Cards

- Home Equity Lines of Credit

- Car Loans

- Student Loans

The loan-to-value limit on FHA cash-out refinancing is 85%. Mortgage applicants may be able consolidate debt through a cash-out loan. So, this means mortgage applicants can refinance up to 85% of the home’s value for the purpose of a debt consolidation mortgage.

HOW MUCH CAN YOU BORROW? up to 85% of your home’s value.

The housing market is always changing. As of late 2013, FHA’s mortgage loan limit for the loan-to-value of any cash-out FHA refinance mortgage was 85% of the FHA appraisers value that includes loans for debt consolidation. This applies if the mortgage applicant has owned the property as his or her principal resident for 12 months or more before they apply for the FHA mortgage loan. If the FHA mortgage applicant has owned the property for less than 12 months, the limit is the lesser amount of 85% of either the appraiser’s estimate or the sales price of the property when acquired.

These FHA mortgage limits were set on April 1, 2009. According to the FHA, they have instituted the conservative LTV limit on cash-outs on a temporary basis due to the volatile housing market. The limit has been higher in the past and could increase as the housing market stabilizes depending upon FHA’s analysis.

OWNER OCCUPANCY REQUIRED FOR FHA MORTGAGE REFINANCE

FHA cash-out refinance for the purpose of combining debt is only permitted for mortgage applicants who meet owner-occupancy requirements. A property financed this way will need to be the primary residence of the mortgage applicant(s).

Mortgage applicants who own their properties free and clear may stand to benefit the most. If they qualify, they can leverage up to 85% of their home’s equity to pay off debts and still have some equity left over to provide a measure of financial security.

Qualified mortgage applicants who wish to use this government-backed cash-out refinancing program to pay off debts will have to meet some other requirements, too.

The Most popular Mortgage Refinance options for consolidating debt:

- FHA Mortgage Refinance – Refinance your debt into one low-cost loan today.

- 15-year fixed-rate loan – Consolidate your debt and pay it off sooner with our 15-year fixed-rate mortgage.

- VA Mortgage Refinance– Veterans and active military members can consolidate debt with a low fixed rate.

- 30-year fixed-rate loan – Have peace of mind always knowing your payment amount with a 30-year fixed.

Basic FHA Mortgage Cash Out Requirements:

- House must be owner-occupied

- Non-occupant co-mortgage applicants/signers may not be on the loan

- Origination services must be from an FHA approved lender

- Properties owned outright may be eligible

- If property is mortgaged, loan cannot be delinquent

- Multi-unit properties must pass FHA criteria for self-sufficiency

- A second appraisal is needed for loans over $417,000 in depressed housing markets

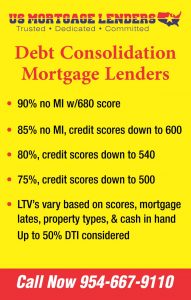

POPULAR CREDIT SCORE INFORMATION INCLUDES: