- STATED GA MORTGAGE LENDERS+STATED GA HOME LOANS

- Stated Income Georgia Mortgage Lenders+ Fast & Easy Approvals!

- STATED INCOME – Georgia Mortgage Lenders

- 10% DOWN-STATED INCOME GEORGIA MORTGAGE LENDERS

- Self Employed Georgia Mortgage Lenders

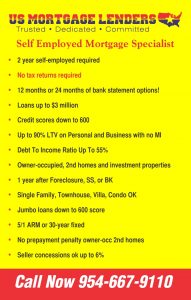

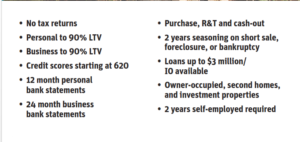

Bank Statement loans for self-employed borrowers who cannot qualify for a traditional bank loan because of business expenses. Self-employed Georgia mortgage Lenders are perfect because while most Georgia self-employed borrowers earn a solid income, they show a smaller net income on their tax returns. Our Georgia mortgage team is well-versed in these bank statement only loans and placing the borrowers where they can get the optimal loan to fit their needs

Self Employed Georgia Bank Statment Lenders Summary

Georgia Self Employed Advantages Include

About Georgia Self Employed Mortgage Lenders

If you’re one of the 1000’s of Georgia self-employed workers that write off to much income to qualify for a Georgia mortgage? it is now easier than ever to be self-employed get approved for a Georgia mortgage if you are self-employed and have sufficient income and payment history you can now qualify for a bank statement only Georgia mortgage. Fannie Mae has relaxed some of their guidelines for documenting self-employed income. Even today Georgia self-employed mortgage applicants are having trouble betting approve for their Georgia dream home. Here we have provided the much-needed information to help you get approved for a self-employed mortgage loan using bank statements only to document your income and ability to make the Georgia mortgage payments.

How Long Must You Be Self Employed in Georgia To Qualify?

Most Georgia mortgage lenders that provide self-employed mortgage loans want to see proof of at least 2 years business history. Some Georgia self-employed mortgage lenders only require 12 months personal bank statements but still want proof of stability for at least 2 years. For self-employed Georgia business owners using business bank statements 24 months business bank statements are required and a Georgia profit and loss statement signed by the Georgia business. NO Tax Returns Needed!

SELF EMPLOYED Georgia MORTGAGE APPLICANTS CAN NOW QUALIFY FOR LESS THAN 2 YEARS SELF EMPLOYED!Here’s more good news for our Self Employed Mortgage Applicants! Self Employed Georgia Mortgage Lenders Home Loans, Inc. may be able to approve your self-employed borrowers, even those with a history with less than two years of self-employment. These applicants may qualify for our Fresh Start, Homeowner’s Access and Premier Access products. When qualifying these borrowers, our underwriters look for:

|

Self Employed Income Using Tax Returns Make it Hard To Qualify

A borrower’s income is still probably the single most important factor in qualifying for a Georgia mortgage. For traditional Georgia mortgage lenders to know what you earn, they will want to see at least the last two-years of a self-employed borrower’s Schedule C from an IRS Form 1040. Schedule C is the tax form that represents the income or loss from your Georgia business. If income increases between year one and year two, Georgia mortgage lenders will take an average of the two years. However, if the second year’s most recent income is lower than the first year, Georgia mortgage lenders are required to use the lower number. With our bank statement only mortgage program this is not an issue because the lender will add u p your most recent 12 or 24 months bank statements and average out your income.

Self Employed Georgia Mortgage Loans

If you’re going to mortgage your Georgia home purchase with traditional financing that is conforming to Fannie Mae and Freddie Mac guidelines you will be required to fully document your self-employment income via adjusted income on your 1040 tax returns. It is standard that Fannie Mae will want a full 2 years worth of tax returns to document your net income after expenses. For many Georgia self-employed mortgage applicants to provide this requirement can be difficult for self-employed Georgia business owners.

If you’re purchasing a new Georgia home or refinancing your existing Georgia mortgage there is a specific process Georgia self-employed must go through to get approved for a Georgia mortgage. Under the old guidelines, self-employed works had difficulty qualifying based on proof of income. This happens for a variety of reasons including how a business is structured most importantly how much income you write off as a self-employed Georgia mortgage applicant.

Georgia self-employed workers have no history of paychecks that can be documented because the employer usually pays the w2 employee expenses. They take may take distributions with no regular amount or frequency making qualifying based on income difficult even with bank statements and tax returns. If your business is new and you don’t have documented sources of revenue or even two years of federal tax returns this can make qualifying for a traditional mortgage difficult, if not impossible.

If you have a history of paying yourself from your Georgia business, Fannie Mae’s guidelines state that your business only needs to have adequate income to support your future distributions. Most Georgia mortgage lenders will require documentation that your Georgia business is legitimate and stable. This could be provided in the form of your letters of incorporation or the K-1 filing which highlights your percent Georgia business ownership.

The underwriting process is still going to be more complicated for Georgia self-employed mortgage applicants. Fannie Mae and Freddie Mac have similar processes to verify income from Georgia self-employment.These requirements follow the ability to repay guidelines to ensure that you have adequate income from Georgia business owners ability to repay the loan. Georgia mortgage lenders adhere strictly to these guidelines so that the loans can be sold to Fannie Mae and Freddie Mac.

If you don’t have two years of business tax returns the guidelines you may be able to qualify for a bank statement program using your personal bank statements as an alternative to a conventional mortgage. These types of programs are available from boutique portfolio lenders and offer reasonable rates and fees.

Roadblocks for Georgia Self Employed Mortgage Applicants

The most common roadblock Georgia self-employed workers face is proving how much your net income is from the business based on tax returns and deductions. Georgia self-employed mortgage applicants may have significant cash flow in your business but could be in for a shock when you learn your qualified net income based on tax write-offs and expenses for your business. If you cannot demonstrate sufficient net income from your business it still may be possible to qualify for a bank statement program using income on your personal statements.

Georgia Business Tax Deductions Lower Documented Income

Running a business as a self-employed worker can be very expensive and often comes with significant tax liability. The temptation can be to lower your taxable income with deductions. These deductions include business expenses for things like equipment, expense accounts, and annual depreciation.

Taking business deductions may save you money on your taxes but it could make it more difficult to qualify for a mortgage. As a self-employed worker, you are qualified for a mortgage based on your net income, not gross income for a traditional worker.

Most self-employed business owners claim as many tax deductions as the law allows which significantly lowers your net income and therefore your ability to qualify for self-employed home loans.

Debt to Income Ratio for the Georgia Self Employed

Maintaining a low debt to income ratio is important in qualifying for any mortgage loan. As a self-employed worker, your debt to income ratio is calculated differently from traditional workers.

Your debt ratio is calculated by your average net income from the most recent tax returns along with current year income and expenses. In order to be approved for a self-employment mortgage, your debt-to-income ratio cannot be more than 43 percent.

If you’re considering purchasing a new home or refinancing your existing mortgage you might want to consider taking fewer tax deductions to reduce your debt-to-income rate with the highest possible net income.

Georgia Mortgage Documentation Makes a Difference

The loan process you’ll go through as a self-employed business owner is the same as everyone else. Where it gets sticky is providing your income documentation. The more you have to prove that business income is sustainable and able to pay the easier the process becomes to qualify as a self-employed Georgia business owner.

Keeping accurate records of income and expenses will make it easier to prove that you are a sustainable business as well as documenting net income which is required for maintaining a favorable debt ratio.

Mortgages for Georgia Self Employed Business Owners

Georgia Mortgage lenders generally consider self-employed business owners to be higher risk than those who work for a traditional paycheck. Higher risk Self-employed Georgia business owners pay more at closing and over the life the loan with higher interest rates. If you’re accepting a higher interest rate when you purchase your Georgia home you may be able to lower that rate down the road by demonstrating a reliable payment history and refinancing.

How You Structure Your Georgia Business Matters

There are several different ways to be self-employed and underwriters treat them all differently. The most common business structures include sole proprietorship, partnerships, LLCs and S corporations.

Under a sole proprietorship, your business income is reported on schedule c of your tax return. With a partnership profits in the business are split between partners based on their respective percent of ownership. Limited Liability Corporations are considered pass-through entities for tax purposes. S corporations follow strict guidelines for distributions. Depending on how you structure your business you could potentially pay yourself on a w-2 and avoid the hurdles of a self-employed mortgage completely. Your accountant can help you choose the optimal business structure for your company.

No matter how you choose to structure your business there are steps you can take to maximize your income from self-employment and maintain an optimal debt ratio. All of these factors are under you control and are part of maintaining healthy finances as a self-employed worker.

- ABBEVILLE GEORGIA Self Employed MORTGAGE LENDERS

- ACWORTH GEORGIA Self Employed MORTGAGE LENDERS

- ADAIRSVILLE GEORGIA Self Employed MORTGAGE LENDERS

- ADEL GEORGIA Self Employed MORTGAGE LENDERS

- ADRIAN GEORGIA Self Employed MORTGAGE LENDERS

- AILEY GEORGIA Self Employed MORTGAGE LENDERS

- ALAMO GEORGIA Self Employed MORTGAGE LENDERS

- ALAPAHA GEORGIA Self Employed MORTGAGE LENDERS

- ALBANY GEORGIA Self Employed MORTGAGE LENDERS

- ALDORA GEORGIA Self Employed MORTGAGE LENDERS

- ALLENHURST GEORGIA Self Employed MORTGAGE LENDERS

- ALLENTOWN GEORGIA Self Employed MORTGAGE LENDERS

- ALMA GEORGIA Self Employed MORTGAGE LENDERS

- ALPHARETTA GEORGIA Self Employed MORTGAGE LENDERS

- ALSTON GEORGIA Self Employed MORTGAGE LENDERS

- ALTO GEORGIA Self Employed MORTGAGE LENDERS

- AMBROSE GEORGIA Self Employed MORTGAGE LENDERS

- AMERICUS GEORGIA Self Employed MORTGAGE LENDERS

- ANDERSONVILLE GEORGIA Self Employed MORTGAGE LENDERS

- ARABI GEORGIA Self Employed MORTGAGE LENDERS

- ARAGON GEORGIA Self Employed MORTGAGE LENDERS

- ARCADE GEORGIA Self Employed MORTGAGE LENDERS

- ARGYLE GEORGIA Self Employed MORTGAGE LENDERS

- ARLINGTON GEORGIA Self Employed MORTGAGE LENDERS

- ASHBURN GEORGIA Self Employed MORTGAGE LENDERS

- ATHENS GEORGIA Self Employed MORTGAGE LENDERS

- ATLANTA GEORGIA Self Employed MORTGAGE LENDERS

- ATTAPULGUS GEORGIA Self Employed MORTGAGE LENDERS

- AUBURN GEORGIA Self Employed MORTGAGE LENDERS

- AUGUSTA GEORGIA Self Employed MORTGAGE LENDERS

- AUSTELL GEORGIA Self Employed MORTGAGE LENDERS

- AVERA GEORGIA Self Employed MORTGAGE LENDERS

- AVONDALE ESTATES GEORGIA Self Employed MORTGAGE LENDER

- BACONTON GEORGIA Self Employed MORTGAGE LENDERS

- BAINBRIDGE GEORGIA Self Employed MORTGAGE LENDERS

- BALDWIN GEORGIA Self Employed MORTGAGE LENDERS

- BALL GROUND GEORGIA Self Employed MORTGAGE LENDERS

- BARNESVILLE GEORGIA Self Employed MORTGAGE LENDERS

- BARTOW GEORGIA Self Employed MORTGAGE LENDERS

- BARWICK GEORGIA Self Employed MORTGAGE LENDERS

- BAXLEY GEORGIA Self Employed MORTGAGE LENDERS

- BERKELEY LAKE GEORGIA Self Employed MORTGAGE LENDERS

- BERLIN GEORGIA Self Employed MORTGAGE LENDERS

- BETHLEHEM GEORGIA Self Employed MORTGAGE LENDERS

- BISHOP GEORGIA Self Employed MORTGAGE LENDERS

- BLACKSHEAR GEORGIA Self Employed MORTGAGE LENDERS

- BLAIRSVILLE GEORGIA Self Employed MORTGAGE LENDERS

- BLAKELY GEORGIA Self Employed MORTGAGE LENDERS

- BLOOMINGDALE GEORGIA Self Employed MORTGAGE LENDERS

- BLUE RIDGE GEORGIA Self Employed MORTGAGE LENDERS

- BLUFFTON GEORGIA Self Employed MORTGAGE LENDERS

- BLYTHE GEORGIA Self Employed MORTGAGE LENDERS

- BOGART GEORGIA Self Employed MORTGAGE LENDERS

- BOSTON GEORGIA Self Employed MORTGAGE LENDERS

- BOSTWICK GEORGIA Self Employed MORTGAGE LENDERS

- BOWDON GEORGIA Self Employed MORTGAGE LENDERS

- BOWERSVILLE GEORGIA Self Employed MORTGAGE LENDERS

- BOWMAN GEORGIA Self Employed MORTGAGE LENDERS

- BRASELTON GEORGIA Self Employed MORTGAGE LENDERS

- BRASWELL GEORGIA Self Employed MORTGAGE LENDERS

- BREMEN GEORGIA Self Employed MORTGAGE LENDERS

- BRINSON GEORGIA Self Employed MORTGAGE LENDERS

- BRONWOOD GEORGIA Self Employed MORTGAGE LENDERS

- BROOKHAVEN GEORGIA Self Employed MORTGAGE LENDERS

- BROOKLET GEORGIA Self Employed MORTGAGE LENDERS

- BROOKS GEORGIA Self Employed MORTGAGE LENDERS

- BROXTON GEORGIA Self Employed MORTGAGE LENDERS

- BRUNSWICK GEORGIA Self Employed MORTGAGE LENDERS

- BUCHANAN GEORGIA Self Employed MORTGAGE LENDERS

- BUCKHEAD GEORGIA Self Employed MORTGAGE LENDERS

- BUENA VISTA GEORGIA Self Employed MORTGAGE LENDERS

- BUFORD GEORGIA Self Employed MORTGAGE LENDERS

- BUTLER GEORGIA Self Employed MORTGAGE LENDERS

- BYROMVILLE GEORGIA Self Employed MORTGAGE LENDERS

- BYRON GEORGIA Self Employed MORTGAGE LENDERS

- CADWELL GEORGIA Self Employed MORTGAGE LENDERS

- CAIRO GEORGIA Self Employed MORTGAGE LENDERS

- CALHOUN GEORGIA Self Employed MORTGAGE LENDERS

- CAMAK GEORGIA Self Employed MORTGAGE LENDERS

- CAMILLA GEORGIA Self Employed MORTGAGE LENDERS

- CANON GEORGIA Self Employed MORTGAGE LENDERS

- CANTON GEORGIA Self Employed MORTGAGE LENDERS

- CARL GEORGIA Self Employed MORTGAGE LENDERS

- CARLTON GEORGIA Self Employed MORTGAGE LENDERS

- CARNESVILLE GEORGIA Self Employed MORTGAGE LENDERS

- CARROLLTON GEORGIA Self Employed MORTGAGE LENDERS

- CARTERSVILLE GEORGIA Self Employed MORTGAGE LENDERS

- CAVE SPRING GEORGIA Self Employed MORTGAGE LENDERS

- CECIL GEORGIA Self Employed MORTGAGE LENDERS

- CEDARTOWN GEORGIA Self Employed MORTGAGE LENDERS

- CENTERVILLE GEORGIA Self Employed MORTGAGE LENDERS

- CENTRALHATCHEE GEORGIA Self Employed MORTGAGE LENDERS

- CHAMBLEE GEORGIA Self Employed MORTGAGE LENDERS

- CHATSWORTH GEORGIA Self Employed MORTGAGE LENDERS

- CHATTAHOOCHEE HILLS GEORGIA Self Employed MORTGAGE LENDERS

- CHAUNCEY GEORGIA Self Employed MORTGAGE LENDERS

- CHESTER GEORGIA Self Employed MORTGAGE LENDERS

- CHICKAMAUGA GEORGIA Self Employed MORTGAGE LENDERS

- CLARKESVILLE GEORGIA Self Employed MORTGAGE LENDERS

- CLARKSTON GEORGIA Self Employed MORTGAGE LENDERS

- CLAXTON GEORGIA Self Employed MORTGAGE LENDERS

- CLAYTON GEORGIA Self Employed MORTGAGE LENDERS

- CLERMONT GEORGIA Self Employed MORTGAGE LENDERS

- CLEVELAND GEORGIA Self Employed MORTGAGE LENDERS

- CLIMAX GEORGIA Self Employed MORTGAGE LENDERS

- COBBTOWN GEORGIA Self Employed MORTGAGE LENDERS

- COCHRAN GEORGIA Self Employed MORTGAGE LENDERS

- COHUTTA GEORGIA Self Employed MORTGAGE LENDERS

- COLBERT GEORGIA Self Employed MORTGAGE LENDERS

- COLLEGE PARK GEORGIA Self Employed MORTGAGE LENDERS

- COLLINS GEORGIA Self Employed MORTGAGE LENDERS

- COLQUITT GEORGIA Self Employed MORTGAGE LENDERS

- COLUMBUS GEORGIA Self Employed MORTGAGE LENDERS

- COMER GEORGIA Self Employed MORTGAGE LENDERS

- COMMERCE GEORGIA Self Employed MORTGAGE LENDERS

- CONCORD GEORGIA Self Employed MORTGAGE LENDERS

- CONYERS GEORGIA Self Employed MORTGAGE LENDERS

- COOLIDGE GEORGIA Self Employed MORTGAGE LENDERS

- CORDELE GEORGIA Self Employed MORTGAGE LENDERS

- CORNELIA GEORGIA Self Employed MORTGAGE LENDERS

- COVINGTON GEORGIA Self Employed MORTGAGE LENDERS

- CRAWFORD GEORGIA Self Employed MORTGAGE LENDERS

- CRAWFORDVILLE GEORGIA Self Employed MORTGAGE LENDERS

- CULLODEN GEORGIA Self Employed MORTGAGE LENDERS

- CUMMING GEORGIA Self Employed MORTGAGE LENDERS

- CUSSETA GEORGIA Self Employed MORTGAGE LENDERS

- CUTHBERT GEORGIA Self Employed MORTGAGE LENDERS

- DACULA GEORGIA Self Employed MORTGAGE LENDERS

- DAHLONEGA GEORGIA Self Employed MORTGAGE LENDERS

- DALLAS GEORGIA Self Employed MORTGAGE LENDERS

- DALTON GEORGIA Self Employed MORTGAGE LENDERS

- DAMASCUS GEORGIA Self Employed MORTGAGE LENDERS

- DANIELSVILLE GEORGIA Self Employed MORTGAGE LENDERS

- DANVILLE GEORGIA Self Employed MORTGAGE LENDERS

- DARIEN GEORGIA Self Employed MORTGAGE LENDERS

- DASHER GEORGIA Self Employed MORTGAGE LENDERS

- DAVISBORO GEORGIA Self Employed MORTGAGE LENDERS

- DAWSON GEORGIA Self Employed MORTGAGE LENDERS

- DAWSONVILLE GEORGIA Self Employed MORTGAGE LENDERS

- DE SOTO GEORGIA Self Employed MORTGAGE LENDERS

- DEARING GEORGIA Self Employed MORTGAGE LENDERS

- DECATUR GEORGIA Self Employed MORTGAGE LENDERS

- DEEPSTEP GEORGIA Self Employed MORTGAGE LENDERS

- DEMOREST GEORGIA Self Employed MORTGAGE LENDERS

- DEXTER GEORGIA Self Employed MORTGAGE LENDERS

- DILLARD GEORGIA Self Employed MORTGAGE LENDERS

- DOERUN GEORGIA Self Employed MORTGAGE LENDERS

- DONALSONVILLE GEORGIA Self Employed MORTGAGE LENDERS

- DOOLING GEORGIA Self Employed MORTGAGE LENDERS

- DORAVILLE GEORGIA Self Employed MORTGAGE LENDERS

- DOUGLAS GEORGIA Self Employed MORTGAGE LENDERS

- DOUGLASVILLE GEORGIA Self Employed MORTGAGE LENDERS

- DU PONT GEORGIA Self Employed MORTGAGE LENDERS

- DUBLIN GEORGIA Self Employed MORTGAGE LENDERS

- DUDLEY GEORGIA Self Employed MORTGAGE LENDERS

- DULUTH GEORGIA Self Employed MORTGAGE LENDERS

- DUNWOODY GEORGIA Self Employed MORTGAGE LENDERS

- EAST DUBLIN GEORGIA Self Employed MORTGAGE LENDERS

- EAST ELLIJAY GEORGIA Self Employed MORTGAGE LENDERS

- EAST POINT GEORGIA Self Employed MORTGAGE LENDERS

- EASTMAN GEORGIA Self Employed MORTGAGE LENDERS

- EATONTON GEORGIA Self Employed MORTGAGE LENDERS

- EDGE HILL GEORGIA Self Employed MORTGAGE LENDERS

- EDISON GEORGIA Self Employed MORTGAGE LENDERS

- ELBERTON GEORGIA Self Employed MORTGAGE LENDERS

- ELLAVILLE GEORGIA Self Employed MORTGAGE LENDERS

- ELLENTON GEORGIA Self Employed MORTGAGE LENDERS

- ELLIJAY GEORGIA Self Employed MORTGAGE LENDERS

- EMERSON GEORGIA Self Employed MORTGAGE LENDERS

- ENIGMA GEORGIA Self Employed MORTGAGE LENDERS

- EPHESUS GEORGIA Self Employed MORTGAGE LENDERS

- ETON GEORGIA Self Employed MORTGAGE LENDERS

- EUHARLEE GEORGIA Self Employed MORTGAGE LENDERS

- FAIRBURN GEORGIA Self Employed MORTGAGE LENDERS

- FAIRMOUNT GEORGIA Self Employed MORTGAGE LENDERS

- FARGO GEORGIA Self Employed MORTGAGE LENDERS

- FAYETTEVILLE GEORGIA Self Employed MORTGAGE LENDERS

- FITZGERALD GEORGIA Self Employed MORTGAGE LENDERS

- FLEMINGTON GEORGIA Self Employed MORTGAGE LENDERS

- FLOVILLA GEORGIA Self Employed MORTGAGE LENDERS

- FLOWERY BRANCH GEORGIA Self Employed MORTGAGE LENDERS

- FOLKSTON GEORGIA Self Employed MORTGAGE LENDERS

- FOREST PARK GEORGIA Self Employed MORTGAGE LENDERS

- FORSYTH GEORGIA Self Employed MORTGAGE LENDERS

- FORT GAINES GEORGIA Self Employed MORTGAGE LENDERS

- FORT OGLETHORPE GEORGIA Self Employed MORTGAGE LENDERS

- FORT VALLEY GEORGIA Self Employed MORTGAGE LENDERS

- FRANKLIN GEORGIA Self Employed MORTGAGE LENDERS

- FRANKLIN SPRINGS GEORGIA Self Employed MORTGAGE LENDERS

- FUNSTON GEORGIA Self Employed MORTGAGE LENDERS

- GAINESVILLE GEORGIA Self Employed MORTGAGE LENDERS

- GARDEN CITY GEORGIA Self Employed MORTGAGE LENDERS

- GARFIELD GEORGIA Self Employed MORTGAGE LENDERS

- GAY GEORGIA Self Employed MORTGAGE LENDERS

- GENEVA GEORGIA Self Employed MORTGAGE LENDERS

- GEORGETOWN GEORGIA Self Employed MORTGAGE LENDERS

- GIBSON GEORGIA Self Employed MORTGAGE LENDERS

- GILLSVILLE GEORGIA Self Employed MORTGAGE LENDERS

- GIRARD GEORGIA Self Employed MORTGAGE LENDERS

- GLENNVILLE GEORGIA Self Employed MORTGAGE LENDERS

- GLENWOOD GEORGIA Self Employed MORTGAGE LENDERS

- GOOD HOPE GEORGIA Self Employed MORTGAGE LENDERS

- GORDON GEORGIA Self Employed MORTGAGE LENDERS

- GRAHAM GEORGIA Self Employed MORTGAGE LENDERS

- GRANTVILLE GEORGIA Self Employed MORTGAGE LENDERS

- GRAY GEORGIA Self Employed MORTGAGE LENDERS

- GRAYSON GEORGIA Self Employed MORTGAGE LENDERS

- GREENSBORO GEORGIA Self Employed MORTGAGE LENDERS

- GREENVILLE GEORGIA Self Employed MORTGAGE LENDERS

- GRIFFIN GEORGIA Self Employed MORTGAGE LENDERS

- GROVETOWN GEORGIA Self Employed MORTGAGE LENDERS

- GUMBRANCH GEORGIA Self Employed MORTGAGE LENDERS

- GUYTON GEORGIA Self Employed MORTGAGE LENDERS

- HAGAN GEORGIA Self Employed MORTGAGE LENDERS

- HAHIRA GEORGIA Self Employed MORTGAGE LENDERS

- HAMILTON GEORGIA Self Employed MORTGAGE LENDERS

- HAMPTON GEORGIA Self Employed MORTGAGE LENDERS

- HAPEVILLE GEORGIA Self Employed MORTGAGE LENDERS

- HARALSON GEORGIA Self Employed MORTGAGE LENDERS

- HARLEM GEORGIA Self Employed MORTGAGE LENDERS

- HARRISON GEORGIA Self Employed MORTGAGE LENDERS

- HARTWELL GEORGIA Self Employed MORTGAGE LENDERS

- HAWKINSVILLE GEORGIA Self Employed MORTGAGE LENDERS

- HAZLEHURST GEORGIA Self Employed MORTGAGE LENDERS

- HELEN GEORGIA Self Employed MORTGAGE LENDERS

- HEPHZIBAH GEORGIA Self Employed MORTGAGE LENDERS

- HIAWASSEE GEORGIA Self Employed MORTGAGE LENDERS

- HIGGSTON GEORGIA Self Employed MORTGAGE LENDERS

- HILTONIA GEORGIA Self Employed MORTGAGE LENDERS

- HINESVILLE GEORGIA Self Employed MORTGAGE LENDERS

- HIRAM GEORGIA Self Employed MORTGAGE LENDERS

- HOBOKEN GEORGIA Self Employed MORTGAGE LENDERS

- HOGANSVILLE GEORGIA Self Employed MORTGAGE LENDERS

- HOLLY SPRINGS GEORGIA Self Employed MORTGAGE LENDERS

- HOMELAND GEORGIA Self Employed MORTGAGE LENDERS

- HOMER GEORGIA Self Employed MORTGAGE LENDERS

- HOMERVILLE GEORGIA Self Employed MORTGAGE LENDERS

- HOSCHTON GEORGIA Self Employed MORTGAGE LENDERS

- HULL GEORGIA Self Employed MORTGAGE LENDERS

- IDEAL GEORGIA Self Employed MORTGAGE LENDERS

- ILA GEORGIA Self Employed MORTGAGE LENDERS

- IRON CITY GEORGIA Self Employed MORTGAGE LENDERS

- IRWINTON GEORGIA Self Employed MORTGAGE LENDERS

- IVEY GEORGIA Self Employed MORTGAGE LENDERS

- JACKSON GEORGIA Self Employed MORTGAGE LENDERS

- JACKSONVILLE GEORGIA Self Employed MORTGAGE LENDERS

- JAKIN GEORGIA Self Employed MORTGAGE LENDERS

- JASPER GEORGIA Self Employed MORTGAGE LENDERS

- JEFFERSON GEORGIA Self Employed MORTGAGE LENDERS

- JEFFERSONVILLE GEORGIA Self Employed MORTGAGE LENDERS

- JENKINSBURG GEORGIA Self Employed MORTGAGE LENDERS

- JERSEY GEORGIA Self Employed MORTGAGE LENDERS

- JESUP GEORGIA Self Employed MORTGAGE LENDERS

- JOHNS CREEK GEORGIA Self Employed MORTGAGE LENDERS

- JONESBORO GEORGIA Self Employed MORTGAGE LENDERS

- JUNCTION CITY GEORGIA Self Employed MORTGAGE LENDERS

- KENNESAW GEORGIA Self Employed MORTGAGE LENDERS

- KEYSVILLE GEORGIA Self Employed MORTGAGE LENDERS

- KINGSLAND GEORGIA Self Employed MORTGAGE LENDERS

- KINGSTON GEORGIA Self Employed MORTGAGE LENDERS

- KITE GEORGIA Self Employed MORTGAGE LENDERS

- LAFAYETTE GEORGIA Self Employed MORTGAGE LENDERS

- LAGRANGE GEORGIA Self Employed MORTGAGE LENDERS

- LAKE CITY GEORGIA Self Employed MORTGAGE LENDERS

- LAKE PARK GEORGIA Self Employed MORTGAGE LENDERS

- LAKELAND GEORGIA Self Employed MORTGAGE LENDERS

- LAVONIA GEORGIA Self Employed MORTGAGE LENDERS

- LAWRENCEVILLE GEORGIA Self Employed MORTGAGE LENDERS

- LEARY GEORGIA Self Employed MORTGAGE LENDERS

- LEESBURG GEORGIA Self Employed MORTGAGE LENDERS

- LENOX GEORGIA Self Employed MORTGAGE LENDERS

- LESLIE GEORGIA Self Employed MORTGAGE LENDERS

- LEXINGTON GEORGIA Self Employed MORTGAGE LENDERS

- LILBURN GEORGIA Self Employed MORTGAGE LENDERS

- LILLY GEORGIA Self Employed MORTGAGE LENDERS

- LINCOLNTON GEORGIA Self Employed MORTGAGE LENDERS

- LITHONIA GEORGIA Self Employed MORTGAGE LENDERS

- LOCUST GROVE GEORGIA Self Employed MORTGAGE LENDERS

- LOGANVILLE GEORGIA Self Employed MORTGAGE LENDERS

- LONE OAK GEORGIA Self Employed MORTGAGE LENDERS

- LOOKOUT MOUNTAIN GEORGIA Self Employed MORTGAGE LENDERS

- LOUISVILLE GEORGIA Self Employed MORTGAGE LENDERS

- LOVEJOY GEORGIA Self Employed MORTGAGE LENDERS

- LUDOWICI GEORGIA Self Employed MORTGAGE LENDERS

- LULA GEORGIA Self Employed MORTGAGE LENDERS

- LUMBER CITY GEORGIA Self Employed MORTGAGE LENDERS

- LUMPKIN GEORGIA Self Employed MORTGAGE LENDERS

- LUTHERSVILLE GEORGIA Self Employed MORTGAGE LENDERS

- LYERLY GEORGIA Self Employed MORTGAGE LENDERS

- LYONS GEORGIA Self Employed MORTGAGE LENDERS

- MACON GEORGIA Self Employed MORTGAGE LENDERS

- MADISON GEORGIA Self Employed MORTGAGE LENDERS

- MANASSAS GEORGIA Self Employed MORTGAGE LENDERS

- MANCHESTER GEORGIA Self Employed MORTGAGE LENDERS

- MANSFIELD GEORGIA Self Employed MORTGAGE LENDERS

- MARIETTA GEORGIA Self Employed MORTGAGE LENDERS

- MARSHALLVILLE GEORGIA Self Employed MORTGAGE LENDERS

- MARTIN GEORGIA Self Employed MORTGAGE LENDERS

- MAXEYS GEORGIA Self Employed MORTGAGE LENDERS

- MAYSVILLE GEORGIA Self Employed MORTGAGE LENDERS

- MCCAYSVILLE GEORGIA Self Employed MORTGAGE LENDERS

- MCDONOUGH GEORGIA Self Employed MORTGAGE LENDERS

- MCINTYRE GEORGIA Self Employed MORTGAGE LENDERS

- MCRAE-HELENA GEORGIA Self Employed MORTGAGE LENDERS

- MEANSVILLE GEORGIA Self Employed MORTGAGE LENDERS

- MEIGS GEORGIA Self Employed MORTGAGE LENDERS

- MENLO GEORGIA Self Employed MORTGAGE LENDERS

- METTER GEORGIA Self Employed MORTGAGE LENDERS

- MIDVILLE GEORGIA Self Employed MORTGAGE LENDERS

- MIDWAY GEORGIA Self Employed MORTGAGE LENDERS

- MILAN GEORGIA Self Employed MORTGAGE LENDERS

- MILLEDGEVILLE GEORGIA Self Employed MORTGAGE LENDERS

- MILLEN GEORGIA Self Employed MORTGAGE LENDERS

- MILNER GEORGIA Self Employed MORTGAGE LENDERS

- MILTON GEORGIA Self Employed MORTGAGE LENDERS

- MITCHELL GEORGIA Self Employed MORTGAGE LENDERS

- MOLENA GEORGIA Self Employed MORTGAGE LENDERS

- MONROE GEORGIA Self Employed MORTGAGE LENDERS

- MONTEZUMA GEORGIA Self Employed MORTGAGE LENDERS

- MONTICELLO GEORGIA Self Employed MORTGAGE LENDERS

- MONTROSE GEORGIA Self Employed MORTGAGE LENDERS

- MORELAND GEORGIA Self Employed MORTGAGE LENDERS

- MORGAN GEORGIA Self Employed MORTGAGE LENDERS

- MORGANTON GEORGIA Self Employed MORTGAGE LENDERS

- MORROW GEORGIA Self Employed MORTGAGE LENDERS

- MORVEN GEORGIA Self Employed MORTGAGE LENDERS

- MOULTRIE GEORGIA Self Employed MORTGAGE LENDERS

- MOUNT AIRY GEORGIA Self Employed MORTGAGE LENDERS

- MOUNT VERNON GEORGIA Self Employed MORTGAGE LENDERS

- MOUNT ZION GEORGIA Self Employed MORTGAGE LENDERS

- MOUNTAIN CITY GEORGIA Self Employed MORTGAGE LENDERS

- MOUNTAIN PARK GEORGIA Self Employed MORTGAGE LENDERS

- NAHUNTA GEORGIA Self Employed MORTGAGE LENDERS

- NASHVILLE GEORGIA Self Employed MORTGAGE LENDERS

- NELSON GEORGIA Self Employed MORTGAGE LENDERS

- NEWBORN GEORGIA Self Employed MORTGAGE LENDERS

- NEWINGTON GEORGIA Self Employed MORTGAGE LENDERS

- NEWNAN GEORGIA Self Employed MORTGAGE LENDERS

- NEWTON GEORGIA Self Employed MORTGAGE LENDERS

- NICHOLLS GEORGIA Self Employed MORTGAGE LENDERS

- NICHOLSON GEORGIA Self Employed MORTGAGE LENDERS

- NORCROSS GEORGIA Self Employed MORTGAGE LENDERS

- NORMAN PARK GEORGIA Self Employed MORTGAGE LENDERS

- NORTH HIGH SHOALS GEORGIA Self Employed MORTGAGE LENDERS

- NORWOOD GEORGIA Self Employed MORTGAGE LENDERS

- OAK PARK GEORGIA Self Employed MORTGAGE LENDERS

- OAKWOOD GEORGIA Self Employed MORTGAGE LENDERS

- OCHLOCKNEE GEORGIA Self Employed MORTGAGE LENDERS

- OCILLA GEORGIA Self Employed MORTGAGE LENDERS

- OCONEE GEORGIA Self Employed MORTGAGE LENDERS

- ODUM GEORGIA Self Employed MORTGAGE LENDERS

- OFFERMAN GEORGIA Self Employed MORTGAGE LENDERS

- OGLETHORPE GEORGIA Self Employed MORTGAGE LENDERS

- OLIVER GEORGIA Self Employed MORTGAGE LENDERS

- OMEGA GEORGIA Self Employed MORTGAGE LENDERS

- ORCHARD HILL GEORGIA Self Employed MORTGAGE LENDERS

- OXFORD GEORGIA Self Employed MORTGAGE LENDERS

- PALMETTO GEORGIA Self Employed MORTGAGE LENDERS

- PARROTT GEORGIA Self Employed MORTGAGE LENDERS

- PATTERSON GEORGIA Self Employed MORTGAGE LENDERS

- PAVO GEORGIA Self Employed MORTGAGE LENDERS

- PAYNE CITY GEORGIA Self Employed MORTGAGE LENDERS

- PEACHTREE CITY GEORGIA Self Employed MORTGAGE LENDERS

- PEACHTREE CORNERS GEORGIA Self Employed MORTGAGE LENDERS

- PEARSON GEORGIA Self Employed MORTGAGE LENDERS

- PELHAM GEORGIA Self Employed MORTGAGE LENDERS

- PEMBROKE GEORGIA Self Employed MORTGAGE LENDERS

- PENDERGRASS GEORGIA Self Employed MORTGAGE LENDERS

- PERRY GEORGIA Self Employed MORTGAGE LENDERS

- PINE LAKE GEORGIA Self Employed MORTGAGE LENDERS

- PINE MOUNTAIN GEORGIA Self Employed MORTGAGE LENDERS

- PINEHURST GEORGIA Self Employed MORTGAGE LENDERS

- PINEVIEW GEORGIA Self Employed MORTGAGE LENDERS

- PITTS GEORGIA Self Employed MORTGAGE LENDERS

- PLAINS GEORGIA Self Employed MORTGAGE LENDERS

- PLAINVILLE GEORGIA Self Employed MORTGAGE LENDERS

- POOLER GEORGIA Self Employed MORTGAGE LENDERS

- PORT WENTWORTH GEORGIA Self Employed MORTGAGE LENDERS

- PORTAL GEORGIA Self Employed MORTGAGE LENDERS

- PORTERDALE GEORGIA Self Employed MORTGAGE LENDERS

- POULAN GEORGIA Self Employed MORTGAGE LENDERS

- POWDER SPRINGS GEORGIA Self Employed MORTGAGE LENDERS

- PRESTON GEORGIA Self Employed MORTGAGE LENDERS

- PULASKI GEORGIA Self Employed MORTGAGE LENDERS

- QUITMAN GEORGIA Self Employed MORTGAGE LENDERS

- RANGER GEORGIA Self Employed MORTGAGE LENDERS

- RAY CITY GEORGIA Self Employed MORTGAGE LENDERS

- RAYLE GEORGIA Self Employed MORTGAGE LENDERS

- REBECCA GEORGIA Self Employed MORTGAGE LENDERS

- REGISTER GEORGIA Self Employed MORTGAGE LENDERS

- REIDSVILLE GEORGIA Self Employed MORTGAGE LENDERS

- REMERTON GEORGIA Self Employed MORTGAGE LENDERS

- RENTZ GEORGIA Self Employed MORTGAGE LENDERS

- RESACA GEORGIA Self Employed MORTGAGE LENDERS

- REYNOLDS GEORGIA Self Employed MORTGAGE LENDERS

- RHINE GEORGIA Self Employed MORTGAGE LENDERS

- RICEBORO GEORGIA Self Employed MORTGAGE LENDERS

- RICHLAND GEORGIA Self Employed MORTGAGE LENDERS

- RICHMOND HILL GEORGIA Self Employed MORTGAGE LENDERS

- RIDDLEVILLE GEORGIA Self Employed MORTGAGE LENDERS

- RINCON GEORGIA Self Employed MORTGAGE LENDERS

- RINGGOLD GEORGIA Self Employed MORTGAGE LENDERS

- RIVERDALE GEORGIA Self Employed MORTGAGE LENDERS

- RIVERSIDE GEORGIA Self Employed MORTGAGE LENDERS

- ROBERTA GEORGIA Self Employed MORTGAGE LENDERS

- ROCHELLE GEORGIA Self Employed MORTGAGE LENDERS

- ROCKMART GEORGIA Self Employed MORTGAGE LENDERS

- ROCKY FORD GEORGIA Self Employed MORTGAGE LENDERS

- ROME GEORGIA Self Employed MORTGAGE LENDERS

- ROSSVILLE GEORGIA Self Employed MORTGAGE LENDERS

- ROSWELL GEORGIA Self Employed MORTGAGE LENDERS

- ROYSTON GEORGIA Self Employed MORTGAGE LENDERS

- RUTLEDGE GEORGIA Self Employed MORTGAGE LENDERS

- SALE CITY GEORGIA Self Employed MORTGAGE LENDERS

- SANDERSVILLE GEORGIA Self Employed MORTGAGE LENDERS

- SANDY SPRINGS GEORGIA Self Employed MORTGAGE LENDERS

- SANTA CLAUS GEORGIA Self Employed MORTGAGE LENDERS

- SARDIS GEORGIA Self Employed MORTGAGE LENDERS

- SASSER GEORGIA Self Employed MORTGAGE LENDERS

- SAVANNAH GEORGIA Self Employed MORTGAGE LENDERS

- SCOTLAND GEORGIA Self Employed MORTGAGE LENDERS

- SCREVEN GEORGIA Self Employed MORTGAGE LENDERS

- SENOIA GEORGIA Self Employed MORTGAGE LENDERS

- SHADY DALE GEORGIA Self Employed MORTGAGE LENDERS

- SHARON GEORGIA Self Employed MORTGAGE LENDERS

- SHARPSBURG GEORGIA Self Employed MORTGAGE LENDERS

- SHELLMAN GEORGIA Self Employed MORTGAGE LENDERS

- SHILOH GEORGIA Self Employed MORTGAGE LENDERS

- SILOAM GEORGIA Self Employed MORTGAGE LENDERS

- SKY VALLEY GEORGIA Self Employed MORTGAGE LENDERS

- SMITHVILLE GEORGIA Self Employed MORTGAGE LENDERS

- SMYRNA GEORGIA Self Employed MORTGAGE LENDERS

- SNELLVILLE GEORGIA Self Employed MORTGAGE LENDERS

- SOCIAL CIRCLE GEORGIA Self Employed MORTGAGE LENDERS

- SOPERTON GEORGIA Self Employed MORTGAGE LENDERS

- SPARKS GEORGIA Self Employed MORTGAGE LENDERS

- SPARTA GEORGIA Self Employed MORTGAGE LENDERS

- SPRINGFIELD GEORGIA Self Employed MORTGAGE LENDERS

- ST. MARYS GEORGIA Self Employed MORTGAGE LENDERS

- STAPLETON GEORGIA Self Employed MORTGAGE LENDERS

- STATENVILLE GEORGIA Self Employed MORTGAGE LENDERS

- STATESBORO GEORGIA Self Employed MORTGAGE LENDERS

- STATHAM GEORGIA Self Employed MORTGAGE LENDERS

- STILLMORE GEORGIA Self Employed MORTGAGE LENDERS

- STOCKBRIDGE GEORGIA Self Employed MORTGAGE LENDERS

- STONE MOUNTAIN GEORGIA Self Employed MORTGAGE LENDERS

- SUGAR HILL GEORGIA Self Employed MORTGAGE LENDERS

- SUMMERVILLE GEORGIA Self Employed MORTGAGE LENDERS

- SUMNER GEORGIA Self Employed MORTGAGE LENDERS

- SURRENCY GEORGIA Self Employed MORTGAGE LENDERS

- SUWANEE GEORGIA Self Employed MORTGAGE LENDERS

- SWAINSBORO GEORGIA Self Employed MORTGAGE LENDERS

- SYCAMORE GEORGIA Self Employed MORTGAGE LENDERS

- SYLVANIA GEORGIA Self Employed MORTGAGE LENDERS

- SYLVESTER GEORGIA Self Employed MORTGAGE LENDERS

- TALBOTTON GEORGIA Self Employed MORTGAGE LENDERS

- TALKING ROCK GEORGIA Self Employed MORTGAGE LENDERS

- TALLAPOOSA GEORGIA Self Employed MORTGAGE LENDERS

- TALLULAH FALLS GEORGIA Self Employed MORTGAGE LENDERS

- TALMO GEORGIA Self Employed MORTGAGE LENDERS

- TARRYTOWN GEORGIA Self Employed MORTGAGE LENDERS

- TAYLORSVILLE GEORGIA Self Employed MORTGAGE LENDERS

- TEMPLE GEORGIA Self Employed MORTGAGE LENDERS

- TENNILLE GEORGIA Self Employed MORTGAGE LENDERS

- THOMASTON GEORGIA Self Employed MORTGAGE LENDERS

- THOMASVILLE GEORGIA Self Employed MORTGAGE LENDERS

- THOMSON GEORGIA Self Employed MORTGAGE LENDERS

- THUNDERBOLT GEORGIA Self Employed MORTGAGE LENDERS

- TIFTON GEORGIA Self Employed MORTGAGE LENDERS

- TIGNALL GEORGIA Self Employed MORTGAGE LENDERS

- TOCCOA GEORGIA Self Employed MORTGAGE LENDERS

- TOOMSBORO GEORGIA Self Employed MORTGAGE LENDERS

- TRENTON GEORGIA Self Employed MORTGAGE LENDERS

- TRION GEORGIA Self Employed MORTGAGE LENDERS

- TUNNEL HILL GEORGIA Self Employed MORTGAGE LENDERS

- TURIN GEORGIA Self Employed MORTGAGE LENDERS

- TWIN CITY GEORGIA Self Employed MORTGAGE LENDERS

- TY TY GEORGIA Self Employed MORTGAGE LENDERS

- TYBEE ISLAND GEORGIA Self Employed MORTGAGE LENDERS

- TYRONE GEORGIA Self Employed MORTGAGE LENDERS

- UNADILLA GEORGIA Self Employed MORTGAGE LENDERS

- UNION CITY GEORGIA Self Employed MORTGAGE LENDERS

- UNION POINT GEORGIA Self Employed MORTGAGE LENDERS

- UVALDA GEORGIA Self Employed MORTGAGE LENDERS

- VALDOSTA GEORGIA Self Employed MORTGAGE LENDERS

- VARNELL GEORGIA Self Employed MORTGAGE LENDERS

- VERNONBURG GEORGIA Self Employed MORTGAGE LENDERS

- VIDALIA GEORGIA Self Employed MORTGAGE LENDERS

- VIENNA GEORGIA Self Employed MORTGAGE LENDERS

- VILLA RICA GEORGIA Self Employed MORTGAGE LENDERS