GEORGIA CO-OP MORTGAGE LENDERS

COOPS – Georgia Mortgage Lenders

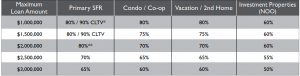

GEORGIA CO-OP MORTGAGE LENDERS LOAN TO VALUE

GEORGIA CO-OP MORTGAGE LENDERS LOAN TO VALUE

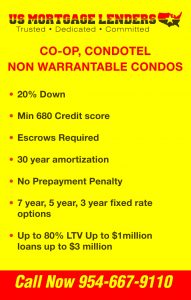

GEORGIA CO-OP MORTGAGE LENDERS TERMS

The ARM is a 1st mortgage adjustable rate loan with principal and interest payments amortized over 30 years.

- 3/1 ARM: Rate is fixed for 3 years.

- 5/1 ARM: Rate is fixed for 5 years.

- 7/1 ARM: Rate is fixed for 7 years.

- 30 Year fixed for 30 years.

- GEORGIA CO-OP MORTGAGE LENDERS APPROVAL PROCESS

GEORGIA CO-OP MORTGAGE LENDERS OPTIONS INCLUDE:

GEORGIA CO-OP MORTGAGE LENDERS OPTIONS INCLUDE:

- Primary GEORGIA Co-op Mortgage Lenders

- Second Home GEORGIA Co-op Mortgage Lenders

- Investments GEORGIA Co-op Mortgage Lenders

- Cash Out GEORGIA Co-op Refinancing

- Second GEORGIA Co-op Home Financing

- Jumbo GEORGIA Co-op Loans

- Low GEORGIA Co-op Closing Costs

- Up to 80 Percent GEORGIA Co-op Mortgage Loans

GEORGIA CO-OP MINIMUM & MAX LOAN AMOUNTS

• $100,000 minimum loan amount. Exceptions considered on a case-by-case.

• Co0OP Loan amount exceptions over $4,000,000 available.

GEORGIA CO-OP MORTGAGE LENDERS CREDIT REQUIREMENTS

• 680 middle score required with some exceptions allowed for lack of credit or unestablished credit.

• For co-co-op mortgage applicants and co-mortgagers, the lowest mid-score is used for pricing and qualification.

• Meeting the minimum credit score requirement does not automatically constitute a credit approval. A pattern of

adverse credit or overextended credit may disqualify co-op mortgage applicant from financing, even if the minimum credit score is met.

• Credit report is used for Pre-Approval and co-op mortgage lenders will also pull credit before issuing a conditional

approval. Mid-score from co-op mortgage lenders credit pull is used for pricing and qualification.

No Credit or Limited Credit

• No credit or limited credit profiles are allowed on a case-by-case basis for U.S. citizens.

• No U.S. credit or credit score is required for the Work Visa/Expatriate/Immigrant Program or Foreign National Program

GEORGIA CO-OP MORTGAGE LENDERS OPTIONS INCLUDE:

- Primary GEORGIA Co-op Mortgage Lenders

- Second Home GEORGIA Co-op Mortgage Lenders

- Investments GEORGIA Co-op Mortgage Lenders

- Cash Out GEORGIA Co-op Refinancing

- Second GEORGIA Co-op Home Financing

- Jumbo GEORGIA Co-op Loans

- Low GEORGIA Co-op Closing Costs

- Up to 80 Percent GEORGIA Co-op Mortgage Loans

GEORGIA CO-OP MORTGAGE MAXIMUM DEBT TO INCOME

Maximum GEORGIA CO-op Mortgage Lenders Debt To Income Ratio

• 43% maximum back-end ratio.

GEORGIA CO-OP MORTGAGE LENDERS APPROVAL PROCESS

2. PRINT OUT CONDO QUESTIONNAIRE FOR ASSOCIATION TO FILL OUT COMPLETE. the questionnaire must be 100% complete for Approval Commitment. No blanks or questions answered “n/a”

or “unknown,” and the questionnaire must pass underwriter review.

ELIGIBLE GEORGIA CO-OP PROPERTY TYPES & OCCUPANCY

GEORGIA Co-op Occupancy Permitted

• Primary GEORGIA Co-op Residence

• Second GEORGIA Co-op Home (minimal rental income allowed)

• Investment GEORGIA Co-op Property (non-owner GEORGIA Co-op occupied) permitted at maximum GEORGIA Co-op loan of 60% LTV

GEORGIA CO-OP MORTGAGE LENDERS CASE BY CASE MORTGAGE APPROVALS

• GEORGIA Co-op Current reserve balance meets or exceeds 2 months of the subject property’s GEORGIA Co-op HOA dues in reserves multiplied by all GEORGIA Co-op units in the GEORGIA Co-op project or 10% or more reserve allocation designated in the most recent Georgia Co-op budget.

SECOND HOME GEORGIA CO-OP MORTGAGE LENDERS

• GEORGIA Co-op Mortgage Lenders will typically define a property as a second GEORGIA Co-op home if it is (1) located in a vacation or resort area 30 or more miles from the primary GEORGIA Co-op residence or (2) used a GEORGIA Co-op college housing for enrolled dependent within 5 miles of campus)

• Short-term GEORGIA Co-op rental income is allowed on second GEORGIA Co-op homes and generally does not constitute a GEORGIA Co-op investment property designation. GEORGIA Co-op Rental income cannot be used to qualify. An evaluation of the 1040 Schedule E is required.

ELIGIBLE GEORGIA CO-OP MORTGAGE REQUIREMENTS

• Minimum Down Payment 20% For GEORGIA Co-op Mortgage Lenders

• Title Insurance for GEORGIA Co-ops title policy issued through a title company or closing attorney must be issued on GEORGIA Co-op certificate

• Leaseholds GEORGIA Co-op allowed on a case-by-case basis

BAD CREDIT GEORGIA CO-OP MORTGAGE LENDERS CREDIT REQUIREMENTS

• Late payments on any mortgage, installment or revolving account of 2×30, 1×60 or more will typically disqualify a

borrower from financing. Exceptions will be reviewed on a case-by-case basis at a lower LTV.

• A pattern of adverse credit or overextended credit may disqualify borrower from financing, even if minimum credit score

is met. Borrowers with 3x monthly income amount in unsecured consumer debt are generally disqualified.

GEORGIA CO-OP MORTGAGE LENDERS REQUIREMENTS AFTER FORECLOSURE, BANKRUPTCY, SHORT SALE

• (4)Four-year seasoning from BK discharge date or sale of property

• Maximum 60% LTV or 40% downpayment

• No derogatory credit allowed since the bad credit event

• Strong extenuating circumstance and signed letter of explanation from co-op mortgage applicant detailing event required.

NOT ALLOWABLE FOR GEORGIA CO-OP MORTGAGE LENDERS

– Structural GEORGIA Co-op deficiencies and certain pending litigation (please contact your AE if litigation is not related to a structural issue)

– Incomplete GEORGIA Co-op construction of the subject phase

APPROVED OR ALLOWED GEORGIA CO-OP MORTGAGE LENDERS CASE BY CASE:

– Low GEORGIA Co-op HOA budget reserves

– HOA GEORGIA Co-op delinquencies exceeding 15%

• GEORGIA Co-op mortgage lenders Questionnaire must be 100% complete for Approval Commitment. No blanks or questions answered “n/a” or “unknown,” and the Georgia Co-op questionnaire must pass underwriter review.

• GEORGIA Co-ops mortgage lenders price GEORGIA Co-ops the same as Non-Warrantable Condos, regardless of loan size or GEORGIA Co-op questionnaire findings.

• GEORGIA Co-op must pust have a full kitchen and at least one separate bedroom. Minimum GEORGIA Co-op size 500 square feet generally required. Efficiency GEORGIA Co-ops or studio units are not permitted.

• Coinsurance GEORGIA Co-op is considered case-by-case if no agreed amount endorsement is available.

SELF EMPLOYED GEORGIA CO-OP MORTGAGE LENDERS

Self-Employed co-op mortgage Income calculations

• Borrower should be self-employed in the U.S. for a minimum of 2 years (max 80% LTV).

• 2-years business & personal tax returns required, plus year-to-date Profit & Loss statement.

• Business tax returns required for all businesses in which the borrower has 25% ownership or more. On occasion

business tax returns are needed if the borrower is has less than 25% ownership.

• Fannie Mae cash flow analysis form can be used.

• NOL Carryover Loss: Treated case-by-case when truly a one-time occurrence (i.e. real estate loss, lawsuit settlement or some other form of a truly one-time occurrence). Detailed CPA letter addressing the one-time occurrence is required.

• Less than two years self-employment is considered on a case-by-case basis with a reduced LTV.

REQUIRED BY GEORGIA CO-OP MORTGAGE LENDERS

• 2-months bank statements for monthly asset accounts, and most recent statement for quarterly asset accounts

(VOD not permitted).

• 6 months PITI for all GEORGIA co-op properties owned including subject.

• At least 3 months of the subject property’s reserves must be liquid non-retirement.

GEORGIA CO-OP MORTGAGE FOR INVESTMENT PROPERTY

• Property titled in LLC allowed

• Maximum GEORGIA Co-op 60% LTV for investor GEORGIA Co-op mortgage lenders.

• Gross rental income is calculated by using a 12 month average of the net Schedule E income (Line 21) plus depreciation, mortgage interest paid to banks, taxes and insurance, and GEORGIA Co-op HOA dues.

• Rental income not appearing on Schedule E may be considered case-by-case with 3 months canceled checks and a

current lease agreement. Use 75% of gross rent as gross rental income.

• Immediate GEORGIA Co-op rental income on the purchase of an investment property is allowed using 75% of the monthly rent schedule as documented by Form 1007 or 1025.

• Cash-out is allowed up to $3,000,000 with no seasoning required.

WHAT IS A GEORGIA CO-OP AND HOW DO I GET A GEORGIA MORTGAGE?

A GEORGIA Co-op or cooperative apartment is an individual living unit within a GEORGIA Co-op building or development where a buyer purchases shares (equal to the value of the unit) in a GEORGIA Co-op corporation that holds title to a building Coops are predominantly located. Normally a GEORGIA Co-op sponsor will buy the building (takes out the underlying GEORGIA Co-op mortgage) and then will sell off the shares. Therefore, when buying a coop, you are actually buying GEORGIA Co-op shares in a corporation, not buying real property.

HOW TO GEORGIA CO-OP BUILDINGS GET PRE QUALIFIED BY GEORGIA MORTGAGE LENDERS?

To start with GEORGIA Co-op lender will look at the following factors to see if a particular GEORGIA Co-op building corresponds with their guidelines: the GEORGIA Co-op property’s resale value, investor concentration, and GEORGIA Co-op owner occupancy. Based on the previous example, if there are 20 units, five sponsor rentals and 15 sold units (with 12 owner-occupied units and 3 units being rented by the GEORGIA Co-op owners), the following ratios and guideline percentages result:

HOW IS A GEORGIA CO OP DIFFERENT FROM A HOUSE OR CONDO?

When you get a mortgage to purchase a house or condo you get the deed. But not with a GEORGIA Co-op, individual units do not have individual deeds. A GEORGIA Co-op mortgage is actually a “share-loan” or a loan that purchases a share within in the GEORGIA Co-op. The difference makes securing a loan for a GEORGIA Co-op more complicated them getting a traditional mortgage and fewer mortgage lenders offer share loans.

GEORGIA COOP BOARDS AND APPROVAL RULES

To buy into a GEORGIA Co-op, you must be approved by the Georgia Co-op board. The approval process is often extensive and may require interviews and character references, in addition to your employment, financial, and credit history. GEORGIA Co-op boards can refuse a prospective buyer for any reason, so long as it doesn’t run afoul of anti-discrimination policies. What you can do WITH your GEORGIA Co-op unit. As a GEORGIA Co-op shareholder, you don’t have the right of alienation where basically, you can’t sell your GEORGIA Co-op share (or rent your GEORGIA Co-op unit) without the permission of the Georgia Co-op board. Some Georgia Co-op associations have the right of first refusal, meaning they have the option to buy the property before you offer your GEORGIA Co-op to outside buyers. GEORGIA Co-op boards, though, can simply deny a sale without matching the sale price.

HOW GEORGIA COOP OWNERSHIP DIFFERS FROM CONDO OWNERSHIP

When you purchase a condominium you are purchasing a specific unit the surface and the interior walls of the unit in the space the condo contains. With a Co-op, you are purchasing a share in a corporation, which then entitles you to a unit. This share is considered personal property rather than real estate.

- SERVING EVERY CITY AND COUNTY IN GEORGIA

-

GEORGIA CO OP MORTGAGE LENDERS

- ABBEVILLE GEORGIA CO OP MORTGAGE LENDERS

- ACWORTH GEORGIA CO OP MORTGAGE LENDERS

- ADAIRSVILLE GEORGIA CO OP MORTGAGE LENDERS

- ADEL GEORGIA CO OP MORTGAGE LENDERS

- ADRIAN GEORGIA CO OP MORTGAGE LENDERS

- AILEY GEORGIA CO OP MORTGAGE LENDERS

- ALAMO GEORGIA CO OP MORTGAGE LENDERS

- ALAPAHA GEORGIA CO OP MORTGAGE LENDERS

- ALBANY GEORGIA CO OP MORTGAGE LENDERS

- ALDORA GEORGIA CO OP MORTGAGE LENDERS

- ALLENHURST GEORGIA CO OP MORTGAGE LENDERS

- ALLENTOWN GEORGIA CO OP MORTGAGE LENDERS

- ALMA GEORGIA CO OP MORTGAGE LENDERS

- ALPHARETTA GEORGIA CO OP MORTGAGE LENDERS

- ALSTON GEORGIA CO OP MORTGAGE LENDERS

- ALTO GEORGIA CO OP MORTGAGE LENDERS

- AMBROSE GEORGIA CO OP MORTGAGE LENDERS

- AMERICUS GEORGIA CO OP MORTGAGE LENDERS

- ANDERSONVILLE GEORGIA CO OP MORTGAGE LENDERS

- ARABI GEORGIA CO OP MORTGAGE LENDERS

- ARAGON GEORGIA CO OP MORTGAGE LENDERS

- ARCADE GEORGIA CO OP MORTGAGE LENDERS

- ARGYLE GEORGIA CO OP MORTGAGE LENDERS

- ARLINGTON GEORGIA CO OP MORTGAGE LENDERS

- ASHBURN GEORGIA CO OP MORTGAGE LENDERS

- ATHENS GEORGIA CO OP MORTGAGE LENDERS

- ATLANTA GEORGIA CO OP MORTGAGE LENDERS

- ATTAPULGUS GEORGIA CO OP MORTGAGE LENDERS

- AUBURN GEORGIA CO OP MORTGAGE LENDERS

- AUGUSTA GEORGIA CO OP MORTGAGE LENDERS

- AUSTELL GEORGIA CO OP MORTGAGE LENDERS

- AVERA GEORGIA CO OP MORTGAGE LENDERS

- AVONDALE ESTATES GEORGIA CO OP MORTGAGE LENDER

- BACONTON GEORGIA CO OP MORTGAGE LENDERS

- BAINBRIDGE GEORGIA CO OP MORTGAGE LENDERS

- BALDWIN GEORGIA CO OP MORTGAGE LENDERS

- BALL GROUND GEORGIA CO OP MORTGAGE LENDERS

- BARNESVILLE GEORGIA CO OP MORTGAGE LENDERS

- BARTOW GEORGIA CO OP MORTGAGE LENDERS

- BARWICK GEORGIA CO OP MORTGAGE LENDERS

- BAXLEY GEORGIA CO OP MORTGAGE LENDERS

- BERKELEY LAKE GEORGIA CO OP MORTGAGE LENDERS

- BERLIN GEORGIA CO OP MORTGAGE LENDERS

- BETHLEHEM GEORGIA CO OP MORTGAGE LENDERS

- BISHOP GEORGIA CO OP MORTGAGE LENDERS

- BLACKSHEAR GEORGIA CO OP MORTGAGE LENDERS

- BLAIRSVILLE GEORGIA CO OP MORTGAGE LENDERS

- BLAKELY GEORGIA CO OP MORTGAGE LENDERS

- BLOOMINGDALE GEORGIA CO OP MORTGAGE LENDERS

- BLUE RIDGE GEORGIA CO OP MORTGAGE LENDERS

- BLUFFTON GEORGIA CO OP MORTGAGE LENDERS

- BLYTHE GEORGIA CO OP MORTGAGE LENDERS

- BOGART GEORGIA CO OP MORTGAGE LENDERS

- BOSTON GEORGIA CO OP MORTGAGE LENDERS

- BOSTWICK GEORGIA CO OP MORTGAGE LENDERS

- BOWDON GEORGIA CO OP MORTGAGE LENDERS

- BOWERSVILLE GEORGIA CO OP MORTGAGE LENDERS

- BOWMAN GEORGIA CO OP MORTGAGE LENDERS

- BRASELTON GEORGIA CO OP MORTGAGE LENDERS

- BRASWELL GEORGIA CO OP MORTGAGE LENDERS

- BREMEN GEORGIA CO OP MORTGAGE LENDERS

- BRINSON GEORGIA CO OP MORTGAGE LENDERS

- BRONWOOD GEORGIA CO OP MORTGAGE LENDERS

- BROOKHAVEN GEORGIA CO OP MORTGAGE LENDERS

- BROOKLET GEORGIA CO OP MORTGAGE LENDERS

- BROOKS GEORGIA CO OP MORTGAGE LENDERS

- BROXTON GEORGIA CO OP MORTGAGE LENDERS

- BRUNSWICK GEORGIA CO OP MORTGAGE LENDERS

- BUCHANAN GEORGIA CO OP MORTGAGE LENDERS

- BUCKHEAD GEORGIA CO OP MORTGAGE LENDERS

- BUENA VISTA GEORGIA CO OP MORTGAGE LENDERS

- BUFORD GEORGIA CO OP MORTGAGE LENDERS

- BUTLER GEORGIA CO OP MORTGAGE LENDERS

- BYROMVILLE GEORGIA CO OP MORTGAGE LENDERS

- BYRON GEORGIA CO OP MORTGAGE LENDERS

- CADWELL GEORGIA CO OP MORTGAGE LENDERS

- CAIRO GEORGIA CO OP MORTGAGE LENDERS

- CALHOUN GEORGIA CO OP MORTGAGE LENDERS

- CAMAK GEORGIA CO OP MORTGAGE LENDERS

- CAMILLA GEORGIA CO OP MORTGAGE LENDERS

- CANON GEORGIA CO OP MORTGAGE LENDERS

- CANTON GEORGIA CO OP MORTGAGE LENDERS

- CARL GEORGIA CO OP MORTGAGE LENDERS

- CARLTON GEORGIA CO OP MORTGAGE LENDERS

- CARNESVILLE GEORGIA CO OP MORTGAGE LENDERS

- CARROLLTON GEORGIA CO OP MORTGAGE LENDERS

- CARTERSVILLE GEORGIA CO OP MORTGAGE LENDERS

- CAVE SPRING GEORGIA CO OP MORTGAGE LENDERS

- CECIL GEORGIA CO OP MORTGAGE LENDERS

- CEDARTOWN GEORGIA CO OP MORTGAGE LENDERS

- CENTERVILLE GEORGIA CO OP MORTGAGE LENDERS

- CENTRALHATCHEE GEORGIA CO OP MORTGAGE LENDERS

- CHAMBLEE GEORGIA CO OP MORTGAGE LENDERS

- CHATSWORTH GEORGIA CO OP MORTGAGE LENDERS

- CHATTAHOOCHEE HILLS GEORGIA CO OP MORTGAGE LENDERS

- CHAUNCEY GEORGIA CO OP MORTGAGE LENDERS

- CHESTER GEORGIA CO OP MORTGAGE LENDERS

- CHICKAMAUGA GEORGIA CO OP MORTGAGE LENDERS

- CLARKESVILLE GEORGIA CO OP MORTGAGE LENDERS

- CLARKSTON GEORGIA CO OP MORTGAGE LENDERS

- CLAXTON GEORGIA CO OP MORTGAGE LENDERS

- CLAYTON GEORGIA CO OP MORTGAGE LENDERS

- CLERMONT GEORGIA CO OP MORTGAGE LENDERS

- CLEVELAND GEORGIA CO OP MORTGAGE LENDERS

- CLIMAX GEORGIA CO OP MORTGAGE LENDERS

- COBBTOWN GEORGIA CO OP MORTGAGE LENDERS

- COCHRAN GEORGIA CO OP MORTGAGE LENDERS

- COHUTTA GEORGIA CO OP MORTGAGE LENDERS

- COLBERT GEORGIA CO OP MORTGAGE LENDERS

- COLLEGE PARK GEORGIA CO OP MORTGAGE LENDERS

- COLLINS GEORGIA CO OP MORTGAGE LENDERS

- COLQUITT GEORGIA CO OP MORTGAGE LENDERS

- COLUMBUS GEORGIA CO OP MORTGAGE LENDERS

- COMER GEORGIA CO OP MORTGAGE LENDERS

- COMMERCE GEORGIA CO OP MORTGAGE LENDERS

- CONCORD GEORGIA CO OP MORTGAGE LENDERS

- CONYERS GEORGIA CO OP MORTGAGE LENDERS

- COOLIDGE GEORGIA CO OP MORTGAGE LENDERS

- CORDELE GEORGIA CO OP MORTGAGE LENDERS

- CORNELIA GEORGIA CO OP MORTGAGE LENDERS

- COVINGTON GEORGIA CO OP MORTGAGE LENDERS

- CRAWFORD GEORGIA CO OP MORTGAGE LENDERS

- CRAWFORDVILLE GEORGIA CO OP MORTGAGE LENDERS

- CULLODEN GEORGIA CO OP MORTGAGE LENDERS

- CUMMING GEORGIA CO OP MORTGAGE LENDERS

- CUSSETA GEORGIA CO OP MORTGAGE LENDERS

- CUTHBERT GEORGIA CO OP MORTGAGE LENDERS

- DACULA GEORGIA CO OP MORTGAGE LENDERS

- DAHLONEGA GEORGIA CO OP MORTGAGE LENDERS

- DALLAS GEORGIA CO OP MORTGAGE LENDERS

- DALTON GEORGIA CO OP MORTGAGE LENDERS

- DAMASCUS GEORGIA CO OP MORTGAGE LENDERS

- DANIELSVILLE GEORGIA CO OP MORTGAGE LENDERS

- DANVILLE GEORGIA CO OP MORTGAGE LENDERS

- DARIEN GEORGIA CO OP MORTGAGE LENDERS

- DASHER GEORGIA CO OP MORTGAGE LENDERS

- DAVISBORO GEORGIA CO OP MORTGAGE LENDERS

- DAWSON GEORGIA CO OP MORTGAGE LENDERS

- DAWSONVILLE GEORGIA CO OP MORTGAGE LENDERS

- DE SOTO GEORGIA CO OP MORTGAGE LENDERS

- DEARING GEORGIA CO OP MORTGAGE LENDERS

- DECATUR GEORGIA CO OP MORTGAGE LENDERS

- DEEPSTEP GEORGIA CO OP MORTGAGE LENDERS

- DEMOREST GEORGIA CO OP MORTGAGE LENDERS

- DEXTER GEORGIA CO OP MORTGAGE LENDERS

- DILLARD GEORGIA CO OP MORTGAGE LENDERS

- DOERUN GEORGIA CO OP MORTGAGE LENDERS

- DONALSONVILLE GEORGIA CO OP MORTGAGE LENDERS

- DOOLING GEORGIA CO OP MORTGAGE LENDERS

- DORAVILLE GEORGIA CO OP MORTGAGE LENDERS

- DOUGLAS GEORGIA CO OP MORTGAGE LENDERS

- DOUGLASVILLE GEORGIA CO OP MORTGAGE LENDERS

- DU PONT GEORGIA CO OP MORTGAGE LENDERS

- DUBLIN GEORGIA CO OP MORTGAGE LENDERS

- DUDLEY GEORGIA CO OP MORTGAGE LENDERS

- DULUTH GEORGIA CO OP MORTGAGE LENDERS

- DUNWOODY GEORGIA CO OP MORTGAGE LENDERS

- EAST DUBLIN GEORGIA CO OP MORTGAGE LENDERS

- EAST ELLIJAY GEORGIA CO OP MORTGAGE LENDERS

- EAST POINT GEORGIA CO OP MORTGAGE LENDERS

- EASTMAN GEORGIA CO OP MORTGAGE LENDERS

- EATONTON GEORGIA CO OP MORTGAGE LENDERS

- EDGE HILL GEORGIA CO OP MORTGAGE LENDERS

- EDISON GEORGIA CO OP MORTGAGE LENDERS

- ELBERTON GEORGIA CO OP MORTGAGE LENDERS

- ELLAVILLE GEORGIA CO OP MORTGAGE LENDERS

- ELLENTON GEORGIA CO OP MORTGAGE LENDERS

- ELLIJAY GEORGIA CO OP MORTGAGE LENDERS

- EMERSON GEORGIA CO OP MORTGAGE LENDERS

- ENIGMA GEORGIA CO OP MORTGAGE LENDERS

- EPHESUS GEORGIA CO OP MORTGAGE LENDERS

- ETON GEORGIA CO OP MORTGAGE LENDERS

- EUHARLEE GEORGIA CO OP MORTGAGE LENDERS

- FAIRBURN GEORGIA CO OP MORTGAGE LENDERS

- FAIRMOUNT GEORGIA CO OP MORTGAGE LENDERS

- FARGO GEORGIA CO OP MORTGAGE LENDERS

- FAYETTEVILLE GEORGIA CO OP MORTGAGE LENDERS

- FITZGERALD GEORGIA CO OP MORTGAGE LENDERS

- FLEMINGTON GEORGIA CO OP MORTGAGE LENDERS

- FLOVILLA GEORGIA CO OP MORTGAGE LENDERS

- FLOWERY BRANCH GEORGIA CO OP MORTGAGE LENDERS

- FOLKSTON GEORGIA CO OP MORTGAGE LENDERS

- FOREST PARK GEORGIA CO OP MORTGAGE LENDERS

- FORSYTH GEORGIA CO OP MORTGAGE LENDERS

- FORT GAINES GEORGIA CO OP MORTGAGE LENDERS

- FORT OGLETHORPE GEORGIA CO OP MORTGAGE LENDERS

- FORT VALLEY GEORGIA CO OP MORTGAGE LENDERS

- FRANKLIN GEORGIA CO OP MORTGAGE LENDERS

- FRANKLIN SPRINGS GEORGIA CO OP MORTGAGE LENDERS

- FUNSTON GEORGIA CO OP MORTGAGE LENDERS

- GAINESVILLE GEORGIA CO OP MORTGAGE LENDERS

- GARDEN CITY GEORGIA CO OP MORTGAGE LENDERS

- GARFIELD GEORGIA CO OP MORTGAGE LENDERS

- GAY GEORGIA CO OP MORTGAGE LENDERS

- GENEVA GEORGIA CO OP MORTGAGE LENDERS

- GEORGETOWN GEORGIA CO OP MORTGAGE LENDERS

- GIBSON GEORGIA CO OP MORTGAGE LENDERS

- GILLSVILLE GEORGIA CO OP MORTGAGE LENDERS

- GIRARD GEORGIA CO OP MORTGAGE LENDERS

- GLENNVILLE GEORGIA CO OP MORTGAGE LENDERS

- GLENWOOD GEORGIA CO OP MORTGAGE LENDERS

- GOOD HOPE GEORGIA CO OP MORTGAGE LENDERS

- GORDON GEORGIA CO OP MORTGAGE LENDERS

- GRAHAM GEORGIA CO OP MORTGAGE LENDERS

- GRANTVILLE GEORGIA CO OP MORTGAGE LENDERS

- GRAY GEORGIA CO OP MORTGAGE LENDERS

- GRAYSON GEORGIA CO OP MORTGAGE LENDERS

- GREENSBORO GEORGIA CO OP MORTGAGE LENDERS

- GREENVILLE GEORGIA CO OP MORTGAGE LENDERS

- GRIFFIN GEORGIA CO OP MORTGAGE LENDERS

- GROVETOWN GEORGIA CO OP MORTGAGE LENDERS

- GUMBRANCH GEORGIA CO OP MORTGAGE LENDERS

- GUYTON GEORGIA CO OP MORTGAGE LENDERS

- HAGAN GEORGIA CO OP MORTGAGE LENDERS

- HAHIRA GEORGIA CO OP MORTGAGE LENDERS

- HAMILTON GEORGIA CO OP MORTGAGE LENDERS

- HAMPTON GEORGIA CO OP MORTGAGE LENDERS

- HAPEVILLE GEORGIA CO OP MORTGAGE LENDERS

- HARALSON GEORGIA CO OP MORTGAGE LENDERS

- HARLEM GEORGIA CO OP MORTGAGE LENDERS

- HARRISON GEORGIA CO OP MORTGAGE LENDERS

- HARTWELL GEORGIA CO OP MORTGAGE LENDERS

- HAWKINSVILLE GEORGIA CO OP MORTGAGE LENDERS

- HAZLEHURST GEORGIA CO OP MORTGAGE LENDERS

- HELEN GEORGIA CO OP MORTGAGE LENDERS

- HEPHZIBAH GEORGIA CO OP MORTGAGE LENDERS

- HIAWASSEE GEORGIA CO OP MORTGAGE LENDERS

- HIGGSTON GEORGIA CO OP MORTGAGE LENDERS

- HILTONIA GEORGIA CO OP MORTGAGE LENDERS

- HINESVILLE GEORGIA CO OP MORTGAGE LENDERS

- HIRAM GEORGIA CO OP MORTGAGE LENDERS

- HOBOKEN GEORGIA CO OP MORTGAGE LENDERS

- HOGANSVILLE GEORGIA CO OP MORTGAGE LENDERS

- HOLLY SPRINGS GEORGIA CO OP MORTGAGE LENDERS

- HOMELAND GEORGIA CO OP MORTGAGE LENDERS

- HOMER GEORGIA CO OP MORTGAGE LENDERS

- HOMERVILLE GEORGIA CO OP MORTGAGE LENDERS

- HOSCHTON GEORGIA CO OP MORTGAGE LENDERS

- HULL GEORGIA CO OP MORTGAGE LENDERS

- IDEAL GEORGIA CO OP MORTGAGE LENDERS

- ILA GEORGIA CO OP MORTGAGE LENDERS

- IRON CITY GEORGIA CO OP MORTGAGE LENDERS

- IRWINTON GEORGIA CO OP MORTGAGE LENDERS

- IVEY GEORGIA CO OP MORTGAGE LENDERS

- JACKSON GEORGIA CO OP MORTGAGE LENDERS

- JACKSONVILLE GEORGIA CO OP MORTGAGE LENDERS

- JAKIN GEORGIA CO OP MORTGAGE LENDERS

- JASPER GEORGIA CO OP MORTGAGE LENDERS

- JEFFERSON GEORGIA CO OP MORTGAGE LENDERS

- JEFFERSONVILLE GEORGIA CO OP MORTGAGE LENDERS

- JENKINSBURG GEORGIA CO OP MORTGAGE LENDERS

- JERSEY GEORGIA CO OP MORTGAGE LENDERS

- JESUP GEORGIA CO OP MORTGAGE LENDERS

- JOHNS CREEK GEORGIA CO OP MORTGAGE LENDERS

- JONESBORO GEORGIA CO OP MORTGAGE LENDERS

- JUNCTION CITY GEORGIA CO OP MORTGAGE LENDERS

- KENNESAW GEORGIA CO OP MORTGAGE LENDERS

- KEYSVILLE GEORGIA CO OP MORTGAGE LENDERS

- KINGSLAND GEORGIA CO OP MORTGAGE LENDERS

- KINGSTON GEORGIA CO OP MORTGAGE LENDERS

- KITE GEORGIA CO OP MORTGAGE LENDERS

- LAFAYETTE GEORGIA CO OP MORTGAGE LENDERS

- LAGRANGE GEORGIA CO OP MORTGAGE LENDERS

- LAKE CITY GEORGIA CO OP MORTGAGE LENDERS

- LAKE PARK GEORGIA CO OP MORTGAGE LENDERS

- LAKELAND GEORGIA CO OP MORTGAGE LENDERS

- LAVONIA GEORGIA CO OP MORTGAGE LENDERS

- LAWRENCEVILLE GEORGIA CO OP MORTGAGE LENDERS

- LEARY GEORGIA CO OP MORTGAGE LENDERS

- LEESBURG GEORGIA CO OP MORTGAGE LENDERS

- LENOX GEORGIA CO OP MORTGAGE LENDERS

- LESLIE GEORGIA CO OP MORTGAGE LENDERS

- LEXINGTON GEORGIA CO OP MORTGAGE LENDERS

- LILBURN GEORGIA CO OP MORTGAGE LENDERS

- LILLY GEORGIA CO OP MORTGAGE LENDERS

- LINCOLNTON GEORGIA CO OP MORTGAGE LENDERS

- LITHONIA GEORGIA CO OP MORTGAGE LENDERS

- LOCUST GROVE GEORGIA CO OP MORTGAGE LENDERS

- LOGANVILLE GEORGIA CO OP MORTGAGE LENDERS

- LONE OAK GEORGIA CO OP MORTGAGE LENDERS

- LOOKOUT MOUNTAIN GEORGIA CO OP MORTGAGE LENDERS

- LOUISVILLE GEORGIA CO OP MORTGAGE LENDERS

- LOVEJOY GEORGIA CO OP MORTGAGE LENDERS

- LUDOWICI GEORGIA CO OP MORTGAGE LENDERS

- LULA GEORGIA CO OP MORTGAGE LENDERS

- LUMBER CITY GEORGIA CO OP MORTGAGE LENDERS

- LUMPKIN GEORGIA CO OP MORTGAGE LENDERS

- LUTHERSVILLE GEORGIA CO OP MORTGAGE LENDERS

- LYERLY GEORGIA CO OP MORTGAGE LENDERS

- LYONS GEORGIA CO OP MORTGAGE LENDERS

- MACON GEORGIA CO OP MORTGAGE LENDERS

- MADISON GEORGIA CO OP MORTGAGE LENDERS

- MANASSAS GEORGIA CO OP MORTGAGE LENDERS

- MANCHESTER GEORGIA CO OP MORTGAGE LENDERS

- MANSFIELD GEORGIA CO OP MORTGAGE LENDERS

- MARIETTA GEORGIA CO OP MORTGAGE LENDERS

- MARSHALLVILLE GEORGIA CO OP MORTGAGE LENDERS

- MARTIN GEORGIA CO OP MORTGAGE LENDERS

- MAXEYS GEORGIA CO OP MORTGAGE LENDERS

- MAYSVILLE GEORGIA CO OP MORTGAGE LENDERS

- MCCAYSVILLE GEORGIA CO OP MORTGAGE LENDERS

- MCDONOUGH GEORGIA CO OP MORTGAGE LENDERS

- MCINTYRE GEORGIA CO OP MORTGAGE LENDERS

- MCRAE-HELENA GEORGIA CO OP MORTGAGE LENDERS

- MEANSVILLE GEORGIA CO OP MORTGAGE LENDERS

- MEIGS GEORGIA CO OP MORTGAGE LENDERS

- MENLO GEORGIA CO OP MORTGAGE LENDERS

- METTER GEORGIA CO OP MORTGAGE LENDERS

- MIDVILLE GEORGIA CO OP MORTGAGE LENDERS

- MIDWAY GEORGIA CO OP MORTGAGE LENDERS

- MILAN GEORGIA CO OP MORTGAGE LENDERS

- MILLEDGEVILLE GEORGIA CO OP MORTGAGE LENDERS

- MILLEN GEORGIA CO OP MORTGAGE LENDERS

- MILNER GEORGIA CO OP MORTGAGE LENDERS

- MILTON GEORGIA CO OP MORTGAGE LENDERS

- MITCHELL GEORGIA CO OP MORTGAGE LENDERS

- MOLENA GEORGIA CO OP MORTGAGE LENDERS

- MONROE GEORGIA CO OP MORTGAGE LENDERS

- MONTEZUMA GEORGIA CO OP MORTGAGE LENDERS

- MONTICELLO GEORGIA CO OP MORTGAGE LENDERS

- MONTROSE GEORGIA CO OP MORTGAGE LENDERS

- MORELAND GEORGIA CO OP MORTGAGE LENDERS

- MORGAN GEORGIA CO OP MORTGAGE LENDERS

- MORGANTON GEORGIA CO OP MORTGAGE LENDERS

- MORROW GEORGIA CO OP MORTGAGE LENDERS

- MORVEN GEORGIA CO OP MORTGAGE LENDERS

- MOULTRIE GEORGIA CO OP MORTGAGE LENDERS

- MOUNT AIRY GEORGIA CO OP MORTGAGE LENDERS

- MOUNT VERNON GEORGIA CO OP MORTGAGE LENDERS

- MOUNT ZION GEORGIA CO OP MORTGAGE LENDERS

- MOUNTAIN CITY GEORGIA CO OP MORTGAGE LENDERS

- MOUNTAIN PARK GEORGIA CO OP MORTGAGE LENDERS

- NAHUNTA GEORGIA CO OP MORTGAGE LENDERS

- NASHVILLE GEORGIA CO OP MORTGAGE LENDERS

- NELSON GEORGIA CO OP MORTGAGE LENDERS

- NEWBORN GEORGIA CO OP MORTGAGE LENDERS

- NEWINGTON GEORGIA CO OP MORTGAGE LENDERS

- NEWNAN GEORGIA CO OP MORTGAGE LENDERS

- NEWTON GEORGIA CO OP MORTGAGE LENDERS

- NICHOLLS GEORGIA CO OP MORTGAGE LENDERS

- NICHOLSON GEORGIA CO OP MORTGAGE LENDERS

- NORCROSS GEORGIA CO OP MORTGAGE LENDERS

- NORMAN PARK GEORGIA CO OP MORTGAGE LENDERS

- NORTH HIGH SHOALS GEORGIA CO OP MORTGAGE LENDERS

- NORWOOD GEORGIA CO OP MORTGAGE LENDERS

- OAK PARK GEORGIA CO OP MORTGAGE LENDERS

- OAKWOOD GEORGIA CO OP MORTGAGE LENDERS

- OCHLOCKNEE GEORGIA CO OP MORTGAGE LENDERS

- OCILLA GEORGIA CO OP MORTGAGE LENDERS

- OCONEE GEORGIA CO OP MORTGAGE LENDERS

- ODUM GEORGIA CO OP MORTGAGE LENDERS

- OFFERMAN GEORGIA CO OP MORTGAGE LENDERS

- OGLETHORPE GEORGIA CO OP MORTGAGE LENDERS

- OLIVER GEORGIA CO OP MORTGAGE LENDERS

- OMEGA GEORGIA CO OP MORTGAGE LENDERS

- ORCHARD HILL GEORGIA CO OP MORTGAGE LENDERS

- OXFORD GEORGIA CO OP MORTGAGE LENDERS

- PALMETTO GEORGIA CO OP MORTGAGE LENDERS

- PARROTT GEORGIA CO OP MORTGAGE LENDERS

- PATTERSON GEORGIA CO OP MORTGAGE LENDERS

- PAVO GEORGIA CO OP MORTGAGE LENDERS

- PAYNE CITY GEORGIA CO OP MORTGAGE LENDERS

- PEACHTREE CITY GEORGIA CO OP MORTGAGE LENDERS

- PEACHTREE CORNERS GEORGIA CO OP MORTGAGE LENDERS

- PEARSON GEORGIA CO OP MORTGAGE LENDERS

- PELHAM GEORGIA CO OP MORTGAGE LENDERS

- PEMBROKE GEORGIA CO OP MORTGAGE LENDERS

- PENDERGRASS GEORGIA CO OP MORTGAGE LENDERS

- PERRY GEORGIA CO OP MORTGAGE LENDERS

- PINE LAKE GEORGIA CO OP MORTGAGE LENDERS

- PINE MOUNTAIN GEORGIA CO OP MORTGAGE LENDERS

- PINEHURST GEORGIA CO OP MORTGAGE LENDERS

- PINEVIEW GEORGIA CO OP MORTGAGE LENDERS

- PITTS GEORGIA CO OP MORTGAGE LENDERS

- PLAINS GEORGIA CO OP MORTGAGE LENDERS

- PLAINVILLE GEORGIA CO OP MORTGAGE LENDERS

- POOLER GEORGIA CO OP MORTGAGE LENDERS

- PORT WENTWORTH GEORGIA CO OP MORTGAGE LENDERS

- PORTAL GEORGIA CO OP MORTGAGE LENDERS

- PORTERDALE GEORGIA CO OP MORTGAGE LENDERS

- POULAN GEORGIA CO OP MORTGAGE LENDERS

- POWDER SPRINGS GEORGIA CO OP MORTGAGE LENDERS

- PRESTON GEORGIA CO OP MORTGAGE LENDERS

- PULASKI GEORGIA CO OP MORTGAGE LENDERS

- QUITMAN GEORGIA CO OP MORTGAGE LENDERS

- RANGER GEORGIA CO OP MORTGAGE LENDERS

- RAY CITY GEORGIA CO OP MORTGAGE LENDERS

- RAYLE GEORGIA CO OP MORTGAGE LENDERS

- REBECCA GEORGIA CO OP MORTGAGE LENDERS

- REGISTER GEORGIA CO OP MORTGAGE LENDERS

- REIDSVILLE GEORGIA CO OP MORTGAGE LENDERS

- REMERTON GEORGIA CO OP MORTGAGE LENDERS

- RENTZ GEORGIA CO OP MORTGAGE LENDERS

- RESACA GEORGIA CO OP MORTGAGE LENDERS

- REYNOLDS GEORGIA CO OP MORTGAGE LENDERS

- RHINE GEORGIA CO OP MORTGAGE LENDERS

- RICEBORO GEORGIA CO OP MORTGAGE LENDERS

- RICHLAND GEORGIA CO OP MORTGAGE LENDERS

- RICHMOND HILL GEORGIA CO OP MORTGAGE LENDERS

- RIDDLEVILLE GEORGIA CO OP MORTGAGE LENDERS

- RINCON GEORGIA CO OP MORTGAGE LENDERS

- RINGGOLD GEORGIA CO OP MORTGAGE LENDERS

- RIVERDALE GEORGIA CO OP MORTGAGE LENDERS

- RIVERSIDE GEORGIA CO OP MORTGAGE LENDERS

- ROBERTA GEORGIA CO OP MORTGAGE LENDERS

- ROCHELLE GEORGIA CO OP MORTGAGE LENDERS

- ROCKMART GEORGIA CO OP MORTGAGE LENDERS

- ROCKY FORD GEORGIA CO OP MORTGAGE LENDERS

- ROME GEORGIA CO OP MORTGAGE LENDERS

- ROSSVILLE GEORGIA CO OP MORTGAGE LENDERS

- ROSWELL GEORGIA CO OP MORTGAGE LENDERS

- ROYSTON GEORGIA CO OP MORTGAGE LENDERS

- RUTLEDGE GEORGIA CO OP MORTGAGE LENDERS

- SALE CITY GEORGIA CO OP MORTGAGE LENDERS

- SANDERSVILLE GEORGIA CO OP MORTGAGE LENDERS

- SANDY SPRINGS GEORGIA CO OP MORTGAGE LENDERS

- SANTA CLAUS GEORGIA CO OP MORTGAGE LENDERS

- SARDIS GEORGIA CO OP MORTGAGE LENDERS

- SASSER GEORGIA CO OP MORTGAGE LENDERS

- SAVANNAH GEORGIA CO OP MORTGAGE LENDERS

- SCOTLAND GEORGIA CO OP MORTGAGE LENDERS

- SCREVEN GEORGIA CO OP MORTGAGE LENDERS

- SENOIA GEORGIA CO OP MORTGAGE LENDERS

- SHADY DALE GEORGIA CO OP MORTGAGE LENDERS

- SHARON GEORGIA CO OP MORTGAGE LENDERS

- SHARPSBURG GEORGIA CO OP MORTGAGE LENDERS

- SHELLMAN GEORGIA CO OP MORTGAGE LENDERS

- SHILOH GEORGIA CO OP MORTGAGE LENDERS

- SILOAM GEORGIA CO OP MORTGAGE LENDERS

- SKY VALLEY GEORGIA CO OP MORTGAGE LENDERS

- SMITHVILLE GEORGIA CO OP MORTGAGE LENDERS

- SMYRNA GEORGIA CO OP MORTGAGE LENDERS

- SNELLVILLE GEORGIA CO OP MORTGAGE LENDERS

- SOCIAL CIRCLE GEORGIA CO OP MORTGAGE LENDERS

- SOPERTON GEORGIA CO OP MORTGAGE LENDERS

- SPARKS GEORGIA CO OP MORTGAGE LENDERS

- SPARTA GEORGIA CO OP MORTGAGE LENDERS

- SPRINGFIELD GEORGIA CO OP MORTGAGE LENDERS

- ST. MARYS GEORGIA CO OP MORTGAGE LENDERS

- STAPLETON GEORGIA CO OP MORTGAGE LENDERS

- STATENVILLE GEORGIA CO OP MORTGAGE LENDERS

- STATESBORO GEORGIA CO OP MORTGAGE LENDERS

- STATHAM GEORGIA CO OP MORTGAGE LENDERS

- STILLMORE GEORGIA CO OP MORTGAGE LENDERS

- STOCKBRIDGE GEORGIA CO OP MORTGAGE LENDERS

- STONE MOUNTAIN GEORGIA CO OP MORTGAGE LENDERS

- SUGAR HILL GEORGIA CO OP MORTGAGE LENDERS

- SUMMERVILLE GEORGIA CO OP MORTGAGE LENDERS

- SUMNER GEORGIA CO OP MORTGAGE LENDERS

- SURRENCY GEORGIA CO OP MORTGAGE LENDERS

- SUWANEE GEORGIA CO OP MORTGAGE LENDERS

- SWAINSBORO GEORGIA CO OP MORTGAGE LENDERS

- SYCAMORE GEORGIA CO OP MORTGAGE LENDERS

- SYLVANIA GEORGIA CO OP MORTGAGE LENDERS

- SYLVESTER GEORGIA CO OP MORTGAGE LENDERS

- TALBOTTON GEORGIA CO OP MORTGAGE LENDERS

- TALKING ROCK GEORGIA CO OP MORTGAGE LENDERS

- TALLAPOOSA GEORGIA CO OP MORTGAGE LENDERS

- TALLULAH FALLS GEORGIA CO OP MORTGAGE LENDERS

- TALMO GEORGIA CO OP MORTGAGE LENDERS

- TARRYTOWN GEORGIA CO OP MORTGAGE LENDERS

- TAYLORSVILLE GEORGIA CO OP MORTGAGE LENDERS

- TEMPLE GEORGIA CO OP MORTGAGE LENDERS

- TENNILLE GEORGIA CO OP MORTGAGE LENDERS

- THOMASTON GEORGIA CO OP MORTGAGE LENDERS

- THOMASVILLE GEORGIA CO OP MORTGAGE LENDERS

- THOMSON GEORGIA CO OP MORTGAGE LENDERS

- THUNDERBOLT GEORGIA CO OP MORTGAGE LENDERS

- TIFTON GEORGIA CO OP MORTGAGE LENDERS

- TIGNALL GEORGIA CO OP MORTGAGE LENDERS

- TOCCOA GEORGIA CO OP MORTGAGE LENDERS

- TOOMSBORO GEORGIA CO OP MORTGAGE LENDERS

- TRENTON GEORGIA CO OP MORTGAGE LENDERS

- TRION GEORGIA CO OP MORTGAGE LENDERS

- TUNNEL HILL GEORGIA CO OP MORTGAGE LENDERS

- TURIN GEORGIA CO OP MORTGAGE LENDERS

- TWIN CITY GEORGIA CO OP MORTGAGE LENDERS

- TY TY GEORGIA CO OP MORTGAGE LENDERS

- TYBEE ISLAND GEORGIA CO OP MORTGAGE LENDERS

- TYRONE GEORGIA CO OP MORTGAGE LENDERS

- UNADILLA GEORGIA CO OP MORTGAGE LENDERS

- UNION CITY GEORGIA CO OP MORTGAGE LENDERS

- UNION POINT GEORGIA CO OP MORTGAGE LENDERS

- UVALDA GEORGIA CO OP MORTGAGE LENDERS

- VALDOSTA GEORGIA CO OP MORTGAGE LENDERS

- VARNELL GEORGIA CO OP MORTGAGE LENDERS

- VERNONBURG GEORGIA CO OP MORTGAGE LENDERS

- VIDALIA GEORGIA CO OP MORTGAGE LENDERS

- VIENNA GEORGIA CO OP MORTGAGE LENDERS

- VILLA RICA GEORGIA CO OP MORTGAGE LENDERS