Federal Housing Administration –Florida FHA Mortgage Lenders

KEY FHA MORTGAGE ADVANTAGES FROM FLORIDA FHA MORTGAGE LENDERS

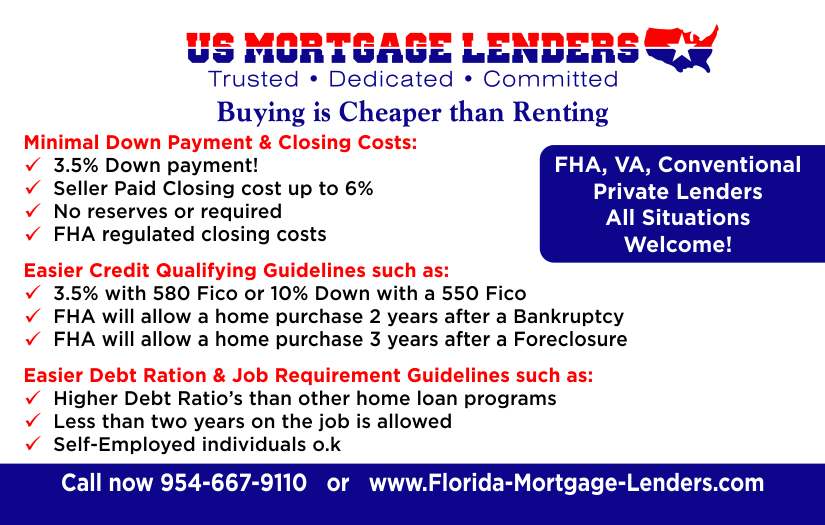

- Lowest Down Payment: Generally, FHA requires as little as 3.5% down payment which is much less than conventional financing.

- Easier Qualifying Standards: Florida mortgage applicants with less than perfect credit, higher debt to income ratios, and little to no money down are likely candidates for Florida FHA loans.

- Lowest Mortgage Interest Rates: Florida FHA loans generally have competitively priced interest rates. Because these loans are Federally Insured, lenders offer competitive rates.

For more information about Tampa FHA loans contact Integrity Financial now!

Over the last several years since the housing markets started to fall there has been a real credit crunch in the weaker credit markets in Florida and across the country. Many of our Florida FHA mortgage applicants who have credit issues are now turning to a Florida FHA home loan for a Florida home loan approval, whether they are looking to purchase a new house or refinance their current Florida home.

FHA Loans in Florida are loans that are federally insured. The Federal Housing Administration has been insuring these FHA mortgages loans since 1934. Florida FHA Loans are mortgage, which usually have a lower down-payment requirement and less stringent qualifications than conventional loans. That is what makes them ideal loans for the first time home buyer.

The result of the Florida FHA Home Loan is federally insured, Florida FHA mortgage lenders are more willing to offer competitive rates. Part of the Florida FHA mortgage requirements is that you have FHA mortgage insurance solution. This is an additional cost at closing as well as part of your monthly Florida FHA mortgage payment. The rest of your monthly payments will include interest rates, taxes, and homeownership fees. Costs can really add up, so having a financial plan in place before getting FHA Approved and saving up for a down payment will help keep you financially on-track.

Unlike most bad credit Florida mortgage options FHA loans do not have pre-payment penalties. Florida FHA loans are insured by the government, but unlike other government programs, there are no income limits.